Spain Online Travel Booking Market Outlook to 2030

By Service Type, By Booking Channel, By Traveler Type, By Device, and By Payment Method

- Product Code: TDR0358

- Region: Asia

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Spain Online Travel Booking Market Outlook to 2030– By Service Type, By Booking Channel, By Traveler Type, By Device, and By Payment Method” provides a comprehensive analysis of the online travel booking market in Spain. The report covers an overview and genesis of the industry, overall market size in terms of gross bookings, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the online travel booking market. The report concludes with future market projections based on traveler flows, digital adoption, booking channels, payment preferences, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

Spain Online Travel Booking Market Overview and Size

Spain’s online travel booking market sits atop a fully recovered travel economy. Spain’s travel gross bookings are valued at €34.6 billion, with digital channels driving the rebound and hitting record transaction levels. Growth is underpinned by restored air capacity and robust international demand—85.1 million foreign visitors and €108.7 billion in foreign tourism receipts—feeding high online search-to-book volumes. Momentum strengthened further as airports handled 309.3 million passengers, signaling elevated digital intent and conversion into bookings.

Dominance concentrates around Madrid, Barcelona, Palma de Mallorca, Canary Islands, and Balearic Islands. These hubs aggregate long-haul and LCC capacity via Adolfo Suárez Madrid-Barajas and Josep Tarradellas Barcelona-El Prat, concentrate hotel and alternative accommodations, and anchor high-frequency short-haul European flows. Tourist arrivals climbed to 94 million with €126 billion in spending, amplifying online inventory depth, dynamic pricing, and last-minute mobile bookings across urban and island destinations, while rail liberalization adds multimodal options between key corridors.

What Factors are Leading to the Growth of the Spain Online Travel Booking Market:

Recovered air & inbound flows powering online intent: Spain’s aviation and tourism networks are functioning at record levels, directly fueling digital search activity, app installs, and last-minute bookings. Airports handled 309,332,069 passengers with 2,590,861 aircraft movements, expanding flight choice across both low-cost carriers and legacy airlines. Border data shows 53,400,000 international visitors over seven months, with a full-year peak of 94,000,000 tourists. This depth of throughput expands conversion pools for accommodation, rail, and activities, driving higher metasearch click-outs and OTA dynamic packaging. Island destinations like the Canaries and Balearics, along with major hubs Madrid and Barcelona, continue to anchor the largest share of digital transactions.

Payments readiness and real-time rails lowering checkout friction: Spain’s retail payment ecosystem is robust, enabling high-volume ecommerce checkouts for travel. Domestic instant-payments scheme Bizum processed 1,093,000,000 transactions with a combined value of €44,206,000,000. In parallel, card transactions, POS networks, and settlement systems offer strong rails for both domestic and cross-border transactions. OTAs and supplier sites increasingly blend cards, wallets, and real-time pay to manage deposits, ancillaries, and refunds. This combination improves authorization and post-sale workflows for reissues and cancellations, while real-time settlement capacity supports large surges in traffic during flash sales or seasonal peaks, directly raising mobile conversion in online travel.

Macroeconomic and demographic base sustaining travel propensity: Spain’s macro fundamentals sustain durable leisure and VFR demand flowing into online booking channels. The economy stands at about $1.8 trillion in current prices, supported by a population of 48,807,137 digitally connected consumers. Hotel activity has strengthened, with overnight stays rising across the year and December contributing further momentum, highlighting resilient capacity in peak and off-peak cycles. This combination of economic scale, strong employment in tourism regions, and an urbanized, digitally active population keeps weekend city-breaks and seasonal island trips consistent. These factors generate predictable app traffic, repeat bookings, and a stable foundation for online travel platforms.

Which Industry Challenges Have Impacted the Growth of the Spain Online Travel Booking Market:

Seasonality concentration stressing service and refunds: Spain’s lodging demand remains highly seasonal, compressing into peak summer and holiday windows. This creates bottlenecks in OTAs and supplier-direct channels, particularly in refund queues, reissues, and claims processing. Hotels report annual overnight increases with December growth adding to the yearly total, yet the summer surge amplifies cancellation spikes. At the same time, airports processed 309,332,069 passengers, intensifying pressure on customer support operations and payment reversals when disruptions occur. Service-level agreements and fraud-safe refund systems must be dimensioned to absorb these shocks, especially in island destinations and during large cultural or sports events.

Payment authentication frictions under SCA and fraud controls: The EU’s PSD2 and Strong Customer Authentication requirements mandate two-factor checks, creating friction for multi-item checkout flows. While these measures protect users, they also introduce step-ups, abandoned sessions, and disputes in online travel flows. Issuers and acquirers enforce fraud controls across card-not-present transactions, affecting bookings that span flights, rail, and activities. Without optimized exemption routing, conversion rates can fall during peak promotion windows tied to heavy airport throughput. Platforms must balance compliance with seamless checkout experiences to protect authorization stability in high-volume sales events.

