Spain Cold Chain Market Outlook to 2029

, By Temperature Type, By Product Type, By End-User Industry, By Ownership Type, and By Region

- Product Code: TDR0324

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Spain Cold Chain Market Outlook to 2029 – By Market Structure, By Temperature Type, By Product Type, By End-User Industry, By Ownership Type, and By Region” provides a comprehensive analysis of the cold chain industry in Spain. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on sales revenue, by market, service type, temperature, end-user industry, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

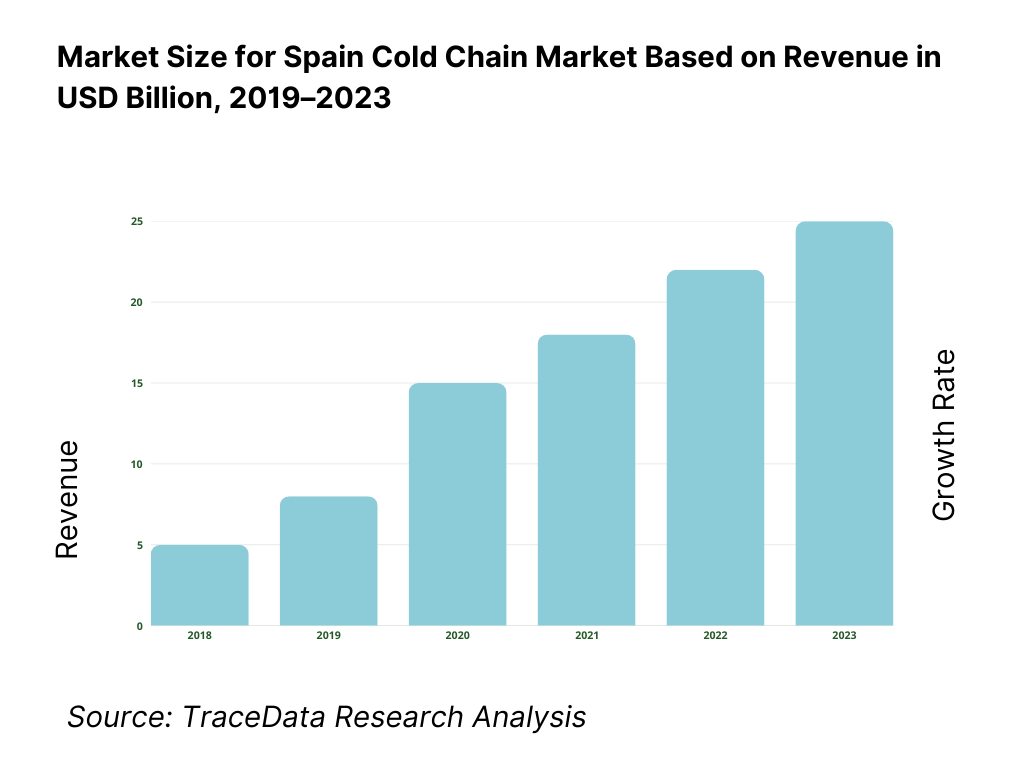

Spain Cold Chain Market Overview and Size

The Spain cold chain market reached a valuation of EUR 3.2 Billion in 2023, driven by the rising demand for temperature-controlled logistics in food, pharmaceuticals, and retail segments. The market is characterized by key players such as Logista, STEF Iberia, DHL Supply Chain Spain, FM Logistic, and Primafrío. These companies are recognized for their large fleet networks, integrated warehousing solutions, and robust temperature monitoring systems.

In 2023, STEF Iberia expanded its cold storage capacity by opening a new temperature-controlled warehouse in Madrid, aiming to enhance last-mile delivery for e-commerce and pharmaceutical clients. Catalonia and Madrid are key markets due to their strategic connectivity, industrial zones, and proximity to major ports and distribution hubs.

