Singapore Logistics and Warehousing Market Outlook to 2029

By Service Segments (Freight Forwarding, Warehousing, Courier & Parcel, Value-Added Services), By Mode of Transport (Land, Air, Sea), By End User (Retail, Manufacturing, Pharmaceuticals, E-commerce, Others), and By Region

- Product Code: TDR0196

- Region: Asia

- Published on: June 2025

- Total Pages: 80

Report Summary

The report titled “Singapore Logistics and Warehousing Market Outlook to 2029 – By Service Segments (Freight Forwarding, Warehousing, Courier & Parcel, Value-Added Services), By Mode of Transport (Land, Air, Sea), By End User (Retail, Manufacturing, Pharmaceuticals, E-commerce, Others), and By Region” provides a comprehensive analysis of the logistics and warehousing market in Singapore.

The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing market. The report concludes with future market projections based on revenue, segmented by service type, transport mode, region, and end-use sectors, including cause-and-effect relationships and success case studies highlighting major opportunities and caution areas.

Singapore Logistics and Warehousing Market Overview and Size

The Singapore logistics and warehousing market was valued at SGD 10.8 Billion in 2023, driven by the city-state’s strategic geographical location, robust port and airport infrastructure, and rising demand from e-commerce and cross-border trade in ASEAN. The market is dominated by players such as DB Schenker, DHL, YCH Group, Kuehne + Nagel, and SATS Ltd, known for their extensive service offerings and integrated supply chain solutions.

In 2023, DHL launched its Smart Warehouse initiative in Singapore, incorporating AI-driven inventory management and robotics. This is aimed at enhancing last-mile efficiency and meeting the increasing demands of omni-channel retailing. Jurong, Changi, and Tuas remain key logistics hubs due to proximity to industrial estates, the port, and airport.

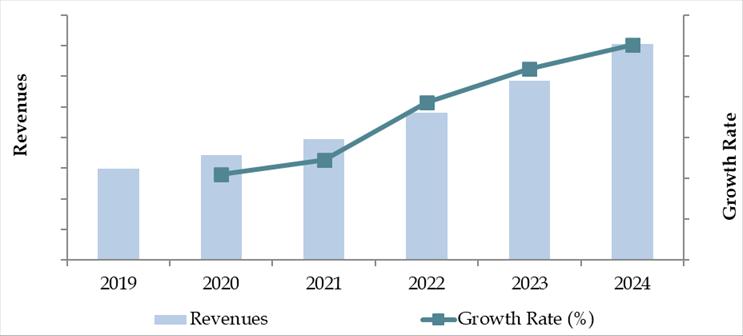

Market Size for Singapore Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of the Singapore Logistics and Warehousing Market:

Geostrategic Location & Port Infrastructure: Singapore ranks among the world’s busiest transshipment hubs, facilitating global trade between Asia-Pacific and Europe. In 2023, the Port of Singapore handled over 37 million TEUs, making it a pivotal point for logistics operations in Southeast Asia.

E-commerce & Digital Trade Expansion: The boom in e-commerce, especially B2C and B2B platforms, has significantly increased the need for fulfillment centers and last-mile delivery services. In 2023, Singapore’s e-commerce market surpassed SGD 9 Billion, driving demand for real-time tracking, micro-warehousing, and express delivery.

Government Initiatives & Smart Logistics Hubs: Initiatives such as the Logistics Industry Digital Plan (IDP) and development of the Tuas Port and Jurong Innovation District are transforming Singapore into a high-tech logistics hub. These programs promote automation, data analytics, and workforce training for digital logistics, enabling SMEs and MNCs alike.

Which Industry Challenges Have Impacted the Growth for Singapore Logistics and Warehousing Market

High Operating Costs and Space Constraints: Singapore’s premium land value and high labor costs significantly increase warehousing and logistics expenses. According to 2023 estimates, warehouse rentals in prime industrial zones such as Tuas and Changi increased by 6% YoY, posing challenges for smaller logistics firms. Additionally, limited space availability in the city-state restricts expansion opportunities, particularly for large-scale fulfillment centers.

