Philippines Ultrasound Machines Market Outlook to 2030

By Market Structure, By End Users, By Clinical Applications, By System/Form Factor, By Technology/Feature Set, and By Region

- Product Code: TDR0365

- Region: Asia

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Philippines Ultrasound Machines Market Outlook to 2030 – By Market Structure, By End Users, By Clinical Applications, By System/Form Factor, By Technology/Feature Set, and By Region” provides a comprehensive analysis of the ultrasound machines market in the Philippines. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the ultrasound machines market. The report concludes with future market projections based on equipment volumes, technology adoption, regional demand distribution, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

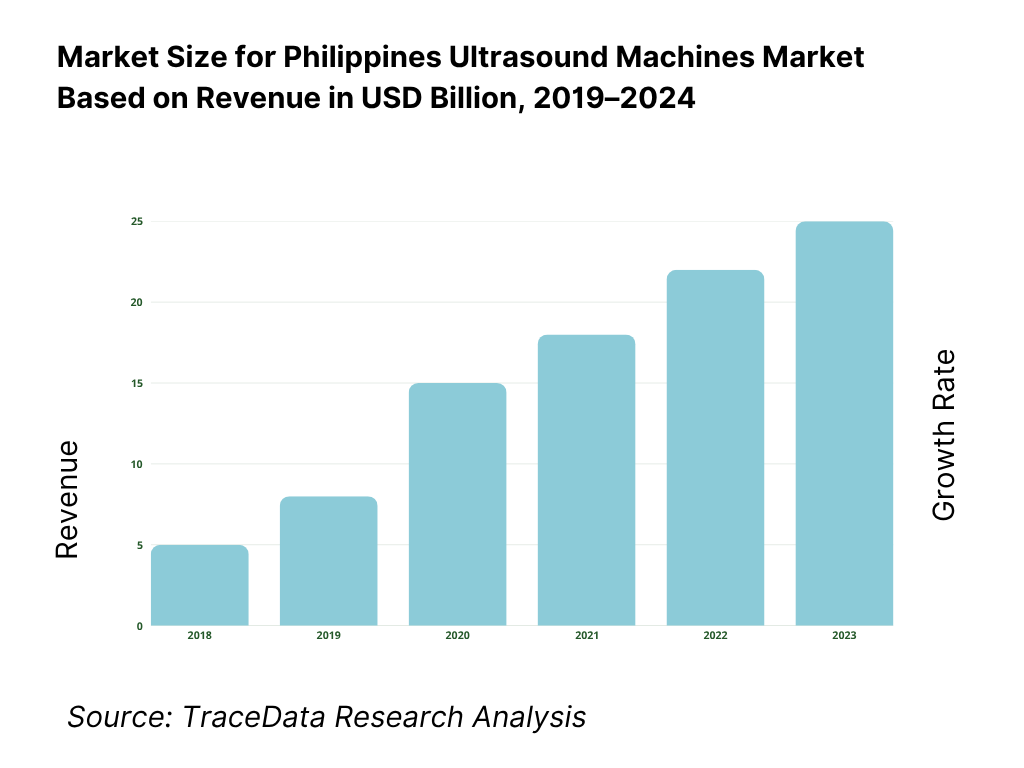

Philippines Ultrasound Machines Market Overview and Size

The Philippines ultrasound machines market is valued at USD 29.73 million, based on a five-year historical analysis of HS 901812 import flows. Procurement is dominated by private hospital upgrades and maternal/child health programs, with suppliers led by Korea, China, Hong Kong, the United States, and Japan in the latest import mix. Broader device demand remains underpinned by import reliance and a goods trade of USD 200.87 billion, reflecting continued openness to equipment inflows and modernization cycles.

Market activity concentrates in Metro Manila (NCR), Calabarzon (Region IV-A), and Central Luzon (Region III), where hospital density is highest—186, ~228, and ~196 hospitals respectively. These corridors host tertiary centers, specialty institutes and large private chains with capital budgets for diagnostic imaging, plus strong obstetrics, cardiology and point-of-care use cases driving ultrasound placements for ED, ICU and outpatient settings. Distribution hubs, service coverage and tender volumes are similarly anchored in these regions.

What Factors are Leading to the Growth of the Philippines Ultrasound Machines Market:

Maternal & women’s health workload anchors scan demand: Registered live births reached 1,448,522, sustaining high-volume obstetric imaging across public and private facilities. With a total population of 115,843,670, prenatal, fetal anomaly and growth scans remain routine in tertiary hospitals and OB-GYN clinics, which also serve referrals from lower-level facilities. PhilHealth’s claims platform processed 12,675,634 paid claims with PHP 122,383,003,091 reimbursed, indicating a broad financing backbone for facility-based care where ultrasound is a frontline diagnostic. This combination—large birth cohort, sizable population, and active claims throughput—keeps OB-GYN and general imaging ultrasound utilization structurally high and replacement cycles active in urban hubs and referral centers.

