Russia Auto Finance Market Outlook to 2029

By Market Structure, By Lender Type (Banks, NBFCs, Captive Finance), By Vehicle Type (New vs. Used), By Loan Tenure, By Interest Rate, By Region, and By Customer Demographics

- Product Code: TDR0307

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Russia Auto Finance Market Outlook to 2029 – By Market Structure, By Lender Type (Banks, NBFCs, Captive Finance), By Vehicle Type (New vs. Used), By Loan Tenure, By Interest Rate, By Region, and By Customer Demographics” provides a comprehensive analysis of the auto finance industry in Russia. The report covers an overview and evolution of the industry, overall market size in terms of disbursed loan value, market segmentation; key trends and developments, regulatory environment, borrower profiling, key challenges, and competitive landscape including market share, cross comparison, opportunities and risks, and company profiles of major players in the Russian auto finance space. The report concludes with future market projections based on disbursement value, by market segment, lender type, vehicle type, region, and other drivers, with success case studies highlighting major opportunities and critical success factors.

Russia Auto Finance Market Overview and Size

The Russian auto finance market reached a valuation of RUB 1.48 trillion in 2023, driven by a rising demand for passenger vehicles, government-backed subsidies, and evolving financing ecosystems. Major contributors to the market include Sberbank Auto Loan, VTB Auto, Gazprombank, Rusfinance Bank (Société Générale Group), and captive entities such as RCI Banque (Renault), and Toyota Bank. These players are known for their strong dealership tie-ups, competitive interest rates, and integrated digital loan processing systems.

In 2023, Sberbank introduced a fully digitized approval and disbursement process that reduced turnaround time by 45%, significantly improving customer acquisition. Key urban markets such as Moscow, Saint Petersburg, and Novosibirsk represent high auto loan penetration due to concentrated dealership networks and high-income customer bases.

%2C%202019-2024.png)

What Factors are Leading to the Growth of Russia Auto Finance Market:

Macroeconomic Recovery and Pent-Up Demand: Despite sanctions and economic volatility, post-pandemic recovery and delayed vehicle purchases have led to a surge in demand for auto loans. In 2023, auto finance penetration in new car sales touched 61%, driven by supportive government programs and inflation-beating interest schemes.

Government-Subsidized Auto Loan Programs: The Russian government, under its national automotive support program, continued subsidies on loans for locally manufactured vehicles, especially for first-time buyers and families with children. In 2023, nearly 25% of all new car loans were issued under subsidized schemes.

Digital Lending Platforms and FinTech Integration: Around 38% of the total auto loans in 2023 were facilitated through digital platforms. Fintech-enabled processes have led to increased transparency, credit scoring accuracy, and accelerated disbursement cycles. Players like Auto.ru Finance and CarMoney have capitalized on tech-led models for market penetration.

Which Industry Challenges Have Impacted the Growth for Russia Auto Finance Market

Macroeconomic Volatility and Currency Depreciation: The weakening of the Russian Ruble in recent years has made imported vehicles more expensive, leading to higher loan amounts and increased default risk. In 2023, Ruble depreciation contributed to a 12% rise in average auto loan ticket size, straining affordability for middle-income borrowers and impacting loan approval rates. Currency instability has also made foreign capital financing for NBFCs and captives more challenging.

High Interest Rates and Credit Risk: In the aftermath of economic sanctions and central bank tightening, average auto loan interest rates in Russia ranged from 14% to 20% in 2023. These elevated rates have significantly discouraged loan uptake, especially among first-time and younger borrowers. Over 35% of loan applications were rejected due to either poor credit scores or high debt-to-income ratios, especially outside major urban centers.

Regulatory Pressure and Compliance Costs: New regulations aimed at increasing financial transparency, such as stricter Know Your Customer (KYC) norms and anti-money laundering checks, have increased operational complexity for lenders. As of 2023, compliance costs rose by 18% year-on-year for mid-size NBFCs, reducing their ability to expand into underserved regions.

What are the Regulations and Initiatives which have Governed the Market

Central Bank Lending Norms: The Bank of Russia imposes a loan-to-value (LTV) cap of 80% for most car loans and mandates thorough borrower profiling, particularly for loans exceeding RUB 1 million. This has led to tighter credit evaluation processes across all lenders. As per Q3 2023 data, approximately 68% of auto loans sanctioned fell below the LTV threshold of 75%.

