Saudi Arabia Surveying Equipment Market Outlook to 2030

By Equipment Type, By Technology, By End-Use Application, By End-User Industry, By Sales Channel, By Accuracy Class, and By Region

- Product Code: TDR0369

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Saudi Arabia Surveying Equipment Market Outlook to 2030 – By Equipment Type, By Technology, By End-Use Application, By End-User Industry, By Sales Channel, By Accuracy Class, and By Region” provides a comprehensive analysis of the surveying equipment market in Saudi Arabia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the surveying equipment market. The report concludes with future market projections based on equipment volumes, technologies, applications, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

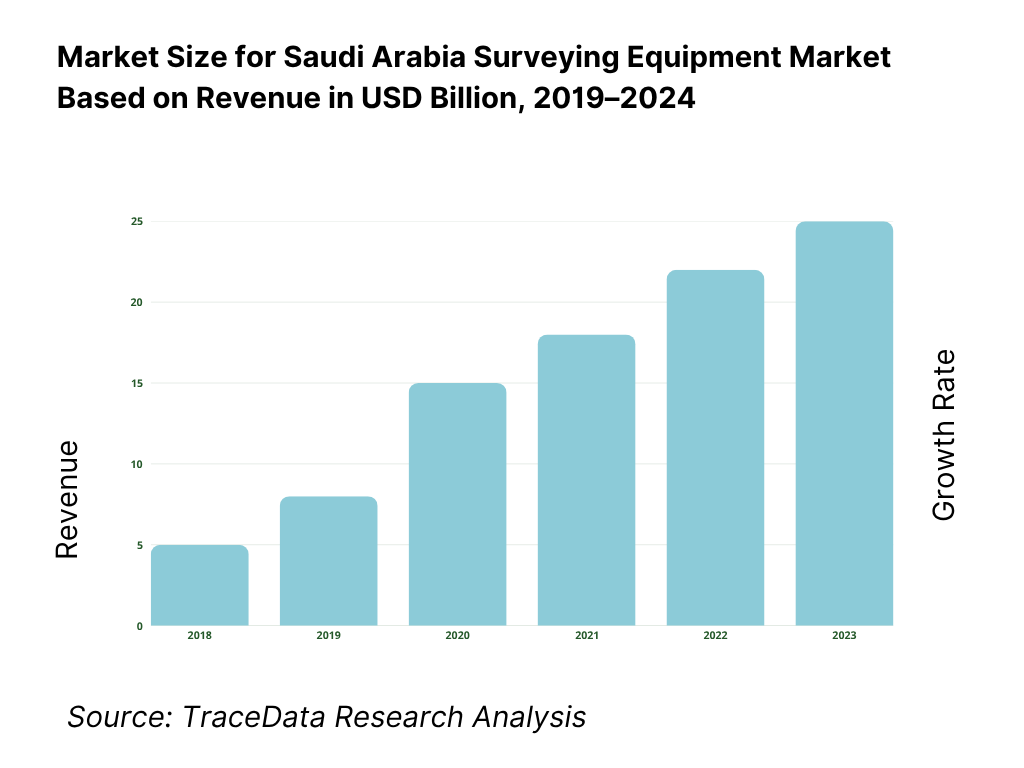

Saudi Arabia Surveying Equipment Market Overview and Size

The Saudi Arabia surveying equipment market is valued at USD 58 million, based on a five-year historical analysis triangulated from country-scope datasets and credible vendor audits; the most recent published cycle indicates USD 60 million on the back of sustained infrastructure awards across giga-projects, corridor mapping in utilities, and UAV/RTK deployments to compress field cycles. These figures are consistent with global and regional benchmarks for land survey equipment and align with robust tendering and import flows for GNSS rovers, total stations, laser scanners, and UAV payloads in the Kingdom.

Riyadh, the Eastern Province (Dammam–Dhahran–Jubail), Jeddah–Makkah, and the NEOM/Tabuk corridor dominate demand due to the highest concentration of mega projects, right-of-way development, and municipal/cadastral programs requiring dense control networks, SANSRS-compliant deliverables, and rapid as-built turnover. These hubs bundle EPC frameworks, rental fleets, and certified calibration capacity, drawing more GNSS/TS fleets and reality-capture systems than other regions; this geographic clustering is reinforced by project logistics in oil & gas, ports, and large residential/industrial precincts.