Hospital footprint and referral tiers concentrate imaging use: PhilHealth’s accredited hospital network lists 122 Level-3, 410 Level-2, and 785 Level-1 hospitals (government and private), creating a clear referral ladder where high-acuity centers concentrate cardiology, vascular and complex abdominal scans while Level-1/2 facilities generate steady throughput in obstetrics and general imaging. Separately, the Department of Health directly supervises 89 hospitals, which act as anchors for training and procurement. The breadth of accredited institutions multiplies ultrasound use across emergency, ICU and outpatient settings, while Level-3 hubs standardize connectivity (PACS/DICOM) and echo labs, pulling in higher-end consoles and specialized probes from national distributors.

Universal membership base enables reimbursable diagnostic pathways: By year-end, PhilHealth reported that 96% of beneficiaries were registered, with direct contributors alone accounting for 66,666,112 beneficiaries (members plus dependents). A national population of 115,843,670 amplifies the eligible patient pool for provider-performed ultrasound across inpatient and outpatient episodes routed through PhilHealth case rates and Z-benefit programs. High claims throughput—12,675,634 paid in the same year—supports consistent facility cashflows, encouraging procurement of portable and premium systems and sustaining probe replacement cycles, service contracts and training budgets tied to reimbursable clinical pathways.

Which Industry Challenges Have Impacted the Growth of the Philippines Ultrasound Machines Market:

FX volatility raises landed-cost risk for an import-reliant category: Monthly average USD/PHP hit 57.2907 across the year, with peaks at 58.6963 in June and 58.6947 in November. Since ultrasound systems and probes are predominantly imported capital goods, swings at 55.9723 in January to 58.4480 in December complicate budgeting for public tenders and private chains, affecting bid validity, delivery scheduling and service parts costing. Hospitals and distributors must hedge or structure price-escalation clauses, while financing/leasing models need contingency bands keyed to reference rates to stabilize procurement cycles and post-warranty service obligations.

Uneven facility levels challenge standardized deployment & training: The accredited network shows 785 Level-1 vs 122 Level-3 hospitals, reflecting a wide base of lower-acuity facilities with tighter biomedical staffing and limited IT backbones. DOH-supervised anchors at 89 hospitals drive clinical standards, yet many provincial sites rely on intermittent vendor training caravans and third-party service. This structural spread complicates roll-outs of AI-assisted measurements, echo packages and elastography that require repeatable protocols, probe care and data archiving—raising variability in image quality and device uptime across regions and stretching distributor service coverage beyond NCR and major urban corridors.

High clinical workload concentrates in urban hubs, straining referral flows: Registered live births totaled 1,448,522, while the population stood at 115,843,670. Claims paid reached 12,675,634, with hospitals accounting for the overwhelming bulk of reimbursements. This volume clusters in NCR and key regions where Level-3 hubs are located, creating heavy ultrasound queues for OB-GYN, cardiology and general imaging while Level-1/2 facilities funnel cases upward. The imbalance elevates demand for portable and handheld systems at feeders, but also exposes gaps in sonographer availability, onsite applications training and PACS connectivity—factors that elongate referral times and repeat scanning rates.

What are the Regulations and Initiatives which have Governed the Market:

Device registration/notification with PFDA–CDRRHR: Ultrasound machines fall under medical device regulation of the PFDA’s CDRRHR, which requires either a Certificate of Medical Device Notification (CMDN) for certain legacy/low-risk products or a Certificate of Medical Device Registration (CMDR) for risk-classified devices, with defined documentary and quality-system requirements. The Citizen Charter details application tracks and turnaround targets, including initial applications and renewals processed under specific checklists for device families and accessories. These gatekeeping steps ensure only duly registered systems and probes enter the provider market, interfacing with hospital licensing and PhilHealth accreditation workflows.

Public procurement under RA 9184 and PhilGEPS: Government hospitals procure via RA 9184 rules and the PhilGEPS e-procurement platform using standardized bidding documents. The IRR mandates generic procurement manuals and standard forms, and sample bidding documents show restrictions such as at least 60 percent Filipino ownership for eligible bidders in certain packages, shaping distributor partnerships and local presence. The IRR prescribes transparent pass/fail criteria and timelines that vendors must meet for ultrasound systems, probes and service contracts, aligning deliveries with budget schedules of DOH and LGU facilities.

Provider accreditation and claims infrastructure (PhilHealth): Operational reimbursement hinges on provider accreditation and data standards. PhilHealth reported 12,675,634 paid claims in the year, with hospitals comprising the dominant share by count and amount. Circular PC2023-0024 sets documentary and competency requirements for accredited health-care professionals, feeding into eClaims and auditability. Facility status tables enumerate 122 Level-3 and 410 Level-2 hospitals, making accreditation and IT readiness a prerequisite for ultrasound-coded services to convert into timely reimbursements and stable cashflows for equipment upkeep and probe replacement.

