Poland AI in Healthcare Market Outlook to 2030

By Solution Type, By Clinical Application, By Deployment Model, By End User, and By Region

- Product Code: TDR0367

- Region: Europe

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Poland AI in Healthcare Market Outlook to 2030 - By Solution Type, By Clinical Application, By Deployment Model, By End User, and By Region” provides a comprehensive analysis of the AI healthcare market in Poland. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the AI healthcare market. The report concludes with future market projections based on AI adoption volumes, clinical applications, deployment models, end users, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

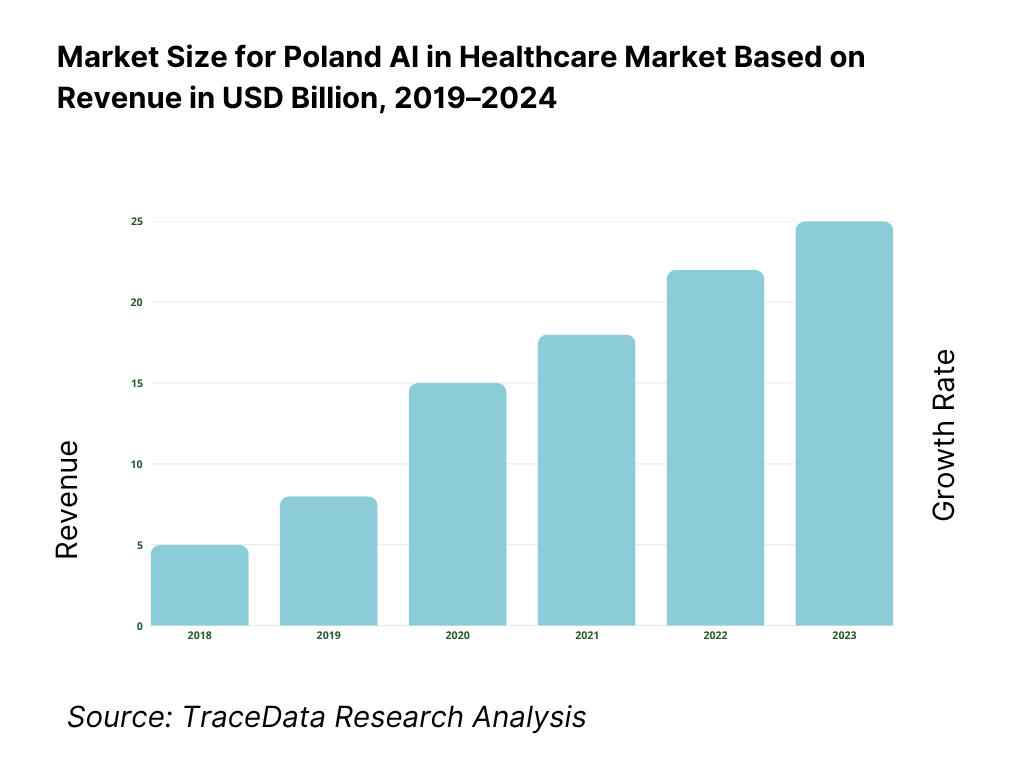

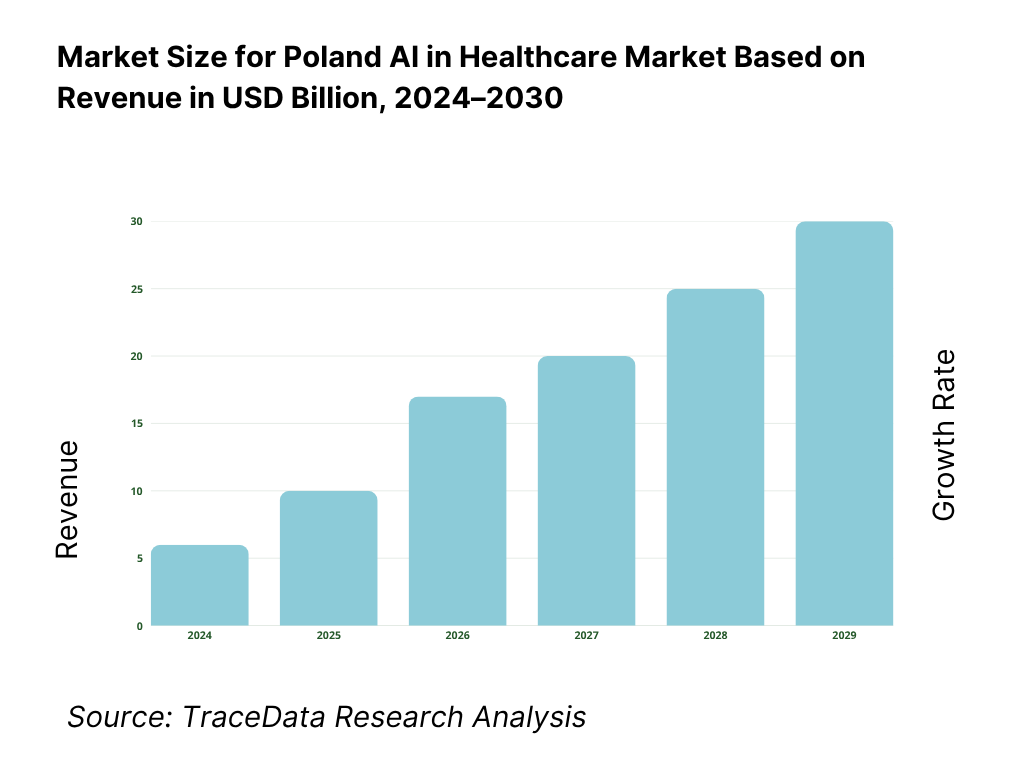

Poland AI in Healthcare Market Overview and Size

The market’s economic base is Poland’s healthcare sector, valued at PLN 191 billion, with digital and AI deployment accelerated by EU funds. On the technology side, USD 22.5 billion in global AI-in-healthcare revenues and USD 32.3 billion the following year frame demand and vendor capacity. Nationally, Poland mobilized EUR 59.8 billion under the National Recovery Plan, with ~USD 400 million explicitly targeted to AI-enabled medical technologies, seeding pipelines in radiology, cardiology, and dermatology.

Warsaw leads adoption due to its concentration of tertiary hospitals and payers, and as Poland’s largest metro economy; the capital also anchors EU-funded digital programs and cloud region build-outs. Wrocław is a core health-AI cluster, home to Infermedica (reported USD 18.6 million revenue), influencing tele-triage and symptom checking across providers. Kraków, Poznań, and Gdańsk add critical mass via university hospitals and IT talent; Warsaw’s AI ecosystem reports significant EU Recovery allocations to AI, reinforcing urban deployment corridors.

What Factors are Leading to the Growth of the Poland AI in Healthcare Market:

Digitized care rails enabling scalable AI deployment: Poland’s e-health backbone is already operating at mass scale: in 2024, 513.4 million prescriptions were issued nationwide and 97.4% were electronic, flowing through the P1/IKP rails managed by the national e-health center. Connectivity is sufficient for hospital-to-cloud workflows as fixed broadband penetration reached 26.11 subscriptions per 100 people. EU recovery funding further strengthens digital foundations, with Poland’s Recovery and Resilience Plan totaling EUR 59.8 billion and EUR 1.4 billion earmarked to expand high-speed internet. This combination lowers integration friction for AI decision support, imaging AI deployment, and patient-facing triage tools across public and private providers.