Subsidized Lending Programs: The Russian government, through the Ministry of Industry and Trade, has continued subsidized lending initiatives for priority vehicles, including electric vehicles and domestically manufactured cars. In 2023, over RUB 20 billion was allocated under this scheme, covering partial interest subsidies for over 150,000 vehicle loans.

Support for Domestic Automakers: Policy frameworks increasingly favor locally assembled vehicles. The state offers tax relief and interest subvention for loans on vehicles produced by AvtoVAZ (Lada), GAZ, and UAZ. This is intended to protect the domestic auto industry from foreign competition and promote financing tied to local production. In 2023, domestic brands accounted for 58% of total financed car sales.

Russia Auto Finance Market Segmentation

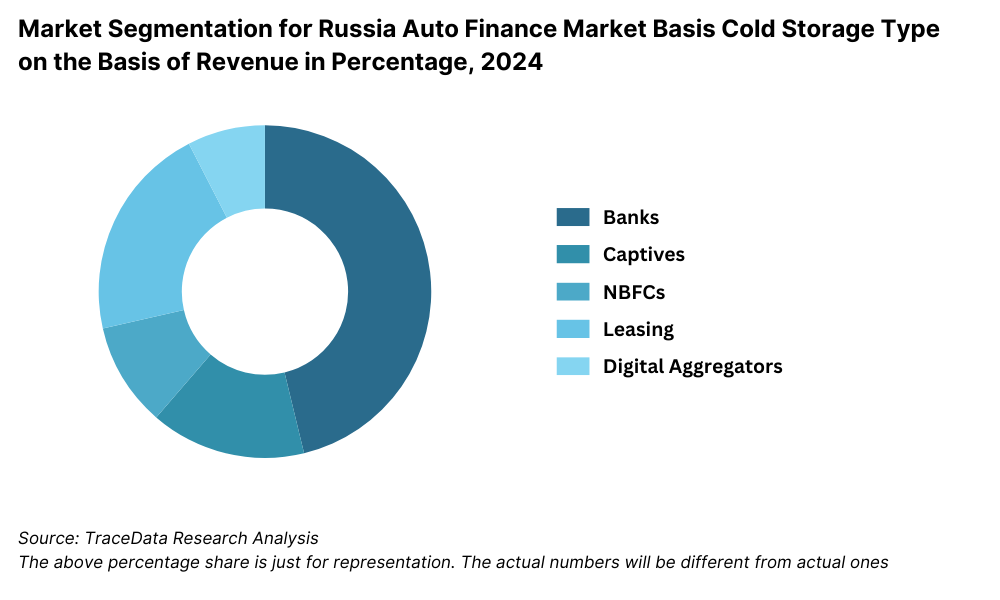

By Market Structure: The banking sector dominates the Russian auto finance market, owing to its wide branch networks, low cost of capital, and strong partnerships with major car dealers. Banks like Sberbank, VTB, and Gazprombank are trusted financial institutions offering competitive interest rates, flexible repayment options, and stable underwriting practices. Captive finance companies—particularly those affiliated with foreign OEMs such as Renault (RCI Banque) and Volkswagen (Volkswagen Bank Rus)—have a significant share as well, offering brand-specific financing deals, promotional EMI schemes, and loyalty-based offers. Non-Banking Financial Companies (NBFCs) are gradually expanding their footprint, especially in Tier 2 and Tier 3 cities, by catering to subprime borrowers and offering quicker loan disbursements.