Philippines Ultrasound Machines Market Segmentation

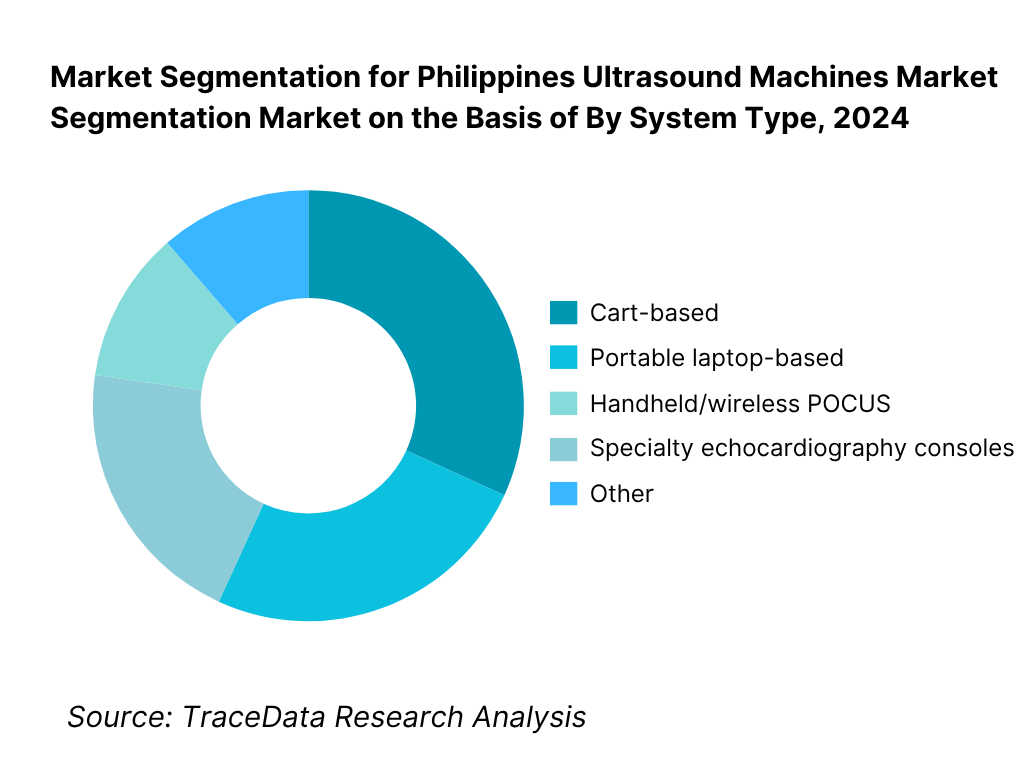

By System Type: The Philippines ultrasound machines market is segmented by system type into cart-based, portable laptop-based, handheld/wireless POCUS, and specialty echocardiography consoles. Recently, cart-based has a dominant market share under system type due to legacy installed bases in tertiary hospitals, high utilization in radiology and OB-GYN suites, and multi-probe versatility for general imaging. Public tenders and private chain refresh cycles often specify full-featured carts with service contracts, ensuring uptime and PACS/DICOM integration.

