Philippines Toys and Games Market Outlook to 2029

By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region

- Product Code: TDR0079

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

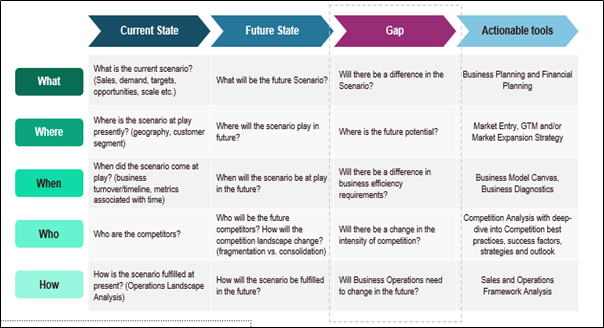

The report titled “Philippines Toys and Games Market Outlook to 2029 - By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region” provides a comprehensive analysis of the toys and games market in the Philippines. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Toys and Games Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

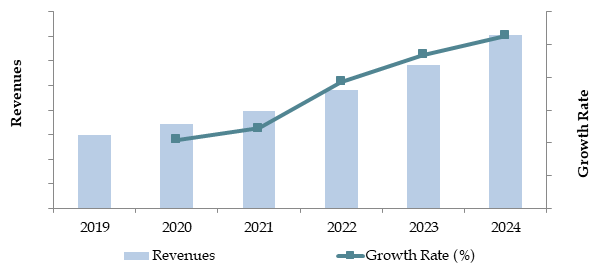

Philippines Toys and Games Market Overview and Size

The Philippines toys and games market reached a valuation of PHP 15 billion in 2023, driven by rising disposable incomes, a growing young population, and increased demand for educational and interactive toys. Major players such as Toy Kingdom, Toys "R" Us, Richprime Global, and SM Department Store dominate the market with their extensive distribution networks, diverse product offerings, and customer-focused strategies.

In 2023, Toy Kingdom introduced new interactive toys aimed at enhancing children's cognitive development and social skills. These innovative products have gained traction in key cities like Metro Manila and Cebu, which are pivotal markets due to their higher population densities and advanced retail infrastructures.

Market Size for Philippines Toys and Games Market on the Basis of Revenue in PHP Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the Philippines Toys and Games Market:

Rising Disposable Income: Increasing income levels have empowered Filipino families to spend more on quality toys and games, particularly those with educational or interactive features. In 2023, spending on toys increased by 8% year-on-year, reflecting a positive trend driven by economic growth and a shift towards higher-value products.

Growing Demand for Educational Toys: Parents are increasingly prioritizing toys that offer educational value, contributing to a 10% rise in sales of educational toys in 2023. This demand is fueled by a focus on child development and the adoption of educational toys in pre-school and elementary curricula.

Expansion of E-commerce Platforms: The rise of e-commerce has significantly transformed the toy market landscape, providing consumers with greater access to a wide range of products. In 2023, approximately 35% of toy sales were made through online platforms like Lazada and Shopee, showcasing the growing importance of digital channels in the retail segment.

Which Industry Challenges Have Impacted the Growth of the Philippines Toys and Games Market?

Counterfeit and Unbranded Products: The influx of counterfeit and unbranded toys in the market poses a significant threat to branded products. These low-cost alternatives, often imported without adherence to safety standards, account for nearly 30% of total market sales in 2023. The presence of these products undermines consumer trust and creates pricing pressure for established brands, thereby impacting their market share and profitability.

Safety and Regulatory Compliance: Compliance with strict safety regulations is a critical concern for toy manufacturers and retailers. The Philippines government has implemented stringent guidelines to ensure that toys meet specific safety and quality standards, such as the Toy and Game Safety Labeling Act of 2013. In 2023, around 20% of toys imported into the country failed to meet these requirements, resulting in increased costs for manufacturers and delays in market entry.

High Price Sensitivity of Consumers: The high price sensitivity of Filipino consumers affects the growth of premium toy segments. Approximately 65% of total toy sales in 2023 were concentrated in the mid-to-low price range. This preference for affordable products limits the demand for premium toys, making it challenging for high-end brands to expand their market presence.

What are the Regulations and Initiatives which have Governed the Market?