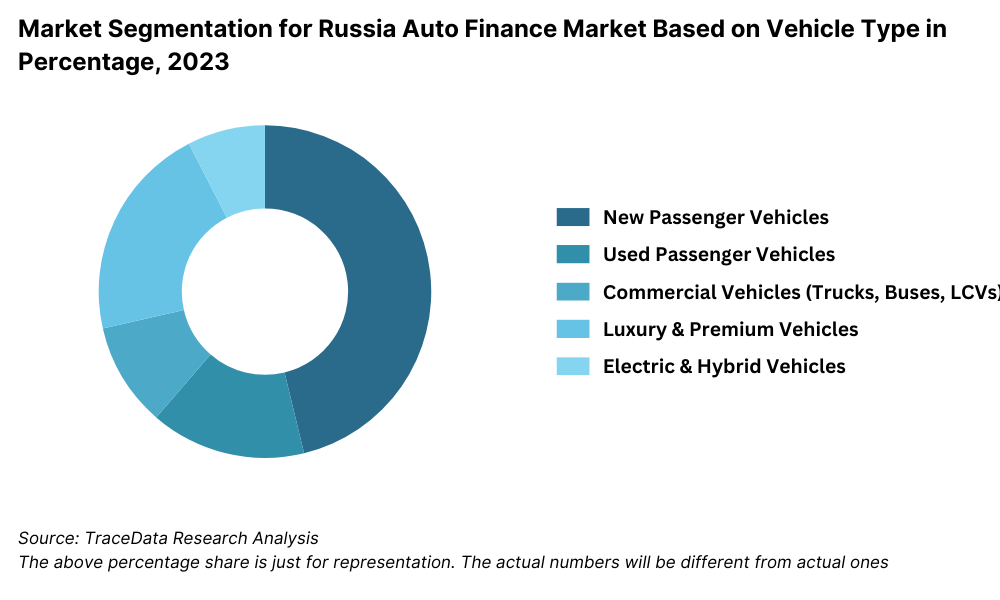

By Vehicle Type: New vehicle financing constitutes a larger share of the total market, especially driven by dealership tie-ups, manufacturer-backed incentives, and financing schemes on locally manufactured vehicles. However, used vehicle financing is steadily growing, driven by rising vehicle costs, affordability concerns, and the increasing presence of certified pre-owned programs. In 2023, nearly 38% of auto finance disbursements were attributed to used car loans, with further growth expected in regional markets.

By Loan Tenure: Loan tenure preferences in Russia vary based on borrower affordability and vehicle type. 3–5-year loan tenures remain the most common, offering a balance between manageable EMIs and total interest outgo. Longer tenures (6–7 years) are popular among low-to-mid income borrowers seeking lower monthly payments, especially for new domestic vehicles. Short-term tenures (1–2 years) are usually chosen by affluent buyers or for used vehicles nearing end-of-life cycles.

Competitive Landscape in Russia Auto Finance Market

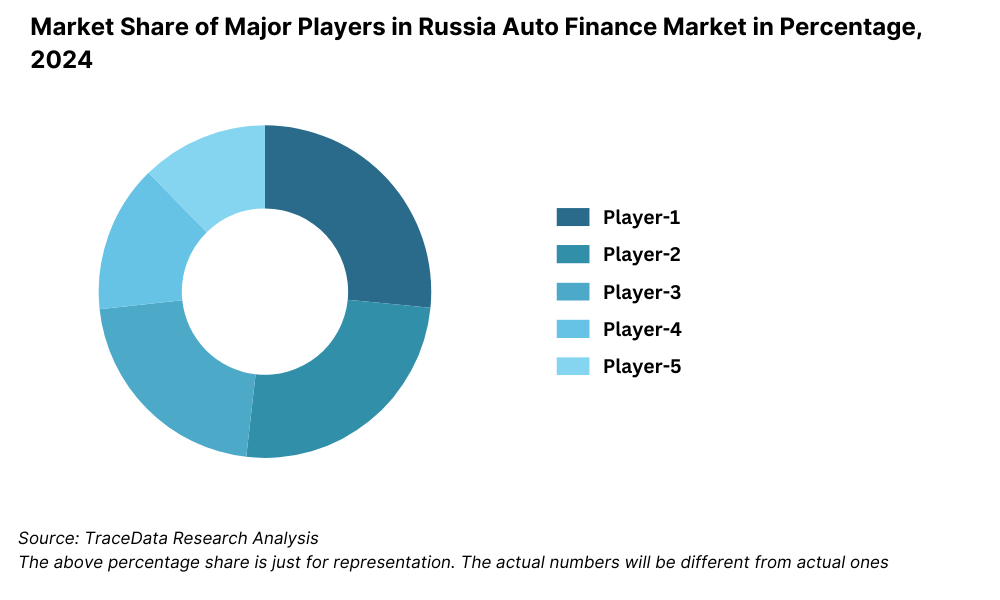

The Russia auto finance market is moderately concentrated, with large commercial banks leading the segment, followed by a growing presence of captive finance arms and regional NBFCs. In recent years, the market has seen increased competition from digital-first lenders and fintech platforms offering auto loans through online channels. Key players include Sberbank, VTB, Gazprombank, Rusfinance Bank, Toyota Bank, RCI Banque, Hyundai Finance, and Renaissance Credit, among others.

