Spain Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Logistics Model (First Party, Second Party, Third Party), By Mode of Transport, By End-User Industry, By Warehousing Type, and By Region

- Product Code: TDR0325

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Spain Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Logistics Model (First Party, Second Party, Third Party), By Mode of Transport, By End-User Industry, By Warehousing Type, and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Spain. The report covers an overview and genesis of the industry, overall market size in terms of revenue, segmentation by key parameters; trends and developments, regulatory environment, customer behavior, major challenges, and comparative landscape including competition scenario, cross comparison, opportunities and constraints, and company profiling of key players in the logistics and warehousing ecosystem. The report concludes with future market projections based on revenue, sector trends, regional distribution, cause-and-effect relationships, and success case studies highlighting growth enablers and risks.

Spain Logistics and Warehousing Market Overview and Size

The Spain logistics and warehousing market reached a value of EUR 82 Billion in 2023, driven by rising e-commerce volumes, modernization of infrastructure, and increased demand from industries such as automotive, retail, and pharmaceuticals. The market features both domestic and international logistics players, including SEUR, DHL, XPO Logistics, Correos Express, and DB Schenker, which offer integrated transport and storage solutions across the country.

Madrid and Catalonia are key logistics hubs due to their strategic connectivity, presence of industrial corridors, and robust road and rail networks. In 2023, SEUR expanded its urban delivery infrastructure in Madrid and Barcelona to meet increasing demand from last-mile e-commerce logistics. Additionally, Spain’s role as a gateway to Europe and Latin America further strengthens its global logistics potential.

What Factors are Leading to the Growth of Spain Logistics and Warehousing Market

E-Commerce Boom: Online shopping in Spain surged post-pandemic, with over 72% of internet users making purchases online in 2023. This exponential growth in e-commerce is fueling demand for faster, more efficient logistics and larger warehousing spaces closer to urban centers.

Infrastructure Development: Government-backed investments in logistics corridors and multimodal transport infrastructure (road, rail, and ports) have improved overall network efficiency. The Mediterranean Corridor and Atlantic Corridor have enhanced cross-border trade capacity, making Spain a regional logistics hub.

Rising 3PL Demand: The rising complexity of supply chains has encouraged businesses to outsource to third-party logistics providers (3PL). In 2023, 3PL services accounted for nearly 45% of total logistics operations in Spain, as companies seek scalable, flexible solutions for storage and distribution.

Which Industry Challenges Have Impacted the Growth of the Spain Logistics and Warehousing Market

High Operating Costs: Rising costs related to fuel, labor, and utilities have posed a significant challenge for logistics providers in Spain. In 2023, logistics companies reported an average increase of 12% in operational expenses, primarily due to energy inflation and driver wage hikes. This has directly affected profitability margins, particularly for small and medium-sized logistics firms.

Labor Shortages: Spain faces a chronic shortage of skilled logistics and warehousing personnel, especially in urban and port cities. A 2023 industry report highlighted that over 30% of logistics companies had difficulty filling warehouse and driver roles, leading to delays in operations and increased reliance on temporary staffing, which compromises service quality.

Urban Delivery Bottlenecks: Last-mile logistics operations in densely populated cities like Madrid and Barcelona are challenged by traffic congestion, restricted delivery windows, and limited loading zones. These issues contribute to an estimated 18% delay rate in urban deliveries, impacting customer satisfaction and increasing operational inefficiencies.

What are the Regulations and Initiatives Which Have Governed the Market

EU Logistics and Sustainability Directives: Spain, as part of the EU, adheres to regulations aimed at decarbonizing the transport sector. This includes compliance with the EU Mobility Package, mandating rest periods, cabotage rules, and digital tachograph implementation. In 2023, over 80% of Spanish logistics companies were compliant, but smaller players are still adjusting to digital mandates.

