Qatar Cold Chain Market Outlook to 2029

By Market Structure, By Service Type (Cold Storage and Cold Transportation), By End Users (Fruits and Vegetables, Dairy Products, Meat and Seafood, Pharmaceuticals), and By Region

- Product Code: TDR0189

- Region: Middle East

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Qatar Cold Chain Market Outlook to 2029 - By Market Structure, By Service Type (Cold Storage and Cold Transportation), By End Users (Fruits and Vegetables, Dairy Products, Meat and Seafood, Pharmaceuticals), and By Region.” provides a comprehensive analysis of the cold chain industry in Qatar. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on sales revenue, by market, service types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Qatar Cold Chain Market Overview and Size

The Qatar cold chain market reached a valuation of QAR 2.1 Billion in 2023, driven by the rising demand for perishable food products, expansion of pharmaceutical logistics, and Qatar’s focus on food security initiatives. The market is characterized by major players such as GWC (Gulf Warehousing Company), Tristar Qatar, Agility Logistics, Al Mana Cold Stores, and Gulf Cold Stores and Ice Factory. These companies are recognized for their extensive network coverage, investment in state-of-the-art cold storage facilities, and focus on maintaining high service quality standards.

In 2023, GWC inaugurated a new temperature-controlled logistics hub in the Logistics Village Qatar (LVQ), aimed at boosting Qatar’s capability to store and distribute perishable and pharmaceutical goods efficiently. Doha and Al Rayyan remain key markets due to their population density and proximity to major distribution hubs.

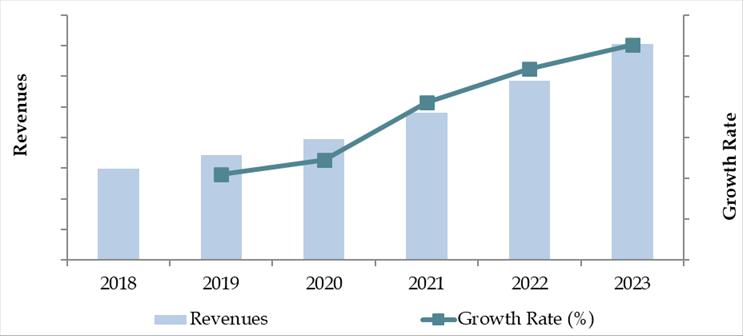

Market Size for Qatar Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2024

What Factors are Leading to the Growth of Qatar Cold Chain Market:

Food Security Initiatives: Qatar’s National Food Security Program and related policies have significantly increased investments in domestic food production and supply chain infrastructure. In 2023, approximately 15% of agricultural produce was supported by advanced cold chain logistics to ensure food safety and reduce spoilage.

Rising Pharmaceutical Imports: With the healthcare sector’s expansion post-COVID-19, pharmaceutical imports requiring cold storage have surged. Pharmaceutical products accounted for approximately 22% of the cold chain demand in 2023, particularly vaccines, biologics, and temperature-sensitive medicines.

Infrastructure Development: Significant investments in logistics parks, warehouse facilities, and temperature-controlled transportation services have boosted the industry. For instance, Hamad Port and associated free zones have prioritized infrastructure to support refrigerated cargo handling, increasing capacity by 30% between 2021 and 2023.

Which Industry Challenges Have Impacted the Growth for Qatar Cold Chain Market

High Operational Costs: The cold chain industry in Qatar faces high operational expenses due to energy costs, advanced refrigeration technology requirements, and specialized logistics. According to industry estimates, operational costs for maintaining cold storage facilities and transportation can be up to 35% higher compared to ambient logistics. These elevated costs have limited the expansion of smaller players and have increased the barrier to entry for new businesses.

Infrastructure Constraints: Despite significant infrastructure development in Qatar, specialized cold storage and transportation networks are still relatively limited. As of 2023, nearly 28% of perishables were reported to experience minor quality deterioration due to gaps in cold chain logistics, especially in last-mile delivery. Inadequate warehouse facilities and a shortage of skilled labor for handling temperature-sensitive goods remain key challenges.