Short-term rental restrictions tightening urban supply: Municipal regulations are constraining short-term rental availability in major cities. Barcelona has announced it will not renew tourist-flat licences, removing around 10,000 units from the legal accommodation pool once current permits expire. This shift channels more demand into hotels or fully licensed alternatives, altering the inventory mix visible on digital platforms. With inbound visitors reaching 94,000,000, these restrictions amplify price dispersion, shift traffic toward regulated supply, and intensify volatility in booking windows. Online platforms must respond with stronger address-level compliance checks and inventory re-ranking to avoid regulatory penalties while maintaining consumer choice.

What are the Regulations and Initiatives which have Governed the Market:

Data protection enforcement shaping personalization and marketing: Spain’s data protection authority has increased enforcement, recording 18,885 complaints and issuing 281 fines totaling €35,500,000. Sectoral breakdowns show millions in sanctions across industries, including internet services. For online travel platforms, GDPR and ePrivacy rules govern consent, cross-border processing, and profiling practices linked to metasearch referrals and app analytics. Compliance requires robust consent-management platforms, documented processing agreements, and rapid incident reporting. These safeguards are essential to maintain marketing funnels, protect remarketing efficiency, and avoid fines that can materially impact digital travel operators.

Platform & competition rules under the EU Digital Markets Act (DMA): The DMA imposes strict obligations on gatekeepers, reshaping ranking, self-preferencing, and attribution in app stores and online search. These requirements directly influence how travel offers are displayed, bundled, or referred, particularly for OTAs and metasearch engines. Spain’s competition authority supervises compliance at the national level, aligning with EU enforcement. With airports handling 309,332,069 passengers and inbound arrivals totaling 94,000,000, traffic surges amplify the importance of compliant referral flows. DMA compliance will thus determine how effectively platforms can acquire and retain Spanish users in a highly competitive environment.

Payments compliance via PSD2/SCA and national reporting: PSD2’s Strong Customer Authentication framework and related technical standards are operationalized through national reporting obligations. Spain’s payment system publishes data on card transactions at POS, accepting devices, cards in circulation, and interbank settlement volumes, providing visibility into compliance outcomes. These metrics allow PSPs and merchants to monitor authorization performance, fraud losses, and exemption utilization. For online travel, aligning routing strategies with these official datasets supports smoother checkout processes while meeting EU security requirements. This ensures that high-risk cross-border bookings can be authorized efficiently without undermining consumer protection.