Ageing demand and constrained clinical capacity: Poland’s age-driven care load is rising, with 7,363,362 people aged 65 and above, intensifying diagnostic and chronic-care demand where AI adds throughput and safety. Clinical capacity is tight: practising doctors stand at 3.4 per 1,000 and nurses at 5.7 per 1,000, while the inpatient footprint remains large at 6.3 hospital beds per 1,000. AI triage for stroke, pulmonary embolism, image quantification, and command-center scheduling directly target these bottlenecks by compressing time to diagnosis and optimizing bed turnover. This combination of demographic pressure, workforce scarcity, and hospital intensity makes AI a practical lever for sustaining service levels.

Public investment momentum and execution runway: The fiscal channel for digital-health modernization is material. Poland’s revised Recovery and Resilience Plan allocates EUR 59.8 billion in grants and loans, and disbursement is advancing, with agreements signed covering PLN 117 billion of available funds. Earlier, the EU unblocked EUR 6.3 billion to accelerate program starts. These macro flows co-finance hospital IT refreshes, imaging fleet upgrades, and cyber hardening—preconditions for AI scale-up. Alongside this, the P1/IKP platform underpins e-referrals and e-prescriptions, creating a high-volume data environment where AI models can be deployed and monitored at national scale with traceable outcomes.

Which Industry Challenges Have Impacted the Growth of the Poland AI in Healthcare Market:

Workforce scarcity and uneven distribution pressure the rollout: Physician density in Poland is 3.4 per 1,000 and nursing density 5.7 per 1,000, with 131,426 practising physicians reported nationally—figures below many EU peers and uneven across regions. AI deployment requires clinical oversight and governance bandwidth; shortages slow validation, training, and adoption. The risk is that high-need regions benefit least, while post-market clinical follow-up and vigilance duties under MDR remain under-resourced. With an older population of over 7.3 million citizens, this mismatch between demand and workforce capacity adds friction to AI integration despite its clear necessity.

Data-protection rigor and compliance overhead at national scale: GDPR imposes strict controls on health data processing, with penalties up to EUR 20 million or 4% of global turnover, enforced by the national authority. Poland’s digitized rails are high-volume, with 513.4 million prescriptions flowing through P1/IKP in the latest year. Providers must scale privacy impact assessments, access controls, and breach responses accordingly. For AI systems, MDR post-market surveillance and AI Act obligations on logging and human oversight compound compliance demands. These safeguards ensure accountability but add significant operational costs and timelines for pilots and enterprise rollouts.

