South Korea Education Market Outlook to 2030

By Market Structure, By Learner Type, By Subject/Program Focus, By Delivery Mode, By Ownership, and By Region

- Product Code: TDR0357

- Region: Asia

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “South Korea Education Market Outlook to 2030 – By Market Structure, By Learner Type, By Subject/Program Focus, By Delivery Mode, By Ownership, and By Region” provides a comprehensive analysis of the education market in South Korea. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the South Korea education market. The report concludes with future market projections based on enrollment flows, delivery models, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

South Korea Education Market Overview and Size

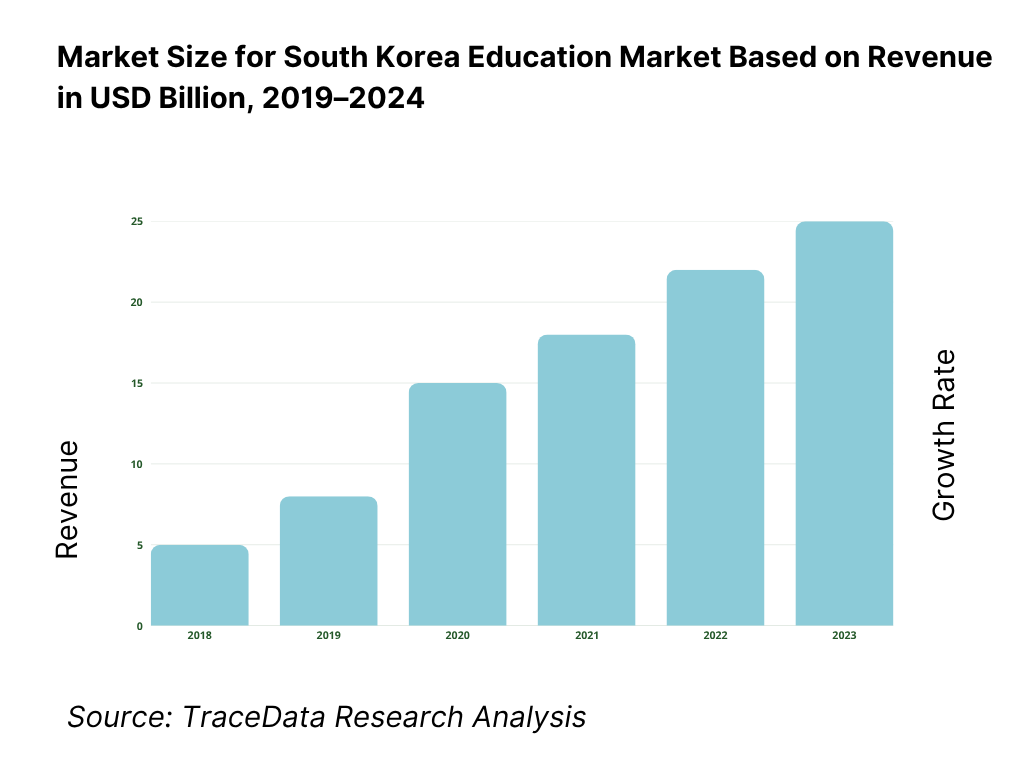

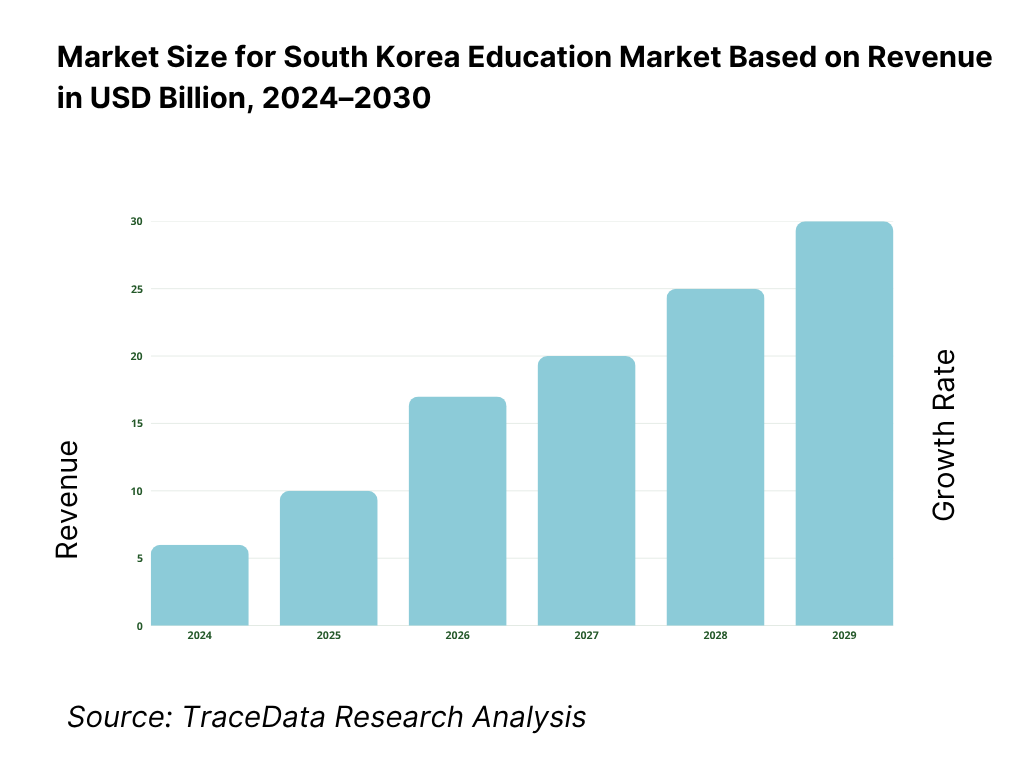

The South Korea education/EdTech market in 2024 is estimated to be worth approximately USD 4.9 billion, according to a report for its digital education segment. Growth over the 2018–2023 period reflects strong adoption of digital learning, government initiatives (such as AI digital textbooks, smart classrooms, and “Digital Leadership Schools”), and private household spending on hagwon and supplementary education.

The Seoul metropolitan region (Seoul + Gyeonggi/Incheon) dominates in education investment and EdTech adoption. This dominance is rooted in high population density, elevated household incomes, intense competition for top universities, and concentration of major hagwon chains headquartered there. In addition, international student inflows also favor Seoul-based universities, and technology infrastructure (broadband, device penetration) is more advanced in urban cores. Thus, capital-area hubs remain the crucibles of innovation, scale, and market pull for education providers.

What Factors are Leading to the Growth of the South Korea Education Market:

Government funding and internationalization pull: South Korea’s education system is being propelled by sustained public spending and growing cross-border student flows. The Ministry of Education set its ₩95.6 trillion budget for education operations, university innovation and lifelong learning, reinforcing digital curricula and capacity across levels. At the same time, inbound demand is deepening the market: the national Study in Korea portal reports 130,556 international students in general universities, reflecting broader program pipelines in language institutes, degree and non-degree programs. This combination of sizeable public outlays and a six-figure foreign student base sustains content development, language services, housing and ancillary training, directly lifting revenues for providers linked to K-12, higher education, and language prep ecosystems.