What Factors are Leading to the Growth of the Saudi Arabia Surveying Equipment Market:

Public investment and project execution creating continuous measurement demand: Saudi Arabia’s fiscal push underpins surveying intensity across giga-projects and public works. The Ministry of Finance reports capital expenditures of SAR 203,000,000,000 in the latest completed cycle, alongside higher total spending linked to Red Sea and Qiddiya implementation (SAR 1,259,000,000,000 budget vs. SAR 1,172,000,000,000 actual in the subsequent cycle). These outlays convert quickly into right-of-way, earthworks, utilities corridors and cadastral updates that require GNSS, robotic total stations and UAV mapping. The non-oil economy’s expansion reinforced utilization, with authorities noting real activity growth that lifted quarterly GDP late in the cycle, supporting survey workflows from site prep to as-built submissions.

Urban concentration and freight throughput amplifying geospatial workloads: A heavily urbanized footprint concentrates surveying needs around utilities relocations, transport links and dense as-built cycles. World Bank data show an urban population of 30,065,600 people and an overall population of 35,300,280, compressing projects into Riyadh, Jeddah–Makkah and the Eastern Province. Concurrently, seaport operations drive continuous hydrographic, terminal expansion and corridor mapping: the Saudi Ports Authority reported 27,461,857 tons handled in the closing month of the latest year, up from 25,132,181 in the comparable month, sustaining berth deepening, yard re-layout and road/rail connectors that depend on RTK, LiDAR and bathymetric surveys.

Logistics capability, labor dynamics and land transport intensity sustaining field demand: Saudi Arabia improved its logistics capability, ranking 38 with an overall score of 3.4 on the World Bank LPI 2023, reflecting stronger infrastructure, timeliness and tracking—conditions that elevate survey volumes for roadway, warehousing and industrial parks. GASTAT’s labor release shows Saudi unemployment at 7.7 in the reference quarter, with an employment-to-population ratio of 47.4, indicating available workforce capacity to scale survey crews and data processing teams. Land transport statistics also document an extensive network requiring frequent maintenance and re-alignment surveys across regions. Together, these macro indicators support recurring GNSS control densification, corridor stake-out and UAV inspections across highways and intermodal assets.

Which Industry Challenges Have Impacted the Growth of the Saudi Arabia Surveying Equipment Market:

Harsh climate and terrain complicate precision and maintenance cycles: Surveying electronics and optics must operate in high-heat, arid conditions with dust exposure that degrades EDM and LiDAR performance and shortens calibration intervals. The World Bank Climate Knowledge Portal characterizes Saudi Arabia’s climate with sustained high mean surface temperatures and low precipitation across most of its 2,149,690 square-kilometer landmass—environmental factors that increase field downtime, battery derating and sensor cleaning frequency. The geographic scale adds logistics lead time for control establishment and check surveys, particularly on remote corridors and mining sites, raising labor-hour inputs and fleet utilization risk.

Permitting and flight approvals constrain UAV productivity on time-critical jobs: Commercial UAV missions that collect photogrammetry or LiDAR must comply with aviation rules. The General Authority of Civil Aviation’s GACAR Part 107 (v4) defines two main operation categories (“Open” requiring a Permit to Operate, and specific permissions for complex missions such as BVLOS) and codifies operator certification and operational limitations—adding processing time to corridor, urban and sensitive-site flights. These procedures are essential for safety but introduce approval lead times that can affect survey-to-as-built schedules for EPCs working under tight milestones.

Skills, calibration capacity and import cycle frictions: Labor market indicators show available workforce, yet specialized RTK/PPK, SLAM and hydrographic skill sets remain uneven, and calibration queues can lengthen during peak execution. GASTAT notes unemployment at 7.7 for Saudis in the reference quarter with a labor force participation of 51.3, implying scope to upskill for advanced geospatial roles. Meanwhile, macro spending profiles from the Ministry of Finance show higher program outlays tied to giga-projects, which intensify fleet demand and stress service centers; aligning procurement with these cycles is critical to avoid downtime on critical path works.

What are the Regulations and Initiatives which have Governed the Market:

National Spatial Reference—SANSRS implementation and KSA-CORS usage: GEOSA mandates the Saudi Arabia National Spatial Reference System (SANSRS), detailing components such as the KSA-GRF (aligned to ITRF2014 at epoch 2017.0), vertical datum (KSA-VRF) and geoid model, with implementation guidance for transformations, metadata and accuracy classes. The Authority also operates the KSA-CORS network supporting network RTK for construction, cadastral and monitoring applications, with official “Getting Started” documentation for users. Compliance standardizes coordinates, audits deliverables and enables seamless device-to-BIM/GIS integration across agencies.

Aerial and land surveying technical guidelines governing acquisition and deliverables: GEOSA’s Technical Guidelines for Land Surveying and Aerial Surveying set out control network hierarchy, data capture, accuracy thresholds, and file-format/metadata requirements for public submissions. These documents define control establishment, GNSS observation standards, aerial mission planning, and quality controls on orthomosaics and point clouds—anchoring the acceptance of as-built packages by municipal and sector agencies and shaping OEM specs (GNSS, LiDAR, IMU) procured by EPCs and service firms.