Fragmentation of infrastructure and uneven digital readiness: While broadband penetration reached 26.11 subscriptions per 100 people, hospital site capabilities differ widely, impacting cloud versus on-premise choices, cybersecurity standards, and integration speeds. Poland’s hospital capacity remains sizable at 6.3 beds per 1,000, spread across facilities with heterogeneous PACS, RIS, and HIS stacks, making multi-site orchestration complex. Although the Recovery and Resilience Plan totals EUR 59.8 billion, absorption and project phasing are gradual, with PLN 117 billion of agreements highlighting pipeline build-out rather than instant modernization. Vendors must tailor deployment models to diverse levels of readiness.

What are the Regulations and Initiatives which have Governed the Market:

Poland AI in Healthcare Market Segmentation

EU Artificial Intelligence Act (horizontal framework for high-risk health AI): The EU AI Act, Regulation (EU) 2024/1689, sets harmonized rules for AI placed on the European market. Clinical AI and diagnostic tools typically fall into high-risk categories, triggering requirements on risk management, data governance, human oversight, and detailed logging. Providers integrating general-purpose AI models must ensure technical documentation meets transparency requirements. For Poland, conformity with the AI Act aligns with e-health rails and hospital governance, complementing P1/IKP flows and NFZ-contracted operations where AI assists in diagnosis or therapy.

EU Medical Device Regulation (MDR) for SaMD: Software with medical purpose is regulated under Regulation (EU) 2017/745. AI-enabled software as a medical device (SaMD) requires notified-body conformity assessment, clinical evaluation, and proportional post-market surveillance, including vigilance reporting. For Polish hospitals, MDR classification and CE-marking are gating criteria for procurement and align with AOTMiT’s evidence standards. NFZ reimbursement pathways increasingly reference MDR status when AI interacts with clinical workflows such as triage, imaging, or therapy support.

GDPR and national enforcement by UODO for health data: The General Data Protection Regulation, Regulation (EU) 2016/679, governs processing of health data with penalties up to EUR 20 million or 4% of worldwide turnover. Enforcement is carried out by Poland’s UODO authority. With 513.4 million prescriptions processed via P1/IKP in the most recent year, hospitals must adopt robust privacy impact assessments, access controls, and audit trails when AI systems interact with clinical data. Compliance with GDPR, alongside MDR and the AI Act, forms a core due diligence requirement for vendors entering Poland’s healthcare ecosystem.