What Factors are Leading to the Growth of Spain Cold Chain Market:

Growth in Perishable Trade and E-commerce: With increasing domestic consumption of perishable products and a surge in cross-border e-commerce, the need for efficient cold storage and transportation has intensified. In 2023, e-commerce contributed to approximately 18% of total temperature-sensitive product distribution in Spain.

Healthcare and Pharmaceutical Expansion: Driven by stringent EU regulations and the rise in temperature-sensitive biologics, the pharmaceutical industry is demanding advanced cold chain solutions. In 2023, nearly 22% of Spain’s cold chain logistics revenue came from the pharmaceutical segment.

Regulatory Compliance and Quality Assurance: Spain’s compliance with European Good Distribution Practices (GDP), along with ISO 9001 and HACCP certifications, has pushed logistics firms to invest in quality cold storage and monitoring technologies. This regulatory push has become a key enabler for modernization and efficiency.

Which Industry Challenges Have Impacted the Growth for Spain Cold Chain Market

High Energy and Operating Costs: Cold storage and refrigerated transportation are energy-intensive operations, and rising electricity and fuel costs in Spain have significantly impacted profitability. According to industry estimates, energy expenses account for 35–45% of total operational costs in the cold chain segment. In 2023, over 40% of small-scale operators reported reduced margins due to volatile energy pricing, making it difficult to maintain service quality.

Infrastructure Gaps in Rural and Secondary Regions: While major hubs like Madrid, Valencia, and Barcelona are well-connected, rural and secondary regions still face inadequate cold storage and transport infrastructure. This geographical disparity hampers the reach of temperature-sensitive goods, particularly fresh produce and pharmaceuticals. Around 28% of Spain’s agri-exporters cited limited cold chain access as a barrier to maintaining product quality in 2023.

Compliance and Standardization Challenges: Although the EU mandates strict cold chain compliance (GDP, ISO, HACCP), smaller Spanish logistics players struggle to consistently meet these standards due to the cost of certification, training, and tech upgrades. In 2023, nearly 30% of SMEs in the sector lacked real-time monitoring capabilities or full traceability compliance, reducing their competitiveness in pharma and high-risk food segments.

What are the Regulations and Initiatives which have Governed the Market

European GDP and National Cold Chain Regulations: Spain enforces Good Distribution Practices (GDP) for the transportation and storage of pharmaceuticals. These standards ensure continuous temperature monitoring, proper documentation, and validated equipment. In 2023, approximately 72% of pharma shipments were GDP-compliant, with the remainder mostly serviced by uncertified regional players.

Public-Private Investments in Logistics Infrastructure: The Spanish government, in collaboration with the EU Recovery and Resilience Facility, has allocated over EUR 500 million between 2021–2025 to improve cold logistics infrastructure, especially in agri-export corridors. As of 2023, around 18 large-scale cold warehouses were under development, aimed at expanding regional access and improving export competitiveness.

Food Safety Modernization and HACCP Mandates: To ensure compliance with EU food safety laws, Spain mandates HACCP implementation across cold storage and food logistics operations. Regular audits and traceability systems are compulsory for exporters. In 2023, the Ministry of Agriculture reported that 83% of certified cold storage facilities passed HACCP compliance inspections on their first audit attempt, indicating improving quality assurance across the ecosystem.

