South Korea K-Beauty Market Outlook to 2029

By Product Category, By Distribution Channel, By Consumer Demographics, By Price Segment, and By Region

- Product Code: TDR0101

- Region: Asia

- Published on: December 2024

- Total Pages: 80-100

Report Summary

The report titled “South Korea K-Beauty Market Outlook to 2029 – By Product Category, By Distribution Channel, By Consumer Demographics, By Price Segment, and By Region” provides a comprehensive analysis of the K-Beauty industry in South Korea. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the K-Beauty Market. The report concludes with future market projections based on revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

South Korea K-Beauty Market Overview and Size

The South Korea K-Beauty market reached a valuation of KRW 14 trillion in 2023, driven by the global demand for innovative beauty products, increasing consumer awareness about skincare, and growing exports to international markets. The market is characterized by major players such as Amorepacific, LG Household & Health Care, The Face Shop, Laneige, Innisfree, and Missha. These companies are recognized for their cutting-edge research, innovative product formulations, and robust distribution networks.

In 2023, brands such as Laneige and Innisfree launched eco-friendly product lines to cater to the growing demand for sustainable beauty products. Seoul and Busan are key markets due to their high population density and thriving beauty culture.

Market Size for South Korea K-Beauty Industry on the Basis of Revenues in USD Billion, 2018–2024

What Factors are Leading to the Growth of the South Korea K-Beauty Market:

Technological Innovations: The integration of advanced technologies like artificial intelligence (AI) in product development and the use of high-quality natural ingredients have positioned South Korea as a leader in the global beauty market. In 2023, K-Beauty accounted for 30% of global skincare innovations.

Global Demand: South Korean beauty products have gained popularity in international markets, especially in China, the United States, and Southeast Asia, due to their high efficacy and attractive packaging. Exports of K-Beauty products grew by 15% in 2023.

Digitalization and E-commerce: The rise of online marketplaces and social media marketing has revolutionized the way consumers discover and purchase K-Beauty products. In 2023, approximately 50% of sales were conducted online, reflecting a growing trend toward digital-first strategies.

Which Industry Challenges Have Impacted the Growth of South Korea K-Beauty Market

Intense Competition: The K-Beauty market faces stiff competition, both domestically and globally, from local brands and international players. In 2023, over 200 brands were actively competing in the domestic market, making differentiation increasingly challenging. Smaller brands struggle to sustain market share due to the dominance of established companies like Amorepacific and LG Household & Health Care.

Sustainability and Cost Pressures: While there is growing demand for eco-friendly products, implementing sustainable practices often leads to higher production costs. In 2023, approximately 30% of brands reported challenges in maintaining profitability while transitioning to sustainable packaging and ingredients.

Evolving Consumer Preferences: Rapid shifts in consumer preferences, driven by trends like "skip-care" routines and vegan beauty, require brands to constantly innovate. Failure to adapt can lead to declining market relevance, particularly among younger consumers who make up 60% of the market's demand.

What are the Regulations and Initiatives Which Have Governed the Market

Cosmetics Safety and Labeling Standards: South Korea has rigorous standards for cosmetics safety, requiring all products to undergo strict testing before entering the market. Regulations mandate clear ingredient labeling, and non-compliance can result in penalties. In 2023, approximately 92% of cosmetic products passed these safety standards on their first attempt.

Export Quality Standards: To support K-Beauty’s global reputation, the government enforces strict quality controls for exported products, ensuring they meet international safety standards. This initiative has helped K-Beauty maintain a strong presence in global markets, contributing to a 15% increase in export revenue in 2023.

Sustainability Initiatives: The South Korean government has introduced incentives to encourage sustainable practices in the cosmetics industry, including tax benefits for companies using eco-friendly packaging and natural ingredients. In 2023, around 40% of K-Beauty brands reported adopting sustainable practices to qualify for these benefits.

