Portugal Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Type of Services (Freight Forwarding, Warehousing, Express Logistics, and 3PL), By End-User Industry, By Region, and By Type of Warehouses

- Product Code: TDR0211

- Region: Asia

- Published on: July 2025

- Total Pages: 80

Report Summary

The report titled “Portugal Logistics and Warehousing Market Outlook to 2029 - By Market Structure, By Type of Services (Freight Forwarding, Warehousing, Express Logistics, and 3PL), By End-User Industry, By Region, and By Type of Warehouses” provides a comprehensive analysis of the logistics and warehousing industry in Portugal. The report covers the overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing ecosystem. The report concludes with future market projections based on service revenue, by logistics sub-segment, region, and type of customers, along with success case studies highlighting key opportunities and market cautions.

Portugal Logistics and Warehousing Market Overview and Size

The Portugal logistics and warehousing market was valued at EUR 6.2 billion in 2023, supported by increased trade activities, e-commerce expansion, and growing investments in port and transport infrastructure. Portugal's strategic location as a transatlantic trade hub, coupled with advancements in digital supply chain platforms, has significantly boosted demand for integrated logistics services. Key players in the market include DHL, Luís Simões, DB Schenker, KLOG Logistics Solutions, and Rangel Logistics Solutions. These companies are recognized for their comprehensive logistics offerings, warehousing capabilities, and last-mile delivery solutions.

In 2023, DHL Supply Chain announced a multi-million-euro investment in expanding its automated warehousing facilities near Lisbon, targeting e-commerce and pharmaceutical clients. The Greater Lisbon and Northern Portugal regions are the most active logistics zones due to their proximity to ports, airports, and dense urban consumption clusters.

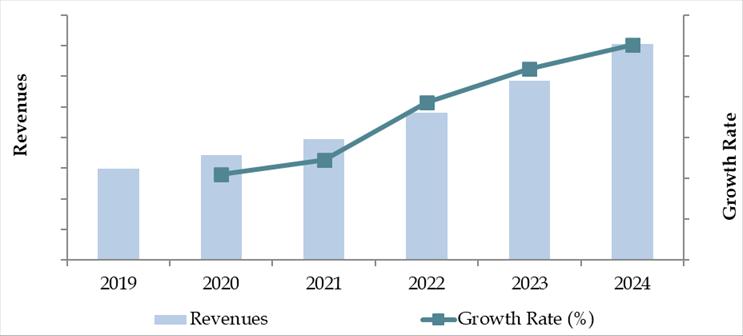

Market Size for Portugal Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Portugal Logistics and Warehousing Market:

Strategic Geographic Position: Portugal’s location on the Atlantic coast makes it a gateway for trade between Europe, the Americas, and Africa. The Port of Sines has seen a 14% CAGR in container throughput between 2018 and 2023, and its deep-water capacity attracts large shipping lines seeking alternative European entry points outside Northern ports.

Growth in E-commerce and Retail: Online retail sales in Portugal crossed EUR 7 billion in 2023, growing at a CAGR of 12% since 2018. This has triggered demand for warehousing, last-mile delivery, and temperature-controlled logistics. Major retailers and marketplaces, including Continente, Worten, and Amazon (via Spanish operations), are increasingly relying on regional fulfillment centers.

Government Incentives and EU Funding: Portugal has benefited from EU funding under the Recovery and Resilience Facility (PRR), which allocated over EUR 1.5 billion for mobility and logistics digitalization projects. The development of smart transport corridors and green logistics zones has improved multimodal connectivity and operational efficiency.

Which Industry Challenges Have Impacted the Growth for Portugal Logistics and Warehousing Market

High Operating Costs and Labor Shortages: Rising energy prices and labor costs have significantly impacted logistics operators in Portugal. In 2023, diesel prices increased by nearly 18% compared to the previous year, directly affecting road freight margins. Furthermore, the industry has faced a 22% shortfall in skilled logistics personnel, particularly in warehouse operations and last-mile delivery, according to a survey by the Portuguese Logistics Association.

Port Congestion and Infrastructure Gaps: Despite Portugal’s strategic coastal location, port congestion—especially at the Port of Lisbon—has delayed container movements, increasing average dwell times by 12% in 2023. Inland connectivity and the limited development of intermodal transport infrastructure (particularly rail-road links) have further constrained throughput, especially for time-sensitive and temperature-controlled goods.

