Saudi Arabia Ice Cream Market Outlook to 2035

By Product Type, By Format, By Distribution Channel, By End Consumer, and By Region

- Product Code: TDR0429

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Saudi Arabia Ice Cream Market Outlook to 2035 – By Product Type, By Format, By Distribution Channel, By End Consumer, and By Region” provides a comprehensive analysis of the ice cream and frozen desserts industry in Saudi Arabia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and food safety landscape, consumer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Saudi Arabia ice cream market. The report concludes with future market projections based on demographic trends, climate-driven consumption patterns, retail and foodservice expansion, premiumization, localization of flavors, and evolving consumer preferences, supported by cause-and-effect relationships and illustrative use cases highlighting the major opportunities and risks shaping the market through 2035.

Saudi Arabia Ice Cream Market Overview and Size

The Saudi Arabia ice cream market is valued at approximately ~USD ~ billion, representing the retail and foodservice consumption of frozen desserts including impulse ice creams, take-home tubs, sticks, cones, cups, novelties, and specialty formats manufactured locally or imported and distributed through organized retail, convenience channels, foodservice outlets, and institutional buyers. Ice cream consumption in the Kingdom is strongly influenced by climatic conditions, demographic composition, urban lifestyles, and evolving indulgence and snacking behaviors.

The market is anchored by Saudi Arabia’s hot desert climate, with extended summer periods driving consistent baseline demand for frozen treats across all regions. A young and urbanizing population, rising disposable incomes, and high exposure to global food trends through travel and digital media further support category expansion. Ice cream has transitioned from being a purely seasonal indulgence to a year-round discretionary food item, supported by indoor retail environments, temperature-controlled logistics, and strong presence across malls, supermarkets, and quick-service restaurants.

Saudi Arabia’s ice cream market also benefits from the dominance of modern trade, including hypermarkets and supermarkets with extensive freezer infrastructure, allowing broad SKU assortment and promotional activity. At the same time, impulse formats remain highly relevant through convenience stores, petrol stations, kiosks, and foodservice counters. Regional demand is concentrated in major urban centers such as Riyadh, Jeddah, and Dammam, where population density, retail penetration, and exposure to international brands are highest. Secondary cities and pilgrimage-linked demand centers contribute incremental volume through seasonal population inflows and tourism-linked consumption.

What Factors are Leading to the Growth of the Saudi Arabia Ice Cream Market

Hot climate and extended summer seasons sustain structural demand: Saudi Arabia’s climatic conditions create a structural, non-cyclical demand base for ice cream and frozen desserts. Long periods of high temperatures encourage frequent consumption of cold treats as both refreshment and indulgence. Unlike temperate markets where ice cream demand is highly seasonal, the Saudi market experiences relatively stable consumption throughout the year, with demand peaks during summer months, Ramadan evenings, school holidays, and festive periods. This climatic advantage provides manufacturers and retailers with predictable baseline volumes and supports continuous product launches and promotional cycles.

Young population and evolving snacking habits expand consumption occasions: Saudi Arabia has a demographically young population with high exposure to global food and beverage trends through social media, international travel, and Western-style retail formats. Ice cream is increasingly positioned not only as a dessert but also as an impulse snack, social treat, and on-the-go indulgence, particularly among teenagers, young adults, and families with children. Single-serve formats, novelty sticks, cones, and premium impulse SKUs benefit from this shift, as consumers seek variety, flavor experimentation, and brand-led experiences rather than purely value-driven purchases.

Expansion of modern retail and cold-chain infrastructure improves accessibility: The continued expansion of hypermarkets, supermarkets, convenience stores, and mall-based retail has significantly improved ice cream accessibility across Saudi Arabia. Investments in cold-chain logistics, freezer cabinets, and in-store merchandising allow retailers to carry wider assortments, including premium, imported, and specialty products. This infrastructure development reduces product loss, improves quality consistency, and enables national rollouts of new SKUs, directly supporting category growth and brand penetration beyond Tier-1 cities.

Which Industry Challenges Have Impacted the Growth of the Saudi Arabia Ice Cream Market:

Temperature-sensitive logistics and cold-chain cost pressures impact operational efficiency and margins: While Saudi Arabia’s hot climate structurally supports ice cream demand, it also creates significant operational challenges across manufacturing, storage, and distribution. Ice cream products require uninterrupted cold-chain integrity from production through last-mile delivery, making logistics highly energy-intensive. Rising electricity costs, refrigeration maintenance expenses, and fuel price volatility increase operating costs for manufacturers, distributors, and retailers. Any disruption in freezer infrastructure—particularly in smaller stores or during peak summer months—can result in product spoilage, inventory losses, and reduced retailer confidence in expanding freezer space. These dynamics place pressure on margins and limit aggressive expansion into lower-density or price-sensitive regions.

