Saudi Arabia Cold Chain Market Outlook to 2029

By Market Structure, By Type of Services (Cold Storage and Cold Transportation), By End-Users (Fruits & Vegetables, Dairy Products, Pharmaceuticals, Meat & Seafood), and By Region.

- Product Code: TDR0206

- Region: Middle East

- Published on: June 2025

- Total Pages: 80

Report Summary

The report titled "Saudi Arabia Cold Chain Market Outlook to 2029 – By Market Structure, By Type of Services (Cold Storage and Cold Transportation), By End-Users (Fruits & Vegetables, Dairy Products, Pharmaceuticals, Meat & Seafood), and By Region." provides a comprehensive analysis of the cold chain market in Saudi Arabia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, service type, end-user industries, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Saudi Arabia Cold Chain Market Overview and Size

The Saudi Arabia cold chain market reached a valuation of SAR 11.5 Billion in 2023, driven by rising demand for perishable goods, growth in the pharmaceutical sector, and increasing investments in food security initiatives. The market is characterized by major players such as Agility Logistics, Al Salem Johnson Controls, United Warehouse Company, Gulf Cold Storage, and Al Raya Logistics. These companies are recognized for their extensive warehousing facilities, advanced refrigeration technology, and integrated cold transportation solutions.

In 2023, Agility Logistics expanded its cold storage capacity in Riyadh to cater to the growing needs of the pharmaceutical and food sectors. This move aligns with Saudi Arabia’s Vision 2030 initiative to enhance the logistics infrastructure and food security across the kingdom. Riyadh, Jeddah, and Dammam are key markets due to their strategic locations, dense population clusters, and proximity to major seaports and airports.

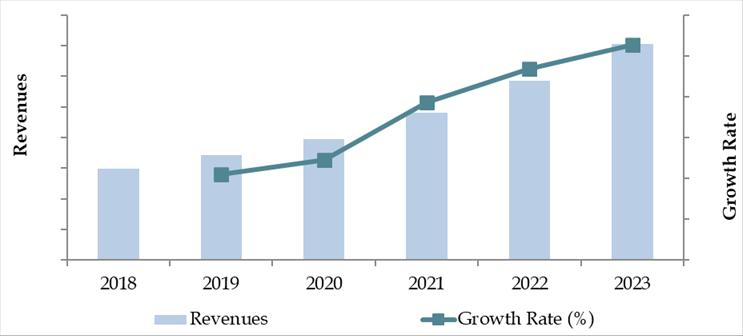

Market Size for Saudi Arabia Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2024

What Factors are Leading to the Growth of Saudi Arabia Cold Chain Market:

Food Security Initiatives: Saudi Arabia’s emphasis on enhancing food security through investments in agricultural imports and storage infrastructure is driving demand for cold chain services. In 2023, the country allocated more than SAR 3 Billion towards agricultural and cold storage infrastructure development.

Growth of Pharmaceuticals: Rising healthcare awareness and expansion of pharmaceutical imports, including vaccines and biologics that require controlled temperature storage, have significantly boosted the need for reliable cold chain logistics. The pharmaceutical cold chain segment grew by approximately 9% in 2023 alone.

Increasing Demand for Processed Food: The growing consumption of frozen and processed food products, fueled by changing lifestyles and increased disposable incomes, has augmented the demand for cold storage and refrigerated transport services. In 2023, frozen foods accounted for nearly 32% of the total cold chain volume in Saudi Arabia.

Which Industry Challenges Have Impacted the Growth for Saudi Arabia Cold Chain Market

High Operational Costs: Maintaining temperature-controlled environments requires significant investment in infrastructure, energy, and technology. In 2023, it was estimated that operational expenses, including electricity costs for cold storages, accounted for nearly 30% of total logistics expenditures in Saudi Arabia. This high cost has made it difficult for smaller players to sustain profitability, limiting market competitiveness.

Limited Skilled Workforce: The shortage of trained personnel specializing in cold chain logistics management, including handling temperature-sensitive goods and managing sophisticated cold storage systems, has hampered industry efficiency. According to a sector survey, around 40% of companies reported challenges in finding adequately skilled labor for cold chain operations.