Company Name | Establishment Year | Headquarters |

Sberbank Auto Loan | 1841 | Moscow, Russia |

VTB Auto | 1990 | Moscow, Russia |

Gazprombank | 1990 | Moscow, Russia |

Rusfinance Bank | 2001 | Samara, Russia |

Toyota Bank | 2007 | Moscow, Russia |

RCI Banque (Russia) | 2006 | Moscow, Russia |

Hyundai Finance | 2010 | Moscow, Russia |

Renaissance Credit | 2003 | Moscow, Russia |

Some of the recent competitor trends and key information about competitors include:

Sberbank Auto Loan: As Russia’s largest lender, Sberbank dominates the auto finance space with over 40% market share in 2023. It introduced an AI-based loan approval system in 2023 that cut processing time by 30%, significantly improving the borrower experience.

VTB Auto: VTB strengthened its dealer partnerships with domestic manufacturers such as Lada and GAZ, offering preferential interest rates and flexible down payment options. It financed over 190,000 vehicles in 2023, up 18% from the previous year.

Gazprombank: Known for its aggressive retail expansion, Gazprombank entered into financing collaborations with several electric vehicle startups in 2023. The bank reported a 12% YoY growth in its auto loan book despite broader macroeconomic pressures.

Rusfinance Bank: A subsidiary of Société Générale, Rusfinance has been successful in the used car loan segment, with more than 50% of its loan portfolio dedicated to second-hand vehicle financing. Its partnerships with independent dealerships in regional cities have bolstered its rural market presence.

Toyota Bank: The captive finance arm of Toyota, it reported a 22% growth in new car financing for Toyota and Lexus models in 2023. The bank introduced bundled insurance-finance packages, appealing to premium buyers seeking all-in-one solutions.

What Lies Ahead for Russia Auto Finance Market?

The Russia auto finance market is projected to grow at a moderate CAGR through 2029, driven by increasing vehicle affordability challenges, rising demand for flexible financing, and government-backed support for domestic automotive production. Despite economic and regulatory headwinds, digitization and evolving consumer expectations are set to redefine the lending landscape in the years ahead.

Expansion of Used Vehicle Financing: With rising vehicle prices and economic uncertainty, demand for used vehicle financing is expected to surge, especially among middle-income consumers in Tier 2 and Tier 3 cities. Lenders are expected to enhance their offerings in this segment through competitive interest rates, flexible loan tenures, and bundled insurance-finance options.

Digitization of Loan Origination and Approval: Auto lenders in Russia are investing heavily in AI-based risk modeling, automated KYC, and digital onboarding. This will enable faster disbursals, lower operational costs, and improved access to credit across remote and underserved geographies. By 2029, it's anticipated that over 70% of all auto loan applications will be fully processed through digital channels.

Growth in Captive Finance Penetration: OEM-linked finance arms are expected to increase their penetration through dealer-level financing programs, zero-interest campaigns, and loyalty-based upgrades. As automakers push for greater market control, captive entities will emerge as strong competitors to banks, especially in the new car financing segment.

Electrification of Vehicle Loans: As Russia slowly moves toward electric mobility, aided by localized EV manufacturing initiatives and government subsidies, EV financing will become a new focus area for lenders. Although currently less than 1% of total financed vehicles, this segment is projected to grow at a CAGR of 35–40% through 2029, primarily driven by financing support for domestic EV brands.