Regulatory Compliance Costs: Compliance with Qatar’s strict food safety and pharmaceutical storage regulations, such as those set by the Ministry of Public Health (MoPH) and Qatar General Organization for Standardization (QS), imposes significant costs. Industry data shows that regulatory compliance can add approximately 10-15% additional costs to cold chain operations, particularly affecting small and medium-sized enterprises (SMEs).

What are the Regulations and Initiatives which have Governed the Market

Food Safety Standards Enforcement: Qatar has implemented stringent food safety regulations under the “Law No. 8 of 1990” concerning the regulation of food control. All cold chain operators must maintain strict temperature controls and traceability standards. In 2023, nearly 85% of cold storage facilities in Qatar were reported compliant with updated food safety inspection protocols, improving trust in cold chain management.

Pharmaceutical Storage Regulations: Under Qatar’s National Health Strategy, the handling of pharmaceutical products requires adherence to WHO GDP (Good Distribution Practices) standards. The Supreme Council of Health mandates continuous temperature monitoring for all pharmaceutical cold chains. As of 2023, around 92% of pharmaceutical distributors were compliant with GDP standards, ensuring the integrity of vaccines and sensitive drugs.

Infrastructure Development Initiatives: Qatar’s government, through programs like the National Food Security Program and Qatar National Vision 2030, has launched initiatives to expand cold chain logistics capacity. In 2023, approximately QAR 400 million was allocated toward developing specialized logistics parks, including temperature-controlled warehousing facilities near Hamad Port and Hamad International Airport, to strengthen Qatar's food security and healthcare sectors.

Qatar Cold Chain Market Segmentation

By Market Structure: Organized players dominate the cold chain market in Qatar due to their compliance with international food safety and pharmaceutical standards, investment in state-of-the-art facilities, and ability to offer integrated cold storage and transport services. Unorganized players, although present, hold a smaller share, mainly catering to small-scale retailers and local businesses. Their services are often characterized by basic storage facilities and limited transportation capabilities.

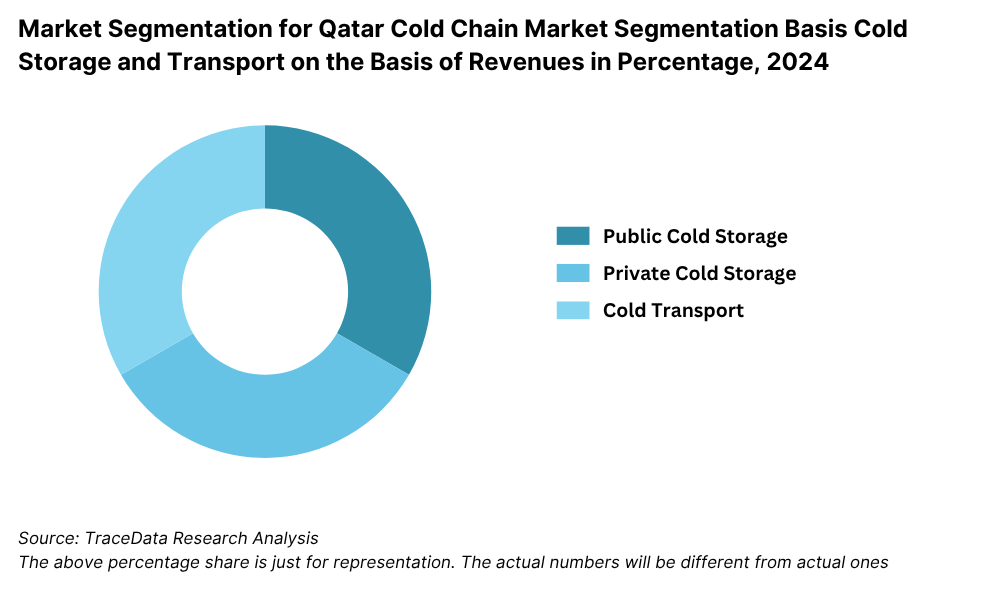

By Service Type: Cold Storage services lead the market owing to Qatar’s strong demand for food imports, pharmaceuticals, and perishable goods that require longer storage periods under controlled temperatures. Cold Transportation is a growing segment, driven by the rise of e-commerce, quick commerce (Q-commerce) for groceries, and increasing distribution of temperature-sensitive pharmaceutical products.