Spain Cold Chain Market Segmentation

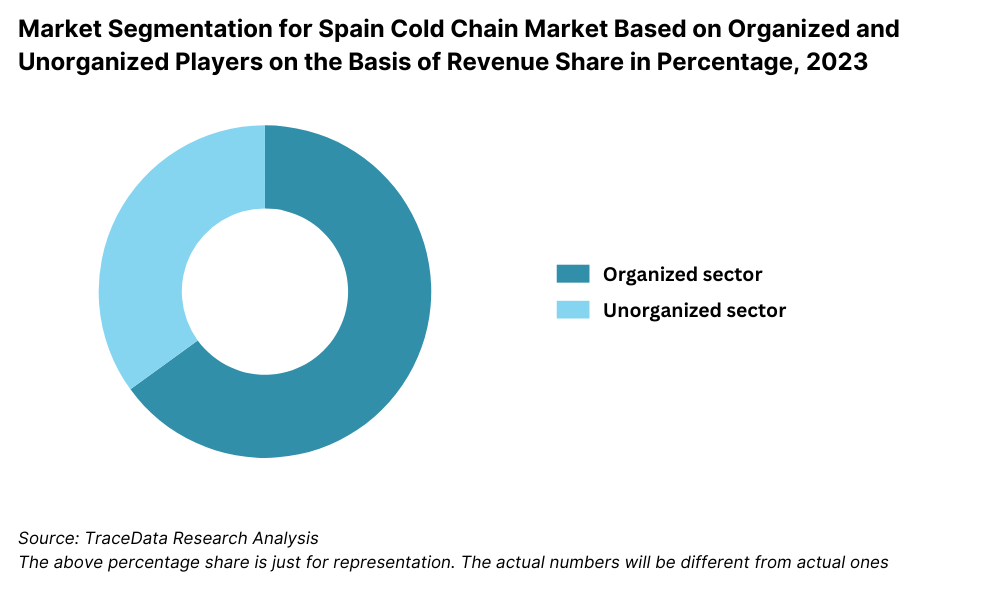

By Market Structure: Organized players dominate the Spanish cold chain market owing to their advanced technological infrastructure, compliance with EU quality standards, and ability to provide end-to-end logistics solutions. These firms include large 3PL providers and multinational logistics companies that offer integrated temperature-controlled storage, packaging, and distribution services. Unorganized and regional operators, though smaller in scale, continue to hold relevance in niche segments such as fresh produce delivery and regional FMCG distribution due to their localized networks and cost competitiveness.

By Temperature Type: The cold chain industry in Spain is bifurcated into chilled (0–8°C) and frozen (-18°C and below) segments. Frozen logistics holds a larger share, driven by high demand from frozen seafood, meat, and ready-to-eat meals industries. However, chilled logistics is rapidly expanding due to increased demand from dairy, bakery, and pharmaceutical segments requiring tight temperature control and shorter turnaround times.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

By End-User Industry: The food & beverage industry accounts for the majority of cold chain demand, particularly for meat, seafood, dairy, and fruits and vegetables. In 2023, this segment contributed over half of the total market revenue. The pharmaceutical industry is the second-largest segment, driven by temperature-sensitive vaccines, biologics, and specialty medicines. The rise of online grocery and food delivery apps has also contributed to increased demand from the retail and e-commerce sector.

