Switzerland Auto Finance Market Outlook to 2029

By Market Structure, By Lenders, By Type of Vehicle Financed, By Tenure, By Consumer Demographics, and By Region

- Product Code: TDR0149

- Region: Europe

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Switzerland Auto Finance Market Outlook to 2029 - By Market Structure, By Lenders, By Type of Vehicle Financed, By Tenure, By Consumer Demographics, and By Region.” provides a comprehensive analysis of the auto finance market in Switzerland. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on financing revenue, by market segment, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Switzerland Auto Finance Market Overview and Size

The Switzerland auto finance market reached a valuation of CHF 9.4 Billion in 2023, supported by rising vehicle ownership rates, increasing availability of financial products, and a well-regulated banking infrastructure. Major players include AMAG Leasing, Cembra Money Bank, MultiLease, and UBS. These institutions are known for competitive loan offerings, streamlined approval processes, and tailored finance solutions catering to various customer segments.

In 2023, AMAG Leasing introduced a fully digital loan approval system, reducing turnaround time and increasing convenience for customers. Zurich, Geneva, and Basel emerged as major auto finance hubs due to their high urban density and advanced transportation networks.

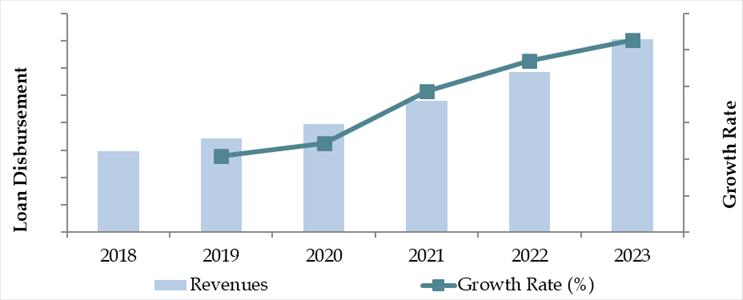

Market Size for Switzerland Auto Finance Industry Size on the Basis of Loan Disbursement in USD Billion, 2018-2024

What Factors are Leading to the Growth of Switzerland Auto Finance Market:

High Vehicle Penetration and Rising Ownership Costs: Switzerland has one of the highest car ownership rates in Europe. With rising vehicle prices and inflationary pressure, consumers are turning to auto finance to manage their purchases. In 2023, over 72% of new vehicle buyers opted for some form of financing or leasing to manage upfront costs.

Shift Towards Leasing and Subscription Models: There has been a strong shift from outright purchases to leasing and flexible subscription-based models, especially among younger consumers and urban populations. Leasing accounted for 58% of auto finance contracts in 2023, as it offers predictable costs and includes maintenance.

Digital Transformation: The integration of AI-based credit scoring and instant digital approvals has transformed the auto finance market. In 2023, over 50% of loan and lease applications were processed through digital channels. Companies are investing in mobile-first platforms to capture digitally savvy customers.

Which Industry Challenges Have Impacted the Growth for Switzerland Auto Finance Market

Rising Interest Rates and Inflationary Pressures: The recent hike in interest rates by the Swiss National Bank has significantly increased the cost of borrowing. In 2023, average auto loan interest rates rose to 4.2%, compared to 2.9% in 2021. This shift has led to a decline in financing demand, particularly for longer-tenure and higher-value loans, affecting nearly 18% of prospective borrowers.

Stringent Credit Assessment Standards: Swiss banks and financial institutions maintain high standards for creditworthiness, often excluding individuals with low or unstable incomes. In 2023, an estimated 25% of applicants were denied auto financing due to strict income verification and credit score requirements, disproportionately impacting young adults and freelancers.

Limited Awareness of Financing Options: Many consumers, especially in rural regions, are still unaware of the full range of financing products available. A 2023 survey by AutoFin.ch indicated that 31% of potential car buyers lacked adequate understanding of leasing versus loan options, leading to underutilization of competitive offers and causing friction in the buying process.

What are the Regulations and Initiatives which have Governed the Market

Consumer Credit Regulations (KKG/LCC): The Swiss Consumer Credit Act (KKG/LCC) ensures responsible lending by requiring comprehensive creditworthiness assessments before financing approval. Financial institutions must validate income, expenses, and credit history. This regulation, while protecting consumers, slows down approval processes and limits access for riskier profiles.