Fragmented Market with Low Tech Penetration: The logistics market in Portugal remains fragmented, with over 60% of logistics providers being small- to mid-sized enterprises lacking digital capabilities. A recent study found that fewer than 35% of warehousing firms utilize automated inventory or WMS (Warehouse Management Systems), slowing productivity and increasing errors in stock handling and order fulfillment.

What are the Regulations and Initiatives which have Governed the Market

EU Green Logistics Mandates: Portugal, as an EU member state, is bound by the European Green Deal and Fit for 55 package, which aim to cut transport emissions by 90% by 2050. In response, the Portuguese government mandated a national logistics decarbonization strategy in 2023, introducing incentives for fleet electrification, low-emission zones, and energy-efficient warehouses. More than 20% of new logistics fleet registrations in 2023 were electric or hybrid vehicles.

Strategic Transport and Logistics Plan 2021–2030 (PETI 3+): This national initiative outlines investment priorities in multimodal infrastructure, logistics platforms, and cross-border connectivity. PETI 3+ allocates EUR 2.5 billion over the decade to enhance port-rail-road integration and expand warehousing capacities near key corridors such as Lisbon-Sines and Leixões-Spain. As of 2023, over 40% of the planned investments had been executed.

Digital Logistics Innovation Hubs: The government has partnered with industry players and universities to establish logistics innovation hubs in Porto and Lisbon. These centers are focused on promoting Industry 4.0 adoption—such as IoT-based fleet tracking, AI-driven route optimization, and robotic warehouse automation. In 2023, 12 pilot projects were launched under these hubs with partial EU funding under the PRR framework.

Portugal Logistics and Warehousing Market Segmentation

By Market Structure: The organized logistics sector in Portugal dominates the market, primarily led by established players such as DHL, DB Schenker, and Luís Simões. These companies offer integrated solutions with a strong focus on digital supply chain management, temperature-controlled warehousing, and last-mile optimization, making them preferred partners for large retailers, pharma clients, and automotive OEMs. The unorganized segment, comprising smaller regional transporters and local warehouse operators, continues to play a vital role, especially in serving rural regions and SMEs due to their cost-effective pricing and local reach, albeit with limited technological capabilities.

