South Korea MRI Scanners Market Outlook to 2035

By Field Strength, By Architecture Type, By Application Area, By End-User, and By Region

- Product Code: TDR0484

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “South Korea MRI Scanners Market Outlook to 2035 – By Field Strength, By Architecture Type, By Application Area, By End-User, and By Region” provides a comprehensive analysis of the magnetic resonance imaging (MRI) scanners market in South Korea. The report covers an overview and genesis of the market, overall market size in terms of value and installed base, detailed market segmentation; technology trends and developments, regulatory and reimbursement landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the South Korea MRI scanners market. The report concludes with future market projections based on demographic aging, disease burden trends, healthcare infrastructure modernization, technology upgrades toward high-field and AI-enabled imaging, public and private hospital investment cycles, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

South Korea MRI Scanners Market Overview and Size

The South Korea MRI scanners market is valued at approximately ~USD ~ billion, representing revenues generated from the sale, installation, and upgrade of magnetic resonance imaging systems across public and private healthcare facilities, including tertiary hospitals, general hospitals, specialty clinics, and diagnostic imaging centers. MRI scanners are critical diagnostic tools used for high-resolution, non-invasive imaging of soft tissues, organs, and neurological structures, enabling early detection, disease staging, and treatment planning across a wide range of clinical applications.

The market is characterized by high technology penetration, strong clinical adoption, and a relatively mature installed base compared to many other Asian markets. South Korea’s advanced healthcare infrastructure, universal health insurance coverage, high physician density, and strong patient awareness contribute to consistent utilization of MRI diagnostics. Demand is further supported by the country’s rapidly aging population, rising prevalence of neurological disorders, musculoskeletal conditions, cardiovascular diseases, and oncology cases, all of which require frequent and high-quality imaging.

Replacement demand and technology upgradation form a significant portion of market activity, as hospitals increasingly shift from older low-field systems to mid- and high-field MRI scanners to improve diagnostic accuracy, reduce scan times, and enhance patient throughput. Compact and patient-friendly MRI systems are also gaining traction in secondary hospitals and outpatient imaging centers, driven by space constraints and the need to improve patient comfort.

From a regional perspective, the Seoul Capital Area accounts for the largest share of MRI scanner installations, supported by a high concentration of tertiary hospitals, university medical centers, and specialized diagnostic facilities. Other metropolitan regions such as Busan, Daegu, Daejeon, and Gwangju represent stable demand centers, while provincial regions show growing adoption as regional hospitals expand capabilities and public healthcare investment improves access to advanced diagnostics outside major cities.

What Factors are Leading to the Growth of the South Korea MRI Scanners Market:

Aging population and rising chronic disease burden increase diagnostic imaging volumes: South Korea is experiencing one of the fastest aging rates globally, with a growing proportion of the population above 60 years of age. This demographic shift significantly increases the incidence of age-related neurological disorders, degenerative musculoskeletal conditions, cardiovascular diseases, and cancer, all of which rely heavily on MRI for diagnosis and disease monitoring. As clinical guidelines increasingly emphasize early detection and regular follow-up imaging, MRI utilization rates continue to rise, strengthening demand for both new installations and capacity expansion in existing facilities.

Technology upgrades toward high-field, faster, and AI-enabled MRI systems drive replacement demand: Hospitals and diagnostic centers in South Korea are actively upgrading older MRI systems to high-field (1.5T and 3T) scanners to improve image quality, shorten scan times, and support advanced clinical applications such as functional MRI, cardiac MRI, and oncology imaging. The integration of artificial intelligence for image reconstruction, noise reduction, and workflow optimization further enhances scanner productivity and diagnostic confidence. These technology-driven benefits encourage healthcare providers to invest in newer-generation MRI systems despite higher upfront costs.

Strong healthcare infrastructure and reimbursement framework support sustained adoption: South Korea’s universal health insurance system provides broad coverage for diagnostic imaging, including MRI procedures for a wide range of clinical indications. While reimbursement policies are carefully regulated, the gradual expansion of coverage criteria and increasing recognition of MRI’s clinical value have improved affordability and access. This stable reimbursement environment reduces demand volatility and enables hospitals to justify capital investments in advanced imaging equipment.

Which Industry Challenges Have Impacted the Growth of the South Korea MRI Scanners Market:

High capital cost of MRI systems and budget constraints limit faster capacity expansion: MRI scanners—particularly high-field (1.5T and 3T) and advanced AI-enabled systems—require significant upfront capital investment, along with recurring costs related to maintenance contracts, software upgrades, helium management, and facility shielding. While large tertiary hospitals are better positioned to absorb these costs, mid-sized hospitals and diagnostic centers often face budget limitations that delay purchase decisions or restrict upgrades. This cost sensitivity slows replacement cycles for older systems and constrains rapid expansion of MRI capacity in smaller facilities despite growing diagnostic demand.

