Sweden Logistics and Warehousing Market Outlook to 2029

By Freight Mode (Road, Rail, Air, and Sea), By End Users (Retail, Automotive, Pharmaceutical, E-commerce, and Others), By Type of Warehousing (Bonded, Private, Cold Storage, and Third-Party Logistics), and By Region

- Product Code: TDR0327

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Sweden Logistics and Warehousing Market Outlook to 2029 – By Freight Mode (Road, Rail, Air, and Sea), By End Users (Retail, Automotive, Pharmaceutical, E-commerce, and Others), By Type of Warehousing (Bonded, Private, Cold Storage, and Third-Party Logistics), and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Sweden. The report covers the industry’s overview and genesis, overall market size in terms of revenue, market segmentation, trends and developments, regulatory framework, customer-level profiling, key challenges and opportunities, competitive landscape including cross-comparison and positioning, and company profiling of major players in the market. The report concludes with future market projections by segment, freight and warehouse type, end-use sectors, and regional performance, along with success case studies and critical market enablers and risks.

Sweden Logistics and Warehousing Market Overview and Size

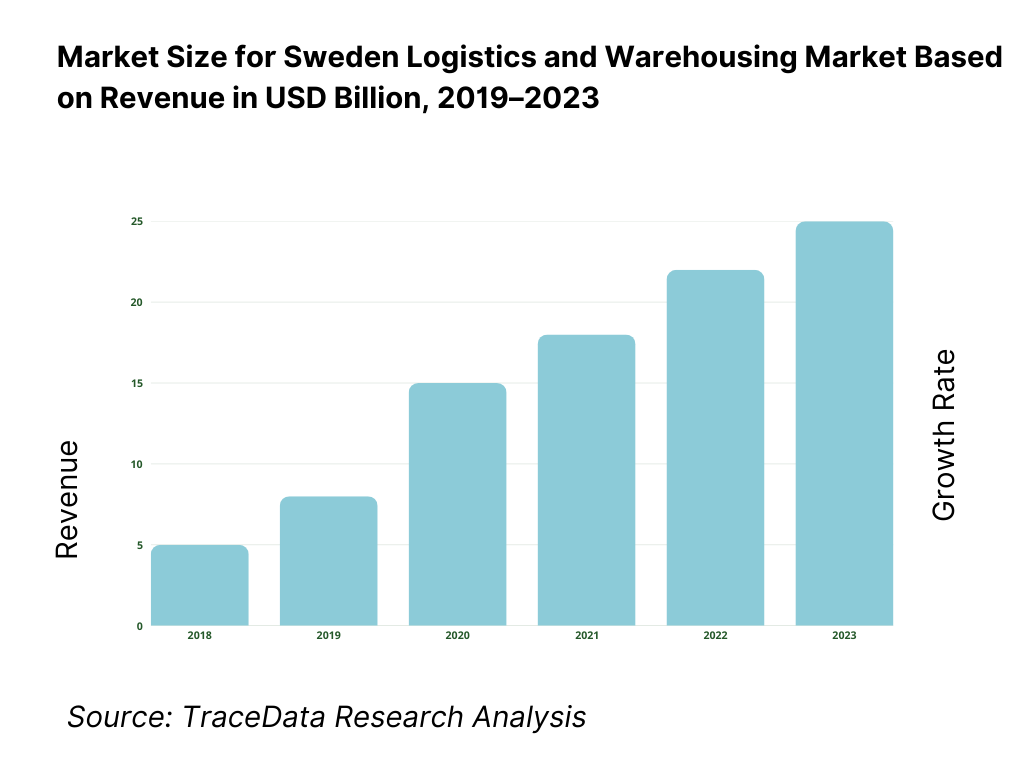

The Sweden logistics and warehousing market reached a valuation of SEK 185 Billion in 2023, driven by the country’s strategic geographic location, strong manufacturing and export sector, and growing demand for last-mile delivery services amid the rise in e-commerce. The market is anchored by key players such as DB Schenker, PostNord, DHL, Bring Logistics, and Green Cargo. These companies offer end-to-end logistics solutions, leveraging digital platforms, automation, and sustainable transportation practices.