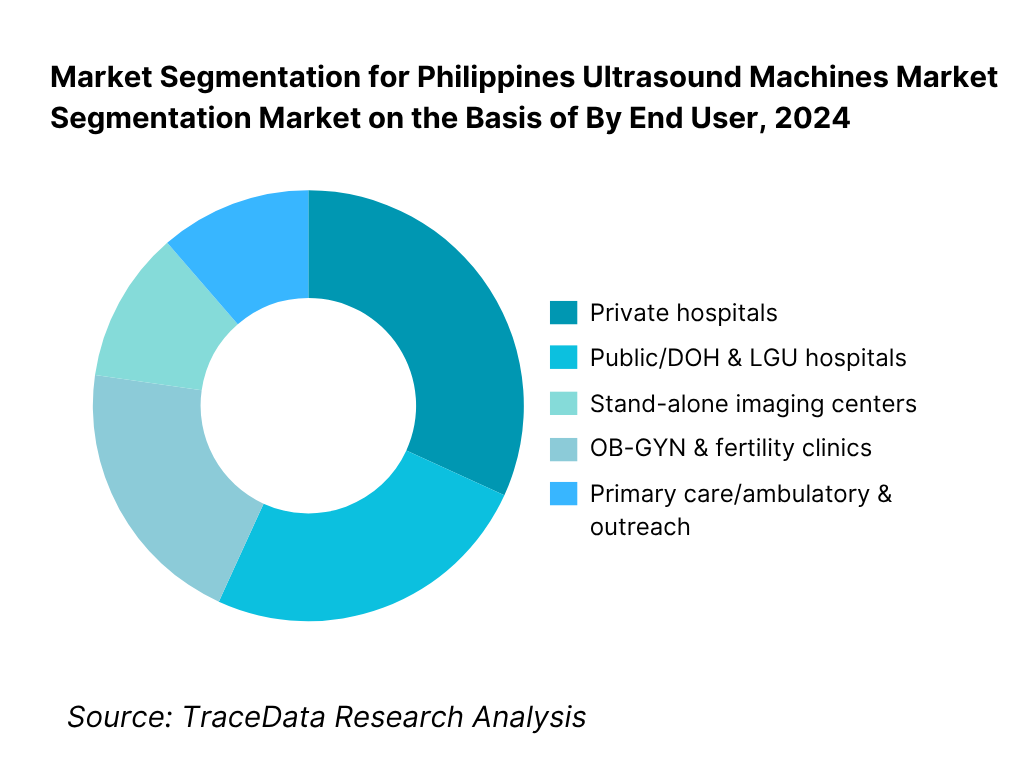

By End User: The Philippines ultrasound machines market is segmented by end user into private hospitals, public/DOH & LGU hospitals, stand-alone imaging centers, OB-GYN & fertility clinics, and primary care/ambulatory & outreach. Private hospitals hold the dominant share owing to concentrated capital expenditure in NCR, Calabarzon and Central Luzon, faster replacement cycles, and preference for premium image quality, advanced probes (e.g., 3D/4D, linear high-frequency), and connectivity suites.

Competitive Landscape in Philippines Ultrasound Machines Market

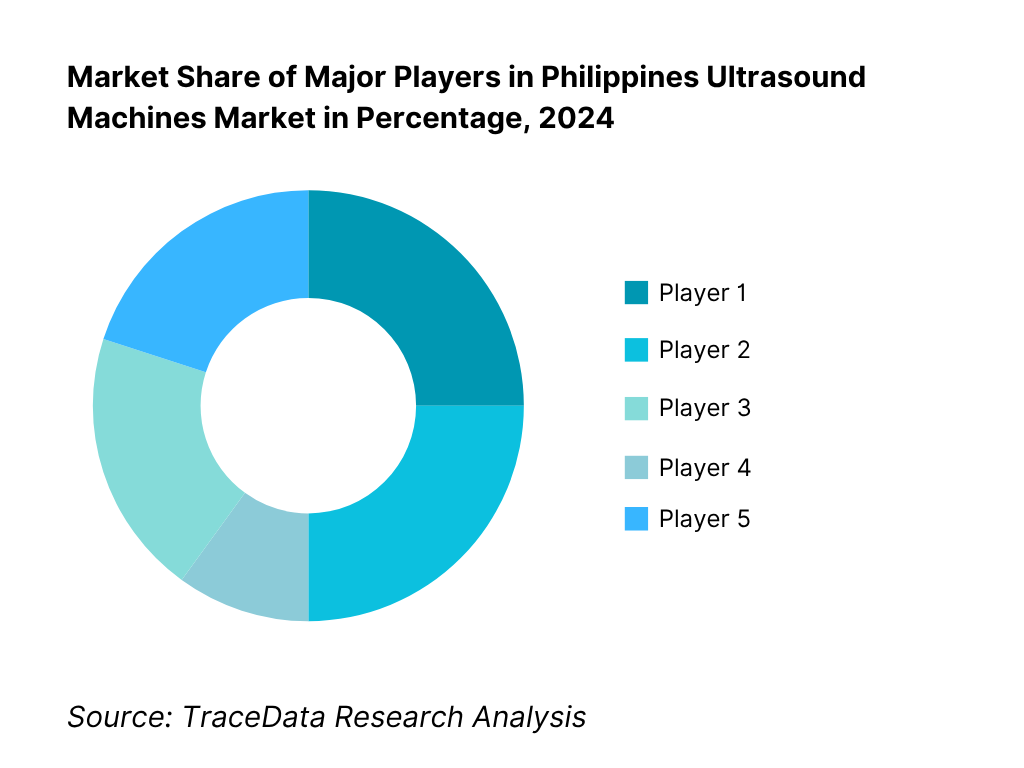

The Philippines ultrasound machines market features multinational OEMs with strong distribution partners across NCR and regional growth corridors. Premium/semi-premium console portfolios from GE HealthCare, Philips, Siemens Healthineers, Canon Medical Systems, and Mindray anchor clinical leadership, while rising handheld ecosystems intensify sales via value channels and clinician-led adoption. Consolidated hospital groups and centralized tenders amplify the influence of a few brands on standards, training curricula and installed-base lock-in.