High dependence on imported raw materials and inputs increases cost volatility: A substantial portion of key ice cream inputs—including dairy derivatives, cocoa, flavoring agents, stabilizers, emulsifiers, and premium inclusions—are imported into Saudi Arabia. Fluctuations in global dairy prices, freight costs, currency movements, and geopolitical trade disruptions directly impact production economics. Sudden increases in input costs can force manufacturers to either absorb margin pressure or pass costs to consumers through price increases, which may affect demand elasticity, particularly in mass-market and family-oriented segments. This exposure reduces pricing predictability and complicates long-term planning for both local and multinational players.

Price sensitivity in mass-market segments limits premium expansion at scale: Although premium and artisanal ice cream segments are growing in urban centers, a large share of Saudi ice cream consumption remains price-sensitive, particularly among families and younger consumers purchasing impulse products. Aggressive promotional activity and frequent price-offs in modern trade create intense competition for freezer space and consumer attention. This environment can constrain the ability of brands to sustainably scale premium SKUs outside affluent urban pockets, as higher price points face resistance when competing against established mass brands offering strong value perception and wide distribution.

What are the Regulations and Initiatives which have Governed the Market:

Food safety, quality, and labeling regulations governing dairy-based frozen products: Ice cream products sold in Saudi Arabia must comply with national food safety regulations covering ingredient approval, hygiene standards, shelf life, and storage conditions. Requirements related to dairy content, permitted additives, emulsifiers, stabilizers, and flavoring substances directly influence formulation strategies. Mandatory labeling rules—including nutritional information, ingredient disclosure, allergen warnings, and expiry dates—shape packaging design and import compliance processes. For imported products, registration and approval procedures add lead time and cost, influencing product launch timelines and SKU rationalization decisions.

Halal compliance and ingredient sourcing standards influencing manufacturing practices: All ice cream products marketed in Saudi Arabia must meet halal requirements, affecting ingredient sourcing, processing aids, emulsifiers, and flavor compounds. This requirement necessitates careful supplier vetting and documentation, particularly for imported raw materials and finished products. Compliance adds an additional layer of operational oversight but also provides consumer trust and market legitimacy. For multinational brands, aligning global formulations with local halal standards can require reformulation or dedicated production lines, impacting economies of scale.

National initiatives supporting food localization and domestic manufacturing capacity: Saudi Arabia’s broader food security and localization initiatives encourage domestic production of food and beverage products, including frozen desserts. Policies promoting local manufacturing investment, supply chain resilience, and reduced reliance on imports indirectly influence strategic decisions by ice cream manufacturers. Establishing local production facilities can improve responsiveness to demand, reduce logistics costs, and enhance regulatory alignment, but also requires upfront capital investment and long-term demand confidence. These initiatives shape competitive dynamics by favoring players with localized operations and integrated distribution networks.