Urban Freight Distribution Plans (PMUS): Local governments in Spain have implemented Sustainable Urban Mobility Plans (Planes de Movilidad Urbana Sostenible – PMUS), which include time-restricted delivery zones, low-emission areas, and dedicated logistics hubs. In Madrid, these measures contributed to a 15% reduction in logistics-related urban emissions in 2023.

Subsidies for Fleet Modernization: The Spanish government offers financial aid under schemes like MOVES III, aimed at supporting the electrification of commercial fleets. In 2023, over EUR 120 million was disbursed to logistics companies upgrading to electric or hybrid vehicles, significantly boosting the adoption of cleaner transport alternatives.

Spain Logistics and Warehousing Market Segmentation

By Market Structure: The Spanish logistics market is dominated by Third-Party Logistics (3PL) providers, as businesses increasingly outsource logistics functions to focus on core operations. These 3PL firms offer scalable solutions, multimodal transportation, and value-added services such as inventory management and returns processing. On the other hand, First-Party (1PL) and Second-Party Logistics (2PL) continue to exist primarily within large manufacturing firms managing their own transportation and storage needs, especially in the automotive and industrial sectors.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

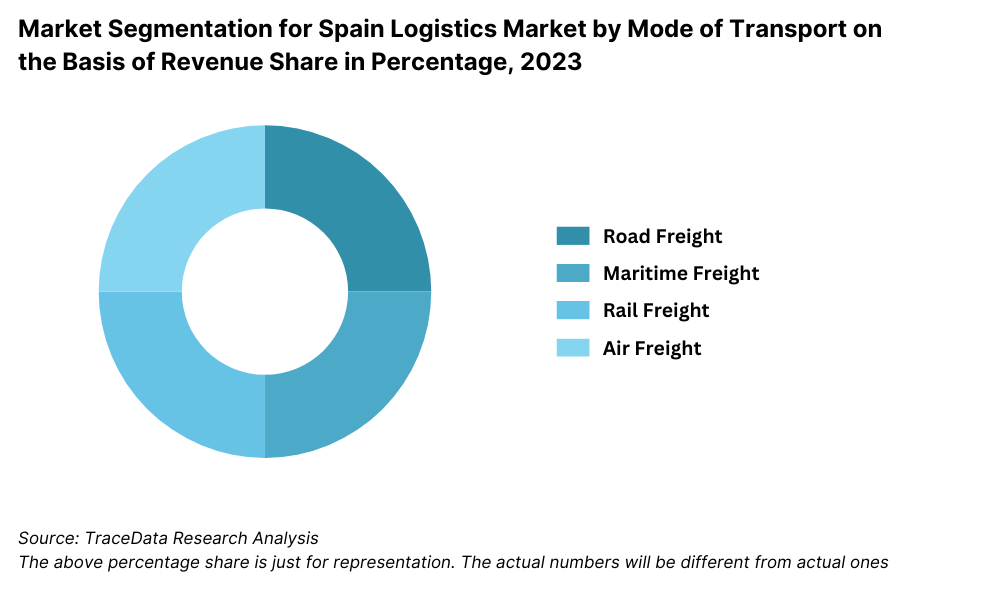

By Mode of Transport: Road transport remains the dominant mode in Spain, accounting for a majority share due to the country’s extensive highway infrastructure and its suitability for last-mile delivery. Rail transport is gaining momentum, especially for long-distance freight within the EU under green logistics goals. Maritime logistics plays a critical role in import/export operations, with ports like Valencia, Algeciras, and Barcelona acting as major gateways. Air freight, although limited in volume, supports high-value, time-sensitive shipments in industries such as pharma and electronics.

By End-User Industry: The e-commerce and retail sectors are the largest contributors to logistics demand in Spain, driven by the growing consumer preference for online shopping. The automotive sector also contributes significantly due to Spain’s role as a leading car manufacturing hub in Europe. Pharmaceuticals and food & beverage require temperature-controlled logistics and specialized warehousing, which is driving investments in cold chain infrastructure.