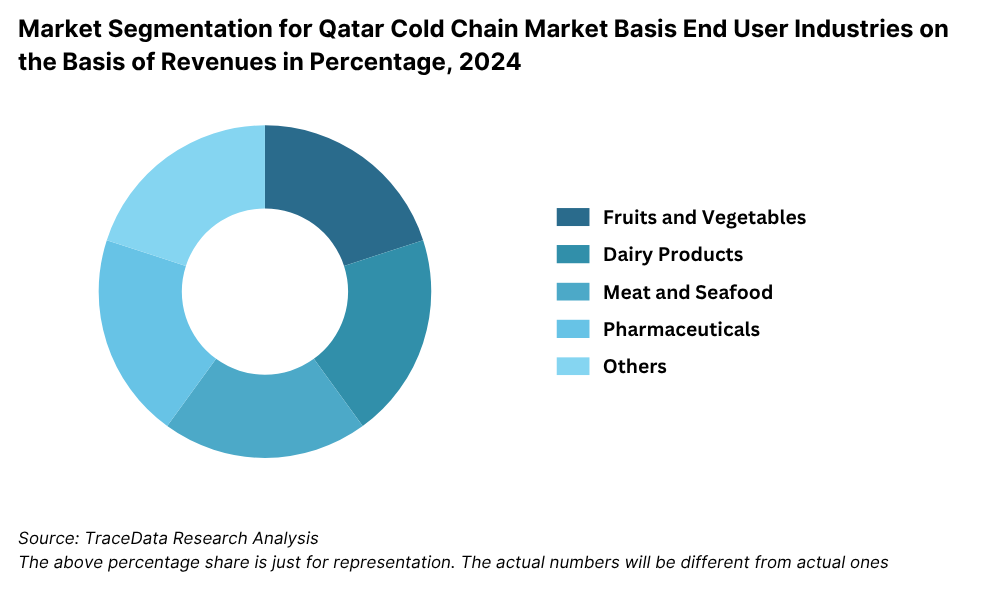

By End User: The food sector, particularly fruits and vegetables, is the largest user of cold chain services, accounting for a major portion of market demand. Qatar imports a significant portion of its fresh produce, requiring efficient cold chain support. Pharmaceuticals are also a rapidly expanding segment, especially post-pandemic, with increased storage needs for vaccines, biologics, and specialty medicines. Meat and seafood contribute significantly as well, considering Qatar’s reliance on imports to meet domestic consumption needs.

