Philippines Carpooling Platforms Market Outlook to 2035

By Platform Type, By User Segment, By Trip Type, By Monetization Model, and By Region

- Product Code: TDR0530

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Philippines Carpooling Platforms Market Outlook to 2035 – By Platform Type, By User Segment, By Trip Type, By Monetization Model, and By Region” provides a comprehensive analysis of the carpooling and shared-ride digital platforms operating across the Philippines. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; platform and usage trends, regulatory and policy environment, user-level demand profiling, key operational and adoption challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and profiling of major carpooling platforms active in the Philippines.

The report concludes with future market projections based on urban congestion patterns, commuting behavior shifts, smartphone and mobile wallet penetration, public transport capacity constraints, fuel cost dynamics, sustainability and traffic decongestion initiatives, regional urbanization trends, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and structural risks shaping the Philippines carpooling platforms market through 2035.

Philippines Carpooling Platforms Market Overview and Size

The Philippines carpooling platforms market is valued at approximately ~USD ~ million, representing digital platforms that enable shared rides among private vehicle owners and passengers traveling along similar routes, either on a recurring or on-demand basis. These platforms typically operate via mobile applications that facilitate ride matching, routing optimization, cost-sharing mechanisms, digital payments, user verification, and basic trust and safety features.

Carpooling platforms in the Philippines primarily address daily commuting needs in dense urban corridors, especially where public transport capacity is constrained, travel times are unpredictable, and private vehicle ownership remains unevenly distributed across income groups. The market includes both pure carpooling models (cost-sharing, non-profit or lightly monetized) and hybrid shared mobility platforms that combine carpooling with ride-hailing, shuttle aggregation, or corporate transport solutions.

Market growth is anchored by persistent urban traffic congestion, rising fuel and vehicle ownership costs, expanding smartphone penetration, and the increasing acceptance of app-based mobility solutions among working professionals and students. Carpooling is also gaining relevance as a complementary mode rather than a direct substitute to mass transit, particularly for first-mile and last-mile connectivity in large metropolitan regions.

Metro Manila represents the largest demand center for carpooling platforms in the Philippines, driven by high population density, long average commute times, and chronic congestion across key arterial routes. The National Capital Region is followed by secondary urban clusters such as Cebu, Davao, and emerging metropolitan areas in Central Luzon and CALABARZON, where suburban expansion and inter-city commuting are increasing. Provincial markets remain relatively underpenetrated, with adoption limited by lower vehicle density, fragmented demand, and weaker digital platform awareness.

What Factors are Leading to the Growth of the Philippines Carpooling Platforms Market:

Severe urban congestion and long commute times strengthen structural demand for shared rides: The Philippines consistently ranks among the most congested urban mobility markets in Southeast Asia, particularly in Metro Manila, where average commute durations are high and peak-hour delays are structurally embedded. Carpooling platforms address this pain point by enabling vehicle seat optimization and reducing the per-capita cost of commuting. For users who already own cars, carpooling helps offset fuel, toll, and parking expenses, while passengers benefit from relatively faster and more predictable travel compared to overcrowded public transport options. This congestion-driven utility forms the foundational demand layer for carpooling platforms.

Rising fuel prices and vehicle operating costs encourage cost-sharing behavior: Fuel price volatility, increasing toll charges, and higher maintenance costs have made daily private vehicle commuting increasingly expensive for Filipino households. Carpooling introduces a cost-sharing mechanism that allows drivers to partially recover operating expenses while maintaining control over routes and schedules. For passengers, carpooling offers a mid-point alternative between low-cost but unreliable public transport and higher-cost ride-hailing services. This economic rationality is particularly appealing to middle-income professionals, students, and suburban commuters traveling fixed routes on a regular basis.

High smartphone and digital payment adoption supports platform scalability: The Philippines has one of the highest social media and mobile app engagement rates globally, supported by widespread smartphone usage and growing adoption of e-wallets and digital payments. This digital readiness lowers friction for onboarding users onto carpooling platforms and enables features such as real-time matching, in-app communication, cashless payments, and ratings-based trust systems. As digital financial infrastructure matures further, carpooling platforms are increasingly able to integrate subscription models, corporate billing, and incentive-based loyalty mechanisms.

Which Industry Challenges Have Impacted the Growth of the Philippines Carpooling Platforms Market:

Regulatory ambiguity around carpooling versus ride-hailing limits platform scalability and investor confidence: Carpooling platforms in the Philippines operate within a regulatory gray zone, often positioned between informal cost-sharing arrangements and fully commercial ride-hailing services. Unlike licensed transport network vehicle services (TNVS), carpooling models are typically not designed for profit per trip, which creates uncertainty around licensing, fare structures, insurance requirements, and enforcement. This ambiguity limits the ability of platforms to scale aggressively, launch monetization features, or partner formally with employers and institutions, as regulatory risk remains a key concern for both operators and users.