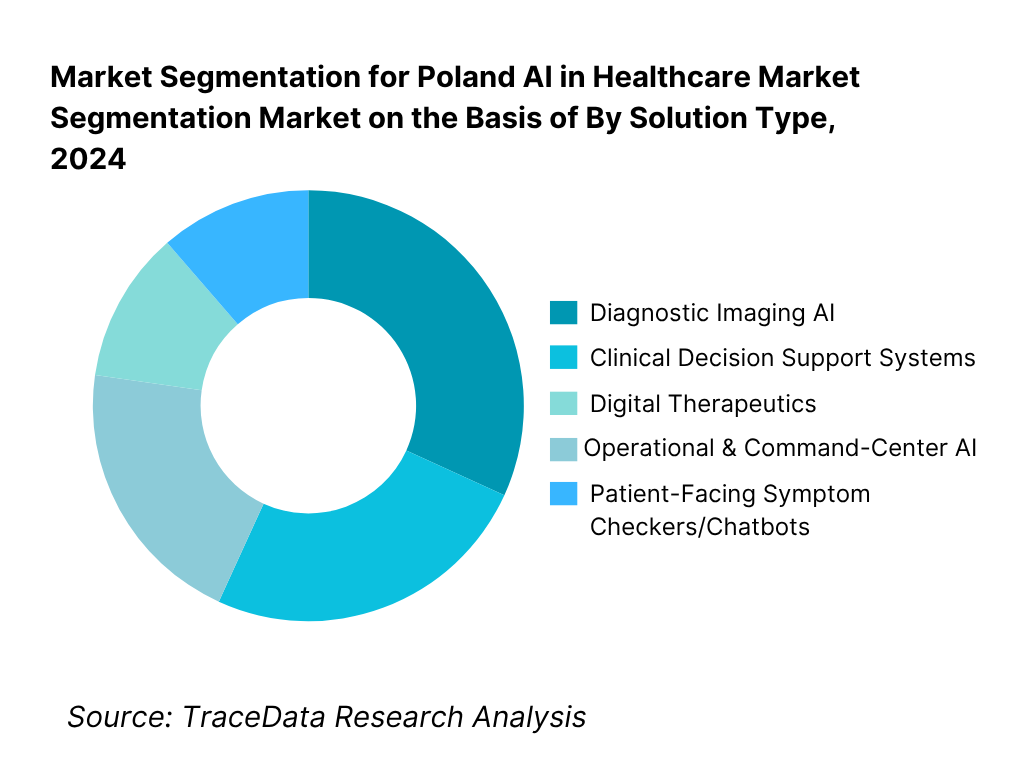

Poland AI in Healthcare Market Segmentation

By Solution Type: Poland AI in Healthcare market is segmented by solution type into diagnostic imaging AI, CDSS, digital therapeutics, operational & command-center AI, and patient-facing symptom checkers/chatbots. Recently, diagnostic imaging AI exhibits the leading share under solution type because radiology is capacity-constrained and image volumes are high in public hospitals, making triage and quantification algorithms immediately valuable. The surge of CE-marked imaging tools, NFZ-aligned workflows, and hospital PACS/VNA upgrades—supported by KPO funds—pushes imaging AI ahead of CDSS and DTx in near-term procurement. KLAS and vendor ecosystems also show imaging AI as the first enterprise-scale AI beachhead in hospitals.

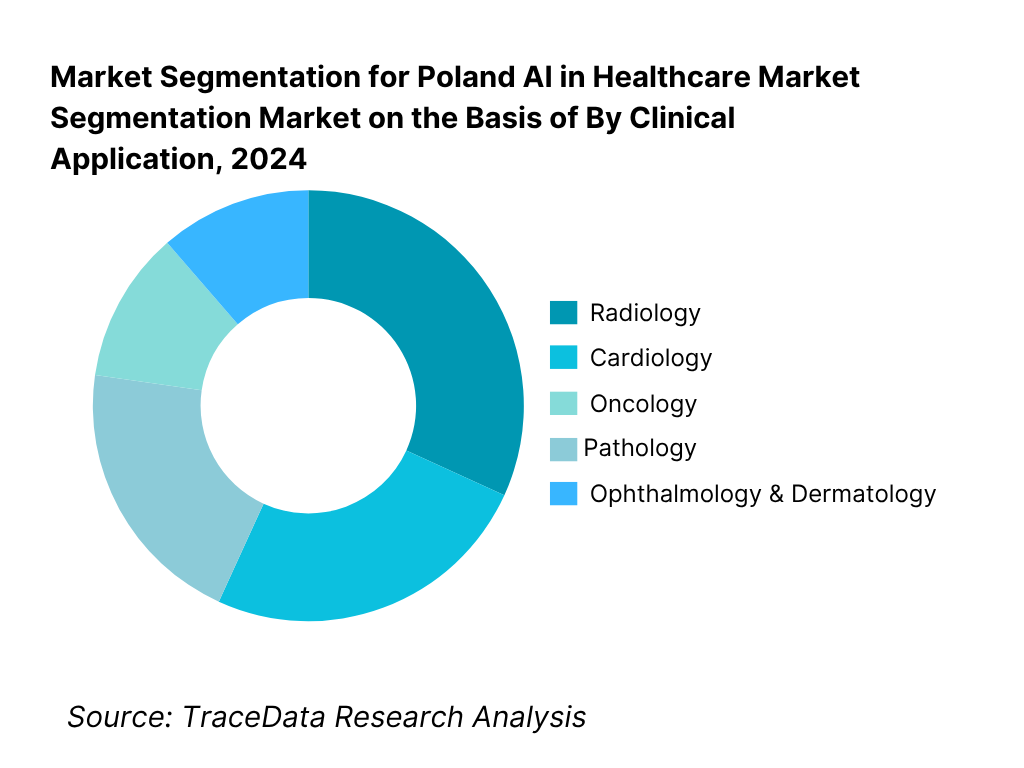

By Clinical Application: Poland AI in Healthcare market is segmented by clinical application into radiology, cardiology, oncology, pathology, ophthalmology & dermatology, and primary care triage & ED. Radiology currently dominates because imaging backlogs are pronounced and AI adds measurable throughput gains in CT, MR, X-ray, and mammography. CE-certified triage for stroke, PE, and fracture improves time-to-diagnosis, aligning with NFZ performance pressures. With USD 400 million in planned AI-medical allocations favoring imaging-intense specialties, radiology secures budget first, while oncology and cardiology acceleration follows as evidence and HTA dossiers mature.

