Saudi Arabia Herbal Supplements Market Outlook to 2035

By Product Type, By Form, By Distribution Channel, By Consumer Segment, and By Region”

- Product Code: TDR0451

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Saudi Arabia Herbal Supplements Market Outlook to 2035 – By Product Type, By Form, By Distribution Channel, By Consumer Segment, and By Region” provides a comprehensive analysis of the herbal supplements industry in the Kingdom of Saudi Arabia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and compliance landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Saudi Arabia herbal supplements market. The report concludes with future market projections based on preventive healthcare adoption, lifestyle disease prevalence, regulatory evolution, retail and e-commerce penetration, consumer trust dynamics, and cause-and-effect relationships highlighting the major opportunities and cautions shaping the market through 2035.

Saudi Arabia Herbal Supplements Market Overview and Size

The Saudi Arabia herbal supplements market is valued at approximately ~USD ~ billion, representing the consumption of plant-based, botanical, and traditional herbal formulations marketed for general wellness, immunity support, digestive health, metabolic balance, and preventive healthcare. Herbal supplements in the Kingdom are offered across capsules, tablets, powders, syrups, teas, and liquid extracts, and are positioned as complementary wellness solutions rather than pharmaceutical therapies.

The market is anchored by rising health awareness among Saudi consumers, increasing incidence of lifestyle-related conditions such as obesity, diabetes, and digestive disorders, and growing preference for natural and minimally processed wellness products. Cultural familiarity with traditional herbal remedies, combined with modern packaging, branding, and retail formats, has further strengthened consumer acceptance across both urban and semi-urban populations.

Demand is concentrated in major metropolitan regions such as Riyadh, Makkah Province, and the Eastern Province, where higher disposable incomes, organized retail penetration, and exposure to global wellness trends drive uptake. These regions also benefit from a dense network of pharmacies, health stores, and online platforms that facilitate access to branded herbal supplements. Secondary cities are witnessing gradual adoption as awareness campaigns, influencer-led marketing, and e-commerce logistics expand nationwide.

The Saudi herbal supplements market is increasingly influenced by premiumization trends, with consumers showing willingness to pay for standardized formulations, imported brands, clinically positioned herbal blends, and products with clear dosage and labeling. At the same time, locally sourced and regionally familiar herbs continue to maintain relevance, especially among older and family-oriented consumer segments.

What Factors are Leading to the Growth of the Saudi Arabia Herbal Supplements Market:

Rising focus on preventive healthcare and wellness-driven consumption strengthens baseline demand: Saudi Arabia is witnessing a structural shift from reactive healthcare spending toward preventive wellness and lifestyle management. Consumers are increasingly seeking daily-use supplements to support immunity, digestion, energy levels, and metabolic health rather than relying solely on prescription medicines. Herbal supplements are perceived as gentler, safer, and more suitable for long-term consumption, which aligns well with this preventive mindset. This shift is reinforced by national health awareness initiatives and growing exposure to global wellness narratives.

High prevalence of lifestyle-related conditions increases adoption of complementary health products: The Kingdom faces a high burden of obesity, diabetes, cardiovascular risk factors, and digestive health issues. While pharmaceuticals remain the primary treatment route, many consumers supplement conventional care with herbal products aimed at weight management, blood sugar support, liver health, and gut balance. Herbal supplements positioned around everyday wellness rather than disease treatment have found stronger acceptance, particularly among middle-aged consumers and working professionals.

Cultural acceptance of traditional and natural remedies supports long-term market relevance: Herbal and plant-based remedies have long been embedded in regional health practices. This cultural familiarity reduces adoption barriers compared to entirely synthetic wellness products. Modern herbal supplements that combine traditional ingredients with standardized dosages, quality certifications, and professional branding benefit from both cultural trust and contemporary credibility. This dual positioning has enabled herbal supplements to bridge generational preferences within Saudi households.