South Korea K-Beauty Market Segmentation

By Product Category: Skincare products dominate the K-Beauty market, driven by the high demand for items like serums, moisturizers, and sunscreens. Skincare products accounted for approximately 65% of total revenue in 2023, thanks to South Korea's reputation for advanced skincare solutions. Makeup follows as the second-largest category, with lip tints, cushion foundations, and eye products being particularly popular. Haircare and body care products also hold notable shares, benefiting from the rise in holistic beauty routines.

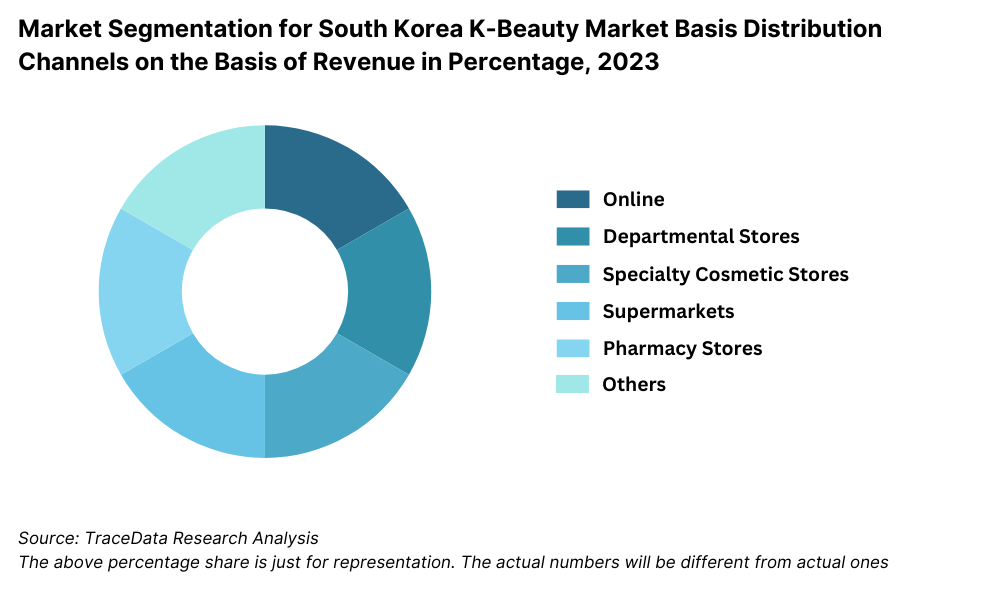

By Distribution Channel: Online channels lead the market due to the increasing preference for digital shopping and the availability of diverse products on e-commerce platforms. In 2023, online sales accounted for nearly 55% of total revenue, supported by the rise of K-Beauty marketplaces and social media-driven purchases. Offline channels, including department stores and specialty cosmetic stores, still hold a significant share, appealing to customers who value in-store consultations and immediate access to products.

By Consumer Demographics: Women aged 20–35 form the largest consumer segment, driven by their focus on skincare routines and experimental beauty trends. This demographic contributed approximately 60% of the market revenue in 2023. Male consumers are an emerging segment, particularly in urban areas, as the stigma around men’s grooming continues to diminish. Consumers over 40 also form a significant share, with anti-aging and skin rejuvenation products being key drivers for this age group.