Ubiquitous connectivity and device-ready users: The education market benefits from one of the world’s densest connectivity footprints, which raises utilization of digital content, live classes and assessment tech. Korea recorded 83,891,800 mobile cellular subscriptions, enabling multi-device access for families, teachers and adult learners. Per user intensity is also high, with mobile lines at 162.114 per 100 people, while fixed broadband reached 46.57 per 100 people, providing a strong base for HD video, AI tutoring and LMS adoption. Such infrastructure underwrites hybrid hagwon models, home-learning tablets and enterprise L&D platforms, improving course completion and enabling always-on test prep, micro-credentials and remote proctoring within the mainstream school calendar.

Policy push for digital curricula and assessment reform: Regulatory momentum is steering classrooms toward adaptive content, analytics and equity of access. The AI Digital Textbook initiative details staged rollouts of AI-supported materials in core subjects, beginning with pilot introductions and scaled application in subsequent phases. In parallel, the College Scholastic Ability Test (CSAT/Suneung) continues to mobilize a nationwide cohort—522,670 examinees registered for the latest sitting—sustaining a large market for curriculum-aligned content, diagnostics and teacher training. Clear policy signals around digital materials, together with system-wide high-stakes assessment cycles, create predictable demand for platform upgrades, item banks and teacher professional development tied to centrally overseen standards.

Which Industry Challenges Have Impacted the Growth of the South Korea Education Market:

Demographic contraction eroding school-age cohorts: Fewer births and an aging populace compress the pipeline of K-12 learners, challenging capacity utilization at schools and hagwon. Statistics show 230,000 live births, reflecting continued structural decline in new entrants to early grades. The population is 51,748,739, with age-structure shifts increasing the share of older residents relative to children. Providers face rising customer acquisition costs in shrinking catchment areas, while municipalities weigh consolidation of small schools. Operators respond by broadening adult, vocational and export lines, yet the near-term headwind from thinner K-12 cohorts remains an operational and planning challenge for both public and private stakeholders.