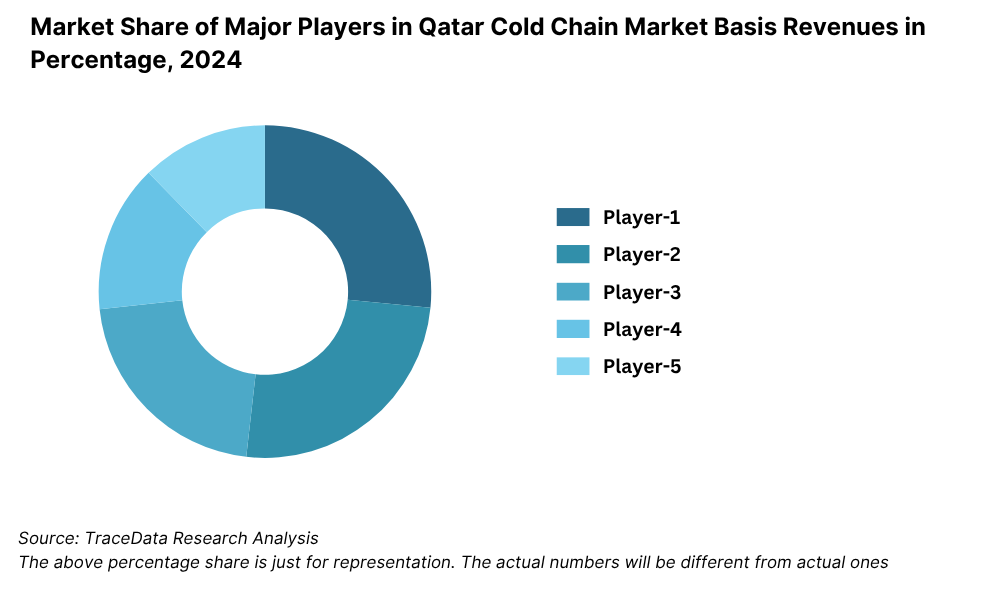

Competitive Landscape in Qatar Cold Chain Market

The Qatar cold chain market is moderately concentrated, with a few major logistics and supply chain companies dominating the organized segment. However, the entry of specialized cold logistics firms and expansion of global players such as GWC, Almuftah Group, Tranzum, Agility Logistics, DHL Qatar, and Gulf Agency Company (GAC) have diversified the market, offering more specialized cold storage and transportation solutions to consumers.

| Company Name | Founding Year | Original Headquarters |

| Gulf Warehousing Company (GWC) | 2004 | Doha, Qatar |

| Milaha (Qatar Navigation) | 1957 | Doha, Qatar |

| Al Rashed Transport (Cold Chain Division) | 1911 | Doha, Qatar |

| Qatar Logistics WLL | 1992 | Doha, Qatar |

| Al Mana Cold Stores & Logistics | 1960s | Doha, Qatar |

| Al Madina Logistics (Qatar Branch) | 2007 (Qatar ops) | Muscat, Oman |

| Tristar Transport (Qatar Ops) | 1998 | Dubai, UAE (Qatar Operations) |

| Agility Logistics Qatar | 1979 (Qatar: ~2006) | Kuwait City, Kuwait |

| DHL Global Forwarding Qatar | 1969 (Qatar: ~1980s) | Bonn, Germany |

| Kuehne + Nagel Qatar (Cold Chain) | 1890 (Qatar: ~1990s) | Schindellegi, Switzerland |

| DB Schenker Qatar | 1872 (Qatar: ~2000s) | Essen, Germany |

| Maersk Qatar (Cold Chain Solutions) | 1904 (Qatar: ~2000s) | Copenhagen, Denmark |

| CEVA Logistics Qatar | 2006 (Qatar: ~2010s) | Marseille, France |

| FedEx Express Qatar (via agent) | 1971 (Qatar: ~2000s) | Memphis, USA |

| UPS Qatar (via local partner) | 1907 (Qatar: ~2000s) | Atlanta, USA |

Some of the recent competitor trends and key information about competitors include:

GWC (Gulf Warehousing Company): As Qatar’s largest logistics provider, GWC operates multiple advanced cold storage facilities across Qatar. In 2023, GWC expanded its refrigerated fleet by 12%, enhancing its capability to serve pharmaceuticals, FMCG, and food industries. Its Logistics Village Qatar (LVQ) complex houses one of the most extensive cold chain facilities in the country.

Almuftah Group (Logistics Division): With a strong legacy, Almuftah Group continues to upgrade its cold storage and transportation services. In 2023, the company invested in smart temperature-monitoring systems across its fleet, aiming to improve pharmaceutical and perishable goods transportation reliability.

Tranzum: Specializing in temperature-sensitive cargo, Tranzum reported a 20% growth in pharmaceutical cold chain volumes in 2023. The company's emphasis on GDP-certified transport and quick turnaround services has bolstered its position among pharmaceutical and healthcare clients.

Agility Logistics: A global logistics giant with a strong presence in Qatar, Agility expanded its cold storage footprint by launching a new 10,000 sqm temperature-controlled facility near Hamad International Airport in 2023, focusing on food security and healthcare logistics.

DHL Qatar: DHL’s specialized cold chain logistics division for Qatar recorded a 17% growth in volumes in 2023. Their temperature-controlled solutions, particularly for medical supplies and vaccines, have made them a preferred partner for several healthcare institutions.