Construction codes and transport surveying code integrating survey obligations: Survey outputs are embedded in construction and highway standards. The Saudi Building Code implementing regulations apply to all construction stages and reference technical requirements for design, execution, operation and modification; ministries and municipalities use these to validate as-built records. For roads, the Saudi Highway Code SHC-202 (“Surveying and Mapping”) comprises 6 parts with 21 chapters, specifying route control, tolerances and documentation—formalizing survey obligations for transport corridors.

Saudi Arabia Surveying Equipment Market Segmentation

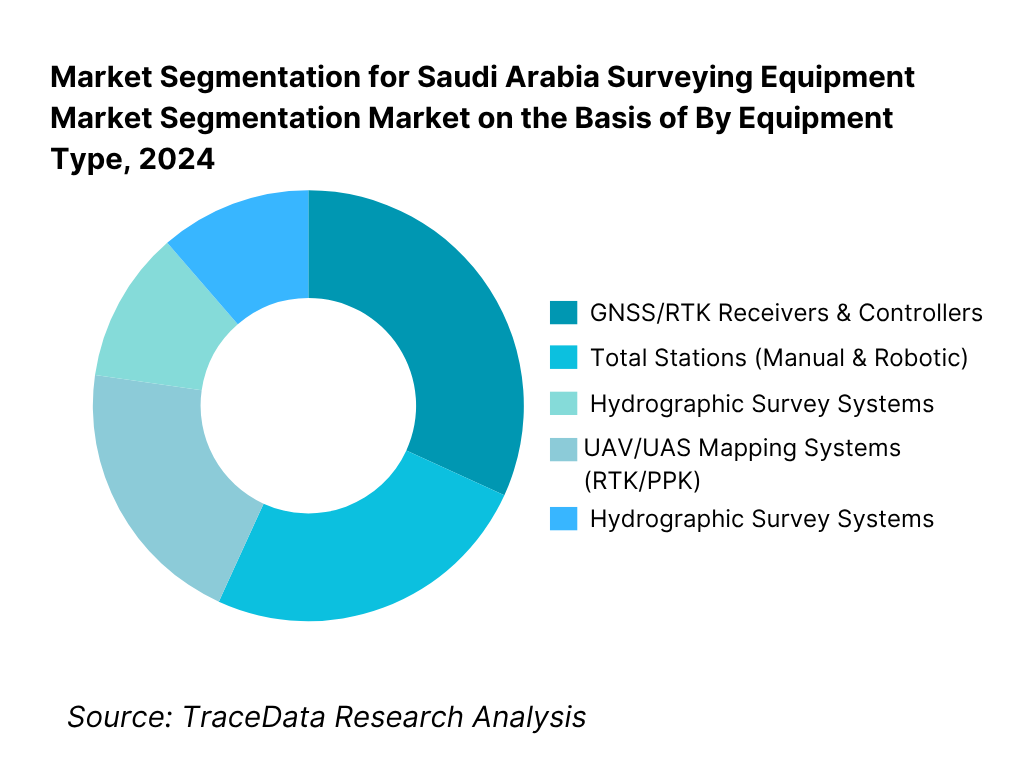

By Equipment Type: Saudi Arabia Surveying Equipment market is segmented by equipment type into GNSS/RTK receivers & controllers, total stations (manual & robotic), 3D laser scanners, UAV/UAS mapping systems, and hydrographic survey systems. GNSS/RTK presently holds the dominant share under equipment type due to ubiquitous use in control establishment, stake-out, and corridor alignment across road, metro, and utility projects. Dense CORS availability, SANSRS workflows, and one-person rover productivity keep unit turnarounds high, while distributor inventories and rapid service swaps minimize downtime. Robotic total stations and UAV mapping grow fast, but GNSS remains the day-to-day backbone for layout, cadastral, and as-built tasks.