Data-protection compliance and platform governance: Education platforms and hagwon increasingly process minors’ information, invoking strict requirements under the Personal Information Protection Act (PIPA). The Act frames duties around consent, purpose limitation and security safeguards. Enforcement has intensified, with the Personal Information Protection Commission imposing a penalty of ₩21.6232 billion on Meta for sensitive-data violations, signaling expectations for lawful processing and robust controls. For education providers using AI tutoring, cloud LMS or parent apps, these obligations necessitate investment in consent flows, data residency, encryption and vendor audits, raising compliance costs and project timelines across districts and private operators.

Regional imbalance in demand and service access: High connectivity is national, but learning intensity and service density concentrate in metropolitan zones and around exam ecosystems. CSAT cohorts—522,670 registrants—are clustered in urban centers where premium hagwon networks, specialist teachers and simulation sites are most available. While broadband is widespread, the fixed layer measured 46.57 per 100 people, with ultrafast tiers and device ecosystems disproportionately prevalent in Seoul-Gyeonggi. This uneven geography drives longer commutes or relocation for families seeking specific subject expertise, constrains equitable access to niche enrichment, and pushes public budgets to balance facility upgrades outside the capital area.

What are the Regulations and Initiatives which have Governed the Market:

Private Teaching Institutes (Hagwon) licensing and operation: Private tutoring in Korea is governed by the Act on the Establishment and Operation of Private Teaching Institutes and Extracurricular Lessons, which stipulates licensing, facility standards, instructor qualifications and record-keeping. The statute provides enforcement mechanisms for fee disclosure, class hour controls and student protection. For operators scaling across districts, compliance entails registration at metropolitan and provincial education offices, notifications for tuition changes and adherence to space-use and safety codes, affecting branch expansion timelines. The Act’s administrative framework underpins market entry, brand roll-ups and M&A diligence, especially for chains planning late-evening schedules and exam bootcamps in dense urban corridors.

Personal Information Protection Act (PIPA) obligations: Education providers collecting student performance, biometrics or parent contacts must comply with PIPA’s lawful-basis and safeguard provisions. Enforcement signals are material: a sanction of ₩21.6232 billion against Meta underscored penalties for sensitive-data misuse and denial of access rights. For schools and hagwon adopting AI analytics or cloud-based LMS, this necessitates data protection impact assessments, child-specific consent flows, secure hosting and incident response procedures. Vendors face procurement criteria emphasizing encryption, localization and audit trails, shaping contract structures and timelines for ed-tech deployments across public and private institutions.

Digital curriculum policy and AI textbook direction: The AI Digital Textbook Promotion Plan sets the trajectory for digitized core subjects and teacher tools. While implementation pacing and legal status have evolved, the program codifies standards for content interoperability, analytics dashboards and formative assessment features, affecting publishers, platform vendors and device OEMs. Budgetary backing through the education account—₩95.6 trillion for education programs—provides fiscal room for pilots, infrastructure and teacher training. Providers aligning with official specifications on item banks and accessibility gain procurement advantages as districts scale digital resources in core math, English, informatics and Korean special education.