Saudi Arabia Ice Cream Market Segmentation

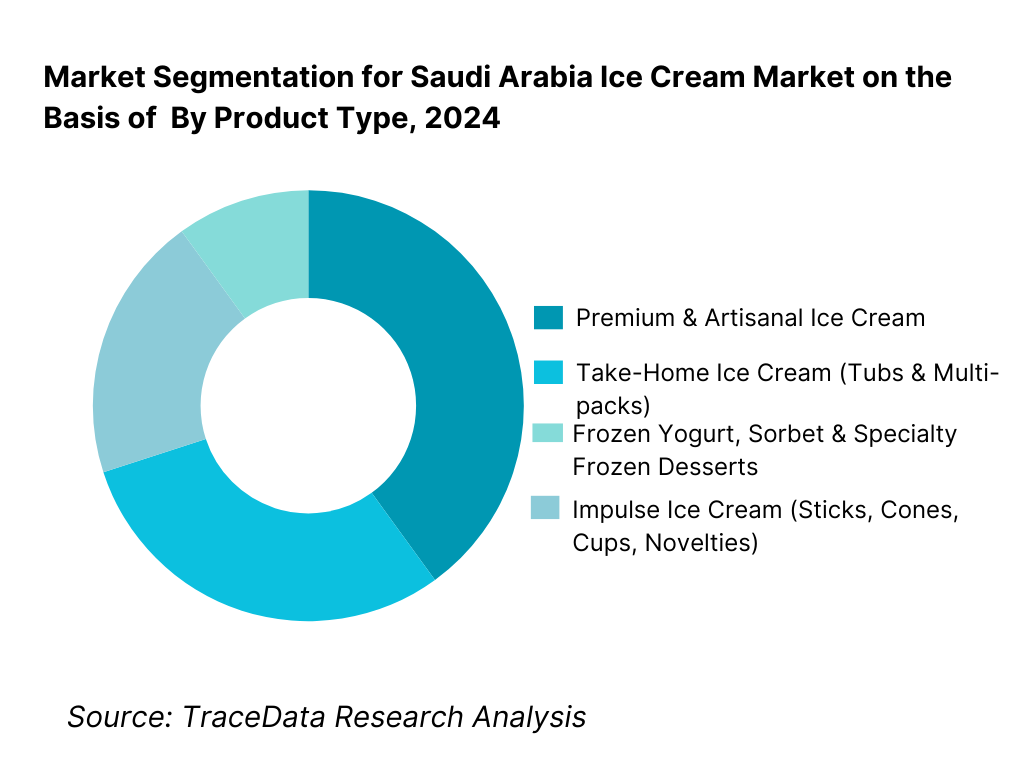

By Product Type: The impulse ice cream segment holds dominance in the Saudi Arabia ice cream market. This is because impulse formats such as sticks, cones, cups, and novelties align strongly with the Kingdom’s hot climate, on-the-go consumption behavior, and dense network of convenience stores, petrol stations, and mall-based retail. These products are affordable, widely accessible, and appeal across age groups, making them the preferred choice for frequent consumption. While take-home tubs and premium artisanal ice creams are expanding—particularly in urban households and higher-income consumer groups—the impulse segment continues to benefit from high purchase frequency, strong brand recall, and extensive freezer penetration across retail and foodservice touchpoints.