Name | Founding Year | Original Headquarters |

GE HealthCare | 2023 | Chicago, USA |

Philips (Koninklijke Philips) | 1891 | Eindhoven, Netherlands |

Siemens Healthineers | 2017 | Erlangen, Germany |

Canon Medical Systems | 1930 | Otawara, Japan |

Samsung Medison (ex-Medison) | 1985 | Seoul, South Korea |

Fujifilm Sonosite (SonoSite) | 1998 | Bothell, USA |

Mindray Medical | 1991 | Shenzhen, China |

Fujifilm Healthcare (Hitachi legacy) | 1949 | Tokyo, Japan |

Esaote S.p.A. | 1982 | Genoa, Italy |

Alpinion Medical Systems | 2007 | Seoul, South Korea |

Chison Medical Technologies | 1996 | Wuxi, China |

Edan Instruments | 1995 | Shenzhen, China |

Clarius Mobile Health | 2014 | Burnaby, Canada |

Butterfly Network | 2011 | Guilford, USA |

SonoScape Medical | 2002 | Shenzhen, China |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

GE HealthCare: A leading player in ultrasound imaging, GE HealthCare introduced enhanced Voluson series systems in the Philippines, focusing on women’s health applications. In 2024, the company expanded AI-assisted measurement tools for OB-GYN scanning, improving workflow efficiency in tertiary hospitals and private chains.

Philips Healthcare: Philips strengthened its foothold with the Lumify handheld ultrasound, seeing rapid adoption in emergency and point-of-care settings across NCR and Visayas. The company has also partnered with local distributors to integrate cloud-enabled diagnostics, enhancing telemedicine capabilities.

Siemens Healthineers: Siemens Healthineers upgraded its ACUSON Juniper and Sequoia platforms in the Philippine market, emphasizing cardiovascular and vascular imaging. In 2024, the company prioritized expanding service contracts and training initiatives for public hospitals through DOH procurement programs.

Canon Medical Systems: Canon introduced new models under its Aplio i-series, with advanced elastography features aimed at radiology and musculoskeletal applications. In the Philippines, the brand has been reinforcing ties with academic hospitals, offering joint training workshops for sonographers and residents.

Mindray Medical: Mindray recorded a notable surge in demand for its portable Resona and TE series, driven by the affordability and versatility of these platforms. In 2024, the company increased its local distributor partnerships, boosting penetration into provincial hospitals and imaging centers outside Metro Manila.

What Lies Ahead for Philippines Ultrasound Machines Market?

The Philippines ultrasound machines market is set to expand steadily over the next five years, driven by rising demand in maternal healthcare, cardiology, and point-of-care imaging, alongside government-backed healthcare programs and increased private hospital investments. With a national population of 115.8 million and over 1.44 million registered live births annually, diagnostic imaging demand is expected to remain structurally high, sustaining procurement of both premium consoles and portable/handheld systems.

Rise of Portable & Handheld Ultrasound Systems: The future of ultrasound in the Philippines will see significant growth in portable and handheld point-of-care devices. These systems are increasingly favored for emergency, ICU, and rural healthcare applications due to their portability and ease of use. Adoption is set to accelerate in provincial hospitals and LGUs, filling gaps in coverage outside NCR and Central Luzon.

Integration of AI & Workflow Automation: Vendors are expanding AI-enabled features such as automatic measurement tools and elastography packages, helping clinicians reduce scanning time and improve diagnostic accuracy. As hospitals and clinics seek efficiency in high-volume settings like OB-GYN and cardiology, workflow automation will become a core differentiator in procurement.

Expansion Across Provincial and Secondary Facilities: While tertiary centers in Metro Manila remain the primary adopters, future growth will come from secondary hospitals and provincial diagnostic centers, which account for the bulk of accredited facilities. As these hospitals upgrade equipment to meet accreditation standards, opportunities for mid-range and portable ultrasound solutions will grow.

Increasing Role of Telemedicine & Connectivity: Tele-radiology and cloud-based ultrasound integration are expected to expand, especially in rural provinces. With over 12.6 million PhilHealth claims processed annually, reimbursement-linked imaging will demand better connectivity between provincial hospitals and tertiary referral centers. Vendors offering seamless PACS/DICOM integration will be well-positioned to lead.

Philippines Ultrasound Machines Market Segmentation

By System Type

2D (B-mode) ultrasound

3D/4D ultrasound

Doppler (color/power/spectral)

Elastography-enabled systems

Automated Breast Ultrasound (ABUS)

High-Intensity Focused Ultrasound (HIFU)* (where applicable/installed)

By Form Factor

Cart/trolley-based consoles

Portable laptop/compact systems

Handheld/wireless POCUS probes

Specialty echocardiography consoles

Tablet-docked portable platforms

By Clinical Application

Obstetrics & Gynecology (antenatal, anomaly, fetal echo, 3D/4D)

Radiology & General Imaging (abdomen, small parts, hepatobiliary)

Cardiology & Vascular (TTE, TEE, stress echo, peripheral vascular)

Urology & Nephrology (renal, prostate, bladder)

Musculoskeletal & Sports Medicine (tendons, ligaments, nerves)

