South Africa Auto Finance Market Outlook to 2029

By Market Structure, By Type of Financial Institution (Banks, NBFCs, Captive), By Vehicle Type (New vs Used), By Tenure, By Region, and By Consumer Age Group

- Product Code: TDR0151

- Region: Africa

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “South Africa Auto Finance Market Outlook to 2029 – By Market Structure, By Type of Financial Institution (Banks, NBFCs, Captive), By Vehicle Type (New vs Used), By Tenure, By Region, and By Consumer Age Group” provides a comprehensive analysis of the auto finance market in South Africa. The report covers an overview and genesis of the industry, overall market size in terms of loan disbursals and outstanding credit, segmentation by vehicle type and financer category, trends and developments, regulatory ecosystem, consumer behavior, major challenges, and competitive landscape including company profiles, key developments, and comparative positioning. It concludes with future projections of the market based on credit growth, auto sales, and interest rate forecasts, as well as key success stories and market risks.

South Africa Auto Finance Market Overview and Size

The South Africa auto finance market reached a valuation of ZAR 97 Billion in total loan disbursals in 2023, supported by rising vehicle demand, an expanding used car ecosystem, and increasing penetration of financial institutions. Major players in the market include Standard Bank Vehicle and Asset Finance, WesBank (FirstRand), Absa Vehicle Finance, Toyota Financial Services, and MFC (a division of Nedbank). These institutions have contributed to the growth of formal auto lending through digital onboarding, flexible loan structures, and customized offerings.

In 2023, WesBank launched a fully online car loan approval system integrated with dealership partners across major metros. The innovation is expected to increase digital penetration among urban millennial borrowers. The Gauteng and Western Cape provinces dominate the market, driven by high-income populations and better access to organized dealerships and bank financing infrastructure.

Market Size for South Africa Auto Finance Industry Size on the Basis of Credit Disbursements in USD Billion, 2018-2024

What Factors are Leading to the Growth of South Africa Auto Finance Market

Economic Rebound and Vehicle Demand: Following the COVID-19 slump, 2021–2023 witnessed a rebound in personal mobility and car ownership aspirations. In 2023, new and used vehicle sales in South Africa crossed 525,000 units, up from 480,000 units in 2021. This directly boosted auto loan demand.

Used Vehicle Financing on the Rise: The high cost of new cars due to currency depreciation and global supply issues has made used cars a preferred choice, especially among first-time car buyers. Used car financing now contributes to over 43% of total loan disbursals, compared to 35% in 2019.

