Sweden Industrial Automation Market Outlook to 2030

By Component, By Industry Vertical, By Solution Type, By Application, and By Region

- Product Code: TDR0359

- Region: Europe

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Sweden Industrial Automation Market Outlook to 2030 – By Component, By Industry Vertical, By Solution Type, By Application, and By Region” provides a comprehensive analysis of the industrial automation market in Sweden. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and market segmentation; trends and developments, regulatory and licensing landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the industrial automation market. The report concludes with future market projections based on automation adoption volumes, technology layers, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions for stakeholders operating in Sweden’s industrial automation ecosystem.

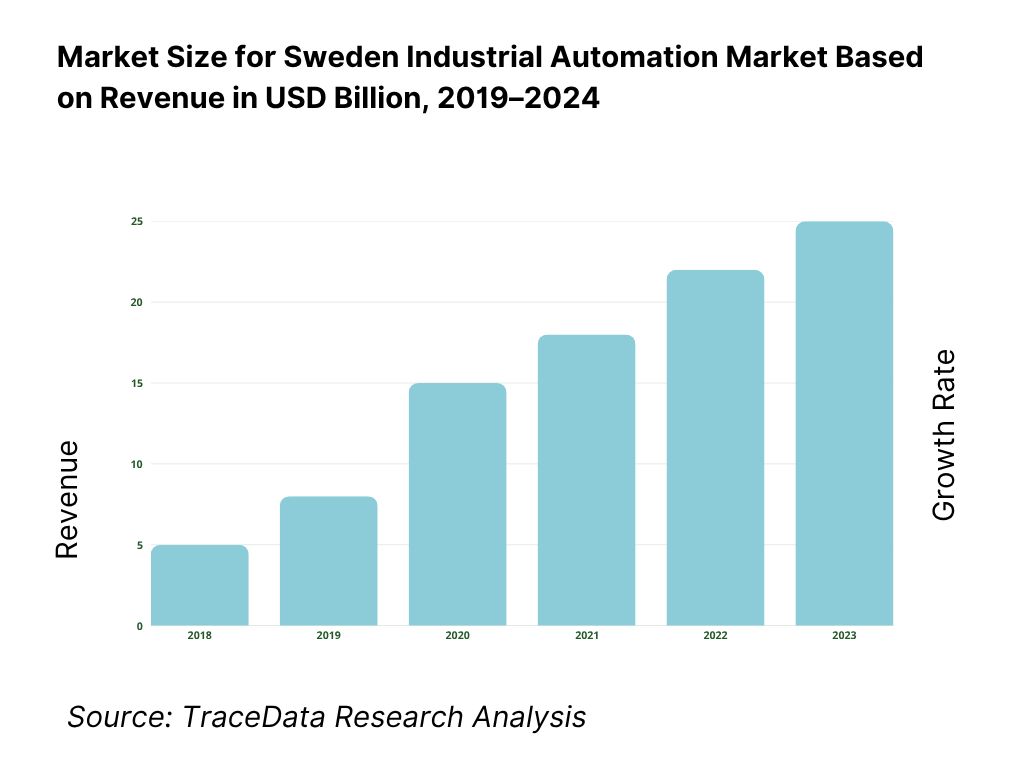

Sweden Industrial Automation Market Overview and Size

The Sweden industrial process automation market is valued at approximately USD 367.8 million in 2024. This valuation reflects the market for process automation (DCS, SCADA, control & instrumentation) rather than the entire automation stack. Growth is currently driven by investments in renewable energy plants (nuclear/wind), pharmaceutical capacity expansion, and efforts by manufacturers to adopt Industry 4.0 technologies to optimize efficiency and reduce energy consumption.

In the Swedish automation landscape, major dominance is seen in industrial hubs such as Stockholm / Mälardalen, Gothenburg / Västra Götaland, and Skåne / Malmö—these regions host clusters of OEMs, advanced manufacturing, automotive, and process industries, which demand high automation adoption. Also, strong ties with German and Nordic automation ecosystems give companies in southern and central Sweden easier access to supply chains and export channels, reinforcing dominance in those cities.

What Factors are Leading to the Growth of the Sweden Industrial Automation Market:

Scale and export-intensity of Swedish manufacturing: Sweden’s automation momentum is reinforced by the size and global orientation of its manufacturing base. Merchandise exports are valued at USD 194,598 million, creating strong demand for high-reliability and high-throughput production systems. Domestically, net turnover in the Swedish business sector has reached SEK 12,457 billion, with large enterprises driving reinvestments into automation upgrades. At the workforce level, 5,132,000 people are employed nationally, providing the scale at which automation improves safety, quality, and operational consistency across industries.

