Poland Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Service Type, By End-User Industry, By Mode of Transportation, By Type of Warehousing, and By Region

- Product Code: TDR0210

- Region: Europe

- Published on: July 2025

- Total Pages: 80

Report Summary

The report titled “Poland Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Service Type, By End-User Industry, By Mode of Transportation, By Type of Warehousing, and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Poland. The report covers an overview and genesis of the sector, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, key issues and challenges, and competitive landscape including market share, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing space. The report concludes with future market projections based on industry revenue, segmented by service verticals, user industries, regional clusters, and key strategic success case studies.

Poland Logistics and Warehousing Market Overview and Size

The Poland logistics and warehousing market was valued at PLN 78 Billion in 2023, driven by the country's strategic location in Central Europe, its integration within the EU supply chain, and a rapid surge in e-commerce and manufacturing activities. Key players in the market include DPD Polska, DB Schenker, DHL, Poczta Polska, InPost, Raben Group, and Panattoni. These companies have established extensive logistics and warehousing networks supported by modern technological solutions, contributing to the sector's rapid evolution.

In 2023, Panattoni expanded its warehousing footprint by launching over 500,000 sq. meters of new logistics space to support the growing demand from the retail and FMCG sectors. Warsaw, Wrocław, Gdańsk, and Łódź are among the most prominent logistics hubs due to their access to highways, airports, and proximity to international borders.

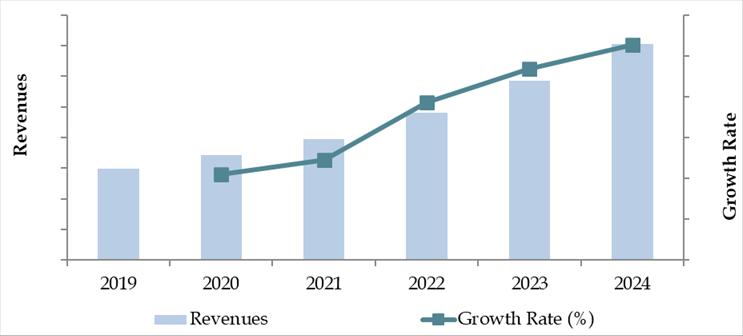

Market Size for Poland Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Poland Logistics and Warehousing Market:

Strategic Location and EU Connectivity: Poland serves as a critical logistics corridor between Western Europe and Eastern markets. As a member of the European Union, it facilitates duty-free, intra-EU trade movement and has benefited significantly from infrastructural development supported by EU funds. In 2023, over 80% of Poland’s logistics volume originated from or was destined to other EU nations, strengthening its role as a continental transit hub.

Rise of E-Commerce and Urban Logistics: The e-commerce sector in Poland grew by 18% year-on-year in 2023, increasing demand for last-mile delivery services and urban warehousing solutions. Fulfillment centers and dark stores have proliferated in cities like Kraków, Poznań, and Katowice to address same-day and next-day delivery expectations.

Industrial and Manufacturing Base Expansion: Poland has become a major destination for nearshoring and contract manufacturing, especially in automotive, electronics, and FMCG industries. This has driven demand for specialized logistics solutions such as cold chain logistics, component warehousing, and JIT (just-in-time) transportation. The manufacturing sector’s contribution to GDP stood at 17.4% in 2023, necessitating high-capacity logistics operations.

Which Industry Challenges Have Impacted the Growth for Poland Logistics and Warehousing Market

Infrastructure Disparities Across Regions: While major urban centers like Warsaw, Wrocław, and Gdańsk benefit from modern logistics infrastructure, secondary cities and eastern regions still face infrastructural constraints such as limited highway access and underdeveloped intermodal terminals. According to 2023 logistics infrastructure assessments, nearly 30% of regional distribution centers in Poland operate with sub-optimal connectivity, leading to increased lead times and higher last-mile delivery costs.

Labor Shortages in Warehousing and Transportation: The logistics sector in Poland is grappling with an acute shortage of skilled labor, particularly warehouse workers, forklift operators, and truck drivers. In 2023, it was estimated that over 120,000 logistics jobs remained unfilled. This labor gap has driven up wage costs by 7–10% year-on-year and affected service levels, especially during seasonal demand peaks.

