Saudi Arabia Textile Manufacturing Market Outlook to 2030

By Process, By Fiber/Polymer, By Product Type, By End-Use, and By Region

- Product Code: TDR0370

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Saudi Arabia Textile Manufacturing Market Outlook to 2030 – By Process, By Fiber/Polymer, By Product Type, By End-Use, and By Region” provides a comprehensive analysis of the textile manufacturing market in Saudi Arabia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the textile manufacturing market. The report concludes with future market projections based on production volumes, product categories, regional demand, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

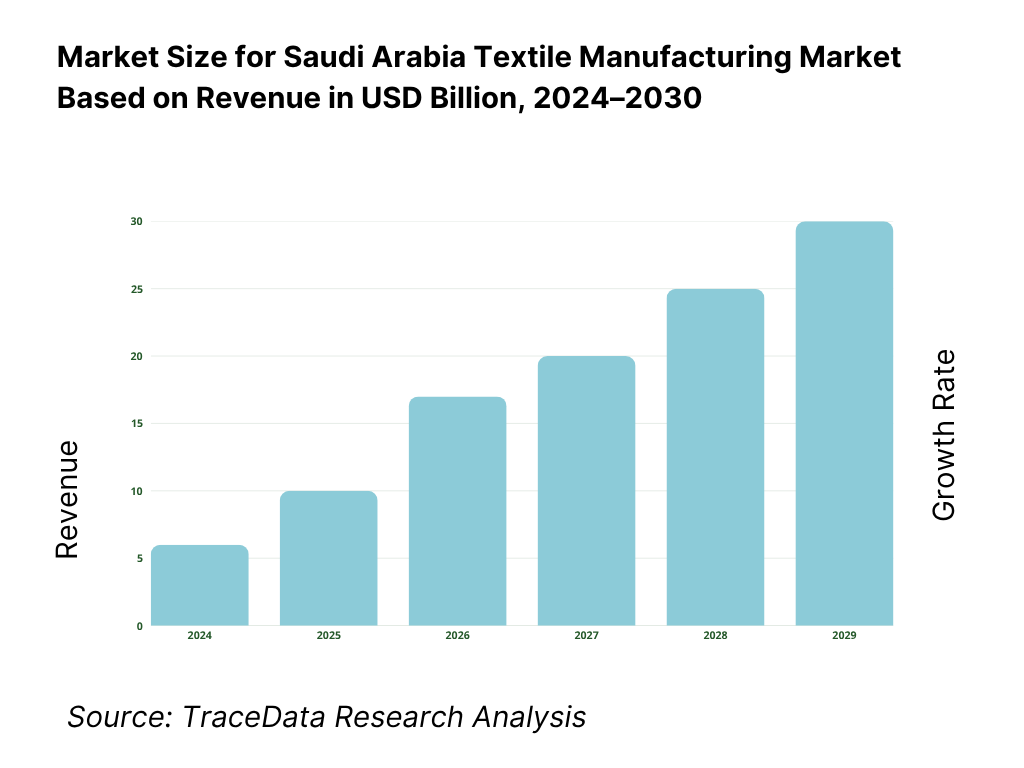

Saudi Arabia Textile Manufacturing Market Overview and Size

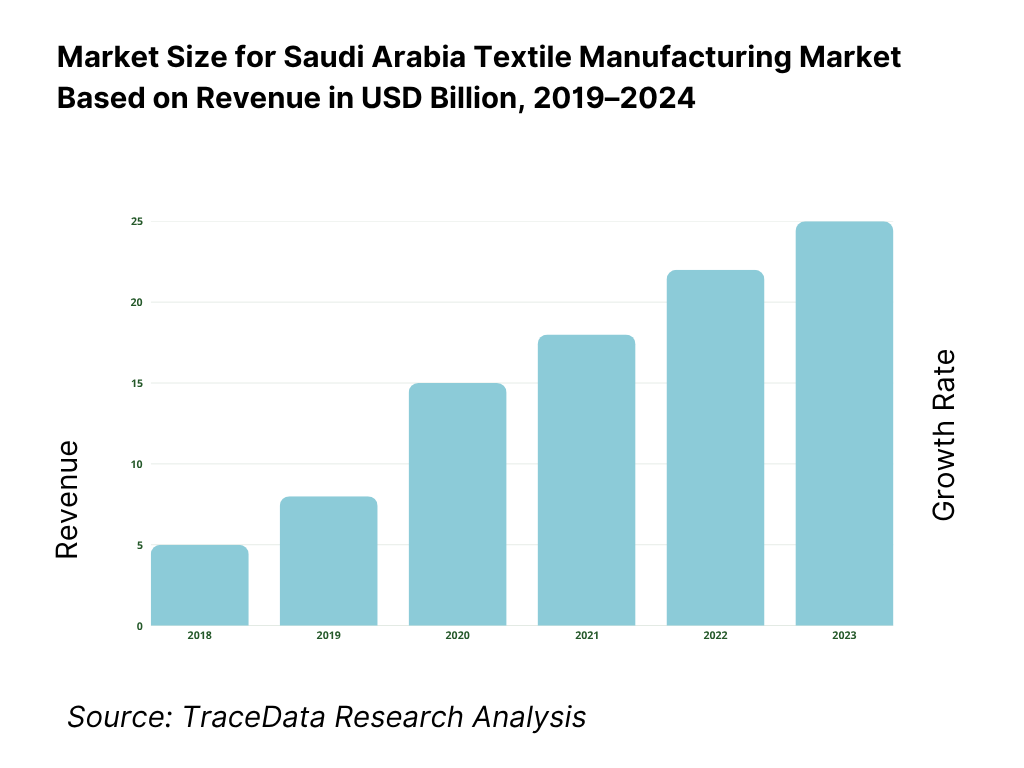

The Saudi Arabia textile manufacturing market is valued at around USD 9.6 billion as of 2024, according to a recent market outlook report of TraceData. Historical revenue data leading up to 2023 reflect steady growth, driven by rising domestic consumption, initiatives under Vision 2030 for industrial diversification, and increasing investments in modernizing textile mills and nonwoven/fabric finishing capacities. Import substitution is playing an important role, as local manufacturing capabilities improve, reducing dependency on imported fabrics and garments.

Major cities such as Riyadh and Jeddah dominate the market owing to their infrastructure, logistics access, availability of skilled labor, proximity to ports, and preferential policy/industrial cluster support. Riyadh benefits from being the capital, with regulatory & investment decision centers nearby, while Jeddah serves as a major trade‐gateway city with better sea import/export connectivity, warehousing, and historical textile & apparel business presence. Additionally, regions in the Eastern Province (e.g. Dammam/Jubail) are rising in importance due to proximity to polymer & petrochemical feedstocks from refining/petrochemical plants, which helps in synthetic fiber supply.

