Romania Auto Finance Market Outlook to 2029

By Vehicle Type (New and Used), By Lenders (Banks, NBFCs, OEMs, and Captives), By Tenure, By Type of Finance (Loan and Lease), and By Region

- Product Code: TDR0148

- Region: Europe

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Romania Auto Finance Market Outlook to 2029 - By Vehicle Type (New and Used), By Lenders (Banks, NBFCs, OEMs, and Captives), By Tenure, By Type of Finance (Loan and Lease), and By Region” provides a comprehensive analysis of the auto finance industry in Romania. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on loan disbursements, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Romania Auto Finance Market Overview and Size

The Romania auto finance market reached a valuation of RON 18 Billion in 2023, driven by increasing vehicle ownership, rising consumer credit adoption, and evolving lending practices. The market is shaped by key players such as Banca Transilvania, BRD Groupe Société Générale, UniCredit Leasing, Porsche Finance Group, and TBI Bank. These financial institutions are known for their diverse financing products, extensive dealership partnerships, and customer-centric credit assessment models.

In 2023, UniCredit Leasing introduced a fully digital loan approval process, improving efficiency and enhancing customer experience for both new and used car financing. Bucharest, Cluj-Napoca, and Timișoara emerged as major urban markets due to higher car penetration rates and dense financial services networks.

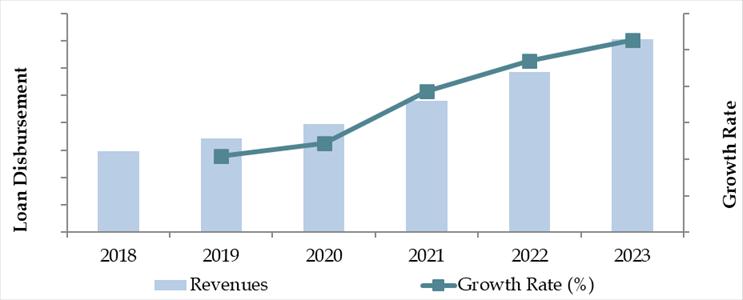

Market Size for Romania Auto Finance Industry on the Basis of Loan Disbursements in RON Billion, 2018–2024

What Factors are Leading to the Growth of Romania Auto Finance Market:

Macroeconomic Stability and Rising Incomes: Romania’s stable macroeconomic environment and increasing average household incomes are encouraging more consumers to finance vehicle purchases. In 2023, nearly 72% of new vehicle purchases were financed through loans or leases, up from 60% in 2018. Financing allows access to higher-end vehicle models without large upfront payments.

Increasing Demand for Used Cars: Rising costs of new vehicles have spurred demand for used cars, which are often financed through shorter-tenure loans. Used car finance accounted for approximately 35% of total auto loan disbursements in 2023. This segment is particularly appealing to first-time buyers and younger demographics.

Digital Transformation in Lending: The adoption of digital lending platforms has streamlined application and disbursement processes. In 2023, about 45% of auto finance applications were submitted online, indicating a shift toward tech-enabled, paperless experiences. Banks and NBFCs are investing in mobile-first platforms to enhance accessibility, especially in semi-urban areas.

Which Industry Challenges Have Impacted the Growth for Romania Auto Finance Market

High Interest Rates and Inflationary Pressure: Romania’s fluctuating interest rates and rising inflation have made auto loans more expensive, especially for lower and middle-income consumers. In 2023, average auto loan interest rates hovered between 7.5% to 10%, discouraging potential borrowers. Surveys indicated that around 35% of prospective car buyers delayed or abandoned their plans due to high financing costs.

Limited Financial Inclusion in Rural Areas: A significant portion of Romania’s rural population faces limited access to formal banking and auto finance services. Data from 2023 shows that only 42% of rural residents have access to auto loans or leasing options, compared to 78% in urban areas. This disparity restricts market penetration and reduces overall vehicle sales outside metropolitan zones.

Credit Risk and Stringent Lending Norms: Lenders in Romania remain cautious due to concerns around default risk, particularly in the used car financing segment. Approximately 28% of loan applications for used vehicles were rejected in 2023, primarily due to low credit scores or insufficient documentation. These tight credit policies limit the addressable market for auto finance providers.