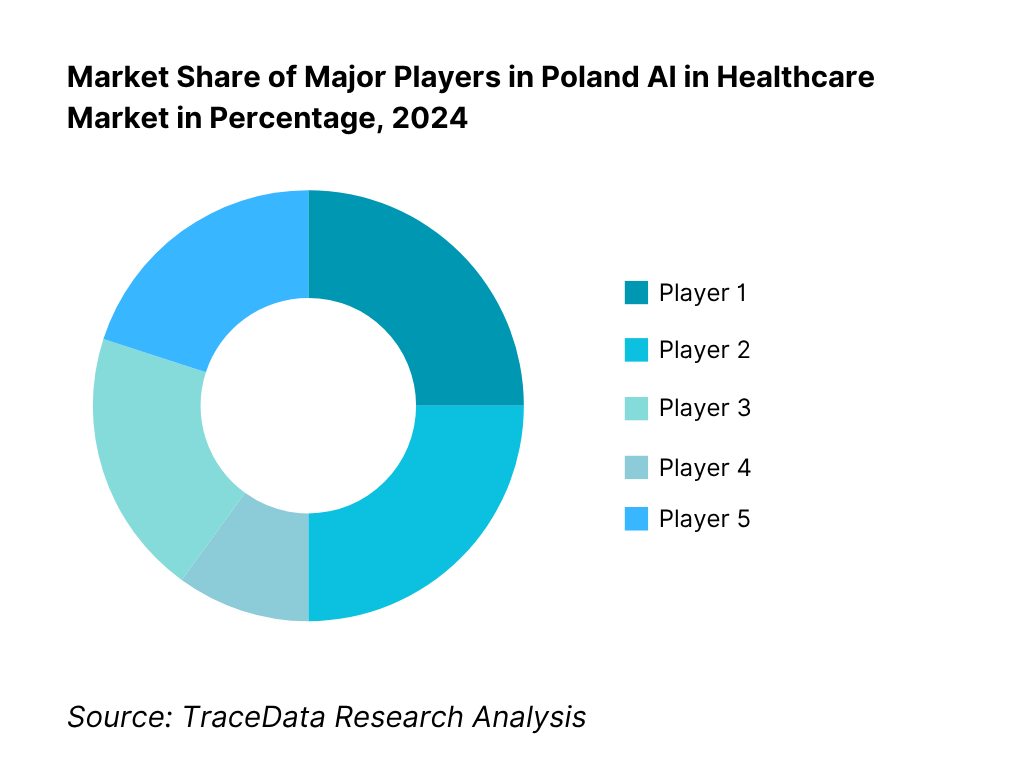

Competitive Landscape in Poland AI in Healthcare Market

The Poland AI in Healthcare market features a blend of domestic innovators and global OEM/platform leaders. Hospitals often procure via imaging/platform partnerships, which advantages multinationals with embedded PACS/RIS channels; at the same time, Polish startups win in patient-facing triage and niche clinical AI, often integrating with mojeIKP/IKP and local EHRs. This dual structure concentrates influence among a handful of platform vendors and a focused group of specialized Polish players.

Name | Founding Year | Original Headquarters |

Infermedica | 2012 | Wrocław, Poland |

StethoMe | 2015 | Poznań, Poland |

Saventic Health | 2019 | Gdańsk, Poland |

Prosoma Digital Therapeutics | 2017 | Warsaw, Poland |

AIDA Diagnostics | 2016 | Warsaw, Poland |

Upmedic | 2020 | Gdańsk, Poland |

Philips (HealthSuite) | 1891 | Amsterdam, Netherlands |

Siemens Healthineers | 1847 | Erlangen, Germany |

GE HealthCare | 1892 | Chicago, USA |

Aidoc | 2016 | Tel Aviv, Israel |

Viz.ai | 2016 | San Francisco, USA |

Lunit | 2013 | Seoul, South Korea |

Nanox AI | 2019 | Neve Ilan, Israel |

Qure.ai | 2016 | Mumbai, India |

Ada Health | 2011 | Berlin, Germany |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Infermedica: A leading Polish AI healthcare startup, Infermedica reported rapid expansion of its symptom-checker and triage platform in 2024, partnering with payers and providers across Europe. The company also integrated with national e-health platforms to enhance patient pre-diagnosis journeys and reduce emergency department burdens.

StethoMe: Known for its AI-powered smart stethoscope, StethoMe secured CE certification updates in 2024, broadening clinical acceptance in respiratory care. The company expanded pilot deployments with pediatric hospitals and integrated its remote monitoring solution with telemedicine platforms to address growing demand for home-based diagnostics.

Saventic Health: Specializing in rare disease detection, Saventic Health expanded its AI algorithms across new specialties in 2024. By collaborating with university hospitals in Poland, the company increased the number of diagnostic cases supported by its platform, thereby strengthening its positioning in clinical decision support for underdiagnosed conditions.

Prosoma Digital Therapeutics: In 2024, Prosoma launched new digital therapeutics programs for oncology rehabilitation, targeting psychological and lifestyle support for cancer patients. The company gained recognition under EU healthcare innovation programs and expanded partnerships with both hospitals and insurers to bring DTx solutions into standard cancer care pathways.

AIDA Diagnostics: AIDA Diagnostics, focusing on blood usage prediction, continued to scale in 2024 with contracts across Central European hospitals. Its AI platform demonstrated significant potential in reducing waste and improving blood bank efficiency, aligning with NFZ-driven goals to optimize hospital resource utilization.

What Lies Ahead for Poland AI in Healthcare Market?