What Factors are Leading to the Growth of the Saudi Arabia Textile Manufacturing Market:

Expanding industrial base and localized manufacturing demand: Saudi Arabia’s industrial footprint is deepening, creating pull for yarn, fabrics, carpets, and technical nonwovens. The Ministry of Finance reported 11,868 factories in operation, with about 410 new factories added from the start of the fiscal year through April, underscoring fresh capacity across MODON industrial cities and special zones that buy textiles, uniforms, filtration media, and geotextiles. This industrialization sits on a macro base of 35,300,280 people, strengthening domestic consumption of apparel and home textiles, while a resilient macro backdrop saw real GDP expand in 2024 as per GASTAT’s national accounts release. Together, more plants, more workers, and a larger consumer base translate into predictable, recurring offtake for upstream textile manufacturers and converters.

Gateway logistics and trade connectivity enabling fast textile flows: Textile supply chains benefit from port throughput and logistics reliability. The Saudi Ports Authority (MAWANI) recorded 27,461,857 tons handled in December 2024 alone, while August container activity reached 750,634 TEUs, reflecting steady box flows for fibers, machinery, and finished textiles across Jeddah, King Abdulaziz, and King Abdullah Ports. On cross-border competitiveness, the World Bank’s Logistics Performance Index shows an overall 3.4 score with rank 38, supporting predictable lead times for textile inputs and exports to GCC and Red Sea markets. This hard throughput plus systemic logistics quality reduces inventory buffers and supports just-in-time replenishment for apparel, home, and technical textiles.