Talent Shortage and Workforce Aging: The logistics industry continues to face a shortage of skilled manpower, particularly in areas like cold chain handling, automation, and last-mile operations. With over 30% of logistics workers aged above 50, the aging workforce is becoming a concern. The challenge is compounded by the need for continual upskilling to handle emerging technologies such as warehouse robotics and AI-based routing.

Last-Mile Delivery Inefficiencies: As e-commerce surges, last-mile delivery has become a major cost and operational challenge. In 2023, logistics companies in Singapore reported last-mile delivery contributing up to 41% of total shipping costs, primarily due to urban congestion, narrow delivery windows, and high expectations for same-day fulfillment.

What are the Regulations and Initiatives which have Governed the Market:

Smart Logistics and Industry 4.0 Roadmap: The Infocomm Media Development Authority (IMDA) and Enterprise Singapore have rolled out initiatives encouraging logistics firms to adopt digital solutions and automation. The roadmap includes support for robotics integration, AI-based demand planning, and digital documentation. By end-2023, over 200 logistics SMEs had adopted new technologies through government grants and co-funding schemes.

Sustainability Regulations: Under the Singapore Green Plan 2030, logistics providers are being encouraged to transition towards low-emission fleets and sustainable warehousing. Regulatory frameworks now mandate sustainability disclosures for large logistics operators and incentivize the use of EVs and solar-powered warehouses. In 2023, about 15% of Singapore’s major warehouse space was operating under green-certified standards.

Free Trade Agreements (FTAs) and Customs Simplification: Singapore’s extensive network of FTAs, including RCEP and CPTPP, along with Singapore Customs' TradeFIRST accreditation scheme, has enhanced the speed and ease of cross-border logistics. As of 2023, more than 2,000 logistics entities benefited from faster customs clearance, enabling smoother international trade flows.

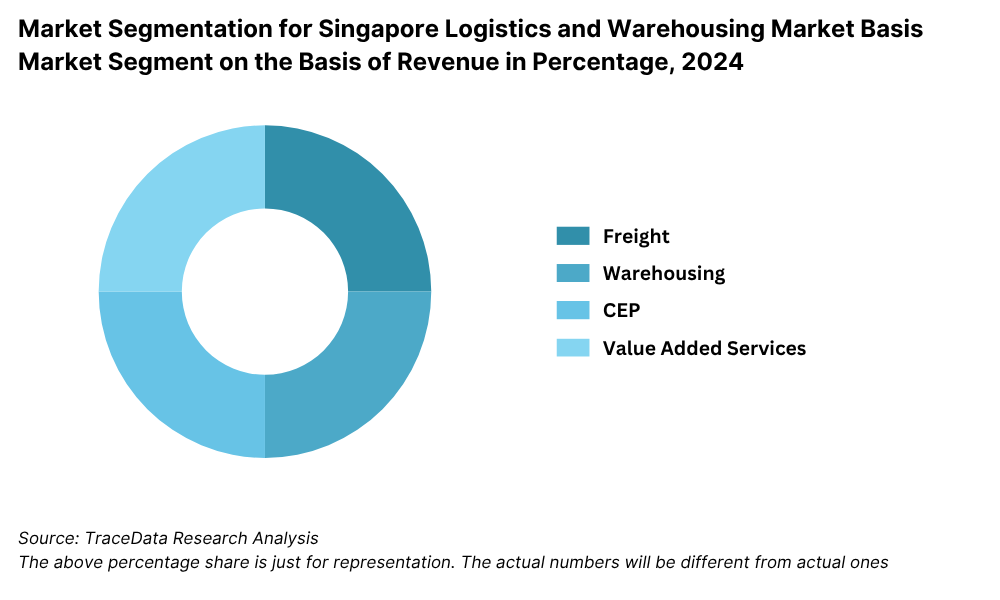

Singapore Logistics and Warehousing Market Segmentation

By Market Structure: The organized segment dominates the logistics market in Singapore, accounting for a major share due to high levels of compliance, integration with global supply chains, and adoption of digital technologies. Multinational and regional logistics providers operate through formal networks offering comprehensive solutions including warehousing, freight forwarding, customs clearance, and value-added services. The unorganized segment includes small fleet operators and local courier businesses, catering primarily to domestic, last-mile deliveries and niche sectors. However, their market share is limited due to scalability constraints and regulatory challenges.