Electrification capacity and green-industry pull on automation: The rapid electrification of industrial processes and the shift to low-carbon production are acting as structural drivers. Sweden generated 163 TWh of electricity in the most recent cycle, ensuring capacity for electrified process heat, advanced drives, and energy optimization through automation. Wind power alone contributed just over 33 TWh from more than 4,700 turbines, driving variability that necessitates automated grid-responsive control. For the mining and metals sector, green steel initiatives alone are expected to require an additional 55 TWh annually, underlining the magnitude of automation-enabled electrification in Sweden.

Pro-industry spectrum policy enabling private 5G and deterministic comms: Industrial automation adoption is being catalyzed by favorable spectrum allocation for site-based 5G. Regulators have made 80 MHz available in the 3.7 GHz band and 1,000 MHz in the 26 GHz band, with flexible rules for both indoor and outdoor deployments. This policy lowers barriers for factories to roll out private 5G networks, supporting mobile robotics, automated guided vehicles, and real-time machine vision. With merchandise exports valued at USD 194,598 million, the automation of export-linked facilities and logistics networks stands to benefit directly from these connectivity measures.

Which Industry Challenges Have Impacted the Growth of the Sweden Industrial Automation Market:

Tight manufacturing labor market and recruitment frictions: Sweden’s automation programs increasingly compensate for persistent skills shortages. Employment levels are at 5,132,000 people, yet recruitment pressures remain high, with 147,500 vacancies recorded in a single quarter. This imbalance reflects difficulties in hiring specialized technicians for OT, robotics, and maintenance roles. Automation helps alleviate these gaps by standardizing processes, enabling remote monitoring, and reducing reliance on scarce skills through guided HMIs and digitized work instructions.

Rising cyber-physical risk and incident load on essential services: The cyber-physical nature of industrial automation creates new exposure for Swedish operators. The national contingency authority reported 334 significant IT incidents among roughly 1,000 critical-service organizations in a recent cycle, highlighting the vulnerability of essential industrial systems. These incidents require plants to invest in network segmentation, identity-based remote access, and anomaly detection. Safety-integrated cybersecurity for PLCs, HMIs, and historians has become essential, with regulatory expectations increasingly aligned to IEC 62443 standards.

Complex environmental permitting throughput for industrial sites: Large-scale automation projects in metals, mining, pulp & paper, and energy are constrained by the environmental permitting process. Land and Environment Courts handled 7,452 cases in a year, including 3,647 environmental filings, 2,403 planning/building cases determined, and 896 still pending. This caseload creates real risks for project schedules in both brownfield upgrades and greenfield expansions. Automation vendors and integrators must plan for compliance instrumentation—such as emissions monitoring, alarm management, and proof-of-compliance logging—as core deliverables in Swedish industrial projects.

What are the Regulations and Initiatives which have Governed the Market:

Local 5G licensing for industrial private networks: Sweden’s regulatory framework explicitly supports industrial digitalization through private 5G licensing. Factories can apply for local permits in the 3.7 GHz and 26 GHz bands, with allocations designed to ensure deterministic communication and reliable performance for mission-critical automation. This policy enables deployment of AGVs, mobile robotics, and connected quality control systems without reliance on public telecom operators.

Work environment compliance and inspection coverage: Industrial sites must comply with strict occupational health and safety rules enforced by the Swedish Work Environment Authority. Inspections typically cover around 4% of all workplaces per cycle, and accident reports recently totaled 22,347 cases nationwide. These figures emphasize the importance of integrating safety PLCs, machine guarding, and CE-marked conformity processes into all automation projects. Plants must demonstrate systematic risk assessments and compliance documentation during regulatory inspections.

Environmental permitting under Sweden’s Environmental Code: Automation projects that involve process modifications or new installations must pass rigorous environmental permitting. Courts reported 3,602 environmental cases determined and 3,409 pending in a recent cycle, underscoring the administrative and scheduling impact. Permitting governs air, water, noise, and waste impacts, making early integration of compliance-focused automation—such as emission controls, environmental alarms, and audit logs—essential for project approvals.