Institutional buyers and public services expanding end-use demand: Healthcare, infrastructure and utilities are large institutional buyers of technical textiles. GASTAT reports 499 hospitals nationally (Riyadh alone hosts 109 hospitals), creating steady demand for medical nonwovens and textiles in linens and PPE; SWCC documents desalinated water output capacity above 11.5 million m³/day, supporting water-reliant finishing clusters; and national roads span over 73,000 kilometers, with further expansion under the Roads General Authority—each program consuming geotextiles and industrial fabrics for stabilization and drainage. This combination of hospital networks, water utilities scale and road building intensity drives reliable, non-discretionary orders for technical fabric manufacturers.

Which Industry Challenges Have Impacted the Growth of the Saudi Arabia Textile Manufacturing

Water and environmental constraints on wet processing and finishing: Textile dyeing and finishing are water-intensive. Saudi production relies heavily on desalination, with SWCC documenting output capability exceeding 11.5 million m³/day; while this scale secures supply, it raises environmental compliance costs in effluent treatment and energy inputs for mills. GASTAT’s national accounts confirm industry growth, but finishing clusters must align with zone-level wastewater and ZLD mandates, which tighten as industrial activity expands. Environmental investment cycles now compete with capex for looms and nonwoven lines, affecting smaller processors’ ability to upgrade quickly. Macro water figures and national growth data underscore the dual imperative of scaling and greening the dye-house footprint.

Dependence on imported natural fibers and selected inputs: Saudi Arabia imports raw cotton for spinning/blending and specialized inputs for technical textiles. UN COMTRADE data show cotton import values of US$35.63 million in 2024, indicating continued reliance on global suppliers for HS-52 staples amid fluctuating international harvest cycles and freight conditions. GASTAT’s International Trade bulletins further record goods import values in the hundreds of billions of riyals, evidencing the breadth of external sourcing pipelines that include textile machinery and chemicals. Such dependencies expose mills to upstream shocks and clearance risks even as port performance improves.

Skilled operator availability and technical upskilling needs: Modern weaving, knitting, and nonwoven lines demand certified technicians. The Technical and Vocational Training Corporation reports 175,682 students enrolled in technical colleges, with an additional 60,605 trainees in private programs—an encouraging pipeline that still must map to loom technicians, dye-house engineers, and quality controllers. Labor market releases show unemployment stabilization with large workforce participation swings that need channeling into industrial skills ladders. The quantitative training base is present, but alignment to plant-floor qualifications and retention remains a near-term constraint for mills scaling advanced automation.

What are the Regulations and Initiatives which have Governed the Market:

SASO Technical Regulation for Textile Products (conformity and labeling): Saudi Standards, Metrology and Quality Organization (SASO) enforces the Technical Regulation for Textile Products, covering fiber composition declaration, country of origin, manufacturer identification, and care labeling—core elements found in the official regulation text. The regulation mandates Arabic labeling and product conformity documentation through recognized notified bodies. Manufacturers and importers must maintain technical files and obtain conformity documentation prior to market entry, ensuring product traceability through specified articles and annexes in the regulation’s official English version.

SABER digital conformity platform (registration and certificates at scale): Regulated textile products are registered and cleared through SABER. In the first half of 2023, the platform registered 800,000 products, issued over 170,000 conformity certificates, and processed 350,000 shipment certificates, illustrating system capacity for high-volume textile flows and compliance throughput before customs release. These concrete counts show the operational scale of pre-market controls relevant to fabrics, apparel, PPE and accessories entering or produced for the Saudi market, helping mills and importers plan documentation and lead times.

Industrial licensing and factory authorizations (manufacturing expansion): Manufacturing activity is underpinned by industrial licensing overseen by the Ministry of Industry and Mineral Resources, reflected in national counts. The Ministry of Finance notes 11,868 factories active and approximately 410 newly added factories during the early months of the fiscal year, signaling ongoing approvals, renewals, and commissioning that are relevant to new textile lines (spinning, weaving, nonwovens, finishing). These numeric markers portray the scale at which licenses are being issued and factories are coming online within Saudi industrial cities—key context for textile investors navigating permitting, utilities allocation, and workforce onboarding.