Rising Operating Costs and Inflationary Pressures: Soaring fuel prices, rising energy costs, and higher rental rates for warehousing space have placed significant strain on profit margins for logistics operators. In 2023, average warehousing rent across major Polish hubs rose by 12%, while diesel prices increased by 14% compared to the previous year. These rising costs have led to price adjustments and impacted smaller 3PL and last-mile delivery firms disproportionately.

What are the Regulations and Initiatives Which Have Governed the Market:

EU Green Logistics Mandates: Poland, as part of the EU, is subject to green logistics regulations including emission reduction targets and sustainability reporting. Under the EU Fit for 55 framework, logistics companies must reduce their CO₂ footprint, with Poland aiming for a 55% reduction in transport emissions by 2030. As of 2023, only 18% of logistics fleet in Poland was compliant with Euro 6 or electric standards, highlighting a significant transition challenge.

Special Economic Zones (SEZs) and Logistics Incentives: The Polish government has designated SEZs in regions like Silesia, Pomerania, and Lower Silesia to attract investment in logistics infrastructure. These zones offer corporate tax relief up to 50%, accelerated permits, and land use benefits. In 2023 alone, over PLN 2.8 billion worth of logistics-related investments were facilitated through SEZ incentives.

National Logistics Strategy 2030: The Polish Ministry of Infrastructure launched the National Logistics Development Strategy in 2022, aimed at enhancing multimodal connectivity and digitalizing freight operations. Key initiatives under this strategy include the Digital Freight Corridor, expansion of intermodal terminals, and integration of real-time cargo tracking across major ports and rail terminals. The strategy is expected to increase Poland’s logistics throughput capacity by 25% by 2029.

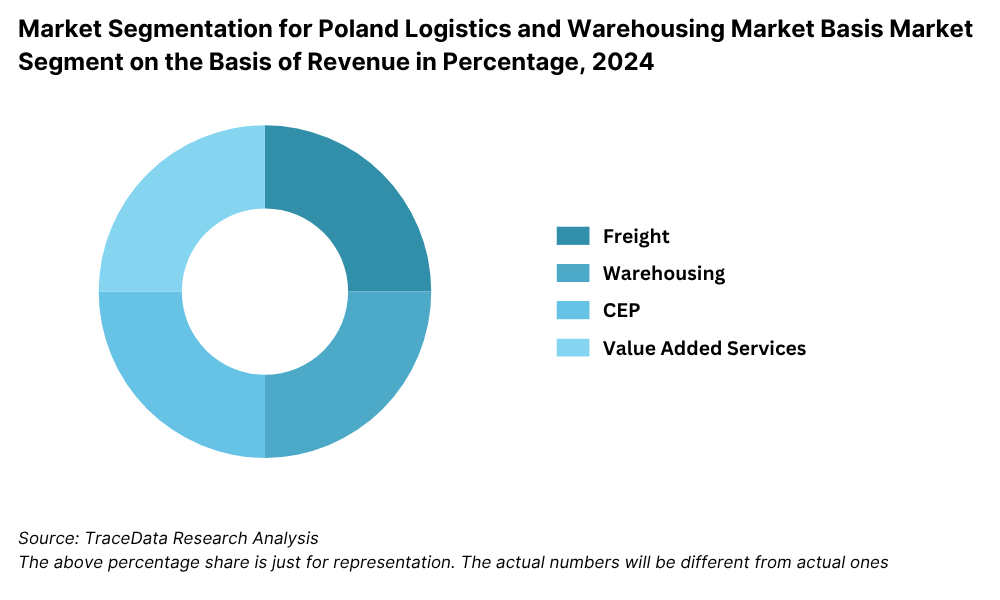

Poland Logistics and Warehousing Market Segmentation

By Market Structure: Organized players dominate the market due to their nationwide presence, adherence to EU logistics regulations, and investments in digital infrastructure and warehousing automation. They provide integrated services including freight forwarding, contract logistics, and real-time tracking, making them a preferred choice for large manufacturers, e-commerce firms, and retailers. Unorganized players hold a smaller share but play a critical role in regional connectivity, especially in Tier 2 and Tier 3 cities. These players offer price flexibility and personalized services but often lack standardized operating procedures and compliance with modern logistics norms.