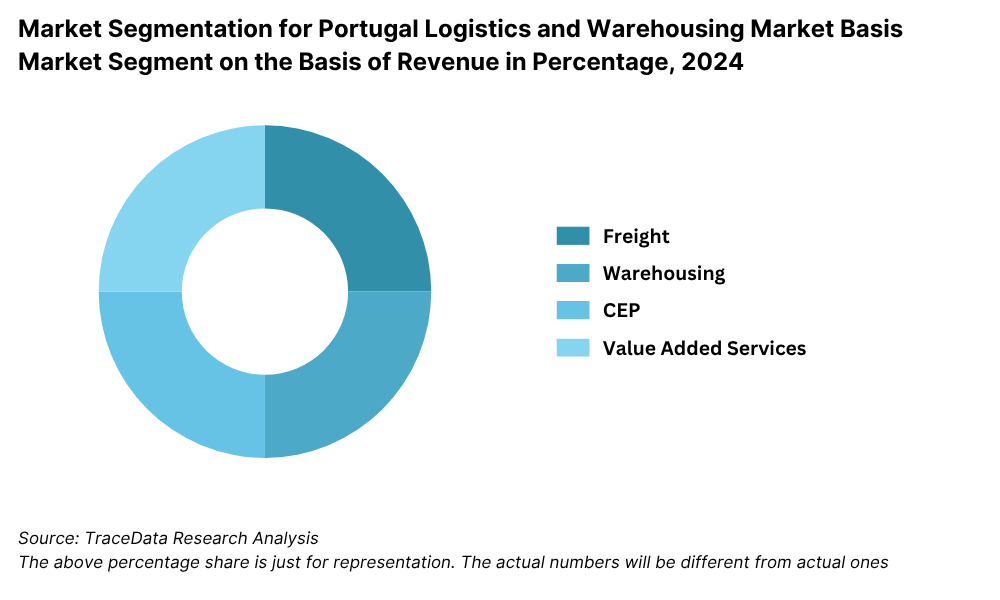

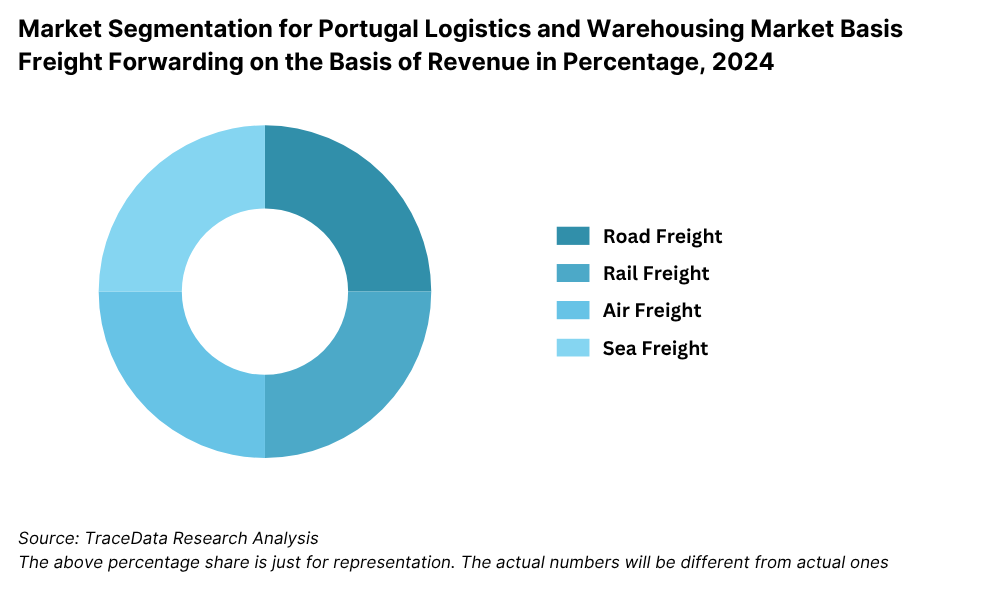

By Type of Services: Freight forwarding accounts for the largest share of the logistics market in Portugal, driven by maritime trade, especially through the ports of Sines, Leixões, and Lisbon. Warehousing services have also witnessed significant growth due to increased demand from e-commerce and pharmaceuticals, with a rise in build-to-suit warehouse spaces in Lisbon’s logistics corridor. Express logistics is growing rapidly, particularly for B2C deliveries, with major parcel players investing in automation. 3PL services are increasingly favored by mid-sized businesses looking to outsource non-core logistics functions.

By End-User Industry: Retail and e-commerce are the leading end-users of logistics services, driven by rising online orders and demand for faster delivery times. The pharmaceuticals and healthcare segment has grown substantially, particularly for temperature-sensitive logistics. The automotive and industrial sectors remain key verticals, leveraging integrated warehousing and just-in-time delivery models. FMCG and food & beverage players are increasingly investing in cold chain and regional distribution networks to maintain shelf life and freshness.