In 2023, PostNord announced the expansion of its parcel delivery network across urban hubs to cater to the growing demand from e-commerce platforms. Stockholm, Gothenburg, and Malmö are primary logistics hubs due to their dense population centers, port access, and proximity to trade routes connecting the Nordics with mainland Europe.

What Factors are Leading to the Growth of Sweden Logistics and Warehousing Market:

Strategic Location and Trade Integration: Sweden’s central positioning in the Nordics makes it a vital logistics corridor for trade across Europe and the Baltics. With 90% of Sweden’s trade volume reliant on sea freight and growing intermodal connectivity, the market benefits from seamless supply chain integration. In 2023, over 400 million tons of cargo were handled through Sweden’s ports, highlighting the nation’s robust maritime infrastructure.

E-commerce Boom and Urban Warehousing Demand: Online shopping in Sweden grew by over 14% in 2023, fueling demand for faster and more flexible last-mile solutions. Companies are increasingly investing in urban warehousing and automated fulfillment centers. Warehousing facilities near Stockholm saw a 20% increase in occupancy rates due to rising e-retail volumes and same-day delivery expectations.

Green Logistics and Automation: Sweden’s push for carbon-neutral freight has accelerated the adoption of electric trucks, green warehousing, and rail freight. In 2023, over 30% of logistics operators in Sweden had implemented carbon reduction measures. Additionally, the adoption of robotics, AI, and IoT in warehousing is improving operational efficiency and inventory management.

Which Industry Challenges Have Impacted the Growth for Sweden Logistics and Warehousing Market

High Operational Costs: Rising fuel prices, increasing labor costs, and inflationary pressure on warehousing rents have impacted the profitability of logistics operators in Sweden. In 2023, operating expenses in the sector increased by nearly 11% YoY, driven primarily by surging electricity and diesel prices. These cost pressures are especially challenging for small and mid-sized logistics players, limiting their scalability.

Infrastructure Bottlenecks in Urban Areas: While Sweden boasts a strong logistics infrastructure overall, urban congestion in cities like Stockholm and Gothenburg has led to delays in last-mile delivery and limited access to warehousing zones. According to the Swedish Transport Administration, delivery delays due to traffic bottlenecks have increased by 18% over the past two years, impacting service reliability for e-commerce and retail customers.

Skilled Labor Shortage: The logistics sector is grappling with a shortage of qualified truck drivers, warehouse operators, and supply chain analysts. In 2023, nearly 25% of logistics companies in Sweden reported workforce shortages as their top challenge. This has pushed firms to increase wages and invest in automation, further inflating costs and slowing operational expansion.

What are the Regulations and Initiatives which have Governed the Market:

Emission Standards and Green Logistics Policy: The Swedish government mandates logistics operators to meet Euro 6 emission standards and encourages adoption of electric trucks and rail freight. In 2022, the Ministry of Infrastructure introduced a Green Freight Program offering financial support to companies investing in low-emission vehicles and infrastructure. By 2023, 28% of heavy-duty trucks in Sweden complied with Euro 6 or higher, and this figure is expected to rise significantly by 2026.

E-commerce and Last-Mile Regulations: To reduce traffic congestion and pollution in city centers, municipal governments in Stockholm and Gothenburg have enforced time-bound delivery windows and congestion charges for logistics vehicles. These restrictions have encouraged warehousing companies to explore micro-hubs and electric vans. In 2023, about 15% of deliveries in central Stockholm were completed through green last-mile solutions such as e-bikes and cargo drones.

Cold Chain Compliance Standards: With increasing demand from pharmaceutical and food sectors, Sweden enforces strict guidelines for temperature-controlled warehousing and transport. The Swedish Medical Products Agency (Läkemedelsverket) requires cold chain providers to maintain GDP (Good Distribution Practices) certification. In 2023, over 90% of compliant cold storage facilities were located near major urban centers and airports, catering to pharma and vaccine logistics.

