Philippines Digital Banking Market Outlook to 2030

By Bank Type, By Product/Service Offering, By Customer Segment, By Technology Platform, and By Region

- Product Code: TDR0366

- Region: Asia

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Philippines Digital Banking Market Outlook to 2030 – By Bank Type, By Product/Service Offering, By Customer Segment, By Technology Platform, and By Region” provides a comprehensive analysis of the digital banking industry in the Philippines. The report covers an overview and genesis of the industry, overall market size in terms of transaction value and revenues, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the digital banking market. The report concludes with future market projections based on transaction volumes, product categories, customer cohorts, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

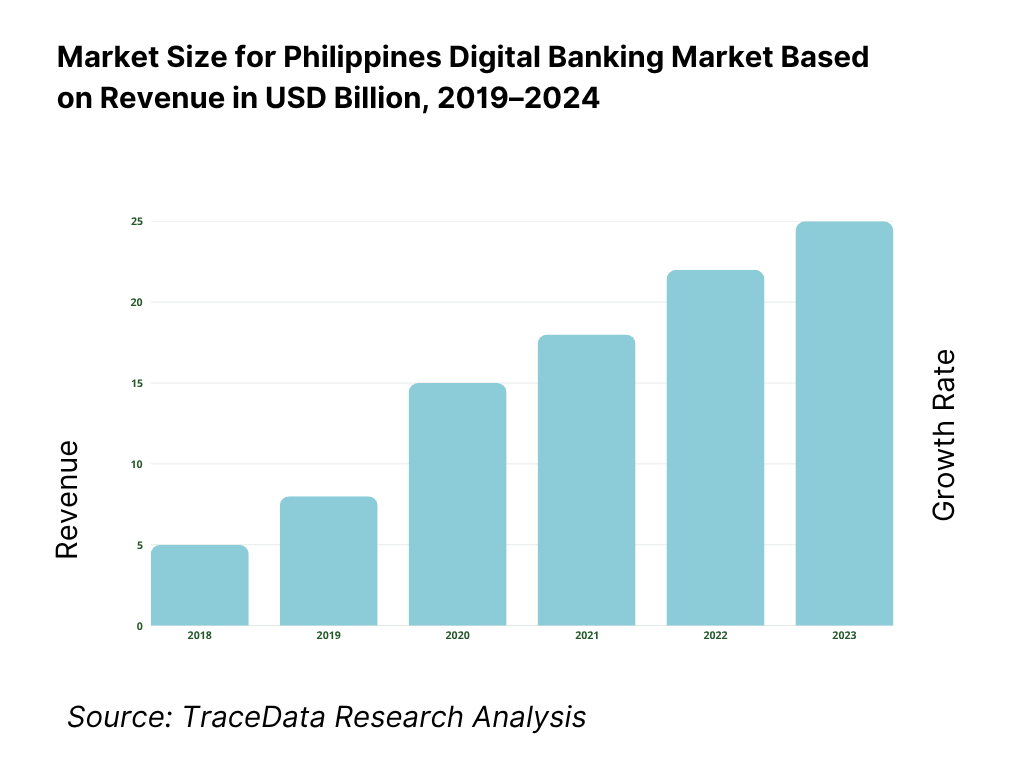

Philippines Digital Banking Market Overview and Size

The Philippines’ digital banking market is anchored in rapidly expanding retail e-payments. Based on the central bank’s retail e-payments measurement, monthly digital transaction value reached USD 110.5 billion, reflecting the mainstreaming of QR Ph, InstaPay and PESONet rails across wallets and banks. The following cycle rose further to USD 136.0 billion per month as person-to-merchant, P2P and B2B supplier payments deepened their shift to cash-lite channels, underpinned by additional settlement windows and pro-inclusion policy.

Metro Manila anchors usage due to wallet penetration, merchant QR acceptance and dense bank networks; Cebu and Davao follow on the back of BPO hubs, logistics corridors and e-commerce density. Use-case data show merchant payments and P2P transfers driving digital volumes, while supplier payments and government disbursements pull high-value transactions; monthly digital value printed USD 110.5 billion then USD 136.0 billion, mirroring these urban demand patterns and policy pushes (e.g., QR Ph P2M, consumer redress, MPAA circulars).

What Factors are Leading to the Growth of the Philippines Digital Banking Market:

Scale effects from population, smartphones, and formal rails adoption: The Philippines’ large addressable base and device access feed digital banking usage. The World Bank reports a population of 115,843,670 people, creating a broad retail and MSME pool for account onboarding and payments. Mobile cellular access is deep: the World Bank/ITU series shows 117.276 mobile subscriptions per 100 people in 2023, supporting app-first banking and QR payments. On the transaction side, the Bangko Sentral ng Pilipinas (BSP) records retail e-payments running at USD 136.0 billion per month in its latest measurement cycle, up from USD 110.5 billion per month in the prior cycle—evidence that national rails (InstaPay/PESONet, QR Ph) are now everyday utilities that anchor recurring digital financial activity and cross-sell.

