Philippines Autonomous Vehicle Market Outlook to 2030

By Market Structure, By Automation Level, By Application, By Vehicle Platform, By Ownership & Commercial Model, and By Region

- Product Code: TDR0395

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Philippines Autonomous Vehicle Market Outlook to 2030 – By Market Structure, By Automation Level, By Application, By Vehicle Platform, By Ownership & Commercial Model, and By Region” provides a comprehensive analysis of the autonomous mobility market in the Philippines. The report covers an overview and genesis of the industry, overall market size in terms of revenues, market segmentation; trends and developments, regulatory and licensing landscape, operator-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the AV market. The report concludes with future market projections based on deployed fleets and route-kilometers, use-case mix (shuttle, logistics, yard/port, highway), regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

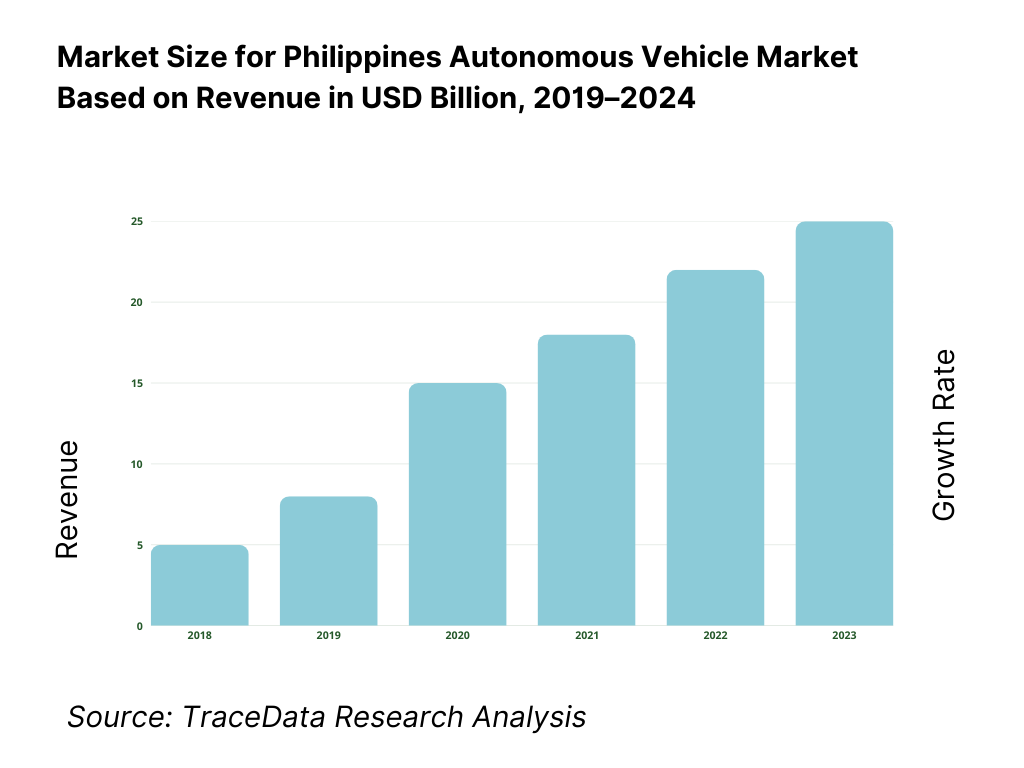

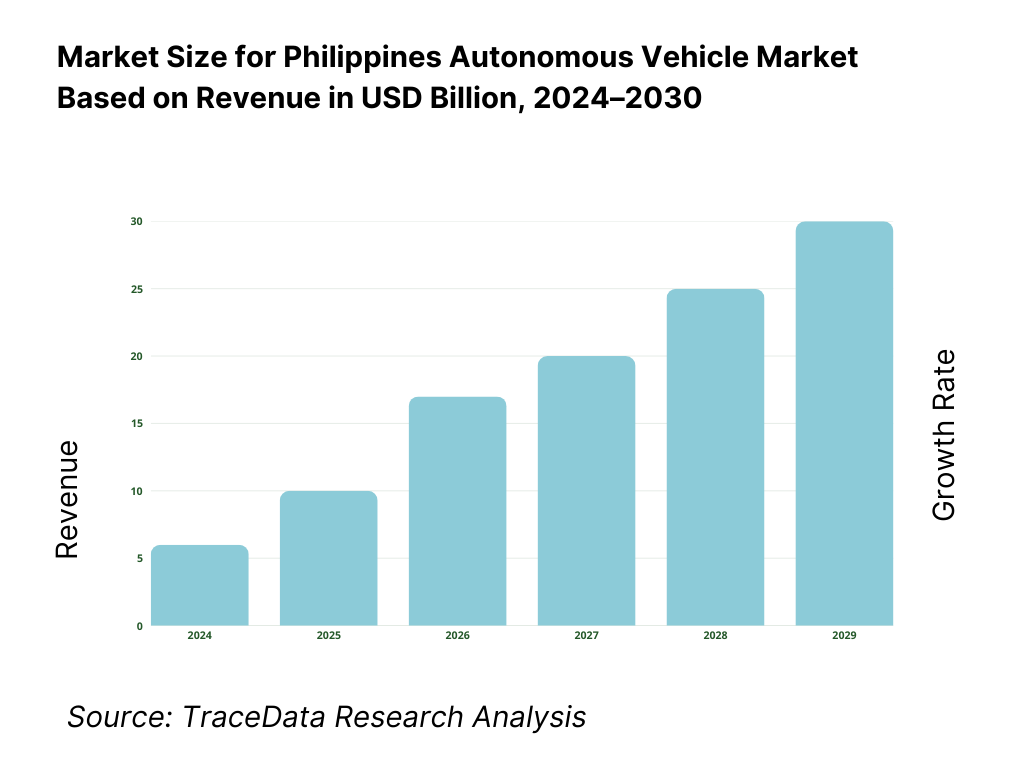

Philippines Autonomous Vehicle Market Overview and Size

The Philippines autonomous vehicle market is valued at approximately USD 0.xx billion, based on five-year historical analysis. Growth is being driven by factors such as increasing urban congestion in Metro Manila and major provincial cities, rising government support for mobility modernization (including smart city initiatives), and the maturation of enabling technologies (5G/C-V2X, LiDAR/radar, AI-based perception). Also, the growing electrification of fleets and logistics hubs within SEZs contribute to AV adoption and revenue generation.

Within the region, major urban clusters such as Metro Manila (NCR), Clark-Subic (Central Luzon), and the CALABARZON industrial belt dominate the Philippines AV market due to their higher road infrastructure readiness, concentration of special economic zones, strong logistics and campus/estate deployments, and early regulatory/municipal pilot programmes. Their dominance stems from combining government-backed mobility programmes, concentrated fleet operators, and available funding for pilots.

What Factors are Leading to the Growth of the Philippines Autonomous Vehicle Market:

Scale of urban mobility demand and corridor intensity: Metro corridors in the Philippines represent a large, immediately addressable base for autonomous shuttle and logistics operations. The country’s population of 112,729,484 is heavily concentrated in NCR and adjacent growth belts, generating sustained commuter and freight demand. Domestic air passenger movement has risen from 28,965,043 to 32,130,322, creating steady airport-to-city mobility requirements. On land, 35,164.13 kilometers of national roads connect major industrial, residential, and tourism centers, while ports handle 149,224 shipcalls and 1,800,778.75 TEUs. These factors combine to provide dense, repeatable routes ideal for geo-fenced AV deployment in estates, freeports, and airports.