Trust, safety, and user verification concerns constrain broader user adoption: Despite growing digital literacy, a significant portion of potential users remain cautious about sharing rides with unknown drivers or passengers. Concerns related to personal safety, data privacy, route deviations, punctuality, and dispute resolution affect willingness to adopt carpooling at scale. While platforms deploy ratings, identity verification, and in-app communication tools, the absence of standardized safety protocols and clearly enforced liability frameworks reduces confidence among first-time users, particularly women and older commuters. This trust barrier slows conversion from awareness to regular usage.

Irregular commuting patterns and weak route density affect matching efficiency: Effective carpooling relies on high route density and predictable travel patterns. In many Philippine cities, commuting schedules are irregular due to flexible work hours, hybrid work models, weather disruptions, and variable traffic conditions. These factors reduce matching efficiency, leading to longer wait times or limited ride availability during off-peak hours. In lower-density suburban and provincial markets, insufficient demand concentration further constrains platform economics and user experience, making it difficult to achieve consistent service reliability.

What are the Regulations and Initiatives which have Governed the Market:

Transport and mobility policies influencing shared mobility classification and compliance requirements: The Philippines’ transport regulatory framework is primarily designed around public utility vehicles and commercial transport services, with limited explicit categorization for non-commercial carpooling platforms. Oversight bodies such as transport and traffic management authorities influence how platforms are perceived, particularly when monetary contributions are involved. The lack of standardized national guidelines results in inconsistent interpretations across cities, affecting platform operations, enforcement exposure, and long-term planning. Clear differentiation between cost-sharing and for-profit mobility remains a critical policy gap.

Local government traffic management and congestion mitigation initiatives shaping platform relevance: Several urban local governments promote traffic decongestion, ride-sharing, and demand management initiatives as part of broader mobility improvement plans. While these initiatives indirectly support carpooling adoption, implementation is often fragmented and pilot-driven rather than institutionalized. Carpooling platforms may benefit from priority lanes, parking incentives, or employer-led mobility programs in select jurisdictions, but the absence of uniform policies limits nationwide impact. Localized rules also increase operational complexity for platforms attempting multi-city expansion.

Data privacy, digital platform compliance, and consumer protection regulations influencing platform design: Carpooling platforms must comply with national data privacy laws governing personal information, location tracking, and digital identity management. These regulations influence app architecture, user onboarding processes, and data storage practices. In addition, consumer protection frameworks affect dispute handling, transparency in cost-sharing mechanisms, and communication of platform terms. While compliance strengthens platform credibility, it also increases operating costs and technical complexity, particularly for smaller or early-stage platforms.

