Saudi Arabia 3D Printing Market Outlook to 2030

By Technology, By Material, By Application, By End-Use Industry, By Component, and By Region

- Product Code: TDR0368

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Saudi Arabia 3D Printing Market Outlook to 2030 - By Technology, By Material, By Application, By End-Use Industry, By Component, and By Region” provides a comprehensive analysis of the 3D printing market in Saudi Arabia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the 3D printing market. The report concludes with future market projections based on installed base, material consumption, regional adoption, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

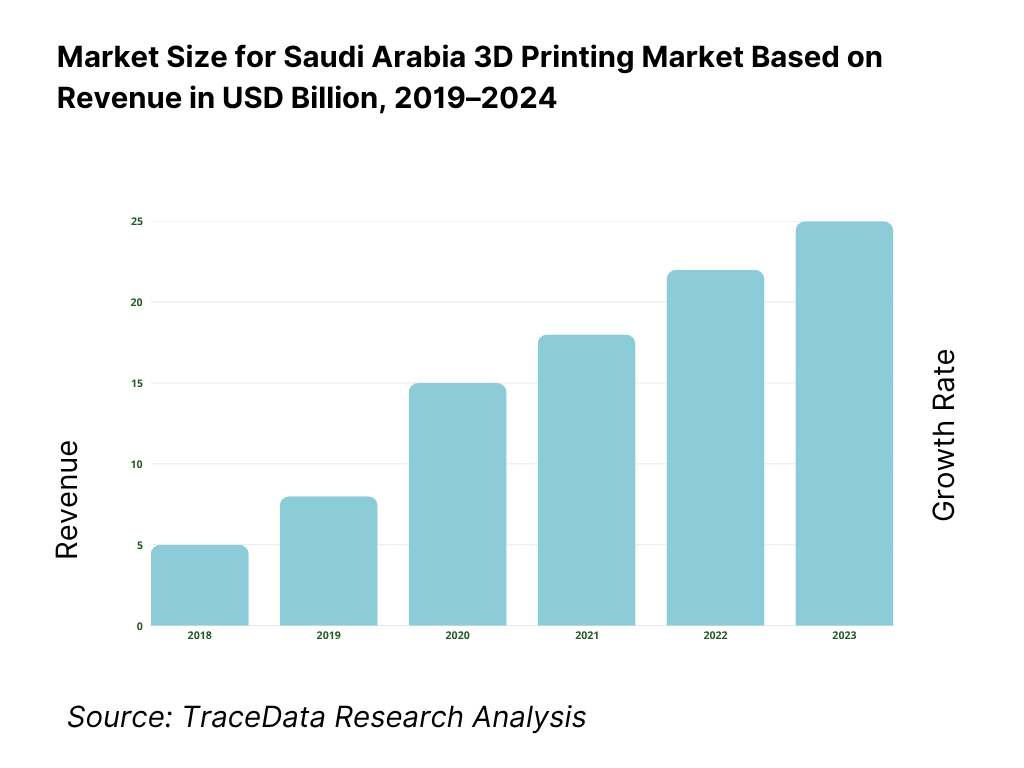

Saudi Arabia 3D Printing Market Overview and Size

The Saudi Arabia 3D printing market is valued at USD 120 million, based on a five-year historical analysis. Momentum has accelerated with national industrial localization and digital warehousing programs, pushing the market to USD 264.5 million in the following year per TraceData’s industry sizing. Demand is concentrated in metals and polymers for oil & gas spares, healthcare devices, and construction printing pilots, with ecosystem build-out led by public-private initiatives and OEM partnerships.

Dominant activity clusters include Riyadh (policy, procurement, and NAMI’s corporate base), the Eastern Province—Dammam/Jubail (oil & gas, utilities, and Immensa’s AM facility serving digital inventory use-cases), Jeddah/Makkah (construction value chain), and the NEOM–OXAGON corridor (advanced manufacturing hub strategy). These locations host flagship projects—digital spares for Saudi Electricity Company, tallest on-site 3D-printed villa deployments, and manufacturing-policy MoUs—thus concentrating installed capacity, certification work, and pilot-to-production pathways.

