South Africa Cold Chain Market Outlook to 2029

By Market Structure, By Key Players, By Temperature Types, By Product Types, and By Region.

- Product Code: TDR001

- Region: Africa

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “South Africa Cold Chain Market Outlook to 2029 - By Market Structure, By Key Players, By Temperature Types, By Product Types, and By Region.” provides a comprehensive analysis of the cold chain market in South Africa. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of Key players in Cold Chain Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

South Africa Cold Chain Market Overview and Size

The South Africa cold chain market reached a valuation of ZAR 15 Billion in 2023, driven by the increasing demand for temperature-sensitive products, expanding retail and pharmaceutical sectors, and improving logistics infrastructure. Major players such as Imperial Logistics, CCS Logistics, Value Logistics, and Grindrod Intermodal dominate the market with their robust infrastructure, advanced technology, and customer-focused services.

In 2023, Imperial Logistics expanded its warehousing capacity by launching a new facility dedicated to cold storage, catering to the rising demand for cold chain logistics in the food and pharmaceutical sectors. Key markets include Johannesburg and Cape Town due to their strategic roles in the trade and logistics sectors.

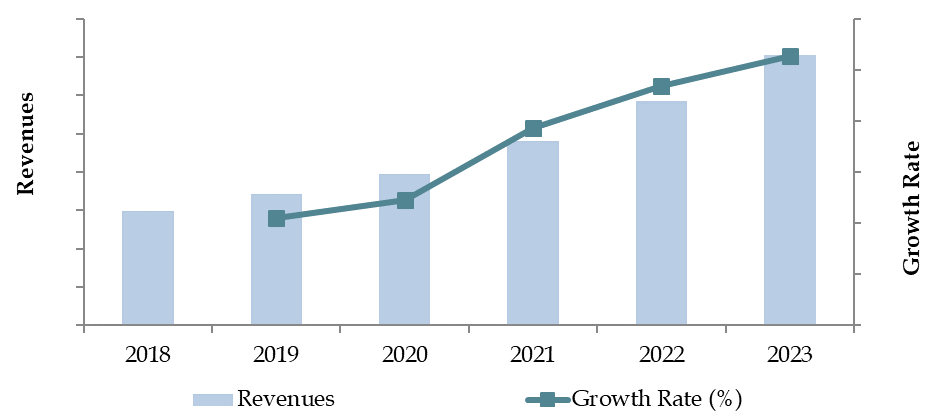

Market Size for South Africa Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of South Africa Cold Chain Market:

Increasing Demand for Temperature-Sensitive Products: The rising demand for perishable goods, such as food, beverages, and pharmaceuticals, has been a significant driver for the cold chain market. In 2023, temperature-sensitive products accounted for approximately 65% of the total cold chain market revenue in South Africa, reflecting the growing need for proper storage and transportation solutions to maintain product quality.

Technological Advancements: The adoption of advanced technologies, including IoT-enabled monitoring systems and real-time tracking, has enhanced operational efficiency in the cold chain market. In 2023, around 40% of cold chain logistics providers integrated real-time tracking solutions, improving transparency and ensuring compliance with temperature regulations. This trend has accelerated the market's growth by offering greater reliability and accuracy in maintaining product integrity.

Government Investments in Infrastructure: The South African government’s efforts to improve logistics infrastructure have played a critical role in supporting the cold chain market. Between 2020 and 2023, the government invested in expanding cold storage capacity and modernizing transport networks, resulting in a 20% increase in overall cold storage capacity across key regions. This has made it easier for businesses to store and transport perishable goods efficiently, boosting market expansion.

Which Industry Challenges Have Impacted the Growth for South Africa Cold Chain Market:

High Energy Costs: One of the most significant challenges in the South African cold chain market is the rising cost of energy required to maintain cold storage and transportation. In 2023, energy expenses accounted for approximately 25% of total operational costs, placing a heavy financial burden on logistics companies and reducing overall profitability. The high cost of electricity and fuel has deterred smaller companies from expanding their operations, limiting market growth.

Regulatory Compliance: Strict regulatory requirements surrounding the transportation and storage of temperature-sensitive goods, particularly in the pharmaceutical and food sectors, have imposed significant operational challenges. In 2023, around 18% of cold chain operators reported difficulties in meeting these regulatory standards, leading to compliance-related delays and increased costs. Smaller operators, in particular, struggle to keep up with these rigorous standards.

Infrastructure Gaps in Rural Areas: The lack of adequate cold storage and transport infrastructure in South Africa’s rural regions continues to be a major barrier to growth. In 2023, rural areas contributed only 15% to the total cold chain market revenue due to limited access to modern cold storage facilities. This gap in infrastructure has restricted the market’s ability to serve remote areas effectively, resulting in lost opportunities for agricultural and perishable goods logistics.