Competitive Landscape in Spain Logistics and Warehousing Market

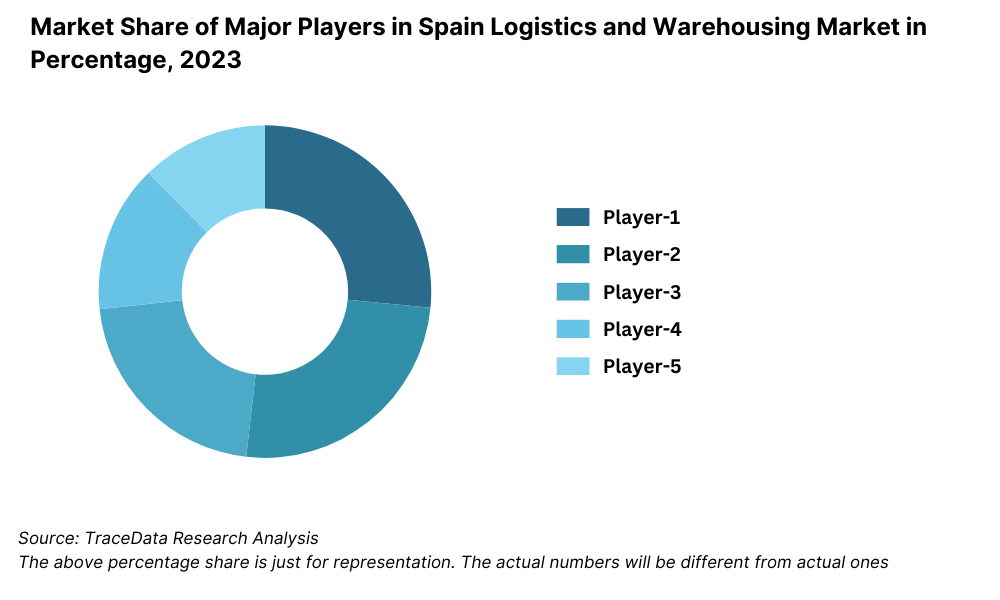

The Spain logistics and warehousing market is moderately consolidated, with major global and regional players operating across transport, storage, and supply chain management. The rise of e-commerce and digital logistics has attracted newer entrants, while traditional players like SEUR, Correos Express, DHL, DB Schenker, XPO Logistics, and Logista continue to dominate with expansive infrastructure and tailored B2B services.

Company | Establishment Year | Headquarters |

SEUR | 1942 | Madrid, Spain |

Correos Express | 2013 | Madrid, Spain |

DHL Spain | 1979 | Madrid, Spain |

DB Schenker Spain | 1977 | Barcelona, Spain |

XPO Logistics Spain | 2015 | Madrid, Spain |

Logista | 1999 | Leganés, Spain |

Some of the recent competitor trends and key information about competitors include:

SEUR: A leading express delivery and logistics provider in Spain, SEUR handled over 130 million parcels in 2023, driven by growth in B2C e-commerce logistics. The company has heavily invested in temperature-controlled last-mile delivery to support pharmaceutical and grocery segments.

Correos Express: The parcel delivery arm of Spain’s national postal service, Correos Express expanded its fleet by 15% in 2023 to meet increasing domestic shipment volumes. Its “Same Day Delivery” service gained strong traction in metropolitan areas like Madrid and Valencia.

DHL Spain: A key player in international and domestic logistics, DHL has launched green warehousing solutions in Spain, integrating solar panels and automated inventory systems. In 2023, DHL Spain saw a 10% YoY growth in its B2B logistics segment.

DB Schenker Spain: Focused on multimodal logistics and contract warehousing, DB Schenker operates over 300,000 sqm of warehouse space across Spain. The company has adopted AI-powered load optimization tools, improving fulfillment efficiency by 12% in 2023.