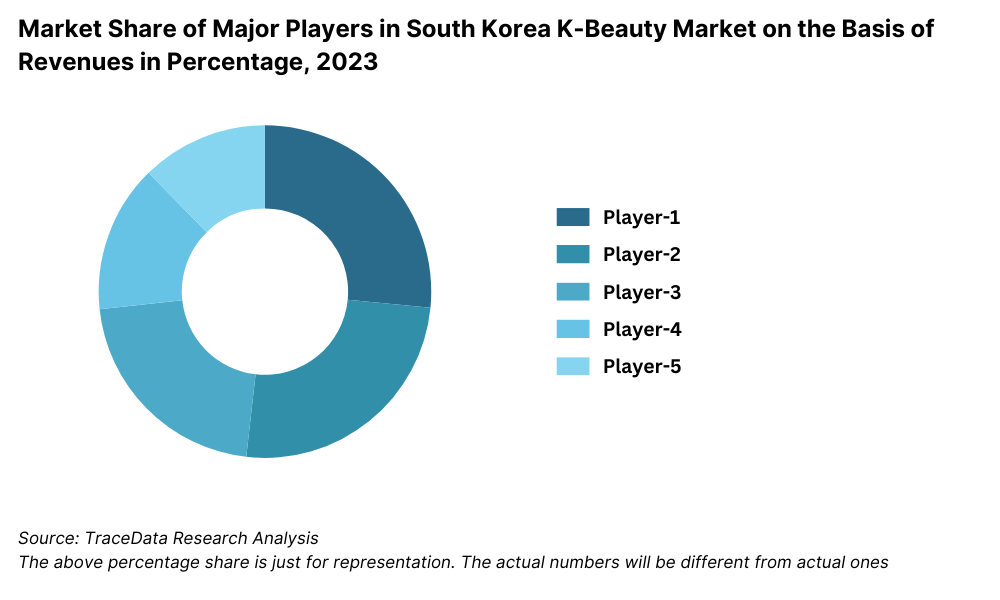

Competitive Landscape in South Korea K-Beauty Market

The South Korea K-Beauty market is highly competitive, with a mix of established players and emerging brands catering to diverse consumer demands. Key players such as Amorepacific, LG Household & Health Care, The Face Shop, Innisfree, Missha, and COSRX dominate the space, while smaller brands and niche startups continue to innovate and capture market share. The market has also seen significant growth in e-commerce platforms and global exports, further intensifying competition.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Amorepacific Corporation | 1945 | Seoul, South Korea |

LG Household & Health Care | 1947 | Seoul, South Korea |

Etude House | 1985 | Seoul, South Korea |

Innisfree | 2000 | Seoul, South Korea |

Laneige | 1994 | Seoul, South Korea |

Sulwhasoo | 1997 | Seoul, South Korea |

The Face Shop | 2003 | Seoul, South Korea |

Dr. Jart+ | 2004 | Seoul, South Korea |

COSRX | 2013 | Seoul, South Korea |

Missha | 2000 | Seoul, South Korea |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Amorepacific: Known for its innovative research and development, Amorepacific reported a 10% increase in global sales in 2023, driven by its flagship brands like Sulwhasoo and Laneige. The company's focus on sustainability and personalized beauty solutions has enhanced its market leadership.

LG Household & Health Care: The company saw a 12% growth in its K-Beauty segment in 2023, supported by strong performances from brands such as The History of Whoo and Belif. LG's investment in AI-powered skincare diagnostics has been a key differentiator.

The Face Shop: In 2023, The Face Shop launched new product lines emphasizing natural and vegan ingredients, leading to a 15% growth in domestic sales. Its focus on eco-friendly packaging has resonated well with environmentally conscious consumers.

Innisfree: A leader in affordable skincare, Innisfree experienced an 8% increase in revenue in 2023, largely due to its Jeju Island-inspired product lines and strong digital marketing campaigns targeting millennials and Gen Z.

Missha: Missha's ability to offer high-quality products at competitive prices has helped it maintain a loyal customer base. In 2023, the company expanded its international footprint, particularly in Southeast Asia, contributing to a 20% rise in export revenues.

COSRX: Known for its minimalist skincare and effective formulations, COSRX recorded a 25% growth in 2023. Its focus on targeting specific skin concerns and leveraging social media influencers has bolstered its appeal among younger consumers.

What Lies Ahead for South Korea K-Beauty Market?

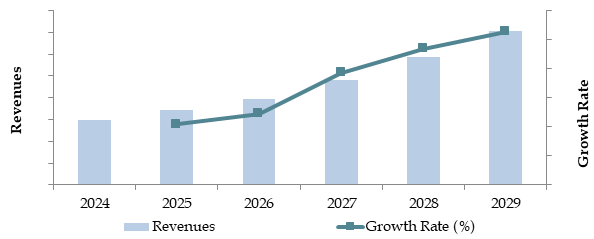

The South Korea K-Beauty market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth will be fueled by global demand for innovative beauty solutions, increasing digitalization, and rising consumer awareness about sustainability and natural ingredients.