Anesthesia/Critical Care & Emergency (nerve blocks, FAST, ICU)

Pediatrics & Neonatal

Breast Imaging (incl. ABUS)

Interventional & Procedural Guidance (biopsies, drainages)

Veterinary & Academic/Training

By Technology/Feature Set

Basic 2D with Doppler options

Advanced Doppler packages (tissue/strain, PW/CW)

3D/4D volumetric imaging

Elastography (strain/shear-wave)

Contrast-enhanced ultrasound (CEUS)* (site-dependent)

AI/automation suites (auto-measurements, auto-EF, OB biometry)

Connectivity tier (DICOM, HL7, PACS/VNA, cloud/tele-ultrasound)

By End User

Private hospitals (tertiary/secondary)

Public hospitals (DOH/LGU; Level-1/2/3)

Stand-alone diagnostic imaging centers

OB-GYN & fertility clinics

Primary care, ambulatory & urgent care centers

Specialty clinics (cardiology, orthopedics, rehab)

Veterinary hospitals & teaching institutions

Players Mentioned in the Report:

Analogic/BK Medical

Butterfly Network

Canon Medical Systems

Clarius Mobile Health

Esaote

Fujifilm Sonosite

GE HealthCare

Hitachi Healthcare

Huawei/Proscenic Ultrasound

Mindray

Philips

Samsung Medison

Shenzhen Anke

Siemens Healthineers

SonoScape

Key Target Audience

Private hospital groups and chains

Public/DOH & LGU hospitals

Government and regulatory bodies

Imaging center operators

OB-GYN & fertility clinics

Primary care and ambulatory networks

Distributors & biomedical service providers

Investments and venture capitalist firms

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

Public hospitals (DOH/PhilHealth), private hospital chains, standalone diagnostic centers, specialty clinics (OB-GYN, cardio, MSK), primary care & birthing clinics, vet & academia, OEMs, distributors/importers, biomedical service providers, training institutes, financing/leasing firms, IT/PACS/AI partners, regulators (PFDA/DOH/BTr customs), professional bodies (PSUMB, PHA, POGS)

4.1 Delivery Model Analysis for Ultrasound-Capex Purchase, Leasing, Managed Equipment Services (MES), Pay-per-Scan, Subscription/Device-as-a-Service (margins, customer preference by site-of-care, strengths/weaknesses, cash-flow impact, approval cycles, risk transfer)

4.2 Revenue Streams for Philippines Ultrasound Market (base system sales, probe & accessory attach, service contracts, parts, software licenses/AI packs, extended warranty, training & CME, trade-ins/refurbished backflow)

4.3 Business Model Canvas for Ultrasound OEMs/Distributors (customer segments, value propositions-POCUS, AI, portability; channels-direct vs. distributor; key partners-PACS/EMR; key activities-KOL development; cost structure-inventory, demos, service; revenue structure-ASP tiers, annuities)

5.1 Independent Imaging Centers vs Hospital-based Imaging (decision criteria, financing access, throughput targets, case-mix)

5.2 Investment Models in Ultrasound (capex budgeting windows, donor/PPP pathways, MES in provincial hubs, refurbishment penetration, lease tenors, interest spreads)

5.3 Comparative Analysis of Procurement Funnel-Public vs Private (pre-qualification, PQ/TF/BAFO steps; PhilGEPS tenders vs hospital board approvals; evaluation metrics: specs, TCO, service SLAs; distributor influence)

5.4 Imaging Budget Allocation by Facility Size (tertiary, secondary, primary; ultrasound share of imaging CAPEX; replacement vs new installs; probe refresh ratio)

By site-of-care, by region, by modality class (cart vs portable vs handheld), by clinical application (OB-GYN, cardio, MSK, urology, primary care) (growth, profitability, competition intensity, payor friendliness, capex barriers)

Sonographer density, scan backlogs, theatre/ER POCUS coverage, rural gaps, probe shortages, service engineer coverage

8.1 Revenues, 2019-2024

9.1 By Market Structure (in-house hospital imaging vs outsourced/diagnostic chains; procurement route-tender/direct; service model-in-house vs third-party), 2023-2024P

9.2 By Application (OB-GYN, radiology/general, cardiology, urology, MSK/orthopedics, anesthesia/critical care POCUS), 2023-2024P

9.3 By Clinical Vertical (public hospitals, private hospital chains, standalone diagnostics, primary care/birthing centers, veterinary & academia), 2023-2024P

9.4 By Facility Size (tertiary >300 beds, secondary 100-300, primary <100, clinics), 2023-2024P

9.5 By User Profile (radiologists, sonographers, OB-GYNs, cardiologists, emergency physicians, anesthesiologists), 2023-2024P