Toy Safety and Labeling Regulations: The Philippine government has implemented stringent regulations under the Toy and Game Safety Labeling Act of 2013 to ensure that all toys sold in the market meet specific safety and quality standards. These regulations mandate that toys must be labeled with appropriate age recommendations and safety warnings. In 2023, approximately 70% of imported toys underwent safety testing before reaching retail shelves, ensuring compliance and enhancing consumer safety.

Ban on Hazardous Materials: The use of hazardous substances such as lead, phthalates, and other toxic chemicals in toy manufacturing is strictly prohibited. The implementation of the Hazardous Substance Labeling Act in 2022 led to the removal of 15% of non-compliant toys from the market, helping to maintain a safer environment for children.

Support for Local Manufacturers: The Philippine government has launched various initiatives to support local toy manufacturers through subsidies, tax incentives, and grants for research and development. These efforts are designed to enhance the competitiveness of domestic manufacturers against imported products. As a result, the local production of toys increased by 12% in 2023.

Philippines Toys and Games Market Segmentation

By Market Structure: Organized retailers such as Toy Kingdom and Toys "R" Us dominate the market due to their well-established retail presence, wide product assortments, and strong brand recognition. The organized sector accounts for 70% of total sales in 2023. These retailers offer a variety of products, including exclusive licensed toys and premium brands, which appeal to consumers seeking quality and reliability. The unorganized sector, comprising small local shops and street vendors, captures the remaining 30% share, primarily serving low-income families and price-sensitive consumers.

By Product Type: Educational and learning toys hold the largest market share, driven by the growing emphasis on cognitive development and STEM (Science, Technology, Engineering, and Mathematics) learning. These toys accounted for 40% of the total sales in 2023. Electronic toys and games, including interactive and digital devices, follow with a 25% share due to rising digital adoption and tech-savvy consumer behavior. Traditional toys such as dolls, action figures, and puzzles make up the remaining 35% of the market.

By Age Group: The 3-5 years age group represents the largest segment, with a 45% share of the market in 2023, as parents prefer to invest in toys that aid in early childhood development. The 6-8 years age group follows with a 30% share, driven by increased demand for educational and interactive toys that cater to school-age children. The 0-2 years and 9-12 years groups collectively account for 25% of total sales, primarily focusing on baby products and more complex toys, respectively.

Competitive Landscape in the Philippines Toys and Games Market

The Philippines toys and games market is characterized by a mix of international and local players. While international brands such as Mattel, Lego, and Hasbro dominate the premium toy segment, local players like Toy Kingdom and Richprime Global hold a strong position in the mid-range and affordable toy categories. The presence of large retail chains and the growing influence of e-commerce platforms such as Lazada and Shopee have diversified the market, providing consumers with more options and better accessibility to various toy products.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Mattel, Inc. | 1945 | El Segundo, California, USA |

Hasbro, Inc. | 1923 | Pawtucket, Rhode Island, USA |

Tomy Company Ltd. | 1924 | Tokyo, Japan |

Funko, LLC | 1998 | Everett, Washington, USA |

Lego Group | 1932 | Billund, Denmark |

Spin Master Corp. | 1994 | Toronto, Canada |

Richwell Trading Corp. | 1986 | Manila, Philippines |

Toy Kingdom (ITWI) | 1990 | Manila, Philippines |

Some of the recent competitor trends and key information about competitors include:

Toy Kingdom: One of the leading toy retailers in the Philippines, Toy Kingdom has over 50 stores nationwide and a robust online presence. In 2023, the company expanded its product range to include more educational and interactive toys, which contributed to a 15% increase in revenue compared to the previous year.

Toys "R" Us: A prominent name in the global toy industry, Toys "R" Us operates a network of stores across key cities in the Philippines. In 2023, the company launched a new e-commerce platform, resulting in a 20% rise in online sales. The brand’s focus on exclusive partnerships with international toy manufacturers has helped it maintain a strong position in the premium toy segment.

Richprime Global: Known for distributing popular international toy brands like Barbie, Hot Wheels, and Fisher-Price, Richprime Global reported a 10% growth in 2023. The company’s strategy of partnering with local schools to promote educational toys has been well-received, enhancing its reputation as a leader in the educational toy category.

Lego Philippines: Lego is renowned for its construction and STEM-based toys that encourage creativity and problem-solving. In 2023, Lego Philippines experienced a 25% increase in sales, driven by the launch of new STEM-focused products and a successful “Build the Future” campaign that targeted young families.