Regulatory Guidelines on Leasing Transparency: The Swiss Leasing Association, in coordination with FINMA, enforces clear disclosure norms for all leasing contracts. As of 2022, it is mandatory for all leasing offers to display effective interest rates and final cost breakdowns, increasing transparency but also adding administrative complexity for lenders.

Incentives for Green Auto Financing: The Swiss government, along with financial institutions, has introduced green auto finance programs promoting the purchase of electric and hybrid vehicles. In 2023, subsidies covered up to CHF 3,000 of the down payment on EVs, and several banks provided 0.5–1% lower interest rates for qualifying green vehicle loans. As a result, green financing contracts grew by 21% YoY.

Switzerland Auto Finance Market Segmentation

By Market Structure: The organized sector, which includes banks, captive finance arms of car manufacturers, and licensed leasing companies, dominates the Swiss auto finance market. These players offer well-structured products, regulatory compliance, and consumer protections, making them the preferred choice for most buyers. The unorganized sector, which includes informal lending and dealership-level financing, holds a smaller share due to limited product transparency and higher risk. Organized lenders also offer digital onboarding, competitive rates, and value-added services such as insurance bundling and vehicle return options.

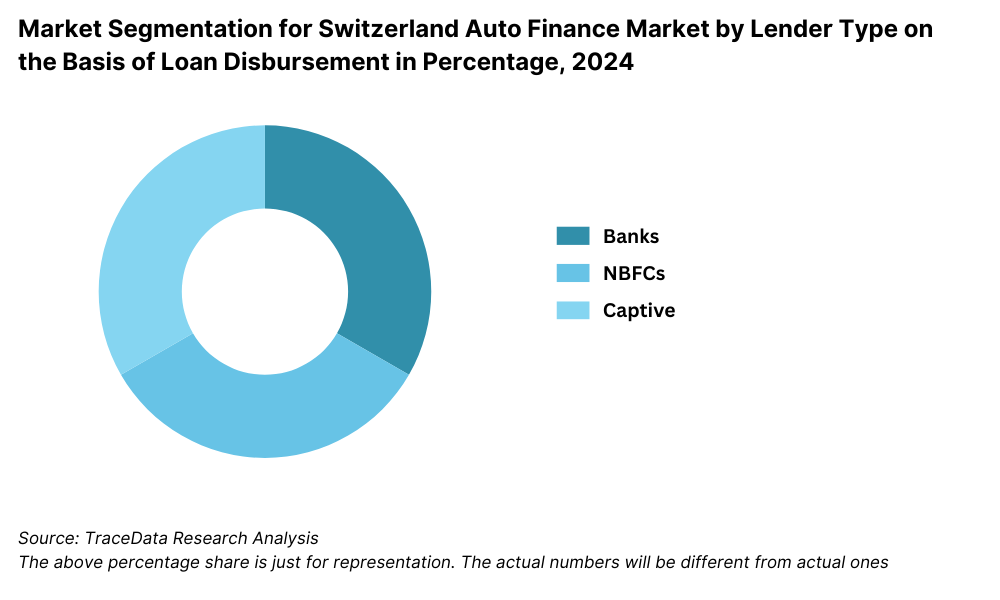

By Lender Type: Captive finance companies (e.g., AMAG Leasing for Volkswagen Group, BMW Financial Services) lead the market due to their integrated dealership offerings, tailored packages, and promotional rates. Commercial banks such as UBS, Credit Suisse, and Raiffeisen also hold a significant market share by offering personal auto loans with flexible repayment terms. Independent leasing companies, including MultiLease and Cembra Money Bank, cater to both individual and SME clients, gaining traction due to speedier approvals and specialized leasing models.