Sweden Logistics and Warehousing Market Segmentation

By Market Structure: Third-Party Logistics (3PL) providers dominate the Swedish market due to their ability to offer integrated solutions across freight, storage, and last-mile delivery. These companies, such as DB Schenker, Bring, and DHL, are preferred by large enterprises for their extensive infrastructure, advanced technology adoption, and scalable operations. Meanwhile, in-house logistics remains prominent among major retail and manufacturing firms, especially those seeking tighter control over inventory and quality. However, the trend is gradually shifting toward outsourcing as companies aim to reduce costs and increase supply chain flexibility.

%20on%20the%20Basis%20of%20Revenue%20in%20Percentage%2C%202023.png)

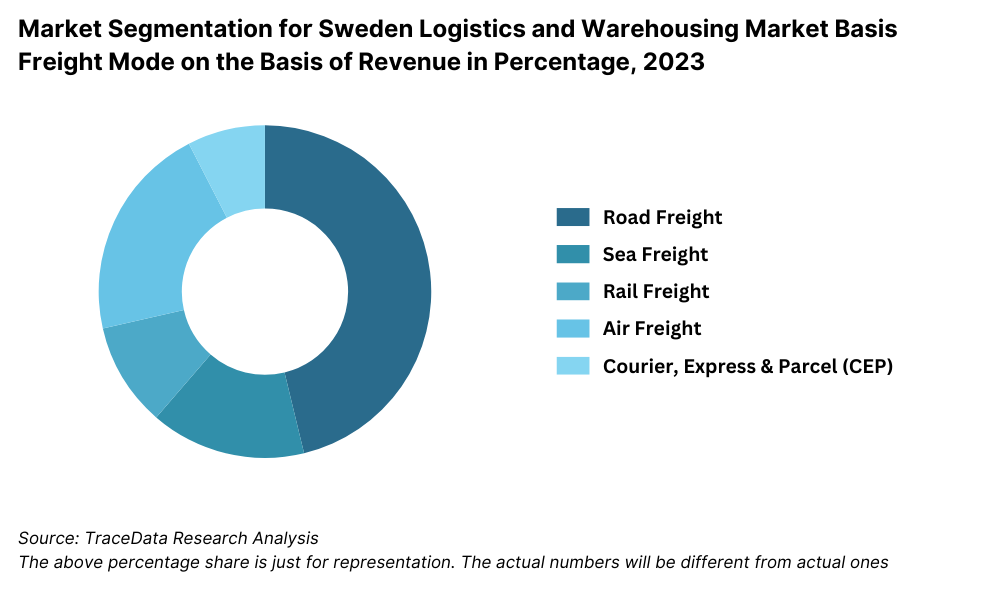

By Freight Mode: Road freight holds the largest share in Sweden's logistics landscape, driven by the country’s well-developed highway network and growing demand for domestic distribution and last-mile delivery. In 2023, road transport accounted for more than half of total freight movement in value terms. Sea freight remains vital for international trade, with key ports like Gothenburg and Helsingborg serving as major gateways. Rail freight is increasingly gaining traction due to Sweden’s focus on sustainability, particularly for bulk goods and long-haul transport across Scandinavia and Central Europe. Air freight, though smaller in volume, plays a critical role in time-sensitive deliveries and pharmaceutical logistics.

By Type of Warehousing: Private warehouses, typically operated by large retailers and manufacturers, constitute a significant portion of Sweden’s warehousing space due to tailored inventory systems and higher control over logistics processes. However, public and bonded warehouses are also growing, especially near port cities for import-export trade. Cold storage facilities are seeing rapid growth driven by pharmaceuticals, dairy, and frozen food segments. In 2023, cold chain warehousing demand increased by nearly 17%, particularly in urban centers and regions close to airports.