Mattel Philippines: Mattel, the manufacturer of iconic brands like Barbie and Hot Wheels, has focused on expanding its presence in digital platforms. In 2023, the company recorded a 12% increase in sales through e-commerce channels, emphasizing the growing trend towards online purchases.

Lazada and Shopee: The rise of e-commerce platforms has significantly impacted the toy market. Lazada and Shopee have become major players, capturing a combined 30% of total toy sales in 2023. Their competitive pricing, wide product range, and convenient delivery options have made them preferred choices for Filipino consumers.

What Lies Ahead for the Philippines Toys and Games Market?

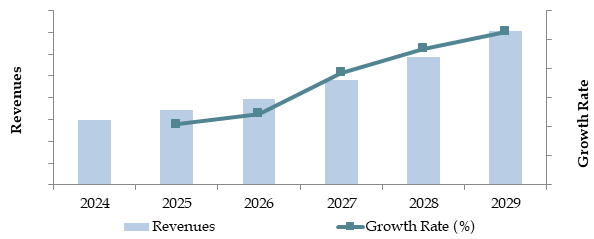

The Philippines toys and games market is expected to grow steadily by 2029, driven by increasing disposable incomes, a rising young population, and growing demand for educational and interactive toys. The market is forecasted to achieve a notable CAGR during the forecast period, supported by several key trends and developments.

Rising Demand for STEM and Educational Toys: With growing awareness of the importance of early childhood development, there is an increasing preference for toys that promote Science, Technology, Engineering, and Mathematics (STEM) learning. This segment is expected to grow significantly, catering to parents looking for toys that enhance cognitive and problem-solving skills in children.

Shift Towards Digital and Interactive Toys: The adoption of digital and interactive toys is expected to rise as technology continues to shape consumer preferences. Products that integrate augmented reality (AR), virtual reality (VR), and other interactive elements are gaining popularity among tech-savvy parents and children. This trend is expected to drive innovation and new product launches in the market.

Expansion of E-commerce Channels: E-commerce platforms like Lazada and Shopee are expected to continue their strong growth, accounting for an increasing share of toy sales. These platforms provide consumers with access to a wide range of products, competitive pricing, and convenient delivery options, making them the preferred choice for online purchases.

Focus on Licensed and Branded Products: Licensed toys, especially those based on popular entertainment franchises, are anticipated to see strong growth in the coming years. The increasing collaboration between toy manufacturers and entertainment companies is expected to result in a wider variety of licensed toys, which are highly appealing to both children and collectors.

Future Outlook and Projections for Philippines Toys and Games Market on the Basis of Revenue in INR Crores, 2024-2029

Philippines Toys and Games Market Segmentation

- By Market Structure:

- Branded

- Local

- By Product Type:

- Educational Toys

- Electronic Toys and Games

- Dolls and Action Figures

- Puzzles and Board Games

- Construction Toys

- Outdoor and Sports Toys

- Infant and Pre-school Toys

- By Age Group:

- 0-2 years

- 3-5 years

- 6-8 years

- 9-12 years

- 13+ years

By Distribution Channel:

Specialty Stores

Online Channels

Hypermarkets/Supermarkets

- By Region:

- Luzon

- Visayas

- Mindanao

- Metro Manila

Players Mentioned in the Report:

- Mattel Inc.

- Hasbro Inc.

- Tomy Company Ltd.

- LEGO Group

- Funko Inc.

- Sony Corp

- Pop Mart

- Sonny Angels

- Toys "R" Us Philippines

- Toy Kingdom

Key Target Audience:

- Toy Manufacturers and Distributors

- Online Marketplaces

- Specialty Retailers

- Educational Institutions

- Regulatory Bodies (e.g., Department of Trade and Industry)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the Philippines Toys and Games Market

5.1. Population by Age Group

5.2. Estimated Time Spent by Age Group on Toys and Recreational Activities

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Action Figures, Ride-Ons and others), 2023-2024P

9.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2023-2024P

9.4. By Distribution Channel (Specialty Stores, Hypermarkets/ Supermarkets, Online Channels), 2023-2024P

9.5. By Region (Luzon, Visayas, Mindanao, Metro Manila), 2023-2024P

9.6. By Price Range, 2023-2024P

9.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2023-2024P

10.1. Customer Segmentation and Profile

10.2. Customer Journey and Buying Decision Process

10.3. Key Motivations and Pain Points

10.4. Product Preferences and Buying Trends

11.1. Trends and Developments in Philippines Toys and Games Market

11.2. Growth Drivers for Philippines Toys and Games Market

11.3. SWOT Analysis for Philippines Toys and Games Market

11.4. Issues and Challenges for Philippines Toys and Games Market

11.5. Government Regulations for Philippines Toys and Games Market

12.1. Market Size and Future Potential for Online Toys and Games Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Toy Platforms Basis Operational and Financial Parameters