The Poland AI in Healthcare market is expected to expand steadily by the end of the decade, supported by EU Recovery and Resilience Facility allocations of EUR 59.8 billion, with EUR 6.3 billion already unlocked to accelerate healthcare digitization. Growth will be driven by the rising demand for advanced diagnostics in ageing populations, the national e-health infrastructure handling over 513 million prescriptions annually, and compliance momentum under the EU AI Act and MDR creating a structured pathway for AI medical solutions.

Rise of AI-Enabled Hybrid Care Models: The future of AI in Poland’s healthcare ecosystem is likely to witness a strong shift toward hybrid care models, blending AI-powered tele-triage with in-person consultations. With broadband penetration at 26.11 subscriptions per 100 people, AI-driven telehealth platforms can reduce strain on hospitals while ensuring continuity of care. Urban centers like Warsaw and Wrocław are set to lead adoption, supported by university hospitals and NFZ pilot funding streams.

Focus on Outcome-Based Clinical AI Deployment: Hospitals and NFZ are expected to increasingly demand measurable clinical outcomes from AI adoption, particularly in radiology and oncology. With practising doctors at only 3.4 per 1,000 people and nurses at 5.7 per 1,000, AI will be deployed where throughput, safety, and measurable reductions in diagnostic delays are achieved. Outcome-based deployment frameworks, aligned with AOTMiT’s HTA requirements, will ensure that AI solutions prove value before scaling.

Expansion of Specialty-Specific AI Solutions: Future demand will lean toward sector-specific AI applications such as oncology triage, cardiology diagnostics, and digital therapeutics for cancer recovery. Poland has 7.36 million people aged 65 and above, creating demand for chronic-care AI support. Specialty-focused AI vendors like Saventic Health (rare diseases) and Prosoma (oncology digital therapeutics) are poised to expand with public–private partnerships, ensuring AI addresses the most resource-intensive clinical domains.

Leveraging AI, Data Lakes, and Analytics: AI deployment will increasingly leverage Poland’s national P1/IKP e-health infrastructure, already processing over 500 million prescriptions annually, to build structured clinical data lakes. This will power advanced analytics for personalized decision support, synthetic data for safer model training, and predictive algorithms for hospital resource allocation. National regulations under GDPR, MDR, and the EU AI Act will govern these analytics while ensuring privacy and clinical accountability.

Poland AI in Healthcare Market Segmentation

By Solution Type

Diagnostic Imaging AI

Clinical Decision Support Systems (CDSS)

Digital Therapeutics (DTx)

Operational & Command-Center AI

Patient-Facing AI Tools

By Clinical Application

Radiology

Cardiology

Oncology

Pathology

Ophthalmology & Dermatology

Primary Care & Emergency Triage

By Deployment Model

On-Premise Solutions

Cloud-Based Solutions

Hybrid Deployments

Embedded AI in Devices

AI-as-a-Service

By End User

Public Hospitals under NFZ

Private Hospitals and Clinics

Outpatient Specialist Clinics

Diagnostic Laboratories & Teleradiology Centers

Telemedicine & Virtual Care Platforms

By Region

Masovian (Warsaw)

Silesian

Lesser Poland (Kraków)

Greater Poland (Poznań)

Pomeranian (Gdańsk)

Players Mentioned in the Report:

Infermedica

StethoMe

Saventic Health

Prosoma Digital Therapeutics

AIDA Diagnostics

Upmedic

Philips (HealthSuite & Imaging AI)

Siemens Healthineers (AI-Rad Companion)

GE HealthCare (Edison)

Aidoc

Viz.ai

Lunit

Nanox AI

Qure.ai

Ada Health

Key Target Audience

Public hospital groups (Directors, CMIOs, CIOs)

Private hospital chains & day-surgery networks (Procurement & Digital leads)

Teleradiology networks & diagnostic lab chains (e.g., large multi-site imaging and labs)

Health insurers & payers (Private payers; Government and regulatory bodies: Ministry of Health, NFZ, AOTMiT, URPL, CeZ, UODO)

Imaging OEMs & modality vendors (channel partners for embedded AI)

Healthcare IT integrators & PACS/RIS providers (systems integration, orchestration)

Telemedicine platforms & virtual clinics (triage, chronic care, DTx onboarding)

Investments and venture capitalist firms

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

(MoH, NFZ, AOTMiT, CeZ, URPL, UODO, research institutes, public & private hospitals, startups, global OEMs, insurers, EU AI Act authorities)

4.1. Delivery Model Analysis (On-prem, Hybrid Cloud, EEA Private Cloud, SaaS AI-as-a-Service, Edge Embedded)-Margins, Preference, Strengths & Weaknesses

4.2. Revenue Streams (NFZ reimbursements, CAPEX licensing, SaaS subscriptions, pay-per-use study reads, outcomes-based contracting)