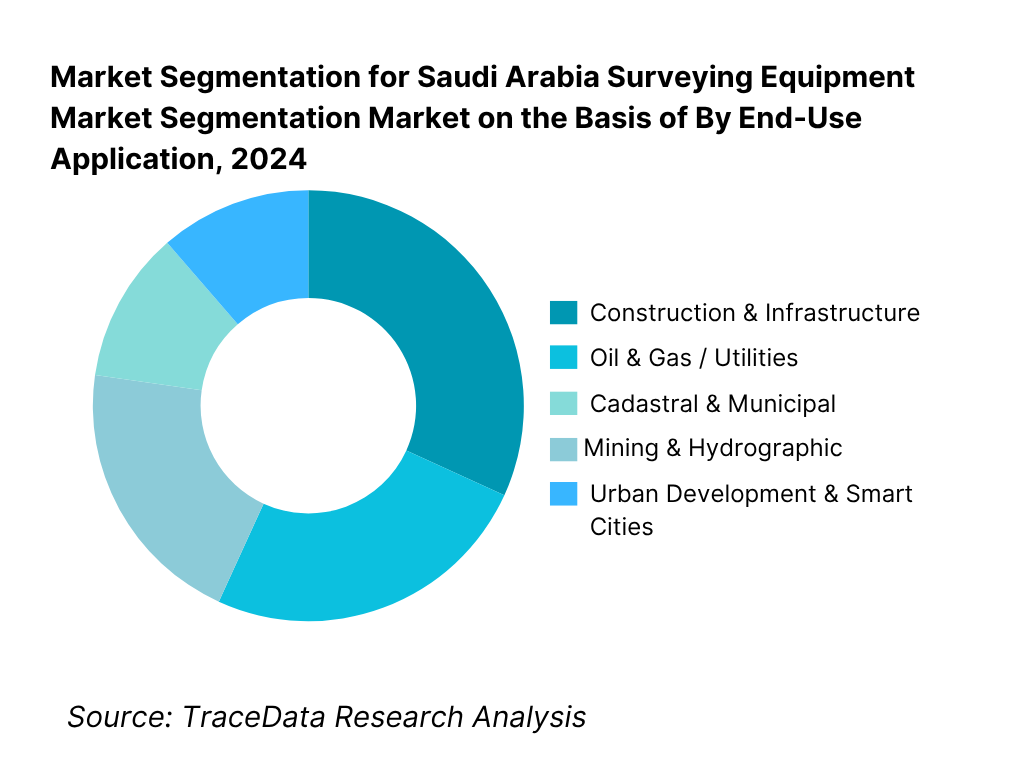

By End-Use Application: Saudi Arabia Surveying Equipment market is segmented by end-use into construction & infrastructure, oil & gas/utilities, cadastral & municipal, urban development & smart cities, and mining & hydrographic. Construction & Infrastructure is currently dominant under the application segmentation because metro, highway, bridges, social housing, and site-prep require continuous layout, control densification, and as-built verification. EPCs workflows combine GNSS/RTK for primary control, robotic total stations for precision layout, and UAV/laser scanning to compress QA/QC cycles—supporting relentless project pacing in Riyadh, Jeddah–Makkah, Eastern Province, and NEOM corridors.