Expansion of Global Exports: The continued international appeal of K-Beauty products is expected to drive significant growth in exports, particularly to markets such as the United States, Europe, and Southeast Asia. South Korean brands are focusing on meeting global regulatory standards and tailoring products to diverse consumer needs, ensuring sustained growth in international markets.

Rising Demand for Clean and Sustainable Beauty: The market is witnessing a shift towards clean beauty, with consumers increasingly prioritizing eco-friendly and cruelty-free products. By 2029, it is expected that a significant portion of brands will adopt sustainable practices, including recyclable packaging and natural formulations, to cater to environmentally conscious consumers.

Integration of AI and Personalization: Advanced technologies like AI and machine learning are expected to revolutionize product development and consumer experiences. From personalized skincare recommendations to virtual try-on features for makeup, these innovations will enhance customer engagement and satisfaction, making K-Beauty brands leaders in tech-enabled beauty solutions.

Growth in Men’s Grooming Segment: The stigma around men’s grooming is diminishing, creating opportunities for brands to expand their product lines to target male consumers. By 2029, the men’s grooming segment is anticipated to account for a larger share of the market, driven by demand for skincare and grooming products tailored to male-specific needs.

Future Outlook and Projections for South Korea K-Beauty Market on the Basis of Revenues in USD Billion, 2024-2029

South Korea K-Beauty Market Segmentation

- By Product Category:

- Skincare (Serums, Sunscreens, Moisturizers)

- Makeup (Lipsticks, Foundations, Eye Products)

- Haircare (Shampoos, Conditioners, Hair Masks)

- Body Care (Body Lotions, Scrubs)

- Men’s Grooming (Cleansers, Shaving Products)

- By Distribution Channel:

- Online Platforms

- Department Stores

- Specialty Cosmetic Stores

- Supermarkets and Hypermarkets

- Duty-Free Shops

- By Consumer Demographics:

- Women (20-35 years old)

- Men (20-35 years old)

- Women (35+ years old)

- Gen Z Consumers (<20 years old)

- By Price Segment:

- Premium

- Mid-range

- Affordable

- By Region:

- Seoul

- Gyeonggi Province

- Busan

- Jeju

- Overseas Markets (Export Focus)

Players Mentioned in the Report:

- Amorepacific

- LG Household & Health Care

- The Face Shop

- Innisfree

- Missha

- COSRX

- Etude House

- Clio

- Dr. Jart+

- Laneige

Key Target Audience:

- Beauty Product Manufacturers

- Online Retailers and Marketplaces

- Research and Development Institutions

- Regulatory Bodies (e.g., Ministry of Food and Drug Safety)

- Export and Trade Associations

- Environmental Advocacy Groups

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges they Face

4.2. Revenue Streams for South Korea K-Beauty Market

4.3. Business Model Canvas for South Korea K-Beauty Market

4.4. Consumer Decision-Making Process

4.5. Supply Decision-Making Process

5.1. Domestic Market vs. Export Market, 2018-2024

5.2. Share of Online and Offline Sales, 2018-2024

5.3. Popularity of K-Beauty Products in Key Global Markets, 2024

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Product Category (Skincare, Makeup, Haircare, Body Care, Men's Grooming), 2023-2024P

9.1.1 By Type of Skincare Products, 2023-2024P

9.1.2 By Type of Makeup Products, 2023-2024P

9.1.3 By Type of Haircare Products, 2023-2024P

9.1.4 By Type of Body Care Products, 2023-2024P

9.2. By Distribution Channel (Online, Department Stores, Specialty Cosmetic Stores, Supermarkets), 2023-2024P

9.3. By Consumer Demographics (Gender and Age Groups), 2023-2024P

9.4. By Price Segment (Premium, Mid-Range, Affordable), 2023-2024P

9.5. By Region (Domestic: Seoul, Busan, Jeju; Global Markets), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for South Korea K-Beauty Market