Saudi Arabia Textile Manufacturing Market Segmentation

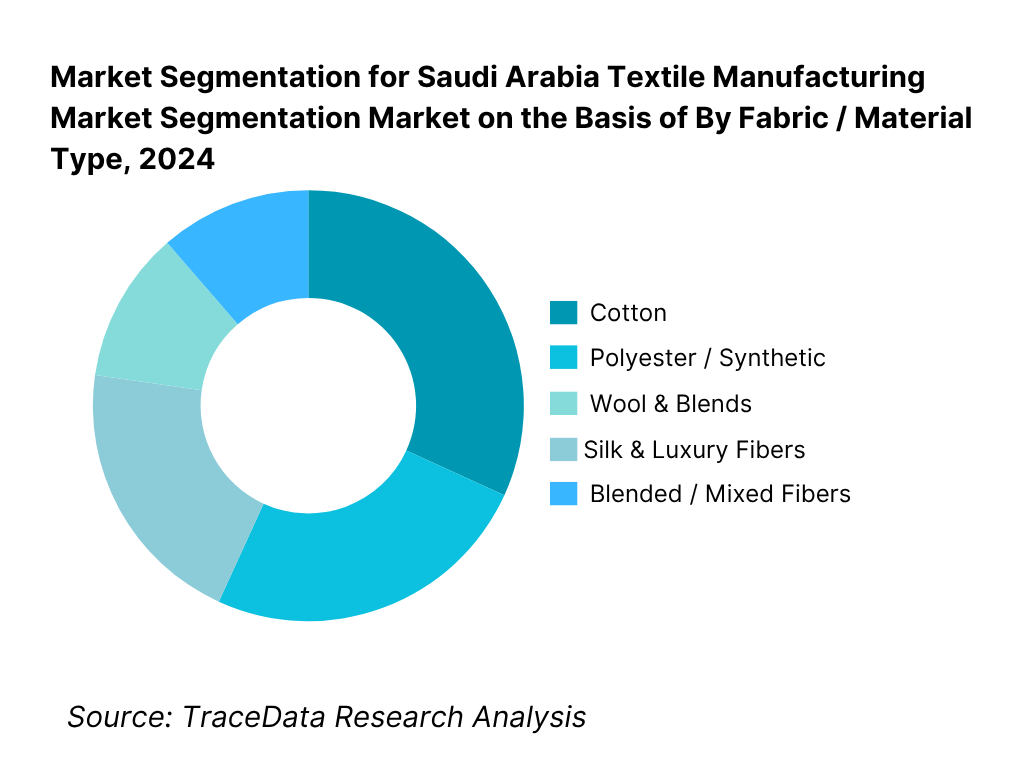

By Fabric / Material Type: Cotton fabric / cotton material dominates the material type segment. This is due to cultural preference, higher comfort in hot climates (breathability), widespread application in home textiles, apparel, and traditional garments. Additionally, local demand for cotton garments and home textiles remains strong, supported by local mills that are equipped for cotton spinning/weaving. Synthetic materials such as polyester are growing, particularly for lower-cost fabrics and technical/nonwoven uses, but the natural fibers retain prestige, and in many consumer product lines, cotton remains preferred. The availability of cotton imports combined with infrastructure for cotton fabric production helps this sub-segment maintain dominance.