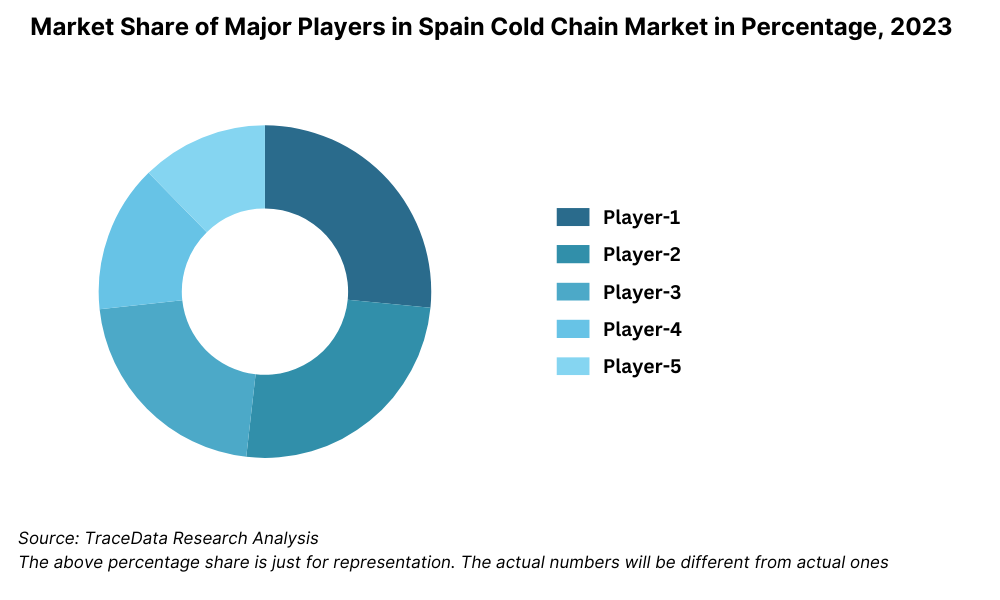

Competitive Landscape in Spain Cold Chain Market

The Spain cold chain market is moderately consolidated, with a mix of domestic giants and international logistics companies offering temperature-controlled storage and transportation solutions. The increasing demand for compliant, tech-enabled cold chain services has also encouraged new entrants and regional operators to modernize and scale. Key players include Logista, STEF Iberia, DHL Supply Chain Spain, Primafrío, FM Logistic, and Sesé Group.

Company | Establishment Year | Headquarters |

Logista | 1999 | Leganés, Spain |

STEF Iberia | 2008 (Spain entry) | Madrid, Spain |

DHL Supply Chain | 1969 | Bonn, Germany (Spain HQ: Madrid) |

Primafrío | 1963 | Murcia, Spain |

FM Logistic | 1967 | Phalsbourg, France (Spain HQ: Illescas) |

Grupo Sesé | 1965 | Zaragoza, Spain |

Some of the recent competitor trends and key information about competitors include:

Logista: A market leader in logistics for tobacco, pharma, and food sectors, Logista managed over 45 million temperature-controlled shipments in 2023. Its pharmaceutical cold chain operations expanded with the addition of GDP-certified depots in Seville and Barcelona, reinforcing its footprint in regulated logistics.

STEF Iberia: A key cold logistics operator, STEF Iberia saw a 12% revenue growth in 2023. The firm launched a new multi-temperature warehouse in Madrid with 20,000 pallet capacity, designed to serve growing demand from supermarkets and food manufacturers for just-in-time deliveries.

DHL Supply Chain Spain: Leveraging its global infrastructure, DHL expanded its pharma and vaccine logistics segment in 2023, including investment in real-time temperature monitoring. The company’s strategic partnership with major healthcare firms has led to a 15% increase in life sciences-related cold shipments.

Primafrío: Known for its refrigerated transport services across Europe, Primafrío operates a fleet of more than 2,300 refrigerated trucks. In 2023, it enhanced cross-border services for fresh produce exports to Germany and France, with 98% on-time delivery performance reported.

FM Logistic Spain: FM Logistic has invested in eco-friendly cold warehouses, including solar-powered refrigeration units. Its temperature-controlled operations for dairy and chocolate producers grew by 17% in 2023, driven by retail and seasonal demand.

Grupo Sesé: While traditionally focused on automotive logistics, Sesé has diversified into cold chain logistics over the last few years. In 2023, it partnered with a national pharma distributor to provide last-mile cold deliveries across 20+ Spanish cities using IoT-based refrigerated vans.

What Lies Ahead for Spain Cold Chain Market?