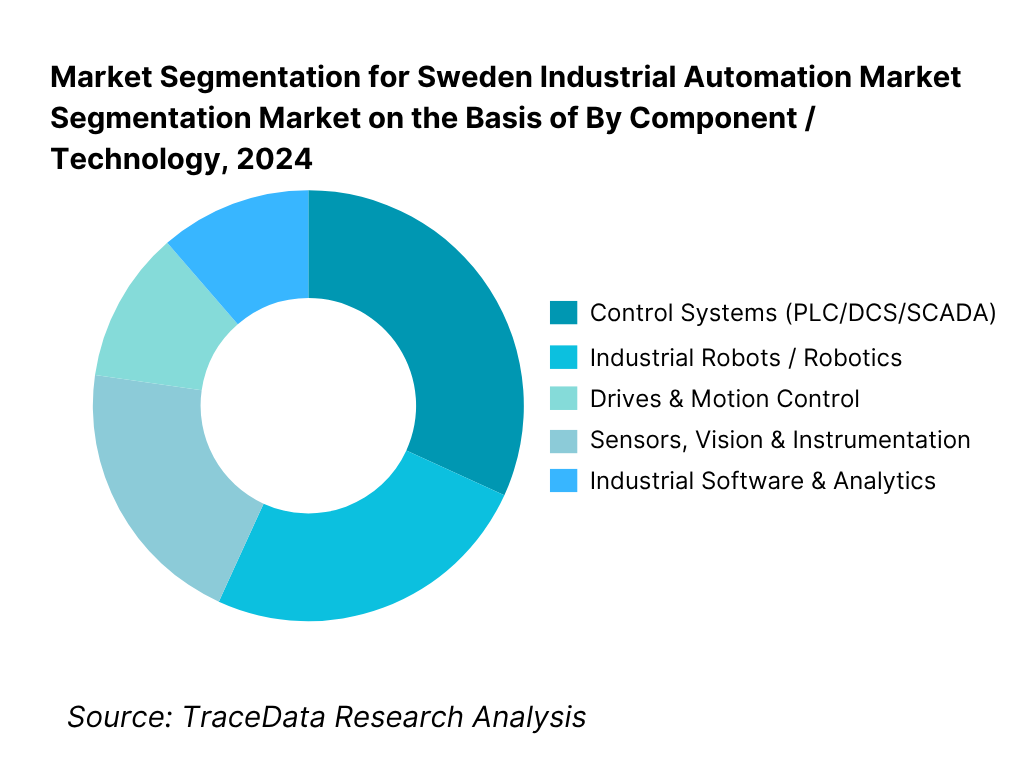

Sweden Industrial Automation Market Segmentation

By Component / Technology: The control systems segment (PLC, DCS, SCADA) is the dominant share in Sweden’s industrial automation market. These control solutions form the core of automation architectures in process and discrete plants, and their continuous replacement, upgrades, and expansions drive stable demand. Swedish process industries (like pulp & paper, chemicals, energy) mostly rely on process control systems, making this segment critical. Moreover, control systems are foundational prerequisites for adding advanced layers (analytics, IIoT, edge), so their dominance is naturally reinforced over time.