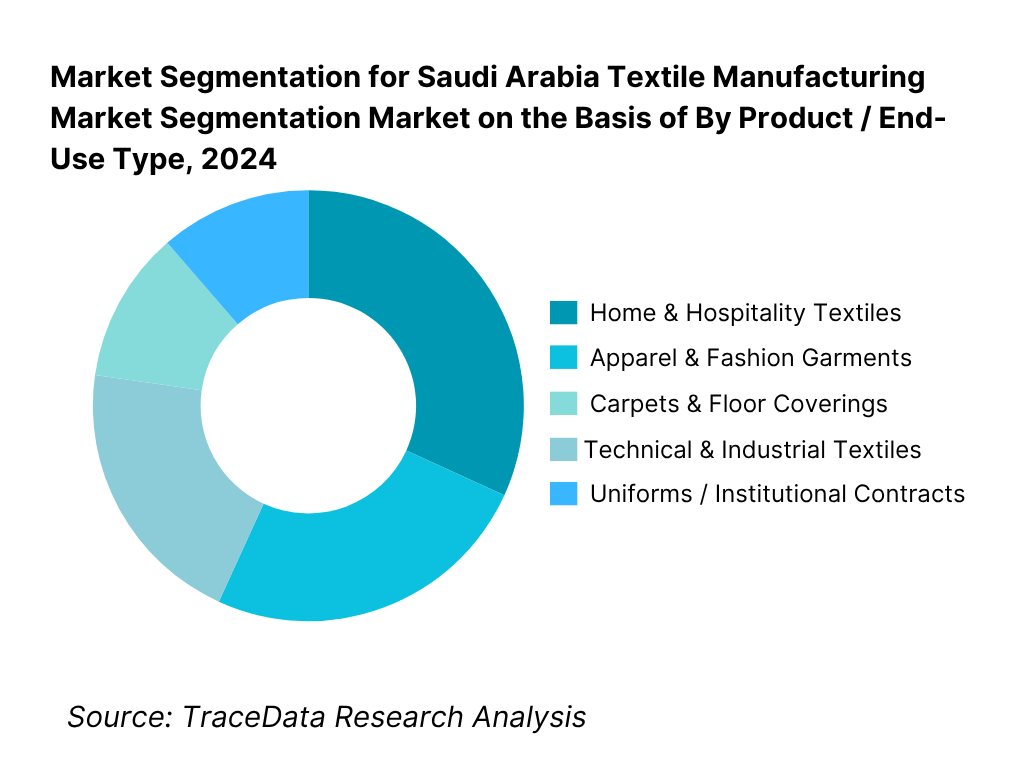

By Product / End-Use Type: The Home & Hospitality Textiles along with Apparel & Fashion Garments are among the leading product / end-use sub-segments. Home textiles (bedding, curtains, towels, carpets) have seen strong demand driven by housing construction, hotel/ hospitality expansion, and renovation activity. Apparel demand remains high due to population growth, rising disposable income, fashion trends, and increased domestic consumption. While carpets & floor coverings are culturally and historically important, their growth is more stable and incremental. On the technical side, nonwoven and industrial textiles are growing rapidly but from a lower base. The familiarity, larger consumer base, and consistent demand for home and apparel textiles give these sub-segments dominant share.

Competitive Landscape in Saudi Arabia Textile Manufacturing Market

The competitive landscape is relatively consolidated with a mix of large integrated players and some specialized manufacturers (nonwovens, carpets, etc.). Key players leverage their scale, distribution networks, and vertical integration to reduce import dependence and improve margins.

Name | Founding Year | Original Headquarters |

Al Abdullatif Industrial Investment Co. | 1981 | Riyadh, Saudi Arabia |

Al-Sorayai Group / Naseej | 1953 | Jeddah, Saudi Arabia |

Saudi German Nonwovens (SGN) | 1994 | Dammam, Saudi Arabia |

Advanced Fabrics (SAAF) | 1997 | Al-Ahsa, Saudi Arabia |

ALYAF Industrial Company | 1992 | Dammam, Saudi Arabia |

GeoNatpet | 2009 | Yanbu, Saudi Arabia |

Saudi Spinning & Weaving Industry Ltd | 1970s | Jeddah, Saudi Arabia |

Saudi Spinning & Textile Mill | 1970s | Riyadh, Saudi Arabia |

Lomar | 2002 | Riyadh, Saudi Arabia |

Al-Aseel | 1986 | Riyadh, Saudi Arabia |

Al Shiaaka | 1990s | Riyadh, Saudi Arabia |

Valleystar Uniforms | 2000s | Jeddah, Saudi Arabia |

Al-Rafa Garment Factory | 1999 | Riyadh, Saudi Arabia |

Aero Filters — Air Solutions Mfg. | 2000s | Dammam, Saudi Arabia |

TexoFib | 2010 | Riyadh, Saudi Arabia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Al Abdullatif Industrial Investment Co.: As one of the largest carpet and rug manufacturers in Saudi Arabia, Al Abdullatif has recently expanded its product portfolio by integrating advanced tufting technologies, enabling higher precision and durability in floor coverings. The company is also strengthening export distribution across GCC countries, positioning itself as a regional leader in home and hospitality textiles.

Saudi German Nonwovens (SGN): A leading nonwoven fabric producer, SGN has ramped up capacity for spunmelt nonwovens to cater to rising domestic demand for medical and hygiene applications. The company has recently secured international certifications for barrier fabrics, improving its competitiveness in export markets and strengthening ties with healthcare procurement agencies.

Advanced Fabrics (SAAF): Specializing in medical and technical nonwovens, SAAF has introduced new high-GSM spunmelt lines to produce superior barrier fabrics for hospitals and hygiene brands. In line with sustainability initiatives, the company has also piloted water-efficient finishing systems to reduce resource intensity in production.