What Factors are Leading to the Growth of the Saudi Arabia 3D Printing Market:

Industrial localization and manufacturing depth: Saudi Arabia’s manufacturing base is expanding in both scale and sophistication, creating immediate pull for 3D printing across tooling, spares, and serial parts. The Kingdom now has over 12,000 factories, with 1,346 new industrial licenses issued in the prior year and investments above SAR 50 billion, while 1,075 factories started production in the same period, employing nearly 39,000 people. Imports also show a heavy tilt toward production technology, with machinery and electrical equipment ranking as the largest import category, representing 23.5% of total imports in a recent month. Foreign direct investment inflows of USD 25.6 billion further support industrial expansion.

Healthcare scale and point-of-care enablement: Saudi Arabia’s healthcare system provides a strong foundation for medical 3D printing adoption. The country has 499 hospitals, supported by 23.8 beds per 10,000 people and 33.6 doctors per 10,000 people, ensuring capacity for specialized medical services. Regulatory momentum is equally strong, with dedicated guidance now governing point-of-care 3D printing inside healthcare facilities. This ensures licensing, quality control, and traceability for patient-specific devices. The Ministry of Health’s virtual care hub already coordinates with 224 hospitals to deliver 44 specialized services, further reinforcing the infrastructure needed for multi-site adoption of additive manufacturing across the healthcare ecosystem.

Logistics gateways and industrial import corridors: 3D-printing feedstocks, resins, and high-value machinery benefit from Saudi Arabia’s concentrated import corridors. Jeddah Islamic Port alone handles imports worth SAR 14.8 billion in a single month, accounting for about a quarter of total inflows, followed by King Abdulaziz Port in Dammam at around 20.0% and King Khalid International Airport in Riyadh at about 12.9%. Overall, merchandise imports reached SAR 201.4 billion in the latest reported quarter, again led by machinery, electrical equipment, and transport goods. These trade dynamics reduce lead times for advanced printing systems, spares, and certified materials, enabling faster ramp-up of production-grade additive operations across energy, aerospace, and healthcare hubs.

Which Industry Challenges Have Impacted the Growth of the Saudi Arabia 3D Printing Market:

Human capital and R&D pipeline for production-grade AM: Scaling production-grade additive manufacturing requires a larger pool of specialized talent. Saudi Arabia recorded SAR 19.2 billion in R&D expenditure with 30,160 researchers and a total of 43,960 R&D employees, most concentrated in the education sector. On a normalized basis, the country has 1,121 researchers per million people, a level that highlights the need for more industry-embedded engineers, materials scientists, and QA/NDT specialists. Bridging this talent gap is critical for scaling programs in oil & gas, aerospace, and medical sectors, where qualification, testing, and documentation are as essential as the printing process itself.

Import reliance for advanced machinery and feedstocks: The Saudi additive manufacturing sector still depends heavily on imported capital equipment and specialized consumables. Machinery and electrical equipment remain the single largest import category, representing 23.5% of total imports in a recent month. Total merchandise imports reached SAR 201.4 billion in the latest quarter, with machinery and transport equipment driving the increase. This reliance exposes local operators to global supply chain disruptions and certification backlogs. Until domestic localization of powders, resins, and advanced printers expands, AM providers must maintain inventories and use multi-supplier strategies to secure operational continuity.

Capital formation and ecosystem crowd-in beyond anchors: Large anchor companies and government-led programs are mobilizing major investments, but broader ecosystem participation is needed. Foreign direct investment inflows stood at USD 25.6 billion in the latest full year, with total FDI stock at SAR 897 billion, yet these remain concentrated in a few sectors. In the energy domain, Aramco’s iktva program reported a 67.0% local-content rate and signed 145 corporate purchase agreements valued at roughly SAR 65.7 billion, showing how localization programs can catalyze supply chain participation. The challenge lies in translating these flows into a diversified AM ecosystem that includes powder atomization, metrology labs, and post-processing facilities across multiple regions.