Competitive Landscape in Portugal Logistics and Warehousing Market

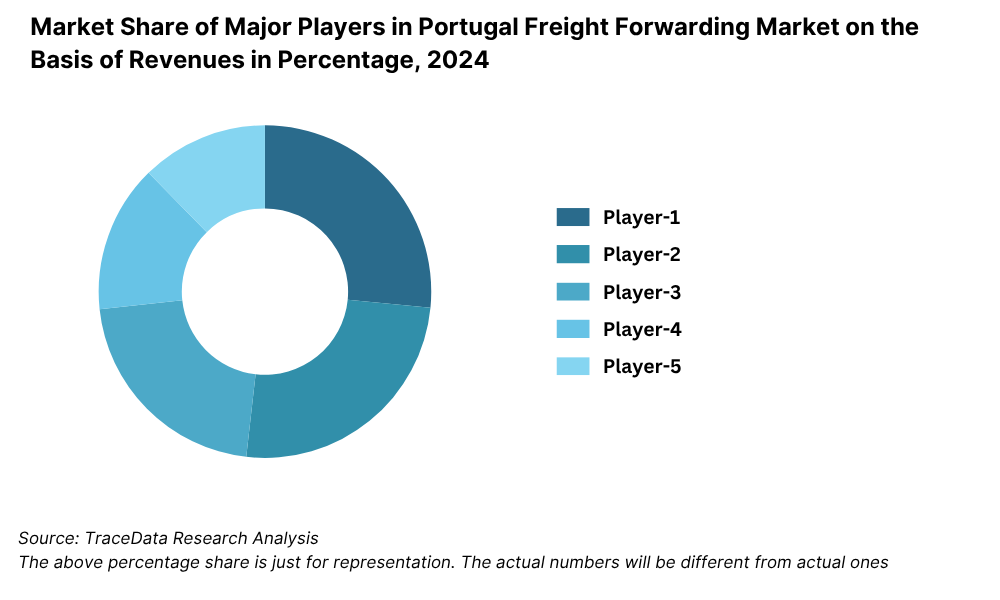

The Portugal logistics and warehousing market is moderately concentrated, with a mix of international logistics giants and strong domestic players. While multinational firms such as DHL, DB Schenker, and Kuehne+Nagel dominate high-volume and international trade logistics, domestic firms like Luís Simões, Rangel Logistics, and KLOG Logistics have built significant market share through regional expertise, warehousing footprint, and industry-specific solutions. In recent years, investments in automation, green logistics, and digital freight platforms have intensified competition.

Company Name | Founding Year | Original Headquarters |

Luis Simões Logística Integrada SA | 1948 | Loures, Portugal |

Rangel Logistics Solutions | 1980 | Porto, Portugal |

Torrestir Transportes SA | 1962 | Braga, Portugal |

Transportes Sardão, Lda. | 1974 | Vila Nova de Gaia, Portugal |

TJA - Transportes J. Amaral | 1947 | Águeda, Portugal |

Grupo Garland (Garland Transportes) | 1776 | Porto, Portugal |

GEFCO Portugal (now part of CEVA Logistics) | 1949 (PT: ~1980s) | Paris, France |

DB Schenker Portugal | 1872 (PT: ~1990s) | Essen, Germany |

Kuehne + Nagel Portugal | 1890 (PT: ~1990s) | Schindellegi, Switzerland |

DHL Supply Chain Portugal | 1969 (PT: ~1980s) | Bonn, Germany |

Maersk Portugal | 1904 (PT: ~1990s) | Copenhagen, Denmark |

Nippon Express Portugal | 1937 (PT: ~2000s) | Tokyo, Japan |

CEVA Logistics Portugal | 2006 (PT: ~2010s) | Marseille, France |

Rhenus Logistics Portugal | 1912 (PT: ~2000s) | Holzwickede, Germany |

Yusen Logistics Portugal | 1955 (PT: ~2010s) | Tokyo, Japan |

TNT Express Portugal (now part of FedEx) | 1946 (PT: ~1980s) | Hoofddorp, Netherlands |

UPS Portugal | 1907 (PT: ~1990s) | Atlanta, USA |

FedEx Express Portugal | 1971 (PT: ~2000s) | Memphis, USA |

Some of the recent competitor trends and key information about competitors include:

DHL Supply Chain: One of the largest players in the market, DHL announced a EUR 50 million investment in 2023 to expand its automated warehouse facility near Lisbon. The site is dedicated to e-commerce and pharmaceutical clients, offering temperature-controlled storage and integrated last-mile delivery across Iberia.

Luís Simões: A leading Portuguese logistics company, Luís Simões operates more than 400,000 sqm of warehouse space across the Iberian Peninsula. In 2023, it launched a new logistics hub in Azambuja with eco-efficient certifications and solar energy integration, reinforcing its commitment to green logistics.

DB Schenker: Specializing in multimodal and contract logistics, DB Schenker’s Portugal division saw a 17% revenue growth in 2023, driven by increased demand in automotive and electronics segments. Its digital freight booking platform also saw higher traction among SME clients.

Rangel Logistics Solutions: Known for its specialization in healthcare logistics and pharma compliance, Rangel expanded its cold chain warehouse capacity by 35% in 2023. The company also operates international logistics lanes linking Portugal with PALOP (Portuguese-speaking African countries), giving it a niche advantage in Lusophone markets.