Reimbursement controls and pricing pressure affect return on investment for providers: South Korea’s national health insurance system tightly regulates reimbursement levels for diagnostic imaging, including MRI procedures. Although coverage has expanded over time, reimbursement rates remain under scrutiny, placing pressure on providers to optimize utilization and throughput to justify high equipment investments. In some clinical indications, reimbursement ceilings and utilization audits can discourage excessive MRI usage, impacting revenue realization and lengthening payback periods for new scanner installations.

Operational complexity and skilled manpower requirements create utilization challenges: MRI operations require specialized radiologists, trained technologists, physicists, and service engineers to ensure optimal image quality, patient safety, and system uptime. Shortages of experienced MRI technologists in certain regions, along with increasing procedural complexity for advanced imaging protocols, can limit effective utilization of installed scanners. This operational dependency reduces the ability of some facilities to fully monetize high-end systems, influencing more conservative purchasing behavior.

What are the Regulations and Initiatives which have Governed the Market:

Medical device regulatory approvals and safety compliance requirements shaping market entry: MRI scanners in South Korea must comply with stringent medical device regulations governing electromagnetic safety, patient protection, and clinical performance. Regulatory approvals require extensive documentation, testing, and post-market surveillance obligations. These requirements influence time-to-market for new technologies and favor established global manufacturers with strong regulatory experience and local compliance infrastructure.

National Health Insurance reimbursement policies guiding utilization and technology adoption: Government reimbursement frameworks play a central role in determining MRI utilization levels and clinical adoption patterns. Coverage criteria specify eligible indications, scan frequency, and documentation standards, shaping how providers deploy MRI services. Gradual expansion of reimbursable indications has supported market stability, but ongoing policy reviews and cost-containment initiatives continue to influence provider investment decisions and scanner mix selection.

Healthcare quality improvement and hospital modernization initiatives supporting advanced imaging: Public-sector initiatives focused on improving diagnostic accuracy, patient outcomes, and healthcare quality indirectly promote the adoption of advanced MRI technologies. Programs encouraging early disease detection, cancer screening, and neurological care strengthen the clinical role of MRI within hospital diagnostic pathways. Additionally, smart hospital and digital health initiatives support integration of MRI systems with hospital information systems, PACS, and AI-based diagnostic workflows.