Philippines Carpooling Platforms Market Segmentation

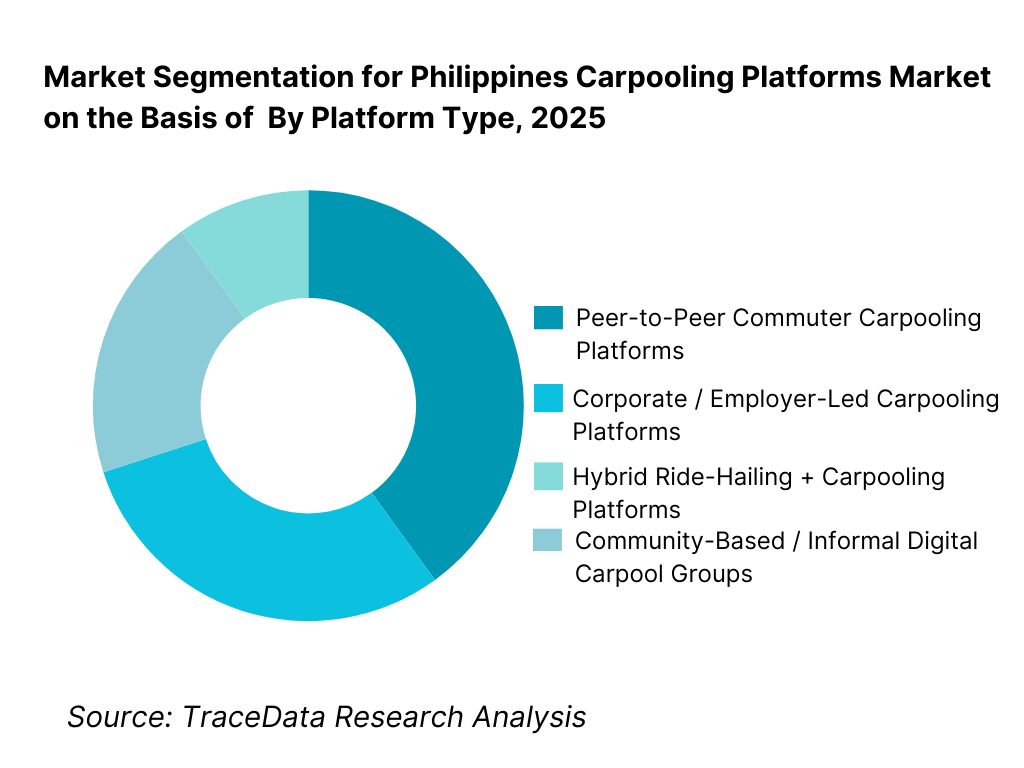

By Platform Type: Peer-to-peer commuter carpooling platforms hold dominance in the Philippines carpooling platforms market. This is because daily commuting demand—especially among office-goers and students—aligns strongly with route-based, repeatable, and cost-sharing carpooling models. These platforms are optimized for fixed origin–destination corridors, predictable travel timings, and recurring ride matching, particularly in congested urban regions such as Metro Manila. While corporate carpooling and hybrid ride-sharing models are gaining traction, peer-to-peer commuter-focused platforms continue to benefit from volume-driven daily demand and low entry barriers for both drivers and passengers.

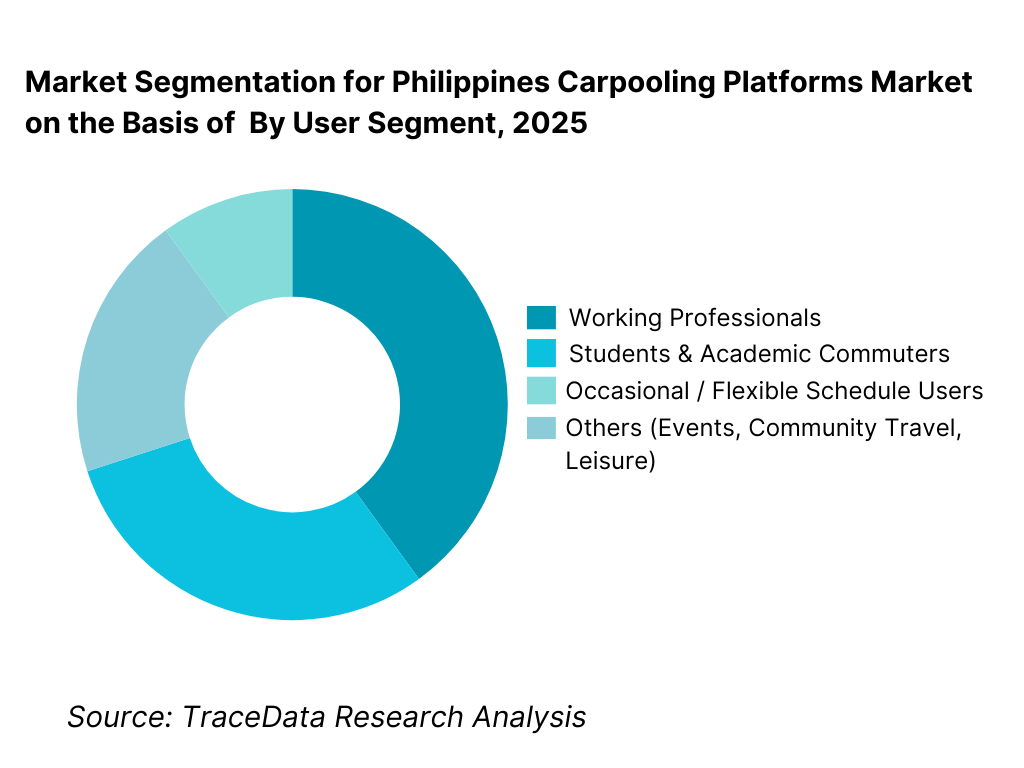

By User Segment: Working professionals represent the largest user segment in the Philippines carpooling platforms market. This segment is driven by long daily commute distances, fixed office schedules, and rising costs associated with private vehicle usage and ride-hailing alternatives. Professionals value reliability, predictable timing, and cost-sharing efficiency, making them the most consistent users of carpooling services. Students and academic commuters form the second-largest segment, particularly around university clusters, while occasional users and leisure travelers contribute smaller but growing volumes.