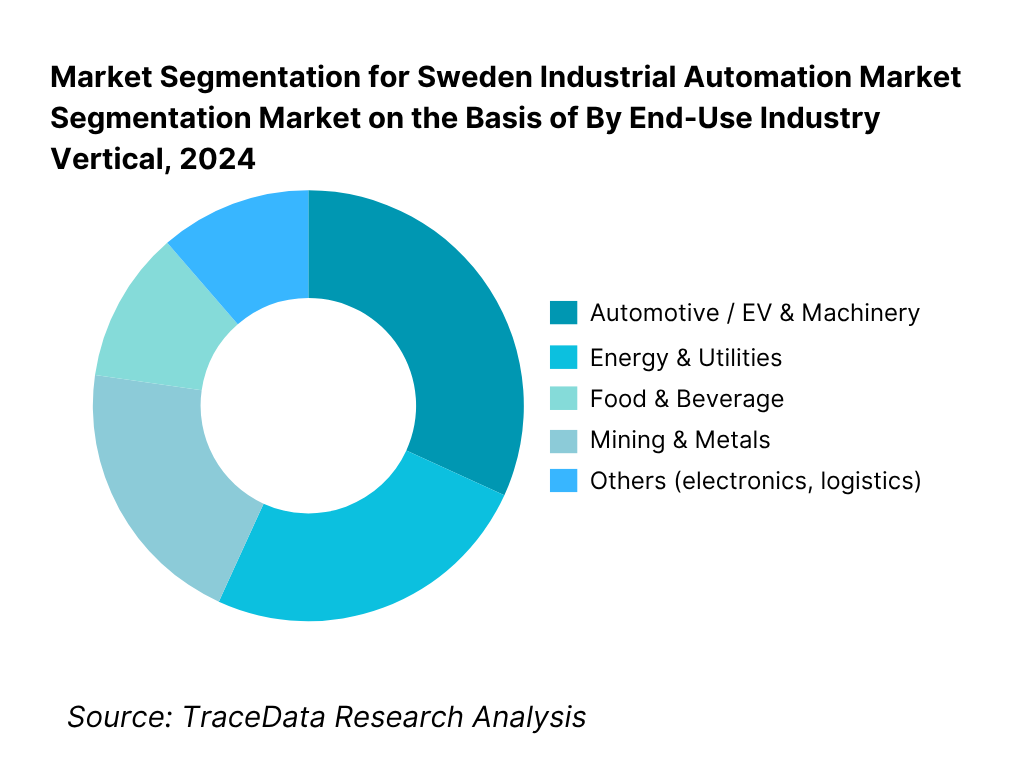

By End-Use Industry Vertical: Process industries (chemicals, pharmaceuticals, pulp & paper) dominate Sweden’s industrial automation market share. These industries feature continuous processes, stringent control requirements, and heavy investments in reliability, safety, and regulatory compliance—hence pushing demand for advanced automation solutions. Sweden is home to a mature pulp & paper sector, leading pharma exports, and a strong chemical industry cluster, which consistently invest in upgrades, green transformation (energy optimization, emissions control), and digitalization. Because of this structural anchor, process industry consumption of automation outpaces that of discrete manufacturing or robotics-only verticals.

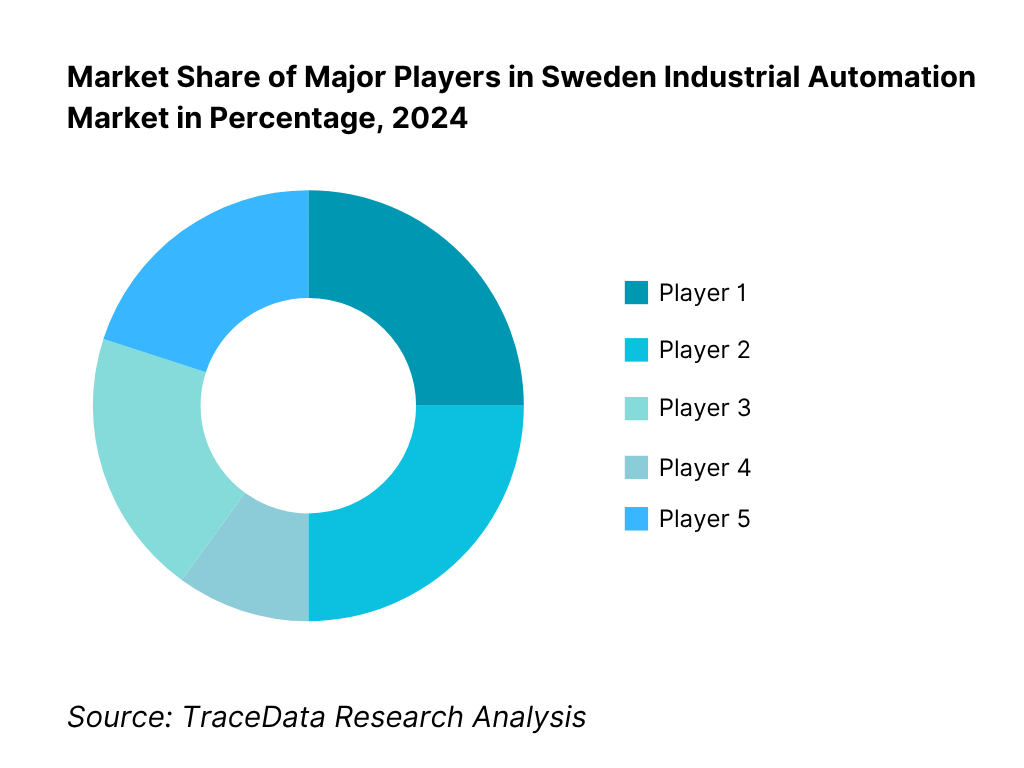

Competitive Landscape in Sweden Industrial Automation Market

The Swedish industrial automation market exhibits moderate consolidation: a few large global players combined with strong local/regional vendors and niche specialists. The presence of global incumbents ensures technology sophistication, while local vendors and integrators provide customization, service proximity, and compliance agility.