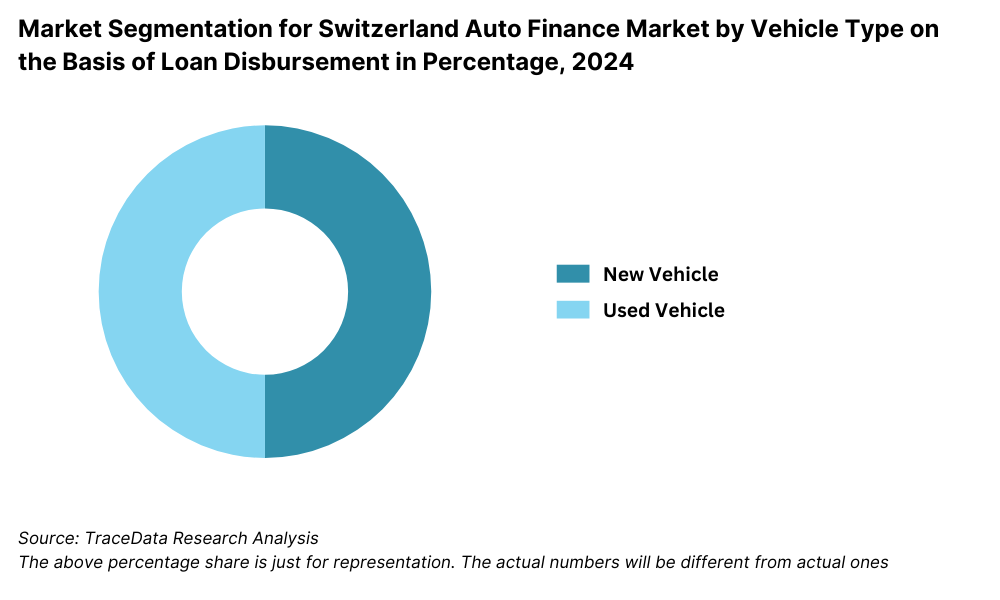

By Vehicle Type Financed: New vehicles represent the majority of financed units, accounting for approximately 64% of total contracts in 2023, driven by strong OEM-captive finance partnerships and promotional interest rates. Used vehicle financing has grown steadily, representing 36% of the market, as more consumers seek cost-effective alternatives and benefit from increased availability of certified pre-owned options.

Competitive Landscape in Switzerland Auto Finance Market

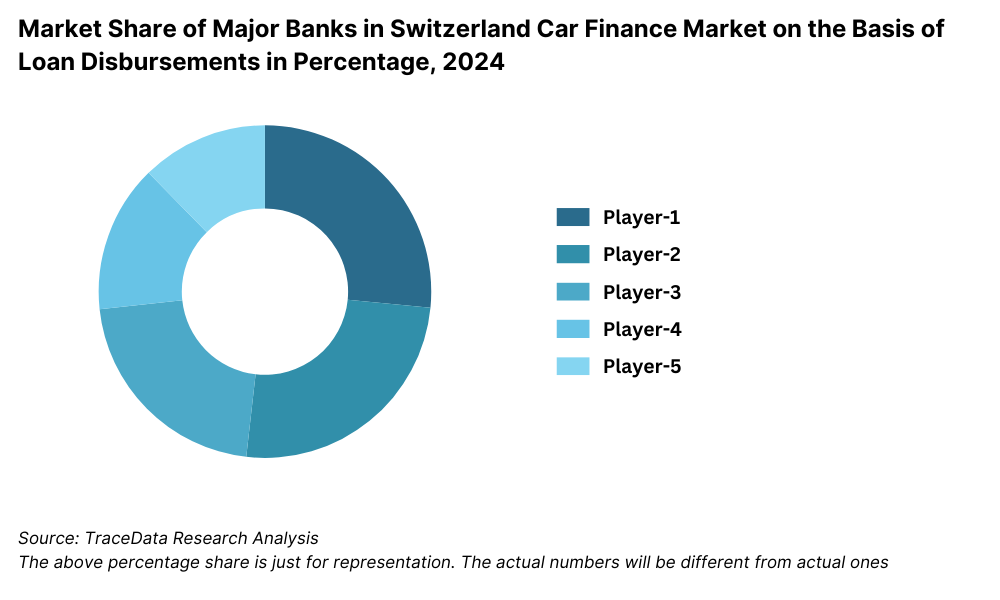

The Switzerland auto finance market is moderately concentrated, with a few established financial institutions, leasing firms, and captive finance arms holding a dominant share. However, the market has seen increasing competition from fintech-driven lenders and digital leasing platforms. Key players include AMAG Leasing, Cembra Money Bank, MultiLease, UBS, Credit Suisse, Migros Bank, and newer digital entrants like Carvolution and gowago.ch, which are reshaping customer experiences through innovative tech-driven models.