Spain Online Travel Booking Market Segmentation

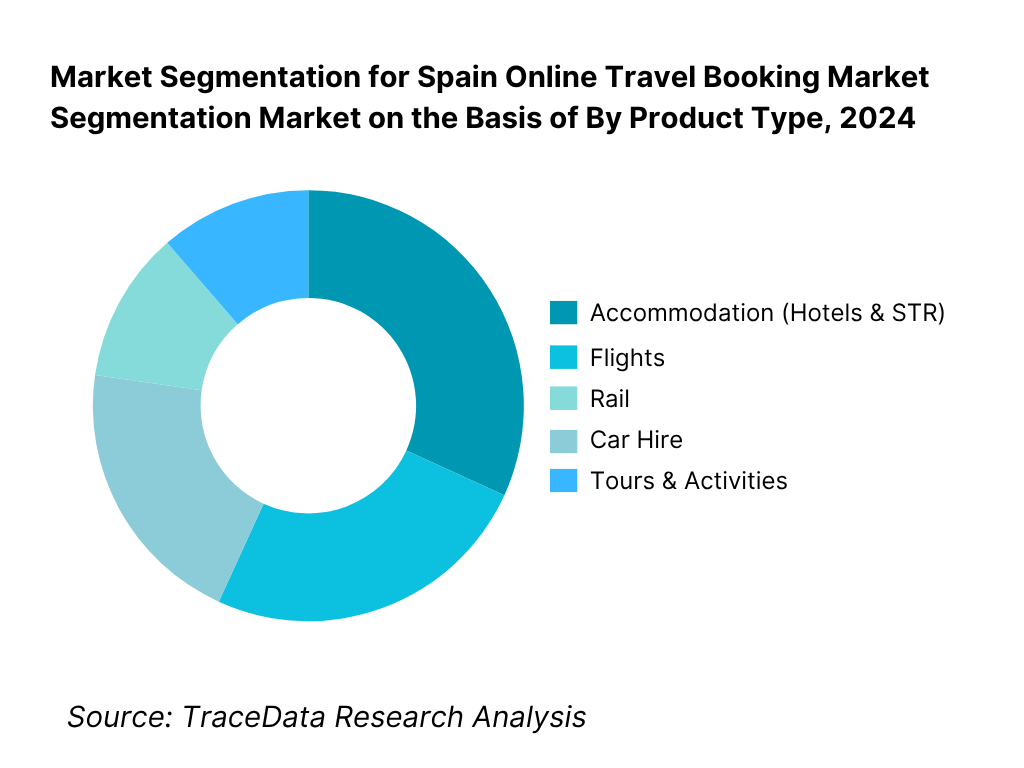

By Product Type: Spain online travel booking market is segmented by product into flights, accommodation (hotels & short-term rentals), rail, car hire, and tours & activities. Recently, accommodation has a dominant market share in Spain under product type because of the breadth of hotel and alternative rental supply in urban and island destinations, deep integration with metasearch and OTAs, and high mobile conversion on short booking windows. Strong content parity, flexible cancellation, and loyalty/subscription offers from leading platforms reinforce consumer habit formation and repeat rate advantages over single-mode products.

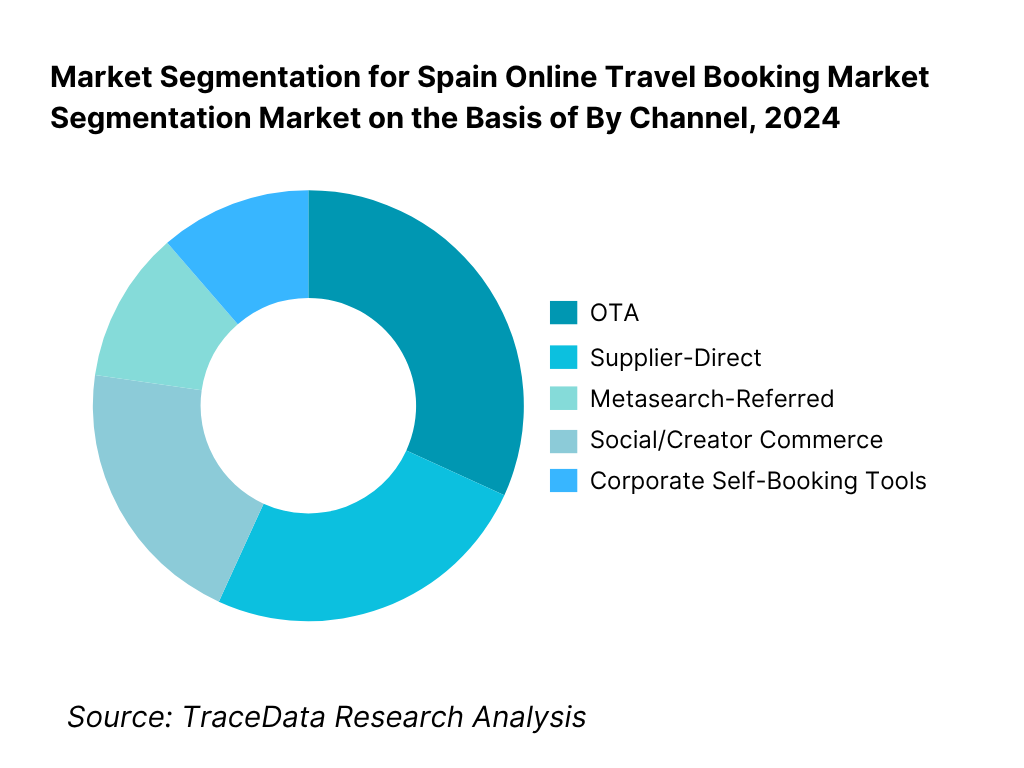

By Channel: Spain online travel booking market is segmented by channel into OTA, supplier-direct, metasearch-referred, social/creator commerce, and corporate self-booking tools. Recently, OTA has a dominant market share in Spain under the channel segmentation due to broad cross-category coverage, bundled dynamic packaging, and superior merchandising of ancillaries. Membership programs and apps from leading OTAs consolidate traffic, while metasearch continues to serve lower-funnel referrals that often convert on the same OTA ecosystem, reinforcing their GBV scale and marketing efficiency.