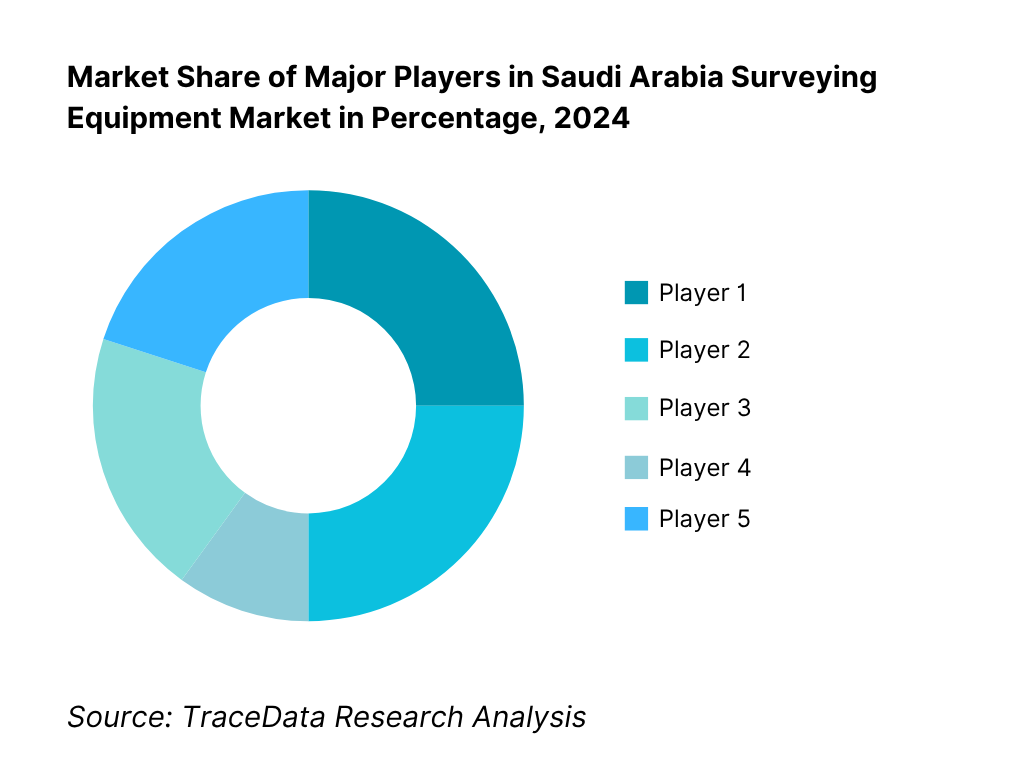

Competitive Landscape in Saudi Arabia Surveying Equipment Market

The Saudi Arabia Surveying Equipment market features global OEMs working through authorized distributors, rental partners, and certified calibration labs. Competition concentrates around GNSS rover ecosystems, robotic total stations, UAV+payload bundles, and laser scanning platforms that map cleanly into BIM/GIS workflows. Service quality (turnaround days), Arabic UI/documentation, and SANSRS toolchains are critical differentiators. Consolidation around giga-projects produces framework wins and multi-year service packages, keeping barriers high for new entrants.

Name | Founding Year | Original Headquarters |

Trimble | 1978 | Sunnyvale, USA |

Leica Geosystems (Hexagon) | 1921 | Heerbrugg, Switzerland |

Topcon Positioning Systems | 1932 | Tokyo, Japan |

Sokkia | 1920 | Tokyo, Japan |

Spectra Geospatial (Spectra Precision) | 1994 | Westminster, USA |

CHC Navigation | 2003 | Shanghai, China |

Hi-Target | 1999 | Guangzhou, China |

Stonex | 2004 | Milan, Italy |

South Surveying & Mapping | 1989 | Guangzhou, China |

RIEGL | 1978 | Horn, Austria |

FARO Technologies | 1981 | Lake Mary, USA |

Teledyne Geospatial (Optech) | 1974 | Toronto, Canada |

DJI Enterprise | 2006 | Shenzhen, China |

Microdrones | 2005 | Siegen, Germany |

senseFly | 2009 | Lausanne, Switzerland |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Trimble: As one of the leading surveying equipment providers in Saudi Arabia, Trimble expanded its presence by partnering with local distributors to strengthen after-sales calibration and service networks. The company also introduced its SX12 scanning total station in the Kingdom, catering to the growing demand for integrated scanning and layout solutions across giga-projects.

Leica Geosystems (Hexagon): Known for its strong role in Saudi Arabia’s giga-project surveying, Leica Geosystems has increased deployments of its RTC360 3D laser scanner and GS GNSS systems in large infrastructure projects. The brand has also enhanced its training programs with local partners to support SANSRS compliance and BIM-ready deliverables.

Topcon Positioning Systems: Specializing in GNSS and robotic total stations, Topcon expanded its UAV mapping integrations with Intel-powered drones in Saudi Arabia. The company has also strengthened its engagement with construction contractors by offering bundled solutions for road alignment and metro rail projects.

DJI Enterprise: A major player in UAV surveying solutions, DJI has seen growing adoption of its Matrice 350 RTK and Zenmuse L2 LiDAR payload in Saudi Arabia during 2023. The demand surge is driven by giga-project needs for high-resolution aerial mapping, with DJI’s local partners facilitating approvals under GACA UAV regulations.

RIEGL: Focusing on LiDAR technology, RIEGL has expanded its market in Saudi Arabia by delivering miniVUX UAV LiDAR systems and VZ terrestrial scanners to contractors engaged in urban development and mining. The company has also collaborated with local integrators to provide advanced training and support for SLAM-based mobile mapping applications.

What Lies Ahead for Saudi Arabia Surveying Equipment Market?