Infrastructure Gaps in Remote Regions: While major cities like Riyadh and Jeddah boast advanced cold storage facilities, remote areas face significant cold chain infrastructure shortages. As of 2023, only 18% of rural distribution centers had access to modern cold storage solutions, leading to high spoilage rates for perishable goods in outlying regions.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety Regulations: The Saudi Food and Drug Authority (SFDA) mandates stringent storage and transportation conditions for food products, pharmaceuticals, and biological goods. Regulations require that perishable products maintain specific temperature ranges throughout the supply chain. Compliance checks in 2023 revealed that 82% of major cold chain operators met SFDA standards on their first inspection.

Vision 2030 Logistics Development Initiative: Under the Vision 2030 strategy, the Saudi government is heavily investing in logistics infrastructure, including cold chain facilities. The National Industrial Development and Logistics Program (NIDLP) has earmarked over SAR 5 Billion for cold chain-related infrastructure by 2026, aiming to position Saudi Arabia as a regional logistics hub.

Pharmaceutical Distribution Licensing: To enhance the quality of pharmaceutical cold storage and distribution, the Ministry of Health (MoH) requires special licenses for companies involved in temperature-sensitive pharmaceutical logistics. In 2023, over 150 new licenses were issued for cold chain companies, a 12% increase compared to 2022, signaling regulatory support for industry expansion.

Saudi Arabia Cold Chain Market Segmentation

By Market Structure: The organized sector dominates the Saudi Arabia cold chain market, driven by increasing demand from large-scale food retailers, pharmaceutical companies, and multinational corporations. Organized players offer integrated cold chain solutions with high-quality infrastructure, compliance with strict regulations, and advanced technology adoption such as IoT-based monitoring. The unorganized sector, although present, mainly caters to local agricultural producers and small traders, often lacking standardized facilities and operating with minimal technological support.

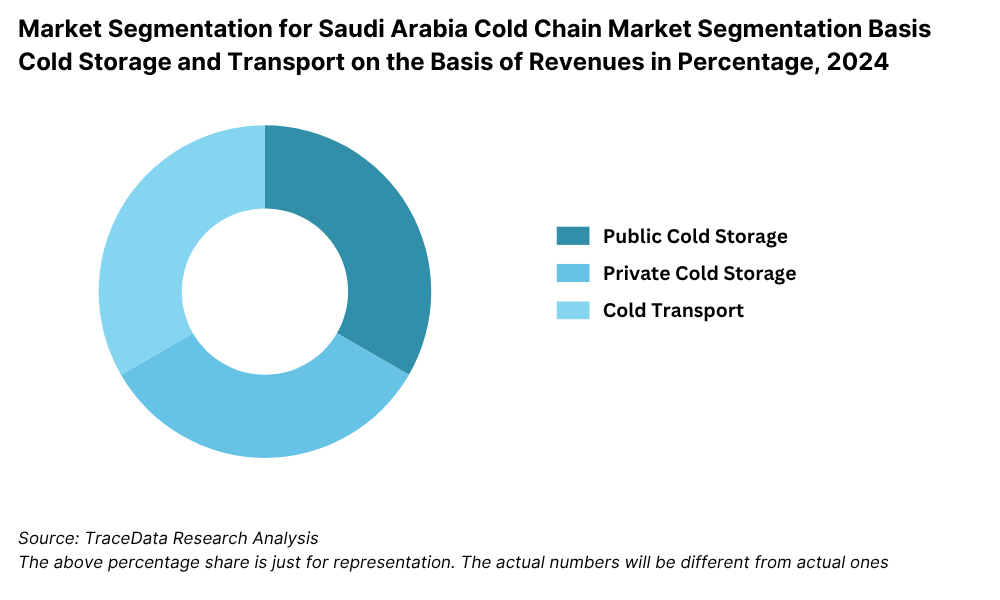

By Type of Service: Cold Storage services contribute the larger share of the Saudi Arabia cold chain market, primarily due to the increasing need for long-term storage of food products, pharmaceuticals, and other temperature-sensitive goods. Cold Transportation services are rapidly growing as well, driven by expanding e-commerce in food delivery, pharmaceutical logistics, and fresh produce supply chains, particularly in metropolitan regions like Riyadh and Jeddah.