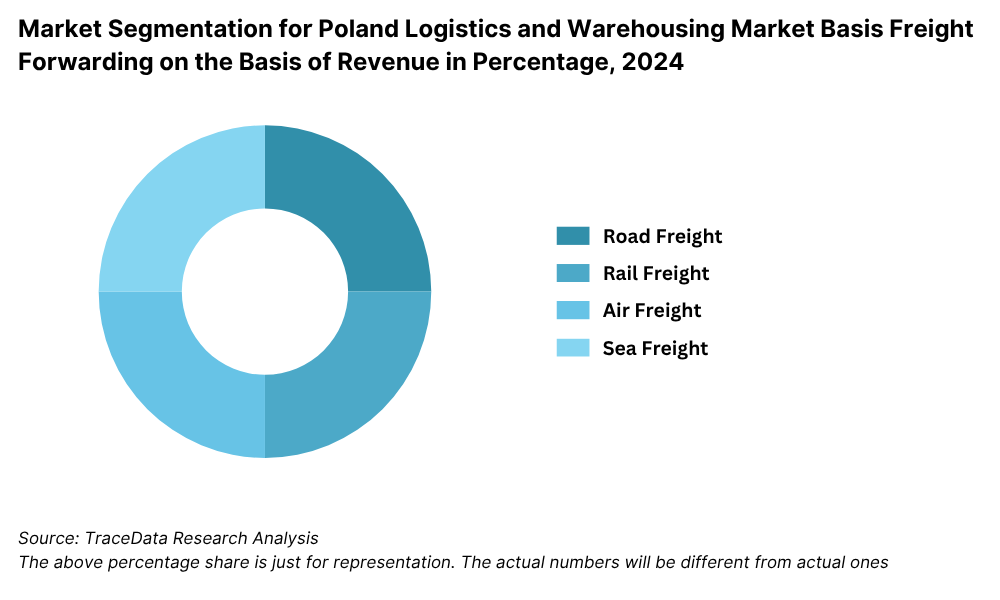

By Service Type: Transportation dominates the logistics value chain in Poland, largely driven by the country’s strong road freight infrastructure and its geographic advantage as a gateway between Western and Eastern Europe. Warehousing is the second-largest segment, bolstered by rapid e-commerce expansion and growing demand for fulfillment centers. Cold chain logistics is emerging, driven by the pharmaceutical and agri-food industries, and is expected to witness strong growth over the forecast period. Value-added services such as inventory management, kitting, and reverse logistics are also gaining traction among 3PL providers.

By End-User Industry: E-commerce is the leading demand driver, accounting for a significant share of warehousing and last-mile delivery volumes, especially from platforms like Allegro and Amazon. FMCG and retail sectors follow, driven by their need for efficient replenishment and distribution. Automotive and electronics sectors have specialized logistics needs, including sequencing, cross-docking, and temperature-controlled storage, contributing significantly to the demand for Grade A warehousing. The pharmaceutical industry also demands high compliance and traceability, thereby increasing the share of cold chain and secure logistics services.