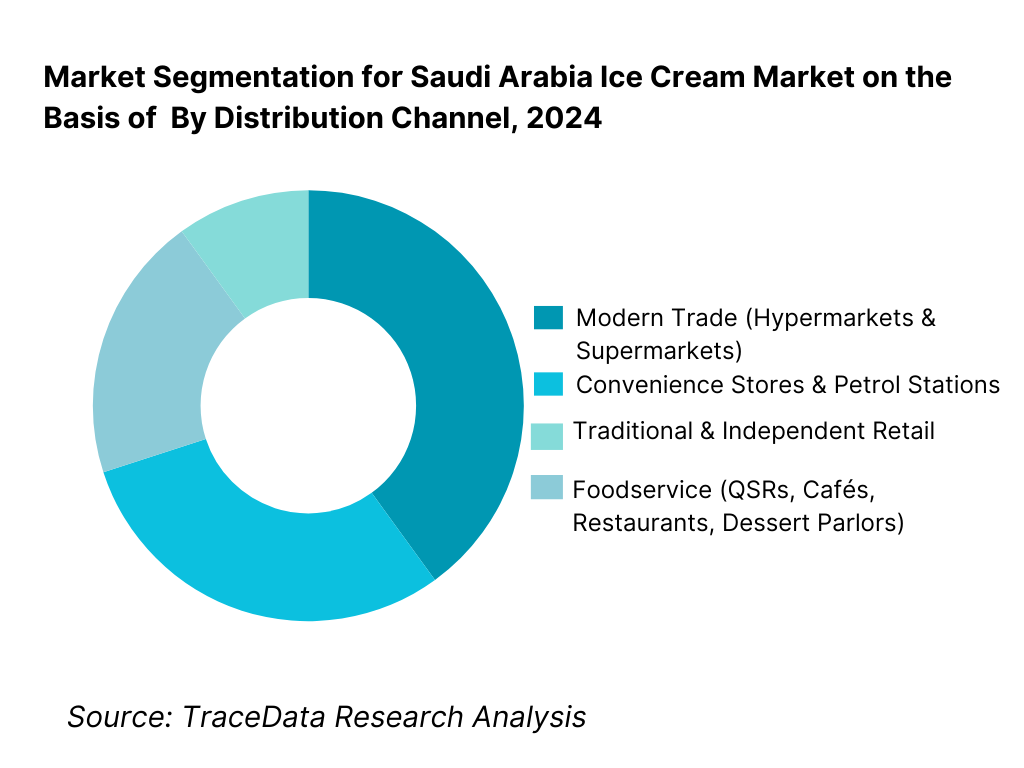

By Distribution Channel: Modern trade dominates ice cream sales in Saudi Arabia due to its superior cold-chain infrastructure, organized freezer placement, and ability to support wide SKU assortments and promotions. Hypermarkets and supermarkets act as the primary channels for take-home and family packs, while convenience retail plays a critical role in impulse-driven consumption. Foodservice channels—including QSRs, cafés, and dessert chains—contribute disproportionately to premium positioning and brand visibility, particularly among younger consumers. Traditional trade remains relevant in select neighborhoods but is structurally constrained by limited freezer capacity and operational costs.

Competitive Landscape in Saudi Arabia Ice Cream Market

The Saudi Arabia ice cream market exhibits moderate-to-high concentration, led by multinational food companies with strong brand portfolios, localized manufacturing or regional supply hubs, and extensive distribution partnerships. Market leadership is driven by brand equity, freezer penetration, promotional intensity, flavor innovation, and the ability to operate efficiently within Saudi Arabia’s demanding cold-chain environment. Global players dominate mass and premium segments, while regional and local brands compete by leveraging localized flavors, pricing flexibility, and proximity to domestic distribution networks. Competitive intensity is particularly high in impulse ice cream, where shelf space, visibility, and trade incentives strongly influence market share.

Name | Founding Year | Original Headquarters |

Unilever (Walls / Magnum / Cornetto) | 1930 | London, UK |

Nestlé | 1866 | Vevey, Switzerland |

Mars Incorporated | 1911 | McLean, Virginia, USA |

General Mills (Häagen-Dazs) | 1866 | Minneapolis, Minnesota, USA |

Saudi Dairy & Foodstuff Company (Saudia) | 1976 | Riyadh, Saudi Arabia |

Almarai | 1977 | Riyadh, Saudi Arabia |

London Dairy | 1989 | Dubai, UAE |

Baskin-Robbins | 1945 | Pasadena, California, USA |

Cold Stone Creamery | 1988 | Scottsdale, Arizona, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Unilever: Unilever remains the market leader in Saudi Arabia’s ice cream category, supported by its broad portfolio spanning mass-market impulse products to premium offerings such as Magnum. The company’s strength lies in extensive freezer penetration, aggressive promotional execution, and localized flavor launches tailored to Middle Eastern preferences. Its scale and logistics capabilities allow consistent product availability even during peak summer demand.

Nestlé: Nestlé competes strongly through its focus on family-oriented take-home formats, trusted quality positioning, and selective premiumization. The company benefits from deep dairy expertise and strong relationships with modern trade retailers. Nestlé’s strategy emphasizes household penetration, nutritional reassurance, and stable pricing across key SKUs.

Mars Incorporated: Mars leverages its globally recognized confectionery brands to create strong crossover appeal in ice cream formats. Products linked to chocolate brands benefit from high impulse conversion, particularly among younger consumers. Mars’ competitive advantage lies in brand-led indulgence and strong resonance within convenience and foodservice channels.

General Mills (Häagen-Dazs): Häagen-Dazs occupies a premium niche in Saudi Arabia, with demand concentrated in affluent urban centers and dessert-focused foodservice outlets. The brand competes on indulgence, ingredient quality, and international prestige, rather than volume. Its growth is tied closely to café culture and premium gifting occasions.

Saudi Dairy & Foodstuff Company (Saudia): Saudia maintains relevance through strong local brand recognition, value-driven pricing, and wide availability. Its positioning resonates with family consumers and price-sensitive segments, supported by local manufacturing and distribution advantages.

Almarai: Almarai leverages its dominance in the dairy sector to build credibility in frozen desserts, particularly in take-home formats. Its integrated supply chain and brand trust enable competitive pricing and consistent quality, supporting gradual expansion in the ice cream category.

What Lies Ahead for Saudi Arabia Ice Cream Market?