XPO Logistics Spain: Specializing in freight and supply chain services, XPO saw strong demand in its palletized less-than-truckload (LTL) network, particularly from retail and fashion sectors. In 2023, XPO added two new cross-docking facilities to strengthen regional coverage.

Logista: A major player in long-distance and controlled temperature logistics, Logista reported €1.2 billion in logistics revenue in 2023. The company services the pharmaceutical, tobacco, and convenience goods sectors, with a robust last-mile delivery network and automated warehousing systems.

What Lies Ahead for Spain Logistics and Warehousing Market?

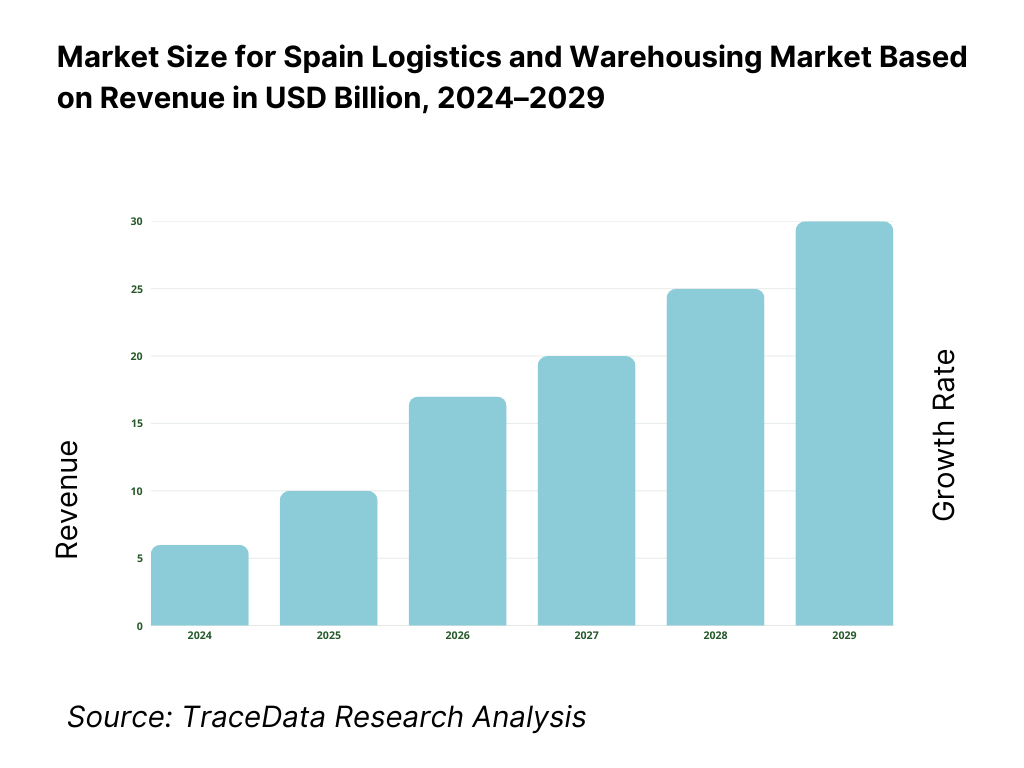

The Spain logistics and warehousing market is expected to witness consistent growth through 2029, supported by increasing trade activity, the rapid rise of e-commerce, government infrastructure investments, and an expanding emphasis on sustainable and tech-enabled supply chains. The sector is projected to grow at a CAGR of 6.5% during the forecast period.

Rise of Smart Warehousing: The adoption of smart warehouse technologies—such as IoT sensors, warehouse management systems (WMS), and robotics—is expected to rise significantly. These innovations will improve inventory accuracy, reduce operational costs, and support real-time decision-making, leading to more efficient supply chains.

Green Logistics Initiatives: With the European Union’s Green Deal and Spain's national carbon reduction targets, logistics players are expected to further invest in electric fleets, low-emission warehousing, and carbon-neutral operations. This shift will not only meet regulatory requirements but also appeal to sustainability-conscious clients.