4.3. Business Model Canvas (For AI imaging, DTx, CDSS, patient engagement & workflow orchestration in Poland)

5.1. Local Startups vs Global OEMs (Polish innovators like Infermedica vs Philips, Siemens, GE)

5.2. Investment Model (ABM/RDMC grants, EU cohesion funds, VC/PE rounds, corporate venturing)

5.3. Comparative Analysis of AI Adoption in Public vs Private Healthcare (procurement models, NFZ-driven vs self-pay)

5.4. Healthcare Digital Budget Allocation (by hospital size, NFZ-contracted facilities, private hospital groups)

(evaluated via Porter’s Five Forces, reimbursement potential, hospital digital maturity indices, regulatory support)

(radiology workload vs radiologist availability, oncology diagnostics vs patient backlogs, telehealth triage capacity vs demand)

8.1. Revenues (Historical to Current)

9.1. By Market Structure (Public Hospitals, Private Hospitals, Outpatient Clinics, Diagnostic Labs, Telehealth Providers)

9.2. By Solution Type (Diagnostic Imaging AI, Clinical Decision Support, Digital Therapeutics, Operational Workflow AI, Patient-facing AI)

9.3. By Clinical Applications (Radiology, Cardiology, Oncology, Pathology, Ophthalmology, Dermatology)

9.4. By End User (NFZ-funded hospitals, private hospitals, outpatient clinics, diagnostic centers, telemedicine platforms)

9.5. By Company Size (Large hospital groups, medium-sized hospitals, private clinics)

9.6. By Deployment Mode (On-premise, Cloud-native, Hybrid, Edge)

9.7. By Open vs Customized Solutions (Standardized AI models vs customized deployments for Polish providers)

9.8. By Region (Masovian, Silesian, Lesser Poland, Greater Poland, Pomeranian, Others)

10.1. Healthcare Provider Cohort & Adoption Readiness (digital maturity scoring, hospital clusters)

10.2. Decision-Making Process (role of NFZ, MoH, CIOs, KOL physicians, IT heads)

10.3. Program Effectiveness & ROI Analysis (workflow efficiency, diagnostic accuracy, NFZ budget impact)

10.4. Gap Analysis Framework (AI solutions vs unmet clinical needs)

11.1. Trends and Developments (cloud-native PACS/VNA, foundation models, explainable AI for HTA dossiers)

11.2. Growth Drivers (oncology & cardiology burden, EU AI Act compliance, NFZ reimbursement pilots, digital hospital push)

11.3. SWOT Analysis for Poland AI in Healthcare Market

11.4. Issues and Challenges (procurement cycles, MDR/IVDR, clinician adoption, data governance)

11.5. Government Regulations (EU MDR/IVDR, EU AI Act, GDPR, NFZ telehealth tariffs, ABM funding programs)

12.1. Market Size & Future Potential (tele-triage, symptom checkers, AI chatbots integrated with mojeIKP)

12.2. Business Models & Revenue Streams (direct-to-patient vs B2B hospital partnerships)

12.3. Delivery Models & Clinical Scope (triage, chronic disease monitoring, patient engagement apps)

(radar chart: oncology imaging, teleradiology hubs, digital therapeutics, tele-triage, hospital workflow orchestration, payer analytics)

(positioning vendors across innovation vs adoption readiness)

15.1. Market Share of Key Players (basis revenues, deployments, NFZ integrations)

15.2. Benchmark of Key Competitors (company overview, USP, CE/MDR class, business strategies, number of deployments, pricing models, technology stack, clinical validations, key clients, strategic tie-ups, marketing strategy, recent developments)

15.3. Operating Model Analysis Framework (on-prem vs SaaS vs hybrid rollouts)

15.4. Gartner Magic Quadrant (vendor positioning for AI healthcare solutions in EMEA/CEE)

15.5. Bowman’s Strategic Clock (competitive advantage mapping-differentiation vs cost focus)

16.1. Revenues (Forecast)

17.1. By Market Structure (Public vs Private, Outpatient Clinics, Diagnostic Labs, Telehealth Providers)

17.2. By Solution Type (Imaging AI, CDSS, DTx, Workflow AI, Patient-facing apps)

17.3. By Clinical Applications (Radiology, Oncology, Cardiology, Pathology, Others)

17.4. By End User (NFZ-contracted hospitals, private hospitals, outpatient clinics, labs, telemedicine providers)

17.5. By Company Size (Large hospital groups, mid-tier hospitals, clinics)

17.6. By Deployment Mode (On-prem, Cloud, Hybrid, Edge)

17.7. By Open vs Customized Solutions (standardized vs tailored models)

17.8. By Region (Masovian, Silesian, Lesser Poland, Greater Poland, Pomeranian, Others)

(strategic entry points, pricing models, partnership opportunities)

(high-growth clinical pathways, payer-driven pilots, hospital alliances)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire Poland AI in Healthcare ecosystem, identifying both demand-side entities—public hospitals funded by the NFZ, private hospital chains, diagnostic laboratories, outpatient clinics, and telehealth platforms—and supply-side entities, including AI startups, multinational MedTech OEMs, IT integrators, and cloud providers. Based on this mapping, we shortlist 5–6 leading AI healthcare vendors in Poland, such as Infermedica, StethoMe, Saventic Health, Prosoma DTx, AIDA Diagnostics, and Philips, using financial disclosures, deployment reach, and reference client bases as benchmarks. Sourcing is carried out using government portals, EU RRP documentation, industry articles, and proprietary healthcare databases.