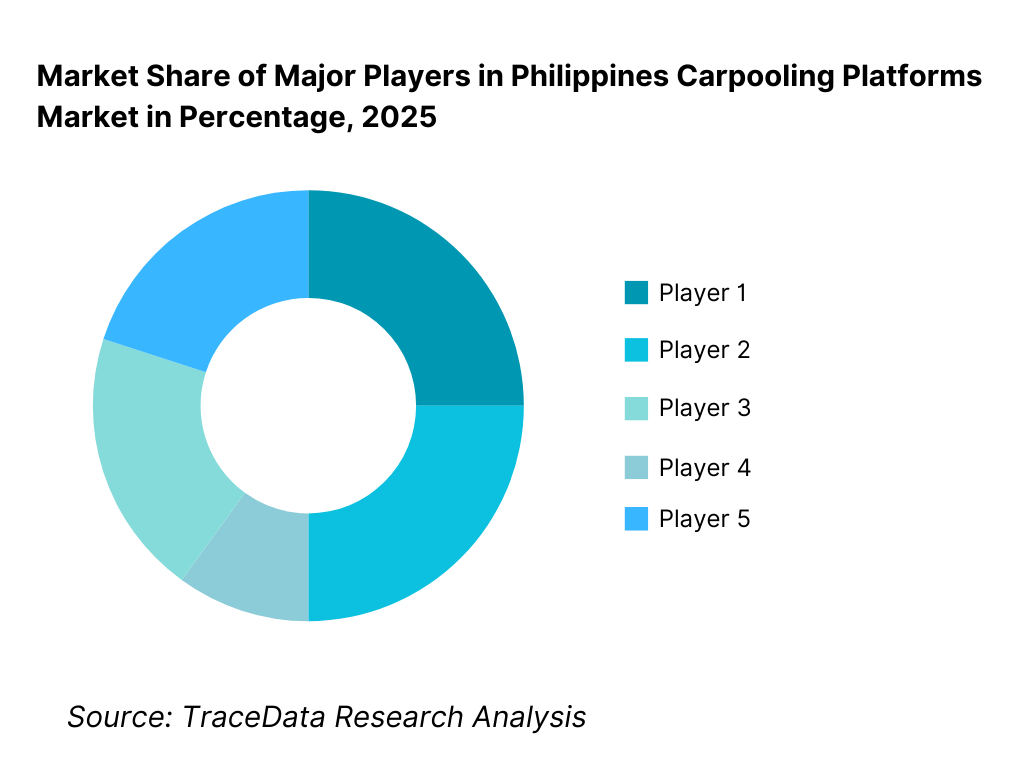

Competitive Landscape in Philippines Carpooling Platforms Market

The Philippines carpooling platforms market remains fragmented and evolving, characterized by a mix of dedicated carpooling startups, hybrid ride-hailing platforms, corporate mobility solutions, and informal community-led digital groups. Market leadership is not driven purely by scale but by user trust, route density, platform usability, and integration with daily commuting behavior.

Unlike mature ride-hailing markets, carpooling platforms in the Philippines face softer network effects and higher behavioral barriers, resulting in moderate user switching and localized dominance along specific routes or communities. Entry barriers remain relatively low, but sustainable scaling is constrained by regulatory uncertainty, monetization challenges, and user safety considerations.

Name | Founding Year | Original Headquarters |

Grab (Carpool / Shared Ride Features) | 2012 | Singapore |

Sakay.ph (Shared Route Discovery) | 2015 | Manila, Philippines |

ToGo | ~2018 | Philippines |

Carpool PH | ~2016 | Philippines |

Facebook Groups (Community Carpools) | 2004 | Menlo Park, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Grab (Shared Ride Features): Grab’s shared mobility offerings leverage its existing ride-hailing user base, payment ecosystem, and brand trust. While not a pure carpooling platform, its ability to bundle shared rides within a broader mobility super-app provides scale advantages. However, regulatory scrutiny and cost structures limit aggressive expansion of true cost-sharing models.

Sakay.ph: Sakay.ph focuses primarily on route intelligence and public transport navigation but plays a supporting role in carpooling by improving route predictability and commute planning. Its strength lies in data-driven urban mobility insights rather than direct ride matching, positioning it as an enabler rather than a primary carpool operator.

Local Startup Carpooling Platforms: Smaller Philippine startups and app-based platforms focus on niche commuter corridors, universities, or corporate parks. Their competitiveness stems from localized community trust, simpler onboarding, and flexibility in cost-sharing arrangements. However, limited funding, weak monetization, and scalability challenges constrain long-term sustainability.

Community-Based Digital Carpool Groups: Informal carpooling organized through social media and messaging platforms remains a significant substitute to formal apps. These groups benefit from zero platform fees and strong social trust but lack safety mechanisms, insurance coverage, dispute resolution, and scalability—creating both competitive pressure and an opportunity for formal platforms to convert users over time.

What Lies Ahead for Philippines Carpooling Platforms Market?