ALYAF Industrial Company: A dominant player in geotextiles, ALYAF has benefited from the surge in large-scale infrastructure and megaprojects across Saudi Arabia. Recently, the company has expanded its portfolio of needle-punched products tailored for road stabilization and landfill projects, reinforcing its role in the technical textiles domain.

GeoNatpet: A relatively newer entrant specializing in PP-based geosynthetics, GeoNatpet has been expanding export operations to GCC and MENA markets. The company has invested in state-of-the-art polymer-to-fiber conversion facilities, enabling greater control over quality and supporting Saudi Arabia’s localization drive in high-performance technical textiles.

What Lies Ahead for Saudi Arabia Textile Manufacturing Market?

The Saudi Arabia textile manufacturing market is anticipated to expand steadily toward 2030, supported by Vision 2030’s localization agenda, diversification of the industrial base, and sustained investments in technical textiles. Growth will be reinforced by rising domestic consumption, infrastructure-driven demand for geotextiles, and healthcare-driven requirements for medical nonwovens, creating a robust long-term outlook for the sector.

Rise of Technical and Industrial Textiles: The future landscape of Saudi Arabia’s textile industry is expected to tilt more toward technical textiles, such as geosynthetics for construction and nonwovens for healthcare. Large-scale infrastructure projects and expanding hospital networks will be the key drivers fueling this structural shift.

Focus on Sustainable Production: With mounting environmental compliance requirements and water-intensive finishing operations, manufacturers will increasingly adopt water recycling, zero-liquid discharge systems, and energy-efficient machinery. This shift will help align production with both global sustainability standards and national regulatory expectations.

Expansion of Localization and Import Substitution: Domestic textile production is projected to reduce reliance on imports of fabrics and uniforms as industrial licensing and investment in integrated mills accelerate. Local players will gain advantage by meeting procurement thresholds under local content policies, boosting competitiveness in government and institutional tenders.

Leveraging Digitalization and Automation: The use of automated looms, digital textile printing, and AI-driven quality control systems will expand, raising efficiency and reducing dependence on skilled manual operators. This adoption of Industry 4.0 tools will allow mills to align with modern supply chain requirements and enhance export competitiveness.

Saudi Arabia Textile Manufacturing Market Segmentation

By Process

Spinning (ring, open-end/rotor)

Weaving (air-jet, rapier, projectile)

Knitting (circular, warp/raschel, flat)

Nonwovens (spunbond, spunmelt/SMMS, meltblown, needle-punched)

Finishing & Dyeing (bleaching, dyeing, printing—rotary/digital, coating/lamination)

By Fiber / Polymer

Cotton

Polyester (PET)

Polypropylene (PP)

Viscose/Rayon

Nylon/Polyamide

Blends (cotton-poly, PET-viscose, etc.)

Technical fibers (aramid, glass, carbon—niche/industrial)

By Product Type

Yarn & Threads

Woven Fabrics (greige, dyed/printed)

Knitted Fabrics (single jersey, interlock, rib)

Nonwovens (medical/hygiene, filtration media, wipes)

Carpets & Rugs (tufted, woven, BCF)

Garments & Uniforms (workwear, thobes, hospitality)

Geotextiles & Industrial Textiles (needle-punched, woven geo, coated)

By End-Use / Application

Apparel & Fashion

Home & Hospitality (bedding, towels, curtains)

Healthcare & Hygiene (PPE, drapes, gowns, disposables)

Construction & Geotechnical (roads, landfills, drainage)

Automotive & Industrial (filtration, seat fabrics, insulation)

By Customer Type / Channel

Institutional & Government Procurement (uniforms, hospitals, municipalities)

B2B Distributors & Traders (GCC/MENA lanes)

Brands/Retail (organized retail, private label)

E-Commerce & D2C (apparel/home)

OEM/Contract Manufacturing

Players Mentioned in the Report:

Al Abdullatif Industrial Investment Company

Al-Sorayai Group / Naseej

Saudi German Nonwovens (SGN)

Advanced Fabrics (SAAF)

ALYAF Industrial Company

GeoNatpet

Saudi Spinning & Weaving Industry Ltd

Saudi Spinning & Textile Mill

Lomar

Al-Aseel

Al Shiaaka

Valleystar Uniforms

Al-Rafa Garment Factory

Aero Filters — Air Solutions Mfg.