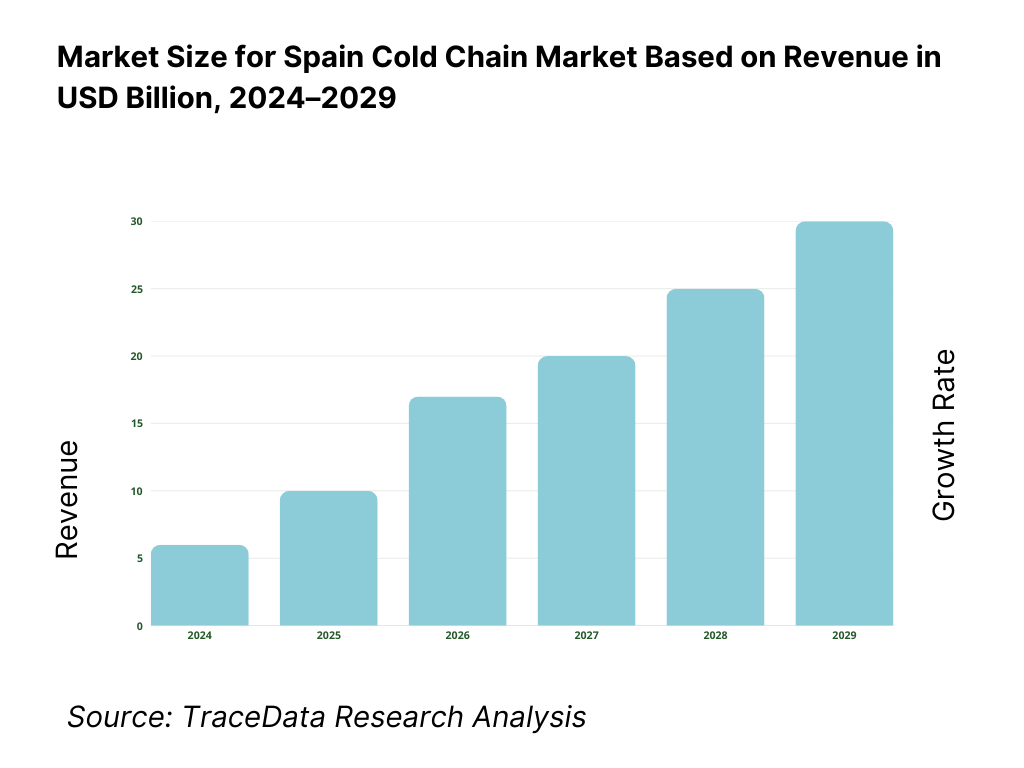

The Spain cold chain market is projected to grow consistently through 2029, exhibiting a strong CAGR driven by increasing demand for temperature-sensitive logistics across food, pharmaceutical, and e-commerce sectors. The market's future will be shaped by technological adoption, sustainability pressures, and expanding regulatory compliance.

Expansion of Pharmaceutical and Biologics Logistics: With Spain emerging as a major hub for pharmaceutical manufacturing and clinical trials in Europe, the need for GDP-compliant, temperature-controlled logistics is expected to rise significantly. Growth in biologics and specialty drugs will drive demand for ultra-low temperature storage and transport capabilities, especially between research clusters in Madrid, Catalonia, and Andalusia.

Acceleration of Digital Cold Chain Technologies: The adoption of IoT sensors, real-time tracking, AI-based route optimization, and predictive maintenance for refrigeration systems will become standard. By 2029, it is expected that over 70% of organized cold chain players in Spain will operate with full visibility platforms, enabling better temperature integrity, reduced spoilage, and enhanced traceability from origin to end-user.

Rise of Retail and Q-Commerce Fulfillment Needs: Quick commerce (Q-commerce) platforms and last-mile delivery for chilled and frozen groceries are expected to grow rapidly in urban markets such as Madrid, Barcelona, and Valencia. This will spur investments in micro cold storage units and urban dark stores to meet delivery windows under 30 minutes, especially for fresh and dairy products.

Sustainability and Energy-Efficient Operations: In response to EU’s Fit for 55 climate goals and rising energy costs, companies are transitioning toward solar-powered refrigeration, green-certified warehouses, and eco-friendly refrigerants. The government is expected to roll out incentive schemes by 2026 to support cold logistics firms adopting low-emission vehicles and energy-saving technologies.