South Korea Education Market Segmentation

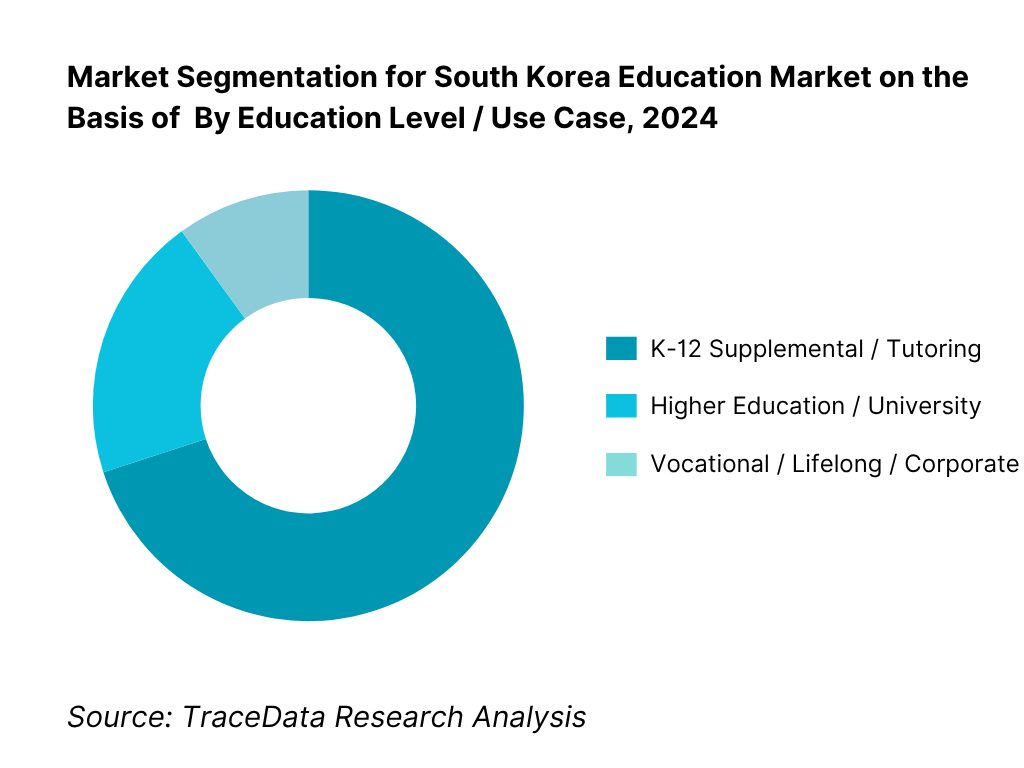

By Education Level / Use Case: Within this segmentation, K-12 Supplemental (tutoring, test prep, language classes, hagwon + digital solutions) holds dominant share in 2023. The dominance arises because the Korean system centers heavily on the College Scholastic Ability Test (CSAT / Suneung) which determines university entrance. Families invest intensively in supplementary education from early ages to boost scores. Also, hagwon attendance rates are high—over 70–80% of students attend at least one hagwon.

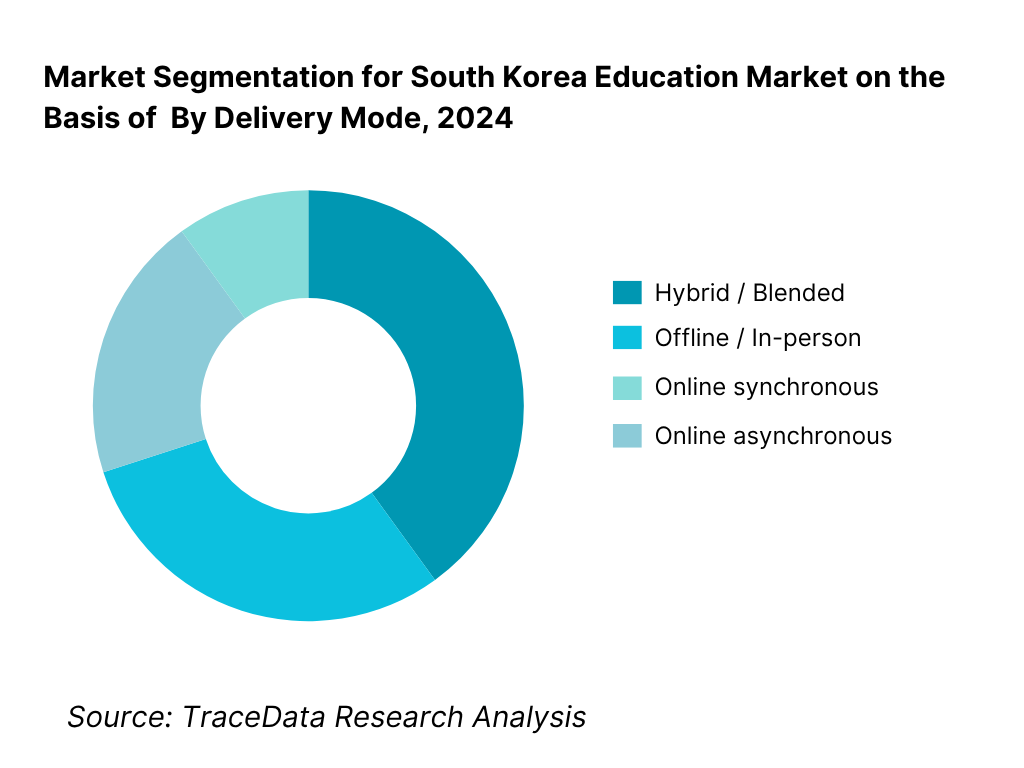

By Delivery Mode: In 2024, the Hybrid / Blended model commands the largest share among delivery modes. Many traditional hagwon chains have begun integrating online platforms and digital content into their business models, combining physical classes with recorded lectures and AI adaptive modules. This blended approach balances personalized face time and scalable digital content. Also, with government support for smart classrooms and digital learning, institutions have incentives to hybridize. Pure online (synchronous) is also growing sharply, especially for remote or specialized subjects, but hybrid gains the advantage across breadth and flexibility.