Gulf Agency Company (GAC): GAC enhanced its cold chain services in Qatar by upgrading its refrigerated transportation fleet and expanding warehouse space in 2023. The company’s diversified service offerings cater to both food and pharmaceutical sectors, emphasizing high compliance with local and international standards.

What Lies Ahead for Qatar Cold Chain Market?

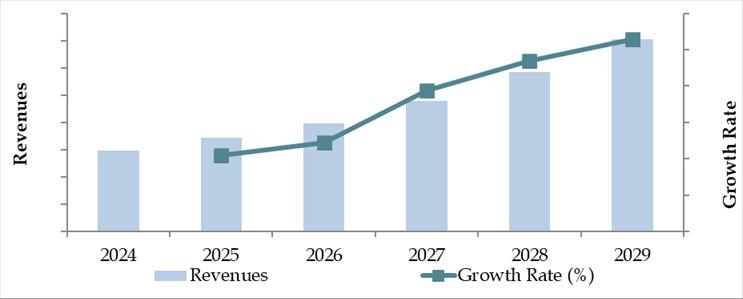

The Qatar cold chain market is projected to grow steadily by 2029, exhibiting a strong CAGR during the forecast period. This growth is expected to be fueled by Qatar’s increasing food security initiatives, expanding pharmaceutical sector, rising healthcare needs, and growth in international trade and logistics infrastructure.

Expansion in Pharmaceutical Cold Chain: Qatar's pharmaceutical sector is anticipated to drive substantial growth in the cold chain market. Rising healthcare investments, expansion of specialized medicine imports, and government emphasis on vaccine storage capabilities are expected to create higher demand for temperature-controlled logistics solutions.

Adoption of IoT and Smart Cold Chain Technologies: The integration of IoT sensors, real-time temperature monitoring systems, and blockchain for supply chain traceability is anticipated to revolutionize the industry. These advancements will enhance operational efficiency, reduce spoilage rates, and provide end-to-end visibility across the cold chain, which will significantly boost customer confidence.

Growth of Organized Cold Storage Facilities: There is an increasing trend toward investment in large-scale, multi-temperature cold storage facilities integrated with logistics hubs such as Hamad Port and Hamad International Airport. This development will cater to growing demands from food imports, pharmaceutical storage, and e-commerce grocery delivery sectors.

Focus on Sustainability and Energy Efficiency: Environmental sustainability will become a key focus area. Cold chain operators are expected to invest in eco-friendly refrigeration systems, solar-powered cold storage units, and energy-efficient transport vehicles to reduce their carbon footprint. Such sustainable practices will align with Qatar National Vision 2030’s environmental goals and appeal to multinational clients.

Future Outlook and Projections for Qatar Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Qatar Cold Chain Market Segmentation

• By Market Structure:

- Organized Sector

- Unorganized Sector

• By Service Type:

- Cold Storage

- Cold Transportation

• By End User:

- Fruits and Vegetables

- Dairy Products

- Meat and Seafood

- Pharmaceuticals

- Processed Food Products

• By Temperature Type:

- Chilled (0°C to 5°C)

- Frozen (-18°C and below)

- Ambient/Controlled Room Temperature (15°C to 25°C)

• By Region:

- Doha

- Al Rayyan

- Al Wakrah

- Al Khor

- Umm Salal

- Al Daayen

Players Mentioned in the Report:

Gulf Warehousing Company (GWC)

Milaha Logistics

BSX Logistics

BrightLink Shipping and Logistics

JSL Global

Maersk Qatar

Kuehne + Nagel Qatar

GEODIS Qatar

DHL Global Forwarding Qatar

Aramex Qatar

Agility Logistics Qatar

Transworld Group

Unicorn Gulf Logistics

Gulf United Cold Stores

Qatar Logistics

Qatar Logistical Services

Tokyo Freight Services

Key Target Audience:

• Cold Storage Providers

• Cold Chain Transportation Companies

• Food Importers and Exporters

• Pharmaceutical Manufacturers and Distributors

• Retail and E-commerce Companies (Grocery and Healthcare)

• Regulatory Bodies (e.g., Ministry of Public Health, Qatar General Organization for Standardization)