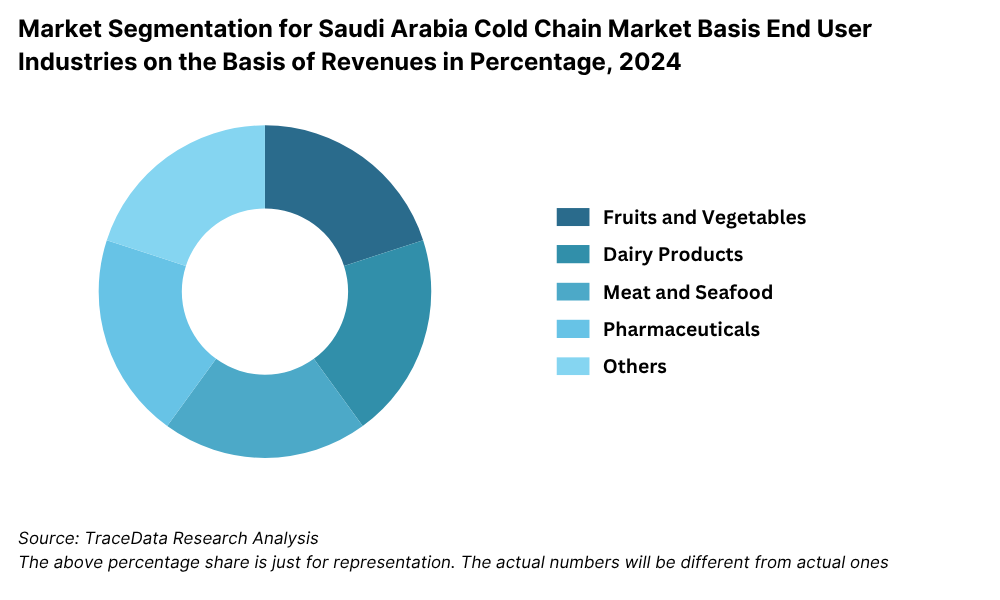

By End-User Industry: The food sector, particularly fruits & vegetables and dairy products, constitutes the largest share of the cold chain market, followed by pharmaceuticals and seafood. Rising health awareness and demand for fresh foods have expanded the need for cold storage. The pharmaceutical sector has witnessed the fastest growth, especially after 2020, due to increased vaccine imports, specialty drugs, and stringent temperature maintenance requirements during distribution.