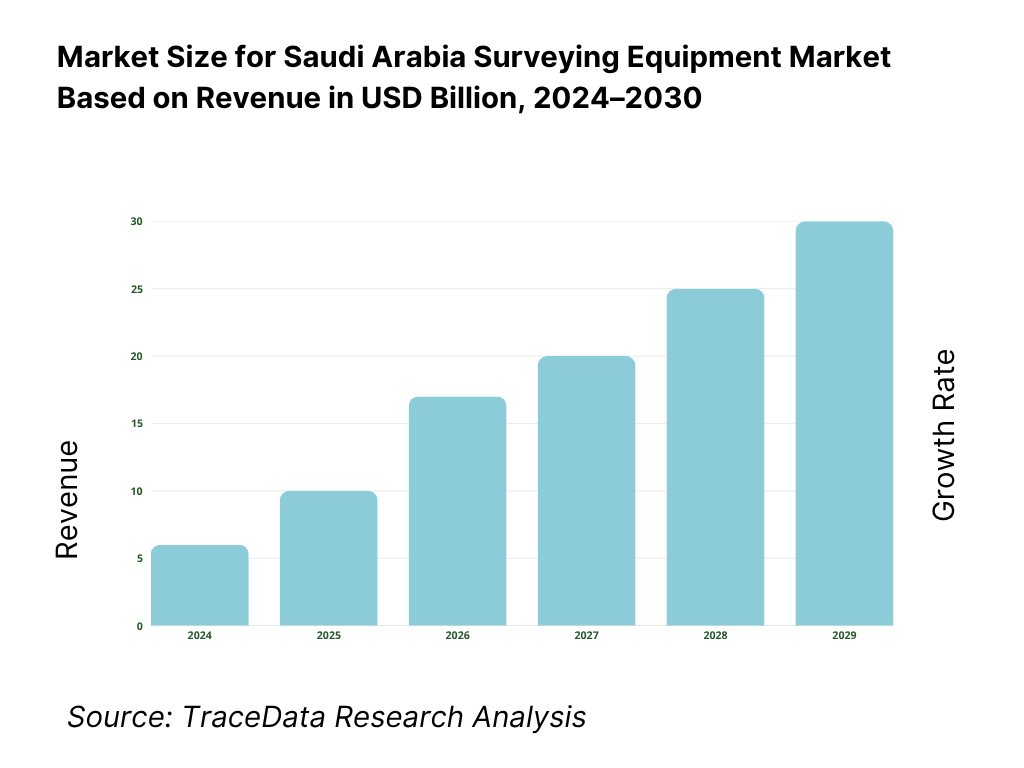

The Saudi Arabia surveying equipment market is expected to continue expanding through 2030, supported by Vision 2030-driven giga-projects, large-scale infrastructure spending, and regulatory enforcement of unified geodetic frameworks like SANSRS. The increasing use of UAVs, LiDAR, and BIM-integrated surveying solutions will define the sector’s trajectory as the Kingdom advances toward digital twins and smart city ecosystems.

Rise of Integrated Digital Surveying Models: The future of surveying in Saudi Arabia will emphasize integrated models combining GNSS/RTK, robotic total stations, UAV photogrammetry, and 3D laser scanning. This convergence is driven by demand for real-time as-built data, enabling EPCs and municipal agencies to accelerate project timelines and ensure compliance with regulatory deliverables.

Focus on BIM-Ready and Outcome-Based Surveying: Contractors and developers will increasingly require survey data that is BIM-ready and seamlessly linked to asset management platforms. This trend mirrors outcome-based demand, where accuracy, digital deliverables, and workflow integration are prioritized over traditional paper outputs—ensuring surveys directly contribute to productivity gains and cost control.

Expansion of Sector-Specific Applications: Sector-specific demand will accelerate in oil & gas pipelines, transport corridors, giga-project housing precincts, and coastal hydrographic mapping. These industries require specialized equipment like hydrographic sonar, UAV LiDAR, or SLAM scanners, prompting OEMs and distributors to localize solutions tailored to sectoral project requirements.

Leveraging AI, Cloud, and Analytics: The adoption of AI-driven processing, cloud-based survey platforms, and analytics dashboards will enhance survey efficiency and accuracy. Real-time processing of UAV and LiDAR datasets, automatic feature extraction, and predictive analytics for infrastructure monitoring will increase ROI, shorten project cycles, and align survey outputs with the Kingdom’s digital twin ambitions.

Saudi Arabia Surveying Equipment Market Segmentation

By Equipment Type

GNSS/RTK/PPK receivers & controllers

Total stations (manual, robotic)

3D laser scanners (terrestrial, mobile, SLAM handheld)

UAV/UAS mapping systems (multirotor, fixed-wing; RGB/LiDAR/thermal payloads)

Levels & digital levels, prisms, poles, data collectors

Hydrographic systems (single-beam, multibeam, USV payloads)

Mobile mapping vans (camera+LiDAR rigs)

By End-User Industry

EPCs & PMCs

Government & municipal/cadastral agencies (GEOSA-aligned)

Utilities & energy asset owners (power, water, pipelines)

Real estate developers & industrial zones

Surveying/geo services firms & UAV operators

Ports/airports & logistics infrastructure owners

By Accuracy Class (Spec Thresholds)

Sub-centimeter survey grade (e.g., H ≤2 cm; V ≤3 cm RTK)

Centimeter grade (construction layout tolerances; angular ″, EDM mm+ppm)

Mapping grade (decimeter)