Remittances and macro liquidity supporting deposits and transfers: Remittances provide stable inflows that digital banks and wallets can capture as deposits, transfers, and bill-pay. BSP’s media release shows cash remittances of USD 33.49 billion for 2023, with the subsequent year-to-date tally rising to USD 34.49 billion—a sustained, high-frequency funding stream entering formal channels that strengthens household liquidity and drives digital payment use cases. In parallel, the World Bank places the country’s current-price GDP at USD 429,457,370,000—a large nominal footprint that underpins enterprise payments and payroll digitization across formal supply chains. Together, these macros—steady external inflows and sizable nominal output—reinforce the value passing through national ACH rails and the digital banks/EMIs that intermediate them.

Policy tailwinds: faster settlement, consumer redress, and merchant acceptance: Regulatory actions reduce friction and build trust. BSP Circular No. 1195 sets standardized consumer redress for EFT disputes, while Circular No. 1198 establishes a Merchant Payment Acceptance Activities framework for OPS/acquirers—clarifying roles in onboarding, processing, and support. These harden UX reliability and extend coverage to small merchants. BSP’s 2024 e-payments report documents the effect in systemwide flow: monthly digital value at USD 136.0 billion, with person-to-merchant and supplier payments as major contributors. When combined with a population base of 115,843,670, the regulatory plumbing enables both scale and frequency in digital banking usage across urban and peri-urban corridors.

Which Industry Challenges Have Impacted the Growth of the Philippines Digital Banking Market:

Connectivity and device access gaps across households and regions: Digital banking still depends on reliable internet at the household level. Preliminary government statistics indicate 48.8 households per 100 with internet connection and roughly two of every three individuals aged 10+ using the internet; this translates into millions still offline during peak transacting hours, especially outside core cities. Meanwhile, mobile infrastructure utilization shows 117.276 subscriptions per 100 people, but SIM ownership concentration does not guarantee stable data connectivity or sufficient bandwidth for app KYC and payments authentication. These usage and quality gaps suppress rural QR acceptance, hinder e-KYC completion, and slow migration from cash in remote municipalities.

Cybersecurity and data-protection incidents straining trust and compliance capacity: The National Privacy Commission’s live breach statistics list 35 reportable incidents in January–August 2024 within tracked categories and 21 notifications from financial services among top reporting sectors, while the Philippine National Police flagged 6 notifications in a single month tied to large enterprises. Even with redress rules, these incidents force banks/EMIs to invest in SOC tooling and fraud operations, raising onboarding and transaction scrutiny. Elevated complaint mediation loads at the central bank—BSP disclosed 703 mediated cases for 2024—signal consumer-experience frictions that digital banks must solve without increasing abandonment at signup or checkout.

Macro headwinds affecting household cashflows and merchant resiliency: Nominal output is large but growth dynamics and prices influence discretionary spend that fuels digital transactions. The World Bank pegs current-price GDP at USD 429,457,370,000 with 115,843,670 people—scale that coexists with price variability captured in the PSA’s CPI series (2018=100), where monthly indices moved through 2024 to 2025 around new highs. Even when inflation moderates, utilities and transport index levels can dampen basket sizes for QR purchases and delay MSME upgrades to formal acceptance. These macro frictions intersect with settlement-fee sensitivity at micro-merchants, slowing full displacement of cash in provincial corridors despite rails availability.

What are the Regulations and Initiatives which have Governed the Market:

Digital bank license regime with hard capital and prudential requirements: BSP Circular No. 1105 establishes “digital bank” as a distinct bank class with a PHP 1,000,000,000 minimum capitalization and full prudential obligations on IT risk, outsourcing, governance, AML/CFT, and consumer protection. The framework restricts brick-and-mortar expansion and anchors supervisory visibility through a single head office, aligning purely digital operations to bank-level standards. For market participants, the capital floor and prudential stack set clear entry and scaling thresholds, and they formalize expectations for liquidity, risk, and data-security controls that underpin instant payments, card issuance, and credit at app scale.

Open Finance Framework enabling secure data portability and interoperability: BSP Circular No. 1122 adopts the Open Finance Framework, creating a governed structure for consented data sharing via APIs across banks, EMIs, and fintechs. The circular (Monetary Board Resolution No. 730) formalizes tiers of data and oversight arrangements under the Open Finance Oversight Committee, enabling use-case development such as alternative credit scoring and multi-bank account aggregation. With 115,843,670 residents and 117.276 mobile subscriptions per 100 people, standardized data access materially expands underwriting and personalization in digital banking while ensuring risk controls and accountability among participating institutions and TPSPs.