Competitive Landscape in Saudi Arabia Cold Chain Market

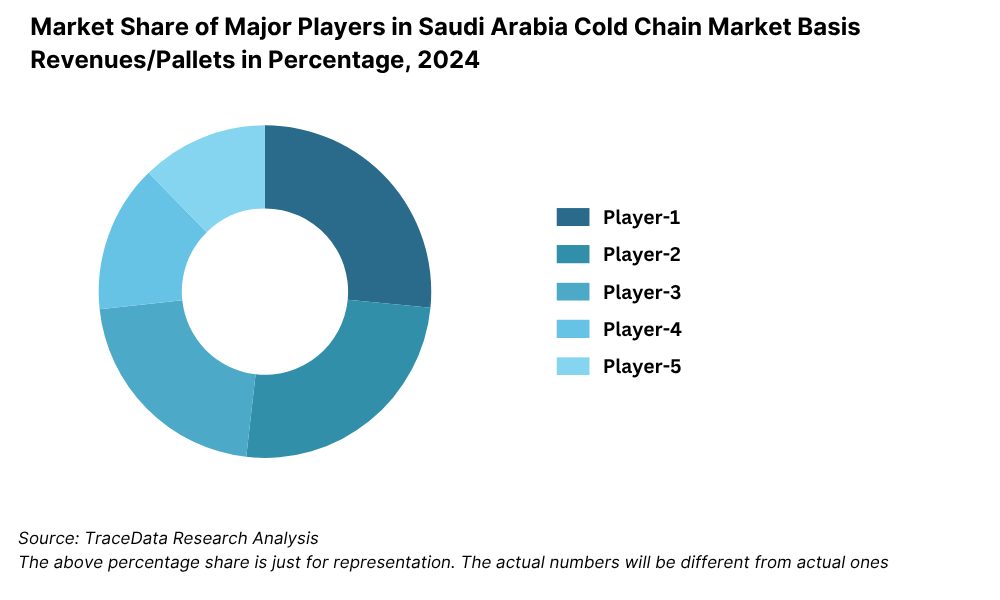

The Saudi Arabia cold chain market is moderately concentrated, with a few dominant players supported by emerging specialized service providers. The market is driven by leading logistics companies, cold storage operators, and specialized cold transportation firms such as Agility Logistics, Gulf Cold Storage, Al Raya Logistics, United Warehouse Company, Al Salem Johnson Controls, Almajdouie Logistics, and Al Khowatir Cold Stores, among others.

Company Name | Founding Year | Original Headquarters |

Tamer Logistics (Tamer Group) | 1922 | Jeddah, Saudi Arabia |

Almarai Company (In-house cold chain fleet) | 1977 | Riyadh, Saudi Arabia |

NAQEL Express (Cold Chain Division) | 1993 | Riyadh, Saudi Arabia |

Almajdouie Logistics (Cold Storage Services) | 1965 | Dammam, Saudi Arabia |

Binzagr Logistics (Cold Chain Warehousing) | 1881 | Jeddah, Saudi Arabia |

GAC Saudi Arabia (Cold Chain Division) | 1956 (KSA: ~1970s) | Gothenburg, Sweden |

SAL (Saudi Arabian Logistics) | 2020 (spun off from Saudia Cargo) | Jeddah, Saudi Arabia |

Al-Jabri Cold Stores & Transport | ~1990s | Dammam, Saudi Arabia |

Mohammad Dossary Cold Stores | ~1980s | Dammam, Saudi Arabia |

Aramex Saudi Arabia (Temperature-Controlled Logistics) | 1982 | Dubai, UAE |

Agility Logistics Saudi Arabia (Cold Chain) | 1979 (KSA: ~2005) | Kuwait City, Kuwait |

DHL Supply Chain Saudi Arabia (Life Sciences & Cold Chain) | 1969 (KSA: ~1976) | Bonn, Germany |

DB Schenker Saudi Arabia (Cold Chain Services) | 1872 (KSA: ~2000s) | Essen, Germany |

Kuehne + Nagel Saudi Arabia (Pharma & Perishables) | 1890 (KSA: ~1990s) | Schindellegi, Switzerland |

CEVA Logistics Saudi Arabia (Cold Chain & Healthcare) | 2006 (KSA: ~2010s) | Marseille, France |

Maersk Saudi Arabia (Cold Chain Solutions) | 1904 (KSA: ~2000s) | Copenhagen, Denmark |

Lineage Logistics (via M&A in GCC region) | 2008 (KSA: ~2020s) | Novi, Michigan, USA |

Some of the recent competitor trends and key information about competitors include:

Agility Logistics: A market leader in end-to-end cold chain solutions, Agility expanded its cold storage capacity by 20% in 2023 through the launch of a new state-of-the-art refrigerated warehouse facility in Riyadh, aimed at catering to food and pharmaceutical sectors.

Gulf Cold Storage: Specializing in multi-temperature storage solutions, Gulf Cold Storage reported a 15% increase in operational capacity in 2023. Their focus on HACCP-certified facilities and flexible storage plans has positioned them as a preferred partner for exporters and importers.

Al Raya Logistics: Known for its comprehensive cold transportation network, Al Raya Logistics introduced a fleet of eco-friendly refrigerated trucks in 2023, reducing carbon emissions by 18% while maintaining temperature integrity during transit.