TexoFib

Key Target Audience

Chief Investment Officers and Investment & Venture Capitalist Firms investing in industrial manufacturing and technical textiles

Government and Regulatory Bodies

Textile Mill Owners / Operations Directors in integrated spinning/weaving/nonwovens plants

Apparel Brands / Home Textile Brands looking to localize sourcing

Institutional Buyers (hotel chains, hospital networks, government uniforms)

Polymeric Raw Material Suppliers (PP, PET, cotton traders)

Export & Trade Promotion Agencies (Saudi Export Development Authority, chambers of commerce)

Logistics & Infrastructure Investors (industrial parks, finishing & dyeing hubs)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis (local integrated mills vs. outsourced dye/finishing; margins, preference, strengths/weaknesses for spinning, weaving, knitting, nonwovens)

4.2. Revenue Streams (domestic sales, GCC exports, institutional contracts, government procurement, private labels, OEM supply)

4.3. Business Model Canvas (integrated fiber-to-garment; contract nonwoven supply; branded carpets & uniforms; D2C apparel)

5.1. Freelance Tailors/Artisans vs. Full-Time Organized Mills (unorganized apparel stitching vs. large-scale integrated plants)

5.2. Investment Model (SIDF concessional loans, JV with foreign tech partners, private equity in nonwovens, industrial city incentives)

5.3. Comparative Analysis (procurement by state projects & megacities vs. private retail groups)

5.4. Textile Budget Allocation (large conglomerates vs. SMEs in apparel, uniforms, and carpets)

8.1. Revenues (historical, import-substitution-adjusted; in USD Bn)

9.1. By Market Structure (Integrated mills vs. outsourced finishing; in value %)

9.2. By Process (Spinning; weaving; knitting; nonwoven-spunbond/spunmelt/needle-punched; finishing & dyeing; in value %)

9.3. By Product Type (yarn & threads; woven/knitted fabrics; carpets/rugs; nonwovens for hygiene/medical/filtration; uniforms & apparel; in value %)

9.4. By Industry Verticals (Apparel & fashion; home & hospitality; healthcare & hygiene; construction & geotechnical; automotive & industrial; in value %)

9.5. By Company Size (Large integrated; medium enterprises; SMEs)

9.6. By End-User (Institutional procurement, B2B distributors, retail, e-commerce/private label, export buyers)

9.7. By Open vs. Customized Production (standard vs. tailored uniforms/carpets)

9.8. By Region (Riyadh, Makkah/Jeddah, Eastern Province, Madinah/Yanbu, others)

10.1. Corporate/Institutional Buyer Landscape (EPCs, healthcare providers, hotels, government agencies, retailers)

10.2. Textile Sourcing & Decision-Making Process (tenders, import substitution, localization thresholds)

10.3. Performance & ROI of Textile Programs (durability, compliance, cost/benefit in uniforms, geotextiles, hygiene fabrics)

10.4. Gap Analysis Framework (imported vs. local manufacturing)

11.1. Trends & Developments (automation, water recycling, technical textiles adoption, sustainability certifications)

11.2. Growth Drivers (Vision 2030 industrialization, megaproject demand, healthcare hygiene boom, localization incentives, export gateways)

11.3. SWOT Analysis (strengths in feedstock; weaknesses in labor/energy; opportunities in nonwovens; threats from Asia)

11.4. Issues & Challenges (high utility costs, wastewater compliance, cotton import reliance, skills gap)

11.5. Government Regulations (SASO standards, SABER conformity, Made in Saudi branding, LCGPA local content thresholds)

12.1. Market Size & Future Potential (medical, filtration, geotextiles)

12.2. Business Models & Revenue Streams (B2B hygiene supply, project-based geotextiles)

12.3. Delivery Models & Types (spunmelt, spunbond, needle-punched, meltblown)

15.1. Market Share of Key Players (carpets vs. nonwovens vs. apparel)

15.2. Benchmark of Key Competitors (company overview, USP, strategies, business model, capacity, revenues, pricing, technology, major clients, certifications, recent developments)