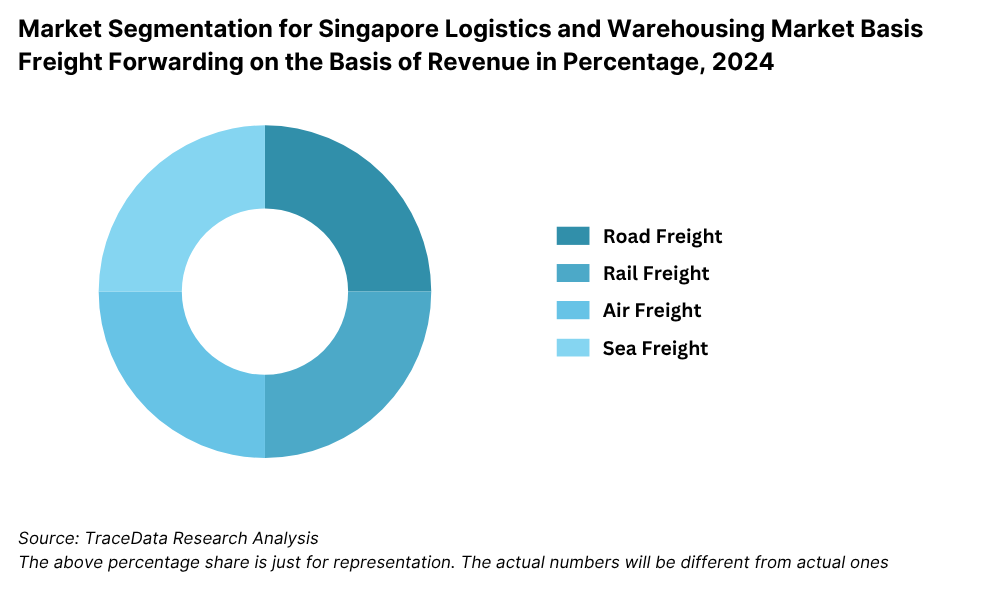

By Mode of Transport: The sea transport segment leads due to Singapore’s strategic maritime position and world-class port infrastructure. The Port of Singapore is one of the busiest globally, making maritime logistics a key driver of the market. Air transport holds a significant share due to the presence of Changi Airport, a leading air cargo hub in the region. Land transport, although smaller in share, plays a vital role in last-mile and intra-country movement, particularly for e-commerce and retail fulfillment.

By End-User Industry: The retail and e-commerce sectors form the largest end-user segment, driven by rising consumer demand for quick delivery and high service reliability. Manufacturing and electronics industries utilize logistics for supply chain coordination and export management. Pharmaceutical and healthcare sectors, with stringent requirements for cold storage and compliance, are growing in importance. Other industries include automotive, aerospace, and food & beverage, each requiring customized logistics solutions.