Competitive Landscape in Sweden Logistics and Warehousing Market

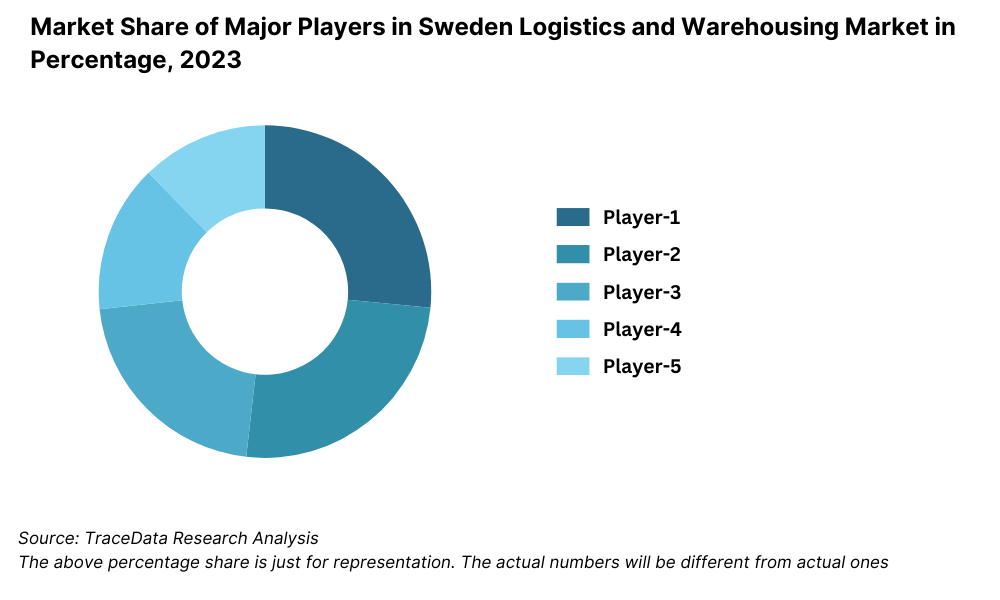

The Sweden logistics and warehousing market is moderately concentrated, with a few major players dominating key freight corridors and warehousing zones. However, the growth of niche service providers, increased investments in sustainable logistics, and the rise of digital freight platforms have added greater diversity to the market. Prominent companies include DB Schenker, PostNord, DHL, Bring Logistics, Green Cargo, Best Transport, and Budbee.

Company | Establishment Year | Headquarters |

DB Schenker | 1872 | Gothenburg, Sweden |

PostNord | 2009 | Solna, Sweden |

DHL Sweden | 1969 | Stockholm, Sweden |

Bring Logistics | 2006 | Malmö, Sweden |

Green Cargo | 2001 | Solna, Sweden |

Budbee | 2016 | Stockholm, Sweden |

Best Transport | 1976 | Stockholm, Sweden |

Some of the recent competitor trends and key information about competitors include:

DB Schenker: One of the largest logistics players in Sweden, DB Schenker operates extensive warehousing facilities and a nationwide transport fleet. In 2023, the company launched a fully electric freight hub near Stockholm, aiming to reduce annual carbon emissions by over 1,200 tons. Its focus on digital tracking and sustainable operations has kept it at the forefront of the industry.

PostNord: The national postal and logistics operator saw strong growth in e-commerce parcel deliveries in 2023, with volumes increasing by 18%. The company also expanded its cold chain logistics infrastructure to support pharmaceutical distribution, aligning with Sweden's rising demand for healthcare logistics.

DHL Sweden: DHL strengthened its position by investing in green warehousing and AI-driven inventory management. In 2023, it opened a new 25,000 sqm warehouse in Malmö powered entirely by renewable energy. The facility uses autonomous mobile robots (AMRs) to streamline picking and packing operations.

Bring Logistics: With a strong presence in last-mile and cross-border delivery, Bring expanded its operations in southern Sweden. In 2023, the company launched a new temperature-controlled facility in Helsingborg to cater to food and pharma clients, enhancing its regional footprint.