Consumer redress & merchant acceptance rules strengthening payments trust and reach: BSP Circular No. 1195 codifies consumer redress standards for account-to-account EFTs, requiring ACH participants and clearing switch operators to meet turnaround and disclosure norms—critical as monthly digital value prints USD 136.0 billion in the latest cycle. BSP Circular No. 1198 regulates Merchant Payment Acceptance Activities (MPAA), defining merchant acquisition, processing, and support obligations for operators and acquirers. Together, these rules stabilize dispute resolution and scale QR Ph acceptance to micro-retailers, driving more consistent usage across 115,843,670 residents and safeguarding confidence in InstaPay/PESONet flows.

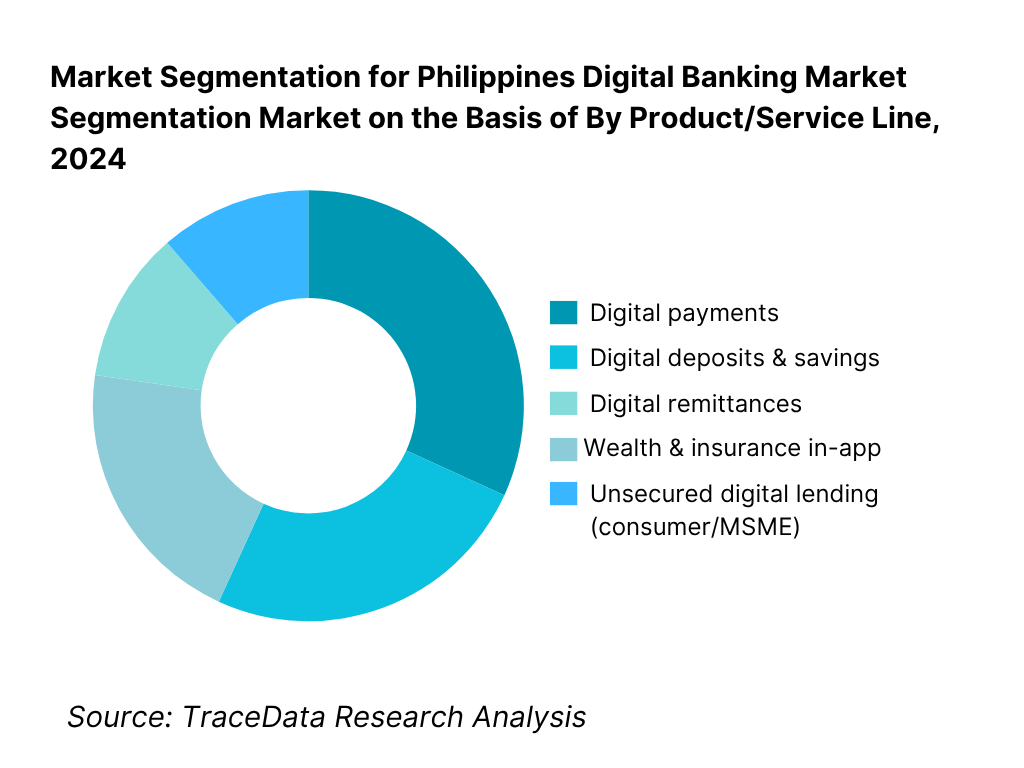

Philippines Digital Banking Market Segmentation

By Product/Service Line: The Philippines Digital Banking market is segmented by product/service line into digital payments, digital deposits & savings, unsecured digital lending (consumer/MSME), digital remittances, and wealth & insurance in-app. Recently, digital payments have a dominant market share under this segmentation because national rails (InstaPay for instant low-value and PESONet for batch high-value) are now ubiquitous across banks and e-money issuers, with QR Ph P2M enabling even micro-merchants to accept wallet payments.