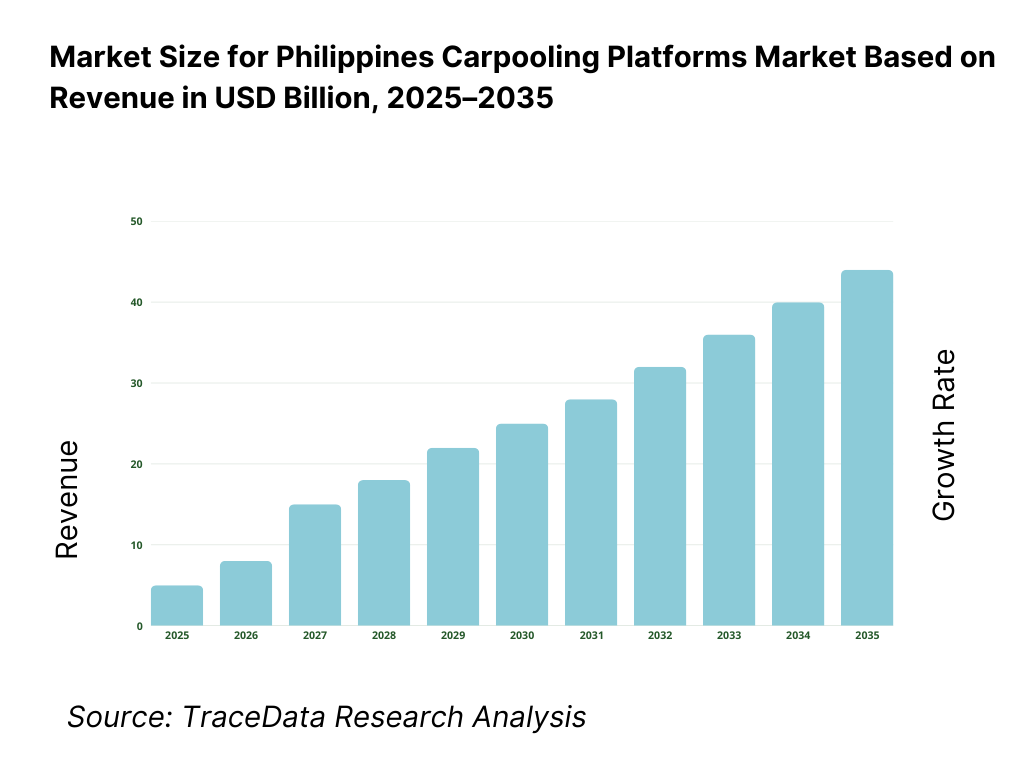

The Philippines carpooling platforms market is expected to expand gradually through 2035, supported by persistent urban congestion, rising commuting costs, growing smartphone and digital payment penetration, and the structural gap between public transport demand and supply in major metropolitan regions. While large-scale mass transit projects will continue to progress, carpooling platforms are likely to remain relevant as flexible, demand-responsive mobility solutions that complement existing transport systems rather than replace them. As commuting patterns evolve and cost sensitivity increases among urban users, organized carpooling is expected to gain wider acceptance, particularly for recurring daily travel.

Transition from informal ride-sharing toward more structured and trusted carpooling platforms: The future of the Philippines carpooling market will see a gradual shift from informal, community-based ride-sharing arrangements toward more structured digital platforms offering standardized safety, verification, and dispute-resolution mechanisms. Users are expected to increasingly favor platforms that provide identity verification, trip tracking, ratings systems, and clearer liability frameworks. Platforms that can balance flexibility with trust-building features will be better positioned to convert occasional users into regular commuters and to differentiate themselves from informal social media–based alternatives.

Growing relevance of recurring commuter-focused and route-based carpooling models: Carpooling adoption will increasingly concentrate around predictable, high-density commuter corridors connecting suburban residential zones to employment hubs, business districts, and educational institutions. Platforms optimized for recurring trips—rather than purely ad-hoc matching—will see stronger retention and operational efficiency. Through 2035, route-based carpooling models aligned with fixed work schedules, hybrid office routines, and institutional travel demand are expected to form the core of sustainable platform growth.

Integration with corporate mobility programs and employer-led commuting initiatives: Corporate participation is expected to play a larger role in the maturation of the carpooling market. Employers facing productivity losses from long employee commute times and rising transport allowances are likely to explore structured carpooling programs as part of broader employee mobility and sustainability strategies. Platforms that offer corporate dashboards, subscription pricing, and integration with HR or facilities management systems will be better positioned to capture this higher-value, lower-churn demand segment.

Improved monetization discipline and diversification of revenue models: As the market evolves, carpooling platforms are expected to move beyond pure transaction-based fees toward more diversified monetization structures. Subscription models for frequent users, corporate contracts, and value-added services such as priority matching, insurance add-ons, or analytics-driven route optimization may gain traction. However, monetization will remain constrained by user price sensitivity, requiring platforms to carefully balance revenue generation with affordability and adoption goals.