South Korea MRI Scanners Market Segmentation

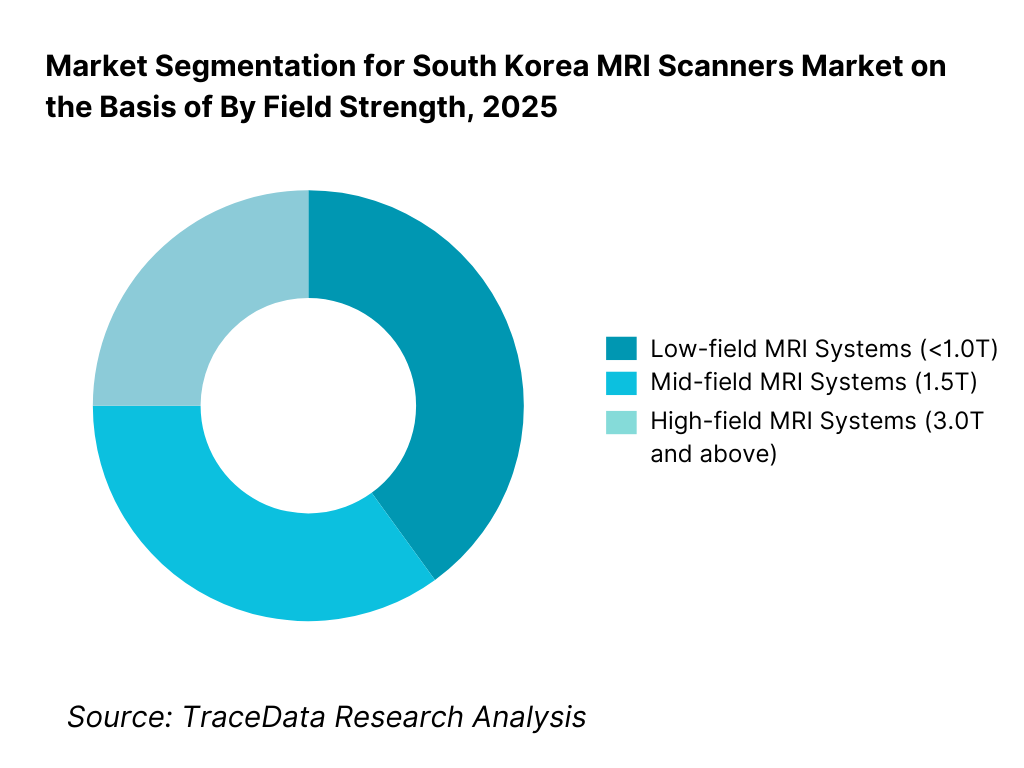

By Field Strength: The 1.5 Tesla and 3 Tesla MRI scanners segment dominates the South Korea MRI scanners market. This dominance is driven by the country’s advanced clinical practices, high diagnostic standards, and strong preference for high-resolution imaging across neurology, oncology, and musculoskeletal applications. Large tertiary hospitals and university medical centers increasingly standardize on 3T systems for advanced neuro, cardiac, and oncology imaging, while 1.5T systems remain the workhorse across general hospitals due to their balance of image quality, scan time, and operating cost. Low-field MRI systems (<1.0T) continue to see limited adoption, primarily in niche applications or budget-constrained facilities.

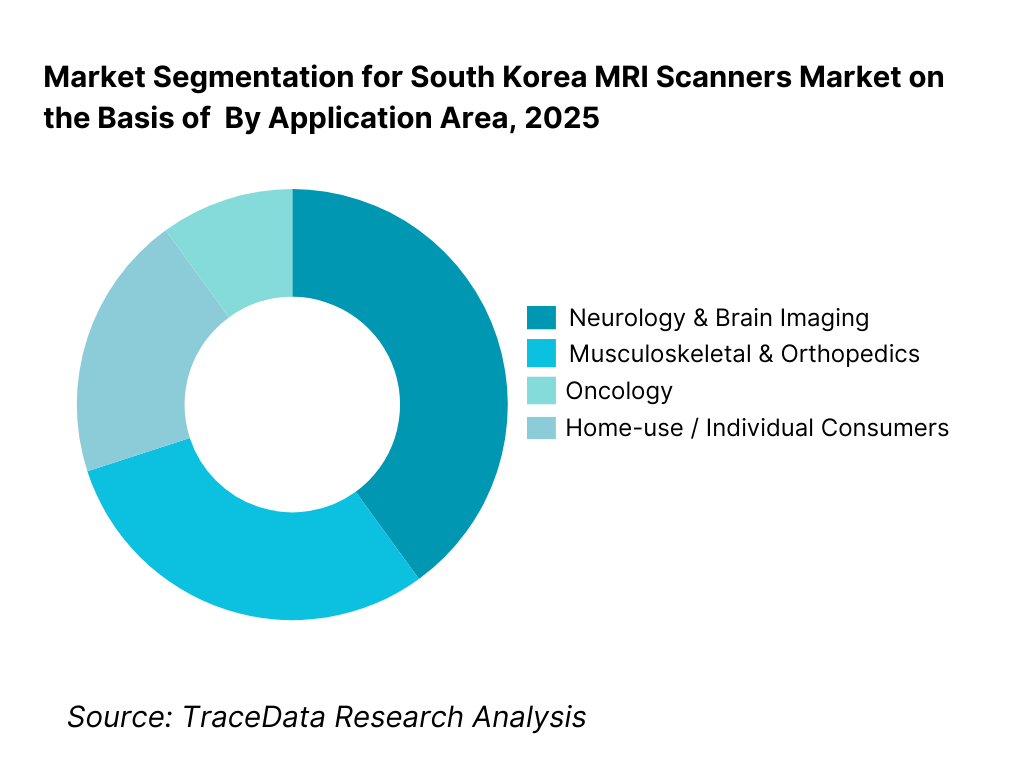

By Application Area: Neurology and musculoskeletal imaging together represent the largest share of MRI utilization in South Korea. High incidence of stroke, neurodegenerative diseases, spinal disorders, and sports-related injuries drives consistent imaging volumes. Oncology imaging is a fast-growing application segment, supported by expanding cancer screening programs, early diagnosis emphasis, and treatment monitoring requirements. Cardiac MRI adoption is increasing but remains comparatively specialized due to protocol complexity and higher expertise requirements.