What are the Regulations and Initiatives which have Governed the Market:

Cold chain companies must comply with South African health and safety laws, which are regulated by the Occupational Health and Safety Act (OHSA). The Foodstuffs, Cosmetics, and Disinfectants Act sets regulations on food safety, hygiene practices, and temperature control for perishable goods

The National Environmental Management: Air Quality Act enforces standards for emissions from cold storage facilities, particularly refrigeration systems that use environmentally hazardous gases. Compliance with the Carbon Tax Act, which imposes taxes on companies emitting greenhouse gases, including those in refrigeration and transport sectors

Compliance with South African Revenue Service (SARS) regulations for importing and exporting temperature-sensitive products. Cold chain companies must follow the regulations set by the Department of Agriculture, Forestry, and Fisheries (DAFF) for the handling and storage of agricultural products, including temperature controls

Cold chain companies are encouraged to comply with the Energy Efficiency Strategy of the Republic of South Africa, which promotes energy-efficient cooling technologies to reduce carbon emissions.

South Africa Cold Chain Market Segmentation

By Market Structure: Third-party logistics providers (3PLs) dominate the cold chain market in South Africa, owing to their ability to offer comprehensive logistics solutions, including storage, transportation, and distribution. Their established infrastructure and wide service offerings make them the preferred choice for companies in various industries, from retail to pharmaceuticals. Independent operators and local logistics companies hold a significant share as well, particularly in regional markets where they provide specialized services and focus on niche sectors such as agricultural products.

By Temperature Type: The frozen segment leads the market, driven by the high demand for frozen food products such as meat, fish, and dairy. The chilled segment also holds a notable share, particularly in the retail and pharmaceutical sectors, which require precise temperature control to maintain product quality.

By Product Type: Perishable foods account for the largest share of the South African cold chain market, driven by the growing demand for fresh produce, meat, and seafood. Pharmaceuticals follow closely, with the cold chain’s importance growing as the country increases its focus on health care and the storage of temperature-sensitive medicines, including vaccines and biologics.

Competitive Landscape in South Africa Cold Chain Market

The South Africa cold chain market is moderately concentrated, with a few key players dominating the space. However, new firms and the expansion of specialized cold chain services have diversified the market, offering businesses more options for logistics solutions. Major players such as Imperial Logistics, CCS Logistics, Value Logistics, Grindrod Intermodal, and Cold Chain Solutions are well-established, providing extensive infrastructure and reliable services.

| Name | Founding Year | Headquarters |

| Imperial Logistics | 1947 | Johannesburg, South Africa |

| Vector Logistics | 2004 | Durban, South Africa |

| Clover SA | 1898 | Johannesburg, South Africa |

| CCS Logistics (Commercial Cold Storage Group) | 1972 | Cape Town, South Africa |

| Etlin International | 1994 | Johannesburg, South Africa |

| Thermo King Southern Africa | 1985 | Johannesburg, South Africa |

| Chilleweni Cold Storage | 2010 | Durban, South Africa |

| Cold Chain Africa | 1990 | Johannesburg, South Africa |

| Cold Chain Logistics | 2004 | Johannesburg, South Africa |

| SAFT Cold Storage | 2015 | Cape Town, South Africa |

Some of the recent competitor trends and key information about competitors include:

Imperial Logistics: As one of the leading logistics providers in South Africa, Imperial Logistics expanded its cold storage capacity by 15% in 2023. The company’s focus on high-volume contracts for the food and pharmaceutical sectors has strengthened its position as a market leader.

CCS Logistics: Known for its specialization in cold storage for perishable goods, CCS Logistics saw a 20% increase in demand for its services in 2023. The company’s commitment to energy-efficient technologies and sustainability has made it a preferred partner for environmentally conscious clients.

Value Logistics: Offering comprehensive logistics solutions, including cold chain transport and warehousing, Value Logistics reported a 25% growth in cold chain revenue in 2023, driven by its expansion into rural markets and increased service offerings for agricultural products.

Grindrod Intermodal: With a strong presence in both frozen and chilled logistics, Grindrod Intermodal experienced a 10% growth in 2023. The company's investment in real-time tracking technologies and IoT-based monitoring systems has enhanced its service reliability, attracting more pharmaceutical clients.

Cold Chain Solutions: Specializing in customized cold chain logistics, Cold Chain Solutions saw a 12% increase in its customer base in 2023, particularly from the fast-growing e-commerce sector, which relies on efficient and timely delivery of temperature-sensitive goods.

What Lies Ahead for South Africa Cold Chain Market?

The South Africa cold chain market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by increasing demand for temperature-sensitive goods, advancements in logistics technology, and government infrastructure investments.

Shift Towards Sustainable Practices: As businesses and consumers alike place more emphasis on sustainability, the South African cold chain market is expected to see a gradual shift towards greener logistics solutions. This includes the adoption of energy-efficient refrigeration systems and the use of eco-friendly packaging materials, supported by government incentives for reducing carbon emissions.

Integration of Technology: The integration of advanced technologies such as IoT and blockchain for real-time tracking, temperature monitoring, and data analytics is expected to enhance operational efficiency and transparency within the cold chain market. These technologies will improve compliance with regulatory standards and help companies ensure the quality and safety of temperature-sensitive goods.

Expansion into Pharmaceutical Logistics: The pharmaceutical sector, driven by rising healthcare demands and the need for safe vaccine transportation, is expected to play a crucial role in the growth of the cold chain market. The increasing volume of temperature-sensitive pharmaceuticals, including biologics and vaccines, is projected to drive demand for specialized cold chain services.