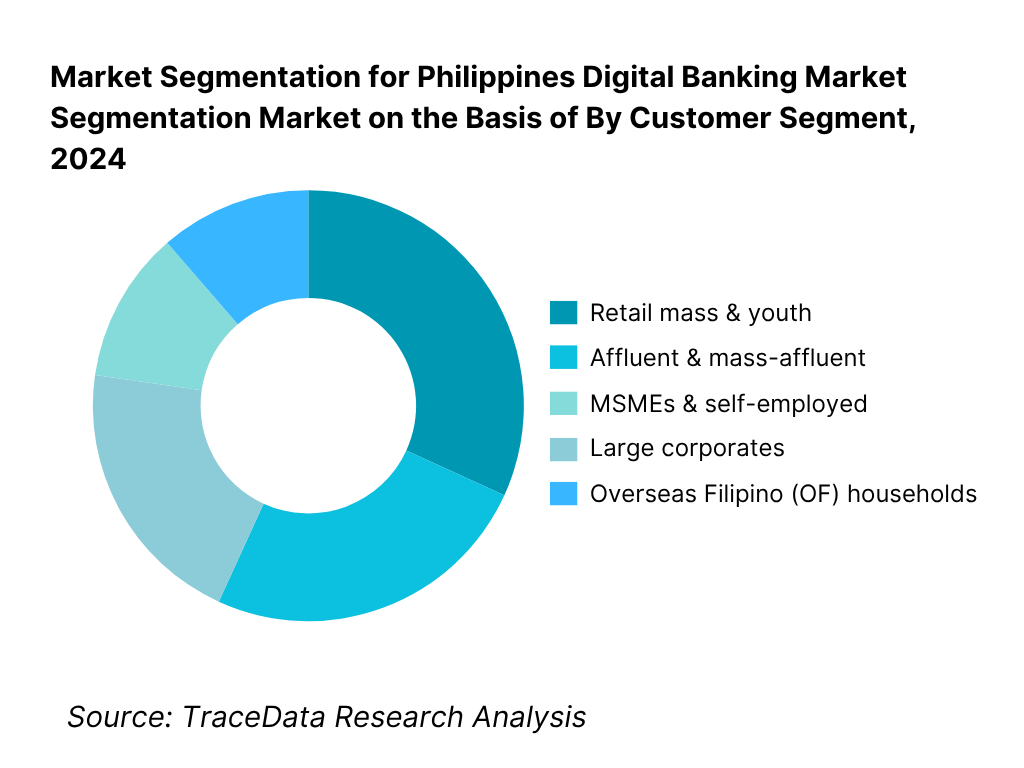

By Customer Segment: The Philippines Digital Banking market is segmented by customer into retail mass & youth, affluent & mass-affluent, MSMEs & self-employed, large corporates, and overseas Filipino (OF) households. Recently, retail mass & youth dominate due to wallet-first adoption, zero-fee instant transfers, and QR acceptance across sari-sari stores, transport and billers. With smartphones as the primary banking interface and data-lite apps, younger cohorts execute frequent small-ticket P2M and P2P transactions that compound into high aggregate value.