Hydrographic tolerances (IHO-aligned classes)

By Mode of Deployment

Ground-based (GNSS rovers, total stations, terrestrial scanners)

UAV-based (RTK/PPK photogrammetry, LiDAR)

Mobile mapping (vehicle-mounted LiDAR/camera)

Hydrographic (boat/USV, single-/multibeam)

By Sales/Procurement Channel

OEM-authorized distributors & value-added resellers

Direct enterprise/framework agreements (giga-projects)

Rental & managed services (instrument + crew)

Online/marketplace procurement

By Region (Project Pipeline Density)

Riyadh cluster

Makkah–Jeddah corridor

Eastern Province (Dammam/Dhahran/Jubail)

Madinah & western corridor

Northern/Northwest (NEOM/Tabuk)

Others

Players Mentioned in the Report:

Trimble

Leica Geosystems (Hexagon)

Topcon; Sokkia

Spectra Geospatial

CHC Navigation

Hi-Target

Stonex

South Surveying & Mapping

DJI Enterprise

Microdrones

senseFly

RIEGL

FARO Technologies

Teledyne Geospatial (Optech).

Key Target Audience

EPC & PMC organizations (Tier-1 civil/industrial contractors)

Giga-project development entities (e.g., NEOM Company, Red Sea Global)

Government and regulatory bodies (GEOSA; MOMRAH municipal cadastral units; GACA for UAV missions)

Utilities and energy asset owners (transmission/distribution, pipelines, water/ports)

Large real-estate developers and industrial zone operators

Surveying & geospatial service companies (as-built, cadastral, corridor mapping)

Investments and venture capitalist firms (hardware, payload, and data-processing ventures)

Calibration labs & rental fleet operators

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis (Direct OEM Sales, Authorized Distributors, Rental/Leasing, Service & Calibration, UAV mapping services-margins, preferences, strengths & weaknesses)

4.2. Revenue Streams (equipment sales, rentals, software licenses, calibration & after-sales, UAV mission outsourcing)

4.3. Business Model Canvas (Saudi surveying ecosystem-key partners, value propositions, customer segments, revenue streams, cost structure)

5.1. Freelance Surveyors vs. Full-Time Surveying Firms (penetration, reliability, project type dependency)

5.2. Investment Model (capex-driven instrument ownership vs. opex-driven rentals & UAV outsourcing)

5.3. Comparative Analysis of Surveying Procurement (public projects via GEOSA/MOMRAH vs. private EPC/giga-project contracts)

5.4. Surveying Budget Allocation by Project Type (infrastructure, utilities, giga-projects, O&G)

8.1. Revenues (historical performance, segmented by equipment class, channels, regions)

9.1. By Market Structure (In-house survey departments vs. outsourced survey firms)

9.2. By Equipment Type (GNSS/RTK, Total Stations, 3D Laser Scanners, UAV Mapping Systems, Hydrographic equipment, Accessories)

9.3. By End-Use Application (Construction, Oil & Gas/Utilities, Cadastral, Urban Development/Smart Cities, Mining & Hydrographic)

9.4. By End-User Industry (EPCs, Government Agencies, Utilities, Real Estate, Mining)

9.5. By Accuracy Class (sub-centimeter RTK, centimeter-grade, decimeter mapping-grade)

9.6. By Mode of Deployment (Ground-based, UAV-based, Mobile Mapping Vans, Hydrographic)

9.7. By Project Type (Open-bid vs. Framework contracts, Giga-project pipeline vs. regular infra)

9.8. By Region (Riyadh, Makkah/Jeddah, Eastern Province, Madinah/Western Corridor, NEOM/Northwest Corridor, Others)

10.1. End-User Cohort Analysis (EPCs, contractors, cadastral offices, giga-projects)

10.2. Procurement & Decision-Making Process (tendering, framework agreements, rental choices)

10.3. Effectiveness & ROI Analysis (time saved with UAV/RTK vs. conventional, lifecycle cost per instrument)

10.4. Gap Analysis Framework (shortage of skilled UAV/RTK operators, calibration labs, service centers)

11.1. Trends & Developments (CORS expansion, UAV RTK mapping, BIM integration, SLAM adoption, cloud processing)

11.2. Growth Drivers (Vision 2030 giga-projects, digital twins, GEOSA/SBC compliance, UAV regulation relaxations)

11.3. SWOT Analysis (local distributor strengths vs. technology dependency, service gaps, harsh environment adaptation)

11.4. Issues & Challenges (import lead times, data sovereignty, harsh climate on optics, skilled workforce shortages)

11.5. Government Regulations (GEOSA mandates, SANSRS, SBC deliverables, GACA UAV rules, calibration & metrology)

12.1. Market Size & Future Potential (multirotor vs. fixed-wing, RTK/PPK adoption)

12.2. Business Models & Revenue Streams (survey-as-a-service, UAV rentals, OEM bundles)

12.3. Payloads & Delivery Models (LiDAR, photogrammetry, multispectral, hydrographic drones)

15.1. Market Share of Key Players (basis revenues & installed base in KSA)

15.2. Benchmark of Key Competitors (company overview, USP, business strategies, product portfolio, distributors, revenues, pricing, accuracy, technology, major clients, tie-ups, marketing, recent developments)