15.3. Operating Model Analysis Framework (integrated vs. specialized)

15.4. Gartner Magic Quadrant (vision vs. execution)

15.5. Bowman’s Strategic Clock (cost leadership vs. differentiation vs. focus in textiles)

16.1. Revenues (USD Bn, projections)

17.1. By Market Structure (integrated vs. outsourced)

17.2. By Process (spinning; weaving; knitting; nonwoven; finishing)

17.3. By Product Type (yarn; fabrics; carpets; nonwovens; garments)

17.4. By Industry Verticals (apparel; home; healthcare/hygiene; construction/geotechnical; automotive/industrial)

17.5. By Company Size (large, medium, SMEs)

17.6. By End-User (institutional, retail, export, e-commerce)

17.7. By Open vs. Customized Production (open stock vs. tailored orders)

17.8. By Region (Riyadh, Makkah/Jeddah, Eastern Province, Madinah/Yanbu, others)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Saudi Arabia Textile Manufacturing Market. On the supply side, this includes polymer producers, fiber & yarn spinners, fabric manufacturers, nonwoven producers, dyeing/finishing houses, machinery/chemical suppliers, and logistics operators. On the demand side, this covers apparel brands, home & hospitality buyers, government and institutional uniform contracts, healthcare networks, infrastructure/EPC firms for geotextiles, and export houses. Based on this mapping, we will shortlist leading 5–6 textile manufacturers in the country by evaluating their production capacity, certifications, financial information, client base, and regional reach. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like total installed spinning capacity, number of weaving/knitting looms, nonwoven line throughput, import–export flows by HS codes, demand from apparel/home/technical segments, and compliance with SASO and SABER regulations. We supplement this with detailed examinations of company-level data, relying on sources such as press releases, factory brochures, tender filings, and audited financials. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, plant managers, procurement heads, and institutional buyers representing various Saudi textile mills and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate output contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach companies as potential buyers. This enables us to validate production capacity, lead times, and order book details, corroborating this information against what is available in secondary databases. These interactions also provide a comprehensive understanding of revenue streams, production processes, compliance cycles, and client categories.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the process. Company-level production throughput is reconciled with national import–export statistics and domestic demand indicators, while utilization factors and scrap rates are stress-tested against industry norms. Any discrepancies are resolved by triangulating between desk research and interview data. This ensures that the final estimates for the Saudi Arabia Textile Manufacturing Market are both consistent and validated.

FAQs

01 What is the potential for the Saudi Arabia Textile Manufacturing Market?

The Saudi Arabia Textile Manufacturing Market holds significant potential, with the sector valued at around USD 9.5–9.6 billion in 2024 according to government and trade reports. Its potential is underpinned by Vision 2030 localization programs, which drive import substitution in fabrics, uniforms, and home textiles. Rising demand for apparel, hospitality textiles, and technical fabrics such as nonwovens and geotextiles further strengthens this potential. With steady industrial expansion and institutional demand from healthcare, infrastructure, and hospitality, the market is positioned to grow as a regional manufacturing hub.

02 Who are the Key Players in the Saudi Arabia Textile Manufacturing Market?

The Saudi Arabia Textile Manufacturing Market features several key players, including Al Abdullatif Industrial Investment Company, Al-Sorayai Group (Naseej), Saudi German Nonwovens (SGN), Advanced Fabrics (SAAF), and ALYAF Industrial Company. These companies dominate due to their scale, vertical integration, and strong distribution channels. Other notable players such as GeoNatpet, Saudi Spinning & Weaving Industry, Lomar, and Al-Aseel enhance the industry’s competitiveness by focusing on specialized segments like geotextiles, apparel, and uniforms.

03 What are the Growth Drivers for the Saudi Arabia Textile Manufacturing Market?

The primary growth drivers include the expansion of the industrial base, with over 11,800 factories in operation and new licensing supporting textile clusters; logistics strength with more than 27 million tons of cargo handled in December 2024 alone through Saudi ports; and institutional demand from healthcare, which operates 499 hospitals nationwide, fueling requirements for uniforms, linens, and nonwovens. Additionally, ongoing megaprojects increase demand for carpets, technical textiles, and geotextiles used in infrastructure development.

04 What are the Challenges in the Saudi Arabia Textile Manufacturing Market?

The Saudi Arabia Textile Manufacturing Market faces challenges including water and environmental constraints, as desalination output exceeds 11.5 million m³/day, raising compliance costs for dyeing and finishing units. The sector also depends on imported cotton worth over USD 35 million annually, exposing it to global price and logistics fluctuations. Another challenge is the skilled labor gap, with only 175,000+ students in technical colleges and a mismatch between graduate profiles and specialized textile needs, slowing adoption of advanced looms and nonwoven technologies.