Expansion of Cold Chain Logistics: Growth in the pharmaceutical, food, and perishable goods sectors will drive demand for temperature-controlled logistics. Spain's role in vaccine distribution and food exports will continue to boost investment in refrigerated storage and transport, especially in regions like Valencia and Andalusia.

Strengthening of Regional Hubs: Logistics hubs in Zaragoza, Seville, and Barcelona are projected to grow as key regional distribution centers. Improved rail-road-port connectivity and strategic public-private partnerships are expected to reduce bottlenecks and facilitate faster goods movement across the Iberian Peninsula and into the broader EU market.

Spain Logistics and Warehousing Market Segmentation

By Market Structure:

First-Party Logistics (1PL)

Second-Party Logistics (2PL)

Third-Party Logistics (3PL)

Fourth-Party Logistics (4PL)

Organized Sector

Unorganized Sector

Public Sector Logistics (Correos, ADIF)

Private Sector Logistics

By Logistics Model:

Contract Logistics

Freight Forwarding

Express Delivery

Last-Mile Delivery

Cold Chain Logistics

Reverse Logistics

By Mode of Transport:

Road Transport

Rail Freight

Maritime Transport

Air Cargo

Multimodal Logistics

By End-User Industry:

E-commerce and Retail

Automotive

Pharmaceuticals and Healthcare

Food and Beverage

Chemicals and Industrials

Fashion and Lifestyle

Technology and Electronics

By Warehousing Type:

General-Purpose Warehouses

Cold Storage Warehouses

Bonded Warehouses

Fulfillment Centers

Automated Warehouses

Urban Micro-Fulfillment Centers

By Region:

Madrid

Catalonia

Andalusia

Valencia

Basque Country

Aragon

Galicia

Castile and León

Players Mentioned in the Report:

SEUR

Correos Express

DHL Spain

DB Schenker Spain

XPO Logistics Spain

Logista

Grupo Carreras

Transcoma Logistics

Azkar Dachser

Kuehne + Nagel Spain

Key Target Audience:

3PL and Freight Forwarding Companies

E-commerce Retailers and Fulfillment Centers

Cold Chain Logistics Providers

Real Estate Developers (Industrial & Warehousing)

Regulatory Bodies (e.g., Ministry of Transport, ADIF, Ports of Spain)

Technology Providers in Supply Chain Management

Research and Consulting Firms

Time Period:

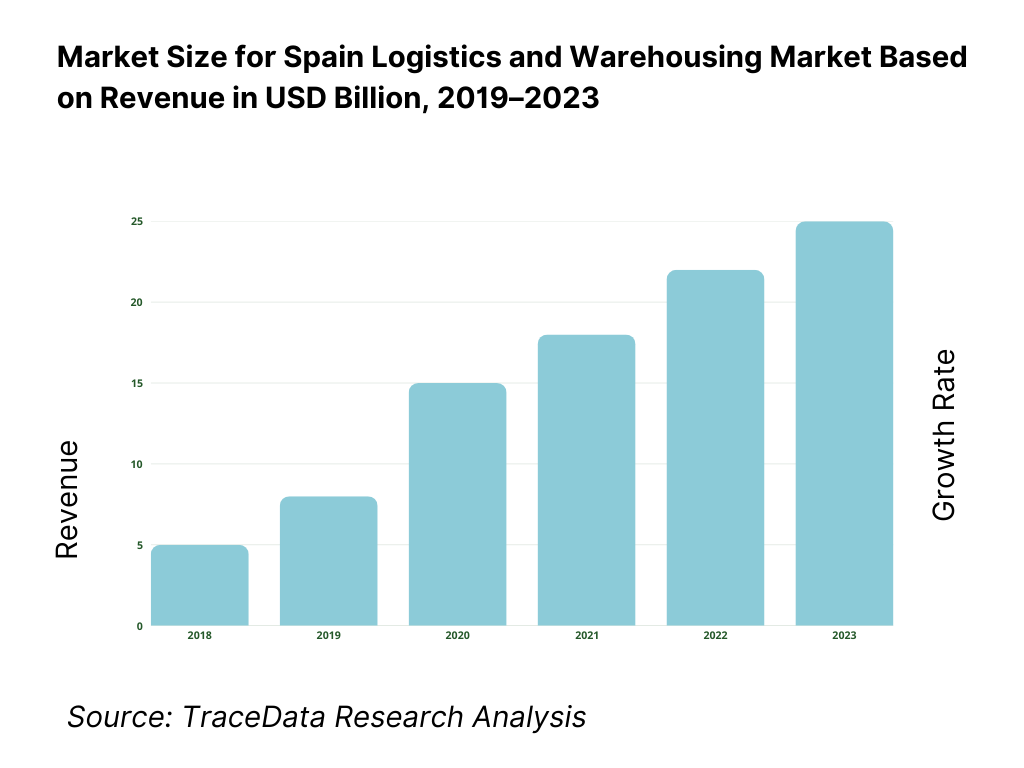

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Spain Logistics and Warehousing Market

4.3. Business Model Canvas for Spain Logistics Sector

4.4. Buying Decision Making Process for Warehousing Services

4.5. Supply Decision Making Process in Logistics Contracts

5.1. Domestic vs. International Logistics Market, Spain, 2018-2024

5.2. Share of 1PL, 2PL, 3PL, and 4PL Models in Spain, 2018-2024

5.3. Public Sector vs. Private Sector Contribution in Logistics, 2024

5.4. Number of Warehousing Facilities by Region in Spain

8.1. Revenue, 2018-2024

8.2. Logistics Volume (in Tons), 2018-2024

8.3. Warehousing Capacity (in Million Sqm), 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Logistics Model (1PL, 2PL, 3PL, 4PL), 2023-2024P

9.3. By Mode of Transport (Road, Rail, Maritime, Air), 2023-2024P

9.4. By Region (Madrid, Catalonia, Andalusia, Valencia, Basque Country, etc.), 2023-2024P

9.5. By End-User Industry (E-commerce, Automotive, F&B, Pharma, etc.), 2023-2024P

9.6. By Warehousing Type (General, Cold Chain, Automated, Fulfillment, etc.), 2023-2024P

10.1. Customer Landscape and Key Sectoral Demand Drivers

10.2. Logistics Outsourcing Decision-Making in Enterprises

10.3. Key Expectations, Pain Points, and Solution Gaps

10.4. Customer Journey and Procurement Lifecycle

11.1. Trends and Developments in Spain Logistics Market

11.2. Growth Drivers for Logistics and Warehousing in Spain

11.3. SWOT Analysis for Spain Logistics and Warehousing Market

11.4. Challenges and Bottlenecks in the Logistics Sector

11.5. Government Regulations and Incentives

12.1. Digital Freight Platforms and WMS Adoption

12.2. Role of AI, IoT, and Robotics in Warehousing

12.3. Cross Comparison of Leading Tech-Enabled Logistics Providers

13.1. Cold Chain Capacity and Growth Forecast, 2018-2029

13.2. Sectoral Demand from F&B and Pharma Industries

13.3. Last-Mile Delivery Ecosystem and Trends

16.1. Benchmark of Key Logistics Players: Company Overview, Strategy, Operations, Market Reach

16.2. Strengths and Weaknesses

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant View for 3PL Providers

16.5. Bowman’s Strategic Clock for Competitive Advantage

17.1. Revenue Forecast, 2025-2029

17.2. Logistics Volume and Warehousing Capacity, 2025-2029

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Logistics Model (1PL to 4PL), 2025-2029

18.3. By Mode of Transport, 2025-2029

18.4. By Region, 2025-2029

18.5. By End-User Industry, 2025-2029

18.6. By Warehousing Type, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities relevant to the Spain Logistics and Warehousing Market. This includes logistics providers (1PL to 4PL), warehousing companies, e-commerce platforms, manufacturing firms, government bodies (e.g., ADIF, Ports of Spain), and supporting tech vendors.