Name | Founding Year | Original Headquarters |

ABB | 1988 | Zurich, Switzerland |

Siemens | 1847 | Berlin, Germany |

Schneider Electric | 1836 | Le Creusot, France |

Rockwell Automation | 1903 | Milwaukee, USA |

Mitsubishi Electric | 1921 | Kobe, Japan |

Omron | 1933 | Kyoto, Japan |

Beckhoff Automation | 1980 | Verl, Germany |

Bosch Rexroth | 2001 | Lohr am Main, Germany |

Emerson | 1890 | St. Louis, USA |

Honeywell | 1906 | Wabash, USA |

FANUC | 1956 | Oshino, Japan |

KUKA | 1898 | Augsburg, Germany |

Yaskawa Electric | 1915 | Kitakyushu, Japan |

HMS Networks | 1988 | Halmstad, Sweden |

Beijer Electronics Group | 1981 | Malmö, Sweden |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

ABB: As one of Sweden’s largest automation players, ABB has expanded its robotics and motion division in 2024, focusing on EV battery and green steel production lines. The company also launched new AI-driven control systems for predictive maintenance and energy optimization.

Siemens: Siemens has strengthened its footprint in Sweden by rolling out industrial edge and private 5G solutions across discrete manufacturing hubs. The company’s emphasis on integrating OT and IT has made its software and digital twin portfolio highly sought after among Swedish automotive and process industries.

Schneider Electric: In 2024, Schneider Electric prioritized energy management in automation by partnering with local Swedish utilities and manufacturing clusters. Their EcoStruxure platform has been deployed in food & beverage and pharmaceuticals to optimize energy consumption and compliance with sustainability mandates.

Beckhoff Automation: Beckhoff has seen strong adoption of its PC-based control technology in Sweden’s high-mix manufacturing facilities. In 2024, the company expanded collaborations with Swedish machine builders, focusing on open standards like OPC UA over TSN to improve interoperability.

HMS Networks (Sweden): HMS Networks, headquartered in Halmstad, has experienced growth through rising demand for industrial connectivity. In 2024, HMS launched new gateway solutions supporting OPC UA and MQTT, aligning with Sweden’s Industry 4.0 and IoT adoption trends.

What Lies Ahead for Sweden Industrial Automation Market?