• Infrastructure Developers and Logistics Parks

• Research and Development Institutions Focused on Supply Chain Innovation

Time Period:

• Historical Period: 2018-2023

• Base Year: 2024

• Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. Qatar Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. Qatar Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities, 2023-2024P

10.3. Qatar Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. Qatar Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. Qatar Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. Qatar Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in Qatar Cold Chain Market

12.2. Issues and Challenges in Qatar Cold Chain Market

12.3. Decision Making Parameters for End Users in Qatar Cold Chain Market

12.4. SWOT Analysis of Qatar Cold Chain Industry

12.5. Government Regulations and Associations in Qatar Cold Chain Market

12.6. Macroeconomic Factors Impacting Qatar Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in Qatar Cold Chain Market

16.2. Competition Scenario in Qatar Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2023) and Employee Base) for Major Players in Qatar Cold Chain Market

16.4. Company Profiles of Major Companies in Qatar Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

18.4. Recommendation

18.5. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Qatar Cold Chain Market. Based on this ecosystem, we shortlisted leading 5–6 players in the country based upon their operational scale, facility capacities (cold storage area in cubic meters), fleet size, and client portfolios.

Sourcing is conducted through industry articles, government publications, international logistics reports, and multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables a thorough analysis of the market, aggregating industry-level insights. We explore aspects such as market revenues, facility capacities, regional coverage, service segmentation (cold storage vs cold transportation), pricing levels, and industry trends.

This is supplemented with detailed examinations of company-level data, relying on sources such as press releases, annual reports, regulatory filings, trade publications, and market news articles. This process helps in constructing a foundational understanding of both the market landscape and the major entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, operational heads, and key logistics managers representing various Qatar cold chain companies, third-party logistics (3PL) firms, pharmaceutical distributors, and large food importers.

This primary interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical and operational data, and extract valuable insights around facility utilization rates, revenue breakdown, service adoption trends, challenges, and client preferences.

As part of our validation strategy, our team also executes disguised interviews, wherein we approach certain players under the guise of potential clients to cross-verify operational information, pricing models, and service capabilities against what is published publicly.

Step 4: Sanity Check

Bottom-up and top-down modeling exercises are undertaken to cross-validate the market size and forecasts.

Revenue triangulation, facility capacity modeling, and demand-supply analysis are performed to ensure consistency and accuracy.

Final numbers are further validated through a series of internal review rounds and external expert consultations to maintain robustness and reliability of the market estimates.

FAQs

1. What is the potential for the Qatar Cold Chain Market

The Qatar Cold Chain Market is poised for substantial growth, supported by the country’s rising food import dependency, increasing healthcare investments, and expanding pharmaceutical sector. With Qatar’s emphasis on food security and healthcare infrastructure under its National Vision 2030, the cold chain market is projected to witness significant expansion through 2029, particularly in cold storage and temperature-controlled logistics services.

2. Who are the Key Players in the Qatar Cold Chain Market?

The Qatar Cold Chain Market features several key players, including GWC (Gulf Warehousing Company), Almuftah Group, Tranzum, and Agility Logistics. These companies dominate the organized segment due to their advanced facilities, strong compliance with global cold chain standards, and diversified service offerings. Other notable players include DHL Qatar, Gulf Agency Company (GAC), Milaha Logistics, and Qatar Logistics WLL.

3. What are the Growth Drivers for the Qatar Cold Chain Market?

Primary growth drivers include the surge in food and pharmaceutical imports, government initiatives towards food security, the increasing need for reliable vaccine and medicine storage, and the expansion of organized retail and e-commerce sectors. Technological advancements like IoT-enabled cold storage monitoring and government-backed infrastructure developments are also propelling the growth of the cold chain sector in Qatar.

4. What are the Challenges in the Qatar Cold Chain Market?

The Qatar Cold Chain Market faces several challenges, including high operational costs, infrastructure limitations for last-mile delivery, and stringent regulatory compliance requirements. Additionally, the shortage of skilled cold chain management professionals and the need for sustainable, energy-efficient solutions pose significant barriers to market growth.