Competitive Landscape in South Korea MRI Scanners Market

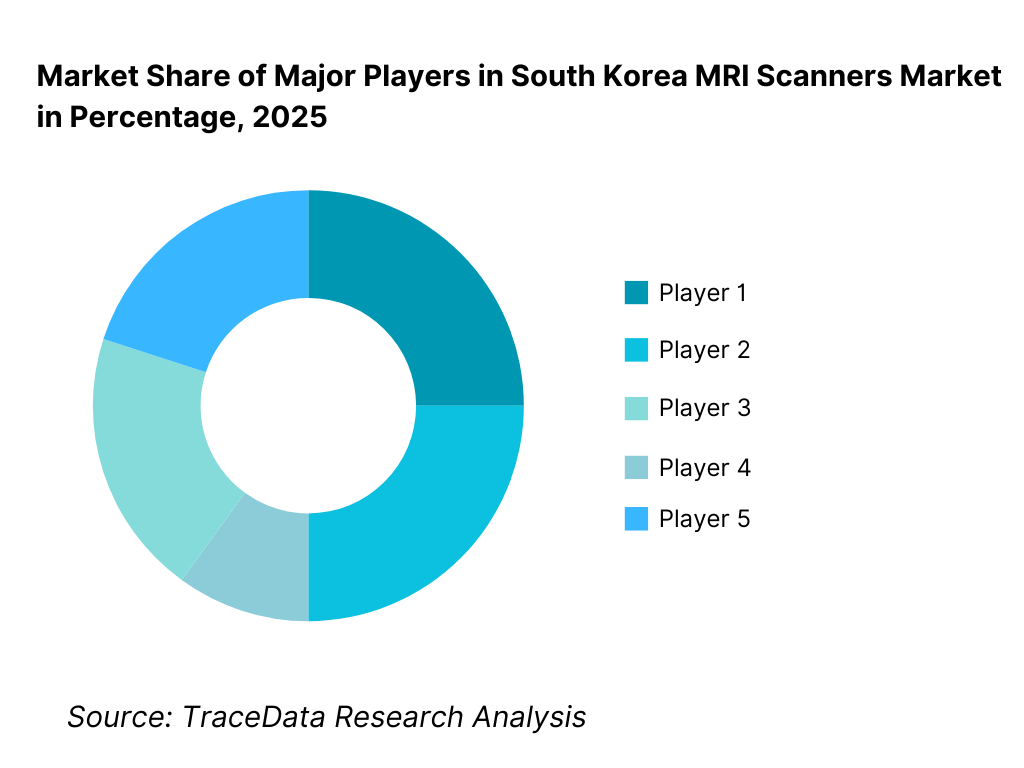

The South Korea MRI scanners market is highly concentrated and technology-driven, dominated by global multinational medical imaging companies with strong brand recognition, deep R&D capabilities, and established service networks. Competition is centered on image quality, scan speed, AI-enabled workflow optimization, system uptime, after-sales service quality, and long-term maintenance support. Given the criticality of MRI uptime and regulatory compliance, hospitals show strong preference for proven vendors with robust local service infrastructure rather than cost-led new entrants.

Name | Founding Year | Original Headquarters |

Siemens Healthineers | 1847 | Erlangen, Germany |

GE HealthCare | 1892 | Chicago, Illinois, USA |

Philips Healthcare | 1891 | Amsterdam, Netherlands |

Canon Medical Systems | 1917 | Tochigi, Japan |

FUJIFILM Healthcare | 1934 | Tokyo, Japan |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Siemens Healthineers: Siemens Healthineers holds a strong leadership position in South Korea, particularly in high-field and advanced MRI systems. The company’s strength lies in cutting-edge gradient technology, AI-powered image reconstruction, and strong integration with hospital IT ecosystems. Siemens systems are widely preferred by tertiary hospitals for neurology, oncology, and research-driven imaging applications.

GE HealthCare: GE HealthCare competes strongly on workflow efficiency, patient comfort innovations, and AI-enabled productivity tools. Its MRI portfolio is well positioned across both high-volume clinical imaging and specialized applications such as cardiac MRI. The company benefits from long-standing relationships with large hospital groups and a strong local service footprint.

Philips Healthcare: Philips differentiates through patient-centric MRI design, wide-bore systems, and strong performance in oncology and musculoskeletal imaging. Its emphasis on reduced scan times, lower acoustic noise, and digital integration aligns well with South Korea’s focus on patient experience and operational efficiency.

Canon Medical Systems: Canon Medical Systems maintains a competitive position through image quality consistency, reliability, and comparatively lower total cost of ownership. The company’s MRI systems are increasingly adopted by mid-sized hospitals and diagnostic centers seeking dependable performance without premium pricing associated with ultra-high-end systems.

FUJIFILM Healthcare: FUJIFILM focuses on compact MRI solutions, imaging software, and AI-assisted diagnostics. While its MRI footprint is smaller compared to top-tier competitors, the company continues to expand selectively by targeting outpatient centers and facilities prioritizing space efficiency and digital workflow integration.

What Lies Ahead for South Korea MRI Scanners Market?