What are the Regulations and Initiatives which have Governed the Market:

SFDA’s Point-of-Care (PoC) manufacturing guidance for medical 3D printing: The Saudi Food & Drug Authority has issued a specific regulatory framework governing point-of-care 3D printing inside healthcare facilities. This sets requirements for licensing, documentation, quality systems, and post-market surveillance. It ensures alignment with broader frameworks such as medical device authorization and unique device identification, guaranteeing that patient-specific devices and surgical models produced within hospitals meet strict safety and traceability standards before deployment in clinical use.

Local content rules shaping procurement for industrial AM adoption: Localization policies directly influence procurement decisions in the additive manufacturing market. Aramco’s iktva program achieved a 67.0% local-content rate, contributed USD 37.1 billion to GDP, and executed 145 purchase agreements worth approximately SAR 65.7 billion, with a national target of 70.0% local content in procurement. Similarly, the National Industrial Development and Logistics Program reported 47.4% local content value across procurement. These frameworks shape vendor qualification, favor local assembly, and encourage in-Kingdom service footprints essential for scaling AM adoption.

Customs and trade facilitation parameters that govern AM inputs: Timely clearance of additive manufacturing machinery and feedstocks is supported by Saudi Arabia’s customs infrastructure. Jeddah Islamic Port handles about SAR 14.8 billion in imports in a single month, King Abdulaziz Port in Dammam manages close to 20.0%, and King Khalid International Airport in Riyadh about 12.9%. Overall, imports reached SAR 201.4 billion in the most recent quarter, dominated by machinery, electrical equipment, and transport goods. These customs and logistics processes are crucial for ensuring reliable supply of 3D printing inputs and for maintaining continuity in industrial and healthcare operations.