Focus on Rural Market Expansion: With increasing urbanization and a push to develop rural regions, cold chain operators are likely to expand their services into less developed areas. This expansion is expected to unlock new opportunities, particularly in agriculture and food logistics, where improved infrastructure can enhance the distribution of fresh produce and other perishable goods.

Future Outlook and Projections for South Africa Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

South Africa Cold Chain Market Segmentation

• By Type of Cold Chain Service:

- Cold Storage

- Cold Transportation

- Cold Packaging

- Temperature Monitoring Systems

• By End-Use Industry:

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Others (e.g., cosmetics, other temperature-sensitive goods)

• By Temperature Range:

- Chilled (2°C to 8°C)

- Frozen (-18°C and below)

- Ambient

• By Technology:

- Refrigerated Containers

- Real-Time Monitoring Systems

- Energy-Efficient Systems

Players Mentioned in the Report:

Imperial Logistics

Vector Logistics

Clover SA

CCS Logistics (Commercial Cold Storage Group)

Etlin International

Thermo King Southern Africa

Chilleweni Cold Storage

Cold Chain Africa

Cold Chain Logistics

SAFT Cold Storage

Key Target Audience:

- Cold Chain Service Providers

- Food and Beverage Companies

- Pharmaceutical Companies

- Logistics and Transportation Companies

- Regulatory Bodies (e.g., Ministry of Health, Ministry of Agriculture and Food Industries)

- Technology Providers for Temperature Monitoring

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. South Africa Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. South Africa Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities, 2023-2024P

10.3. South Africa Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. South Africa Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. South Africa Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. South Africa Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in South Africa Cold Chain Market

12.2. Issues and Challenges in South Africa Cold Chain Market

12.3. Decision Making Parameters for End Users in South Africa Cold Chain Market

12.4. SWOT Analysis of South Africa Cold Chain Industry

12.5. Government Regulations and Associations in South Africa Cold Chain Market

12.6. Macroeconomic Factors Impacting South Africa Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in South Africa Cold Chain Market

16.2. Competition Scenario in South Africa Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2024) and Employee Base) for Major Players in South Africa Cold Chain Market

16.4. Company Profiles of Major Companies in South Africa Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the South Africa Cold Chain Market. Based on this ecosystem, we will shortlist leading 5-6 logistics providers in the country, using criteria such as financial performance, storage capacity, and operational efficiency.

Sourcing is done through industry articles, multiple secondary sources, and proprietary databases to perform desk research around the market to gather industry-level information.

Step 2: Desk Research

We engage in comprehensive desk research by referencing diverse secondary and proprietary databases. This approach allows us to conduct an in-depth analysis of the market, aggregating industry-level insights. We explore factors such as market revenues, the number of players, demand trends, price levels, and other variables. Additionally, we conduct detailed examinations of company-level data, using sources like press releases, annual reports, financial statements, and similar documents. This step aims to build a foundational understanding of both the market and the key entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various South Africa Cold Chain Market companies and end-users. These interviews serve multiple purposes: validating market hypotheses, verifying statistical data, and extracting valuable operational and financial insights. A bottom-up approach is undertaken to evaluate revenue and capacity for each player, which is then aggregated to determine the overall market size.

As part of our validation strategy, we also conduct disguised interviews where we approach companies as potential customers. This allows us to verify the operational and financial information shared by company executives, cross-referencing it with data from secondary sources. These interviews help us better understand revenue streams, value chains, processes, pricing, and other relevant factors.

Step 4: Sanity Check

Bottom-up and top-down analyses, along with market size modeling exercises, are conducted to ensure the accuracy and validity of the research findings.

FAQs

01 What is the potential for the South Africa Cold Chain Market?

The South Africa cold chain market is poised for substantial growth, reaching a valuation of ZAR 15 Billion in 2023. This growth is driven by the increasing demand for temperature-sensitive goods, expanding retail and pharmaceutical sectors, and government investments in infrastructure. The market's potential is further enhanced by advancements in technology, such as IoT-enabled monitoring systems and real-time tracking solutions.

02 Who are the Key Players in the South Africa Cold Chain Market?

The South Africa Cold Chain Market features several key players, including Imperial Logistics, CCS Logistics, and Value Logistics. These companies dominate the market due to their extensive infrastructure, strong brand presence, and comprehensive service offerings. Other notable players include Grindrod Intermodal and Cold Chain Solutions.

03 What are the Growth Drivers for the South Africa Cold Chain Market?

The primary growth drivers include the increasing demand for temperature-sensitive products, technological advancements that improve operational efficiency and transparency, and government investments in cold chain infrastructure. Additionally, the growth of the pharmaceutical and retail sectors is further driving demand for cold storage and transport services in South Africa.

04 What are the Challenges in the South Africa Cold Chain Market?

The South Africa Cold Chain Market faces several challenges, including high energy costs, regulatory compliance hurdles related to food safety and pharmaceutical transportation, and infrastructure gaps in rural regions. These challenges can limit market expansion and create operational inefficiencies for logistics providers.