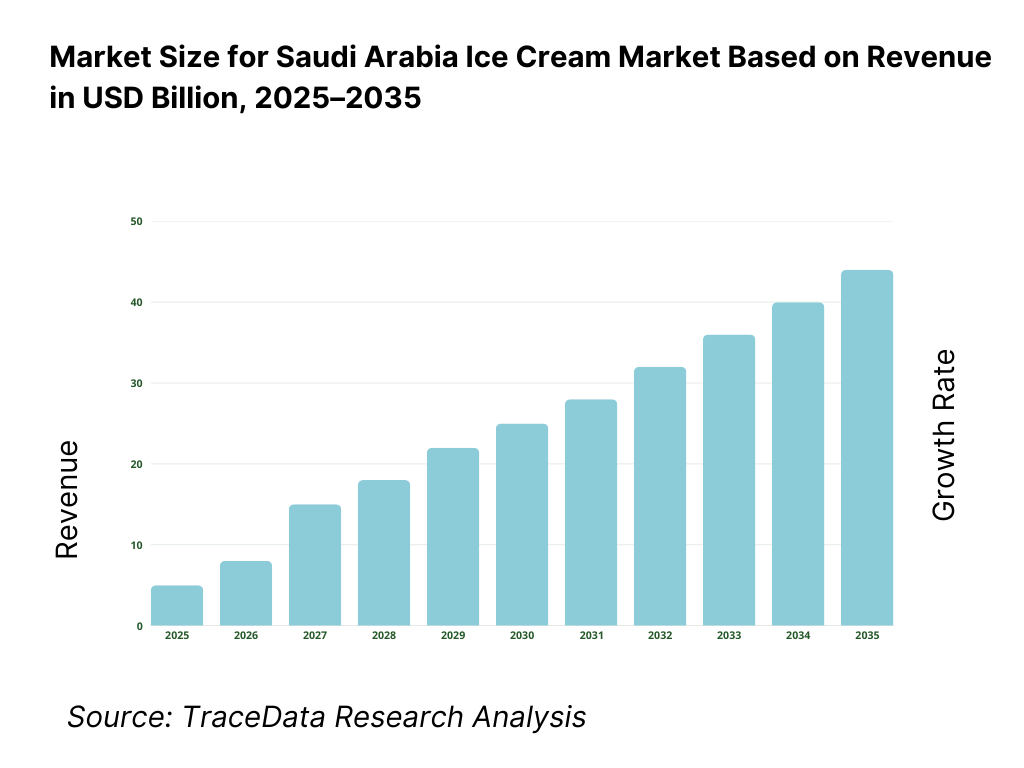

The Saudi Arabia ice cream market is expected to expand steadily through 2035, supported by structural climate-driven demand, population growth, urban lifestyle shifts, and continued expansion of organized retail and foodservice infrastructure. Rising disposable incomes, increasing exposure to global food trends, and the normalization of ice cream as a year-round indulgence rather than a purely seasonal product will continue to support volume and value growth. As consumers increasingly seek variety, quality, and differentiated experiences within affordable indulgence categories, ice cream will remain a resilient and adaptive segment within the Kingdom’s broader packaged food and dessert landscape.

Transition Toward Premium, Functional, and Differentiated Ice Cream Offerings: The future of the Saudi ice cream market will see a gradual shift from purely mass-market impulse products toward more differentiated offerings positioned around premium ingredients, texture innovation, and lifestyle alignment. Demand is expected to rise for products featuring indulgent inclusions, international dessert inspirations, reduced-sugar formulations, dairy alternatives, and functional positioning such as low-calorie or high-protein variants. While mass formats will continue to dominate volumes, premium SKUs will capture a disproportionate share of value growth, particularly among urban, higher-income, and younger consumers seeking novelty and perceived quality.

Strengthening Role of Foodservice, Cafés, and Dessert-Led Consumption Occasions: Foodservice channels are expected to play an increasingly important role in shaping consumer preferences and brand positioning. Café culture, dessert parlors, and international QSR chains will continue to act as trendsetters, introducing new flavors, formats, and presentation styles that later influence retail offerings. Ice cream consumption will increasingly be linked to social occasions, evening outings, and experiential dining rather than only impulse refreshment, supporting higher price points and premium brand narratives through 2035.

Greater Localization of Flavors and Cultural Relevance in Product Innovation: Product development strategies will increasingly emphasize localization alongside global inspiration. Flavors and formats aligned with regional tastes—such as date-based profiles, pistachio, saffron, Arabic coffee, and dessert-inspired combinations—are expected to gain traction as brands seek deeper cultural resonance. This localization will not only support differentiation but also strengthen emotional connection and repeat purchase behavior, particularly for locally produced and regionally marketed brands.