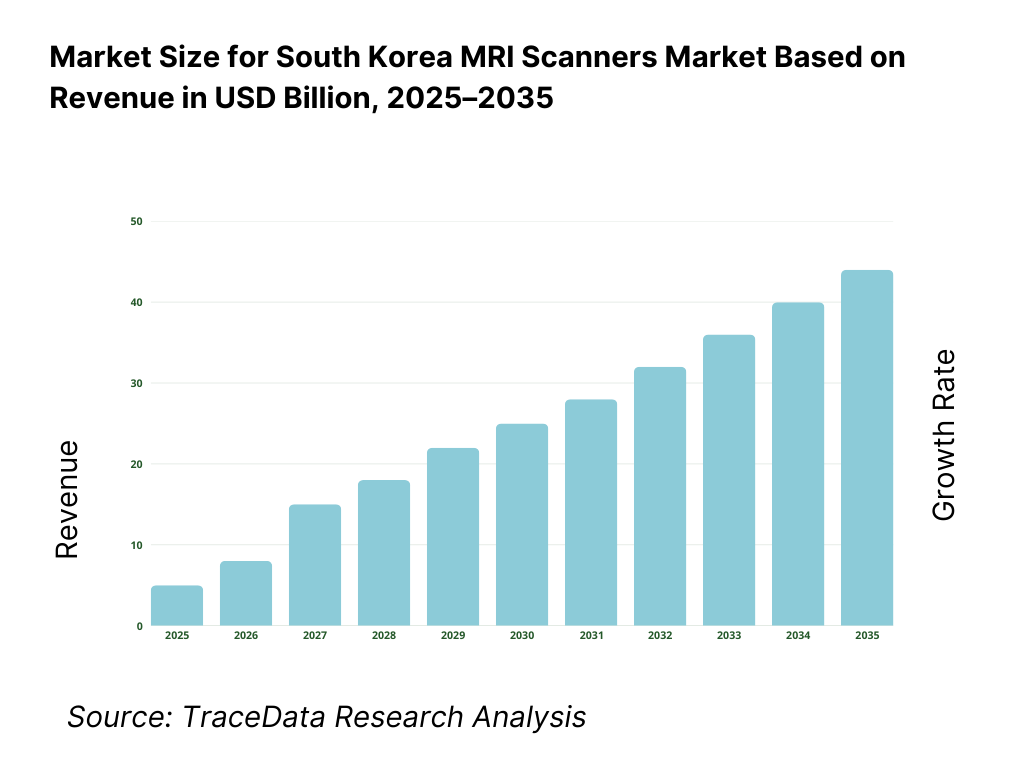

The South Korea MRI scanners market is expected to expand steadily by 2035, supported by sustained diagnostic imaging demand, a rapidly aging population, and continued investment in hospital modernization and advanced clinical capabilities. Growth momentum is further enhanced by replacement-led upgrades from older installed systems, increasing adoption of high-field MRI for complex clinical pathways, and a stronger emphasis on productivity and patient throughput in both public and private healthcare settings. As providers focus on improving diagnostic accuracy, reducing scan times, and integrating imaging workflows with digital hospital ecosystems, MRI technology will remain a critical pillar of South Korea’s high-quality healthcare delivery model through 2035.

Transition Toward High-Field, Faster, and AI-Enabled MRI Systems for Advanced Diagnostics: The next decade will see a continued shift toward high-field MRI scanners, particularly 3T systems, as hospitals expand advanced neuro, oncology, and cardiac imaging capabilities. AI-enabled image reconstruction, motion correction, and noise reduction will play a larger role in improving scan efficiency and standardizing image quality across varied patient profiles. Providers will increasingly prioritize systems that deliver faster acquisition times, higher-quality images, and improved diagnostic confidence, especially where complex protocols and time-sensitive clinical decisions are required. This transition will accelerate replacement demand, as older mid-field and legacy systems become less competitive in clinical performance and operational efficiency.

Rising Emphasis on Patient Comfort, Wide-Bore Systems, and Workflow Productivity in High-Utilization Facilities: With higher patient volumes and increasing utilization pressure, hospitals and imaging centers will prioritize MRI systems that improve patient experience and reduce incomplete scans caused by claustrophobia, anxiety, and motion artifacts. Wide-bore designs, quieter scanning technologies, and faster protocols will become more central purchasing criteria, particularly in urban diagnostic centers and multi-specialty hospitals. Productivity-driven procurement will also strengthen demand for systems that enable high daily scan throughput, streamlined patient positioning, protocol automation, and reduced downtime through predictive maintenance capabilities.

Integration of MRI with Smart Hospital Infrastructure, PACS, and Data-Driven Clinical Workflows: South Korea’s healthcare ecosystem is steadily progressing toward more digital, integrated, and data-driven care delivery. MRI systems will increasingly be purchased not only as standalone imaging equipment but as part of end-to-end diagnostic workflow platforms integrated with PACS, RIS, EMR, and AI-based decision support tools. Hospitals will place higher value on interoperability, cybersecurity readiness, and seamless digital reporting workflows. Vendors that deliver strong software ecosystems, upgradeable platforms, and robust service infrastructure will strengthen long-term customer lock-in and lifecycle revenue opportunities.