Digital connectivity and compute readiness for AV operations: The Philippines’ growing digital infrastructure supports connected and autonomous mobility. With 72,646,000 active mobile broadband subscribers and broadband density reaching nearly 79 per 100 people, the network backbone enables real-time tele-operations, telemetry, and data streaming for AV fleets. The country’s GDP of USD 497.5 billion reflects a strong macroeconomic base to support investments in high-performance computing, LiDAR calibration, safety testing, and mapping. These digital and financial resources form a solid platform for scaling autonomous operations, data analytics, and AI-based route optimization across controlled and mixed-traffic environments.

Logistics intensity in ports and air systems enabling controlled ODD deployments: Autonomy adoption accelerates fastest in controlled Operational Design Domains (ODDs) such as ports, airports, and industrial parks—areas where the Philippines shows strong throughput. The national port network processes over 149,000 shipcalls and nearly 1.8 million TEUs annually, while domestic aviation moves more than 32 million passengers each year. These high-volume but geographically contained environments are ideal for early AV pilots, including autonomous yard tractors, baggage shuttles, and last-mile delivery vehicles. The country’s 35,164.13 kilometers of interconnected roads further allow consistent point-to-point loops for fleet operations, minimizing edge-case risk and enabling scalable automation.

Which Industry Challenges Have Impacted the Growth of the Philippines Autonomous Vehicle Market:

High baseline road-safety risk that raises AV safety-case thresholds: The Philippines experiences elevated levels of road incidents, with 13,125 deaths recorded due to land transport accidents in the most recent statistical cycle. This high fatality baseline imposes a strict safety benchmark for AV developers and regulators. Any autonomous deployment must demonstrate superior reliability through simulation, scenario validation, and on-road testing. Regulatory agencies are expected to require extensive safety-case documentation, human factors studies, and disengagement data before granting operational approvals, making safety assurance one of the highest-cost components in AV pilot readiness.