Competitive Landscape in Spain Online Travel Booking Market

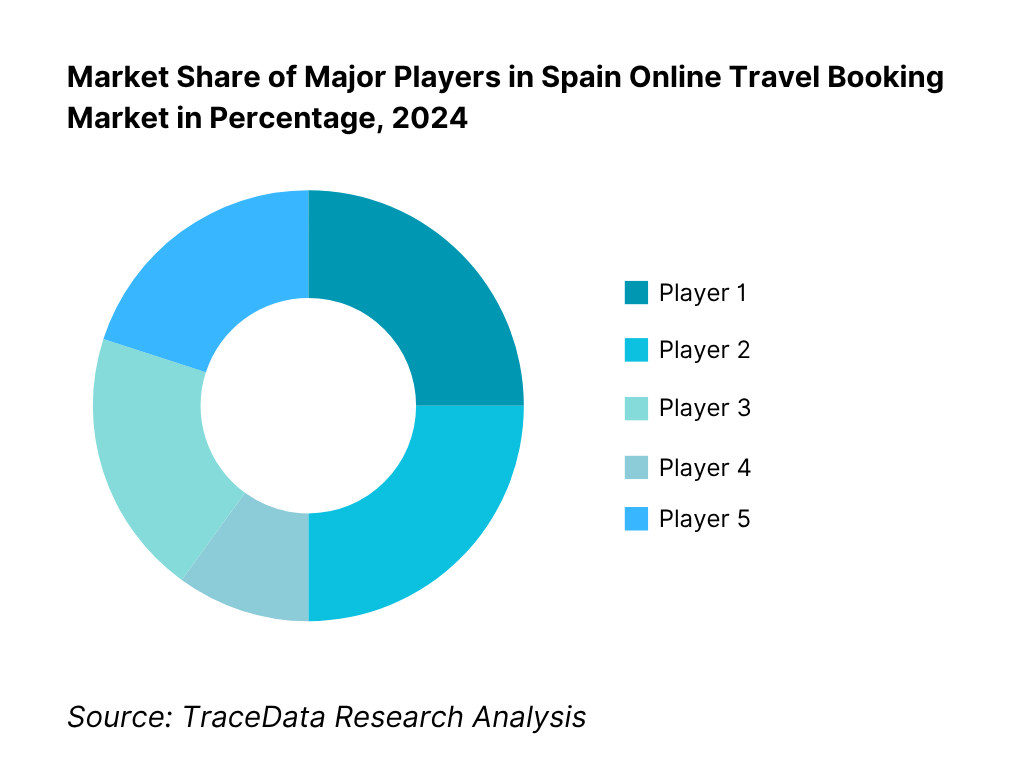

The Spain online travel booking market shows a concentrated competitive core spanning global OTAs, metasearch, and scaled supplier-direct portals. Local champion eDreams ODIGEO has pivoted to a subscription-led model with multi-million members and record revenue, while Booking Holdings, Expedia Group, Airbnb, and metasearch leaders shape traffic acquisition and mobile share. Airports and inbound flows at historic highs further entrench these platforms’ inventory leverage and performance marketing flywheels.

Name | Founding Year | Original Headquarters |

Booking.com (Booking Holdings) | 1996 | Amsterdam, Netherlands |

eDreams ODIGEO (eDreams/Opodo) | 2011 | Barcelona, Spain |

Expedia Group | 1996 | Seattle, USA |

Viajes El Corte Inglés | 1969 | Madrid, Spain |

Logitravel | 2004 | Palma de Mallorca, Spain |

Destinia | 2001 | Madrid, Spain |

Atrápalo | 2000 | Barcelona, Spain |

Rumbo (lastminute.com group) | 2000 | Madrid, Spain |

Travelgenio | 2010 | Madrid, Spain |

Civitatis | 2008 | Madrid, Spain |

Skyscanner | 2003 | Edinburgh, United Kingdom |

Trivago | 2005 | Düsseldorf, Germany |

Airbnb | 2008 | San Francisco, USA |

Iberia.com (Iberia) | 1927 | Madrid, Spain |

Renfe | 1941 | Madrid, Spain |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Booking.com (Booking Holdings): As one of the largest OTA platforms globally, Booking.com continues to strengthen its dominance in Spain by expanding its Genius loyalty program and enhancing flexible cancellation policies. The company has invested heavily in mobile-first innovations, with mobile now accounting for the majority of bookings in Spain.

eDreams ODIGEO: Headquartered in Barcelona, eDreams ODIGEO has reinforced its leadership in Spain by scaling its Prime subscription program, which has surpassed several million global members. The firm reported record revenues in its latest cycle, supported by increased adoption of bundled dynamic packages and flight+hotel deals.

Expedia Group: With brands such as Expedia, Hotels.com, and VRBO, Expedia Group has expanded its Spain portfolio by boosting vacation rental integrations. The company has also launched One Key, a unified loyalty program, positioning itself strongly in Spain’s urban and coastal leisure markets.

Airbnb: Airbnb has consolidated its strong position in Spain by increasing partnerships with local hosts in Barcelona, Madrid, and Balearic Islands. The platform has introduced enhanced guest verification and sustainable travel filters, aligning with Spain’s regional tourism regulations.

Skyscanner: Operating as a leading metasearch platform, Skyscanner has optimized its Spain operations by expanding rail and low-cost carrier coverage. The firm has also integrated “Greener Choice” filters into the Spain market, helping travelers choose lower CO₂ itineraries in line with consumer sustainability preferences.

What Lies Ahead for Spain Online Travel Booking Market?