Spain Cold Chain Market Segmentation

• By Market Structure:

o Organized Logistics Providers

o Regional/Local Cold Chain Operators

o Asset-Heavy Cold Chain Players

o Asset-Light and 3PL Providers

o Cold Storage Warehousing

o Cold Transportation Services

o Cross-Border Temperature-Controlled Logistics

• By Temperature Type:

o Chilled (0°C to 8°C)

o Frozen (-18°C and below)

o Ambient-Controlled (15°C to 25°C)

o Ultra-Low Temperature (below -40°C, mainly for pharmaceuticals)

• By Product Type:

o Fruits & Vegetables

o Meat & Seafood

o Dairy Products

o Ready-to-Eat & Frozen Foods

o Pharmaceuticals & Biologics

o Floral & Specialty Chemicals

• By End-User Industry:

o Food & Beverage Manufacturers

o Retail & Q-Commerce

o Foodservice (Hotels, Restaurants, Cafés)

o Pharmaceutical & Life Sciences

o Agriculture & Horticulture

o Cosmetics and Specialty Products

• By Ownership Type:

o Own Fleet and Warehousing (Asset-Heavy)

o Outsourced Cold Chain (Asset-Light)

o Hybrid Ownership Models

• By Region:

o Catalonia

o Madrid

o Andalusia

o Valencia

o Basque Country

o Castilla-La Mancha

o Galicia

Players Mentioned in the Report:

• Logista

• STEF Iberia

• DHL Supply Chain Spain

• Primafrío

• FM Logistic Spain

• Grupo Sesé

• Frío Guerrero

• TIBA Group

• Eurofrigo

Key Target Audience:

• Cold Chain Logistics Companies

• Retail Chains and Foodservice Operators

• Pharmaceutical Distributors and Manufacturers

• Cold Storage Equipment Providers

• Policy Makers and Regulatory Authorities

• Private Equity and Infrastructure Investors

• Market Research & Consulting Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Spain Cold Chain Market

4.3. Business Model Canvas for Spain Cold Chain Market

4.4. Logistics Planning & Procurement Decision-Making Process

4.5. Storage and Transport Partner Selection Process

5.1. Cold Storage Capacity Trends in Spain, 2018-2024

5.2. Refrigerated Transport Fleet Size Trends, 2018-2024

5.3. Average Cold Chain Logistics Cost per Ton in Spain, 2024

5.4. Number of Cold Chain Operators in Spain by Region

8.1. Revenue, 2018-2024

8.2. Volume (Tons Handled), 2018-2024

9.1. By Market Structure (Organized vs Unorganized), 2023-2024P

9.2. By Temperature Type (Chilled, Frozen, Ambient, Ultra-Low), 2023-2024P

9.3. By Ownership Model (Asset-Heavy, Asset-Light, Hybrid), 2023-2024P

9.4. By End-User Industry (F&B, Pharma, Retail, Others), 2023-2024P

9.5. By Region (Catalonia, Madrid, Andalusia, etc.), 2023-2024P

9.6. By Product Type (Meat, Dairy, Seafood, Fruits & Vegetables, etc.), 2023-2024P

10.1. Customer Landscape and Sector-wise Logistics Dependency

10.2. Buyer Journey and Cold Chain Partner Selection

10.3. Procurement Needs, SLAs, and Pain Point Analysis

10.4. Cold Chain Adoption Gaps by Sector and Region

11.1. Trends and Developments in Spain Cold Chain Market

11.2. Growth Drivers for Spain Cold Chain Market

11.3. SWOT Analysis for Spain Cold Chain Market

11.4. Issues and Challenges in Spain Cold Chain Market

11.5. Government Regulations & EU Directives

12.1. Volume of Cross-Border Cold Chain Goods Movement (Spain-EU), 2018-2029

12.2. Compliance Requirements for Exported Goods

12.3. Cost and Time Comparison: Domestic vs Export Supply Chains

13.1. Infrastructure Investment Trends in Cold Storage and Fleet, 2018-2024

13.2. Public-Private Partnerships and EU Grant Programs

13.3. Lending Patterns for Cold Chain Infrastructure (Banks, VC, PE)

13.4. Impact of Energy Pricing and Carbon Taxation on Logistics Cost Structure

16.1. Benchmark of Key Competitors including Company Overview, USPs, Business Strategies, Infrastructure Strength, Technology Stack, Operating Cities, Warehouse Size, Fleet Type, Certifications, and Key Clients