Severe weather exposure and typhoon disruptions complicate ODD design: The Philippines is struck by an average of 20 tropical cyclones annually, with around 8–9 typically making landfall. These conditions affect visibility, sensor accuracy, and road traction—critical parameters for AV safety and route performance. Autonomous vehicles must therefore integrate weather-adaptive algorithms, waterproof sensors, and resilient mapping systems. Frequent weather disruptions increase downtime and maintenance complexity, requiring AV operators to design fleets with redundancy and high ingress protection ratings. The climatic volatility thus extends the time and cost needed to validate ODD safety standards.

Road-network density per capita underscores complexity in mixed traffic: The country’s 35,164.13 kilometers of national roads serve a population of over 112 million, translating to roughly 0.31 kilometers of national roads per 1,000 people. This results in congested, mixed-traffic conditions involving jeepneys, tricycles, motorcycles, and pedestrians—factors that create unpredictable interaction environments for autonomous systems. For AV developers, this necessitates high-fidelity planning algorithms, robust perception stacks, and frequent tele-operator interventions. Urban traffic density also increases AV training data requirements and the frequency of disengagements, extending the time to achieve safe, consistent autonomous operation.

What are the Regulations and Initiatives which have Governed the Market:

Electric Vehicle Industry Development Act (RA 11697) enabling AV-EV fleets: The Electric Vehicle Industry Development Act establishes a comprehensive framework for EV adoption, covering vehicle categories, charging standards, and fleet allocation mandates. Its implementation provides an enabling foundation for AVs that rely on electric drivetrains, as many autonomous fleets operate in fixed routes ideal for EV integration. By standardizing charging infrastructure and defining responsibilities for public and private entities, the regulation encourages AV operators to combine autonomy with electrification, aligning with sustainability goals in economic zones and urban centers.

Data Privacy Act of 2012 (RA 10173) governing AV data processing: Autonomous vehicles depend on continuous data collection from sensors, cameras, and connectivity systems. The Data Privacy Act of 2012 governs the acquisition, storage, and use of such data, establishing clear rules on consent, security, and data sharing. For AV deployments, this law ensures that visual, geolocation, and telemetric data are handled responsibly while maintaining passenger privacy. It also shapes how AV companies design cloud architectures, data retention protocols, and anonymization processes for compliance and ethical operations.

DOTr Department Order 2018-019 and MVIS directives for roadworthiness: The Department of Transportation’s Motor Vehicle Inspection System (MVIS) serves as the foundation for ensuring roadworthiness across all vehicle types. Through Department Order 2018-019, the government mandates comprehensive testing for emissions, braking, lighting, and overall vehicle performance. Although no standalone AV certification exists yet, MVIS provides the baseline for retrofitted or purpose-built AVs operating in the country. This framework bridges traditional vehicle compliance with future autonomous regulations, ensuring that early AV fleets meet both mechanical and safety performance standards before operational approval.