Which Industry Challenges Have Impacted the Growth of the Saudi Arabia Herbal Supplements Market:

Regulatory scrutiny on health claims and product approvals impacts speed-to-market and brand communication: While demand for herbal supplements in Saudi Arabia continues to rise, the market is tightly governed by regulatory oversight related to ingredient safety, labeling accuracy, and permissible health claims. Herbal supplements are prohibited from making disease treatment or therapeutic claims, which limits how brands can communicate product benefits to consumers. Approval timelines for product registration, reformulation requirements for imported products, and claim revisions to meet local guidelines can delay launches and restrict marketing flexibility. These dynamics particularly affect international brands and innovation-led formulations, slowing category expansion despite strong underlying demand.

Consumer skepticism around efficacy and quality differentiation creates trust-related adoption barriers: Despite cultural familiarity with herbal remedies, modern herbal supplements face consumer skepticism related to product efficacy, adulteration concerns, and exaggerated marketing claims. The absence of immediate, measurable outcomes compared to pharmaceutical products leads some consumers to question value-for-money, especially in premium-priced segments. Variability in ingredient sourcing, formulation transparency, and dosage standardization across brands further complicates consumer decision-making. This trust gap places pressure on manufacturers to invest in certifications, testing disclosures, and professional endorsements, increasing operating and marketing costs.

Price sensitivity in mass-market segments limits premiumization and volume scalability: Although disposable incomes are relatively high in Saudi Arabia, a significant portion of consumers remain price-conscious when purchasing non-essential wellness products. Imported herbal supplements, clinically positioned blends, and specialty formulations often carry higher price points, which can restrict repeat purchases and limit penetration beyond affluent urban consumers. Local brands face margin pressure when competing with international players while maintaining compliance and quality standards. This pricing dynamic constrains volume-led growth and slows broader category adoption in middle-income households.

What are the Regulations and Initiatives which have Governed the Market:

Product registration, ingredient compliance, and labeling regulations governing market entry and commercialization: Herbal supplements sold in Saudi Arabia must comply with national regulatory requirements covering ingredient safety, manufacturing standards, labeling disclosures, and product registration prior to commercialization. Authorities closely monitor ingredient lists to prevent the inclusion of restricted or pharmaceutical-like substances, while labeling must clearly specify dosage instructions, warnings, and non-therapeutic positioning. Claims related to curing, preventing, or treating diseases are restricted, requiring brands to carefully position products around general wellness and nutritional support. These regulatory requirements shape formulation decisions, packaging design, and go-to-market strategies.

Halal compliance and quality certification standards influencing consumer trust and sourcing decisions: Halal compliance plays a critical role in governing herbal supplement acceptance in the Kingdom. Manufacturers must ensure that raw materials, excipients, encapsulation agents, and processing methods align with halal standards. In addition, quality certifications related to manufacturing practices, safety testing, and traceability increasingly influence consumer trust and retailer acceptance. Brands that demonstrate transparent sourcing, quality assurance, and halal integrity are better positioned to scale across organized retail and pharmacy channels.

National health initiatives promoting preventive care indirectly supporting herbal supplement adoption: Broader national health initiatives focused on preventive care, lifestyle disease management, and wellness awareness indirectly support the herbal supplements market. Public health messaging around nutrition, weight management, physical activity, and long-term health maintenance has increased openness toward complementary wellness products. While herbal supplements are not explicitly promoted under public healthcare programs, the shift toward self-managed health and preventive consumption creates a favorable demand environment. This policy-driven emphasis on wellness strengthens long-term category relevance, provided products remain compliant and responsibly marketed.