Saudi Arabia 3D Printing Market Segmentation

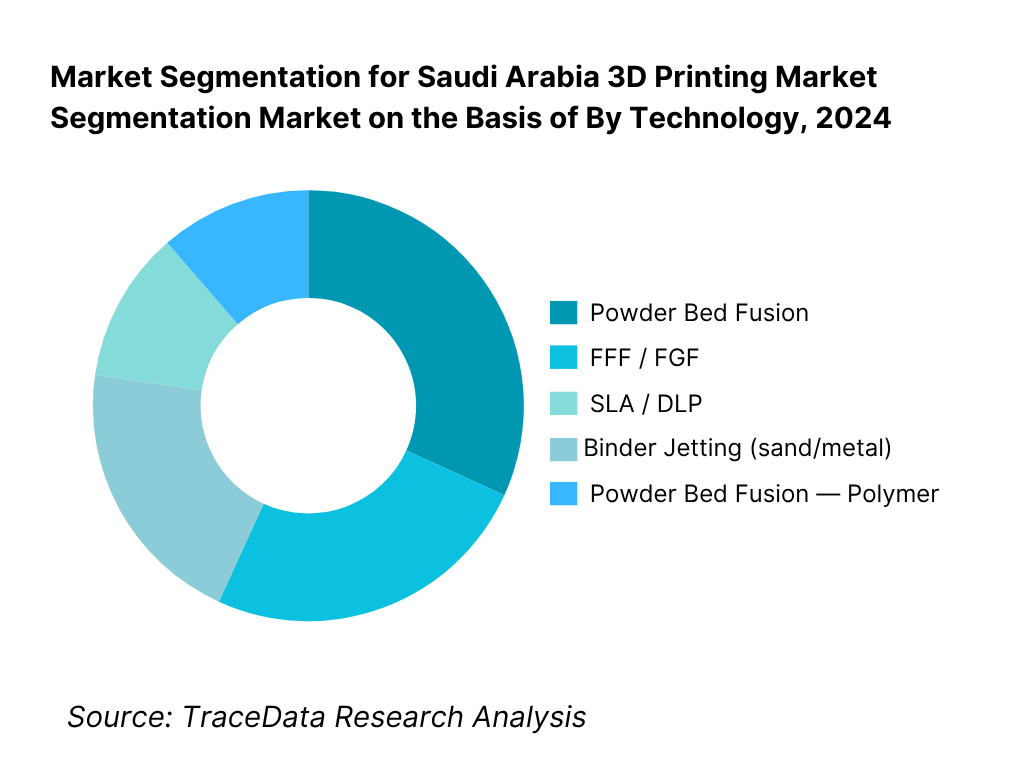

By Technology: Saudi Arabia’s 3D printing market is segmented by technology into powder bed fusion (metal and polymer), FFF/FGF, SLA/DLP, binder jetting, DED/WAAM, and construction 3DCP. Powder Bed Fusion—Metal currently holds a dominant share in Saudi Arabia under the technology segmentation, driven by oil & gas, utilities, and aero-defense qualification needs for complex, high-value parts. Programs such as NAMI–SEC digital spare parts and aero-defense part qualification emphasize dense metals, pedigree, and repeatability—areas where PBF-metal excels in mechanical properties and certification pathways. Construction 3DCP remains smaller but visible through record-setting pilot projects and policy experimentation.

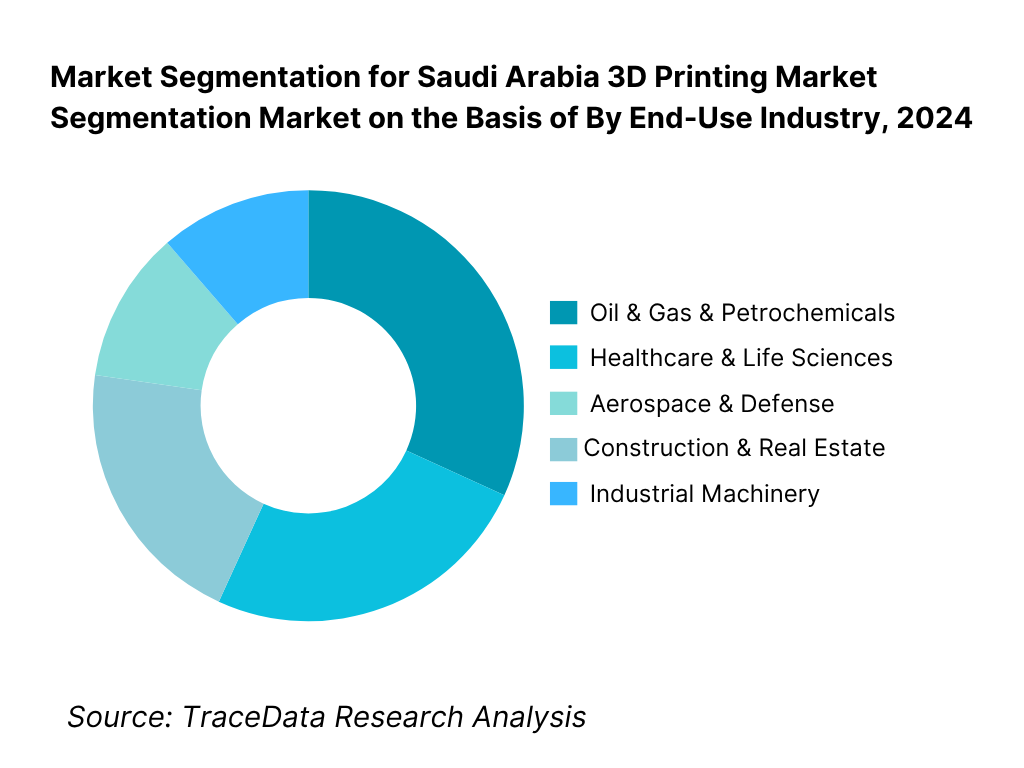

By End-Use Industry: Saudi Arabia’s 3D printing market is segmented by end-use into energy/petrochemicals, aero-defense, construction/real estate, healthcare, automotive, industrial machinery, consumer/electronics, and education/research. Oil & Gas & Petrochemicals dominate due to the Kingdom’s outsized industrial base and the strategic pivot to digital warehousing and on-demand spares where AM reduces lead times and inventory costs. Initiatives by NAMI with utilities and Immensa in Dammam, combined with Aramco’s long-standing localization agenda, pull complex metal parts, high-temperature polymers, and certified workflows into production, reinforcing sectoral leadership.