What are the Regulations and Initiatives which have Governed the Market:

Consumer Credit Regulation: Romania adheres to the EU’s Consumer Credit Directive, which mandates clear disclosure of interest rates, fees, and borrower obligations. Financial institutions must also assess creditworthiness prior to approval. In 2023, 92% of auto loan agreements complied with the transparency norms set by the Romanian National Authority for Consumer Protection (ANPC).

Registration and Taxation Policies: New regulations introduced in 2022 imposed a standardized registration tax based on CO₂ emissions, impacting loan structures for higher-emission vehicles. This tax ranges between RON 1,000 to RON 3,500 depending on vehicle category, influencing both consumer choice and financing affordability.

Incentives for Green and Electric Vehicles: The Romanian government, through its Rabla Plus and Rabla Classic programs, continues to promote electric and environmentally friendly vehicles. These initiatives offer subsidies of up to RON 54,000 for electric vehicles, including options for financing support. In 2023, green vehicle financing accounted for nearly 6% of all auto loans disbursed, a figure projected to grow with expanded government support.

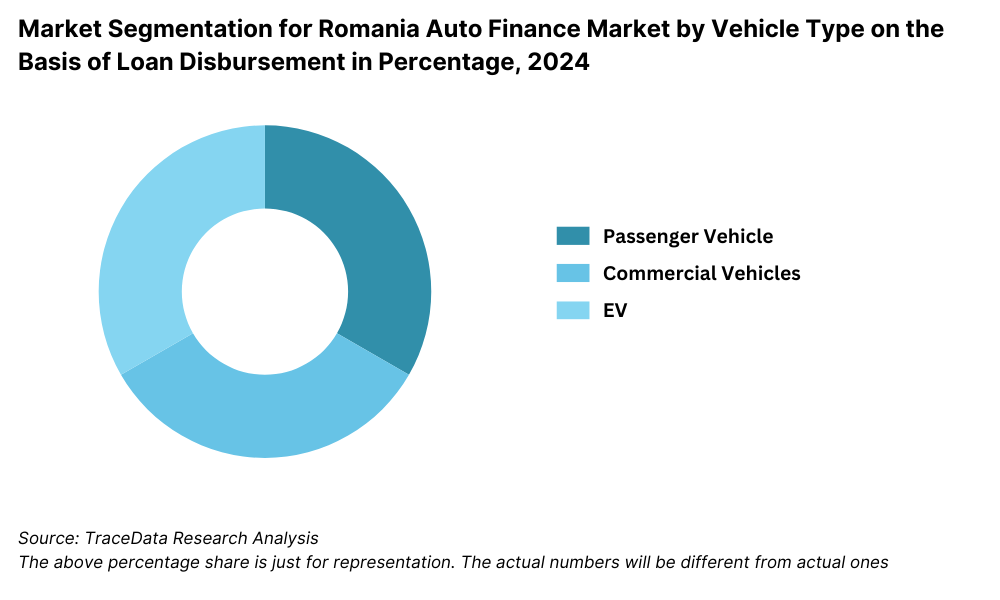

Romania Auto Finance Market Segmentation

By Vehicle Type: New car financing leads the market, driven by demand for reliable, warranty-backed vehicles and stronger partnerships between banks and authorized dealerships. New cars are often associated with more favorable loan terms, including lower interest rates and longer tenures. Used car financing is growing steadily due to increasing affordability and rising vehicle prices in the new car segment. Consumers seeking cost-effective mobility options increasingly turn to used cars, financed through leasing and bank loans with flexible down payments.