Competitive Landscape in South Korea Education Market

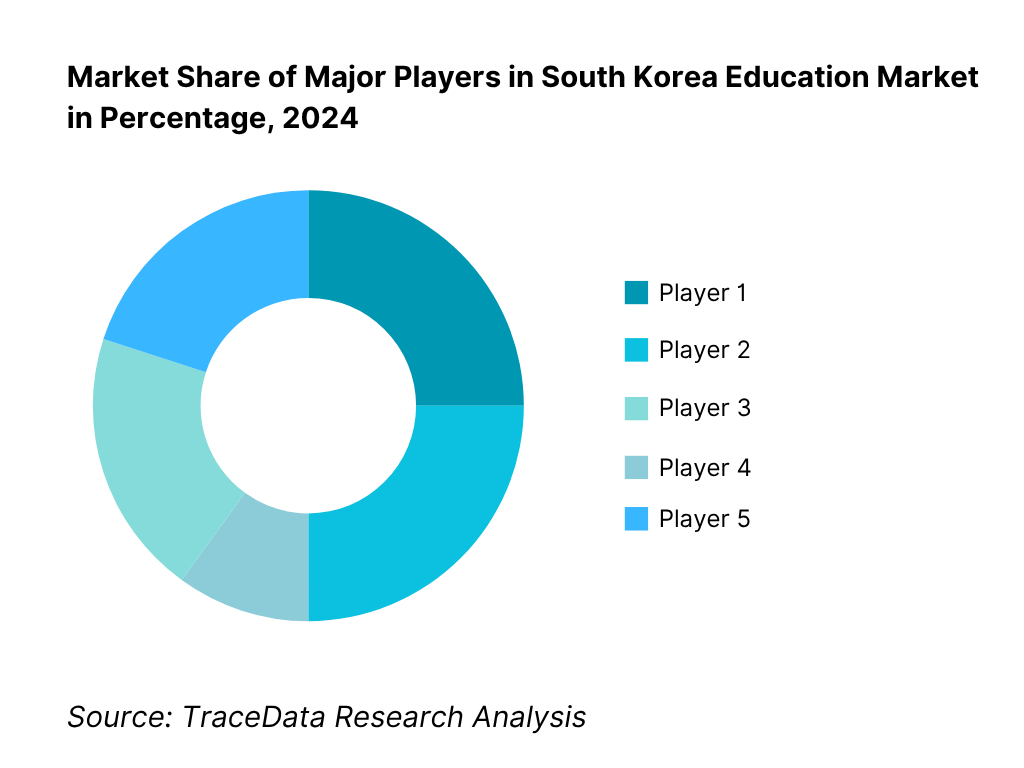

The South Korea education/EdTech market is relatively consolidated at the top among a mix of traditional providers and digital natives. Major players include large hagwon chains that are adopting digital platforms, pure EdTech firms, and publishers with digital arms. The ability to scale through both content and platform, combined with regulatory alignment (e.g. working with MOE, KERIS), drives competitive moats.

Name | Founding Year | Original Headquarters |

MegaStudyEdu | 2000 | Seoul, South Korea |

ETOOS (Etoos Education) | 1998 | Seoul, South Korea |

ST Unitas | 2010 | Seoul, South Korea |

Daekyo (Eye Level/Noonnoppi) | 1976 | Seoul, South Korea |

Kyowon | 1985 | Seoul, South Korea |

Woongjin ThinkBig | 1980 | Paju, South Korea |

YBM Education | 1961 | Seoul, South Korea |

Pagoda Education Group | 1969 | Seoul, South Korea |

Hackers Education Group | 1998 | Seoul, South Korea |

Eduwill | 1992 | Seoul, South Korea |

Chungdahm Learning (CREVERSE) | 1998 | Seoul, South Korea |

Riiid | 2014 | Seoul, South Korea |

Mathpresso (QANDA) | 2015 | Seoul, South Korea |

Visang Education | 1997 | Seoul, South Korea |

Multicampus (Samsung Group) | 2000 | Seoul, South Korea |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

MegaStudyEdu: As one of the largest CSAT and K-12 education providers, MegaStudyEdu has expanded its hybrid learning offerings by integrating live-streamed lectures with AI-based adaptive assessments. In 2024, it recorded rising enrollments in its online lecture packages, supported by strong demand for university entrance preparation.