Saudi Arabia Herbal Supplements Market Segmentation

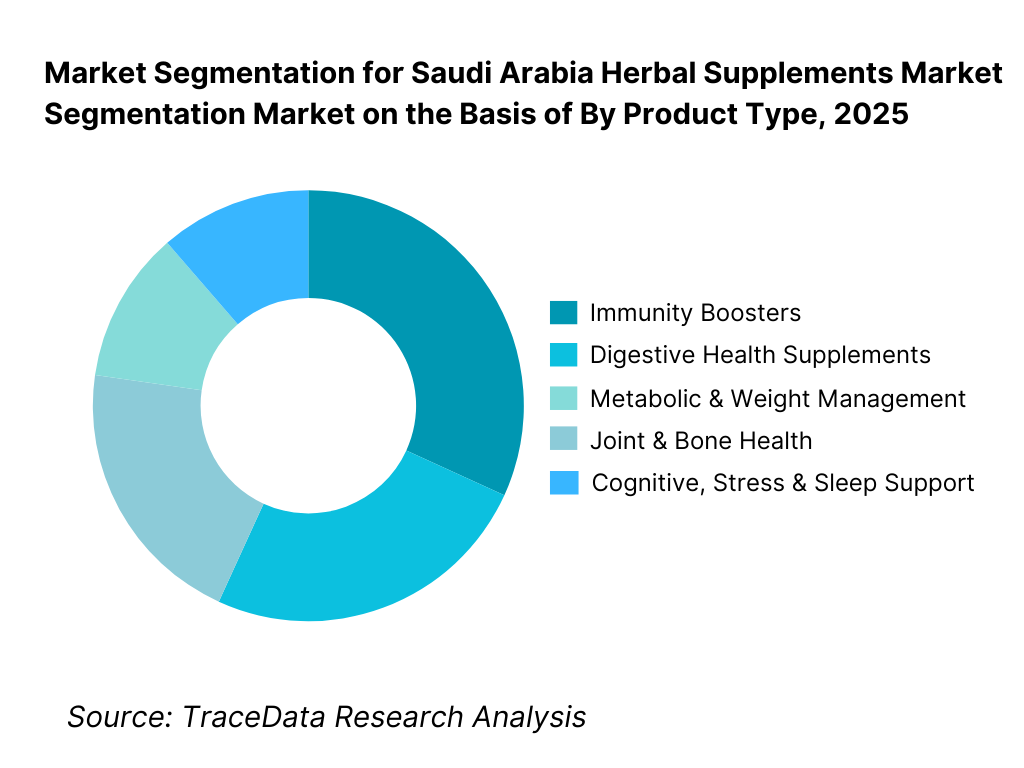

By Product Type: Immunity and digestive health supplements hold dominance The immunity and digestive health segment holds a dominant position in the Saudi Arabia herbal supplements market. This is because these products align closely with everyday wellness consumption patterns rather than episodic or condition-specific usage. Consumers increasingly use herbal immunity boosters and digestive aids as part of daily routines, particularly in response to lifestyle-related health concerns, seasonal illnesses, and preventive health awareness. While segments such as metabolic health, joint support, and cognitive wellness are expanding, immunity and digestion benefit from high repeat purchase behavior and broad demographic relevance across age groups.