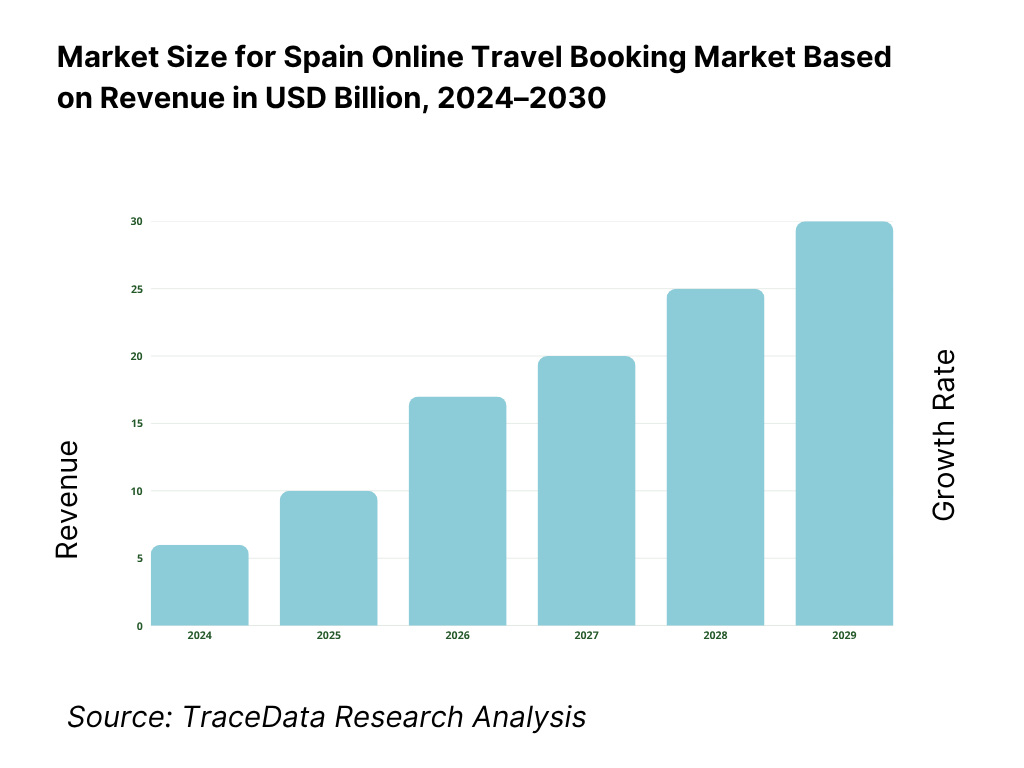

The Spain online travel booking market is positioned to expand steadily as international arrivals, aviation throughput, and digital adoption reinforce each other. AENA reported 309.3 million passengers handled across Spanish airports, while INE confirmed 94 million tourist arrivals generating €126 billion in spending. These structural tourism flows, combined with regulatory modernization and mobile-first behavior, sustain long-term digital transaction growth in Spain’s travel sector.

Rise of Multimodal and Hybrid Booking Models: Spain is expected to witness increasing adoption of hybrid booking models that combine air, rail, ferry, and bus in single itineraries. Liberalization of high-speed rail has introduced new operators on Madrid–Barcelona and Madrid–Valencia corridors, complementing the 309.3 million airport passengers and expanding consumer choice. Online platforms integrating multiple transport modes will capture rising demand for flexibility and sustainability. This mirrors broader European transport shifts and positions Spain as a prime testing ground for multimodal booking apps that can reduce reliance on single-carrier transactions.

Focus on Personalization and Outcome-Based Travel Experiences: Spanish tourism’s scale—94 million international visitors and €126 billion in receipts—is driving platforms to differentiate through measurable outcomes: satisfaction, loyalty, and cross-sell success. As consumer spend grows, OTAs and suppliers are expected to invest in AI-powered recommendation engines, dynamic packaging, and loyalty programs that align directly with traveler goals such as lower CO₂ travel, flexible cancellation, or bundled activities. This outcome-based orientation transforms booking flows from commodity price comparison into curated trip management, reinforcing customer lifetime value.

Expansion of Destination-Specific Digital Offerings: Spain’s urban hubs (Madrid, Barcelona) and leisure destinations (Balearic Islands, Canary Islands) will continue to anchor high booking intensity due to airport throughput and hotel overnight volumes confirmed in INE statistics. Online players are expected to develop sector- and destination-specific verticals—such as resort packages for the Canaries or cultural tours in Barcelona—to align with demand peaks. This expansion enhances digital capture of ancillary categories (tours, dining, insurance), providing platforms with diversified revenue streams while matching sector-specific travel flows.

Leveraging AI and Data Analytics in Bookings: Spain’s online booking platforms are increasingly investing in AI and analytics to optimize personalization and reduce cart abandonment. With 1.093 billion Bizum operations valued at €44.2 billion in national instant payments, a strong digital transaction base exists to support granular behavioral analytics. Platforms can track funnel drop-offs, price elasticity, and refund patterns to deliver tailored offers. The ability to monitor conversion and loyalty outcomes in real time will enhance ROI for travel companies, strengthen customer retention, and ensure Spain maintains its leadership in Europe’s digital travel booking evolution.