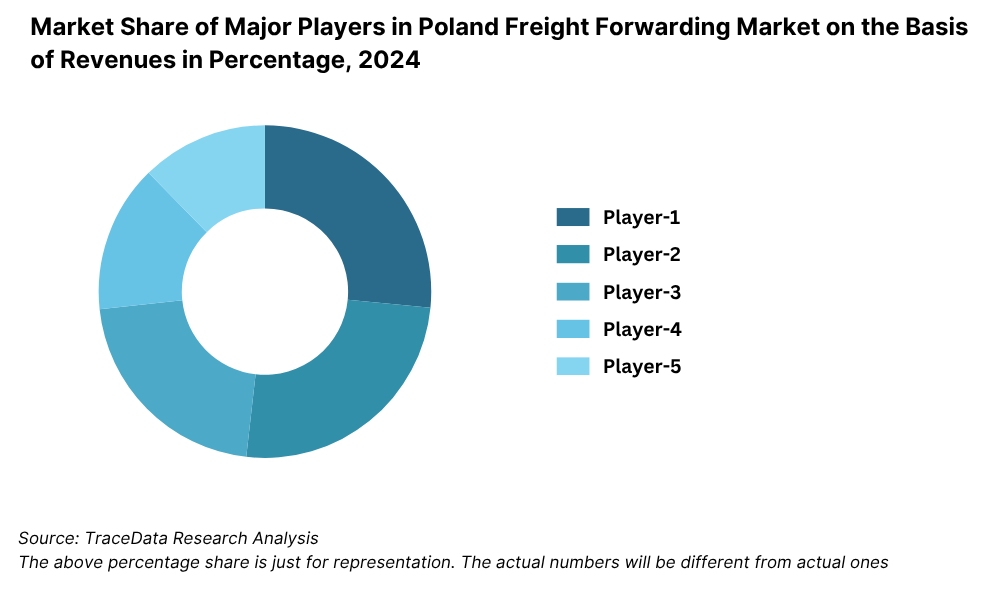

Competitive Landscape in Poland Logistics and Warehousing Market

The Poland logistics and warehousing market is moderately consolidated, with a mix of global logistics giants and leading domestic players. The presence of international 3PL providers such as DB Schenker, DHL, and DPD Polska, alongside regional specialists like Raben Group and InPost, has created a dynamic ecosystem offering diverse logistics and fulfillment services across the country. The expansion of e-commerce and demand for urban logistics has also encouraged the entry of tech-driven platforms and warehouse developers like Panattoni and 7R.

Company Name | Founding Year | Original Headquarters |

PKP Cargo S.A. | 2001 | Warsaw, Poland |

Raben Group | 1931 | Oss, Netherlands (Polish HQ in Gądki) |

DB Schenker Poland | 1872 (PL: ~1990s) | Essen, Germany |

DHL Parcel Polska (DHL Group) | 1969 (PL: ~1990s) | Bonn, Germany |

Poczta Polska Logistics | 1558 (modern ops: 2009) | Warsaw, Poland |

GEFCO Polska (now part of CEVA Logistics) | 1949 (PL: ~1990s) | Paris, France |

Kuehne + Nagel Poland | 1890 (PL: ~1990s) | Schindellegi, Switzerland |

DSV Poland (formerly Panalpina) | 1976 (PL: ~2000s) | Hedehusene, Denmark |

Rohlig Suus Logistics S.A. | 1989 | Warsaw, Poland |

No Limit Sp. z o.o. | 1990 | Warsaw, Poland |

FedEx Express Poland | 1971 (PL: ~2000s) | Memphis, USA |

UPS Poland | 1907 (PL: ~1990s) | Atlanta, USA |

Maersk Poland | 1904 (PL: ~1990s) | Copenhagen, Denmark |

Yusen Logistics (Polska) Sp. z o.o. | 1955 (PL: ~2000s) | Tokyo, Japan |

Nippon Express Poland | 1937 (PL: ~2000s) | Tokyo, Japan |

FM Logistic Central Europe (Poland branch) | 1967 (PL: ~1995) | Phalsbourg, France |

Rhenus Logistics Poland | 1912 (PL: ~2000s) | Holzwickede, Germany |

PEKAES Sp. z o.o. (part of GEODIS Group) | 1958 | Błonie, Poland |

Some of the recent competitor trends and key information about competitors include:

DB Schenker: One of the largest logistics operators in Poland, DB Schenker handled over 65 million shipments in 2023 across its domestic and international routes. The company has made significant investments in sustainable logistics, including deploying electric delivery vehicles in Warsaw and Poznań as part of its zero-emission initiative.

DHL Supply Chain: DHL has been expanding its warehouse automation capabilities in Poland, with over 300,000 sq. meters of warehousing space dedicated to FMCG and retail logistics as of 2023. The company’s investment in robotic picking systems has improved throughput times by nearly 20% year-over-year.

DPD Polska: A leader in last-mile delivery, DPD recorded a 28% increase in parcel volume in 2023, driven largely by the e-commerce boom. Its development of urban depots and integration with local e-grocery and fashion platforms has bolstered its footprint in major cities.

Raben Group: Operating more than 130 warehouse facilities across Poland and Central Europe, Raben continues to expand its contract logistics and cold chain divisions. In 2023, it launched a new 100,000 sq. meter logistics park near Łódź to cater to growing demand from the automotive and pharmaceutical sectors.

InPost: Specializing in automated parcel lockers (Paczkomaty), InPost has emerged as a key player in e-commerce logistics. As of 2023, it had over 20,000 lockers installed across Poland, handling over 750 million parcels annually. Its smart logistics model and mobile-first interface have attracted younger, tech-savvy customers.

Panattoni Europe: The largest industrial real estate developer in Poland, Panattoni delivered more than 2 million sq. meters of warehousing space in 2023. The company is focusing on BREEAM-certified green warehouses and strategic locations near highways and border crossings.

What Lies Ahead for Poland Logistics and Warehousing Market?