| Name | Founding Year | Original Headquarters |

| Credit Suisse Auto Finance | 1856 | Zurich, Switzerland |

| UBS Auto Loan Services | 1862 | Zurich, Switzerland |

| Raiffeisen Switzerland Auto Finance | 1899 | St. Gallen, Switzerland |

| PostFinance Car Loan | 1906 | Bern, Switzerland |

| Bank Cler Auto Finance | 1927 | Basel, Switzerland |

| Cembra Money Bank (Auto Finance) | 1912 | Zurich, Switzerland |

| Migros Bank Auto Loan | 1958 | Zurich, Switzerland |

| Zürcher Kantonalbank Auto Loan | 1870 | Zurich, Switzerland |

| BMW Financial Services Switzerland | 1988 | Munich, Germany |

| Toyota Financial Services Switzerland | 1982 | Toyota City, Japan |

| AMAG Leasing AG (Volkswagen Group) | 1945 | Zurich, Switzerland |

Some of the recent competitor trends and key information about competitors include:

AMAG Leasing: A leading captive finance company for Volkswagen Group vehicles, AMAG Leasing processed over 120,000 new lease contracts in 2023. Its seamless integration with dealerships and focus on EV financing contributed to a 14% YoY growth.

Cembra Money Bank: Known for its consumer lending and auto finance solutions, Cembra expanded its digital platform in 2023, enabling instant pre-approvals and personalized loan offers. The bank reported a 9% rise in new auto loan disbursements.

MultiLease: Catering primarily to SMEs and individual clients, MultiLease introduced flexible business leasing plans in 2023. Their SME leasing segment saw a 17% increase, driven by the rising popularity of commercial EVs.

UBS: While not a pure auto financier, UBS expanded its personal loan offerings with auto-specific bundles in 2023. The bank emphasized green financing options, including preferential rates for low-emission vehicles, capturing interest among environmentally conscious borrowers.

Credit Suisse: Prior to its merger activity, Credit Suisse played a role in auto loans via partnerships with dealerships. In 2023, the bank focused on wealthier clientele seeking premium financing plans, particularly for high-end vehicles.

Migros Bank: A consumer-friendly bank, Migros Bank emphasized transparent loan structures and competitive rates. Their online auto loan applications increased by 22% in 2023, driven by strong adoption among younger consumers.

Carvolution: As a pioneer in car subscriptions, Carvolution saw 40% YoY growth in 2023. Its flexible pricing, all-inclusive packages, and user-friendly platform made it especially popular with millennials and urban professionals.

gowago.ch: Offering a fully digital car leasing experience, gowago.ch partnered with major banks in 2023 to expand its vehicle selection and financing capabilities. The company saw a 35% increase in customers, particularly in Zurich and Geneva.

What Lies Ahead for Switzerland Auto Finance Market?

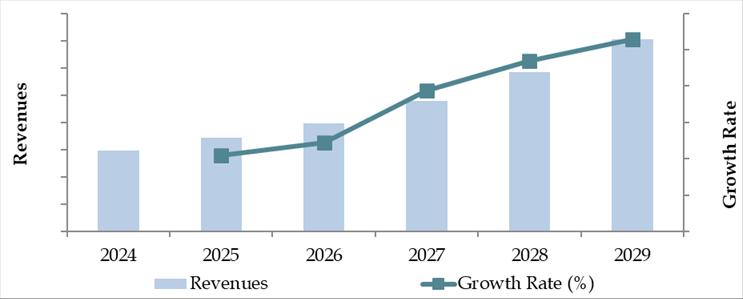

The Switzerland auto finance market is projected to experience steady growth through 2029, with a moderate yet stable CAGR anticipated during the forecast period. The expansion is expected to be driven by a mix of digital transformation, evolving consumer preferences, and increasing emphasis on sustainable financing solutions.

Rise of Electric Vehicle Financing: With the Swiss government's continued focus on decarbonization and the growing popularity of EVs, the demand for specialized EV financing is expected to rise. Lenders are likely to introduce more incentive-driven products such as lower interest rates, flexible terms, and bundled insurance for electric and hybrid vehicles. By 2029, EVs are expected to account for over 45% of all newly financed vehicles.

Expansion of Subscription and Mobility Services: Car subscription models are anticipated to grow rapidly, especially among younger, urban consumers who prioritize flexibility over ownership. Companies like Carvolution and gowago.ch are likely to expand their footprint, leading to more widespread adoption of all-inclusive car financing packages that include maintenance, insurance, and roadside assistance.

