Philippines Video Conferencing Market Outlook to 2029

By Hardware Type (Infrastructure and Endpoints), End Point (USB Cameras, Monitor and CODEC), By Industry (Manufacturing, IT, Academia, Government, Healthcare, Others)

- Product Code: TDR0037

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled "Philippines Video Conferencing Market Outlook to 2029 - By Hardware Type (Infrastructure and Endpoints), End Point (USB Cameras, Monitor and CODEC), By Industry (Manufacturing, IT, Academia, Government, Healthcare, Others)" provides a comprehensive analysis of the video conferencing market in the Philippines. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a comparative landscape including competition scenario, cross comparison, opportunities, bottlenecks, and company profiling of major players in the Video Conferencing Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationships, and success case studies highlighting the major opportunities and cautions.

Philippines Video Conferencing Market Overview and Size

The Philippines video conferencing market reached a valuation of PHP 3.2 Billion in 2023, driven by increasing demand for remote communication solutions due to the rise of remote work, growing digital infrastructure, and the demand for cost-effective business communication tools. Key players such as Zoom, Microsoft Teams, Cisco Webex, and Google Meet dominate the market, recognized for their user-friendly interfaces, extensive feature sets, and strong security measures.

In 2023, Zoom introduced a new suite of features specifically tailored to the education sector, which has gained widespread adoption across the country. Key regions like Metro Manila and Cebu are significant markets due to their concentration of businesses and educational institutions with robust IT infrastructures.

Market Size for Philippines Video Conferencing Market on the Basis of Revenues in USD Billion, 2018-2024

Source: TraceData Research Analysis.

What Factors are Leading to the Growth of the Philippines Video Conferencing Market:

Remote Work Adoption: The rapid shift towards remote and hybrid work models in the Philippines, driven by the COVID-19 pandemic, has significantly increased the demand for video conferencing solutions. By 2023, over 70% of businesses in the Philippines regularly used video conferencing for communication, contributing to the market’s growth.

Growing Digital Infrastructure: The government’s continued investment in enhancing digital infrastructure, such as improved internet connectivity and increased access to cloud services, has facilitated the adoption of video conferencing platforms. In 2023, approximately 65% of video conferencing solutions were cloud-based, reflecting the growing importance of accessible digital platforms.

Cost-Effective Communication: Video conferencing provides businesses, educational institutions, and government agencies with a cost-effective alternative to traditional in-person meetings, reducing travel costs and time. This is particularly beneficial for SMEs and organizations operating on tight budgets, which has driven widespread adoption across various sectors.

Which Industry Challenges Have Impacted the Growth for the Philippines Video Conferencing Market:

Internet Connectivity Issues: Inconsistent and unreliable internet connections, particularly in rural areas, pose significant challenges to the growth of the video conferencing market. According to a recent survey, approximately 35% of users in the Philippines face connectivity problems, leading to poor user experiences and limiting the effectiveness of video conferencing solutions.

Data Privacy and Security Concerns: With the increasing reliance on video conferencing platforms, concerns over data privacy and security have escalated. In 2023, around 25% of organizations expressed reservations about potential data breaches and unauthorized access, which have deterred some businesses from fully adopting video conferencing tools, particularly in sensitive sectors like finance and healthcare.

High Costs for SMEs: While large enterprises have widely adopted video conferencing, small and medium-sized enterprises (SMEs) often struggle with the cost of advanced solutions. Approximately 30% of SMEs reported that they find it difficult to invest in premium video conferencing platforms due to budget constraints, limiting their access to high-quality communication tools and slowing overall market growth.

What are the Regulations and Initiatives which have Governed the Philippines Video Conferencing Market:

Data Privacy Regulations: The Philippines Data Privacy Act of 2012 mandates stringent regulations for organizations handling personal data, including video conferencing platforms. These regulations ensure that user data is safeguarded, requiring companies to implement robust security measures. In 2023, compliance with these regulations became a critical factor for video conferencing providers, with around 80% of platforms adhering to the standards.

Cybersecurity Initiatives: To combat rising cyber threats, the Philippine government, through the Department of Information and Communications Technology (DICT), has launched the National Cybersecurity Plan. This initiative requires all digital communication platforms, including video conferencing tools, to integrate strong encryption and other security protocols to protect sensitive information. In 2023, approximately 90% of video conferencing platforms operating in the country had implemented enhanced security features in line with these requirements.

Digitalization Efforts in Government: As part of the e-Government Masterplan, the Philippine government has actively promoted the use of video conferencing tools for internal and external communication, particularly during the pandemic. This initiative has increased the adoption of video conferencing within government agencies by 15% in 2023, fostering growth in the public sector.