Philippines Autonomous Vehicle Market Segmentation

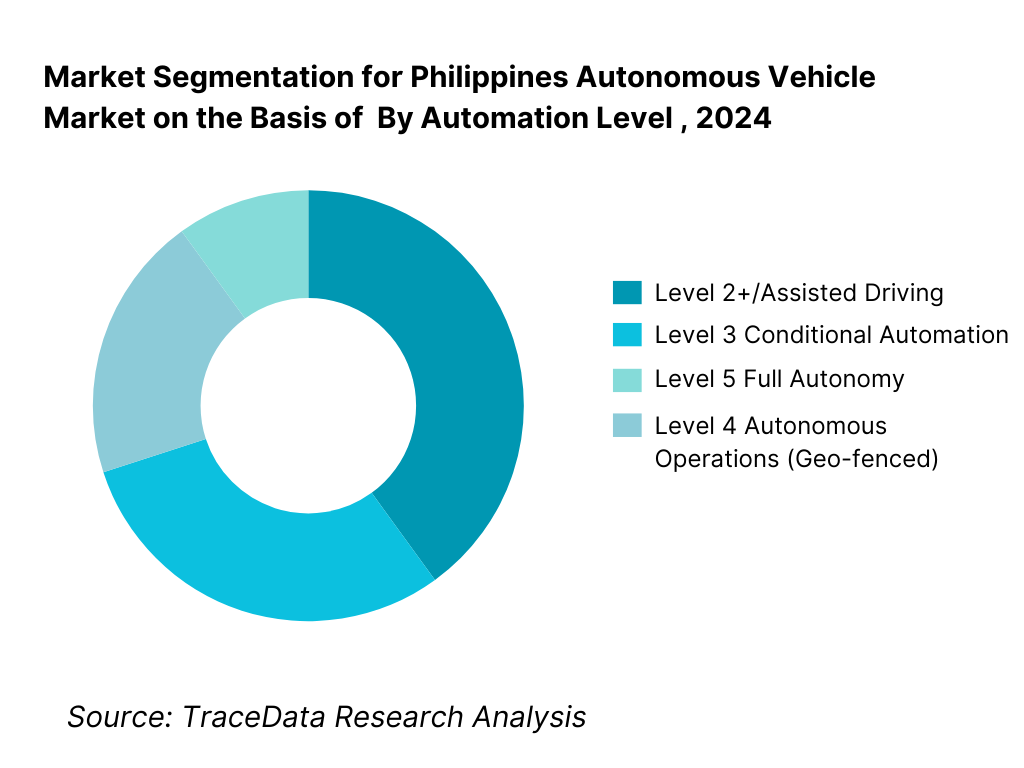

By Automation Level: Level 4 Autonomous Operations (Geo-fenced) segment is currently dominating market share (2023) because it aligns best with the Philippines infrastructure and regulatory readiness. Geo-fenced deployments (in SEZs, airports, and defined corridors) require less complex ODD (Operational Design Domain) compared to full public-road Level 5 operations, and therefore operators and integrators are able to deploy commercially and scale faster. This sub-segment also benefits from public-private pilot programmes, manageable safety-case exposure, and concentrated fleet deployments that deliver visible ROI, making it the most attractive segment.

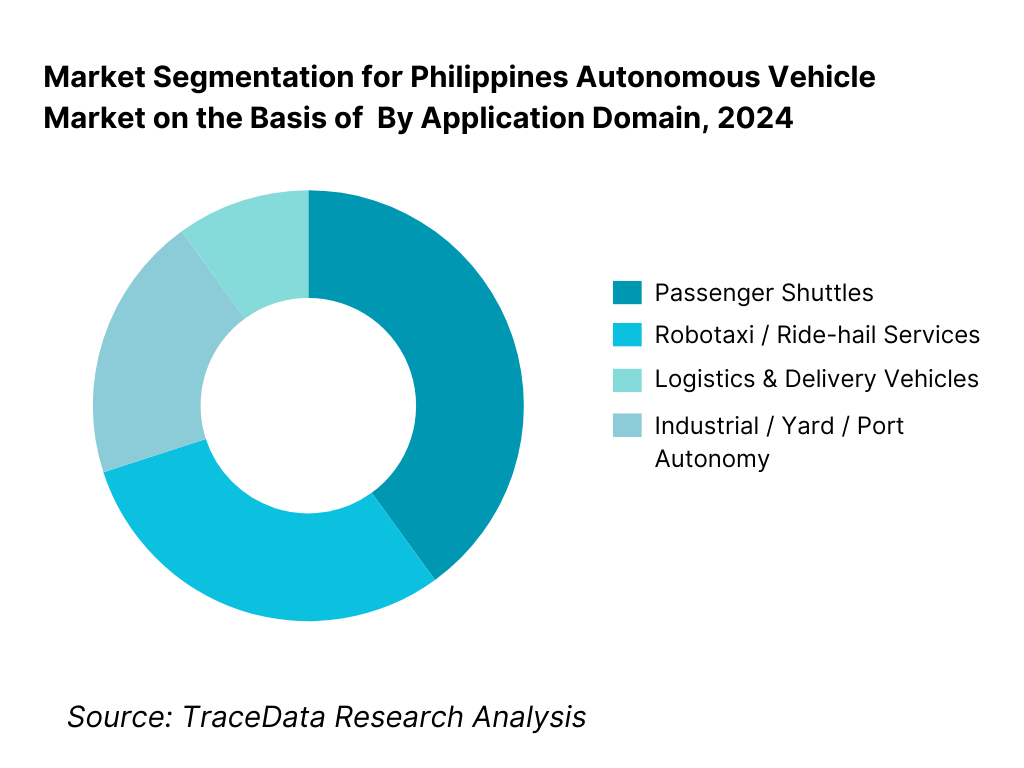

By Application Domain: The Logistics & Delivery Vehicles sub-segment is dominating market share because the Philippines has a strong industrial and port infrastructure base in areas such as CALABARZON, Clark-Subic and Cebu, with high demand for automation in warehouses, yard operations and parcel delivery. Logistics flows are well-suited for defined corridors and controlled environments where AV solutions can be costed and scaled. Furthermore, fleet operators and integrators view logistics deployments as lower risk—fewer passengers, more predictable routes—and hence investments have accelerated, giving this sub-segment a lead in revenue and deployments.