Step 2: Desk Research

An exhaustive desk research process is undertaken, leveraging trusted secondary and proprietary databases. We gather national healthcare indicators from bodies like OECD, Eurostat, Statistics Poland (GUS), and World Bank, combined with vendor-specific data from press releases, financial filings, and EU project reports. The analysis covers adoption patterns of AI in radiology, cardiology, and oncology, the scale of public investment in digital healthcare, and infrastructure readiness such as broadband penetration and e-health prescription volumes. Company-level examination highlights CE-mark certifications, NFZ pilot programs, clinical validation studies, and interoperability readiness (HL7/DICOM/FHIR). This structured approach establishes a detailed baseline for market sizing and segment-level insights.

Step 3: Primary Research

We complement desk research with in-depth interviews conducted with stakeholders across the Poland AI in Healthcare market. This includes CMIOs, CIOs, heads of radiology, AOTMiT reviewers, NFZ procurement officials, and executives from AI healthcare startups. Interviews are designed to validate hypotheses formed in Step 2, authenticate statistical and operational data, and capture real-world insights into barriers, ROI expectations, and adoption timelines. A bottom-up approach is applied to derive revenue contributions from each vendor, while a top-down lens benchmarks national health IT expenditure and AI adoption rates. To ensure robustness, our team also conducts disguised interviews, approaching companies as potential clients to validate financial and operational metrics, pricing models, and value-chain structures against secondary sources.

Step 4: Sanity Check

Finally, a dual top-to-bottom and bottom-to-top triangulation is performed to verify the integrity of the findings. Market size modeling combines public healthcare expenditure, EU RRP disbursement flows, and AI deployment indicators to cross-check calculated totals. Comparative benchmarking with global AI-in-healthcare adoption metrics further validates reasonability. This sanity check ensures that both macro-level drivers (government budgets, infrastructure investments) and micro-level inputs (vendor revenues, hospital deployments) align consistently, producing a validated and defensible analysis of the Poland AI in Healthcare Market.

FAQs

01 What is the Potential for the Poland AI in Healthcare Market?

The Poland AI in Healthcare Market shows strong potential, underpinned by the country’s healthcare expenditure of PLN 191 billion and ongoing allocations from the EUR 59.8 billion Recovery and Resilience Plan, of which EUR 6.3 billion was released to accelerate healthcare digitization. This environment creates a favorable foundation for AI-driven solutions in radiology, oncology, and cardiology. The market’s potential is reinforced by the nationwide adoption of e-prescriptions, with 513.4 million issued in the most recent year, demonstrating both digital maturity and readiness for AI scale-up.

02 Who are the Key Players in the Poland AI in Healthcare Market?

The Poland AI in Healthcare Market features a mix of domestic innovators and global technology leaders. Key Polish players include Infermedica, StethoMe, Saventic Health, Prosoma Digital Therapeutics, AIDA Diagnostics, and Upmedic, recognized for their strong integration with local hospitals and payer systems. Internationally, companies like Philips, Siemens Healthineers, GE HealthCare, Aidoc, Viz.ai, Lunit, Nanox AI, Qure.ai, and Ada Health dominate through imaging platforms and clinical AI ecosystems. These companies hold influence due to CE-marked product portfolios, local clinical collaborations, and strong integration with Poland’s e-health infrastructure.

03 What are the Growth Drivers for the Poland AI in Healthcare Market?

Major growth drivers include the ageing population, with 7.36 million citizens aged 65+, creating high demand for chronic-care diagnostics and monitoring. Limited physician density at 3.4 per 1,000 people and nurse density at 5.7 per 1,000 highlight systemic capacity constraints, where AI enables faster workflows and decision support. Finally, digital infrastructure maturity, evidenced by 513.4 million e-prescriptions processed annually and broadband penetration of 26.11 per 100 people, provides the technical foundation for scaling AI solutions across both urban and regional care facilities.

04 What are the Challenges in the Poland AI in Healthcare Market?

The Poland AI in Healthcare Market faces significant challenges. First, regulatory complexity under MDR and the EU AI Act requires costly clinical validation and post-market monitoring before AI systems can be widely deployed. Second, healthcare workforce shortages—only 131,426 practising physicians in the country—limit hospitals’ capacity to adopt and govern new AI systems effectively. Third, compliance with GDPR, with penalties up to EUR 20 million or 4% of turnover, raises barriers for startups and hospitals deploying AI at national e-health scale. These factors slow procurement cycles and increase adoption risk.