United Warehouse Company: Focusing on pharmaceutical and healthcare logistics, United Warehouse Company expanded its specialized storage units for biologics and vaccines, achieving ISO 9001:2015 certification for quality management systems in 2023.

Al Salem Johnson Controls: Leveraging its expertise in HVAC and refrigeration systems, Al Salem Johnson Controls entered strategic partnerships with food retailers in 2023 to supply customized cold chain solutions, leading to a 25% growth in their cold chain business segment.

Market Share of Major Players in Saudi Arabia Cold Chain Market Basis Revenues/Pallets in Percentage, 2024

What Lies Ahead for Saudi Arabia Cold Chain Market?

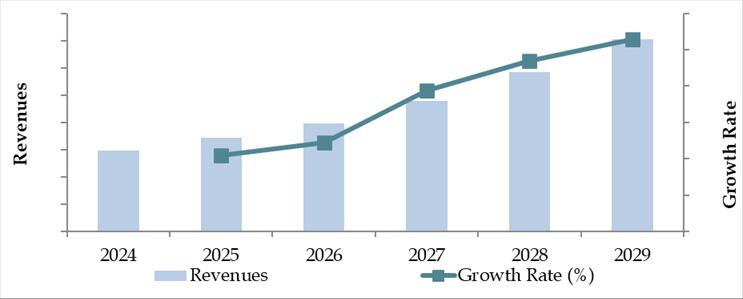

The Saudi Arabia cold chain market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by rising demand for perishable goods, healthcare logistics expansion, technological upgrades, and government initiatives to enhance food security and supply chain resilience.

Expansion of Pharmaceutical Cold Chain: With the growing demand for vaccines, biologics, and specialty pharmaceuticals, the pharmaceutical cold chain segment is expected to witness significant growth. Increased healthcare investments and regulatory support will drive the need for specialized temperature-controlled logistics solutions, especially in urban and remote regions.

Adoption of Advanced Cold Chain Technologies: The integration of IoT sensors, real-time tracking, automated warehousing, and predictive analytics is expected to transform the cold chain landscape. These technologies will enhance temperature monitoring, reduce spoilage rates, optimize delivery routes, and improve compliance with regulatory standards.

Development of Regional Cold Chain Hubs: As part of Vision 2030, Saudi Arabia is set to establish dedicated logistics hubs with integrated cold chain facilities in key cities such as Riyadh, Jeddah, and Dammam. These hubs will not only cater to domestic needs but also position Saudi Arabia as a regional re-export center for perishable goods.

Focus on Sustainability and Energy Efficiency: The cold chain industry is expected to increasingly adopt sustainable practices, including energy-efficient refrigeration systems, solar-powered cold storage units, and eco-friendly transportation solutions. These initiatives align with Saudi Arabia’s broader green energy and sustainability goals and are likely to become critical competitive differentiators.

Future Outlook and Projections for Saudi Arabia Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Saudi Arabia Cold Chain Market Segmentation

By Market Structure:

Organized Sector

Unorganized Sector

Integrated Cold Chain Providers

Standalone Cold Storage Operators

Standalone Cold Transportation Providers

By Type of Service:

Cold Storage

Cold Transportation

By End-User Industry:

Fruits & Vegetables

Dairy Products

Pharmaceuticals

Meat & Seafood

Bakery and Confectionery

Chemicals and Industrial Products

By Temperature Type:

Chilled

Frozen

Ambient Controlled

By Region:

Riyadh

Jeddah

Dammam

Mecca

Medina

Others (Including Tabuk, Al Khobar)

Players Mentioned in the Report:

Agility Logistics

Mosanada Logistics

Takhzeen Logistics

Wared Logistics

United Warehouse Company

Almajdouie Logistics

AL Jelaidan

Cold Chain Packing & Logistics

Four Winds Cold Chain

Global Star Cold Storage & Logistics

Maersk (Cold Chain Services)

DHL Global Forwarding (Cold Chain division)

Key Target Audience:

Cold Storage Companies

Cold Transportation Service Providers

Food and Beverage Companies

Pharmaceutical Companies

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority - SFDA)