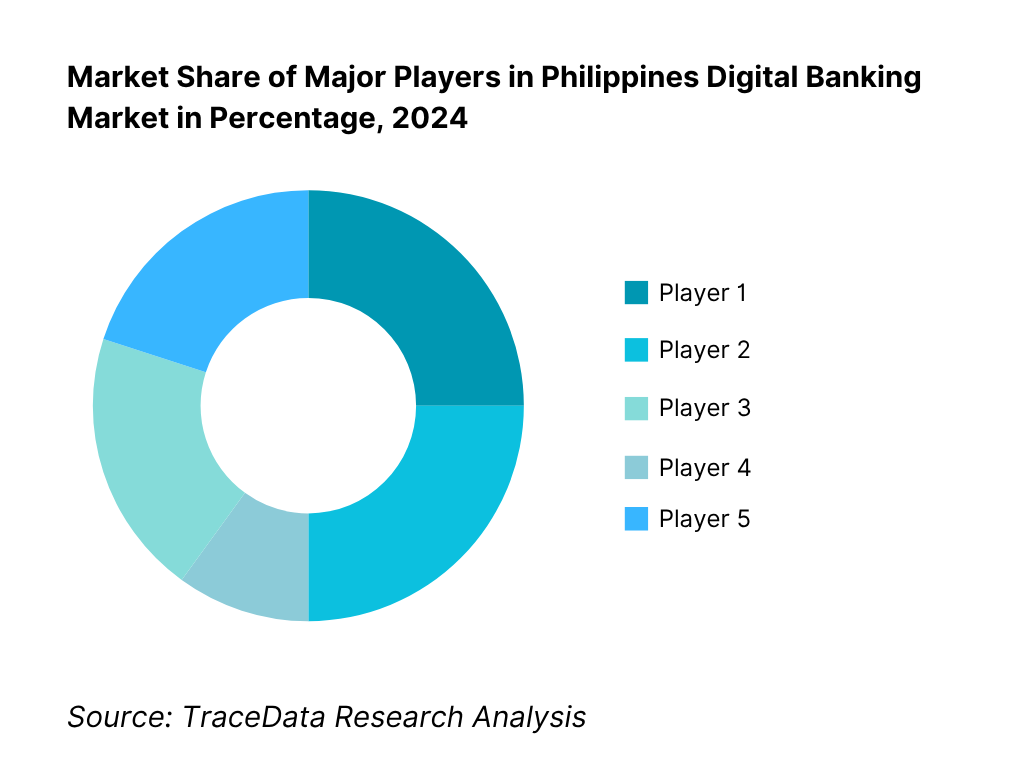

Competitive Landscape in Philippines Digital Banking Market

The Philippines digital banking market is a two-engine arena: e-money/wallet super-apps (e.g., GCash, Maya) that dominate everyday payments, and licensed digital banks (e.g., Maya Bank, Tonik, UnionDigital, GoTyme, UNO Digital Bank, OFBank) scaling deposits and credit. Incumbent universal banks (BPI, BDO, Metrobank, UnionBank) power rails participation and embedded finance, while specialized players (SeaBank, CIMB Bank PH) drive deposit-led growth via mobile-first models. Consolidation of volumes over QR Ph, InstaPay and PESONet, alongside regulatory clarity, gives large ecosystems significant influence over UX, merchant acquiring and cross-sell economics.

Name | Founding Year | Original Headquarters |

GCash (Mynt) | 2004 | Taguig, Philippines |

Maya Bank (formerly PayMaya) | 2007 | Taguig, Philippines |

UnionDigital Bank | 2022 | Muntinlupa, Philippines |

Tonik Digital Bank | 2020 | Makati, Philippines |

GoTyme Bank | 2022 | Pasay, Philippines |

UNO Digital Bank | 2021 | Manila, Philippines |

Overseas Filipino Bank (OFBank) | 2018 | Manila, Philippines |

SeaBank Philippines | 2021 | Taguig, Philippines |

CIMB Bank Philippines | 2018 (PH launch) | Kuala Lumpur, Malaysia |

RCBC DiskarTech | 2020 (launch) | Makati, Philippines |

BPI (BanKo, BPI Online) | 2009 | Makati, Philippines |

BDO Digital (BDO Pay) | 2021 | Mandaluyong, Philippines |

Metrobank (Metrobank Online) | Digital rollout 2017 | Makati, Philippines |

GrabFin Philippines (GrabPay) | 2013 | Singapore |

ShopeePay Philippines | 2019 (PH launch) | Singapore |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

GCash (Mynt): As the largest digital wallet in the Philippines, GCash crossed 81 million registered users and saw merchant acceptance surge in 2024 with QR Ph expansion. The company has deepened its product suite by expanding GCredit, GGives (BNPL), and GSave, highlighting its role as a super-app beyond payments.

Maya Bank: Transitioning from PayMaya to Maya Bank, the company reported growth in its deposit base exceeding PHP 20 billion within its first year of operations. Maya integrated credit, crypto trading, and savings into its wallet ecosystem, positioning itself as the most diversified digital bank in the country.

Tonik Digital Bank: Tonik has scaled aggressively in deposits, surpassing PHP 10 billion within months of launch, largely via time-deposit products with higher yields. In 2023, it emphasized secured lending (auto, home equity, and cash loans), leveraging alternative credit scoring and partnerships with retailers.

UnionDigital Bank: A subsidiary of UnionBank, UnionDigital leveraged its parent’s ecosystem to capture SMEs and embedded finance opportunities. In 2024, it focused on ecosystem lending and building API-based partnerships with e-commerce and logistics firms, solidifying its role in B2B and embedded finance.

GoTyme Bank: Backed by the Gokongwei Group and Tyme Group, GoTyme expanded its customer acquisition through retail kiosks across malls and supermarkets. In 2024, it prioritized democratizing investments and savings by offering low-barrier entry products, while integrating seamlessly with Gokongwei’s retail network.

What Lies Ahead for Philippines Digital Banking Market?