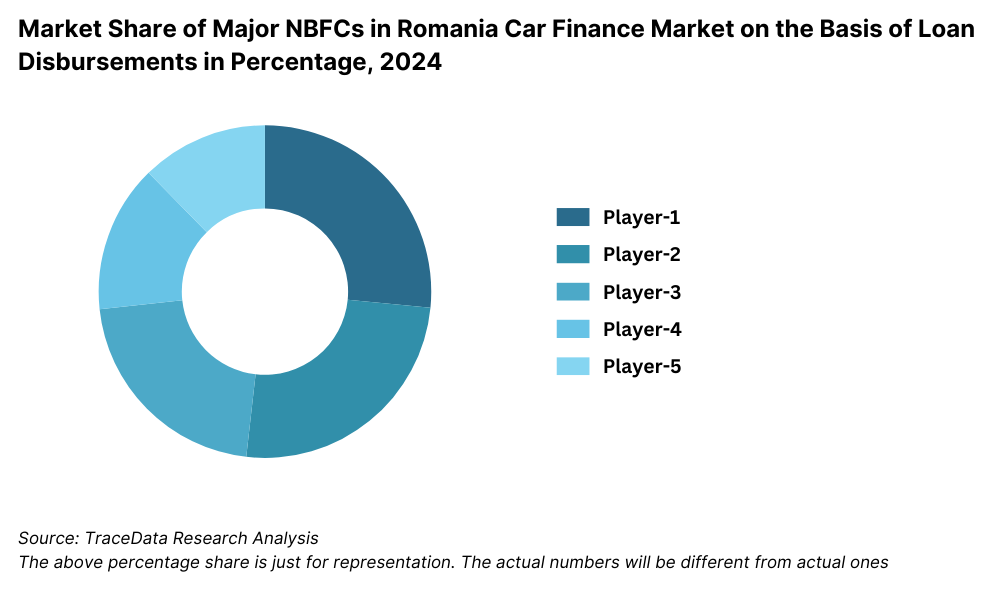

By Lender Type: Banks are the dominant lenders due to their established financial networks, competitive rates, and trust among Romanian consumers. Non-Banking Financial Companies (NBFCs) and leasing companies are gaining traction, especially in the used car segment, offering quicker approvals and customized products. OEM Captive finance arms are also growing in presence, supported by in-house dealership financing.

.png)

By Loan Tenure: Loans with a tenure of 3–5 years dominate the market, offering a balance between manageable monthly installments and total interest outgo. Short-term loans (1–3 years) are more common among high-income urban buyers aiming to minimize interest costs, while longer-term loans (5–7 years) appeal to buyers of higher-end or electric vehicles due to their larger ticket sizes.

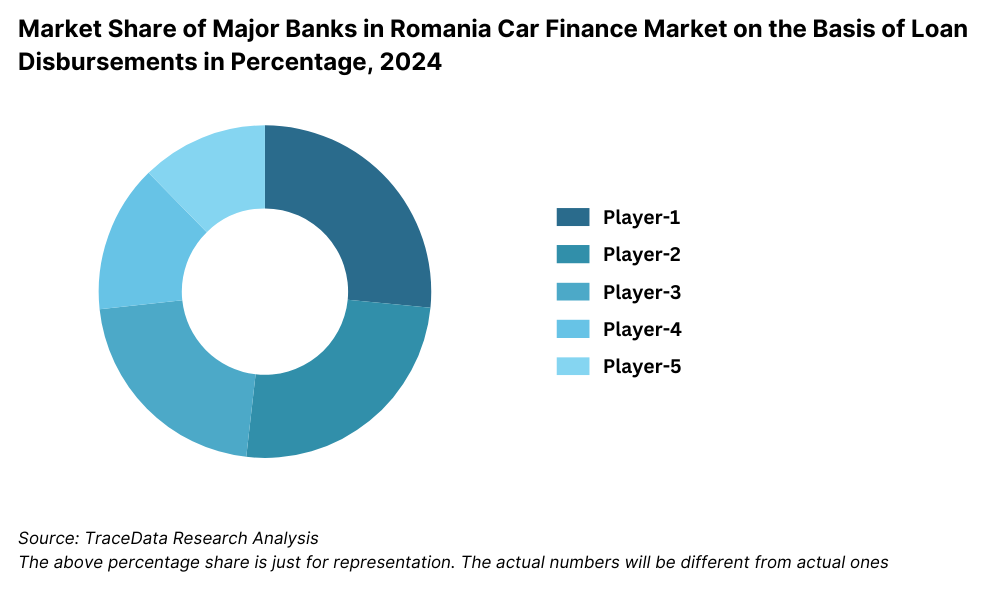

Competitive Landscape in Romania Auto Finance Market

The Romania auto finance market is moderately concentrated, with a mix of traditional banks, leasing companies, and OEM-affiliated finance arms leading the industry. In recent years, the emergence of digital lending platforms and fintech partnerships has expanded consumer access to car financing, offering faster processing and innovative financing solutions. Key players in the market include Banca Transilvania, BRD Finance, UniCredit Leasing, Porsche Finance Group, TBI Bank, and Ideal Leasing.