Competitive Landscape in Philippines Autonomous Vehicle Market

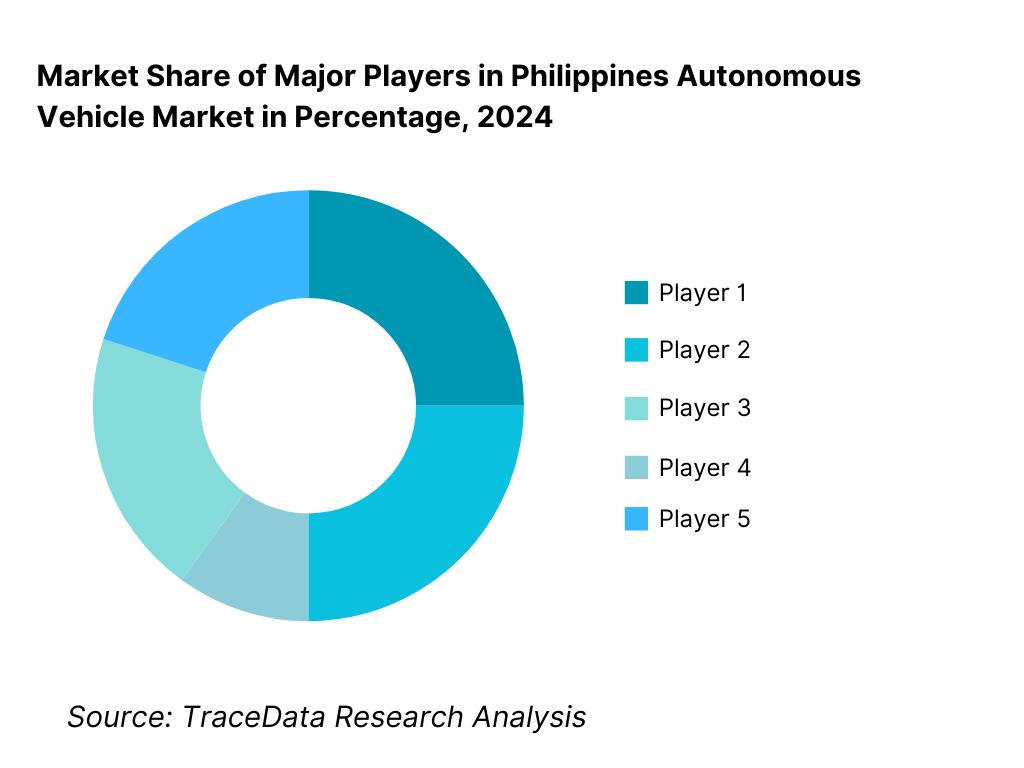

The Philippines AV market is still nascent but increasingly being shaped by a few major global and regional players that are entering or planning deployments in SEZs, campuses and logistic corridors. This consolidation of capability shows that the competitive landscape will gravitate around technology stack strength, route-ODD readiness, local partnerships and regulatory support.

Name | Founding Year | Original Headquarters |

Waymo | 2009 | Mountain View, USA |

Cruise | 2013 | San Francisco, USA |

Mobileye | 1999 | Jerusalem, Israel |

May Mobility | 2017 | Ann Arbor, USA |

Huawei ADS | 2017 | Shenzhen, China |

Zenmov | 2016 | Tokyo, Japan |

Toyota Mobility Foundation | 2014 | Tokyo, Japan |

NVIDIA | 1993 | Santa Clara, USA |

Qualcomm | 1985 | San Diego, USA |

EasyMile | 2014 | Toulouse, France |

AutoX | 2016 | Shenzhen, China |

Zoox | 2014 | Foster City, USA |

Pony.ai | 2016 | Fremont, USA |

Baidu Apollo | 2017 | Beijing, China |

Motional | 2020 | Boston, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Waymo: As one of the global pioneers in autonomous mobility, Waymo expanded its collaboration network in Southeast Asia, including feasibility discussions for controlled-route AV pilots within the Philippines’ smart city zones. The company also enhanced its safety stack by integrating real-time telemetric updates with HD-map refresh cycles, improving performance in dense traffic conditions similar to those in Metro Manila.

Cruise: Cruise has reinforced its L4 fleet operations with new simulation tools and remote monitoring protocols applicable to emerging Asian markets. In the Philippines, its strategy revolves around knowledge transfer and partnerships with fleet operators in SEZs, particularly for campus-based and airport shuttle pilots under DOTr regulatory frameworks.

Mobileye: Leveraging its vision-based REM mapping technology, Mobileye has collaborated with ASEAN automotive assemblers for ADAS-to-L4 retrofitting opportunities. In the Philippines, its REM mapping data collection expanded across NCR and CALABARZON, supporting local OEM readiness for semi-autonomous driving deployments.

May Mobility: Known for turnkey shuttle operations, May Mobility has initiated partnership dialogues with Clark and Subic development authorities to deploy small-scale AV shuttle loops. The company’s operational expertise in campus and corporate parks is being localized to the Philippine urban estate environment, emphasizing reliability and cost efficiency.

Huawei ADS: Huawei’s autonomous driving division continued its push into smart mobility ecosystems by integrating C-V2X and 5G edge computing within its AV stack. In the Philippines, it has partnered with major telecoms to develop real-time data links for shuttle telemetry and vehicle-to-infrastructure communication, positioning itself as a key enabler of AV connectivity.

What Lies Ahead for Philippines Autonomous Vehicle Market?