15.3. Operating Model Analysis Framework (direct OEM vs. authorized distributor vs. rental vs. UAV service operator)

15.4. Gartner-style Quadrant (technology vs. execution ability of OEMs & service providers)

15.5. Bowman’s Strategic Clock (competitive advantage in pricing vs. differentiation for surveying OEMs in KSA)

16.1. Revenues (future projections by equipment type, channel, end-use)

17.1. By Market Structure (In-house vs. Outsourced)

17.2. By Equipment Type (GNSS, Total Stations, UAVs, Scanners, Hydrographic, Accessories)

17.3. By End-Use Application (Construction, O&G/Utilities, Cadastral, Smart Cities, Mining, Hydrographic)

17.4. By End-User Industry (EPCs, Government, Utilities, Real Estate, Mining)

17.5. By Accuracy Class (sub-cm RTK, cm-grade, decimeter)

17.6. By Mode of Deployment (Ground-based, UAV, Mobile Mapping, Hydrographic)

17.7. By Project Type (Open-bid, Framework, Giga-project)

17.8. By Region (Riyadh, Makkah/Jeddah, Eastern, Madinah/West, NEOM/Northwest, Others)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Saudi Arabia Surveying Equipment Market. Based on this ecosystem, we will shortlist leading 5–6 equipment providers and distributors in the country based on their financial information, market reach, and client base. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like equipment revenues, number of suppliers, distribution networks, rental models, demand patterns, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Saudi Arabia Surveying Equipment Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process.

FAQs

01 What is the potential for the Saudi Arabia Surveying Equipment Market?

The Saudi Arabia Surveying Equipment Market is positioned for steady expansion, supported by the Kingdom’s large-scale infrastructure push under Vision 2030 and the execution of giga-projects such as NEOM, Qiddiya, and the Red Sea Development. The market’s potential is further reinforced by rising adoption of advanced technologies including GNSS/RTK, robotic total stations, UAV mapping systems, and 3D laser scanners. Strong government emphasis on digital twins, cadastral reforms, and national geospatial frameworks ensures that surveying equipment will remain a critical enabler of project delivery and regulatory compliance.

02 Who are the Key Players in the Saudi Arabia Surveying Equipment Market?

The Saudi Arabia Surveying Equipment Market features several key players, including Trimble, Leica Geosystems (Hexagon), and Topcon Positioning Systems. These companies dominate the market due to their comprehensive product portfolios, established distributor networks, and strong presence in giga-projects. Other notable players include Sokkia, Spectra Geospatial, CHC Navigation, Hi-Target, Stonex, South Surveying & Mapping, DJI Enterprise, Microdrones, RIEGL, FARO Technologies, Teledyne Geospatial, and senseFly. Collectively, these players bring expertise across GNSS, robotic total stations, UAV LiDAR, and terrestrial/mobile scanning solutions.

03 What are the Growth Drivers for the Saudi Arabia Surveying Equipment Market?

The primary growth drivers include the Kingdom’s robust infrastructure expenditure, with capital spending exceeding SAR 200 billion in recent fiscal cycles, directly fueling surveying demand. Urban concentration, with more than 30 million urban residents, creates recurring surveying workloads in utilities, housing, and transport corridors. Additionally, the expansion of logistics and port throughput, with over 27 million tons handled in a single month at national ports, sustains hydrographic and corridor surveying needs. These macroeconomic and project-level factors collectively accelerate adoption of advanced surveying equipment across sectors.

04 What are the Challenges in the Saudi Arabia Surveying Equipment Market?

The Saudi Arabia Surveying Equipment Market faces multiple challenges, starting with the harsh climate—heat, sand, and arid conditions shorten calibration intervals and impact equipment performance. UAV surveying remains constrained by stringent aviation regulations under GACA, requiring permits and approvals that extend project timelines. Another major barrier is the shortage of specialized skills in RTK/PPK, UAV LiDAR, and SLAM technologies, with calibration service capacity often stretched during peak project phases. Together, these factors create operational hurdles that companies must overcome to ensure seamless and timely project delivery.