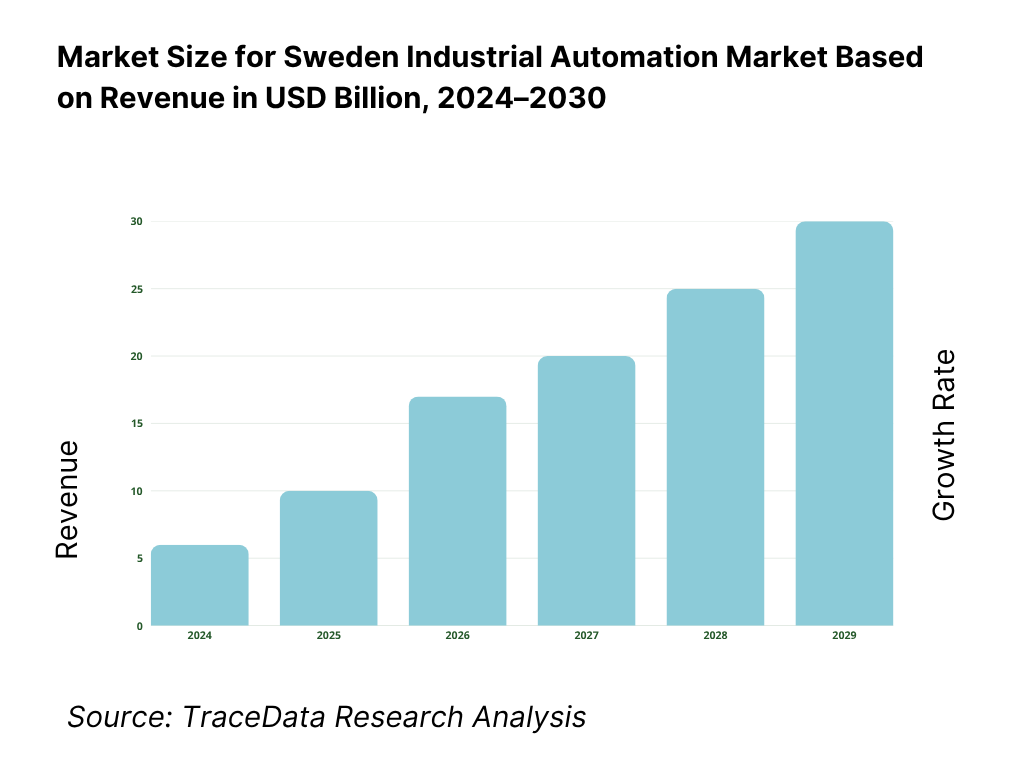

The Sweden industrial automation market is projected to grow steadily toward the end of this decade, supported by Sweden’s strong manufacturing base, green industrial transition, and advanced connectivity infrastructure. Expansion of electrification projects, automation in battery and green steel industries, and the adoption of AI-driven industrial software will continue to create opportunities across both discrete and process industries. Government support for innovation and sustainability further enhances the long-term outlook.

Rise of Hybrid Automation Models: The Swedish market is expected to see broader adoption of hybrid automation models that blend traditional hardware (PLCs, DCS, robotics) with software layers (IIoT, digital twins, predictive analytics). This approach allows plants to maintain reliability in core systems while benefiting from flexible digital overlays, which is crucial in industries like pulp & paper and pharmaceuticals where continuous processes cannot be disrupted.

Focus on Outcome-Based Automation: Swedish industrial firms are increasingly aligning automation investments with measurable business outcomes—such as energy efficiency, safety compliance, and uptime gains. As sustainability mandates expand, automation solutions that quantify CO₂ savings, optimize electricity use, and minimize downtime will see stronger demand. Vendors integrating energy dashboards, KPI-based monitoring, and outcome-driven control packages will be at the forefront.

Expansion of Sector-Specific Solutions: Future growth will come from highly sector-specific automation solutions. Automotive and EV battery plants in Västra Götaland, mining operations in Norrbotten, and pulp & paper clusters across central Sweden are pushing demand for tailored robotics, process control, and AI inspection tools. These sector-specific demands ensure that vendors customizing their solutions by industry will capture significant opportunities.

Leveraging AI and Industrial Connectivity: The Swedish market is poised for increased integration of AI and connectivity technologies. With private 5G licenses now available, plants can deploy mobile robotics, AR-assisted maintenance, and real-time quality monitoring. Coupled with AI algorithms for predictive maintenance and process optimization, these advances will deliver higher operational efficiency and long-term ROI, positioning Sweden as a leader in Industry 4.0 within Europe.

Sweden Industrial Automation Market Segmentation

By Component / Technology

Control Systems (PLC, DCS, SCADA, HMI)

Industrial Robots (Articulated, SCARA, Collaborative, AMRs)

Drives & Motion Control (Motors, Drives, Controllers)

Sensors & Vision Systems

Industrial Software & IIoT Platforms

By Industry Vertical

Automotive & EV Batteries

Mining & Metals

Pulp & Paper

Food & Beverage

Pharmaceuticals & Biotech

By Solution Type

Discrete Automation

Process Automation

Hybrid Automation

Integration & Consulting Services

Maintenance & Remote Monitoring

By Application

Assembly & Material Handling

Packaging & Palletizing

Process Control & Optimization

Machine Tending & Intralogistics

Quality Inspection & Metrology

By Region

Götaland (Gothenburg, Malmö hubs)

Svealand (Stockholm, Mälardalen cluster)

Norrland (Mining, green steel, pulp & paper projects)

Players Mentioned in the Report:

ABB

Siemens

Schneider Electric

Rockwell Automation

Mitsubishi Electric

Omron

Beckhoff Automation

Bosch Rexroth

Emerson

Honeywell

FANUC

KUKA

Yaskawa

HMS Networks (Sweden)

Beijer Electronics Group (Sweden)

Key Target Audience

Industrial automation OEMs and control system vendors

Large manufacturing / process plant owners & operations leadership

Private equity / investment & venture capitalist firms (targeting automation / industrial tech)