Green Cargo: A state-owned rail logistics provider, Green Cargo is leading Sweden’s transition toward eco-friendly freight transport. In 2023, the company transported over 20 million tons of goods via electric rail, reducing CO₂ emissions by approximately 450,000 tons. It continues to be a preferred partner for heavy industries and cross-border Nordic trade.

What Lies Ahead for Sweden Logistics and Warehousing Market?

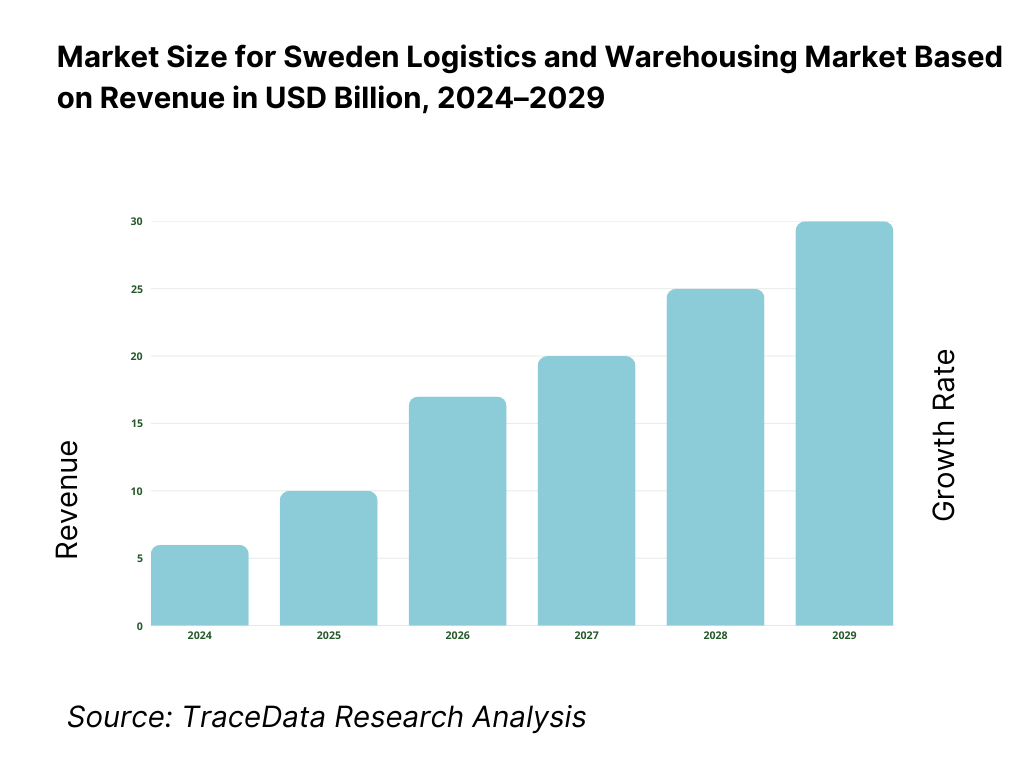

The Sweden logistics and warehousing market is projected to experience steady growth through 2029, driven by rising e-commerce penetration, advancements in green logistics, and increased digital transformation across the supply chain. A combination of infrastructure investments, policy support, and automation is expected to help the sector achieve a healthy CAGR during the forecast period.

Expansion of Sustainable Logistics Solutions: Sweden is poised to lead the Nordic region in the adoption of sustainable logistics practices. This includes a wider deployment of electric and hydrogen-powered trucks, green-certified warehouses, and the continued expansion of rail freight. By 2029, it is anticipated that over 50% of urban deliveries in major Swedish cities will be made via carbon-neutral transport modes, supported by regulatory incentives and corporate ESG targets.

Rise of Automation and Smart Warehousing: The use of robotics, automated storage and retrieval systems (AS/RS), AI-powered inventory management, and real-time visibility platforms will become mainstream in warehousing operations. These technologies are expected to improve order accuracy, reduce labor dependency, and optimize space utilization. By 2029, over 70% of modern warehouses in Sweden are expected to adopt at least one form of smart technology to stay competitive.