| Name | Founding Year | Original Headquarters |

| Banca Transilvania | 1994 | Cluj-Napoca, Romania |

| OTP Bank Romania | 2004 | Budapest, Hungary |

| tbi bank | 2002 | Sofia, Bulgaria |

| Porsche Finance Group Romania | 1999 | Salzburg, Austria |

| Deutsche Leasing Romania | 2007 | Bad Homburg, Germany |

| Volksbank Leasing Romania | 2000 | Vienna, Austria |

| Țiriac Leasing | 1999 | Bucharest, Romania |

| Credit Europe Bank Romania | 1994 | Amsterdam, Netherlands |

| FAST Auto Finance S.R.L. | 2007 | Bucharest, Romania |

| Link Financial Romania | 2004 | London, UK |

Some of the recent competitor trends and key information about competitors include:

Banca Transilvania: As the largest bank in Romania by assets, Banca Transilvania continues to lead the auto finance sector. In 2023, it introduced an AI-driven loan evaluation tool, reducing approval times by 30% and enhancing customer satisfaction. The bank financed over 35,000 vehicles during the year.

BRD Finance: A subsidiary of Société Générale, BRD Finance expanded its partnership network with several car dealerships in 2023. The company reported a 20% increase in used vehicle loan disbursements, driven by competitive fixed-rate financing options and targeted offers for repeat customers.

UniCredit Leasing: Known for its flexible leasing solutions, UniCredit Leasing saw a 15% rise in electric vehicle financing in 2023. Its digital onboarding and document verification platform significantly reduced processing times, contributing to increased adoption in urban markets.

Porsche Finance Group: Operating as the captive finance arm for Volkswagen Group brands in Romania, Porsche Finance Group reported strong growth in new car financing. In 2023, it financed over 10,000 vehicles, focusing heavily on Audi and Škoda models. Their bundled insurance and service packages have also boosted customer retention.

TBI Bank: With a strong presence in the fintech space, TBI Bank leveraged its mobile-first lending platform to provide instant approvals for auto loans. In 2023, the bank experienced a 40% growth in car loan applications, especially among young, first-time buyers.

Idea Leasing: Focused on SMEs and commercial fleet financing, Idea::Leasing registered a 12% increase in fleet vehicle leases. The company’s integration with digital marketplaces has allowed faster approvals and wider outreach to small businesses across Romania.

What Lies Ahead for Romania Auto Finance Market?

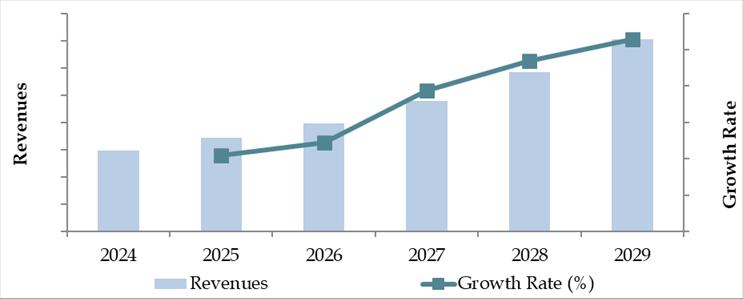

The Romania auto finance market is projected to grow steadily by 2029, exhibiting a healthy CAGR during the forecast period. Growth is expected to be supported by rising vehicle ownership, expanding access to credit, digital innovation in lending, and increasing demand for flexible financing options across both new and used vehicle segments.

Expansion of Green Vehicle Financing: As Romania continues to align with EU climate goals, the market is expected to see a rise in financing options tailored for electric and hybrid vehicles. Government incentives under programs like Rabla Plus, combined with lower operating costs of EVs, will encourage more consumers to choose green alternatives. Financial institutions are expected to launch specialized loan products with preferential rates for eco-friendly vehicles.