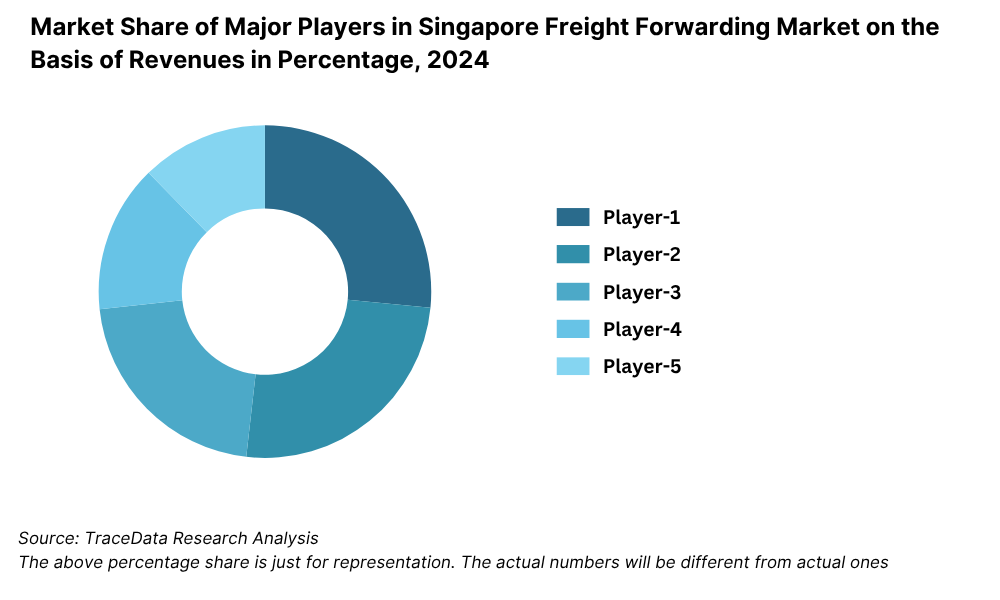

Competitive Landscape in Singapore Logistics and Warehousing Market

The Singapore logistics and warehousing market is moderately concentrated, with several large international and regional players leading the market. The sector has seen increasing digital transformation, automation, and strategic partnerships, especially in the wake of e-commerce growth and supply chain reconfiguration. Major players such as DHL, DB Schenker, YCH Group, Kuehne + Nagel, SATS Ltd, FedEx, and Ninja Van offer integrated logistics, cross-border services, and last-mile delivery solutions.

| Company Name | Founding Year | Original Headquarters |

| SATS Ltd. (Food & Logistics Division) | 1972 | Singapore |

| YCH Group | 1955 | Singapore |

| SingPost Logistics | 1819 (Logistics arm active ~2000s) | Singapore |

| CWT Limited | 1970 | Singapore |

| ST Logistics Pte Ltd. | 1970 | Singapore |

| Poh Tiong Choon Logistics Ltd. | 1950 | Singapore |

| C&P Holdings Pte Ltd. | 1970 | Singapore |

| Rhenus Logistics Singapore | 1912 (SG: ~2000s) | Holzwickede, Germany |

| DHL Supply Chain Singapore | 1969 (SG: ~1970s) | Bonn, Germany |

| Kuehne + Nagel Singapore | 1890 (SG: ~1970s) | Schindellegi, Switzerland |

| DB Schenker Singapore | 1872 (SG: ~1970s) | Essen, Germany |

| CEVA Logistics Singapore | 2006 (SG: ~2007) | Marseille, France |

| FedEx Express Singapore | 1971 (SG: ~1980s) | Memphis, USA |

| UPS Singapore | 1907 (SG: ~1988) | Atlanta, USA |

| Nippon Express Singapore | 1937 (SG: ~1950s) | Tokyo, Japan |

| Agility Logistics Singapore | 1979 (SG: ~1990s) | Kuwait City, Kuwait |

| Maersk Singapore Pte. Ltd. | 1904 (SG: ~1970s) | Copenhagen, Denmark |

| Yusen Logistics Singapore | 1955 (SG: ~1980s) | Tokyo, Japan |

Some of the recent competitor trends and key developments include:

DHL: In 2023, DHL launched its Smart Warehouse in Singapore, equipped with AI-based inventory optimization and autonomous mobile robots. The facility has improved picking accuracy by 30% and enhanced warehouse throughput for key clients in retail and pharma.

DB Schenker: The company expanded its regional contract logistics hub at Tampines Logistics Park, adding automated racking systems and real-time tracking solutions for high-value electronics. Schenker reported 12% YoY revenue growth from ASEAN operations centered in Singapore.

YCH Group: Singapore’s leading homegrown logistics company, YCH has focused on building regional connectivity through its ASEAN Logistics Hub. In 2023, it partnered with ST Engineering to implement IoT-based fleet and temperature monitoring across its fleet, enhancing reliability for cold chain logistics.

Kuehne + Nagel: The firm continues to dominate in freight forwarding, especially air and ocean freight. Its KN PharmaChain solution, certified by IATA CEIV, positioned the company as a leading cold chain provider in Singapore, particularly for pharmaceuticals and biotech exports.

SATS Ltd: SATS has invested heavily in automated air freight handling at Changi Airport, increasing its cargo capacity by 20%. The company’s focus on food logistics and airline catering makes it a niche but essential player in Singapore’s logistics ecosystem.