The Philippines autonomous vehicle market is on the cusp of accelerated growth, supported by rapid urbanization, increasing logistics throughput, and large-scale investment in transport modernization. Corridors across Metro Manila, Clark–Subic, and CALABARZON are expected to emerge as focal points for AV testing and early commercial deployments. These regions combine high road density, concentrated logistics demand, and advanced telecom networks, enabling controlled operations in airports, ports, and special economic zones. Collectively, these factors will transition the market from experimental pilots to structured fleet rollouts within the next planning horizon.

Rise of Hybrid Deployment Models: The next evolution of AV integration in the Philippines will emphasize hybrid operations—autonomous driving within geo-fenced estates and assisted human control on public routes. This approach leverages the country’s 35,164 kilometers of national road infrastructure, ensuring flexibility and scalability without compromising safety. Operators will increasingly deploy AV fleets in semi-supervised modes, supported by tele-operations and remote monitoring centers. This hybrid structure balances cost and reliability, allowing continuous operations even in areas with incomplete mapping or signal variability.

Focus on Outcome-based Mobility Solutions: Businesses, SEZ operators, and industrial logistics firms are shifting toward outcome-oriented AV solutions. Instead of focusing purely on technology adoption, decision-makers are prioritizing measurable operational metrics—such as vehicle uptime, safety improvements, and route optimization efficiency. With domestic aviation handling over 32 million passengers and major ports managing more than 1.8 million TEUs annually, AV technologies are positioned to enhance turnaround times, reduce congestion, and optimize fleet utilization across key economic corridors.

Sector-specific Deployment Growth: The immediate adoption potential for AVs in the Philippines lies in logistics, warehousing, airports, and industrial parks. Controlled environments—like Clark Freeport, Subic Bay, and CALABARZON’s manufacturing hubs—offer predictable traffic conditions ideal for automated operations. AV deployment will expand through autonomous yard tractors, port-hauling trucks, inter-terminal shuttles, and estate mobility loops, rather than passenger-focused robotaxis. Over time, these localized deployments will mature into scalable networks, setting the foundation for national-level AV integration.

Leveraging AI, Edge Compute & Connectivity: The Philippines’ digital backbone supports advanced AV infrastructure. With more than 72 million active broadband connections and strong 5G expansion, the country possesses the network depth required for C-V2X communication, tele-operations, and real-time fleet analytics. As global leaders such as NVIDIA, Qualcomm, and Huawei extend partnerships with local telecoms and mobility startups, the integration of AI-driven perception, predictive maintenance, and adaptive routing will redefine the operational efficiency of AV fleets. These technology enablers will reduce human supervision requirements and advance the Philippines toward full-scale, data-driven autonomous mobility.

Philippines Autonomous Vehicle Market Segmentation

By Application / Use Case

Passenger AV shuttles (campus, township, airport)

Robotaxi / on-demand ride-hail (geo-fenced urban)

Logistics & delivery AVs (last-mile, depot-to-depot)

Port / yard tractors and AGVs

Industrial & estate circulation (factories, tech parks, SEZs)

Autonomous trucks (middle-mile highway corridors)

Municipal services (street sweeping, inspection, security)

By Automation Level (SAE Focus)

L2+ advanced driver assistance

L3 conditional automation (limited operational domains)

L4 passenger mobility (geo-fenced)

L4 logistics/industrial (closed-course, port/yard)

L4 highway depot-to-depot

By Vehicle Platform

Low-speed shuttles (10–30 pax)

Robotaxi pods / purpose-built AVs

Light commercial vans / small cargo

Medium/heavy trucks (box, reefer, flatbed)

Tractors/tugs (port, yard, airside)

Service/utility vehicles (sweepers, patrol, inspection)

By Ownership & Commercial Model

AV-as-a-Service (AvaaS) with availability SLAs

Operator-owned fleets (transport firms, logistics)

OEM-captive mobility programs

PPP / concession (airport, SEZ, LGU)

Estate/park-managed fleets (townships, campuses)

By Operating Domain (ODD)

Closed-campus (SEZs, universities, industrial parks)

Airside/landside airport corridors

Port/ICD/yard environments

Urban mixed-traffic loops (CBDs, BRT feeders)

Highway/depot-to-depot corridors

Residential townships / new city developments

Players Mentioned in the Report:

Waymo

Cruise

Mobileye

May Mobility

Huawei ADS

AutoX

Zoox

Pony.ai

EasyMile

NVIDIA

Qualcomm

Toyota Mobility Foundation / Woven by Toyota

Zenmov

Baidu Apollo

Motional

Key Target Audience

Investment and venture capital firms (targeting AV / mobility tech)

Government and regulatory bodies (e.g., DOTr Philippines, LTFRB Philippines)