Logistics and Supply Chain Associations

Technology Providers for Cold Chain Solutions

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. Saudi Arabi Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. Saudi Arabi Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities, 2023-2024P

10.3. Saudi Arabi Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. Saudi Arabi Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. Saudi Arabi Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. Saudi Arabi Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in Saudi Arabi Cold Chain Market

12.2. Issues and Challenges in Saudi Arabi Cold Chain Market

12.3. Decision Making Parameters for End Users in Saudi Arabi Cold Chain Market

12.4. SWOT Analysis of Saudi Arabi Cold Chain Industry

12.5. Government Regulations and Associations in Saudi Arabi Cold Chain Market

12.6. Macroeconomic Factors Impacting Saudi Arabi Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in Saudi Arabi Cold Chain Market

16.2. Competition Scenario in Saudi Arabi Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2023) and Employee Base) for Major Players in Saudi Arabi Cold Chain Market

16.4. Company Profiles of Major Companies in Saudi Arabi Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

18.4. Recommendation

18.5. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Saudi Arabia Cold Chain Market. Based on this ecosystem, we shortlist the leading 5–6 players in the country based upon their service capabilities, financial information, storage capacity, transportation fleet size, and technology adoption.

Sourcing is made through industry articles, government publications, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like overall market revenues, segmental contribution (cold storage vs cold transportation), number of operational players, price structures, demand drivers, and other variables.

We supplement this with detailed examinations of company-level data, relying on sources such as press releases, company websites, annual reports, Ministry of Health updates, Saudi Food and Drug Authority announcements, and industry association reports. This process aims to construct a foundational understanding of both the market dynamics and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, operations heads, cold storage facility managers, transportation managers, and other stakeholders representing various Saudi Arabia Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational, technological, and financial insights from these industry representatives.

Bottom to top approach is undertaken to evaluate the revenue and service volume contribution of each player, thereby aggregating to derive the overall market sizing and segmentation.

As part of our validation strategy, our team executes disguised interviews wherein we approach companies under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against secondary sources. These interactions also provide us with a comprehensive understanding of service models, cold storage occupancy rates, refrigerated fleet utilization, pricing trends, and other critical factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis, along with market size modeling exercises, is undertaken to assess and perform the sanity check process, ensuring the consistency and reliability of the overall research findings.

FAQs

1. What is the potential for the Saudi Arabia Cold Chain Market?

The Saudi Arabia cold chain market is poised for substantial growth, reaching a valuation of SAR 11.5 Billion in 2023. This growth is driven by factors such as increasing demand for perishable goods, expansion in the pharmaceutical and healthcare sectors, rising food security initiatives, and the shift towards more organized logistics solutions. The market's potential is further bolstered by Saudi Arabia's Vision 2030 initiatives, which focus on enhancing logistics infrastructure and regional trade capabilities.

2. Who are the Key Players in the Saudi Arabia Cold Chain Market?

The Saudi Arabia Cold Chain Market features several key players, including Agility Logistics, Gulf Cold Storage, Al Raya Logistics, and United Warehouse Company. These companies dominate the market due to their extensive warehousing capacity, advanced refrigeration technologies, integrated cold transportation solutions, and strong partnerships with major food and pharmaceutical businesses. Other notable players include Al Salem Johnson Controls and Almajdouie Logistics.

3. What are the Growth Drivers for the Saudi Arabia Cold Chain Market?

The primary growth drivers include increased demand for fresh food products and pharmaceuticals requiring temperature-controlled logistics. Government investments under the National Industrial Development and Logistics Program (NIDLP) are also accelerating infrastructure development. Additionally, the adoption of technology such as IoT-based monitoring systems, real-time tracking, and data analytics in cold chain operations is significantly enhancing service quality and efficiency.

4. What are the Challenges in the Saudi Arabia Cold Chain Market?

The Saudi Arabia Cold Chain Market faces several challenges, including high operational costs associated with energy-intensive cold storage and transportation, shortage of skilled labor specialized in cold chain management, and infrastructure gaps in remote regions. Regulatory compliance requirements, although driving quality improvements, also impose additional operational burdens on smaller logistics providers.