Growth in Urban Micro-Fulfillment Centers (MFCs): Driven by rising expectations for same-day and next-day delivery, logistics firms are increasingly setting up micro-fulfillment centers in high-density urban locations. These facilities help minimize delivery time and reduce last-mile emissions. Stockholm, Gothenburg, and Malmö are projected to see a 25–30% increase in MFC deployment by 2029, especially for e-grocery, health, and fashion retail categories.

Enhanced Cross-Border Integration in Nordic and EU Supply Chains: Sweden’s integration with pan-European and Nordic supply chains will deepen further. The expansion of rail corridors, digital customs platforms, and coordinated port logistics with Denmark, Norway, and Germany will streamline cross-border freight movement. This will enhance Sweden’s positioning as a key logistics gateway between mainland Europe and the Nordics.

Sweden Logistics and Warehousing Market Segmentation

• By Market Structure:

o Third-Party Logistics (3PL) Providers

o Fourth-Party Logistics (4PL) Coordinators

o Asset-Light Logistics Companies

o In-house/Private Logistics

o Contract Logistics Providers

o Small Freight Forwarders

o Micro-Fulfillment Operators

• By Freight Mode:

o Road Freight

o Rail Freight

o Sea Freight

o Air Freight

o Multimodal Transportation

• By Type of Warehousing:

o Private Warehouses

o Public Warehouses

o Bonded Warehouses

o Cold Storage Warehouses

o Automated Warehouses

o Urban/Micro-Fulfillment Centers

• By End Use Industry:

o E-commerce and Retail

o Automotive

o Food & Beverage

o Pharmaceutical and Healthcare

o Industrial and Manufacturing

o Technology & Electronics

o Chemicals and Hazardous Materials

• By Region:

o Stockholm Region

o Southern Sweden (Skåne, Malmö, Lund)

o Central Sweden (Uppsala, Västmanland)

o Northern Sweden (Norrbotten, Västerbotten)

o Western Sweden (Gothenburg, Västra Götaland)

Players Mentioned in the Report:

• DB Schenker

• PostNord

• DHL Sweden

• Bring Logistics

• Green Cargo

• Budbee

• Best Transport

• TNT Sweden

• Scanlog (Scandinavian Logistics Partners)

• DSV Sweden

Key Target Audience:

• Logistics and Warehousing Companies

• E-commerce and Retail Firms

• Manufacturing and Industrial Exporters

• Government Transport Authorities

• Cold Chain Operators

• Third-Party Logistics (3PL) Providers

• Technology Solution Providers in Supply Chain

• Investment and Infrastructure Development Firms

• Research and Consulting Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Sweden Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges they Face

4.2. Revenue Streams for Sweden Logistics and Warehousing Market

4.3. Business Model Canvas for Sweden Logistics and Warehousing Market

4.4. Service Selection Decision-Making Process

4.5. Warehouse Location and Freight Route Selection Process

5. Market Structure

5.1. Freight Volume Handled by Mode in Sweden, 2018-2024

5.2. E-commerce Growth and its Impact on Logistics Demand, 2018-2024

5.3. National Logistics Spending as % of GDP, 2024

5.4. Number of Warehousing and Logistics Service Providers in Sweden by Region

6. Market Attractiveness for Sweden Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Sweden Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Warehousing Capacity (in Million Sqm), 2018-2024