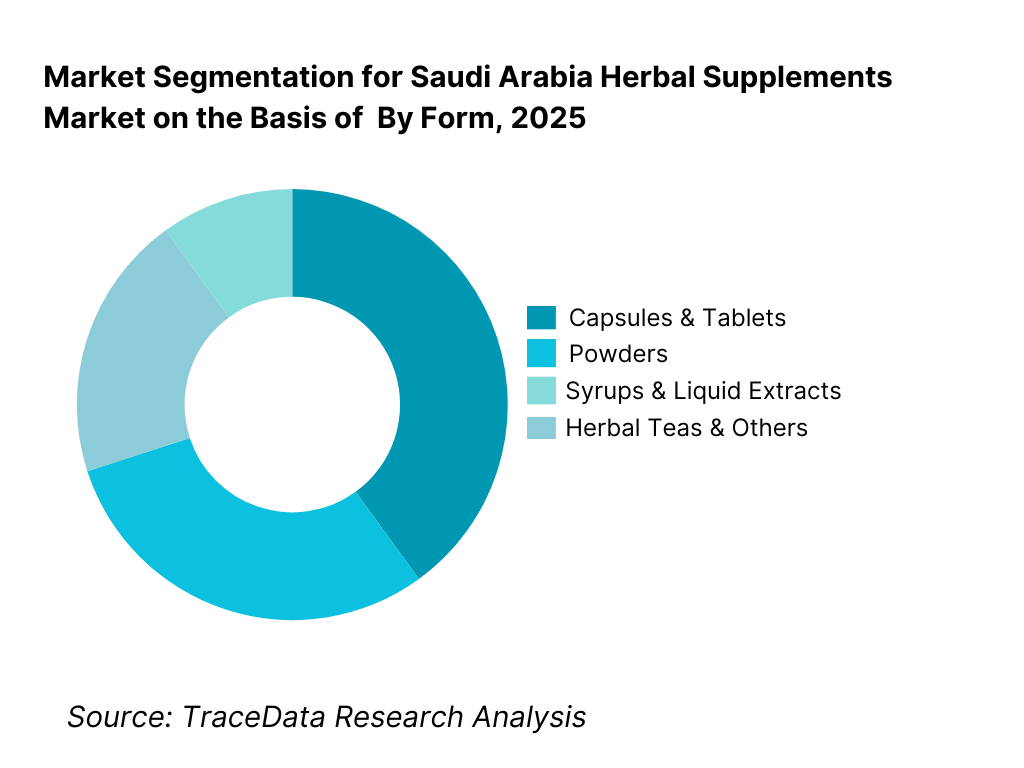

By Form: Capsules and tablets dominate due to convenience and dosage standardization Capsules and tablets dominate the Saudi Arabia herbal supplements market as they offer ease of consumption, precise dosage control, longer shelf life, and better portability. These formats are particularly preferred by urban consumers, working professionals, and pharmacy-led buyers who associate capsules with standardized and regulated products. Powders, syrups, and herbal teas continue to maintain relevance among consumers who value traditional consumption formats and perceive them as more natural or faster-acting, but their usage remains more situational and less scalable.

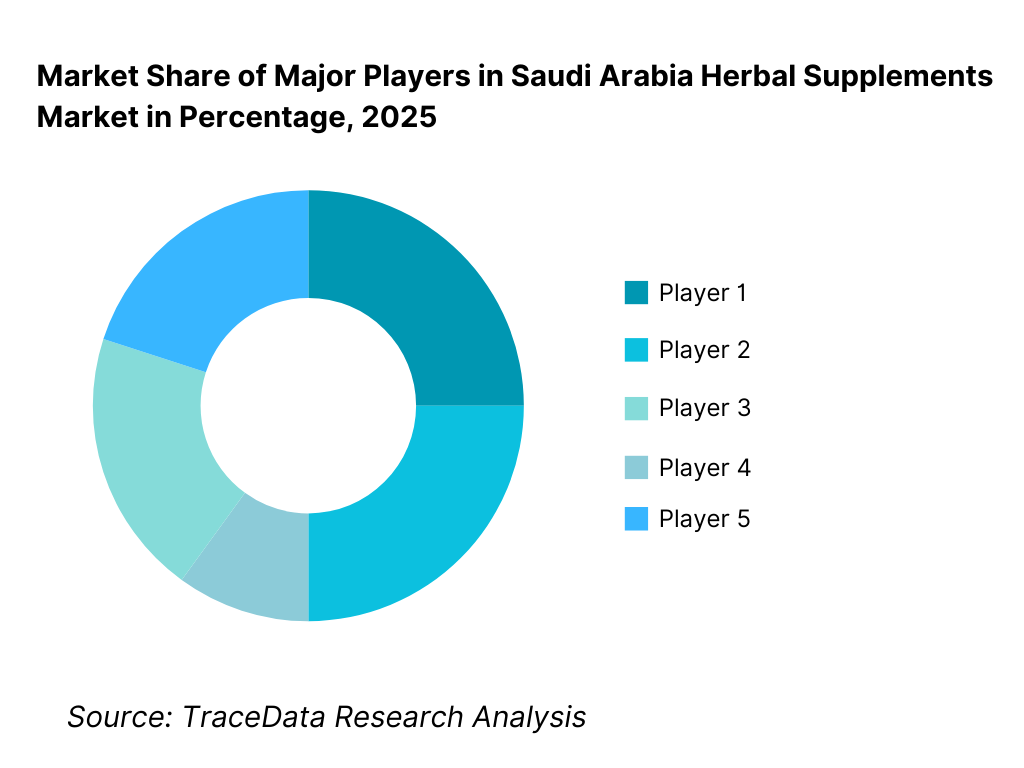

Competitive Landscape in Saudi Arabia Herbal Supplements Market

The Saudi Arabia herbal supplements market exhibits moderate fragmentation, characterized by a mix of international wellness brands, regional Middle Eastern players, and domestic manufacturers. Market competitiveness is driven by brand trust, regulatory compliance, halal certification, formulation credibility, and distribution reach across pharmacy chains and digital platforms. International brands tend to dominate premium and imported segments, while regional and local players compete effectively in mass and mid-priced categories through localized formulations and pricing advantages.