Saudi Arabia Ice Cream Market Segmentation

By Product Type

- Impulse Ice Cream (Sticks, Cones, Cups, Novelties)

- Take-Home Ice Cream (Tubs & Multi-packs)

- Premium & Artisanal Ice Cream

- Frozen Yogurt

- Sorbet & Specialty Frozen Desserts

By Format

- Single-Serve Ice Cream

- Multi-Serve / Family Packs

- Portion-Controlled & Mini Packs

By Distribution Channel

- Modern Trade (Hypermarkets & Supermarkets)

- Convenience Stores & Petrol Stations

- Foodservice (QSRs, Cafés, Restaurants, Dessert Parlors)

- Traditional & Independent Retail

By End Consumer

- Children

- Teenagers & Young Adults

- Families & Household Consumers

- Premium Adult Consumers

By Region

- Central Region

- Western Region

- Eastern Region

- Southern & Northern Regions

Players Mentioned in the Report:

- Unilever (Walls / Magnum / Cornetto)

- Nestlé

- Mars Incorporated

- General Mills (Häagen-Dazs)

- Saudi Dairy & Foodstuff Company (Saudia)

- Almarai

- London Dairy

- Baskin-Robbins

- Cold Stone Creamery

- Regional ice cream manufacturers, private-label producers, and artisanal dessert brands

Key Target Audience

- Ice cream manufacturers and frozen dessert producers

- Dairy companies and ingredient suppliers

- Modern trade retailers and convenience store chains

- Foodservice operators, QSRs, cafés, and dessert chains

- Cold-chain logistics providers and freezer equipment suppliers

- Private equity and strategic investors in food & beverage

- Distributors and importers of frozen food products

Time Period:

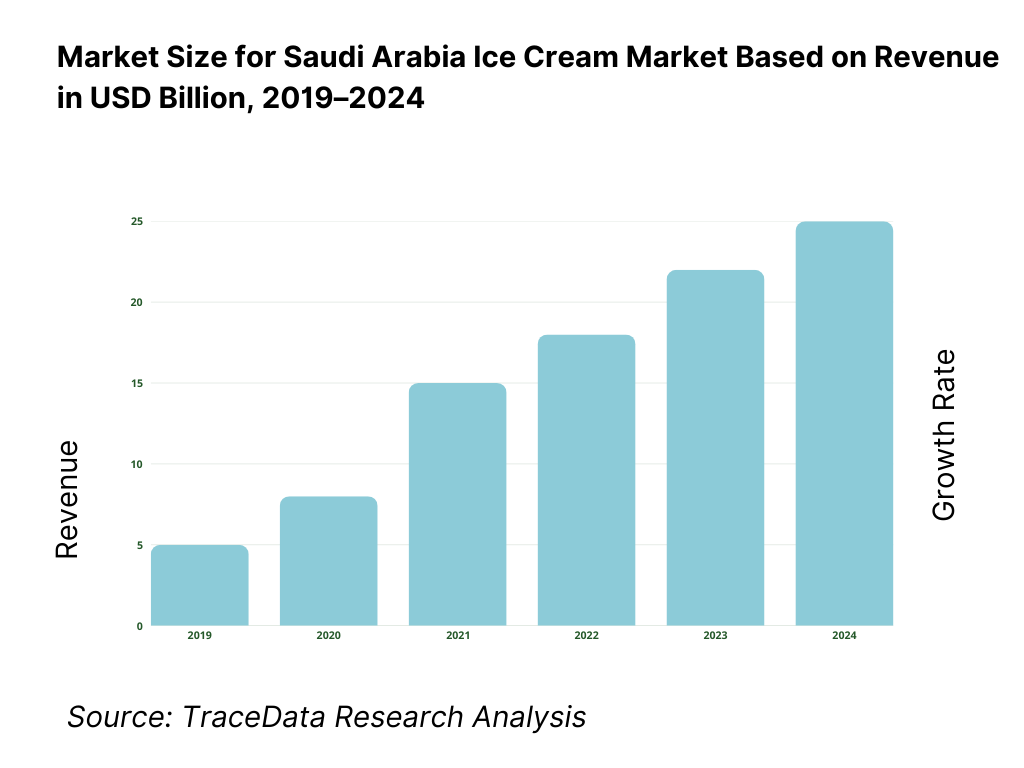

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in Saudi Arabia Ice Cream Market