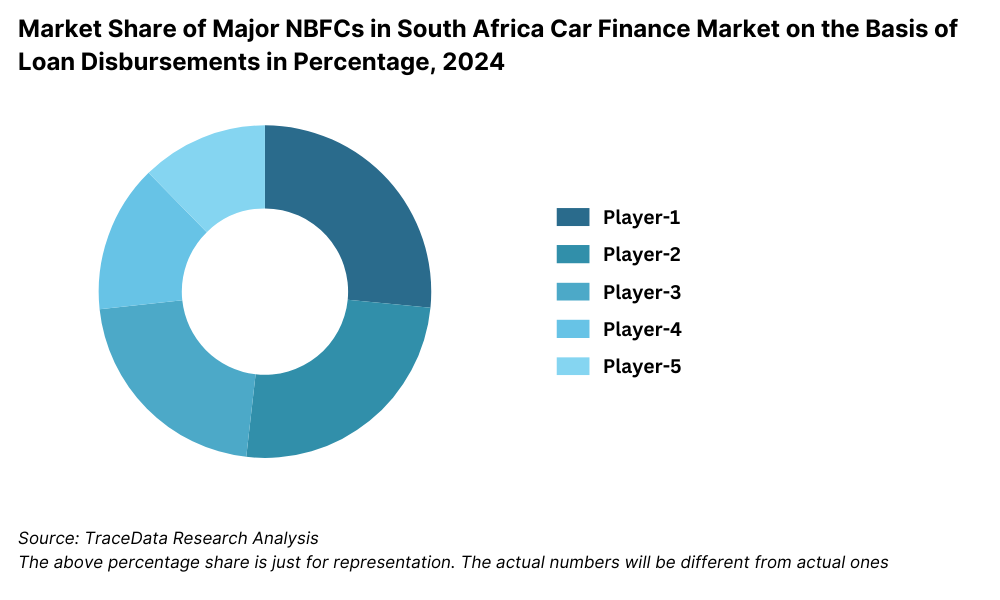

Bank-Led Market with Growing NBFC Interest: Traditional banks dominate the sector, but non-banking financial companies (like SA Taxi Finance) are rapidly expanding in niche areas such as minibus taxi loans and informal segment coverage. In 2023, NBFCs held a 17% market share in auto finance disbursals.

Which Industry Challenges Have Impacted the Growth for South Africa Auto Finance Market

High Default Rates and Credit Risk: One of the significant challenges in the South African auto finance sector is the elevated rate of loan defaults, particularly in the entry-level and used car financing segments. According to 2023 data from the National Credit Regulator (NCR), approximately 34% of vehicle finance accounts were in arrears, affecting the risk appetite of lenders and reducing access to credit for subprime borrowers. This situation has led many financial institutions to tighten their credit approval norms, thereby excluding a large pool of potential customers.

Limited Financing for Used Vehicles: Despite growing demand for used vehicles, financing penetration in the used car segment remains below 50%, primarily due to valuation complexities, lack of collateral assurance, and higher perceived risk. Many banks and formal NBFCs prefer lending for new vehicles, leaving a gap in the market that informal or high-interest lenders attempt to fill—leading to affordability issues for consumers.

Interest Rate Volatility: The repo rate fluctuations by the South African Reserve Bank (SARB) over the past three years have impacted EMIs and loan affordability. In 2022–23, repo rates increased by nearly 200 basis points, pushing average auto loan interest rates close to 12%–13%, significantly dampening demand in the low-to-mid-income segment.

What are the Regulations and Initiatives which have Governed the Market

National Credit Act (NCA): The NCA governs all aspects of vehicle financing in South Africa, including affordability assessments, interest rate ceilings, and consumer protection guidelines. In 2023, more than 25% of vehicle loan applications were rejected due to stringent affordability checks introduced by financial institutions under this regulation, particularly for first-time buyers and gig workers.

Automotive Code of Conduct by Competition Commission: Enforced to promote fair competition between banks, OEMs, and insurers, this regulation aims to prevent anti-competitive practices and promote consumer choice in auto financing and insurance bundling. Implemented in phases since 2021, it requires OEMs and their financial arms to offer non-exclusive financing options at dealerships.

Digital Onboarding and e-KYC Regulations: The Financial Sector Conduct Authority (FSCA) has encouraged e-KYC and digital lending models, reducing documentation burdens and enabling faster loan processing. As of 2023, over 35% of approved auto finance applications were processed via digital verification and onboarding tools.

South Africa Auto Finance Market Segmentation

By Market Structure: The auto finance market in South Africa is predominantly bank-led, with traditional banks accounting for most of the disbursals due to their extensive branch networks, brand credibility, and lower interest rates. Non-Banking Financial Companies (NBFCs) such as SA Taxi Finance are gaining traction in niche segments like minibus taxis and low-income borrowers. Captive finance arms of OEMs such as Toyota Financial Services and Ford Credit provide attractive loan schemes and bundled offerings directly at dealerships, appealing to urban salaried buyers.