KLOG Logistics Solutions: Among the fastest-growing domestic firms, KLOG reported a 22% year-over-year growth in warehousing services in 2023, with notable traction in FMCG and retail sectors. It also invested in AI-powered TMS (Transport Management Systems) to improve route optimization and delivery precision.

Kuehne + Nagel: Leveraging its global network, K+N operates key freight forwarding operations through Lisbon and Porto. In 2023, the firm partnered with major Portuguese exporters in the wine and seafood industries to provide refrigerated container logistics and customs clearance support.

What Lies Ahead for Portugal Logistics and Warehousing Market?

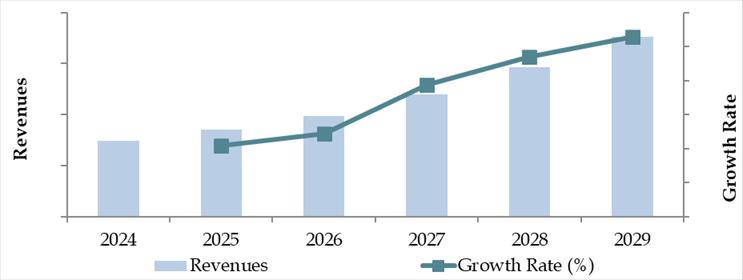

The Portugal logistics and warehousing market is projected to grow steadily through 2029, registering a healthy CAGR driven by trade diversification, e-commerce acceleration, and the modernization of supply chain infrastructure. Government-backed investments, sustainability mandates, and technological innovation will play a pivotal role in reshaping the sector.

Expansion of E-commerce Fulfillment Infrastructure: With online retail sales expected to surpass EUR 10 billion by 2029, the demand for fulfillment centers and last-mile hubs will intensify. Logistics players are anticipated to develop micro-fulfillment centers closer to urban clusters like Lisbon, Porto, and Coimbra to meet the growing demand for same-day and next-day deliveries.

Rise of Green and Energy-Efficient Warehousing: As the EU Green Deal mandates stricter emissions targets, logistics firms in Portugal are increasingly adopting green building certifications, solar-powered warehouses, and electric vehicle fleets. By 2029, it is projected that over 40% of new warehouse constructions in Portugal will meet BREEAM or LEED sustainability standards.

Digital Transformation and Automation: The integration of automation, robotics, AI, and IoT into warehousing and transport operations is expected to accelerate. Technologies like automated guided vehicles (AGVs), drone-based inventory audits, and predictive analytics will reduce lead times, enhance accuracy, and lower costs, especially for high-volume sectors like retail and pharmaceuticals.

Logistics Corridor Development: Strategic infrastructure investments under the PETI 3+ plan will further integrate Portugal into trans-European and transatlantic supply chains. Key corridors—such as Sines-Lisbon-Madrid and Leixões-Galicia—are expected to attract new logistics investments from global players seeking access to Iberian and African markets.

Future Outlook and Projections for Portugal Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Portugal Logistics and Warehousing Market Segmentation

• By Market Structure:

o Multinational Logistics Companies

o Domestic 3PL Providers

o Freight Brokers and Independent Transporters

o Government-Linked Operators (e.g., Infraestruturas de Portugal)

o Organized Sector

o Unorganized Sector

o Niche Sector Players (e.g., Cold Chain, Dangerous Goods)

• By Type of Services:

o Freight Forwarding

o Warehousing

o Express Logistics

o Contract Logistics (3PL & 4PL)

o Last-Mile Delivery

o Cold Chain Logistics

o Customs Brokerage

• By End-User Industry:

o Retail & E-commerce

o Automotive & Industrial

o Pharmaceuticals & Healthcare

o FMCG & Food & Beverage

o Textiles & Fashion

o Electronics & Appliances

o Agriculture & Perishables

• By Type of Warehouses:

o Ambient Warehouses

o Cold Storage Warehouses

o Bonded Warehouses

o Distribution Centers

o Automated Warehousing

o Urban Fulfillment Centers

• By Region:

o Lisbon Metropolitan Area

o Northern Portugal (Porto, Braga, Vila Real)

o Central Portugal (Coimbra, Leiria)

o Alentejo

o Algarve

o Madeira and Azores Islands

Players Mentioned in the Report:

Freight Forwarding Companies

- Transportes Pascoal

- Transitario Portugal

- Transmaia

- Transportes Matos & Filhos

- IMT Logistics

- Abreu Carga

- All Ways Cargo

- CMA CGM Logistics

- Maersk

- Hapag‑Lloyd

- MSC

- Kuehne + Nagel

- DHL Global Forwarding

- GEODIS

- Rhenus

- Nippon Express

Warehousing Companies

- Rhenus Portugal

- GEODIS

- DB Schenker

- Kuehne + Nagel

- Noatum Logistics

- One Union Solutions

- Americold Portugal

E‑Commerce Logistics Companies

- DHL eCommerce

- Asendia

- ShipBob

- Amphora Logistics

- Heyworld

Express Logistics Companies

- DHL Express

- FedEx

- UPS

- DPD

- InPost

Key Target Audience:

• Logistics Companies and Freight Forwarders

• Warehouse Operators and Developers

• E-commerce and Retail Corporates

• Transport and Port Authorities

• Government Agencies (e.g., IMT, AICEP)

• Industry Associations (e.g., APLOG)

• Research and Policy Institutions

• Real Estate and Infrastructure Investors

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Portugal Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Portugal

4.4. LPI Index of Portugal and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Portugal Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Portugal

5.2. Current Scenario for Logistics Infrastructure in Portugal

5.3. Road Infrastructure in Portugal including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Portugal including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Portugal including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Portugal including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Portugal Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Portugal 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Portugal

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Portugal Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Portugal Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Portugal Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Portugal Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Portugal 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Portugal Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Portugal and Portugal), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Portugal Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Portugal Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Portugal 3PL Warehousing Segmentation

9.4.1. Portugal Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Portugal Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Portugal Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Portugal 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Portugal Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Portugal Warehousing Future Market Size on the Basis of Revenues, 2025-2029

9.7. Portugal Warehousing Market Future Segmentation

9.7.1. Portugal Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Portugal Warehousing Revenue By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Portugal Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Portugal CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Portugal CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Portugal CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Portugal CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Portugal E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Portugal CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Portugal CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Portugal CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Portugal Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 service providers in the country based upon their financial information, warehouse footprint, freight volume, and digital capabilities.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market size by service type, number of logistics players, pricing trends, service adoption by end-user sectors, and warehouse availability. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Portugal Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate service-level revenues for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, service pricing, and warehouse capacity utilization.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Portugal Logistics and Warehousing Market?

The Portugal logistics and warehousing market is positioned for steady growth, reaching a valuation of EUR 6.2 Billion in 2023. The country’s strategic location as a gateway to Europe, Africa, and the Americas makes it a critical node for international trade. Growth is further driven by increasing demand from e-commerce, the modernization of supply chain infrastructure, and Portugal's improving road and port logistics capabilities. The market is also seeing greater adoption of automation and digital technologies, creating additional room for expansion through 2029.

2. Who are the Key Players in the Portugal Logistics and Warehousing Market?

The Portugal logistics and warehousing market includes several key players such as DHL Supply Chain, Luís Simões, DB Schenker, Rangel Logistics Solutions, and Kuehne+Nagel. These companies hold significant market share due to their strong operational presence, multimodal logistics solutions, and investments in sustainable and temperature-controlled storage capabilities. Other notable regional players include Transitex, Torrestir, and Garland Logistics.

3. What are the Growth Drivers for the Portugal Logistics and Warehousing Market?

Growth in the Portugal logistics market is driven by increasing demand from sectors such as pharmaceuticals, food & beverage, and retail. Expansion of e-commerce has significantly increased the need for last-mile delivery and express logistics services. Additionally, government support through logistics infrastructure projects, development of industrial parks, and integration with European logistics corridors further boosts market prospects. The country’s role in European nearshoring strategies and green logistics adoption is also accelerating market expansion.

4. What are the Challenges in the Portugal Logistics and Warehousing Market?

The market faces several challenges, including rising operational costs such as labor and energy, limited availability of Grade-A warehousing in key hubs, and congestion in major ports such as Sines and Leixões. Additionally, smaller logistics companies may face difficulty in digital transformation and meeting regulatory compliance requirements around sustainability and emissions. Workforce shortages in skilled logistics labor and the need for improved multimodal connectivity across inland regions remain persistent bottlenecks.