Name | Founding Year | Original Headquarters |

Himalaya Wellness | 1930 | Bengaluru, India |

Blackmores | 1932 | Brisbane, Australia |

Herbalife Nutrition | 1980 | Los Angeles, USA |

Nature’s Way | 1969 | Wisconsin, USA |

Jamieson Wellness | 1922 | Toronto, Canada |

Arkopharma | 1980 | Carros, France |

Local & Regional Private Labels | — | Saudi Arabia / GCC |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Himalaya Wellness: Himalaya continues to leverage its strong herbal heritage and wide product portfolio to maintain relevance in the Saudi market. The brand benefits from high consumer recognition, pharmacy penetration, and trust built around traditional formulations presented in modern dosage formats. Its positioning resonates strongly with consumers seeking authenticity combined with regulatory credibility.

Herbalife Nutrition: Herbalife maintains a strong presence through its direct-selling and community-based wellness model. Its products are positioned around lifestyle transformation, weight management, and daily nutrition, supported by coaching networks and repeat consumption. This engagement-driven model strengthens customer stickiness despite premium pricing.

Blackmores: Blackmores competes in the premium segment, emphasizing quality sourcing, clean formulations, and international manufacturing standards. The brand appeals to affluent and well-informed consumers who prioritize perceived purity, scientific backing, and global brand reputation.

Jamieson Wellness: Jamieson’s competitive position is supported by its strong quality credentials, clear labeling, and pharmacy-friendly positioning. The brand continues to gain traction in regulated retail environments where compliance, transparency, and consistent formulation matter.

Regional and Local Brands: Local and regional private-label players compete aggressively on price and familiarity with regional preferences. Their ability to adapt formulations, packaging, and communication to local tastes and regulatory nuances allows them to remain competitive in mass-market segments, particularly outside major metropolitan areas.

What Lies Ahead for Saudi Arabia Herbal Supplements Market?