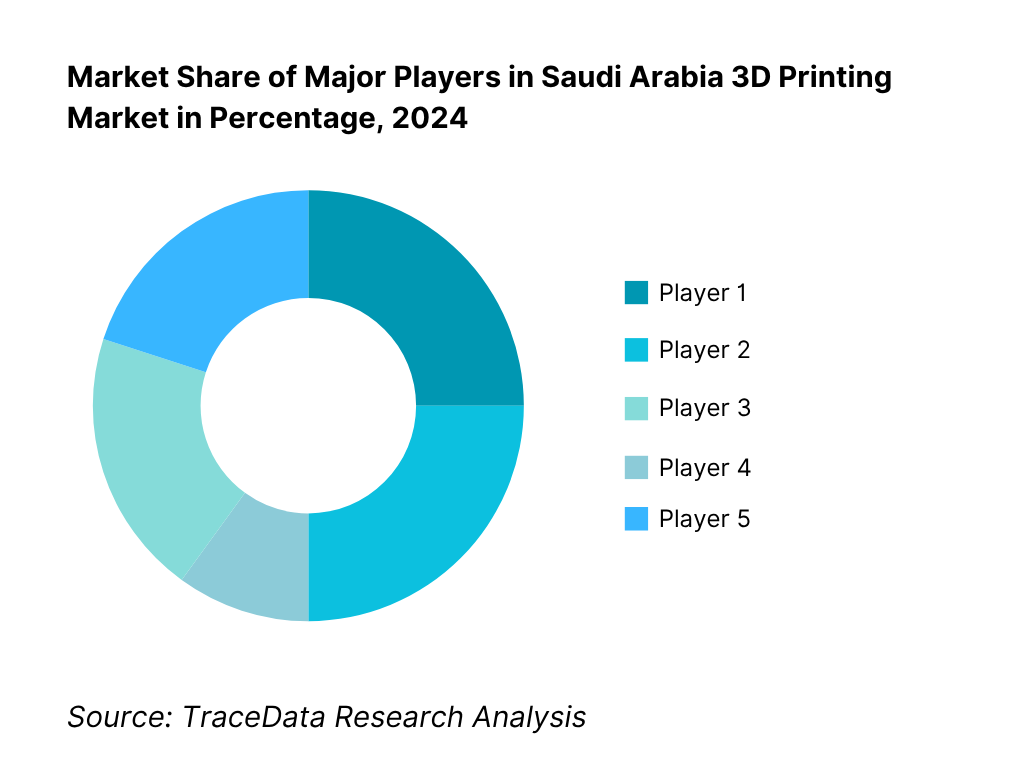

Competitive Landscape in Saudi Arabia 3D Printing Market

The Saudi Arabia 3D printing market features a blend of global OEMs and localized integrators. A small group of companies influences specification standards, training, and certification—notably the NAMI–3D Systems alliance for digital spare parts, and global leaders like EOS, Stratasys, and HP with polymer and metal platforms. Construction printing is shaped by COBOD deployments with leading real estate developers. This consolidation highlights the influence of scale, installed base, and qualification toolkits.

Name | Founding Year | Original Headquarters |

NAMI (3D Systems–Dussur JV) | 2022 | Riyadh, Saudi Arabia |

3D Systems | 1986 | Rock Hill, USA |

EOS | 1989 | Krailling, Germany |

Stratasys | 1989 | Eden Prairie, USA |

HP (MJF) | 1939 | Palo Alto, USA |

Renishaw | 1973 | Wotton-under-Edge, UK |

Nikon SLM Solutions | 2006 | Lübeck, Germany |

GE Additive | 2016 | Cincinnati, USA |

Desktop Metal | 2015 | Burlington, USA |

Markforged | 2013 | Watertown, USA |

Materialise | 1990 | Leuven, Belgium |

Formlabs | 2011 | Somerville, USA |

Farsoon Technologies | 2009 | Changsha, China |

BigRep | 2014 | Berlin, Germany |

COBOD | 2017 | Copenhagen, Denmark |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

NAMI (3D Systems–Dussur JV): As the flagship national additive manufacturing integrator, NAMI has scaled its collaboration with 3D Systems in 2024 by delivering certified spare parts for the Saudi Electricity Company and initiating aerospace and defense qualification projects. The company is positioning itself as a localization hub under Vision 2030 by offering in-Kingdom facilities for part certification and materials processing.