%2C%202024-2030.png)

Russia Auto Finance Market Segmentation

• By Market Structure:

o Commercial Banks

o Captive Finance Companies

o Non-Banking Financial Companies (NBFCs)

o Digital Lenders / Fintechs

o Dealer Financing

o Government-Backed Lending Programs

• By Lender Type:

o Sberbank

o VTB

o Gazprombank

o Rusfinance Bank

o Toyota Bank

o RCI Banque (Renault)

o Hyundai Finance

o Renaissance Credit

• By Vehicle Type:

o New Passenger Vehicles

o Used Passenger Vehicles

o Commercial Vehicles

o Electric Vehicles (EVs)

• By Loan Tenure:

o <1 Year

o 1–3 Years

o 3–5 Years

o 5–7 Years

• By Interest Rate Type:

o Fixed Rate Loans

o Floating Rate Loans

o Zero Interest Promotional Loans

• By Customer Profile:

o Salaried Individuals (Urban)

o Self-Employed Professionals

o Subprime / Low-Income Borrowers

o Fleet Owners / SMEs

o First-Time Vehicle Buyers

• By Region:

o Central Russia (including Moscow)

o Northwestern (including St. Petersburg)

o Volga Region

o Siberia

o Southern Russia

o Far Eastern Federal District

Players Mentioned in the Report:

• Sberbank

• VTB

• Gazprombank

• Rusfinance Bank

• Toyota Bank

• RCI Banque

• Hyundai Finance

• Renaissance Credit

• Yandex Auto Loans (Fintech)

• AutoMoney (NBFC)

Key Target Audience:

• Commercial Banks & NBFCs

• Captive Auto Finance Companies

• Car Dealerships and OEMs

• Digital Loan Aggregators and Fintechs

• Regulatory Bodies (e.g., Bank of Russia, Ministry of Industry and Trade)

• Automotive Industry Associations

• Research and Analytics Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Russia Auto Finance Market

4.3. Business Model Canvas for Russia Auto Finance Market

4.4. Loan Decision-Making Process-Demand Side 4.5. Loan Disbursement and Sourcing Process-Supply Side

5.1. New Car Sales in Russia, 2018-2024

5.2. New vs. Used Car Sales Ratio in Russia, 2018-2024

5.3. Financing Penetration across Vehicle Types in Russia, 2024

5.4. Distribution of Auto Loan Providers by Region in Russia, 2024

8.1. Disbursed Loan Value, 2018-2024

8.2. Number of Auto Loans Financed, 2018-2024

9.1. By Market Structure Banks, NBFCs, Captives, Fintech, 2023-2024P

9.2. By Vehicle Type New, Used, Commercial, EV, 2023-2024P

9.3. By Loan Tenure 0-1, 1-3, 3-5, 5+ Years, 2023-2024P

9.4. By Interest Rate Type Fixed, Floating, Zero Interest, 2023-2024P

9.5. By Average Loan Ticket Size, 2023-2024P

9.6. By Customer Profile Salaried, Self-Employed, First-Time Buyers, SMEs, 2023-2024P

9.7. By Region Central, Northwestern, Southern, Siberian, Volga, Far Eastern, 2023-2024P

10.1. Customer Landscape and Borrower Profiling

10.2. Customer Journey and Loan Selection Behavior

10.3. Loan Usage, Preferences, and Pain Points

10.4. Gap Analysis Framework

11.1. Trends and Developments in Russia Auto Finance Market

11.2. Growth Drivers for Russia Auto Finance Market

11.3. SWOT Analysis for Russia Auto Finance Market

12.1. Market Size and Digital Penetration Trends, 2018-2029

12.2. Fintech Business Models and Revenue Streams

12.3. Cross Comparison of Leading Digital Auto Finance Platforms-Platform Overview, Loan Approval Process, Partner Dealers, Ticket Size, Approval Time, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for Used Cars, 2018-2029

13.2. Changes in Penetration Rates Over Time and Reasons

13.3. Vehicle Segment-Wise Finance Adoption Patterns

13.4. Used Car Finance Split by Banks, NBFCs, Captives, and Private Lenders, 2023-2024P

13.5. Average Loan Tenure and EMI Preferences in Used Car Financing

13.6. Used Car Finance Disbursement Trends, 2018-2024P

16.1. Benchmark of Key Competitors including Company Overview, USP, Business Model, Marketing Strategy, Loan Book, Dealer Network, Recent Developments, Digital Capabilities, and Customer Segments

16.2. Strength and Weakness Comparison

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant-Auto Finance Lenders in Russia