Spain Online Travel Booking Market Segmentation

By Service / Product Type

Flights

Accommodation (Hotels & Short-Term Rentals)

Rail / Surface Transport (High-Speed Rail, Intercity, Bus, Ferry)

Car Hire / Rental

Tours & Activities / Excursions

Packages / Bundled (Flight + Hotel + Add-ons)

By Booking Channel / Mode

OTA / Aggregators

Supplier-Direct (Airline / Railway / Hotel Websites)

Metasearch-Referred (Click-through to OTA or Supplier)

Social / Creator Commerce / Affiliate

Corporate / Self-Booking Tools (TMCs, Managed Portals)

By Device / Interface

Mobile App

Mobile Web

Desktop Web

Voice / Chat Interface

Others (Kiosk, Smart TV)

By Traveler Type / Segment

Domestic Leisure

Inbound Leisure

Business / Corporate (Managed & Unmanaged)

VFR (Visiting Friends & Relatives)

Group / MICE

Players Mentioned in the Report:

Booking.com (Booking Holdings)

eDreams ODIGEO (eDreams/Opodo/Travellink/Liligo)

Expedia Group (Expedia/Hotels.com/VRBO)

Viajes El Corte Inglés (online)

Logitravel

Destinia

Atrápalo

Rumbo (lastminute.com)

Travelgenio/Travel2be

Civitatis

Skyscanner

Trivago

Airbnb

Iberia.com

Renfe.com.

Key Target Audience

OTAs & Metasearch leadership teams (Category owners, growth & performance heads)

Airlines & rail operators (Network, distribution, NDC/ONE Order, revenue management)

Hotel chains & short-term rental managers (Revenue, distribution, and channel teams)

Payments & risk platforms (PSPs, anti-fraud, BNPL providers)

Investments and venture capitalist firms (Tourism tech and marketplaces)

Government & regulatory bodies (Ministerio de Industria y Turismo; CNMC; AENA; RENFE; regional tourism boards)

Destination management companies & bedbanks (Contracting, API distribution)

Large advertisers & affiliates

Time Period:

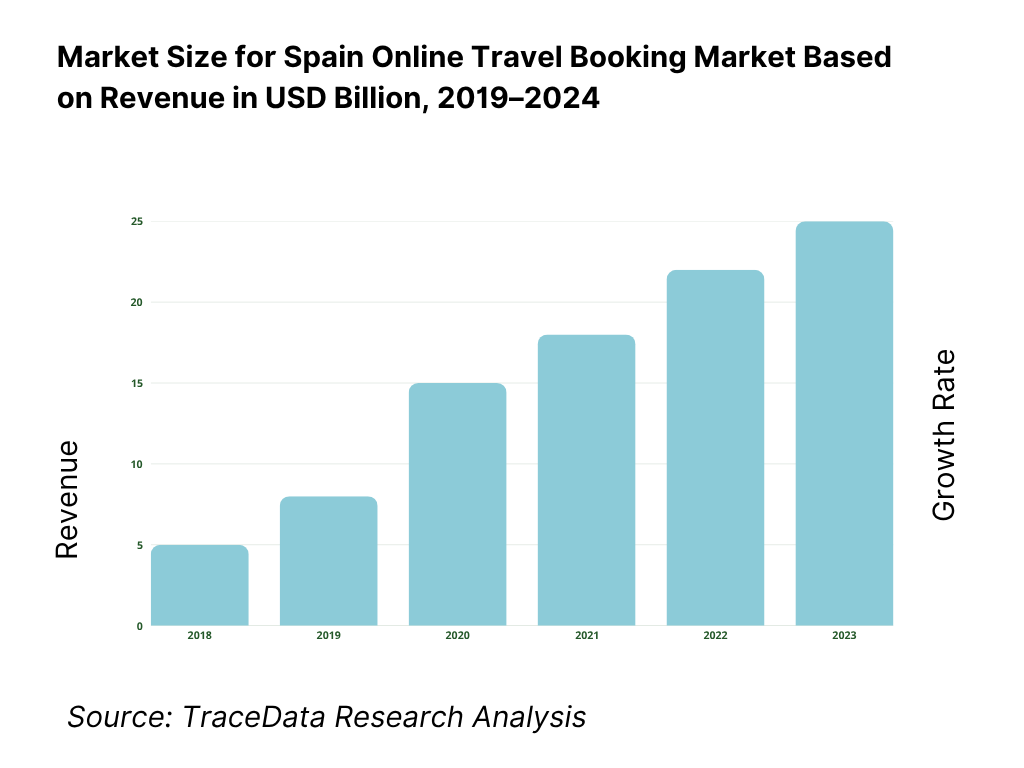

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis (App-Based, Web-Based, Supplier-Direct, Metasearch Referral-Margins, User Preference, Strength & Weakness)