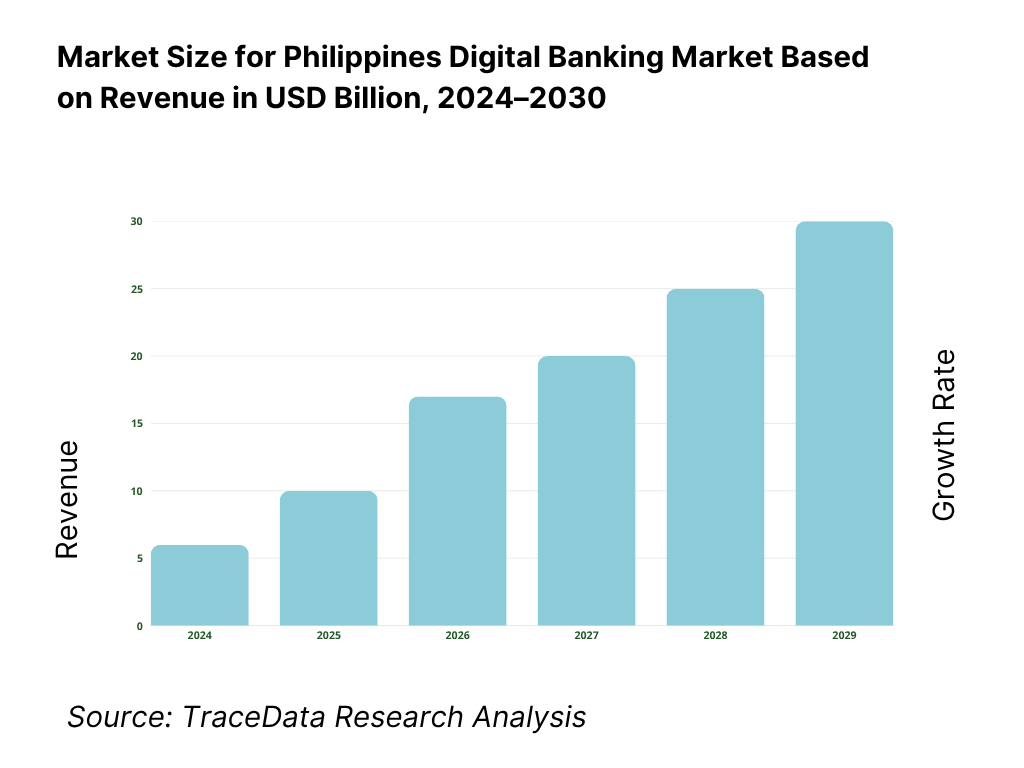

The Philippines digital banking market is set to expand steadily over the next planning cycle, supported by strong regulatory backing from the Bangko Sentral ng Pilipinas (BSP), sustained remittance inflows, and rapid consumer adoption of mobile-first platforms. This momentum will be shaped by inclusion-focused policies, the proliferation of QR Ph, and the shift of micro, small, and medium enterprises (MSMEs) into formal digital ecosystems.

Rise of Super-App Ecosystems: The future of digital banking in the Philippines will see wallets and digital banks evolve into full-service super-apps, integrating payments, deposits, credit, investments, and insurance. This shift is enabled by customer demand for convenience and the scalability of mobile-first platforms.

Stronger Embedded Finance & SME Solutions: With MSMEs accounting for nearly the entire business base of the country, digital banks will increasingly embed finance into retail and e-commerce platforms, providing tailored credit, payroll, and supplier-payment solutions to fuel their growth.

Acceleration of Interoperability and Cross-Border Payments: The BSP’s participation in global fast-payment linkages (e.g., Project Nexus) will enhance cross-border connectivity, allowing overseas Filipino remittances and regional trade payments to settle faster, more cheaply, and with greater transparency.

Adoption of AI-Driven Risk and Credit Scoring: The use of AI and alternative data will gain ground in digital credit underwriting, enabling banks and fintechs to extend lending to unbanked and underbanked populations. This will enhance financial inclusion while managing default risks in a scalable way.

Expansion of Regulatory Oversight & Open Finance: The implementation of BSP’s Open Finance Framework will allow more secure data-sharing across financial institutions, giving consumers better choice and control, while spurring product innovation through collaboration between banks, fintechs, and third-party providers.

Philippines Digital Banking Market Segmentation

By Bank Type

Licensed Digital Banks

Traditional Banks with Digital Platforms

Foreign Digital Banks

Neobanks/Fintech Wallets

Rural & Cooperative Banks with Digital Extensions

By Product/Service Offering

Digital Payments & Wallets

Deposits & Savings Accounts

Lending Products

Remittances & Cross-Border Transfers

Wealth & Insurance

By Customer Segment

Retail Mass Market & Youth

Affluent & Mass Affluent

MSMEs & Self-Employed

Large Corporates

Overseas Filipino (OF) Households

By Technology Platform

Mobile-Only Platforms

Omni-Channel Platforms

API/Open Banking Enabled

Cloud-Based Core Banking Systems

Blockchain & DLT-Enabled Platforms

By Region

National Capital Region (Metro Manila)

Luzon

Visayas

Mindanao

Remote & Island Provinces

Players Mentioned in the Report:

GCash (Mynt)

Maya (Maya Bank, Inc.)