Strategic business units in conglomerates (e.g. ABB, Bosch, Siemens)

System integrators and regional automation distributors

Industrial automation software / analytics providers

Energy & utility operators (grid, renewables, power plant firms)

Government & regulatory bodies

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Industrial Automation-Hardware sales, software licensing, subscription models, integration services, remote monitoring, and predictive maintenance (Margins, Preference, Strengths, Weaknesses)

4.2. Revenue Streams for Sweden Industrial Automation Market-Hardware, Software, Services, Lifecycle Management

4.3. Business Model Canvas for Sweden Industrial Automation Market

5.1. Freelance Integrators vs Full-Time System Integrators (capabilities, scalability, certification levels)

5.2. Investment Model in Sweden Industrial Automation Market (public funding, private equity, corporate R&D investments, EU innovation grants)

5.3. Comparative Analysis of Deployment Models by SMEs vs Large Enterprises (adoption, training, digital maturity)

5.4. Automation Budget Allocation by Company Size

8.1. Revenues, Historical to Present

9.1. By Market Structure (In-House Automation Teams vs Outsourced System Integrators)

9.2. By Solution Type (Discrete Automation, Process Automation, Hybrid Automation, Services)

9.3. By Industry Verticals (Automotive & EV Batteries, Mining & Metals, Pulp & Paper, Food & Beverage, Pharmaceuticals & Biotech)

9.4. By Company Size (Large Enterprises, Mid-Market, SMEs)

9.5. By Application (Material Handling, Process Control, Machine Tending, Intralogistics)

9.6. By Mode of Operation (Manual-Semi Automated, Automated, Fully Autonomous/AI-driven)

9.7. By Open vs Customized Solutions

9.8. By Region (Götaland, Svealand, Norrland)

10.1. Industrial Client Landscape and Cohort Analysis

10.2. Automation Needs and Decision-Making Process

10.3. Effectiveness & ROI Analysis of Automation Programs

10.4. Gap Analysis Framework

11.1. Trends and Developments (Industrial 5G, Edge AI, Digital Twins, Cobots, Energy Optimization)

11.2. Growth Drivers (robot density, sustainability policies, EV battery factories, digital maturity)

11.3. SWOT Analysis for Sweden Industrial Automation Market

11.4. Issues and Challenges (high capex, skills shortage, legacy integration, cybersecurity risks)

11.5. Government Regulations & Standards (EU Machinery, Functional Safety, IEC 62443, GDPR, local 5G spectrum policies)

12.1. Market Size and Future Potential for Smart/Connected Automation in Sweden

12.2. Business Models and Revenue Streams (Hardware, Subscription, AI/analytics-based services)

12.3. Delivery Models and Type of Solutions Offered (On-premise, Edge, Cloud)

15.1. Market Share of Key Players (by PLC, DCS, SCADA, Robots, Drives, Software & Services)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategy, Local Presence, Service Network, Revenues, Installed Base, Key Clients, Pricing Approach, Technology Used, Best-Selling Solutions, Strategic Tie-ups, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant (Adapted for Industrial Automation Vendors)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues, Forecast Period

17.1. By Market Structure (In-House vs Outsourced), Forecast Period

17.2. By Solution Type (Discrete, Process, Hybrid, Services), Forecast Period

17.3. By Industry Verticals (Automotive, Mining, Pulp & Paper, F&B, Pharma), Forecast Period

17.4. By Company Size (Large, Mid-Market, SMEs)

17.5. By Application (Process Control, Packaging, Intralogistics, Machine Tending)

17.6. By Mode of Operation (Manual-Semi Automated, Automated, Fully Autonomous)

17.7. By Open vs Customized Solutions

17.8. By Region (Götaland, Svealand, Norrland)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire ecosystem of the Sweden Industrial Automation Market, identifying all demand-side and supply-side stakeholders. On the demand side, this includes end-user industries such as automotive & EV batteries, mining & metals, pulp & paper, food & beverage, pharmaceuticals, and energy & utilities. On the supply side, we cover automation OEMs (ABB, Siemens, Schneider Electric, etc.), system integrators, component suppliers (PLCs, DCS, SCADA, robotics, drives, sensors), software providers (IIoT platforms, MES, digital twins), and networking firms (5G, Ethernet, gateways). Based on this mapping, we shortlist 5–6 leading automation providers in Sweden by analyzing their financials, market penetration, and installed base across key industries. Sourcing is conducted through industry articles, EU and Swedish trade statistics, and multiple secondary and proprietary databases to collate industry-level insights.