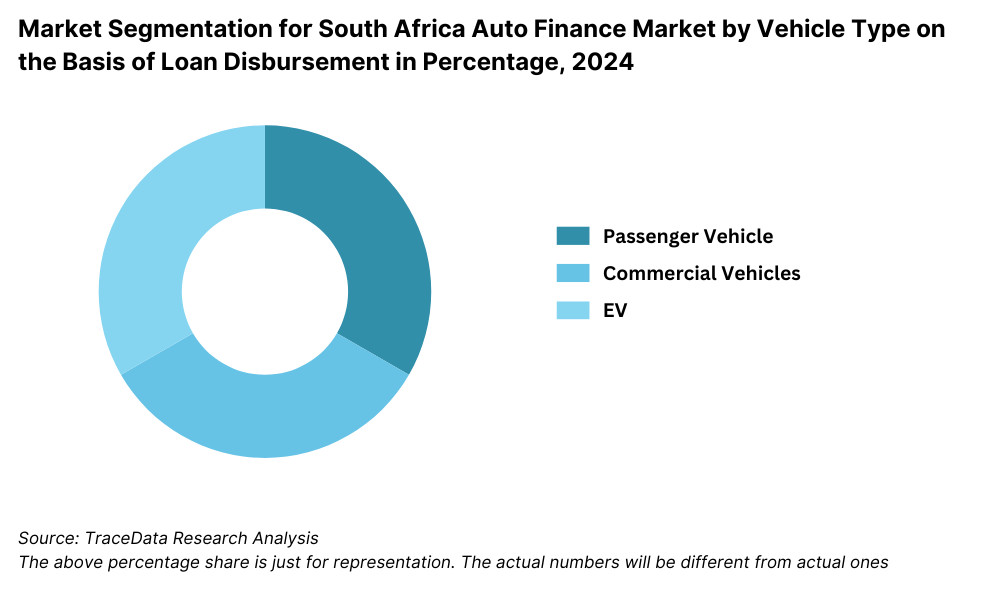

By Vehicle Type: Financing for new vehicles remains the dominant segment, largely driven by formal lenders’ preference for low-risk and high-ticket loans. However, the used vehicle finance segment has grown significantly over the past five years, supported by rising affordability concerns and broader used car market expansion. NBFCs and fintech lenders are more active in financing used vehicles, particularly in semi-urban and informal sectors.

By Loan Tenure: Most vehicle loans in South Africa fall in the 48–60 month tenure bracket, offering a balance between monthly affordability and total interest cost. Short-term loans (less than 36 months) are less common due to higher EMIs, while longer tenures (beyond 72 months) are gaining traction among low-income borrowers via NBFC-led lending.

Competitive Landscape in South Africa Auto Finance Market

The South Africa auto finance market is moderately consolidated, with a few dominant players led by major commercial banks and captive finance entities. However, the growing presence of non-banking financial companies (NBFCs) and digital lending platforms is gradually reshaping the competitive dynamics, especially in underserved and informal segments. Key players include WesBank, Standard Bank Vehicle and Asset Finance, Absa Vehicle Finance, MFC (Nedbank Division), Toyota Financial Services, and SA Taxi Finance.

| Company Name | Founding Year | Original Headquarters |

| WesBank (FirstRand Group) | 1968 | Johannesburg, South Africa |

| MFC (Nedbank Group) | 2006 | Johannesburg, South Africa |

| Standard Bank Vehicle and Asset Finance | 1862 | Johannesburg, South Africa |

| Absa Vehicle Finance | 1991 | Johannesburg, South Africa |

| Investec Vehicle Finance | 1974 | Johannesburg, South Africa |

| Al Baraka Bank Vehicle Finance | 1989 | Durban, South Africa |

| Toyota Financial Services South Africa | 2000 | Sandton, South Africa |

| Volkswagen Financial Services South Africa | 2008 | Sandton, South Africa |

| BMW Financial Services South Africa | 1990 | Midrand, South Africa |

| AutoFin Assist | 2005 | Johannesburg, South Africa |

Some of the recent competitor trends and key information about competitors include:

WesBank: As a market leader in vehicle asset finance, WesBank financed over 160,000 vehicles in 2023, including both passenger and commercial vehicles. Their enhanced dealer integration system and early adoption of AI-driven credit assessment tools have strengthened their underwriting efficiency and turnaround time.

Standard Bank Vehicle and Asset Finance: A dominant bank in South Africa’s VAF space, Standard Bank disbursed more than ZAR 27 billion in vehicle loans in 2023. They expanded their digital onboarding platforms, with over 40% of loans processed through mobile or online applications, showing their digital transformation efforts.