16.5. Bowman’s Strategic Clock for Competitive Advantage

17.1. Disbursed Loan Value, 2025-2029

17.2. Number of Loans Financed, 2025-2029

18.1. By Market Structure Banks, NBFCs, Captives, Fintech, 2025-2029

18.2. By Vehicle Type New, Used, Commercial, EV, 2025-2029

18.3. By Loan Tenure, 2025-2029 18.4. By Interest Rate Type, 2025-2029

18.5. By Average Ticket Size, 2025-2029

18.6. By Customer Profile, 2025-2029

18.7. By Region, 2025-2029

18.8. Recommendation

18.9. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side (individual borrowers, SMEs, fleet operators) and supply-side (banks, NBFCs, captives, fintech lenders) entities active in the Russia Auto Finance Market. Based on this ecosystem, we shortlist the leading 5–6 financing entities in the country based on auto loan disbursal volume, customer base, and financial strength.

Sourcing is performed through a combination of public disclosures, industry association reports, government regulatory filings, and proprietary databases to establish a comprehensive ecosystem structure and benchmark key players.

Step 2: Desk Research

An extensive desk research phase is conducted using diverse secondary and proprietary data sources. This step involves aggregating market-level and player-level insights on variables such as loan disbursements, market share by lender type, borrower demographics, default rates, and regional spread.

We consult financial disclosures, central bank data (e.g., Bank of Russia reports), media coverage, OEM financials, analyst reports, and company filings to understand macro and micro trends.

Further, we map trends in vehicle financing preferences, interest rate shifts, policy interventions, and digital lending penetration levels across the Russian auto finance space.

Step 3: Primary Research

We conduct a structured series of in-depth interviews with senior executives, product heads, and operations leaders from leading banks, NBFCs, captives, auto OEMs, and car dealerships. Demand-side interviews are conducted with both individual consumers and fleet operators across key cities like Moscow, St. Petersburg, Kazan, and Novosibirsk.

This dual-layered primary research validates assumptions around interest rate ranges, loan processing timelines, delinquency behavior, and borrower segmentation.

As part of our triangulation strategy, disguised interviews are also undertaken where our researchers engage as potential borrowers or dealership clients to cross-verify operational parameters, EMI structures, approval workflows, and incentives.

We also capture qualitative feedback on digital onboarding, customer satisfaction, and dealer-financier relationships.

Step 4: Sanity Check

Both bottom-up (aggregated disbursements from key players) and top-down (total vehicle sales × financing penetration × average loan ticket size) methods are used to arrive at market size estimates.

This dual-approach modeling is further stress-tested through sensitivity analysis and triangulated with inputs from independent analysts, government policy direction, and internal market simulation tools.

The final outputs undergo a multi-layered validation cycle to ensure alignment with real-world industry conditions.

FAQs

1. What is the potential for the Russia Auto Finance Market?

The Russia auto finance market holds significant potential, with the total disbursed loan value reaching approximately RUB 1.48 trillion in 2023. Growth is expected to continue steadily through 2029, fueled by rising vehicle prices necessitating financing, growing middle-income population segments, and government incentives for vehicle ownership. Digital lending platforms and innovative financing models such as subscription-based and EV financing are expected to further expand market accessibility and penetration.

2. Who are the Key Players in the Russia Auto Finance Market?

The market is led by major commercial banks such as Sberbank, VTB, and Gazprombank, alongside captive financing arms like Toyota Bank, RCI Banque (Renault), and Hyundai Finance. NBFCs such as Rusfinance Bank and fintech lenders like Renaissance Credit and AutoMoney are also gaining traction, particularly in the used vehicle and subprime lending segments.

3. What are the Growth Drivers for the Russia Auto Finance Market?

Key growth drivers include the rising cost of vehicles, which boosts demand for financing, and the increased digitization of loan origination and approval processes. Government-backed interest subsidies for new and electric vehicles, stronger dealer-lender partnerships, and rising consumer aspirations—particularly in urban centers—are also propelling market expansion.

4. What are the Challenges in the Russia Auto Finance Market?

Challenges include macroeconomic instability and Ruble depreciation, which raise financing costs and default risk. High interest rates, tightened lending regulations, and limited credit access in rural areas also constrain the market. Additionally, increasing compliance costs and stringent KYC and transparency requirements under the Bank of Russia’s supervision add operational pressure on lenders.