Expansion of Regional Diagnostic Capabilities and Secondary Hospital Upgrades Beyond the Capital Area: While the Seoul Capital Area will continue to lead MRI adoption, incremental growth through 2035 will increasingly come from secondary hospitals and regional medical centers upgrading diagnostic infrastructure. As regional healthcare access improves and patient referrals expand outside major metros, demand for modern 1.5T and selective 3T installations will rise in provincial clusters. This will be driven by the need to reduce patient travel burden, improve regional clinical outcomes, and build stronger diagnostic pathways in oncology, neurology, and orthopedics across non-capital regions.

South Korea MRI Scanners Market Segmentation

By Field Strength

• Low-field MRI Systems (<1.0T)

• Mid-field MRI Systems (1.5T)

• High-field MRI Systems (3.0T and above)

By Architecture Type

• Closed MRI Systems

• Wide-bore / Open MRI Systems

By Application Area

• Neurology & Brain Imaging

• Musculoskeletal & Orthopedics

• Oncology

• Cardiology & Vascular

• Other Applications

By End-User

• Hospitals (Tertiary & General)

• Diagnostic Imaging Centers

• Specialty Clinics & Others

By Region

• Seoul Capital Area (Seoul–Incheon–Gyeonggi)

• Chungcheong Region (Daejeon–Sejong–North/South Chungcheong)

• Yeongnam Region (Busan–Daegu–Ulsan–North/South Gyeongsang)

• Honam Region (Gwangju–North/South Jeolla)

• Gangwon & Jeju

Players Mentioned in the Report:

• Siemens Healthineers

• GE HealthCare

• Philips Healthcare

• Canon Medical Systems

• FUJIFILM Healthcare

• Regional distributors, imaging service providers, and equipment leasing/maintenance partners in South Korea

Key Target Audience

• MRI scanner manufacturers and imaging technology suppliers

• Hospital groups, tertiary hospitals, and general hospitals

• Diagnostic imaging centers and specialty clinic chains

• Radiology departments, imaging procurement heads, and biomedical engineering teams

• Healthcare infrastructure planners and smart hospital program stakeholders

• Medical device distributors, service providers, and equipment leasing companies

• Healthcare investors and operators focused on diagnostics and outpatient expansion

Time Period:

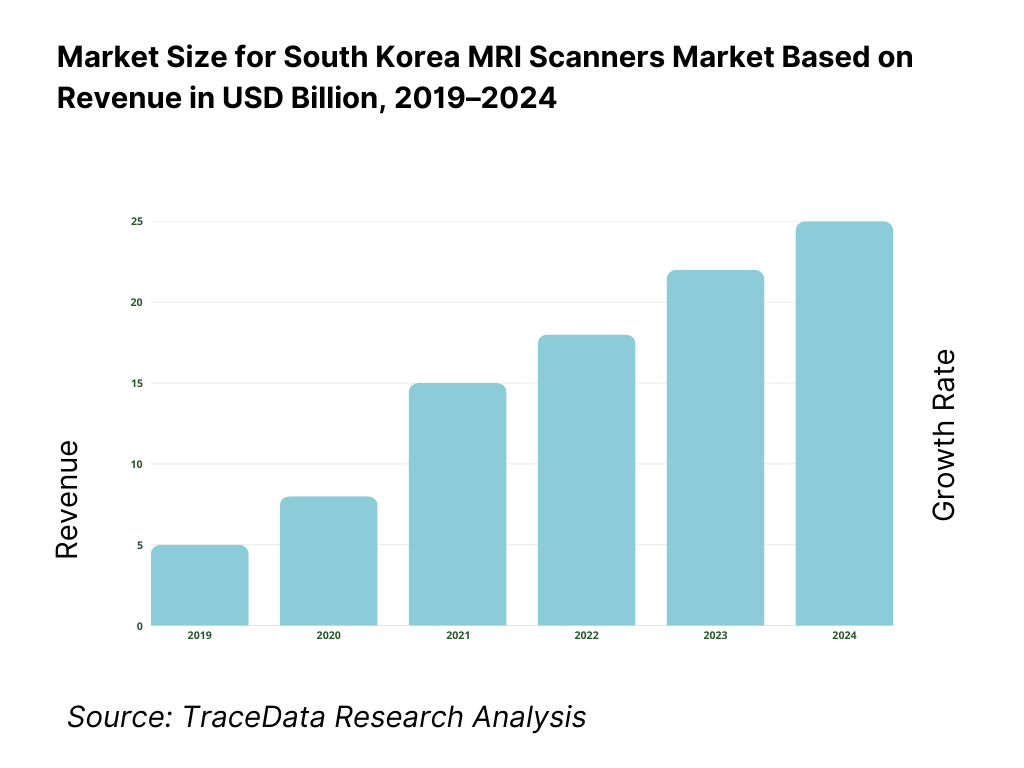

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for MRI Scanners including direct OEM sales, distributor-led sales, turnkey installation models, leasing and managed equipment services with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for MRI Scanners Market including equipment sales, installation and commissioning, service and maintenance contracts, software upgrades, and imaging workflow solutions