4.2. Revenue Streams for Online Travel Booking (Commissions, Advertising/CPC, Subscription/Membership, Ancillary Attachments, White-Label & B2B)

4.3. Business Model Canvas for Spain Online Travel Booking Market (Key Partners, Key Activities, Value Propositions, Channels, Customer Segments, Cost Structure, Revenue Streams)

5.1. OTA-Aggregated vs Supplier-Direct Bookings (Relative Share & Channel Conflict)

5.2. Investment Model in Spain Online Travel Booking (Capex on Tech, Marketing Spend, Affiliate Networks, Subscription Programs)

5.3. Comparative Analysis of Funnel Metrics (Private OTAs vs National Rail/Airline Portals-Conversion Rates, Drop-Offs, CAC, Repeat Bookings)

5.4. Travel Booking Budget Allocation by Traveler Segment (Leisure, Business, VFR, Inbound vs Domestic)

8.1. Revenues / Gross Bookings Value, Historical (In EUR Bn; OTA vs Supplier-Direct Split; App vs Web Share)

9.1. By Market Structure (OTA vs Supplier-Direct)

9.2. By Product Type (Flights, Accommodation, Rail, Car Hire, Ferries/Bus, Packages)

9.3. By Traveler Segments (Domestic Leisure, Inbound Leisure, Business-Managed & Unmanaged, VFR)

9.4. By Device (Mobile App, Mobile Web, Desktop)

9.5. By Booking Window (Last-Minute, Short, Standard, Early, Ultra-Early)

9.6. By Payment Method (Cards, Bizum, Wallets, BNPL, Wire)

9.7. By Open & Packaged Programs (Standalone Bookings vs Dynamic Packaging)

9.8. By Region (Inbound Source Markets, Domestic, Outbound EU, Outbound LATAM, Outbound North Africa/Med)

10.1. Traveler Cohort Landscape & Cohort Analysis (Families, Solo, Groups, SME Business, Backpackers)

10.2. Booking Decision Process (Price Sensitivity, Loyalty, Reviews, Cancellation Policies)

10.3. Booking Effectiveness & ROI Analysis (Conversion Funnel, Repeat Rate, App Stickiness, NPS)

10.4. Gap Analysis Framework (Supply Coverage vs Traveler Needs-Rail, Accommodation, Ancillaries)

11.1. Trends & Developments (Mobile-First, BNPL, Sustainability Filters, Virtual Interlining, Subscription Models)

11.2. Growth Drivers (Inbound Tourism, Domestic City-Breaks, LCC Expansion, High-Speed Rail Liberalization)

11.3. SWOT Analysis (Demand Strength vs Regulatory & CAC Risks)

11.4. Issues & Challenges (Seasonality, Refund Delays, Regulatory Compliance Costs, Supply Fragmentation)

11.5. Government Regulations (EU Package Travel, PSD2/SCA, GDPR, DMA, Regional STR Rules)

12.1. Market Size & Potential of Online Flight Bookings in Spain

12.2. Accommodation Segment (Hotels, Alternative Rentals)

12.3. Rail & Bus Segment (Renfe, Ouigo, iryo, ALSA)

12.4. Tours & Activities (Platform Models, Instant Confirmation %)

15.1. Market Share of Key Players Basis GBV/Revenues (OTA vs Supplier-Direct)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Business Model, MAUs, Revenues, Pricing, Technology Used, Top Routes/Hotels, Strategic Tie-Ups, Marketing Strategy, Recent Developments)