Etoos Education: Etoos has invested in upgrading its video lecture platforms, adding interactive features and mobile-first interfaces. It has also partnered with major broadcasting channels to enhance accessibility for students in smaller cities, reinforcing its reach beyond the Seoul metropolitan area.

ST Unitas: Known for operating The Princeton Review in Korea, ST Unitas has broadened its test-prep portfolio, adding civil service and global exam programs. In 2024, it strengthened its AI-driven personalization tools to improve learning efficiency for both domestic and international students.

Riiid: A leading AI tutoring company, Riiid expanded its B2B partnerships with education ministries and private institutions across Asia. Its AI engine has been increasingly adopted for adaptive learning and predictive analytics, reinforcing South Korea’s image as a global hub for education technology exports.

Mathpresso (QANDA): Mathpresso has seen user growth both domestically and internationally, surpassing millions of active users in 2024. Its focus on AI-powered homework solutions and recent introduction of MathGPT, a specialized large language model, has positioned it as a pioneer in AI-driven tutoring.

What Lies Ahead for South Korea Education Market?

The South Korea education market is expected to continue expanding steadily toward the end of the decade, supported by strong public spending, the growing role of private hagwon and EdTech platforms, and the government’s push for AI-driven digital textbooks and smart classrooms. Demographic pressures will challenge K-12 enrollments, but diversification into lifelong learning, vocational training, and international student inflows will sustain growth momentum.

Rise of Hybrid Learning Models: The future of education in South Korea will be shaped by a clear move towards hybrid models that combine offline hagwon teaching with online adaptive platforms. Students and parents favor this approach due to the convenience of on-demand lectures alongside structured face-to-face learning, creating a resilient ecosystem.

Emphasis on Outcome-Driven Education: As competition for top universities and public exams remains intense, demand will tilt further toward outcome-driven solutions. Providers will increasingly showcase quantifiable improvements in CSAT scores, pass rates in civil-service exams, and admissions to prestigious institutions, aligning services tightly with measurable educational milestones.

Expansion of Lifelong & Vocational Learning: Beyond K-12, growth opportunities will lie in adult education, vocational programs, and corporate L&D. With employers demanding reskilling in AI, coding, and new-age competencies, education providers are set to launch targeted programs serving not just students but also the workforce, strengthening market resilience.

Integration of AI & Analytics: AI tutors, predictive learning engines, and data dashboards will become integral to Korea’s education ecosystem. Platforms like Riiid and Mathpresso have already pioneered adaptive systems, and future adoption will spread across schools, hagwon, and higher education to personalize learning and track outcomes, enhancing efficiency and return on investment.

South Korea Education Market Segmentation

By Market Structure

Public Institutions (K-12 schools, national universities, public vocational centers)

Private Institutions (private schools, universities, and for-profit education centers)

Hagwon (private tutoring and after-school institutes)

Online/EdTech Platforms

Corporate & Lifelong Learning Providers

By Learner Type

Pre-Primary & Kindergarten (early childhood education)

K-12 Students (elementary, middle, high school)

Higher Education Students (undergraduate, postgraduate, exchange)

Vocational/Professional Learners (technical skills, certification)

Adult & Corporate Learners (reskilling, language training, L&D)

By Subject / Program Focus

CSAT Preparation & Core Subjects (Korean, Math, English, Sciences)

Language Training (English, Japanese, Chinese, global test prep TOEIC/IELTS/TOEFL)

STEM & Coding Programs (robotics, AI, programming, math enrichment)

Soft Skills & Leadership Training (communication, problem-solving, creativity)

Vocational & Certification Programs (civil service, licensing exams, technical upskilling)

By Delivery Mode

Offline / In-Person (public schools, universities, hagwon)

Online Synchronous (real-time live classes and lectures)

Online Asynchronous (recorded/self-paced digital modules)

Hybrid / Blended (offline + digital integration)

Mobile-Only Learning (apps, AI chatbots, microlearning platforms)

By Region

Seoul

Gyeonggi & Incheon

Busan–Ulsan–Gyeongnam

Daegu–Gyeongbuk

Daejeon–Sejong–Chungcheong

Gwangju–Jeolla

Gangwon & Jeju

Players Mentioned in the Report:

MegaStudyEdu

Etoos Education

ST Unitas

Daekyo

Kyowon

Woongjin ThinkBig

YBM Education

Pagoda Education

Hackers Education

Eduwill

Chungdahm Learning

Riiid

Mathpresso (QANDA)

Cheongdam Learning

Multicampus

Key Target Audience

Corporate strategic investment arms

Private equity / venture capital firms investing in EdTech

International education publishers & content houses

Technology device / hardware OEMs (tablets, smart classrooms)

Government & regulatory bodies (Ministry of Education MOE, KERIS, KEDI)

School chains / education service operators (hagwon chains, private K-12 groups)

International expansion units of foreign EdTech / education firms

Corporate training / L&D divisions (enterprises wanting to partner or acquire)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Education (Public schools, Private schools, Hagwon, Online/Mobile, Hybrid)-Margins, Preferences, Strengths & Weaknesses

4.2. Revenue Streams for South Korea Education Market (Tuition fees, MOE subsidies, household out-of-pocket, EdTech subscriptions, corporate training budgets, international student inflows)

4.3. Business Model Canvas for South Korea Education Market (Key partners, activities, value propositions, customer segments, cost structure, revenue streams)

5.1. Freelance Tutors vs. Full-Time Instructors (Hagwon, online platforms, universities)

5.2. Investment Model in South Korea Education (Public funding, PPPs, private capital, VC/PE in EdTech)

5.3. Comparative Analysis of Admission & Funneling Processes (Public schools vs Hagwon-driven pathways to CSAT & universities)

5.4. Household Education Budget Allocation by Income Segment

8.1. Revenues, Historical to Current (In USD Bn)

9.1. By Market Structure (Public schools, Private schools, Hagwon, Online/Hybrid)

9.2. By Training Type (Academic tutoring, Language training, Test prep, Skills development, Corporate L&D)

9.3. By Education Verticals (K-12, Higher Education, Vocational, Corporate, Lifelong learning)

9.4. By Institution Size (Large universities, Mid-sized, Small private schools)

9.5. By Learner Profile (Pre-K, K-12, HE, Adults, Corporate employees)

9.6. By Mode of Learning (Offline, Online synchronous, Online asynchronous, Hybrid, Mobile-only)

9.7. By Program Type (Standardized vs Customized Programs)

9.8. By Region (Seoul, Gyeonggi-Incheon, Busan-Ulsan-Gyeongnam, Chungcheong, Jeolla, Gangwon, Jeju)

10.1. Learner & Parent Landscape and Cohort Analysis

10.2. Decision-Making Process for Education Spending (Households, corporates, public institutions)

10.3. Training & Learning Effectiveness and ROI Analysis (CSAT outcomes, admission success rates, corporate training ROI)

10.4. Gap Analysis Framework (Skills gap, regional gap, digital divide)

11.1. Trends & Developments in South Korea Education (AI digital textbooks, hybrid hagwon models, study-abroad mobility)

11.2. Growth Drivers (Low fertility/attainment race, digitalization, EdTech adoption, export of K-education)

11.3. SWOT Analysis

11.4. Issues & Challenges (Teacher fatigue, affordability, regional disparity, demographic decline)

11.5. Government Regulations (MOE policies, Hagwon fee caps, CSAT reforms, PIPA compliance)

12.1. Market Size and Future Potential for Online Education Industry in South Korea

12.2. Business Model and Revenue Streams (Subscriptions, freemium, test-prep bundles, B2B licensing)

12.3. Delivery Models and Types of Courses Offered (K-12 tutoring, language training, corporate skills, vocational exams)

15.1. Market Share of Key Players (Daekyo, Kyowon, Woongjin ThinkBig, MegaStudyEdu, Etoos, ST Unitas, YBM, Pagoda, Hackers, Eduwill, JLS, Cheongdam Learning, Riiid, Mathpresso, Multicampus)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Business Model, No. of Trainers/Teachers, Revenues, Pricing, Technology Used, Best-selling Programs, Major Clients, Partnerships, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant Mapping (Top players in K-12, HE, Corporate training, EdTech)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues (Forecast in USD Bn)