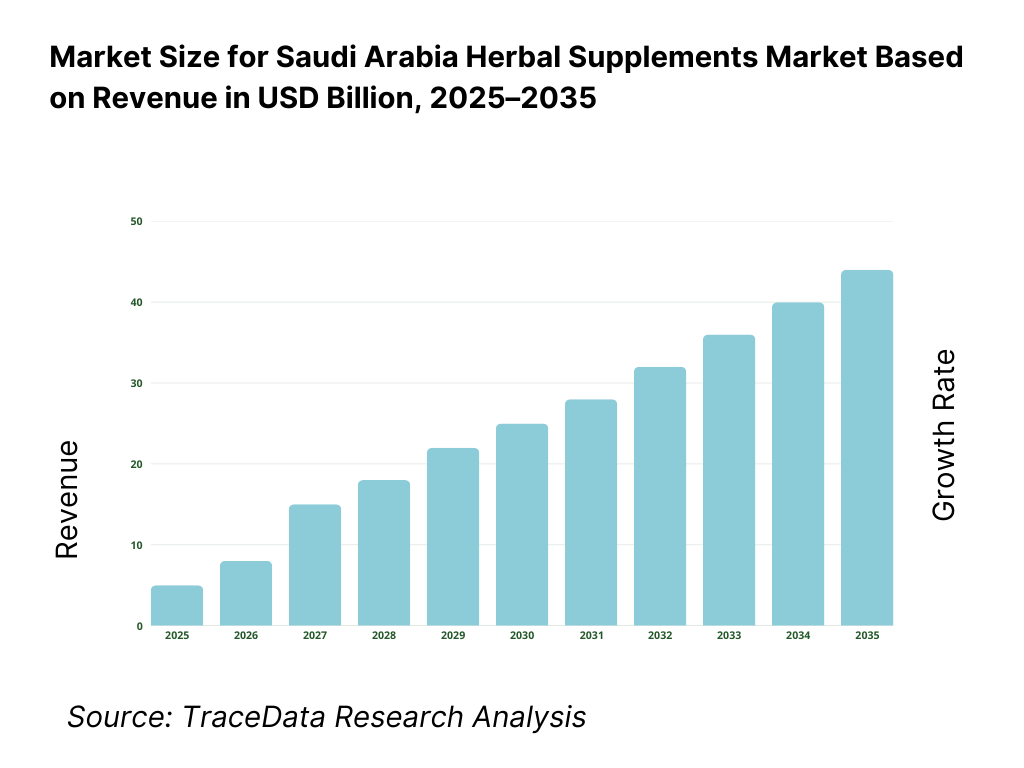

The Saudi Arabia herbal supplements market is expected to expand steadily by 2035, supported by rising preventive healthcare awareness, increasing lifestyle-related health concerns, and a growing preference for natural and plant-based wellness solutions. Growth momentum is further reinforced by expanding organized retail and pharmacy networks, rising e-commerce penetration, and gradual normalization of herbal supplements as part of everyday health routines rather than occasional remedies. As consumers increasingly seek long-term wellness maintenance, immunity support, and digestive balance, herbal supplements are expected to remain a core category within the Kingdom’s broader health and nutrition ecosystem.

Transition Toward Standardized, Scientifically Positioned Herbal Formulations: The future of the Saudi Arabia herbal supplements market will see a continued shift from loosely positioned traditional remedies toward standardized, clearly dosed, and professionally branded formulations. Consumers are showing greater preference for products that combine herbal ingredients with documented quality controls, transparent labeling, and consistent efficacy expectations. Formulations targeting immunity, metabolism, digestive health, and stress management will increasingly be positioned around daily-use wellness rather than episodic consumption. Brands that invest in formulation consistency, ingredient traceability, and credible positioning will be better placed to capture sustained demand.

Growing Emphasis on Preventive Wellness and Lifestyle Health Management: Preventive healthcare will remain a central growth driver through 2035, as Saudi consumers increasingly focus on managing weight, energy levels, immunity, and metabolic health before the onset of chronic conditions. Herbal supplements are expected to benefit from this shift as complementary solutions that fit into daily routines alongside diet and physical activity. Products aligned with stress management, sleep support, gut health, and general vitality are likely to see rising adoption, particularly among working professionals and middle-aged consumers.

Expansion of Pharmacy-Led and Digital-First Distribution Models: Pharmacies and drugstores will continue to anchor market growth due to their role in trust-building and regulated retail. However, online and digital-first platforms are expected to gain increasing relevance through 2035, driven by convenience, broader product selection, and health-focused digital content. Brands that optimize omnichannel distribution—combining pharmacy credibility with online engagement—will be better positioned to scale nationally, including in secondary and emerging cities.

Increased Importance of Halal Integrity, Transparency, and Quality Assurance: Consumer expectations around halal compliance, ingredient sourcing, and manufacturing integrity will become more pronounced. Herbal supplement brands will increasingly be evaluated not only on efficacy claims but also on ethical sourcing, quality certifications, and transparency around production processes. This trend will favor companies that can demonstrate end-to-end quality assurance and alignment with national regulatory and cultural standards.