The Poland logistics and warehousing market is projected to grow steadily by 2029, exhibiting a healthy CAGR over the forecast period. This growth will be fueled by Poland’s strategic geographic location, continued expansion of e-commerce, manufacturing growth, and rising demand for modern warehousing and value-added services.

Acceleration of E-Commerce Fulfillment and Last-Mile Delivery: With online retail penetration rising rapidly, the demand for hyperlocal logistics, same-day delivery, and micro-fulfillment centers is expected to surge. E-commerce players will continue investing in urban warehouses and automated fulfillment technologies to cater to consumer expectations for speed and convenience.

Expansion of Green and Sustainable Logistics Solutions: As environmental regulations tighten and ESG (Environmental, Social, and Governance) goals become central to corporate strategies, the logistics sector will see a shift towards greener practices. This includes the adoption of electric vehicles for urban delivery, solar-powered warehouses, and carbon offset programs. By 2029, a significant portion of logistics operations in Poland is expected to meet EU carbon reduction benchmarks.

Rise of Multimodal and Cross-Border Logistics Hubs: Given Poland’s role as a central gateway between Western Europe and Eastern markets, there will be increased investment in multimodal logistics hubs connecting road, rail, air, and sea routes. Border towns and logistics clusters like Rzeszów, Białystok, and Lublin are expected to witness increased development as trade volumes with Ukraine and other Eastern neighbors rebound.

Digitization and Smart Logistics: The integration of AI, IoT, and blockchain in supply chain visibility, inventory management, and predictive analytics will significantly enhance logistics efficiency and responsiveness. By 2029, over 60% of modern warehousing facilities in Poland are expected to be equipped with smart systems enabling real-time data sharing, automation, and optimized resource utilization.

Future Outlook and Projections for Poland Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Poland Logistics and Warehousing Market Segmentation

• By Market Structure:

o Organized Logistics Providers

o Unorganized Logistics Providers

o Regional Warehousing Operators

o National 3PL Companies

o International Freight Forwarders

o Asset-Light Digital Logistics Platforms

o Last-Mile Delivery Companies

• By Service Type:

o Transportation (Road, Rail, Air, Sea)

o Warehousing & Storage

o Fulfillment & Distribution

o Cold Chain Logistics

o Reverse Logistics

o Value-Added Services (Labeling, Kitting, Assembly)

• By End-User Industry:

o E-Commerce and Retail

o FMCG

o Automotive

o Pharmaceuticals and Healthcare

o Electronics and Electricals

o Agriculture and Food Processing

o Industrial Manufacturing

• By Mode of Transportation:

o Road Freight

o Rail Freight

o Air Cargo

o Sea Freight

o Multimodal Logistics

• By Type of Warehousing:

o Grade A Warehouses

o Grade B/C Warehouses

o Urban Warehouses / Micro Fulfillment Centers

o Cold Storage Facilities

o Bonded Warehouses

• By Region:

o Warsaw & Central Poland

o Silesia (Katowice, Gliwice)

o Pomerania (Gdańsk, Gdynia)

o Lower Silesia (Wrocław)

o Eastern Poland (Lublin, Białystok)

o Southern Poland (Kraków, Rzeszów)

Players Mentioned in the Report:

Freight Forwarding Companies

Omida Logistics

POL‑AGENT Sp. z o.o.

Real Logistics

Canvas Logistics

DTA

SKAT Transport

Transmec Poland

Grupa Geis Poland

Pekaes S.A.

C.H. Robinson

Mainfreight Ltd.

Trans‑Petro‑Color

TON‑POL

STOR‑AGE Sp. z o.o.

REGESTA S.A.

Raben Logistics Polska

DB Schenker Polska

Kuehne + Nagel Poland

CEVA Logistics Poland

InPost

DPD Polska

DHL (e‑commerce parcel services)

GLS

Polish Post (Poczta Polska)

FedEx

UPS

DHL Express

FedEx

UPS

DPD Group

InPost (courier services)

GLS

Polish Post

Warehousing Companies

E‑Commerce Logistics Companies

Express Logistics Companies

Key Target Audience:

• Third-Party Logistics (3PL) Providers

• E-Commerce and Retail Companies

• Real Estate and Warehousing Developers

• Freight Forwarders and Transporters

• Regulatory Bodies (e.g., Ministry of Infrastructure, EU Transport Commission)

• Investors and PE/VC Firms

• Supply Chain Technology Providers

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Poland Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Poland

4.4. LPI Index of Poland and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Poland Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Poland