17.1. By Market Structure (Public, Private, Hagwon, Online)

17.2. By Training Type (Academic tutoring, Language, Test prep, Skills, Corporate L&D)

17.3. By Education Verticals (K-12, HE, Vocational, Corporate, Lifelong learning)

17.4. By Institution Size

17.5. By Learner Profile

17.6. By Mode of Learning

17.7. By Program Type

17.8. By Region

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire South Korea Education Market ecosystem, identifying both demand-side and supply-side entities. On the demand side, this includes students across K-12, higher education, vocational programs, adult learners, and corporate training participants. On the supply side, the ecosystem encompasses public institutions (schools, universities, and MOE agencies), private hagwon chains, EdTech startups, publishers, device manufacturers, and corporate L&D providers. Based on this mapping, we shortlist 5–6 leading players—including MegaStudyEdu, Etoos Education, Daekyo, Riiid, and Mathpresso—by evaluating financial data, market presence, and breadth of clientele. Sourcing is conducted through industry articles, Ministry of Education data, and multiple secondary and proprietary databases.

Step 2: Desk Research

An exhaustive desk research process is then undertaken by referencing secondary and proprietary databases to compile insights on revenues, number of institutions, enrollment flows, and delivery modes. This involves analyzing MOE statistics, company press releases, audited financial statements, and investor reports. Specific focus is given to variables such as student participation rates, broadband adoption, instructor workforce size, and exam participation. Additionally, company-level intelligence is gathered on pricing strategies, course formats, and digital penetration, helping to establish a comprehensive baseline understanding of the South Korean education landscape and its key entities.

Step 3: Primary Research

We conduct in-depth interviews with executives from leading hagwon chains, EdTech platforms, publishing houses, and regulatory stakeholders. Parallel engagements are also held with parents, students, and university officials to capture demand-side perspectives. This process validates market hypotheses, authenticates secondary data, and generates operational insights on learner acquisition, retention, pricing models, and technology adoption. A bottom-up approach is employed to assess revenue contributions per player, which are then aggregated to the market level. As part of validation, our team also carries out disguised interviews posing as potential clients, cross-verifying responses with public financial filings and MOE data, ensuring accuracy in metrics such as student volumes, pricing tiers, and operational costs.

Step 4: Sanity Check

Finally, top-down and bottom-up modeling exercises are carried out to validate the market size estimates. In the top-down approach, MOE budget allocations, national education expenditure, and student cohort sizes are mapped against average spend per learner. The bottom-up approach aggregates revenues from major providers (hagwon chains, EdTech platforms, publishers, and universities). Cross-comparison of both models provides a sanity check, ensuring that the derived numbers fall within realistic ranges. This dual validation process guarantees a reliable and comprehensive understanding of the South Korea Education Market.

FAQs

01 What is the potential for the South Korea Education Market?

The South Korea Education Market is positioned for sustained expansion, with a valuation of USD 4.9 billion in 2023 for the EdTech segment. Growth potential is reinforced by a unique combination of factors: the high intensity of private education spending, the government’s push for AI digital textbooks, and widespread broadband penetration supporting hybrid learning. Additionally, the country’s emphasis on exam preparation and international competitiveness ensures that investment in education remains a top priority for households, institutions, and policymakers alike.

02 Who are the Key Players in the South Korea Education Market?

The South Korea Education Market features several prominent players, including MegaStudyEdu, Etoos Education, and ST Unitas, which lead the space through extensive CSAT preparation portfolios and innovative online learning solutions. Other notable providers such as Daekyo, Kyowon, Woongjin ThinkBig, Riiid, and Mathpresso are strengthening their positions through AI-driven tutoring, blended learning platforms, and international expansion. These companies dominate due to their content quality, strong learner networks, and ability to align with national curricula and exam standards.

03 What are the Growth Drivers for the South Korea Education Market?

The major growth drivers include macroeconomic and social factors such as high household expenditure on supplementary education, with South Korea’s government allocating ₩95.6 trillion to the sector. Rapid technological adoption, backed by 83.9 million mobile subscriptions, supports digital classrooms and hybrid models. Furthermore, the presence of over 130,000 international students underscores Korea’s role as a global education hub, boosting demand for language, higher education, and preparatory services while creating a strong pipeline for future growth.

04 What are the Challenges in the South Korea Education Market?

The market faces multiple challenges, starting with demographic decline: South Korea recorded only 230,000 live births in 2024, shrinking the K-12 pipeline. Regulatory hurdles around hagwon fee caps and late-night operating restrictions also constrain flexibility for private providers. In addition, strict data protection under the Personal Information Protection Act (PIPA) has created compliance burdens, as highlighted by a ₩21.6 billion fine imposed on a tech company by the PIPC, signaling increased scrutiny for EdTech players. Together, these challenges compel providers to diversify into adult learning and innovate within tighter regulatory frameworks.