EOS: Known for its strong presence in metal powder bed fusion technologies, EOS expanded its footprint in Saudi Arabia through partnerships with energy sector clients. In 2024, EOS supported local qualification of high-temperature alloys for oil & gas and defense applications, addressing the need for certified, durable components in critical infrastructure.

COBOD: Specializing in construction 3D printing, COBOD achieved a major milestone in Saudi Arabia with the tallest on-site 3D-printed villa project developed alongside Dar Al Arkan. The company has been aligning with public housing initiatives and real estate developers to demonstrate large-scale 3DCP adoption for affordable and sustainable housing solutions.

Immensa: As one of the first dedicated additive manufacturing service providers in the region, Immensa expanded its Saudi operations in 2024 by investing in its Dammam facility, focused on digital inventory solutions for oil & gas and utilities. The company has been signing contracts with industrial clients to replace conventional spare parts supply chains with localized on-demand production.

Stratasys: Focusing on healthcare and industrial applications, Stratasys increased its installations of FDM and PolyJet printers across Saudi hospitals and universities in 2024. The company has been working closely with regulators and medical institutions to integrate 3D printing for surgical planning, prosthetics, and education, strengthening its role in healthcare innovation.

What Lies Ahead for Saudi Arabia 3D Printing Market?

The Saudi Arabia 3D printing market is expected to advance steadily toward 2030, supported by national industrial localization, Vision 2030 diversification programs, and the integration of additive manufacturing into energy, aerospace, healthcare, and construction supply chains. As Saudi Arabia strengthens its advanced manufacturing base through NEOM’s OXAGON and major defense-industrial partnerships, additive technologies will be positioned as a key enabler of industrial self-reliance and efficiency.

Rise of Industrial-Scale AM Facilities: The market is likely to witness the expansion of large-scale additive hubs, such as those led by NAMI and Immensa, enabling mass adoption in oil & gas, defense, and utilities. These facilities will reduce dependence on global supply chains by localizing spare parts production.

Shift Toward Regulated Healthcare Printing: The issuance of SFDA’s point-of-care medical device manufacturing guidance signals a future where hospitals and clinics increasingly integrate certified 3D printing labs. This will allow patient-specific devices, implants, and surgical models to move from pilot to mainstream adoption.

Acceleration in Construction 3D Printing: Saudi Arabia is expected to scale construction 3D printing under housing and urban development programs. The success of pilot projects like the tallest 3D-printed villa points to wider applications in affordable housing, infrastructure, and modular real estate.

Integration with Digital Warehousing: The push for digital spare-parts inventories, particularly in oil & gas and utilities, will be a major growth driver. By leveraging AM for on-demand production, companies will cut lead times and reduce stockpiling, creating sustainable cost and time efficiencies.

Adoption of Advanced Materials and Processes: With global OEM partnerships, Saudi Arabia is poised to expand local access to high-performance alloys, composites, and biocompatible materials. This will enhance the utility of 3D printing for aerospace, defense, and medical-grade applications.

Saudi Arabia 3D Printing Market Segmentation

By Technology

Powder Bed Fusion — Metal (PBF-M)

Powder Bed Fusion — Polymer (PBF-P)

Material Extrusion (FFF/FGF)

Vat Photopolymerization (SLA/DLP/mSLA)

Binder Jetting

Directed Energy Deposition (DED/WAAM)

Construction 3D Printing (3DCP)

Hybrid Cells

By Organization Size

Large Enterprises / State-Owned

Mid-Market Industrials

SMEs & Startups

Government / Academia / Public Hospitals

By Access / Sales Channel

Direct OEM Sales

Authorized Distributors / Systems Integrators

Service Bureaus / Contract Manufacturers

Online / E-commerce Platforms

By Post-Processing & QA Workflow

Mechanical & Thermal

Subtractive Finishing

Surface Finishing

Inspection & Certification

By Region

Riyadh

Eastern Province (Dammam/Jubail/Dhahran)

Makkah Region (Jeddah)

Madinah

Tabuk Corridor (NEOM/OXAGON)

Others

Players Mentioned in the Report:

NAMI (3D Systems–Dussur)

3D Systems

EOS

Stratasys

HP (MJF)

Renishaw

Nikon SLM Solutions

GE Additive

Desktop Metal

Markforged

Materialise

Formlabs

Farsoon

BigRep

COBOD.