11.2. Growth Drivers for South Korea K-Beauty Market

11.3. SWOT Analysis for South Korea K-Beauty Market

11.4. Issues and Challenges for South Korea K-Beauty Market

11.5. Government Regulations for South Korea K-Beauty Market

12.1. Market Size and Future Potential for Online K-Beauty Market Basis GMV and Number of Orders, 2018-2029

12.2. Business Models and Revenue Streams for Online Platforms Selling K-Beauty Products

12.3. Cross Comparison of Leading Online K-Beauty Brands Basis Operational and Financial Variables

15.1 Market Share of Key Players in South Korea K-Beauty Market Basis Revenues, 2023

15.1.1 By Type of Skincare Products, 2023

15.1.2 By Type of Makeup Products, 2023

15.1.3 By Type of Haircare Products, 2023

15.1.4 By Type of Body Care Products, 2023

15.1. Benchmark of Key Competitors in South Korea K-Beauty Market Basis Operational and Financial Indicators

15.2. Strengths and Weaknesses

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowman's Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Product Category (Skincare, Makeup, Haircare, Body Care, Men's Grooming), 2025-2029

17.1.1 By Type of Skincare Products, 2025-2029

17.1.2 By Type of Makeup Products, 2025-2029

17.1.3 By Type of Haircare Products, 2025-2029

17.1.4 By Type of Body Care Products, 2025-2029

17.2. By Distribution Channel (Online, Department Stores, Specialty Cosmetic Stores, Supermarkets), 2025-2029

17.3. By Consumer Demographics (Gender and Age Groups), 2025-2029

17.4. By Price Segment (Premium, Mid-Range, Affordable), 2025-2029

17.5. By Region (Domestic: Seoul, Busan, Jeju; Global Markets), 2025-2029

17.6. Recommendations

17.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the South Korea K-Beauty Market. This includes manufacturers, distributors, online platforms, and end consumers. Based on this ecosystem, we shortlist 5–6 leading companies in the market using financial data, production volume, and market presence.

Sourcing is made through industry articles, secondary sources, and proprietary databases to perform desk research and compile industry-level information.

Step 2: Desk Research

We conduct an exhaustive desk research process referencing diverse secondary and proprietary databases. This includes analyzing sales revenues, market players, pricing trends, demand patterns, and more.

Secondary data sources include press releases, annual reports, financial statements, and similar documentation. This enables us to construct a foundational understanding of the market and its major participants.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives and stakeholders representing K-Beauty companies and end-users. These interviews serve to validate market hypotheses, verify statistical data, and extract insights regarding operations and strategies.

A bottom-up approach is undertaken to evaluate the revenue and market share of each player, aggregating this data to determine the overall market size.

Validation strategies include disguised interviews where our team approaches companies as potential customers to confirm operational and financial information. These interactions provide a comprehensive view of revenue streams, value chains, and pricing structures.

Step 4: Sanity Check

- Both bottom-up and top-down analyses, combined with market size modeling, are performed to cross-verify data accuracy and ensure consistency.

FAQs

1. What is the potential for the South Korea K-Beauty Market?

The South Korea K-Beauty market is poised for substantial growth, with a projected valuation of KRW 18 trillion by 2029. Growth is driven by global demand for innovative beauty solutions, increasing awareness of skincare, and expanding exports to international markets.

2. Who are the Key Players in the South Korea K-Beauty Market?

Key players include Amorepacific, LG Household & Health Care, The Face Shop, Innisfree, Missha, and COSRX. These companies dominate the market due to their strong brand presence, innovative products, and extensive global distribution networks. Emerging brands such as Dr. Jart+ and Clio are also gaining traction.

3. What are the Growth Drivers for the South Korea K-Beauty Market?

Major growth drivers include rising consumer interest in clean and sustainable beauty, the increasing adoption of advanced technologies like AI for personalized skincare solutions, and the continued expansion of K-Beauty exports to key markets such as the U.S. and China. Additionally, the growing men’s grooming segment and demand for anti-aging products are boosting market growth.

4. What are the Challenges in the South Korea K-Beauty Market?

Challenges include intense competition among local and international brands, evolving consumer preferences requiring constant innovation, and the high costs associated with adopting sustainable practices. Regulatory barriers and compliance requirements also pose challenges, especially for companies targeting global markets.