Philippines Carpooling Platforms Market Segmentation

By Platform Type

• Peer-to-Peer Commuter Carpooling Platforms

• Corporate / Employer-Led Carpooling Platforms

• Hybrid Ride-Hailing + Carpooling Platforms

• Community-Based / Informal Digital Carpool Groups

By User Segment

• Working Professionals

• Students & Academic Commuters

• Occasional / Flexible Schedule Users

• Others (Events, Community Travel, Leisure)

By Trip Type

• Daily Recurring Commute Trips

• Inter-City / Suburban Commute Trips

• Ad-Hoc / One-Time Shared Trips

By Monetization Model

• Commission / Platform Fee-Based

• Subscription-Based (Corporate / Premium Users)

• Advertising & Partnerships

• Non-Monetized / Cost-Sharing Only

By Region

• Metro Manila

• CALABARZON

• Central Luzon

• Cebu

• Davao

• Rest of the Philippines

Players Mentioned in the Report:

• Grab (Shared Ride and Hybrid Mobility Offerings)

• Local and Regional Carpooling Startups

• Corporate Mobility Solution Providers

• Community-Based Digital Carpool Networks

• Emerging Mobility and Transport-Tech Platforms

Key Target Audience

• Carpooling and shared mobility platform operators

• Corporate employers and HR / facilities management teams

• Urban mobility planners and transport consultants

• Local government and traffic management authorities

• Investors focused on mobility, platform economy, and urban infrastructure

• Technology providers supporting mobility platforms

• Sustainability and ESG-focused organizations

Time Period:

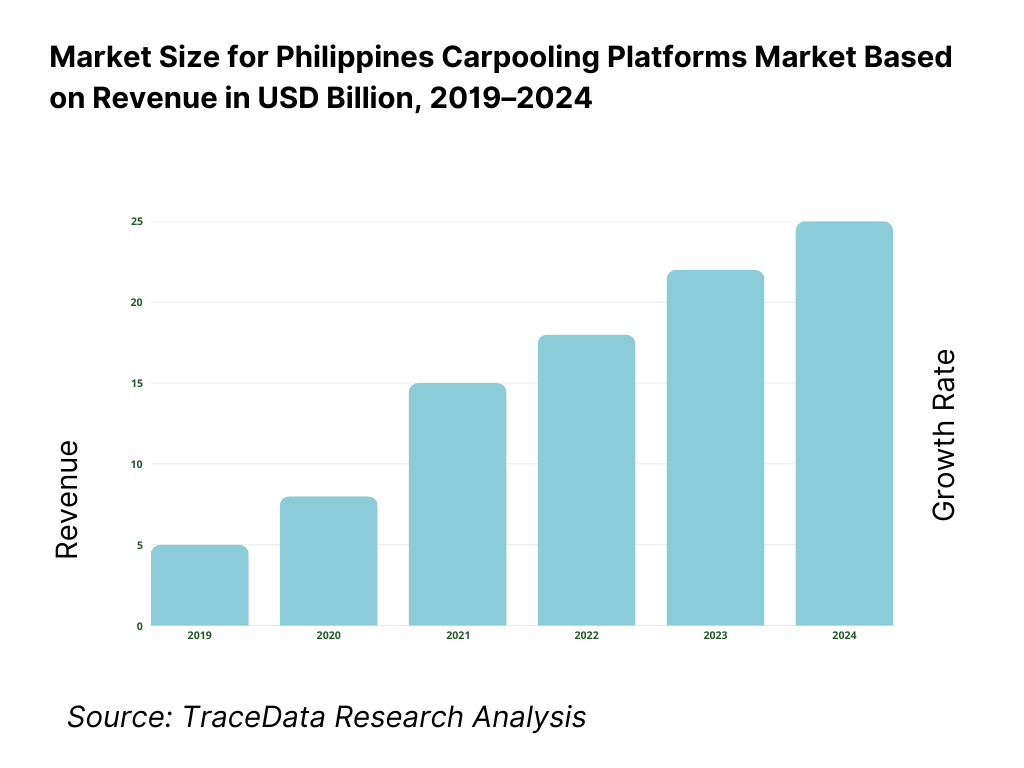

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Philippines Carpooling Platforms Market

4. Value Chain Analysis

4.1 Delivery Model Analysis for Carpooling Platforms including peer-to-peer commuter carpooling, corporate or employer-led carpooling, hybrid ride-hailing plus carpooling models, and community-based digital carpool networks with margins, preferences, strengths, and weaknesses

4.2 Revenue Streams for Carpooling Platforms Market including platform commissions, subscription fees, corporate contracts, advertising and partnerships, and ancillary services

4.3 Business Model Canvas for Carpooling Platforms Market covering drivers, passengers, platform operators, corporate employers, payment partners, mapping and routing providers, and insurance or risk partners

5. Market Structure

5.1 Global Mobility Platforms vs Regional and Local Carpooling Players including hybrid ride-hailing platforms, local startups, and community-led digital carpool networks

5.2 Investment Model in Carpooling Platforms Market including platform technology investments, user acquisition spending, corporate mobility programs, and partnership-led expansion

5.3 Comparative Analysis of Carpooling Platform Distribution by Direct-to-Consumer and Corporate or Community-Based Channels including employer partnerships and closed-user-group models

5.4 Consumer Mobility Budget Allocation comparing carpooling spend versus public transport, ride-hailing, and private vehicle commuting with average spend per commuter per month