Key Target Audience

Government & Regulatory Bodies

Oil & Gas & Utilities Procurement Heads

Aerospace & Defense Primes and Tier-1s

Healthcare Provider Networks

EPC & Industrial Contractors

Real Estate & Construction Developers

Industrial Parks & SEZ Developers

Investments and Venture Capitalist Firms

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for 3D Printing-In-house Production, Outsourced Service Bureau, Hybrid/Shared Facility-[Margins, Preference, Strength & Weakness]

4.2. Revenue Streams for Saudi Arabia 3D Printing Market [printer sales, consumables, software licenses, service contracts, training & certification]

4.3. Business Model Canvas for Saudi Arabia 3D Printing Market [key activities, resources, partners, value propositions, channels, customer segments, cost structure, revenue streams]

5.1. Service Bureaus vs. In-house Additive Manufacturing Units [adoption, throughput, scalability]

5.2. Investment Model in Saudi Arabia 3D Printing Market [public investments, JV models, SEZ incentives, financing]

5.3. Comparative Analysis of Procurement/Funneling Process by State-Owned vs. Private Industrial Organizations [qualification cycles, supplier vetting, project-based adoption]

5.4. 3D Printing Budget Allocation by Company Size [large enterprises, SMEs, startups]

8.1. Revenues, Historical to Current [USD Bn basis; equipment vs. materials vs. services]

9.1. By Market Structure (In-house vs. Outsourced Service Bureau)

9.2. By Technology (PBF-Metal, PBF-Polymer, FFF/FGF, SLA/DLP, Binder Jetting, WAAM/DED, Construction 3DCP)

9.3. By Industry Verticals (Oil & Gas & Petrochemicals, Aerospace & Defense, Construction, Healthcare, Automotive & Mobility, Industrial Machinery, Consumer/Electronics)

9.4. By Company Size (large enterprises/state-owned vs. SMEs/startups)

9.5. By Material Type (metals, polymers, composites, concrete, bio-materials)

9.6. By Mode of Access (direct OEM purchase, distributors, online platforms, outsourced bureau)

9.7. By Open vs. Proprietary Platforms

9.8. By Region (Riyadh, Eastern Province, Makkah Region, NEOM/OXAGON Corridor, Others)

10.1. Industrial & Corporate Client Landscape and Cohort Analysis

10.2. Decision-Making Process for 3D Printing Adoption [qualification, ROI frameworks, procurement cycle]

10.3. Effectiveness and ROI Analysis of 3D Printing Programs [cost savings, lead time reduction, localization impact]

10.4. Gap Analysis Framework [adoption vs. capacity availability]

11.1. Trends and Developments [construction 3DCP adoption, localized powders, hybrid cells, aerospace part certification]

11.2. Growth Drivers [Vision 2030 localization, NEOM/OXAGON industrial hubs, IKTVA, defense offset programs, healthcare digital transformation]

11.3. SWOT Analysis for Saudi Arabia 3D Printing Market

11.4. Issues and Challenges [high CAPEX, certification bottlenecks, lack of skilled workforce, dependency on imported resins/powders]

11.5. Government Regulations [SFDA medical device guidance, construction code integration, API/ASME for oil & gas, defense standards]

12.1. Market Size and Future Potential for Distributed AM & Digital Warehousing in Saudi Arabia

12.2. Business Model and Revenue Streams [pay-per-print, subscription models, licensing of design files]

12.3. Delivery Models and Types of Services Offered [digital twin libraries, on-demand spare parts, cloud-based design repositories]

15.1. Market Share of Key Players in Saudi Arabia 3D Printing Market Basis Revenues

15.2. Benchmark of Key Competitors in Saudi Arabia 3D Printing Market [company overview, USP, business strategies, business model, installed base, revenues, pricing, technology portfolio, major Saudi clients, tie-ups, marketing strategies, recent developments]