Value Chain Analysis

4.1 Delivery Model Analysis for Ice Cream Products-In-House Manufacturing, Contract Manufacturing, Cold Chain Distribution, Direct-to-Retail [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for Saudi Arabia Ice Cream Market [Branded Retail Sales, Impulse Products, Foodservice Supply, Private Label Manufacturing]

4.3 Business Model Canvas for Saudi Arabia Ice Cream Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Brands [Regional Dairy & Ice Cream Producers vs Multinational Ice Cream Companies]

5.2 Investment Model in Saudi Arabia Ice Cream Market [Capacity Expansion, Cold Chain Investments, Private Equity, Strategic Partnerships]

5.3 Comparative Analysis of Ice Cream Consumption in Household vs Out-of-Home Channels [Procurement Models, Consumption Occasions, Pricing, Margin Benchmarks]

5.4 Ice Cream Spend Allocation by Consumer Segment [Mass Market Consumers, Premium Consumers, HoReCa Buyers]Market Attractiveness for Saudi Arabia Ice Cream Market

Supply-Demand Gap Analysis

Market Size for Saudi Arabia Ice Cream Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for Saudi Arabia Ice Cream Market Basis

9.1 By Market Structure (Branded vs Private Label Ice Cream)

9.2 By Product Type (Impulse Ice Cream, Take-Home Ice Cream, Artisanal & Premium Ice Cream)

9.3 By Flavor Category (Chocolate, Vanilla, Fruit-Based, Nuts & Specialty Flavors)

9.4 By Price Segment (Economy, Mid-Priced, Premium)

9.5 By Consumption Channel (Retail, Foodservice, Quick Service Restaurants, Cafés)

9.6 By Packaging Format (Single-Serve, Multi-Pack, Family Packs)

9.7 By Conventional vs Premium/Artisanal Ice Cream

9.8 By Region (Central Region, Western Region, Eastern Region, Southern Region, Northern Region)Demand-Side Analysis for Saudi Arabia Ice Cream Market

10.1 Consumer, Retailer & Foodservice Buyer Landscape and Cohort Analysis

10.2 Consumption Drivers & Purchase Decision-Making Process

10.3 Brand Preference, Price Sensitivity & Value Perception Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in Saudi Arabia Ice Cream Market

11.2 Growth Drivers for Saudi Arabia Ice Cream Market

11.3 SWOT Analysis for Saudi Arabia Ice Cream Market

11.4 Issues & Challenges for Saudi Arabia Ice Cream Market

11.5 Government Regulations & Food Safety Standards for Saudi Arabia Ice Cream MarketSnapshot on Packaged & Branded Ice Cream Market in Saudi Arabia

12.1 Market Size and Future Potential for Premium & Value-Added Ice Cream Products

12.2 Business Models & Revenue Streams [Branded Sales, Foodservice Contracts, Private Label Supply]

12.3 Delivery Models & Product Offerings [Impulse Products, Take-Home Packs, Premium & Artisanal Lines]Opportunity Matrix for Saudi Arabia Ice Cream Market

PEAK Matrix Analysis for Saudi Arabia Ice Cream Market

Competitor Analysis for Saudi Arabia Ice Cream Market

15.1 Market Share of Key Players in Saudi Arabia Ice Cream Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Manufacturing & Cold Chain Capabilities, Revenues, Pricing Strategy, Product Portfolio, Distribution Reach, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Competitive Positioning Matrix for Ice Cream Brands

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for Saudi Arabia Ice Cream Market Basis