9.6 By Form Factor (cart/trolley, compact portable, handheld/wireless), 2023-2024P

9.7 By Product Tier (entry, midrange, premium; feature sets-Doppler, 3D/4D, elastography, AI), 2023-2024P

9.8 By Region (NCR, Balance of Luzon-North/Central/South, Visayas-WV/CV/EV, Mindanao-NM/SM), 2023-2024P

10.1 Provider Landscape & Cohort Analysis (ownership model, bed-size cohorts, service mix, payer mix, accreditation)

10.2 Decision-Making Process (clinical champions, spec committees, capex boards; trigger events-new service line, replacement, accreditation)

10.3 Program Effectiveness & ROI (throughput per system, scan yield, re-scan reduction via AI, referral capture, LOS reduction, revenue per scan, service uptime impact)

10.4 Gap Analysis Framework (skill gaps, regional access, maintenance coverage, training availability)

11.1 Trends & Developments (POCUS mainstreaming, handheld democratization, AI measurement automation, wireless probes, subscription models, MES adoption, refurbished momentum)

11.2 Growth Drivers (maternal/child health priorities, NCD burden, cath-lab expansion, perioperative POCUS, rural primary care expansion, PhilHealth coverage)

11.3 SWOT Analysis (local context across OEMs/distributors)

11.4 Issues & Challenges (import lead times, FX risk, fragmented service, grey imports, training deficits, budget cycles)

11.5 Government & Payor Regulations (PFDA device registration classes, DOH facility guidelines, PhilHealth benefits & tariffs, customs/tariff codes, local standards for radiation-free imaging acceptance)

12.1 Market Size & Future Potential-Handheld/POCUS, 2018-2029 (adoption S-curve, site-of-care distribution, clinician-led procurement)

12.2 Business Models & Revenue Streams (device + app subscription, probe-as-a-service, enterprise licenses, CME bundles)

12.3 Delivery Models & Course Types (POCUS credentialing, specialty-specific tracks-ER, ICU, anesthesia, primary care)

15.1 Market Share of Key Players-Revenues/Installed Base (public vs private split; cart vs portable vs handheld)

15.2 Benchmark of Key Competitors (company overview, USP, portfolio breadth, business model, distribution, number of service engineers, pricing bands by tier, technology stack-AI/elastography/3D/TEE, best-selling models, major hospital clients, partnerships, marketing levers, recent moves)