Large mobility-platform operators and fleet-owners

OEMs and Tier-1 automotive suppliers entering AV domain

Logistics and port/yard operators in Philippines SEZs

Telecom, 5G & edge compute providers investing in AV infrastructure

Smart-city developers and township integrators

Insurance and safety-certification organisations focusing on AV risk management

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Operational Model Analysis for AV Deployments-Pilot, Commercial Fleet, Shared Shuttle, and Logistics Route Models

4.2. Revenue Streams for the Philippines Autonomous Vehicle Market

4.3. Business Model Canvas for the Philippines Autonomous Vehicle Market

5.1. In-House Fleet Operations vs. Outsourced AV Services (Integrator Model)

5.2. Investment Model in the Philippines AV Market

5.3. Comparative Analysis of Pilot and Regulatory Approval Processes by Government vs. Private Entities

5.4. Budget Allocation and Capital Intensity by Operator Size (Startups, Integrators, Large Mobility Platforms)

8.1. Revenues (Fleet Deployments, Software Licensing, and Data Services Base)

9.1. By Market Structure (In-House and Outsourced Operations)

9.2. By Automation Level (L2+/L3 Assisted Driving, L4 Urban Shuttle, L4 Logistics, L4 Port/Industrial)

9.3. By Application Domain (Passenger Shuttle, Robotaxi, Logistics/Delivery, Industrial/Port Yard, Mining/Defense)

9.4. By Company Size (Startups, Regional Integrators, Multinationals)

9.5. By Vehicle Platform (Passenger, Cargo, Specialized, Retrofit)

9.6. By Mode of Connectivity (C-V2X, DSRC, 5G-Enabled, Hybrid Connectivity)

9.7. By Operating Domain (Closed-Campus, Public Road Pilots, Mixed Traffic, Highways)

9.8. By Region (NCR, Clark-Subic, CALABARZON, Cebu, Davao)

10.1. Operator Landscape and Fleet Cohort Analysis (public vs. private; SEZ vs. urban shuttle providers)

10.2. Decision-Making Process for AV Integration by Operators and LGUs

10.3. Performance and ROI Analysis of AV Pilots (uptime, safety metrics, opex savings, CO₂ reduction)

10.4. Gap Analysis Framework (infrastructure, regulatory, talent, and tele-ops capacity gaps)

11.1. Trends and Developments in the Philippines AV Market (AI stack convergence, LiDAR cost curve, AV-EV integration, C-V2X pilots)

11.2. Growth Drivers (smart city projects, SEZ logistics automation, EV ecosystem maturity, safety regulation push)

11.3. SWOT Analysis (policy support, infrastructure gaps, cost barriers, R&D collaboration potential)

11.4. Issues and Challenges (road quality, ODD weather limits, insurance clarity, data privacy)

11.5. Government Regulations and Policy Framework (DOTr/LTFRB pilot programs, LTO homologation, DICT spectrum, DPWH road markings)

12.1. Market Size and Future Potential for Connected & Autonomous Mobility in the Philippines

12.2. Business Models and Revenue Streams (Mobility-as-a-Service, Fleet Subscription, Data Sharing, Software Licensing)

12.3. AV Delivery Models and Vehicle Categories Offered (Passenger, Logistics, Industrial, Specialized)

15.1. Market Share of Key Players (Fleet Deployments, Route Coverage, Software Revenue)

15.2. Benchmark of Key Competitors based on: Company Overview, USP and Differentiating Technology, Business Model and Partnership Networks, Number of Deployed Vehicles & Pilots, Pricing Structure and Service Model, Technology Stack (LiDAR, Radar, AI, Compute Platform), Safety Metrics and Disengagements, Major Clients, SEZ Contracts, and Smart City Projects, Strategic Tie-Ups (Telcos, OEMs, Integrators), Marketing Strategy and Positioning, Recent Developments and Funding Updates