Saudi Arabia Herbal Supplements Market Segmentation

By Product Type

• Immunity Boosters

• Digestive Health Supplements

• Metabolic & Weight Management

• Joint & Bone Health

• Cognitive, Stress & Sleep Support

• Other Herbal Wellness Products

By Form

• Capsules & Tablets

• Powders

• Syrups & Liquid Extracts

• Herbal Teas & Others

By Distribution Channel

• Pharmacies & Drugstores

• Supermarkets & Hypermarkets

• Online & E-commerce Platforms

• Health Stores & Others

By Consumer Segment

• Adults

• Elderly

• Women-Specific Wellness

• Pediatric

By Region

• Central Region (Riyadh and surrounding areas)

• Western Region (Makkah Province)

• Eastern Province

• Southern & Northern Regions

Players Mentioned in the Report:

• Himalaya Wellness

• Herbalife Nutrition

• Blackmores

• Jamieson Wellness

• Nature’s Way

• Arkopharma

• Regional herbal supplement brands and private-label manufacturers in Saudi Arabia and GCC

Key Target Audience

• Herbal supplement manufacturers and brand owners

• Pharmaceutical and nutraceutical distributors

• Pharmacy chains and organized retail groups

• E-commerce and digital health platforms

• Importers and regulatory consultants

• Wellness-focused consumers and lifestyle health practitioners

• Private equity and strategic investors in health and nutrition

• Government and regulatory bodies overseeing food and supplement safety

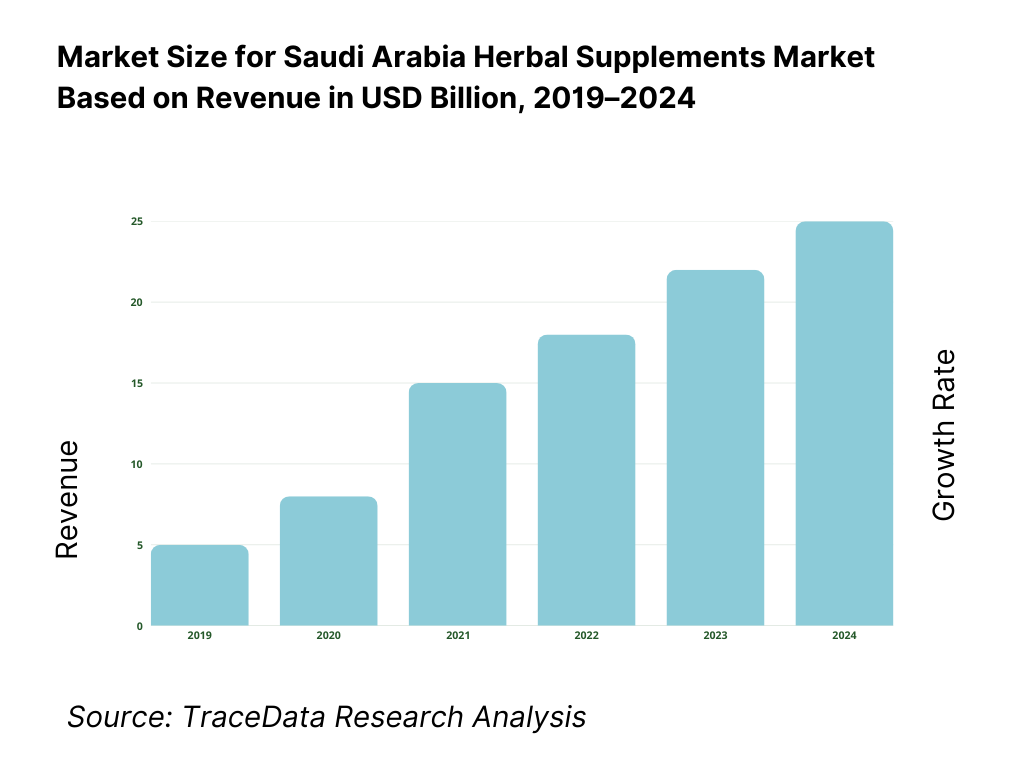

Time Period:

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Saudi Arabia Herbal Supplements Market across demand-side and supply-side entities. On the demand side, entities include adult wellness consumers, elderly populations, women-focused wellness buyers, fitness- and lifestyle-driven consumers, preventive healthcare adopters, and households integrating herbal supplements into daily routines. Demand is further segmented by usage intent (daily wellness, immunity support, digestive health, metabolic support), consumption frequency (routine vs episodic), and purchasing channel (pharmacy-led, retail-led, or digital-first). On the supply side, the ecosystem includes international herbal supplement brands, regional GCC players, domestic manufacturers, contract manufacturers, importers and distributors, pharmacy chains, supermarkets and hypermarkets, e-commerce platforms, quality testing laboratories, packaging suppliers, and regulatory and compliance bodies overseeing product approval and labeling. From this mapped ecosystem, we shortlist 8–12 leading herbal supplement brands and a representative set of local and regional distributors based on brand visibility, product breadth, regulatory compliance, retail penetration, and presence across immunity, digestive, and general wellness categories. This step establishes how value is created and captured across formulation, sourcing, manufacturing, distribution, retail, and consumer engagement.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Saudi Arabia herbal supplements market structure, demand drivers, and segment behavior. This includes reviewing national health and wellness trends, lifestyle disease prevalence, preventive healthcare adoption patterns, retail and pharmacy expansion, and e-commerce penetration across regions. We assess consumer preferences related to natural ingredients, halal compliance, dosage formats, and perceived efficacy. Company-level analysis includes review of product portfolios, formulation positioning, pricing bands, distribution strategies, and brand communication approaches. We also examine regulatory and compliance dynamics shaping market participation, including product registration requirements, ingredient restrictions, labeling norms, and claim limitations. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and creates the assumptions needed for market estimation and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with herbal supplement manufacturers, importers, distributors, pharmacy chains, e-commerce sellers, wellness practitioners, and selected consumer cohorts. The objectives are threefold: (a) validate assumptions around demand concentration, purchasing behavior, and channel preference, (b) authenticate segment splits by product type, form, and consumer group, and (c) gather qualitative insights on pricing sensitivity, repeat purchase drivers, brand trust factors, and regulatory challenges. A bottom-to-top approach is applied by estimating consumption frequency, average spend per consumer, and penetration across key demographic segments and regions, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with pharmacies and online platforms to validate shelf positioning, product availability, promotional intensity, and consumer inquiry patterns.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population demographics, health awareness trends, retail expansion, and preventive healthcare focus. Assumptions around regulatory approval timelines, claim restrictions, pricing dynamics, and consumer trust are stress-tested to understand their impact on market growth. Sensitivity analysis is conducted across key variables including premiumization intensity, e-commerce growth rates, halal compliance expectations, and local brand competitiveness. Market models are refined until alignment is achieved between supply availability, channel throughput, and consumer demand behavior, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Saudi Arabia Herbal Supplements Market?

The Saudi Arabia Herbal Supplements Market holds strong long-term potential, supported by rising preventive healthcare awareness, increasing lifestyle-related health concerns, and growing consumer preference for natural and plant-based wellness solutions. Herbal supplements are increasingly being adopted as part of daily health routines rather than occasional remedies. As trust in regulated products improves and retail accessibility expands, the market is expected to witness sustained growth through 2035.

02 Who are the Key Players in the Saudi Arabia Herbal Supplements Market?

The market features a mix of international herbal and nutraceutical brands, regional GCC players, and domestic manufacturers. Competition is shaped by brand credibility, regulatory compliance, halal certification, formulation consistency, and distribution reach across pharmacy chains and digital platforms. International brands tend to dominate premium segments, while local and regional players compete effectively in mass and mid-priced categories through localized offerings and pricing advantages.

03 What are the Growth Drivers for the Saudi Arabia Herbal Supplements Market?

Key growth drivers include increasing focus on preventive wellness, high prevalence of lifestyle-related conditions, cultural acceptance of herbal remedies, and expansion of organized pharmacy and e-commerce channels. Additional momentum comes from improved product standardization, cleaner labeling, halal compliance, and greater consumer exposure to global wellness trends. The positioning of herbal supplements as everyday wellness products continues to reinforce long-term adoption.

04 What are the Challenges in the Saudi Arabia Herbal Supplements Market?

Challenges include regulatory restrictions on health claims, approval timelines for new products, consumer skepticism around efficacy, and price sensitivity in mass-market segments. Variability in product quality across brands can impact trust, while premium pricing limits penetration beyond affluent urban consumers. Navigating compliance requirements while maintaining innovation and competitive pricing remains a key challenge for market participants.