5.2. Current Scenario for Logistics Infrastructure in Poland

5.3. Road Infrastructure in Poland including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Poland including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Poland including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Poland including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Poland Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Poland 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Poland

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Poland Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Poland Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Poland Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Poland Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Poland 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Poland Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Poland and Poland), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Poland Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Poland Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Poland 3PL Warehousing Segmentation

9.4.1. Poland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Poland Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Poland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Poland 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Poland Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Poland Warehousing Future Market Size on the Basis of Revenues, 2025-2029

9.7. Poland Warehousing Market Future Segmentation

9.7.1. Poland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Poland Warehousing Revenue By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Poland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Poland CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Poland CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Poland CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Poland CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Poland E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Poland CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Poland CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Poland CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities within the Poland Logistics and Warehousing Market. On the demand side, we consider industries such as e-commerce, FMCG, automotive, pharmaceuticals, and industrial manufacturing. On the supply side, we profile key logistics providers, warehousing developers, last-mile operators, and technology enablers. Based on this mapping, we shortlist 5–6 leading logistics players in the country based on financial strength, warehousing footprint, volume handled, and geographic presence.

Sourcing is done through industry journals, government publications, trade association data, and multiple secondary and proprietary databases to perform desk research and establish a strong base of industry-level information.

Step 2: Desk Research

An exhaustive desk research phase is carried out by referencing diverse secondary and proprietary databases. This includes EU logistics reports, government portals, press releases, company financial statements, transport infrastructure databases, and real estate market intelligence platforms. We analyze sector-level insights such as warehousing capacity, logistics throughput, market segmentation by mode and service, pricing trends, regulatory developments, and investment patterns.

Company-level research is undertaken by reviewing annual reports, investor presentations, logistics park listings, media coverage, and operational performance disclosures. This phase constructs a foundational understanding of both macro-level trends and micro-level operations of key entities.

Step 3: Primary Research

We conduct in-depth interviews with C-level executives, operations heads, and logistics managers representing 3PL companies, warehouse developers, e-commerce players, and large manufacturing firms. The purpose of these interactions is to validate secondary data, test market hypotheses, and extract firsthand insights on pricing structures, service preferences, operational bottlenecks, and future expectations.

To further validate our assumptions, our team performs disguised interviews where we engage with companies as prospective customers or partners. This allows us to cross-check operational and financial information, service benchmarks, warehousing rates, and process flow models. These interviews also shed light on warehousing demand dynamics, capacity utilization, and multimodal integration.

Step 4: Sanity Check

- Top-down and bottom-up estimation techniques are used to triangulate the overall market size and forecast projections. Key assumptions are tested using scenario modeling, sensitivity analysis, and benchmarking with adjacent EU markets to ensure consistency and accuracy of findings.

FAQs

1. What is the potential for the Poland Logistics and Warehousing Market?

The Poland logistics and warehousing market holds significant growth potential, reaching a valuation of PLN 78 Billion in 2023. Its strategic location as a logistics hub between Western Europe and Eastern markets, combined with robust demand from sectors like e-commerce, automotive, and FMCG, positions Poland as a key player in the European logistics corridor. Continued investments in infrastructure, smart warehouses, and cross-border connectivity further strengthen the market’s long-term outlook.

2. Who are the Key Players in the Poland Logistics and Warehousing Market?

The market is led by a mix of international and domestic players including DB Schenker, DHL Supply Chain, DPD Polska, Raben Group, InPost, Panattoni Europe, and 7R SA. These companies dominate the sector through their expansive logistics networks, modern warehousing infrastructure, multimodal capabilities, and focus on technology-driven solutions.

3. What are the Growth Drivers for the Poland Logistics and Warehousing Market?

Major growth drivers include the rapid expansion of e-commerce, which has increased demand for last-mile delivery and fulfillment centers. Manufacturing and export growth, particularly in automotive and electronics, has created the need for scalable and specialized logistics. Additionally, EU-backed infrastructure projects, urbanization, and Poland’s central role in regional supply chains are accelerating market momentum.

4. What are the Challenges in the Poland Logistics and Warehousing Market?

The sector faces challenges such as regional infrastructure disparities, especially in eastern Poland, and labor shortages in warehousing and transport roles. Rising fuel and energy costs, along with increasing pressure to comply with green logistics standards, are straining operational margins. Moreover, fragmentation among smaller players and a slow pace of digital adoption among unorganized providers remain hurdles to be addressed.