16.2. Strength and Weakness Matrix

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowman’s Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Volume Handled (Tons), 2025-2029

18.1. By Market Structure (Organized vs Unorganized), 2025-2029

18.2. By Temperature Type, 2025-2029

18.3. By Ownership Model, 2025-2029

18.4. By End-User Industry, 2025-2029

18.5. By Region, 2025-2029

18.6. By Product Type, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities involved in the Spain Cold Chain Market. This includes cold storage operators, refrigerated transport providers, food and pharmaceutical manufacturers, and retail/e-commerce companies. Based on this mapping, we shortlist the leading 5–6 players in the country by evaluating their service capacity, asset ownership (fleet and warehousing), and financial performance.

Sourcing is done through government publications, industry associations (e.g., AECOC, Transprime), logistics databases, and business directories to perform desk research and understand the structural dynamics of the industry.

Step 2: Desk Research

We conduct exhaustive desk research by referencing a range of proprietary and public databases, including company filings, logistics trade portals, Eurostat, ICEX, and industry whitepapers. This helps analyze macro trends such as temperature-controlled freight volumes, cold storage utilization rates, pricing benchmarks, investment activity, and regional disparities.

In addition, we review company-level information from sources such as annual reports, press releases, investor presentations, and official websites. This data helps us assess capacity expansion, service models, technology adoption, and regulatory compliance for key players.

Step 3: Primary Research

We conduct in-depth interviews with key decision-makers, including cold chain logistics managers, pharma and food procurement heads, warehouse operators, and fleet managers across Spain. These interviews are aimed at validating secondary data findings, estimating market size, and extracting insights on pricing, process efficiency, utilization levels, and strategic priorities.

Disguised interviews are also performed, where analysts pose as potential customers or partners to cross-verify operational claims such as temperature maintenance, uptime, fleet size, and turnaround times. This dual-validation ensures authenticity of data and provides visibility into business models and pain points.

Step 4: Sanity Check

We perform a bottom-up analysis by aggregating company-wise capacities and operations to arrive at an overall market size estimate. This is triangulated with a top-down approach using national-level logistics indices, freight volumes, and warehousing data to ensure accuracy. Market size modeling is supported by growth drivers, historical benchmarks, and validation with industry experts.

FAQs

1. What is the potential for the Spain Cold Chain Market?

The Spain cold chain market is poised for robust growth, reaching a valuation of EUR 3.2 Billion in 2023, with strong momentum expected through 2029. This growth is driven by increasing demand from the food and pharmaceutical sectors, rising e-commerce penetration, and stricter regulatory standards around product safety and traceability. The market's potential is further reinforced by Spain’s strategic location as a logistics hub connecting Europe to North Africa and Latin America.

2. Who are the Key Players in the Spain Cold Chain Market?

The Spain Cold Chain Market is served by both domestic and international logistics companies. Key players include Logista, STEF Iberia, DHL Supply Chain Spain, Primafrío, and FM Logistic. These companies dominate the landscape due to their temperature-controlled fleet capacity, extensive cold storage infrastructure, and compliance with GDP and HACCP standards. Regional players such as Frío Guerrero and Grupo Sesé are also influential in specific segments like fresh produce and pharma logistics.

3. What are the Growth Drivers for the Spain Cold Chain Market?

Major growth drivers include the expanding pharmaceutical and biologics industry, rising demand for frozen and chilled food products, and the growth of Q-commerce and online grocery delivery. Increasing regulatory emphasis on temperature-sensitive logistics and technological advancements such as IoT tracking and AI-powered route optimization are also contributing to the market’s acceleration.

4. What are the Challenges in the Spain Cold Chain Market?

The Spain Cold Chain Market faces several challenges, including high energy and fuel costs, uneven infrastructure in rural and non-coastal regions, and the difficulty faced by SMEs in meeting strict compliance and certification standards. In addition, rising demand is placing pressure on existing capacity, creating a need for sustained investment in modern warehousing and fleet expansion.