16.1 Revenues (Projections)

Market Breakdown for Saudi Arabia Ice Cream Market Basis

17.1 By Market Structure (Branded vs Private Label)

17.2 By Product Type (Impulse, Take-Home, Premium & Artisanal)

17.3 By Flavor Category (Chocolate, Vanilla, Fruit, Specialty)

17.4 By Price Segment (Economy, Mid-Priced, Premium)

17.5 By Consumption Channel (Retail, HoReCa, QSRs, Cafés)

17.6 By Packaging Format (Single-Serve, Multi-Pack, Family Packs)

17.7 By Conventional vs Premium Ice Cream

17.8 By Region (Central, Western, Eastern, Southern, Northern)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Saudi Arabia Ice Cream Market across demand-side and supply-side entities. On the demand side, entities include household consumers, children and youth segments, working professionals, foodservice consumers, café and dessert outlet patrons, and institutional buyers such as hotels, catering companies, and entertainment venues. Demand is further segmented by consumption occasion (impulse, at-home dessert, social consumption, foodservice-led indulgence), price positioning (mass, mid-premium, premium), and purchase channel (modern trade, convenience retail, foodservice). On the supply side, the ecosystem includes multinational ice cream manufacturers, regional and local producers, dairy and ingredient suppliers, flavor and additive providers, packaging suppliers, cold-chain logistics operators, distributors and importers, freezer equipment providers, and retail and foodservice partners. From this mapped ecosystem, we shortlist 6–10 leading ice cream brands and a representative set of regional and local players based on brand strength, distribution reach, freezer penetration, product portfolio depth, and presence across impulse and take-home segments. This step establishes how value is created and captured across sourcing, manufacturing, cold storage, distribution, retail execution, and brand-led demand generation.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Saudi Arabia ice cream market structure, consumption drivers, and segment behavior. This includes reviewing demographic trends, climate-linked consumption patterns, disposable income growth, retail expansion, and foodservice development. We assess consumer preferences around flavor profiles, portion sizes, price sensitivity, and premiumization trends. Company-level analysis includes review of product portfolios, brand positioning, manufacturing footprints, distribution models, and channel strategies across modern trade, convenience retail, and foodservice. We also examine regulatory and food safety dynamics governing dairy-based frozen products, halal compliance requirements, labeling norms, and cold-chain handling standards. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and creates the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with ice cream manufacturers, dairy companies, distributors, cold-chain logistics providers, modern trade buyers, convenience store operators, and foodservice managers. The objectives are threefold: (a) validate assumptions around demand concentration, channel mix, and competitive positioning, (b) authenticate segment splits by product type, format, distribution channel, and region, and (c) gather qualitative insights on pricing strategies, promotional intensity, freezer space dynamics, supply constraints, and consumer response to new product launches. A bottom-to-top approach is applied by estimating consumption volumes, average price realization, and channel throughput across key segments and regions, which are aggregated to build the overall market view. In selected cases, buyer-style interactions with retailers and distributors are used to validate trade margins, promotional expectations, and operational challenges related to cold-chain execution and inventory turnover.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population growth, urbanization, retail footprint expansion, and foodservice outlet growth. Assumptions around raw material costs, energy and refrigeration expenses, and promotional intensity are stress-tested to assess their impact on margins and pricing behavior. Sensitivity analysis is conducted across key variables including premiumization rates, cold-chain infrastructure expansion, and shifts in consumer purchasing power. Market models are refined until alignment is achieved between production capacity, distribution capability, retail freezer availability, and observed consumption patterns, ensuring internal consistency and a robust directional forecast through 2035.

FAQs

01 What is the potential for the Saudi Arabia Ice Cream Market?

The Saudi Arabia ice cream market holds strong long-term potential, supported by the Kingdom’s hot climate, young population profile, expanding urban lifestyles, and growing penetration of modern retail and foodservice channels. Ice cream has evolved into a year-round indulgence category rather than a purely seasonal product, with demand driven by impulse consumption, family dessert occasions, and café-led social experiences. Premiumization, flavor localization, and improved cold-chain infrastructure are expected to further enhance value growth through 2035.

02 Who are the Key Players in the Saudi Arabia Ice Cream Market?

The market features a mix of multinational food companies with strong global brands, regional Middle Eastern players, and local Saudi dairy and food manufacturers. Competition is shaped by brand equity, freezer penetration, distribution reach, promotional execution, and the ability to balance mass-market affordability with premium offerings. Multinational brands dominate impulse and premium segments, while local players leverage pricing flexibility, localized flavors, and domestic manufacturing advantages.

03 What are the Growth Drivers for the Saudi Arabia Ice Cream Market?

Key growth drivers include climate-driven baseline demand, rising disposable incomes, a young and digitally influenced consumer base, and continued expansion of modern trade and foodservice infrastructure. Additional momentum comes from premiumization, innovation in flavors and formats, increased café and dessert culture, and improved cold-chain logistics enabling broader geographic reach. Localization of products and alignment with cultural preferences further strengthen repeat consumption and brand loyalty.

04 What are the Challenges in the Saudi Arabia Ice Cream Market?

Challenges include high dependence on cold-chain infrastructure, rising energy and logistics costs, volatility in imported raw material prices, and intense competition for freezer space in retail outlets. Price sensitivity in mass-market segments limits rapid premium scaling outside major urban centers. Regulatory compliance, halal ingredient sourcing, and maintaining consistent product quality across extreme climatic conditions also add operational complexity for market participants.