Philippines Video Conferencing Market Segmentation

By Hardware Type: In the Philippines Video Conferencing Market, infrastructure hardware is the dominant segment under hardware type. This includes server rooms, communication hubs, and network infrastructure that are essential for establishing large-scale video conferencing capabilities. These investments are driven by large enterprises, government agencies, and academic institutions looking to enhance their communication networks. However, the demand for endpoints such as USB cameras, monitors, and CODEC systems is also increasing, particularly among SMEs and the healthcare industry, as they expand their remote communication needs.

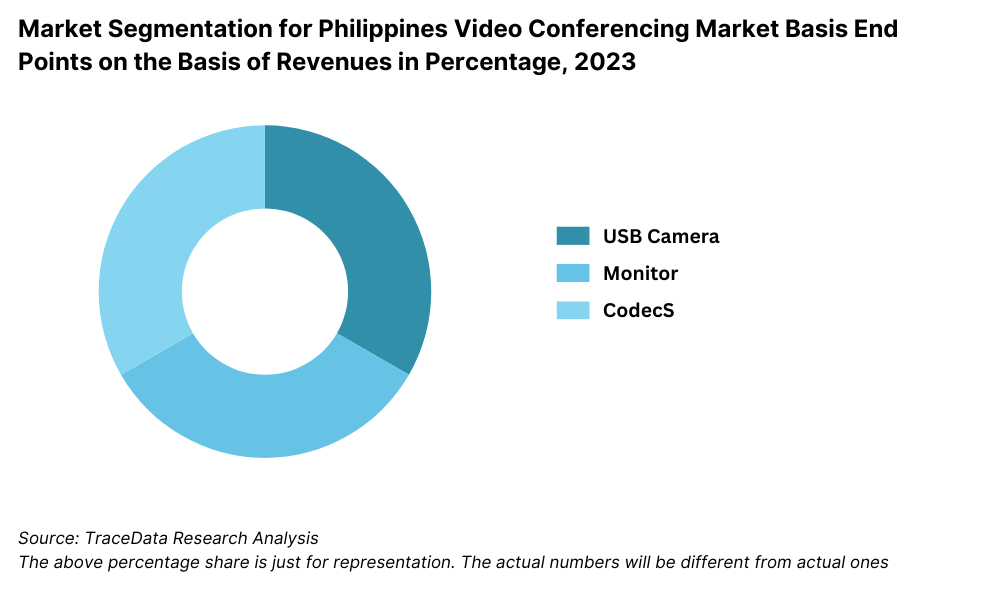

By End Point: Under endpoints, USB cameras are the most widely used devices, particularly in small to medium-sized rooms. They are affordable, easy to set up, and compatible with a wide range of video conferencing software, making them popular for individual professionals, SMEs, and larger organizations that require quick and reliable video conferencing setups. Monitors and CODEC systems are more commonly used in larger enterprises and government sectors where more sophisticated setups are needed for boardrooms and conference halls.

By Industry: In terms of industry, IT and academia lead the adoption of video conferencing technologies in the Philippines. The rapid digital transformation of IT companies and the shift towards remote or hybrid working models during and after the pandemic have increased the demand for robust video conferencing solutions. Academia, particularly universities and colleges, have integrated video conferencing as a core tool for remote learning. The healthcare sector is also witnessing growth in video conferencing adoption, primarily for telemedicine and remote consultations

Competitive Landscape in the Philippines Video Conferencing Market

The Philippines Video Conferencing Solutions Market is a competitive and rapidly evolving landscape, driven by the growing demand for remote communication and collaboration solutions across industries such as IT, education, healthcare, and government sectors. The competitive landscape in this market includes a mix of global technology companies offering end-to-end video conferencing solutions and local distributors facilitating access to hardware and software products.

| Name | Founding Year | Original Headquarters |

| Poly (formerly Polycom) | 1990 | San Jose, California, USA |

| Logitech | 1981 | Lausanne, Switzerland |

| Cisco Systems (Webex Hardware) | 1984 | San Jose, California, USA |

| Lifesize | 2003 | Austin, Texas, USA |

| Avaya | 2000 | Durham, North Carolina, USA |

| Huawei Technologies | 1987 | Shenzhen, China |

| Zoom Rooms | 2011 | San Jose, California, USA |

| Yealink | 2001 | Xiamen, China |

| Aver Information Inc. | 2008 | New Taipei, Taiwan |

| Crestron Electronics | 1971 | Rockleigh, New Jersey, USA |

Some of the recent competitor trends and key information about competitors include:

Cisco Systems, Inc: Cisco is a global leader in video conferencing solutions, particularly through its Webex product line. Cisco offers comprehensive hardware solutions including CODECs, USB cameras, monitors, and integrated communication systems tailored for both small-to-medium enterprises (SMEs) and large enterprises. Cisco's strength lies in its scalability, robust security features, and integration capabilities across devices and software platforms, making it a popular choice among large enterprises and government sectors in the Philippines

Logitech: Logitech is a dominant player in the endpoint market, particularly with its popular USB cameras and video conferencing kits designed for small and medium-sized rooms. Logitech’s hardware is widely recognized for being user-friendly, reliable, and cost-effective, making it a strong competitor in the SME and education markets in the Philippines. Logitech’s "Rally" and "MeetUp" systems are highly regarded for their affordability and quality, providing versatile options for businesses and educational institutions

Poly: Poly has a strong presence in both infrastructure and endpoints for video conferencing. Its range of video collaboration devices, including CODECs, microphones, cameras, and monitors, offers flexibility for both small and large-scale deployments. Poly’s video conferencing solutions are known for their audio and video quality, making them popular in the healthcare and government sectors in the Philippines, where reliability is critical

Huawei: Huawei provides a complete suite of video conferencing hardware, including USB cameras, CODECs, and large-scale conference room systems. Its solutions are popular in sectors such as government and large enterprises, particularly due to its competitive pricing and high-quality technology. Huawei has also invested in cloud-based integration, making its systems compatible with a wide range of software platforms.

What Lies Ahead for the Philippines Video Conferencing Market?

The Philippines video conferencing market is projected to grow steadily through 2029, with a strong CAGR during the forecast period. This growth will be driven by the continued digitalization of businesses, advancements in internet connectivity, and the evolving needs of remote work and communication tools.

Increased Adoption of Hybrid Work Models: As businesses increasingly adopt hybrid work models, there will be a sustained demand for reliable video conferencing solutions. The flexibility of remote communication tools is expected to remain a critical component of business operations, with approximately 70% of companies planning to continue some form of remote work by 2029.

Advancements in AI and Automation: The integration of AI and automation into video conferencing platforms is expected to revolutionize the user experience. Features such as real-time language translation, facial recognition, and smart scheduling will enhance productivity and improve the accessibility of these tools across diverse industries. By 2029, AI-driven solutions will account for a significant share of the video conferencing market in the Philippines.

Expansion of E-Learning and Telehealth: The education and healthcare sectors will continue to drive growth, with video conferencing becoming a critical tool for e-learning and telehealth services. Government initiatives to enhance digital education infrastructure and promote telemedicine are expected to boost the adoption of video conferencing in rural and underserved areas.

Increased Focus on Cybersecurity: With the growing reliance on digital communication tools, cybersecurity will be a key area of focus for both providers and users. Video conferencing platforms will increasingly incorporate advanced security features such as end-to-end encryption and multi-factor authentication to address rising concerns about data privacy and security.

Emergence of Virtual Reality (VR) and Augmented Reality (AR): The incorporation of VR and AR into video conferencing platforms is expected to create new opportunities for immersive remote collaboration, particularly in industries such as design, architecture, and healthcare. By 2029, these technologies could become mainstream in the Philippines video conferencing market, offering more engaging and interactive communication experiences.

Future Outlook and Projections for Philippines Video Conferencing Market on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

Philippines Video Conferencing Market Segmentation

- By Hardware Type:

- Endpoints

- Infrastructure

- By Endpoints:

- Monitors

- CODECS

- USB Camera

- By Industry:

- Education

- IT and Telecommunications

- Healthcare

- Financial Services

- Government

- Retail and E-commerce

- Manufacturing

- By USB Camera:

- Small Rooms

- Big Rooms

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Region:

- Metro Manila

- Visayas

- Mindanao

- Northern Luzon

- Southern Luzon

Players Mentioned in the Report:

- Poly (formerly Polycom)

- Logitech

- Cisco Systems (Webex Hardware)

- Lifesize

- Avaya

- Huawei Technologies (Video Conferencing Hardware)

- Zoom Rooms (Zoom Hardware Solutions)

- Yealink

- Aver Information Inc.