15.3. Operating Model Analysis Framework (AV Fleet Operations, Tele-Ops Centers, Simulation Pipelines)

15.4. Gartner-Style Quadrant for Technology Leadership and Market Presence

15.5. Bowman’s Strategic Clock Analysis for Competitive Advantage

16.1. Revenues (Fleet Deployments, Software, Data, and Service Layer)

17.1. By Market Structure (In-House and Outsourced Operations)

17.2. By Automation Level (L2+, L3, L4 Passenger, L4 Logistics)

17.3. By Application Domain (Passenger Shuttle, Robotaxi, Logistics, Industrial, Mining)

17.4. By Company Size (Startups, Integrators, Global Players)

17.5. By Vehicle Platform (Passenger, Cargo, Retrofit)

17.6. By Mode of Connectivity (C-V2X, DSRC, 5G)

17.7. By Operating Domain (Closed-Campus, Public Roads, Mixed Traffic)

17.8. By Region (NCR, Clark-Subic, CALABARZON, Cebu, Davao)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Philippines Autonomous Vehicle (AV) Market. Based on this ecosystem, we will shortlist the leading 5–6 AV technology and fleet solution providers operating in or targeting the Philippines, based on their financial strength, operational footprint, route presence, and local partnerships with SEZs, airports, and government authorities. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the AV industry to collate detailed ecosystem-level information on both global and domestic participants, including technology stack providers, fleet operators, and infrastructure enablers.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables a comprehensive understanding of the Philippines AV market and the underlying ecosystem. We analyze metrics such as fleet deployment volumes, automation level penetration, logistics corridor density, regulatory milestones, and infrastructure readiness. We also perform company-level examinations covering operational data, partnership models, financial statements, investor briefings, and press announcements. Regulatory analysis includes review of DOTr, LTO, and DPWH circulars, while infrastructure data are taken from PPA, CAB, and DPWH statistical publications. This process aims to build a reliable foundation for hypothesis testing and market sizing exercises, ensuring an accurate baseline of both industry structure and stakeholder dynamics.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and senior operational leaders representing autonomous vehicle OEMs, technology integrators, logistics fleet owners, SEZ authorities, telecom partners, and regulatory officials in the Philippines. These interviews serve multiple purposes — to validate market assumptions, authenticate quantitative indicators like fleet size and operating kilometers, and to extract insights into pricing, safety validation, and tele-operations models. A bottom-to-top approach is adopted to aggregate revenue contributions and operational metrics of each player, thereby developing the total market structure. As part of our validation strategy, our team conducts disguised interviews, approaching companies as potential clients to cross-verify claims regarding deployment scale, maintenance cost, and safety statistics. This technique enhances the credibility of our data triangulation, aligning on-the-ground information with secondary database intelligence.

Step 4: Sanity Check

A top-to-bottom and bottom-to-top validation is performed to ensure the reliability of market estimates and operational assumptions. Multiple market size modeling exercises are undertaken by reconciling the total addressable fleet volume with route density and logistics corridor readiness. Through iterative checks between infrastructure data (e.g., 35,164.13 kilometers of national roads reported by DPWH), operational figures from logistics corridors (e.g., 1,800,778.75 TEUs handled across ports per PPA), and stakeholder interviews, the analysis undergoes rigorous sanity testing. This step ensures that our Philippines AV market insights are both quantitatively sound and aligned with ground realities across SEZs, airports, and industrial parks.

FAQs

01 What is the Potential for the Philippines Autonomous Vehicle Market?

The Philippines Autonomous Vehicle (AV) Market holds immense potential as the nation moves toward intelligent transport systems and automated logistics. With a GDP of USD 497.5 billion and a population exceeding 112.7 million, the country provides a robust foundation for advanced mobility solutions. Investments in infrastructure, including 35,164.13 kilometers of national roads, combined with expanding smart city and SEZ projects, have positioned the Philippines as a regional testbed for AV technologies. These developments are expected to drive widespread adoption across logistics, public transport, and industrial corridors, supporting sustainable mobility and efficiency.

02 Who are the Key Players in the Philippines Autonomous Vehicle Market?

The Philippines Autonomous Vehicle Market includes a blend of global AV pioneers and regional mobility innovators. Leading players such as Waymo, Cruise, Mobileye, May Mobility, and Huawei ADS are advancing AI-driven, LiDAR-enabled, and C-V2X-based systems tailored for local routes. Other significant contributors include Pony.ai, Baidu Apollo, AutoX, Zoox, and Motional, each adapting their technologies for the country’s urban and industrial ODDs. Supporting ecosystem partners such as Toyota Mobility Foundation, Zenmov, NVIDIA, Qualcomm, and EasyMile are strengthening collaborations with SEZ authorities, government transport agencies, and telecom operators to facilitate integration and deployment.

03 What are the Growth Drivers for the Philippines Autonomous Vehicle Market?

Key growth drivers include robust connectivity infrastructure, surging urban mobility needs, and strong government support for modernization. The 72.6 million active mobile-broadband subscriptions enable seamless tele-operation and vehicle connectivity nationwide. High logistics throughput, illustrated by 149,224 annual shipcalls and 1,800,778.75 TEUs handled through ports, underlines the scalability of autonomous operations. Further, implementation of the Electric Vehicle Industry Development Act and smart-mobility projects under DOTr are fostering a favorable policy landscape, encouraging investments in fleet automation across airports, economic zones, and industrial estates.

04 What are the Challenges in the Philippines Autonomous Vehicle Market?

The Philippines AV market faces multifaceted challenges across infrastructure, safety, and policy alignment. The 35,164 kilometers of national roads still lack consistent digital mapping and lane-marking standards, complicating full-scale deployment. Road safety remains a concern, with 13,125 fatalities recorded from land transport incidents, emphasizing the need for stringent safety validation. Additionally, 20 tropical cyclones annually—of which 8–9 typically make landfall—create adverse weather conditions that disrupt perception sensors and operational stability. Compliance with data localization laws and limited clarity in testing licensing frameworks further add to deployment complexity and timeline delays.