Absa Vehicle Finance: Absa has positioned itself strongly in the used car loan segment by partnering with large dealership networks and offering flexible balloon repayment options. In 2023, they rolled out a new EV financing scheme, aligning with South Africa’s transition to sustainable transport.

MFC (Division of Nedbank): MFC is one of the largest vehicle financers in the used vehicle financing market. In 2023, it financed approximately 100,000 vehicles, with an emphasis on offering competitive rates and quick approvals through strategic dealership tie-ups.

Toyota Financial Services: The captive finance arm of Toyota, it focuses on new car loans and lease options, especially for Toyota Hilux and Corolla Cross buyers. In 2023, they launched a pre-approved loan program that increased dealership-level conversions by 18%.

SA Taxi Finance: Specializing in financing minibus taxis, SA Taxi has created a niche by underwriting loans for vehicles often excluded by traditional banks. In 2023, they financed more than 7,500 taxis and reported a loan book exceeding ZAR 12 billion, highlighting their stronghold in the informal transport sector.

What Lies Ahead for South Africa Auto Finance Market?

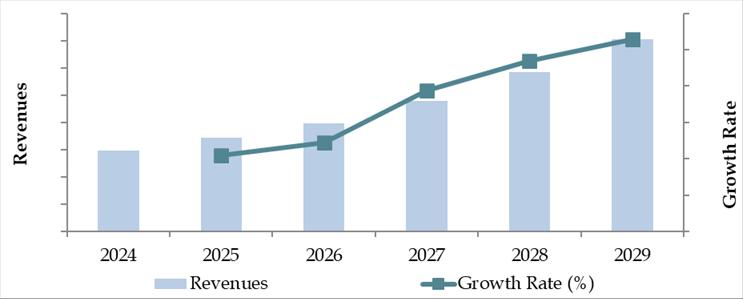

The South Africa auto finance market is projected to witness steady growth through 2029, supported by macroeconomic recovery, increasing vehicle ownership aspirations, and continued digital adoption in the financial services sector. The market is expected to grow at a moderate CAGR, driven by broader access to credit, fintech innovation, and government support for sustainable mobility solutions.

Expansion of Used Vehicle Financing: With affordability becoming a key concern for South African consumers, the used vehicle financing segment is expected to outpace new vehicle loan growth during the forecast period. Lenders are increasingly building risk models specific to used car loans, leading to wider acceptance and better-tailored financing products.

Digitization and AI-Driven Lending: The future of vehicle finance in South Africa will be heavily shaped by digital transformation, including AI-led credit scoring, document-free e-KYC processes, and fully online loan disbursements. By 2029, it is estimated that over 55% of auto loan applications will originate from digital platforms, led by urban youth and salaried professionals.

Emergence of Green Auto Financing: The EV and hybrid vehicle financing segment is expected to gradually scale, aligned with national sustainability goals and proposed government tax relief measures for green mobility. Captive finance companies and select banks are likely to launch green auto loan products, offering lower interest rates and longer tenures to promote eco-friendly vehicle adoption.

Rise of Subscription and Lease Models: Alternative ownership models like vehicle leasing and car subscription services are likely to gain momentum, especially among younger consumers in metro areas. This trend may encourage finance providers to diversify offerings beyond traditional loans, creating flexible packages that blend financing, maintenance, and insurance.

Future Outlook and Projections for South Africa Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

South Africa Auto Finance Market Segmentation

By Market Structure:

Bank-Owned Finance Institutions

Non-Banking Financial Companies (NBFCs)

Captive Finance Companies (OEM-backed)

Organized Finance Institutions (Digital/Online Lenders)

Informal and Micro-Lenders

By Vehicle Type:

New Passenger Vehicles

Used Passenger Vehicles

New Commercial Vehicles (LCV, HCV, Buses)

Used Commercial Vehicles (LCV, HCV, Buses)

Electric Vehicles (EVs) and Hybrids

By Loan Tenure:

Less than 36 Months

36–60 Months

61–84 Months

More than 84 Months

By Type of Lending Entity:

Full-Service Commercial Banks

Captive Auto Finance Firms

Digital-Only Fintech Lenders

Specialized NBFCs (e.g., Minibus Taxi Loans)

By Age of Consumer:

18–24 Years

25–34 Years

35–50 Years

50+ Years

By Region:

Gauteng (Johannesburg, Pretoria)

Western Cape (Cape Town)

KwaZulu-Natal (Durban)

Eastern Cape

Limpopo and North West

Free State and Northern Cape

Players Mentioned in the Report (Banks):

- Absa Bank

- Standard Bank

- Nedbank (via MFC)

- First National Bank (FNB)

- Capitec Bank

- Investec

- Al Baraka Bank

Players Mentioned in the Report (NBFCs):

- WesBank

- RCS

- TFS Finance

- Jumo

- Lula

- Retail Capital

- Paymenow

- Letshego

Players Mentioned in the Report (Captive):

- Toyota Financial Services South Africa

- Volkswagen Financial Services South Africa

- BMW Financial Services South Africa

- Mercedes-Benz Financial Services South Africa

- Volvo Financial Services South Africa

- Stellantis Financial Services South Africa

Key Target Audience:

Auto Finance Companies

Commercial Banks and NBFCs

OEM Captive Finance Arms

Car Dealership Networks

Online Lending Platforms and Aggregators

Insurance and Telematics Companies

South African Reserve Bank (SARB)

National Credit Regulator (NCR)

Automotive Industry Development Centre (AIDC)

Consumer Credit Advocacy Groups

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in South Africa by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for South Africa Car Finance Market

11.2. Growth Drivers for South Africa Car Finance Market

11.3. SWOT Analysis for South Africa Car Finance Market

11.4. Issues and Challenges for South Africa Car Finance Market

11.5. Government Regulations for South Africa Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in South Africa Car Finance Market, 2024

17.2. Market Share of Key NBFCs in South Africa Car Finance Market, 2024

17.3. Market Share of Key Captive in South Africa Car Finance Market, 2024

17.4. Benchmark of Key Competitors in South Africa Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for South Africa Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 lenders in the country based upon their financial information, disbursal capacity, customer base, and operational coverage.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like loan disbursal volumes, number of market players, product-wise penetration, interest rate trends, and demand across vehicle segments. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various South Africa Auto Finance Market entities and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate loan disbursal volumes for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue models, credit processes, risk mitigation strategies, tenure structures, and rate offerings.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the South Africa Auto Finance Market?

The South Africa Auto Finance Market holds strong potential for sustained growth, reaching a valuation of ZAR 97 Billion in total loan disbursals in 2023. This momentum is driven by rising vehicle ownership demand, increasing urban mobility needs, and deeper credit penetration across used vehicle segments. The market’s future is also supported by digital innovation, regulatory support for green vehicle finance, and expanding financial inclusion initiatives targeting underbanked consumers.

2. Who are the Key Players in the South Africa Auto Finance Market?

The South Africa Auto Finance Market is led by major banks and financial institutions including WesBank (FirstRand), Standard Bank Vehicle and Asset Finance, Absa Vehicle Finance, MFC (a division of Nedbank), and Toyota Financial Services. Other significant contributors include SA Taxi Finance, Merchant West, and emerging digital lenders such as Planet42 and JUMO.

3. What are the Growth Drivers for the South Africa Auto Finance Market?

Key growth drivers include the rebound in vehicle sales post-pandemic, increasing reliance on formal credit channels, and the growing demand for used vehicle financing due to affordability constraints. The expansion of digital lending ecosystems, favorable demographics (especially urban youth), and government support for EV and hybrid financing also contribute to long-term growth.

4. What are the Challenges in the South Africa Auto Finance Market?

Challenges include high loan default rates in subprime segments, limited credit access for informal sector borrowers, and relatively low financing penetration in the used vehicle market. Volatile interest rates, regulatory tightening on affordability checks, and limited adoption of green vehicle finance products further pose hurdles to market expansion.