Digital Transformation in Lending: Automation, AI-driven credit scoring, and end-to-end digital loan processing are set to redefine the consumer financing experience. By 2029, a majority of auto loan applications in Romania are projected to be processed digitally. This shift will significantly reduce paperwork, lower approval times, and enhance financial inclusion—especially among younger, tech-savvy consumers.

Increased Penetration in Rural Markets: As financial literacy improves and mobile banking adoption rises, auto financing is expected to expand into Romania’s underserved rural regions. Banks and NBFCs are likely to collaborate with auto dealers and fintech platforms to introduce targeted micro-loan products, making vehicle ownership more accessible outside urban centers.

Growth in Used Vehicle Financing: The high cost of new vehicles and increased consumer awareness about vehicle quality are expected to drive the financing of used cars. Lenders will increasingly offer structured used-car loan products with competitive rates and insurance bundles. By 2029, used vehicle loans could account for over 45% of total auto financing volume.

Future Outlook and Projections for Romania Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Romania Auto Finance Market Segmentation

• By Vehicle Type:

o New Vehicles

o Used Vehicles

o Commercial Vehicles

o Electric Vehicles

• By Lender Type:

o Banks

o Non-Banking Financial Companies (NBFCs)

o OEM Captive Finance

o Digital Fintech Platforms

• By Loan Tenure:

o Less than 3 Years

o 3 to 5 Years

o More than 5 Years

• By Type of Finance:

o Auto Loans

o Leasing (Operational and Financial)

o Balloon Payment Schemes

o Subscription-Based Ownership

• By Consumer Profile:

o Salaried Individuals

o Self-Employed Professionals

o First-Time Buyers

o Fleet Operators

• By Age of Consumer:

o 18–34

o 35–54

o 55+

• By Region:

o Bucharest & Ilfov

o Central Romania

o Western Romania

o Northern Romania

o Southern Romania

o Eastern Romania

Players Mentioned in the Report (Banks):

- Banca Comercială Română (BCR)

- BRD – Groupe Société Générale

- Raiffeisen Bank Romania

- UniCredit Bank Romania

- Alpha Bank Romania

- OTP Bank Romania

- CEC Bank

Players Mentioned in the Report (NBFCs):

- BT Leasing

- Idea::Leasing

- TBI Bank

- Patria Bank

- Garanti BBVA Leasing

- Banca Transilvania Leasing

- Porsche Finance Group Romania

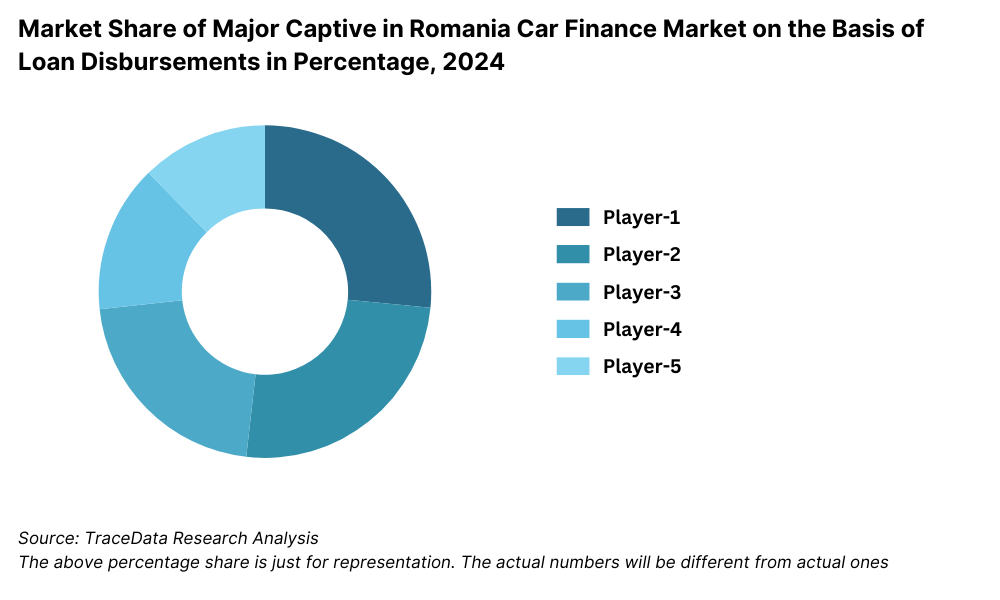

Players Mentioned in the Report (Captive):