4. 3 Business Model Canvas for MRI Scanners Market covering OEMs, distributors, hospitals and imaging centers, service partners, software providers, and regulatory stakeholders

5. 1 Global MRI OEMs vs Regional and Local Suppliers including Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, FUJIFILM Healthcare, and other domestic or regional distributors

5. 2 Investment Model in MRI Scanners Market including capital purchase models, leasing and pay-per-use models, upgrade-driven investments, and technology refresh cycles

5. 3 Comparative Analysis of MRI Deployment by Hospital-Owned Imaging Departments and Independent Diagnostic Centers including ownership, utilization, and ROI dynamics

5. 4 Healthcare Diagnostic Budget Allocation comparing MRI versus CT, X-ray, ultrasound, and nuclear imaging with average spend per hospital per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by field strength and by end-user type

8. 3 Key Market Developments and Milestones including regulatory approvals, major hospital upgrades, AI-enabled MRI launches, and reimbursement policy updates

9. 1 By Market Structure including global OEM-led systems and distributor-supported installations

9. 2 By Field Strength including low-field, 1.5T, and 3T MRI systems

9. 3 By Architecture Type including closed-bore and wide-bore/open MRI systems

9. 4 By Application Area including neurology, musculoskeletal, oncology, cardiology, and others

9. 5 By End-User including tertiary hospitals, general hospitals, diagnostic imaging centers, and specialty clinics

9. 6 By Healthcare Facility Type including public hospitals and private healthcare providers

9. 7 By Procurement Model including direct purchase, leasing, and managed service models

9. 8 By Region including Seoul Capital Area, Chungcheong, Yeongnam, Honam, and Gangwon & Jeju

10. 1 Healthcare Provider Landscape and Imaging Capacity Analysis highlighting tertiary hospitals and regional centers

10. 2 MRI System Selection and Purchase Decision Making influenced by clinical needs, reimbursement, uptime, and service support

10. 3 Utilization and ROI Analysis measuring scan volumes, throughput, and payback periods

10. 4 Gap Analysis Framework addressing access gaps, technology obsolescence, and workforce constraints

11. 1 Trends and Developments including shift to high-field MRI, AI-assisted imaging, wide-bore systems, and workflow automation

11. 2 Growth Drivers including aging demographics, chronic disease prevalence, hospital modernization, and diagnostic accuracy requirements

11. 3 SWOT Analysis comparing global OEM technology leadership versus cost, service, and local support factors

11. 4 Issues and Challenges including high capital costs, reimbursement controls, manpower shortages, and infrastructure readiness

11. 5 Government Regulations covering medical device approvals, safety standards, reimbursement policies, and healthcare governance in South Korea

12. 1 Market Size and Future Potential of advanced diagnostic imaging including MRI within the broader imaging ecosystem

12. 2 Business Models including capital equipment sales, leasing, and service-led models

12. 3 Delivery Models and Type of Solutions including turnkey installations, integrated IT solutions, and AI-enabled imaging platforms

15. 1 Market Share of Key Players by revenues and installed base

15. 2 Benchmark of 15 Key Competitors including Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, FUJIFILM Healthcare, and other regional distributors and service providers

15. 3 Operating Model Analysis Framework comparing OEM-direct models, distributor-led models, and service-integrated offerings

15. 4 Gartner Magic Quadrant positioning global leaders and niche challengers in MRI technology

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through technology differentiation versus cost and service-led strategies

16. 1 Revenues with projections

17. 1 By Market Structure including global OEM systems and regional delivery models

17. 2 By Field Strength including 1.5T and 3T dominance trends

17. 3 By Architecture Type including closed and wide-bore MRI systems

17. 4 By Application Area including neurology, oncology, and musculoskeletal imaging

17. 5 By End-User including hospitals and diagnostic centers

17. 6 By Healthcare Facility Type including public and private providers

17. 7 By Procurement Model including purchase and leasing models

17. 8 By Region including Seoul Capital Area, Chungcheong, Yeongnam, Honam, and Gangwon & Jeju