15.3 Operating Model Analysis Framework (demo fleet, KOL programs, service SLAs, parts logistics, training academies)

15.4 Gartner-style Positioning (leaders, challengers, visionaries, niche-criteria: vision, execution, support)

15.5 Bowman’s Strategic Clock (price-value positions across tiers and channels)

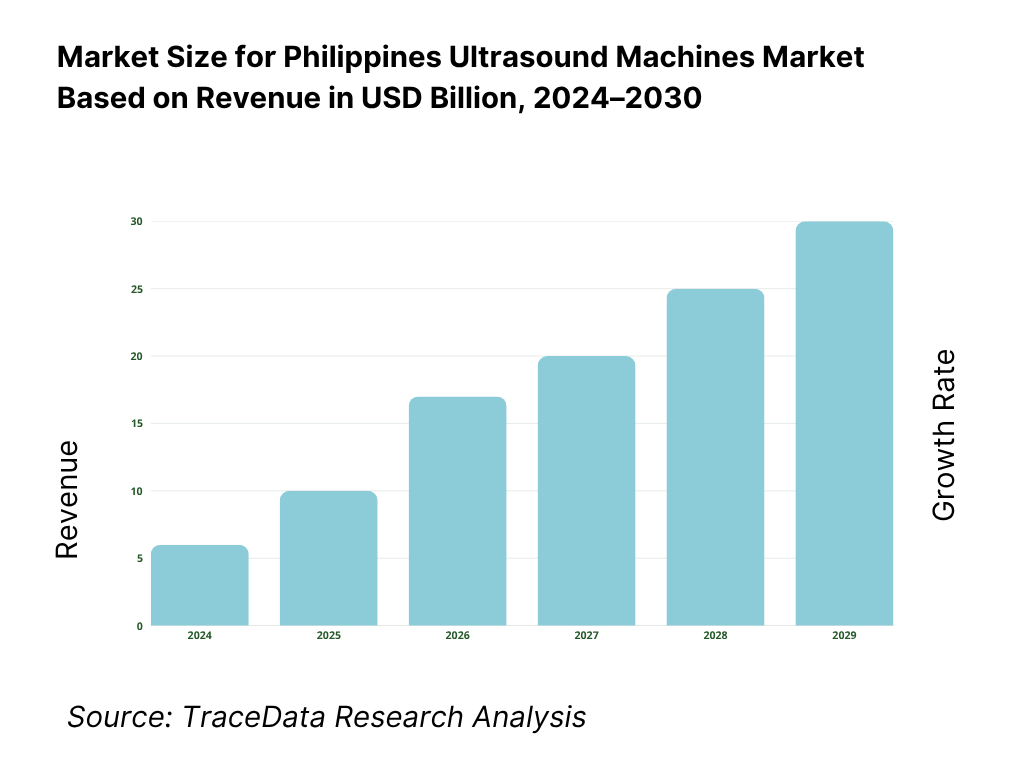

16.1 Revenues, 2025-2030

17.1 By Market Structure (in-house vs outsourced/chain diagnostics; procurement route; service ownership), 2025-2030

17.2 By Application (OB-GYN, radiology, cardiology, urology, MSK/orthopedics, anesthesia/critical care POCUS), 2025-2030

17.3 By Clinical Vertical (public hospitals, private hospital chains, standalone diagnostics, primary care/birthing centers, veterinary & academia), 2025-2030

17.4 By Facility Size (tertiary, secondary, primary, clinics), 2025-2030

17.5 By User Profile (radiologists, sonographers, OB-GYNs, cardiologists, ER, anesthesia), 2025-2030

17.6 By Form Factor (cart/trolley, compact portable, handheld/wireless), 2025-2030

17.7 By Product Tier (entry, midrange, premium; feature sets), 2025-2030

17.8 By Region (NCR, Balance of Luzon, Visayas, Mindanao), 2025-2030

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Philippines Ultrasound Machines Market. On the demand side, this includes public and private hospitals, diagnostic imaging centers, OB-GYN & fertility clinics, cardiology labs, ambulatory centers, and veterinary/teaching institutions. On the supply side, it covers global OEMs, handheld ultrasound providers, national distributors, third-party service providers, PACS/IT integrators, and regulators such as PFDA–CDRRHR. Based on this ecosystem, we will shortlist the leading 5–6 ultrasound equipment providers in the country by assessing their financial performance, installed base, market reach, and client portfolio. Sourcing is conducted through industry articles, procurement records, government hospital listings, and multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This enables us to conduct a thorough analysis of the ultrasound machines market, aggregating industry-level insights. We explore aspects such as import volumes (HS 901812), number of accredited hospitals, hospital level mix, probe replacement cycles, service coverage, and other structural variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, distributor agreements, regulatory approvals, and tender outcomes. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, distributors, biomedical engineers, and hospital imaging heads representing various Philippines Ultrasound Machines Market participants. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions and unit placements for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, probe ecosystems, pricing corridors, and service-level agreements.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. Trade value data is reconciled with realistic ASP bands, facility-level placement counts, and regional procurement trends. This dual validation ensures the final market model is robust, transparent, and supported by both macro-level imports and micro-level hospital adoption patterns.

FAQs

01 What is the potential for the Philippines Ultrasound Machines Market?

The Philippines Ultrasound Machines Market is positioned for sustained expansion, supported by the country’s 115.8 million population and 1.44 million registered live births annually. The market’s potential is driven by the growing need for diagnostic imaging in maternal health, cardiology, and emergency care. With more than 1,300 accredited hospitals and over 12.6 million PhilHealth claims processed yearly, ultrasound remains a frontline modality across both public and private sectors, making it one of the most indispensable diagnostic markets in the Philippine healthcare system.

02 Who are the Key Players in the Philippines Ultrasound Machines Market?

The Philippines Ultrasound Machines Market features several key players, including GE HealthCare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, and Mindray. These companies dominate the market through their extensive product portfolios ranging from premium consoles to portable and handheld solutions. Other notable players include Samsung Medison, Fujifilm Sonosite, Esaote, Butterfly Network, Clarius, Alpinion, Chison, Edan Instruments, Hitachi Healthcare (Fujifilm), and SonoScape, each contributing to specialized applications like OB-GYN, cardiology, and point-of-care ultrasound.

03 What are the Growth Drivers for the Philippines Ultrasound Machines Market?

The primary growth drivers include the high birth cohort of 1.44 million live births, which sustains demand for obstetric and gynecological scans; the expansion of accredited hospitals (over 1,300 nationwide) that require diagnostic capacity across radiology, cardiology, and emergency departments; and the broad PhilHealth membership base of 96%, which supports reimbursement pathways for ultrasound procedures. Additionally, the adoption of portable and handheld POCUS devices is accelerating in provincial and secondary care settings, expanding diagnostic access outside NCR and large private hospitals.

04 What are the Challenges in the Philippines Ultrasound Machines Market?

The Philippines Ultrasound Machines Market faces several challenges, including currency volatility—the peso averaged 57.29 per USD with peaks above 58.69, complicating import-based procurement. Uneven facility levels (with 785 Level-1 vs only 122 Level-3 hospitals) hinder standardized adoption of advanced ultrasound and training protocols. Furthermore, high clinical workload concentration in urban hubs like NCR leads to overutilization of tertiary centers, while many provincial hospitals face shortages in trained sonographers, service engineers, and connectivity infrastructure, creating disparities in diagnostic access across the archipelago.