Basis this mapping, we shortlisted the leading 5–6 logistics providers in the country based on revenue size, fleet strength, warehousing footprint, service verticals, and digital capability.

Sourcing was initiated using industry reports, public records, proprietary databases, and sector-focused publications to perform a comprehensive desk research around logistics operations and supply chain trends in Spain.

Step 2: Desk Research

We then engaged in a detailed desk research process by referencing multiple secondary sources and proprietary intelligence platforms. This included reviewing sector-wide reports, analyst briefings, and logistics performance indices for Spain.

Key focus areas included market size (by revenue and capacity), number of warehousing facilities, transport modal shares, average delivery timelines, and warehousing cost benchmarks.

This analysis was supplemented with company-level data from press releases, investor presentations, financial statements, and business model breakdowns to develop a clear picture of the competitive and operational landscape.

Step 3: Primary Research

Conducted in-depth interviews with CXOs, operations managers, and supply chain heads of top logistics firms and large warehousing operators in Spain. Additional interviews were held with stakeholders from e-commerce companies, manufacturers, real estate developers, and cold chain specialists.

The interviews were designed to validate desk research findings, capture forward-looking insights, and assess key market shifts—such as sustainability initiatives, automation, and last-mile innovations.

A bottom-up approach was employed to estimate company-level revenues, capacity utilization rates, and service footprints, which were aggregated to arrive at an overall market size.

In parallel, disguised interviews were conducted posing as potential B2B clients to gather first-hand operational intelligence (e.g., delivery SLAs, warehouse leasing models, transportation rates), validating or adjusting company disclosures.

Step 4: Sanity Check

A dual-layered top-down and bottom-up validation framework was applied to ensure robustness of the market sizing and forecasting. Key variables were modeled across historical and projected timelines, calibrated using macroeconomic indicators, trade growth rates, e-commerce penetration, and industry benchmarks.

The triangulation of qualitative inputs, financial data, and transport infrastructure utilization helped confirm the logical consistency and commercial realism of our findings.

FAQs

1. What is the potential for the Spain Logistics and Warehousing Market?

The Spain logistics and warehousing market is positioned for steady growth, reaching an estimated valuation of EUR 82 Billion in 2023. This growth is fueled by expanding e-commerce demand, strategic geographic positioning as a trade gateway between Europe and Africa, and increasing investment in infrastructure and automation. The country’s integration into EU trade corridors further enhances its potential to become a logistics hub for Southern Europe.

2. Who are the Key Players in the Spain Logistics and Warehousing Market?

Key players in the market include SEUR, Correos Express, DHL Spain, DB Schenker Spain, XPO Logistics, and Logista. These companies lead the sector with their extensive transport networks, advanced warehousing solutions, and strategic partnerships. Other notable players include Grupo Carreras, Transcoma Logistics, and Azkar Dachser.

3. What are the Growth Drivers for the Spain Logistics and Warehousing Market?

Growth is primarily driven by the boom in e-commerce, improvements in multimodal infrastructure, and increasing demand for third-party logistics (3PL) services. Additional factors include growing investments in smart warehousing technologies, rising environmental sustainability mandates, and increasing cross-border trade with both EU and non-EU markets.

4. What are the Challenges in the Spain Logistics and Warehousing Market?

Challenges include rising operational costs (fuel, labor, and utilities), urban delivery constraints in congested cities, and a shortage of skilled labor across transport and warehousing roles. Additionally, compliance with EU sustainability and digitalization mandates can be resource-intensive for smaller firms. Market fragmentation also creates inefficiencies in service standardization and pricing.