15.1. Market Share of Key Organized Brands in Philippines Toys and Games Market, FY2024

15.2. Market Share of Key Distributors in Philippines Toys and Games Market, FY2024

15.3. Benchmark of Key Competitors in Philippines Toys and Games Market Including Operational and Financial Parameters

15.4. Strength and Weakness Analysis

15.5. Operating Model Analysis Framework

15.6. Porters Five Forces Analysis for Competitor Strategy

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), 2025-2029

17.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2025-2029

17.4. By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels), 2025-2029

17.5. By Region (North Philippines, South Philippines, West Philippines, East Philippines, Central Philippines), 2025-2029

17.6. By Price Range, 2025-2029

17.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2025-2029

17.8. Recommendation and Strategic Insights

17.9. Opportunity Analysis for Philippines Toys and Games Market

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: Identify all demand-side and supply-side entities within the Philippines Toys and Games Market. This includes manufacturers, distributors, retailers, e-commerce platforms, and regulatory bodies. Leading manufacturers are shortlisted based on financial performance, production capacity, and market reach.

Data Sourcing: Information is sourced from industry articles, multiple secondary sources, and proprietary databases. This approach enables us to collate market-level data, focusing on key metrics such as revenue, growth rates, and market share.

Step 2: Desk Research

Comprehensive Market Analysis: Conduct exhaustive desk research using a diverse range of secondary sources, including market reports, financial statements, and press releases. This analysis provides an in-depth understanding of market size, structure, competitive landscape, and emerging trends.

Company-Level Insights: Review detailed company-level data to assess the operational and financial performance of key players. Sources include annual reports, investor presentations, and company press releases. This step helps to understand the strategic initiatives and growth drivers for each company.

Step 3: Primary Research

In-Depth Interviews: Engage in a series of interviews with industry experts, C-level executives, and other stakeholders in the Philippines Toys and Games Market. These interviews aim to validate market hypotheses, verify secondary data, and obtain unique insights into market dynamics.

Data Validation: Disguised interviews are conducted with key industry participants to cross-verify the operational and financial data gathered from secondary research. This approach ensures the accuracy and reliability of the information collected.

Step 4: Sanity Check

- Market Size Modeling: Conduct top-to-bottom and bottom-to-top analysis to ensure the accuracy and consistency of market size estimates. Cross-validation with historical data and industry benchmarks is performed to assess the reliability of projections.

FAQs

1. What is the potential for the Philippines Toys and Games Market?

The Philippines toys and games market is poised for substantial growth, reaching a valuation of PHP 20 billion by 2029. This growth is driven by factors such as increasing disposable incomes, a growing young population, and rising consumer awareness of educational and interactive toys. The market's potential is further enhanced by the expanding digital landscape, which facilitates easier access to a wide range of toy products through e-commerce channels.

2. Who are the Key Players in the Philippines Toys and Games Market?

The Philippines toys and games market features several key players, including Toy Kingdom, Toys "R" Us, and Richprime Global. These companies dominate the market due to their extensive retail networks, strong brand presence, and diverse product offerings. Other notable players include international manufacturers like Lego and Mattel, as well as e-commerce platforms such as Lazada and Shopee.

3. What are the Growth Drivers for the Philippines Toys and Games Market?

The primary growth drivers include rising disposable incomes, a young and growing population, and an increased emphasis on educational and interactive toys. The expanding e-commerce sector has made it easier for consumers to access a variety of toy products, further boosting market growth. Additionally, the growing popularity of licensed and branded toys contributes significantly to the expansion of the market.

4. What are the Challenges in the Philippines Toys and Games Market?

The Philippines toys and games market faces several challenges, including the prevalence of counterfeit and unbranded products, which undermine consumer trust and create pricing pressures. Regulatory compliance related to toy safety and quality standards can also be burdensome for manufacturers and importers. Furthermore, the high price sensitivity of Filipino consumers limits the growth potential of premium toy segments, posing a challenge for high-end international brands looking to expand their presence.