Ninja Van: A last-mile delivery disruptor, Ninja Van handled over 1 million parcels daily in 2023 across Southeast Asia. In Singapore, the company upgraded its sorting hubs and piloted AI-based route optimization, reducing delivery times by 18%.

FedEx Express: FedEx strengthened its express delivery services by introducing Same Day City service in Singapore and rolled out paperless trade solutions for SMEs. In 2023, FedEx Singapore operations saw a double-digit growth in cross-border e-commerce deliveries.

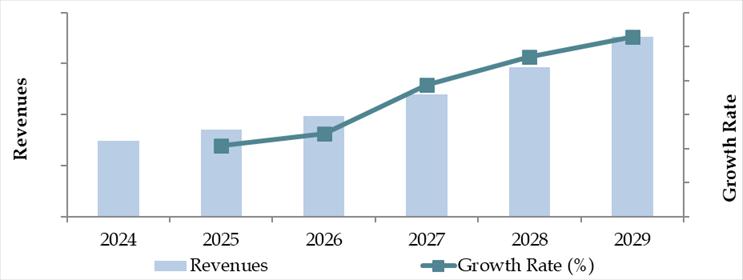

What Lies Ahead for Singapore Logistics and Warehousing Market?

The Singapore logistics and warehousing market is projected to witness steady and resilient growth by 2029, supported by regional trade integration, digital transformation, and increasing demand for high-value logistics services. The market is expected to register a healthy CAGR over the forecast period, with Singapore continuing to position itself as a regional logistics and supply chain innovation hub.

Expansion of Cross-Border E-commerce Logistics: With ASEAN e-commerce expected to exceed USD 230 billion by 2029, Singapore is likely to see rising demand for cross-border fulfillment services, particularly in B2C and D2C segments. Its established free trade agreements and efficient customs clearance processes make it an ideal transshipment and regional distribution center.

Rise of Cold Chain and Pharma Logistics: The pharmaceutical and life sciences sectors will increasingly rely on temperature-controlled and validated logistics solutions, particularly as biologics and clinical trials expand in the region. Singapore is well-placed to benefit from this trend through its specialized facilities and IATA CEIV Pharma certifications.

Adoption of Automation and Robotics in Warehousing: Continued investment in automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), and AI-based warehouse management software will improve space utilization, order accuracy, and labor productivity. By 2029, over 35% of warehousing space is expected to operate with some level of automation.

Focus on Green Logistics and Net-Zero Goals: In alignment with the Singapore Green Plan 2030, logistics providers will increasingly adopt electric vehicles, solar-powered warehouses, and carbon-neutral delivery models. ESG compliance and environmental credentials will become key differentiators for logistics firms in securing enterprise and government contracts.

Future Outlook and Projections for Singapore Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Singapore Logistics and Warehousing Market Segmentation

- By Market Structure:

o Global Logistics Providers

o Regional 3PL Companies

o Local Fleet Operators

o E-commerce Fulfillment Providers

o Integrated Logistics Hubs

o Organized Sector

o Unorganized Sector

o Last-Mile Delivery Players - By Mode of Transport:

o Sea Freight

o Air Freight

o Land Transport

o Multimodal Transport - By End-User Industry:

o Retail & E-commerce

o Pharmaceuticals & Healthcare

o Food & Beverage

o Electronics & Electricals

o Automotive

o Aerospace

o Manufacturing & Industrial Goods - By Service Segment:

o Freight Forwarding

o Warehousing & Storage

o Courier & Parcel Delivery

o Cold Chain Logistics

o Value-Added Services (e.g., labelling, kitting, packaging)

o Customs Clearance & Trade Compliance - By Technology Adoption:

o Manual/Traditional Operations

o Digitized Tracking & WMS

o Semi-Automated Warehouses

o Fully Automated Warehousing (AS/RS, AMRs) - By Region:

o Jurong Industrial Zone

o Tuas Logistics Hub

o Changi & East Region

o Central Region

o North Region

Players Mentioned in the Report:

Freight Forwarding Companies

- NRS Logistics

- Beehive Fulfillment

- J Logistics

- Global Airfreight International

- Singapore Post

- e-Ship Pro

- RAK Logistics

- CMA CGM Logistics

- Fastrans Forwarding

- WE Freight

- AM Global

- Baylink Logistics

- Best Global

- LCH Logistics

- Aspac Aircargo Services

- GMT Transpeed

- Star Concord

Warehousing Companies

- Yamato Singapore (contract logistics)

- Pacific Logistics Group

- Noatum Logistics

- Omni Logistics

- Singapore Post (SP eCommerce)

- DB Schenker

- Kuehne + Nagel

- DHL Global Forwarding

E‑Commerce Logistics Companies

- Beehive Fulfillment

- Omni Logistics

- Ninja Van (cold-chain service)

- Singapore Post (SP eCommerce)

- Fast & accurate fulfillment and last-mile providers

Express Logistics Companies

- DHL Express

- FedEx

- UPS

- Aramex

Key Target Audience:

- Logistics Service Providers (3PL/4PL)

- E-commerce Companies

- Manufacturing & Pharma Firms

- Government & Regulatory Bodies (e.g., Enterprise Singapore, LTA)

- Real Estate and Industrial Park Developers

- Cold Chain and Warehouse Automation Solution Providers

- Supply Chain Technology Firms

- Research and Development Institutions

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Singapore Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Singapore

4.4. LPI Index of Singapore and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Singapore Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Singapore

5.2. Current Scenario for Logistics Infrastructure in Singapore

5.3. Road Infrastructure in Singapore including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Singapore including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Singapore including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Singapore including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Singapore Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Singapore 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Singapore

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Singapore Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Singapore Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Singapore Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Singapore Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Singapore 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Singapore Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Thailand and Singapore), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Singapore Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Singapore Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Singapore 3PL Warehousing Segmentation

9.4.1. Singapore Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Singapore Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Singapore Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Singapore 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Singapore Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Singapore Warehousing Future Market Size on the Basis of Revenues, 2025-2029

9.7. Singapore Warehousing Market Future Segmentation

9.7.1. Singapore Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Singapore Warehousing Revenue By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Singapore Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Singapore CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Singapore CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Singapore CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Singapore CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Singapore E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Singapore CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Singapore CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Singapore CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Singapore Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 logistics providers, warehouse developers, and last-mile delivery companies in the country based upon their financial information, warehousing capacity, fleet size, and service offerings.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like total logistics spending, warehouse occupancy rates, number of market players, freight volumes, pricing models, and service trends. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Singapore Logistics and Warehousing companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate throughput and revenue for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Singapore Logistics and Warehousing Market?

The Singapore logistics and warehousing market is poised for steady growth, reaching a valuation of SGD 10.8 Billion in 2023. This growth is fueled by the country's strategic geographic location, world-class port and airport infrastructure, and the rising demand for efficient supply chain solutions across Southeast Asia. The market’s potential is further enhanced by technological innovation, government-backed smart logistics initiatives, and increasing cross-border e-commerce activities.

2. Who are the Key Players in the Singapore Logistics and Warehousing Market?

The Singapore Logistics and Warehousing Market features several prominent players, including DHL, DB Schenker, YCH Group, and Kuehne + Nagel. These firms dominate due to their integrated logistics capabilities, advanced infrastructure, and strong presence across Southeast Asia. Other key companies include SATS Ltd, Ninja Van, FedEx Express, and SingPost Logistics, each contributing uniquely across segments such as air freight, last-mile delivery, and cold chain logistics.

3. What are the Growth Drivers for the Singapore Logistics and Warehousing Market?

Key growth drivers include the rise in e-commerce and digital trade, regional trade agreements like RCEP, and the development of smart logistics hubs such as Tuas Port. Increasing demand for cold chain and pharmaceutical logistics, adoption of automation in warehouses, and sustainability initiatives aligned with the Singapore Green Plan 2030 also contribute significantly to market expansion.

4. What are the Challenges in the Singapore Logistics and Warehousing Market?

The Singapore Logistics and Warehousing Market faces several challenges, including high real estate and operational costs, limited land for warehouse expansion, and a shortage of skilled labor. Last-mile delivery inefficiencies in urban areas, driven by high expectations and narrow delivery windows, also pose operational hurdles. Moreover, transitioning to green logistics practices and digital transformation can be capital intensive for small and mid-sized firms.