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant-Mapping of 3D Printing Companies in Saudi Arabia

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues, Forecast [USD Bn basis]

17.1. By Market Structure (In-house and Outsourced Training/Printing)

17.2. By Technology (Metal, Polymer, Composites, Construction, Hybrid)

17.3. By Industry Verticals (Oil & Gas, Construction, Aerospace & Defense, Healthcare, Automotive)

17.4. By Company Size (Large Enterprises, SMEs, Startups)

17.5. By Material Type

17.6. By Mode of Access (OEM, Distributor, Online, Outsourced)

17.7. By Open and Proprietary Platforms

17.8. By Region (Riyadh, Eastern Province, Makkah Region, NEOM/OXAGON, Others)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Saudi Arabia 3D Printing Market. On the demand side, this includes oil & gas and petrochemical operators, aerospace and defense primes, healthcare systems with point-of-care labs, utilities, construction developers, automotive and industrial manufacturers, and SEZ authorities such as NEOM OXAGON. On the supply side, it encompasses global OEMs, local service bureaus, materials suppliers, post-processing providers, software vendors, and research institutions. Based on this mapping, we will shortlist 5–6 leading additive manufacturing providers in the Kingdom, considering their financial performance, local presence, client base, and regulatory certifications. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the revenues by stream (hardware, materials, services, software), installed base by technology, demand across end-use sectors, and qualification requirements under Saudi regulations. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, government procurement portals, and financial disclosures. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Saudi Arabia 3D Printing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. This includes reconciling technology adoption with sectoral demand, validating regional distribution with industrial clusters such as Riyadh, Eastern Province, Jeddah/Makkah, and NEOM OXAGON, and aligning application claims with regulatory feasibility. The result is a validated and reliable dataset that ensures consistency between primary insights, secondary findings, and macroeconomic indicators.

FAQs

01 What is the potential for the Saudi Arabia 3D Printing Market?

The Saudi Arabia 3D Printing Market is poised for substantial expansion, reaching a valuation of USD 120 million in 2023 as reported by Ken Research. This potential is being fueled by the Kingdom’s Vision 2030 industrial diversification program, investments into NEOM’s OXAGON advanced manufacturing hub, and the localization of critical spare parts in oil & gas and utilities. The market’s trajectory is further bolstered by government-backed initiatives encouraging digital warehousing, medical device innovation, and construction 3D printing pilots across major cities.

02 Who are the Key Players in the Saudi Arabia 3D Printing Market?

The Saudi Arabia 3D Printing Market features several prominent players, including NAMI (3D Systems–Dussur JV), EOS, Stratasys, HP, and GE Additive. These companies dominate the market due to their strong technology portfolios, local partnerships, and sector-specific certifications. Other notable participants include Renishaw, Nikon SLM Solutions, Desktop Metal, Markforged, Materialise, Formlabs, Farsoon, BigRep, and COBOD, each bringing specialized expertise ranging from metals and polymers to construction 3D printing.

03 What are the Growth Drivers for the Saudi Arabia 3D Printing Market?

The primary growth drivers include Saudi Arabia’s industrial transformation under Vision 2030, which emphasizes localization of manufacturing and reducing dependency on imports. Large-scale programs like iktva (In-Kingdom Total Value Add) and government procurement through LCGPA are accelerating adoption across oil & gas, defense, and utilities. Additionally, the Saudi Food & Drug Authority’s regulatory framework for point-of-care 3D-printed medical devices is enabling healthcare adoption, while construction 3D printing projects in Riyadh and Jeddah highlight the market’s potential in housing and infrastructure.

04 What are the Challenges in the Saudi Arabia 3D Printing Market?

The Saudi Arabia 3D Printing Market faces several challenges, including heavy reliance on imported powders, resins, and advanced printing equipment, which can be impacted by supply chain disruptions. Workforce readiness is another barrier, as the Kingdom has only 1,121 researchers per million people according to World Bank data, limiting the talent pool for specialized AM roles. Furthermore, certification and quality assurance remain critical hurdles, with industries such as aerospace and healthcare requiring stringent compliance, often slowing the pace from pilot projects to mass adoption.