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the South Korea MRI Scanners market across demand-side and supply-side entities. On the demand side, entities include tertiary and general hospitals, university medical centers, public hospitals, diagnostic imaging centers, specialty clinics (orthopedics, neurology, oncology), and preventive health-check providers. Demand is further segmented by installation purpose (new installation vs replacement/upgrade), clinical intensity (routine imaging vs advanced protocols such as oncology staging, neuro-functional imaging, cardiac MRI), and operating model (hospital-owned radiology departments vs outsourced/partnered imaging operations). On the supply side, the ecosystem includes global MRI OEMs, local authorized distributors, service and maintenance partners, RF shielding and site-prep contractors, coil and accessory suppliers, PACS/RIS/EMR integration partners, AI imaging software providers, helium supply and lifecycle management vendors, and regulatory and reimbursement stakeholders influencing procurement behavior. From this mapped ecosystem, we shortlist 6–10 leading MRI OEMs and a representative set of distributors and service providers based on installed base presence, tertiary hospital penetration, service footprint, technology portfolio, and strength in high-field systems. This step establishes how value is created and captured across equipment sales, installation, clinical workflow integration, service contracts, and technology upgrades.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the South Korea MRI scanners market structure, demand drivers, and segment behavior. This includes reviewing healthcare infrastructure distribution by region, diagnostic imaging utilization patterns, demographic aging indicators, disease burden trends influencing MRI use (neurology, musculoskeletal, oncology, cardiac), and investment cycles in public and private hospitals. We assess adoption patterns by field strength (1.5T vs 3T), architecture preferences (closed vs wide-bore/open), and technology evolution (AI reconstruction, motion correction, workflow automation, silent scanning, faster gradients). Company-level analysis includes review of OEM portfolios, product positioning across tiers, installed base strategy, local service models, typical upgrade cycles, warranty and maintenance packages, and distributor coverage. We also examine the regulatory and reimbursement environment shaping purchasing decisions, including device approvals, reimbursement eligibility criteria, and utilization controls that influence provider ROI. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and creates the assumptions needed for market estimation and future outlook modeling.

Step 3: Primary Research

We conduct structured interviews with MRI OEM representatives, authorized distributors, biomedical engineering heads, radiology department decision-makers, imaging center operators, and service contractors involved in installation and uptime management. The objectives are threefold: (a) validate assumptions around procurement behavior, upgrade cycles, and the balance between 1.5T and 3T demand, (b) authenticate segment splits by end-user type, application area, and regional concentration, and (c) gather qualitative insights on pricing dynamics, tender versus negotiated procurement, installation constraints, service performance expectations, and technology adoption priorities such as AI productivity tools and patient-comfort features. A bottom-to-top approach is applied by estimating the annual equipment replacement rate, new installations, average selling price bands by system type, and service contract penetration, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with distributors and service providers to validate field-level realities such as lead times, site readiness requirements, warranty negotiation norms, and common bottlenecks in commissioning and acceptance testing.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as healthcare capex trends, hospital expansion and modernization activity, regional diagnostic infrastructure strengthening, and expected growth in MRI procedure volumes driven by aging and chronic disease prevalence. Assumptions around reimbursement controls, staffing constraints, and service uptime requirements are stress-tested to understand their impact on new purchases and replacement timing. Sensitivity analysis is conducted across key variables including the pace of 3T adoption, AI workflow penetration, outpatient imaging growth intensity, and the acceleration of regional hospital upgrades beyond the capital area. Market models are refined until alignment is achieved between installed base dynamics, supplier delivery capacity, and provider utilization economics, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the South Korea MRI Scanners Market?

The South Korea MRI scanners market holds strong potential, supported by rapid demographic aging, increasing imaging volumes for neurology, musculoskeletal, and oncology care, and sustained investments in hospital modernization. Replacement-led upgrades from older systems, rising adoption of 3T MRI for advanced diagnostics, and increasing use of AI to improve throughput and image quality are expected to strengthen market value through 2035. As providers focus on productivity, patient experience, and diagnostic precision, MRI will remain a high-priority modality across both tertiary hospitals and growing outpatient imaging centers.

02 Who are the Key Players in the South Korea MRI Scanners Market?

The market is dominated by global MRI OEMs with established installed base presence, strong clinical credibility, and robust local service infrastructure. Competition is shaped by image quality performance, scan speed, AI-enabled workflow enhancements, system uptime, service responsiveness, and upgradeable software platforms. Authorized distributors and service partners play a critical role in procurement support, installation readiness, acceptance testing, and lifecycle maintenance delivery.

03 What are the Growth Drivers for the South Korea MRI Scanners Market?

Key growth drivers include expanding diagnostic imaging demand from an aging population, increasing prevalence of chronic diseases requiring MRI-based diagnosis and monitoring, and ongoing technology upgrades toward high-field systems. Additional growth momentum comes from AI-enabled productivity improvements, rising adoption of wide-bore designs for patient comfort, expansion of outpatient imaging centers, and regional healthcare development initiatives aimed at strengthening diagnostic capacity outside major metro areas.

04 What are the Challenges in the South Korea MRI Scanners Market?

Challenges include high capital and lifecycle operating costs for advanced MRI systems, reimbursement controls that influence provider ROI, and operational dependencies on trained technologists and service uptime. Infrastructure readiness and space constraints can delay installations, especially in older hospital buildings requiring costly retrofits. Competitive pressure and procurement scrutiny also increase vendor expectations around service quality, uptime guarantees, and long-term cost predictability.