6. Market Attractiveness for Philippines Carpooling Platforms Market including urban congestion levels, smartphone penetration, digital payment adoption, commuter density, and sustainability potential

7. Supply-Demand Gap Analysis covering commuter demand intensity, route density constraints, platform availability, pricing sensitivity, and adoption barriers

8. Market Size for Philippines Carpooling Platforms Market Basis

8.1 Revenues from historical to present period

8.2 Growth Analysis by platform type and by monetization model

8.3 Key Market Developments and Milestones including platform launches, regulatory discussions, corporate mobility initiatives, and major partnership announcements

9. Market Breakdown for Philippines Carpooling Platforms Market Basis

9.1 By Market Structure including global mobility platforms, regional platforms, and local carpooling players

9.2 By Platform Type including peer-to-peer carpooling, corporate carpooling, hybrid ride-hailing plus carpooling, and community-based models

9.3 By Monetization Model including commission-based, subscription-based, advertising-supported, and cost-sharing-only models

9.4 By User Segment including working professionals, students, occasional users, and community-based users

9.5 By Consumer Demographics including age groups, income levels, and urban versus suburban users

9.6 By Device Type including smartphones, feature phones with app access, and web-based platforms

9.7 By Usage Type including recurring commute usage and ad-hoc shared trips

9.8 By Region including Metro Manila, CALABARZON, Central Luzon, Cebu, Davao, and Rest of Philippines

10. Demand Side Analysis for Philippines Carpooling Platforms Market

10.1 Commuter Landscape and Cohort Analysis highlighting office commuters, student clusters, and suburban travel patterns

10.2 Platform Selection and Usage Decision Making influenced by cost savings, safety perception, convenience, and route availability

10.3 Engagement and ROI Analysis measuring usage frequency, ride match success rates, and user retention

10.4 Gap Analysis Framework addressing trust and safety gaps, regulatory ambiguity, and platform differentiation challenges

11. Industry Analysis

11.1 Trends and Developments including growth of hybrid work, employer-led mobility programs, and app-based shared commuting

11.2 Growth Drivers including traffic congestion, fuel cost pressure, smartphone penetration, and digital payment adoption

11.3 SWOT Analysis comparing platform scalability versus trust and regulatory constraints

11.4 Issues and Challenges including safety concerns, route density limitations, monetization pressure, and competition from ride-hailing and informal transport

11.5 Government Regulations covering transport classification, data privacy, digital platform compliance, and local traffic management policies in the Philippines

12. Snapshot on Shared Mobility and Carpooling Ecosystem in the Philippines

12.1 Market Size and Future Potential of shared mobility and carpooling within the broader urban transport ecosystem

12.2 Business Models including pure cost-sharing, freemium platforms, and corporate-sponsored commuting programs

12.3 Delivery Models and Type of Solutions including app-based ride matching, route optimization, and payment integration

13. Opportunity Matrix for Philippines Carpooling Platforms Market highlighting corporate commuting programs, high-density commuter corridors, university-led carpools, and sustainability-driven initiatives

14.PEAK Matrix Analysis for Philippines Carpooling Platforms Market categorizing players by platform maturity, user trust, and route coverage

15. Competitor Analysis for Philippines Carpooling Platforms Market

15.1 Market Share of Key Players by revenues and by active user base

15.2 Benchmark of 15 Key Competitors including hybrid ride-hailing platforms, local carpooling startups, corporate mobility providers, and community-based digital networks

15.3 Operating Model Analysis Framework comparing peer-to-peer carpooling, corporate-led models, and hybrid shared mobility platforms

15.4 Gartner Magic Quadrant positioning global mobility leaders and local challengers in carpooling and shared commute platforms

15.5 Bowman’s Strategic Clock analyzing competitive advantage through cost leadership, differentiation via trust and safety, and niche community focus

16. Future Market Size for Philippines Carpooling Platforms Market Basis

16.1 Revenues with projections

17. Market Breakdown for Philippines Carpooling Platforms Market Basis Future

17.1 By Market Structure including global, regional, and local platforms

17.2 By Platform Type including peer-to-peer, corporate, and hybrid models

17.3 By Monetization Model including commission-based, subscription-based, and advertising-supported

17.4 By User Segment including professionals, students, and occasional users

17.5 By Consumer Demographics including age and income groups

17.6 By Device Type including smartphones and web-based access

17.7 By Usage Type including recurring and ad-hoc trips

17.8 By Region including Metro Manila, CALABARZON, Central Luzon, Cebu, Davao, and Rest of Philippines

18. Recommendations focusing on regulatory clarity, trust and safety enhancement, corporate partnerships, and monetization innovation

19. Opportunity Analysis covering structured commuter corridors, employer-led carpooling, sustainability-linked mobility programs, and platform ecosystem partnerships

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Philippines Carpooling Platforms Market across demand-side and supply-side stakeholders. On the demand side, entities include working professionals, students and academic commuters, suburban households, corporate employers, business parks, universities, and organized communities with recurring travel needs. Demand is further segmented by trip type (daily recurring commute, inter-city commute, ad-hoc shared trips), user profile (individual commuters vs employer-led programs), and willingness to pay (pure cost-sharing vs platform-fee-based usage).