8.3. Freight Volume by Mode (in Million Tons), 2018-2024

9. Market Breakdown for Sweden Logistics and Warehousing Market Basis

9.1. By Market Structure (3PL, 4PL, In-house), 2023-2024P

9.2. By Freight Mode (Road, Rail, Sea, Air), 2023-2024P

9.3. By Warehouse Type (Private, Public, Bonded, Cold Storage), 2023-2024P

9.4. By Region (Stockholm, Malmö, Gothenburg, Central Sweden, Northern Sweden), 2023-2024P

9.5. By End Use Industry (Retail, Automotive, Pharma, F&B, Manufacturing), 2023-2024P

10. Demand Side Analysis for Sweden Logistics and Warehousing Market

10.1. Client Profile and Sectoral Demand

10.2. Decision-Making Parameters for Logistics Service Provider Selection

10.3. Key Logistics Outsourcing Trends by Sector

10.4. Service Gaps and Infrastructure Challenges

11. Industry Analysis

11.1. Trends and Developments in Sweden Logistics and Warehousing Market

11.2. Growth Drivers for Sweden Logistics and Warehousing Market

11.3. SWOT Analysis for Sweden Logistics and Warehousing Market

11.4. Issues and Challenges for Sweden Logistics and Warehousing Market

11.5. Government Regulations and Incentives

12. Snapshot on Urban and E-commerce Logistics

12.1. Market Size and Growth Forecast for Urban Logistics Hubs, 2018-2029

12.2. Micro-Fulfillment Center Trends and Business Model

12.3. Cross Comparison of Leading Urban Logistics Providers

13. Sweden Cold Chain Logistics Market

13.1. Growth in Cold Chain Infrastructure and Capacity, 2018-2029

13.2. Pharmaceutical and Food Industry Demand Dynamics

13.3. Key Players and Revenue Models in Cold Chain Logistics

13.4. Compliance Requirements (GDP, ISO, etc.) and Certification Trends

13.5. Future Outlook for Cold Chain Logistics, 2024-2029

14. Opportunity Matrix for Sweden Logistics and Warehousing Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Sweden Logistics and Warehousing Market

16. Competitor Analysis for Sweden Logistics and Warehousing Market

16.1. Benchmark of Key Competitors in Sweden Logistics and Warehousing Market Including Variables such as Company Overview, USP, Business Strategy, Strength, Weakness, Fleet Size, Warehouse Area, Green Initiatives, and Recent Developments

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Sweden Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Warehousing Capacity, 2025-2029

17.3. Freight Volume by Mode, 2025-2029

18. Market Breakdown for Sweden Logistics and Warehousing Market Basis

18.1. By Market Structure, 2025-2029

18.2. By Freight Mode, 2025-2029

18.3. By Warehouse Type, 2025-2029

18.4. By Region, 2025-2029

18.5. By End Use Industry, 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Sweden Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics and warehousing providers in the country based upon their financial information, infrastructure footprint, and volume of operations.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the total logistics spending, warehousing capacity, number of market players, freight volumes, demand split by sector, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Sweden Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate warehousing capacity and freight movement for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service portfolios, value chain, process, pricing, and other factors.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Sweden Logistics and Warehousing Market?

The Sweden logistics and warehousing market holds strong growth potential, reaching a valuation of SEK 185 Billion in 2023. Growth is driven by Sweden’s strategic geographic position in Northern Europe, robust infrastructure, increasing e-commerce activity, and rising demand for cold chain and last-mile logistics solutions. With ongoing investments in automation and sustainability, the market is expected to expand steadily through 2029.

2. Who are the Key Players in the Sweden Logistics and Warehousing Market?

The Sweden Logistics and Warehousing Market features several major players, including DB Schenker, PostNord, and DHL Sweden. These companies lead the market due to their comprehensive logistics networks, large-scale warehousing facilities, and advanced digital capabilities. Other prominent players include Bring Logistics, Green Cargo, Budbee, and Best Transport.

3. What are the Growth Drivers for the Sweden Logistics and Warehousing Market?

Key growth drivers include the rapid expansion of e-commerce, government investment in transport infrastructure, and the increasing adoption of sustainable and green logistics practices. The shift towards automation and AI in warehousing, combined with the growth of cold chain services and cross-border trade integration with the EU, is also propelling the market forward.

4. What are the Challenges in the Sweden Logistics and Warehousing Market?

The Sweden Logistics and Warehousing Market faces several challenges, including high operational costs due to rising fuel and labor prices, congestion in urban centers affecting last-mile delivery efficiency, and a shortage of skilled logistics personnel. Additionally, compliance with stringent environmental regulations poses financial and operational pressures, particularly for smaller logistics providers.