UnionDigital Bank

Tonik Digital Bank

GoTyme Bank

UNO Digital Bank

Overseas Filipino Bank (OFBank)

SeaBank Philippines (rural bank)

CIMB Bank Philippines

BPI (BPI Online/BPI BizLink)

BDO Unibank (BDO Digital)

Metrobank (Metrobank Online)

RCBC (DiskarTech)

GrabPay Philippines

ShopeePay Philippines

Key Target Audience

Universal and commercial banks (digital channels, embedded finance leaders)

Digital banks & EMI operators (BSP-supervised institutions)

Payment aggregators/OPS & merchant acquirers (QR Ph enablers)

Large retailers & MSME platforms (QR acceptance, POS, settlement)

Telco & super-app ecosystems (wallets, bundles, data)

Investments and venture capitalist firms (fintech/banking scale-ups)

Government and regulatory bodies

Cross-border payment networks & remittance operators

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Digital Banking-Mobile-only, Web-based, Omni-channel, API-driven, Cloud/DLT-based (Margins, Preference, Strengths, Weaknesses)

4.2. Revenue Streams for Digital Banks in the Philippines (Interest Income, Transaction Fees, Cross-border Remittances, Wealth & Insurance Products, SME Lending)

4.3. Business Model Canvas for Digital Banks in the Philippines

5.1. Neobanks / Digital-only Banks vs. Traditional Banks with Digital Offerings

5.2. Investment Model in Philippines Digital Banking Market (Venture Capital, Strategic Investors, Government Initiatives)

5.3. Comparative Analysis of Customer Acquisition Models (Fintech vs. Telco Wallets vs. Traditional Banks)

5.4. Digital Banking Budget Allocation by Bank Size

8.1. Revenues, Transaction Values, and Deposits-Historical Period

9.1. By Market Structure (Licensed Digital Banks, Traditional Digital Platforms, Neobanks/Fintech Wallets)

9.2. By Service Offering (Payments, Deposits, Lending, Wealth, Insurance)

9.3. By Customer Segments (Retail, SMEs, Corporates, OFWs, Unbanked/Underbanked)

9.4. By Bank Size (Large Banks, Mid-sized Banks, Start-up Neobanks)

9.5. By Region (NCR, Luzon, Visayas, Mindanao, Remote/Island Provinces)

9.6. By Technology Adoption (Mobile-only, API/Open Banking, Cloud-native, Blockchain-enabled)

9.7. By Partnerships (E-commerce, Telcos, Super-app Integrations)

9.8. By Regulatory Compliance (BSP Licensed vs. Non-licensed Fintech Platforms)

10.1. Customer Landscape and Cohort Analysis (Retail, SME, OFW)

10.2. Digital Banking Needs and Decision-Making Process (Trust, Fees, Convenience, Security)

10.3. Program Effectiveness and ROI Analysis (Customer Lifetime Value, Cost of Acquisition vs. Retention)

10.4. Gap Analysis Framework (Unbanked vs. Digitally Banked, SME Lending Demand vs. Supply)

11.1. Trends and Developments in Philippines Digital Banking (Neobanks, Super-app Finance, BNPL, AI Credit Scoring)

11.2. Growth Drivers (BSP’s Digital Payments Roadmap, Smartphone Penetration, Remittance Digitization, Open Finance)

11.3. SWOT Analysis for Philippines Digital Banking Market

11.4. Issues and Challenges (Rural Connectivity, Cybersecurity, Financial Literacy, Regulatory Burden)

11.5. Government Regulations for Philippines Digital Banking Market (BSP Licensing, Data Privacy Act, AML/KYC Standards, Open Finance Framework)

12.1. Market Size and Future Potential for Mobile-first Digital Banking, Historical to Future Outlook

12.2. Business Models and Revenue Streams (Wallets, Digital-only Banks, Telco-led Finance)

12.3. Delivery Models and Product Offerings (Deposits, Loans, Remittances, Wealth, Insurance)

15.1. Market Share of Key Players (Deposits, Transactions, Loans)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Business Model, User Base, Revenues, Pricing, Technology Used, Best Products, Major Clients/Partners, Strategic Tie-ups, Marketing, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant (Digital Banking Platforms-Philippines)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues, Deposits, and Transaction Values-Forecast Period