15.3. Operating Model Analysis Framework (Inventory Acquisition, Tech Stack, Media Mix, Support Infrastructure)

15.4. Gartner-Style Quadrant Mapping (Leader, Challenger, Visionary, Niche)

15.5. Bowman’s Strategic Clock (Competitive Positioning-Low Price, Differentiation, Hybrid Models)

16.1. Revenues / GBV Projections (OTA vs Supplier-Direct; Category Splits)

17.1. By Market Structure (OTA vs Supplier-Direct)

17.2. By Product Type (Flights, Accommodation, Rail, Car Hire, Ferries/Bus, Packages)

17.3. By Traveler Segments (Domestic, Inbound, Business, VFR)

17.4. By Device (App, Mobile Web, Desktop)

17.5. By Booking Window (Last-Minute to Ultra-Early)

17.6. By Payment Method (Cards, Bizum, Wallets, BNPL, Wire)

17.7. By Open & Packaged Programs (Standalone vs Dynamic Packaging)

17.8. By Region (Inbound, Domestic, Outbound EU, Outbound LATAM, Outbound North Africa/Med)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Spain Online Travel Booking Market. On the demand side, this includes domestic leisure travelers, inbound international tourists, SME and corporate travelers, and in-destination activity buyers. On the supply side, the ecosystem comprises OTAs, metasearch platforms, airlines, rail operators, ferry and bus companies, hotel chains, short-term rental providers, bedbanks, and PSPs. Based on this ecosystem, we will shortlist 5–6 leading booking providers in Spain (e.g., Booking.com, eDreams ODIGEO, Expedia, Airbnb, Iberia.com, Renfe.com) using financial disclosures, app usage metrics, and market penetration indicators. Sourcing is conducted through industry articles, government datasets, and proprietary databases to collate comprehensive market-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This enables us to construct a robust Spain-specific market view, analyzing inbound arrivals, air and rail passenger volumes, accommodation overnight stays, and digital adoption patterns. Company-level intelligence is gathered from press releases, financial statements, and investor presentations to evaluate GBV exposure, loyalty program adoption, app penetration, and regulatory compliance. Insights from INE, AENA, CNMC, Bank of Spain, and European Commission sources supplement this dataset. The outcome of this stage is a foundational understanding of Spain’s online travel booking demand and the key entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with executives across OTAs, airlines, rail/ferry operators, hotel chains, PSPs, and regulatory bodies, as well as feedback sessions with end-users such as SMEs and tourism boards. These conversations validate hypotheses on conversion rates, mobile adoption, cancellations, refund handling, SCA impacts, and NDC adoption. A bottom-up approach aggregates Spain-specific revenues and GBV contributions of leading players. As part of our validation strategy, disguised interviews are conducted where our team approaches companies as potential clients, enabling direct verification of pricing strategies, refund processes, and customer support practices. This ensures operational and financial insights are corroborated with secondary sources.

Step 4: Sanity Check

A dual-layer bottom-up and top-down modeling process is employed to validate results. Top-down modeling anchors estimates against macro indicators such as 94 million international arrivals, €126 billion in receipts, and 309 million airport passengers. Bottom-up aggregation reconciles company-level contributions validated through primary interviews. Stress-testing is performed against variables like seasonality peaks, STR licensing restrictions in Barcelona, SCA-induced conversion impacts, and DMA-driven ranking changes. The final dataset undergoes multiple consistency checks to ensure it reflects a balanced, accurate, and Spain-specific view of the online travel booking market.

FAQs

01 What is the potential for the Spain Online Travel Booking Market?

The Spain Online Travel Booking Market is poised for substantial expansion, supported by a fully recovered tourism ecosystem. Spain welcomed 94 million international visitors generating €126 billion in tourism receipts, while airports processed 309 million passengers in the latest cycle. This momentum highlights Spain’s potential as one of Europe’s largest digital booking markets. Growth is reinforced by mobile-first adoption, multimodal connectivity with high-speed rail, and strong inbound demand from European and global source markets, positioning Spain’s online booking landscape for continued digital penetration and scale.

02 Who are the Key Players in the Spain Online Travel Booking Market?

The Spain Online Travel Booking Market features several dominant players, including Booking.com, eDreams ODIGEO, and Expedia Group, which lead due to extensive cross-category portfolios and strong brand visibility. Other major entities include Airbnb, Skyscanner, Trivago, Viajes El Corte Inglés, Logitravel, Destinia, Atrápalo, Rumbo, Travelgenio, Civitatis, Iberia.com, and Renfe.com. These platforms differentiate themselves by loyalty programs, dynamic packaging, and mobile-first customer engagement, supported by rail liberalization, alternative accommodation growth, and activities platforms that capture in-destination spend. Together, they shape the competitive intensity of Spain’s online travel ecosystem.

03 What are the Growth Drivers for the Spain Online Travel Booking Market?

The primary growth drivers include the tourism inflows of 94 million visitors and foreign tourism receipts of €126 billion, which provide a robust demand base for digital transactions. Spain’s airports handling 309 million passengers strengthen connectivity across LCC and legacy carriers, creating heavy online search and booking flows. Additionally, the rapid expansion of instant payments such as Bizum, which processed 1.09 billion operations valued at €44.2 billion, enhances mobile conversion and checkout efficiency. These macroeconomic and infrastructure drivers ensure continued strength in Spain’s online travel booking market.

04 What are the Challenges in the Spain Online Travel Booking Market?

The Spain Online Travel Booking Market faces several challenges, including seasonality and concentration of demand that stresses refund and customer service systems, especially during peak summer flows and disruptions. Regulatory challenges such as Barcelona’s move to phase out 10,000 tourist flat licenses restrict short-term rental supply, impacting digital inventory availability. Additionally, PSD2/SCA regulations introduce friction in multi-step digital checkouts, with ECB reporting rising card-not-present fraud cases across the euro area. These factors create operational and compliance hurdles that platforms must address to maintain conversion and profitability.