On the supply side, the ecosystem includes dedicated carpooling platform operators, hybrid ride-hailing platforms offering shared ride features, corporate mobility solution providers, digital payment partners, mapping and routing technology providers, identity verification and data security vendors, insurance facilitators, and local transport and traffic management authorities. Informal community-based digital carpool groups are also included as an indirect substitute within the ecosystem.

From this mapped ecosystem, we shortlist 6–10 relevant platforms and solution providers based on user base scale, geographic presence, commuter corridor coverage, monetization approach, and degree of platform formalization. This step establishes how value is created and captured across user acquisition, ride matching, trust and safety mechanisms, payment processing, and platform governance.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the structure, evolution, and operating dynamics of the Philippines carpooling platforms market. This includes reviewing urban mobility trends, traffic congestion data, commuting behavior patterns, fuel price dynamics, smartphone and digital wallet adoption, and public transport capacity constraints across major metropolitan regions.

We analyze platform-level models, including peer-to-peer carpooling, corporate carpool programs, and hybrid shared mobility offerings. User preferences around cost savings, reliability, safety, and convenience are assessed, along with adoption barriers linked to trust, regulation, and matching efficiency. Regulatory and policy dynamics related to shared mobility, transport classification, and data privacy are also examined to understand their impact on platform design and scalability.

The outcome of this stage is a comprehensive market foundation that defines segmentation logic and establishes the assumptions required for market estimation, scenario building, and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with carpooling platform operators, mobility startups, corporate HR and facilities managers, frequent commuters, student groups, and urban mobility experts. The objectives are threefold:

(a) validate assumptions around demand concentration, usage frequency, and commuter corridor density,

(b) authenticate segment splits by platform type, user segment, and monetization model, and

(c) gather qualitative insights on user trust, safety perceptions, pricing sensitivity, regulatory friction, and operational challenges such as ride matching and retention.

A bottom-to-top approach is applied by estimating active user bases, average trip frequency, and platform-level monetization across key regions, which are then aggregated to develop the overall market view. In selected cases, user-style platform interactions and app walkthroughs are conducted to validate onboarding friction, matching reliability, pricing transparency, and in-app safety features, ensuring alignment between reported strategies and actual user experience.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market size estimates, segmentation splits, and forecast assumptions. Demand projections are reconciled with macro indicators such as urban population growth, employment clustering, commuting distance trends, and transport infrastructure expansion timelines.

Sensitivity analysis is conducted across key variables including fuel price movements, adoption of hybrid work models, regulatory clarity on carpooling classification, and corporate participation in structured mobility programs. Market models are refined until consistency is achieved between user behavior, platform economics, and regional mobility dynamics, ensuring a robust and internally coherent outlook through 2035.

FAQs

01 What is the potential for the Philippines Carpooling Platforms Market?

The Philippines carpooling platforms market holds moderate-to-strong long-term potential, driven by chronic urban congestion, rising commuting costs, and gaps in public transport capacity in major cities. Carpooling offers a cost-effective and flexible mobility alternative, particularly for recurring daily commutes. While adoption remains gradual due to trust and regulatory challenges, increasing digital maturity and employer-led mobility initiatives are expected to support sustained growth through 2035.

02 Who are the Key Players in the Philippines Carpooling Platforms Market?

The market comprises a mix of dedicated carpooling startups, hybrid ride-hailing platforms offering shared ride features, corporate mobility solution providers, and informal community-based digital carpool networks. Competition is shaped less by scale alone and more by user trust, route density, platform usability, and integration with daily commuting behavior. Hybrid platforms with existing user bases hold structural advantages, while niche players compete through localized focus and community engagement.

03 What are the Growth Drivers for the Philippines Carpooling Platforms Market?

Key growth drivers include persistent traffic congestion, increasing fuel and vehicle operating costs, high smartphone and digital payment penetration, and growing acceptance of app-based mobility solutions. Additional momentum comes from corporate interest in structured commuting solutions, sustainability narratives linked to reduced single-occupancy vehicle usage, and the need for flexible first-mile and last-mile connectivity in urban and suburban corridors.

04 What are the Challenges in the Philippines Carpooling Platforms Market?

Major challenges include regulatory ambiguity around carpooling classification, user trust and safety concerns, inconsistent ride matching due to irregular commuting patterns, and competition from subsidized ride-hailing services and entrenched informal transport modes. Monetization remains constrained by user price sensitivity, requiring platforms to balance affordability with operational sustainability as the market matures.