17.1. By Market Structure (Licensed Digital Banks, Traditional Banks, Neobanks/Fintech Wallets)

17.2. By Service Offering (Payments, Deposits, Lending, Wealth, Insurance)

17.3. By Customer Segments (Retail, SMEs, Corporates, OFWs, Unbanked/Underbanked)

17.4. By Bank Size (Large, Mid-sized, Neobanks)

17.5. By Region (NCR, Luzon, Visayas, Mindanao, Remote Provinces)

17.6. By Technology Adoption (API/Open Banking, Mobile-first, Cloud-native, Blockchain-enabled)

17.7. By Partnerships (E-commerce, Telcos, Super-apps)

17.8. By Regulatory Compliance Level (BSP Licensed vs. Non-licensed Fintechs)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the Philippines Digital Banking ecosystem, identifying both demand-side and supply-side entities. On the demand side, this includes retail customers, MSMEs, corporates, and overseas Filipino households who form the bulk of transaction flows. On the supply side, we map licensed digital banks, universal and commercial banks with digital platforms, fintech wallets, telcos, payment aggregators, clearing and settlement providers (InstaPay, PESONet, QR Ph), and regulators such as the Bangko Sentral ng Pilipinas (BSP). Based on this ecosystem, we shortlist 5–6 leading digital banks and wallet providers in the Philippines using parameters such as financial disclosures, transaction volumes, user base, and merchant network reach.

Step 2: Desk Research

We conduct exhaustive secondary research using industry articles, BSP publications, IMF and World Bank databases, and company disclosures. This process captures indicators such as transaction values through InstaPay and PESONet, adoption levels across QR Ph, and usage data on remittances and retail payments. Company-level data are collated from press releases, annual filings, and regulatory reports, providing insight into product lines (payments, deposits, lending), user growth, and partnerships. By consolidating macroeconomic data (population, remittances, mobile penetration) with firm-level performance, we create a foundational understanding of market structure, revenue streams, and the role of each ecosystem participant.

Step 3: Primary Research

We initiate in-depth interviews with executives from digital banks, fintechs, merchant acquirers, and regulators, alongside merchants and MSMEs using these services. These interviews validate market hypotheses, authenticate secondary statistics, and reveal operational and financial insights not available publicly. A bottom-up approach is applied to estimate each provider’s contribution to total digital transaction value, supported by disguised interviews where our analysts pose as potential clients to verify pricing, onboarding, merchant settlement terms, and service performance. This approach ensures validation of official disclosures against operational realities while mapping customer journeys and pain points across digital platforms.

Step 4: Sanity Check

A top-down and bottom-up reconciliation is performed to test the robustness of our findings. Top-down involves using BSP’s aggregate e-payment values and remittance inflows as a baseline, while bottom-up aggregates company-level transaction values and user base estimates. Market size models are then adjusted to ensure internal consistency between institutional-level data and macroeconomic indicators (GDP, population, mobile subscriptions). This dual validation strengthens the reliability of our market estimates and ensures that both demand- and supply-side realities are reflected accurately in the final report.

FAQs

01 What is the potential for the Philippines Digital Banking Market?

The Philippines Digital Banking Market is positioned for strong growth, with transaction values on national payment rails reaching PHP 12.86 trillion in 2023, according to the Bangko Sentral ng Pilipinas. This potential is driven by the country’s large population of over 115 million people, rising mobile subscriptions at 117 per 100 inhabitants, and remittances that reached USD 33.49 billion in 2023. The market’s outlook is further strengthened by regulatory support, increasing adoption of QR Ph, and demand for accessible, mobile-first financial solutions across urban and rural segments.

02 Who are the Key Players in the Philippines Digital Banking Market?

The Philippines Digital Banking Market features several key players, including GCash (Mynt), Maya Bank, UnionDigital Bank, Tonik Digital Bank, and GoTyme Bank. These players dominate due to their extensive customer base, innovative product offerings, and integration into everyday merchant ecosystems. Other notable players include UNO Digital Bank, OFBank, SeaBank Philippines, CIMB Bank Philippines, and RCBC DiskarTech, alongside traditional banks like BPI, BDO, and Metrobank which have rolled out robust digital channels.

03 What are the Growth Drivers for the Philippines Digital Banking Market?

The primary growth drivers include strong remittance inflows of USD 34.49 billion in 2024 year-to-date, fueling liquidity into digital platforms. Rising smartphone access with 117.276 mobile subscriptions per 100 inhabitants enables mobile-first banking. Regulatory tailwinds, such as BSP’s Circular 1195 on consumer redress and Circular 1198 on merchant payment acceptance, strengthen trust and adoption. Combined with the USD 429 billion GDP economy, these drivers create scale for digital payments, deposits, and lending, particularly among SMEs and unbanked segments.

04 What are the Challenges in the Philippines Digital Banking Market?

The Philippines Digital Banking Market faces several challenges. Connectivity gaps persist, with only 48.8 households per 100 having internet access, limiting adoption in rural areas. Cybersecurity risks remain high, with the National Privacy Commission reporting 35 breach incidents in the first eight months of 2024, including 21 from financial services. Budget and trust constraints for MSMEs also persist, as many micro-merchants hesitate to absorb transaction fees or invest in digital acceptance tools. These issues, coupled with the need for stronger consumer education, remain key hurdles to scaling digital banking further.