Step 2: Desk Research

An exhaustive desk research exercise is conducted using secondary and proprietary databases to build a comprehensive industry-level understanding. This includes analysis of automation deployment by sector, Sweden’s manufacturing gross value added, merchandise trade flows, energy consumption, labor force data, and export statistics. At the company level, press releases, annual reports, EU filings, financial statements, and government disclosures are reviewed. Variables such as revenues, installed robot density, system integration capacity, demand distribution, and technology adoption trends are mapped. This process ensures we establish a solid base of Sweden-specific industrial automation insights and construct a detailed industry profile supported by hard data.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives, engineering heads, automation project managers, and end-user stakeholders across major Swedish industries. These interviews validate hypotheses, authenticate datasets, and extract operational insights. A bottom-up approach is applied by evaluating revenue contributions for each supplier and aggregating these figures to build the total market structure. To strengthen accuracy, disguised interviews are also performed where our researchers approach system integrators, distributors, and OEMs as potential industrial clients. This technique allows us to validate company-level disclosures, triangulate with secondary databases, and gather detailed insights on pricing, service models, revenue streams, and value chains.

Step 4: Sanity Check

A two-way validation is performed by conducting both bottom-up and top-down market sizing. Bottom-up analysis aggregates revenues and installed base estimates from company and sectoral data, while top-down analysis uses macroeconomic indicators such as Sweden’s manufacturing output (SEK 12,457 billion turnover), export flows (USD 194,598 million), and electricity production (163 TWh). The two methods are reconciled to ensure alignment, with discrepancies resolved through recalibrated modeling exercises. This sanity check ensures the robustness of our methodology and accuracy of the final Sweden Industrial Automation Market assessment.

FAQs

01 What is the potential for the Sweden Industrial Automation Market?

The Sweden Industrial Automation Market is poised for significant growth, with a strong foundation in advanced manufacturing, process industries, and renewable energy. Sweden’s merchandise exports stood at USD 194,598 million in the latest year, underlining its reliance on efficient, high-tech production systems. Automation potential is further driven by expansion in green steel, EV batteries, and pulp & paper industries, along with government-backed innovation programs and access to private 5G spectrum. These factors position the Swedish market as one of Europe’s leading hubs for next-generation industrial automation solutions.

02 Who are the Key Players in the Sweden Industrial Automation Market?

The Sweden Industrial Automation Market features several global and domestic players. Key global leaders include ABB, Siemens, Schneider Electric, Rockwell Automation, and Mitsubishi Electric, known for their wide-ranging automation portfolios and installed base in Swedish plants. Other notable players are Omron, Beckhoff, Bosch Rexroth, Emerson, Honeywell, FANUC, KUKA, and Yaskawa. Local champions such as HMS Networks and Beijer Electronics Group stand out for their strong role in industrial networking, connectivity, and operator interface technologies, giving them an edge in Sweden’s digital-first industrial landscape.

03 What are the Growth Drivers for the Sweden Industrial Automation Market?

Key growth drivers for the Sweden Industrial Automation Market include the scale of the country’s industrial sector, supported by SEK 12,457 billion in total business turnover as reported by Statistics Sweden. Rising electricity production of 163 TWh, with 33 TWh from wind, supports electrification and automation in energy-intensive industries. Additionally, pro-industry spectrum licensing policies by the Swedish Post and Telecom Authority (PTS), allocating 80 MHz at 3.7 GHz and 1,000 MHz at 26 GHz for private 5G, are enabling factories to adopt advanced connectivity, robotics, and mobile automation at scale.

04 What are the Challenges in the Sweden Industrial Automation Market?

The Sweden Industrial Automation Market faces challenges linked to labor and compliance dynamics. Employment levels of 5,132,000 people coupled with 147,500 job openings illustrate ongoing skill shortages that slow automation integration. Regulatory and legal pressures are high, with Land and Environment Courts managing 3,647 environmental cases and 2,403 planning/building cases in one year, delaying industrial expansion projects. Additionally, cybersecurity risks are intensifying, with the Civil Contingencies Agency (MSB) reporting 334 significant IT incidents among essential-service organizations, compelling companies to increase investments in cyber-physical system protection alongside automation deployments.