- Crestron Electronics

Key Target Audience:

- Video Conferencing Software Providers

- Video Conferencing Hardware Providers

- Telecommunication Companies

- Educational Institutions

- Government Agencies

- IT and Tech Firms

- Healthcare Providers

- Large Enterprises and SMEs

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor Network, System Integrators

4.2. Business Model Canvas for the Philippines Video Conferencing Market

5.1. Growth of Remote Work in the Philippines, 2018-2023

5.2. Business Communication Tools Adoption in the Philippines, 2018-2024

5.3. Spend on IT and Communication Tools in the Philippines, 2024

5.4. Major System Integrators in Philippines

8.1. Revenues, 2018-2024

9.1. By Hardware Type (Infrastructure and Endpoints), 2023-2024P

9.1.1. By End Point (USB Cameras, Monitor and CODEC)

9.2. By Industry (Manufacturing, IT, Academia, Government, Healthcare, Others), 2023-2024P

9.3. By USB Camera Types (Small/Medium and Big Size Rooms), 2023-2024

9.4. By Enterprise Size (SMEs, Large Enterprises), 2023-2024P

9.5. By Region (Metro Manila, Visayas, Mindanao, Northern Luzon, Southern Luzon), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for the Philippines Video Conferencing Market

11.2. Growth Drivers for the Philippines Video Conferencing Market

11.3. SWOT Analysis for the Philippines Video Conferencing Market

11.4. Issues and Challenges for the Philippines Video Conferencing Market

11.5. Government Regulations for the Philippines Video Conferencing Market

14.1. Product Heatmap (Infrastructure, CODEC, USB Cameras, Monitor) of Players operating in Philippines Video Conferencing Market

14.2. Market Share of Major Players in Philippines Video Conferencing Hardware Endpoints Market Basis Revenues, 2023

14.3. Market Shares of Major Players in Philippines Video Conferencing Small/Medium Meeting Room Market by Revenue, 2023

14.4. Market Shares of Major Players in Philippines Video Conferencing Large Meeting Room Market by Revenue, 2023

14.5. Benchmark of Key Competitors in the Philippines Video Conferencing Market across Operational and Financial Variables

14.6. Strength and Weakness

14.7. Operating Model Analysis Framework

14.8. Gartner Magic Quadrant

14.9. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

16.1. By Hardware Type (Infrastructure and Endpoints), 2025-2029

16.1.1. By End Point (USB Cameras, Monitor and CODEC), 2025-2029

16.2. By Industry (Manufacturing, IT, Academia, Government, Healthcare, Others), 2025-2029

16.3. By USB Camera Types (Small/Medium and Big Size Rooms), 2025-2029

16.4. By Enterprise Size (SMEs, Large Enterprises), 2025-2029

16.5. By Region (Metro Manila, Visayas, Mindanao, Northern Luzon, Southern Luzon), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Philippines Video Conferencing Market. Based on this ecosystem, we will shortlist leading 5-6 providers in the country based on their financial information, user adoption rate, and market share.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information on video conferencing trends, platform usage, and provider performance.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights such as market size, number of participants, pricing trends, and demand drivers. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and other documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Philippines Video Conferencing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate market penetration and user adoption for each provider, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, product pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process, ensuring data accuracy and reliability.

FAQs

01 What is the potential for the Philippines Video Conferencing Market?

The Philippines video conferencing market is poised for substantial growth, reaching a valuation of PHP 3.2 Billion in 2023. This growth is driven by factors such as the increasing shift towards remote and hybrid work models, expanding digital infrastructure, and the rising demand for cost-effective communication solutions. The market's potential is further bolstered by the ongoing adoption of cloud-based technologies across various industries, particularly education and healthcare.

02 Who are the Key Players in the Philippines Video Conferencing Market?

The Philippines video conferencing market features several key players, including Zoom, Microsoft Teams, and Cisco Webex. These companies dominate the market due to their comprehensive feature sets, ease of use, and strong security measures. Other notable players include Google Meet, BlueJeans, and GoToMeeting, which also offer competitive solutions tailored to different industries and user needs.

03 What are the Growth Drivers for the Philippines Video Conferencing Market?

The primary growth drivers include the rapid adoption of remote work and digital collaboration tools, advancements in cloud technology, and the increasing need for flexible communication options across various sectors. Additionally, the rise of e-learning and telehealth services has significantly boosted the demand for video conferencing solutions, further driving the market's expansion.

04 What are the Challenges in the Philippines Video Conferencing Market?

The Philippines video conferencing market faces several challenges, including inconsistent internet connectivity, particularly in rural areas, which affects user experience. Data privacy and security concerns also pose significant challenges, as organizations become increasingly cautious about potential breaches. Additionally, high costs for premium solutions may limit adoption among small and medium-sized enterprises (SMEs), constraining overall market growth.