- Renault Finance Romania

- Toyota Financial Services Romania

- Volkswagen Financial Services Romania

- BMW Financial Services Romania

- Mercedes-Benz Financial Services Romania

- Stellantis Financial Services Romania

Key Target Audience:

• Auto Finance Companies

• Commercial Banks and NBFCs

• Auto Dealerships

• Online Auto Loan Platforms

• Government and Regulatory Bodies (e.g., ASF Romania, National Bank of Romania)

• Vehicle Leasing Firms

• Automotive Industry Consultants

• Market Research and Financial Analysts

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Romania by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Romania Car Finance Market

11.2. Growth Drivers for Romania Car Finance Market

11.3. SWOT Analysis for Romania Car Finance Market

11.4. Issues and Challenges for Romania Car Finance Market

11.5. Government Regulations for Romania Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Romania Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Romania Car Finance Market, 2024

17.3. Market Share of Key Captive in Romania Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Romania Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19. Market Breakdown for Romania Car Finance Market Basis

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Romania Auto Finance Market. Based on this ecosystem, we shortlist the leading 5–6 financial institutions and lenders in the country using criteria such as loan disbursement volumes, market presence, digital penetration, and customer base.

Sourcing is done through industry articles, multiple secondary and proprietary databases to perform desk research and collate industry-level information on key stakeholders, emerging fintech entrants, and traditional lending institutions.

Step 2: Desk Research

An exhaustive desk research process is initiated by referencing diverse secondary and proprietary databases. This enables a detailed market analysis covering variables such as loan disbursements, interest rates, tenure trends, major lenders, and consumer preferences.

We review company-level data from sources such as press releases, investor presentations, audited financials, leasing association reports, and sector-specific publications. This desk research provides foundational insights into the competitive landscape, lending patterns, regulatory compliance, and customer financing behavior.

Step 3: Primary Research

A series of in-depth interviews are conducted with C-level executives, risk officers, and operational managers from leading Romanian banks, NBFCs, and leasing firms. Interviews also include auto dealers and end-users. This primary research aims to validate desk research findings, confirm assumptions, and gather real-time insights into lending practices and market dynamics.

Disguised interviews are executed by approaching companies under the guise of prospective borrowers. This process validates information provided by executives with on-ground customer experiences and transactional data. It also helps gather in-depth details about approval criteria, repayment trends, interest rate brackets, and digital loan processing mechanisms.

Step 4: Sanity Check

- A combination of bottom-to-top and top-to-bottom market sizing approaches is applied to ensure accuracy and alignment of data points. Multiple modeling techniques are employed to triangulate final market numbers, backed by validations from both secondary and primary research stages.

FAQs

1. What is the potential for the Romania Auto Finance Market?

The Romania auto finance market holds significant growth potential, reaching an estimated valuation of RON 18 Billion in 2023. This expansion is fueled by rising vehicle ownership, increased access to consumer credit, and the growing preference for flexible financing options such as leasing and balloon payment schemes. Digital transformation and government incentives for green vehicles further enhance market opportunities through 2029.

2. Who are the Key Players in the Romania Auto Finance Market?

Key players in the Romania Auto Finance Market include Banca Transilvania, BRD Finance, UniCredit Leasing, Porsche Finance Group, TBI Bank, and Idea::Leasing. These companies lead the market with their wide dealership networks, competitive loan products, digital innovation, and strong consumer trust. Emerging fintech platforms are also entering the space, offering faster and more accessible loan processing.

3. What are the Growth Drivers for the Romania Auto Finance Market?

Major growth drivers include rising disposable incomes, increasing car ownership rates, the affordability of used vehicles, and favorable regulatory frameworks. The surge in electric vehicle adoption, expansion of digital lending platforms, and government-backed incentives for green mobility are expected to propel market growth over the forecast period (2024–2029).

4. What are the Challenges in the Romania Auto Finance Market?

The market faces several challenges such as high interest rates due to inflationary pressures, limited financial inclusion in rural areas, and cautious lending practices stemming from credit risk concerns. Additionally, disparities in digital adoption and the need for more flexible, consumer-centric financing products are key areas where the market must evolve to sustain long-term growth.