Integration of AI and Automation: Auto lenders are expected to further integrate AI and machine learning to enhance credit scoring, fraud detection, and customer service. Automation of loan approvals and personalized financing offers will make the application process faster and more consumer-centric, reducing approval times from days to minutes.

Growth in Used Vehicle Financing: As vehicle prices continue to rise, demand for used vehicle financing is projected to increase. Banks and leasing firms are expected to expand their offerings for certified pre-owned vehicles, giving customers access to lower-cost alternatives with added trust and support.

Future Outlook and Projections for Switzerland Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Switzerland Auto Finance Market Segmentation

- By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Lenders

- Public Sector Banks

- Private Sector Banks

- Microfinance Institutions

- Captive Finance Companies

- By Vehicle Type:

- New Vehicles

- Used Vehicles

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

- By Loan Tenure:

- <3 Years

- 3-5 Years

- 5-7 Years

- More than 7 Years

- By Interest Rates:

- Below 7%

- 7%-9%

- 9%-12%

- Above 12%

- By Region:

o Zurich

o Geneva

o Basel

o Bern

o Vaud

o Lucerne

o Ticino

Players Mentioned in the Report (Banks):

- Cembra Money Bank

- Banque Cantonale de Genève (BCGE)

- Berner Kantonalbank (BEKB)

- Schwyzer Kantonalbank (SZKB)

- PostFinance

- Habib Bank AG Zurich

Players Mentioned in the Report (NBFCs):

- Lend

- Swiss Continental Trust

Players Mentioned in the Report (Captive):

- CA Auto Finance Swisse

- CA Auto Bank

Key Target Audience:

• Automotive Finance Providers

• Banks and Leasing Companies

• Fintech Startups in Auto Lending

• Car Dealerships and Auto OEMs

• Regulatory Bodies (e.g., FINMA, Swiss Leasing Association)

• Research and Consulting Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Switzerland by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Switzerland Car Finance Market

11.2. Growth Drivers for Switzerland Car Finance Market

11.3. SWOT Analysis for Switzerland Car Finance Market

11.4. Issues and Challenges for Switzerland Car Finance Market

11.5. Government Regulations for Switzerland Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Switzerland Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Switzerland Car Finance Market, 2024

17.3. Market Share of Key Captive in Switzerland Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Switzerland Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Switzerland Auto Finance Market. Based on this mapping, we shortlist 5–6 leading financial institutions and leasing companies in the country by evaluating their financial data, loan/lease portfolios, and operational scale.

Sourcing is carried out through industry reports, regulatory publications, financial databases, fintech newsletters, and other proprietary databases to perform initial desk research and gather market-level insights.

Step 2: Desk Research

We then conduct in-depth desk research by leveraging diverse secondary and proprietary data sources. This step helps in thoroughly analyzing the market landscape by aggregating data related to financing volumes, number of contracts, types of lenders, pricing trends, consumer preferences, and emerging technologies.

We also extract company-specific information from investor presentations, annual reports, financial statements, and official press releases to gain a better understanding of the competitive and operational environment in Switzerland’s auto finance sector.

Step 3: Primary Research

We carry out a series of structured interviews with C-level executives, finance managers, product heads, and strategic leads across auto finance providers, leasing firms, and fintech platforms in the Swiss market. These interviews help validate market assumptions, financial data, and business model specifics.

In addition, we employ a disguised customer approach to interact with market players under the pretense of being potential clients. This helps us gather insights on interest rates, approval criteria, pricing structures, product features, and the customer journey. These insights are cross-referenced with available secondary data to enhance accuracy and depth of understanding.

Step 4: Sanity Check

- We employ both bottom-up and top-down modeling techniques to verify the reliability and consistency of our data. These techniques help validate the volume and value estimates for the auto finance market, providing a comprehensive and balanced view.

FAQs

1. What is the potential for the Switzerland Auto Finance Market?

The Switzerland auto finance market reached a valuation of CHF 9.4 Billion in 2023 and is poised for consistent growth through 2029. The market’s potential is driven by rising vehicle ownership, the increasing adoption of electric vehicles, and the shift toward flexible financing and subscription models. Additionally, digital transformation and ESG-focused financing are expected to unlock new segments and drive greater efficiency and customer engagement.

2. Who are the Key Players in the Switzerland Auto Finance Market?

Key players in the Swiss auto finance landscape include AMAG Leasing, Cembra Money Bank, UBS, Credit Suisse, MultiLease, and Migros Bank. New-age platforms such as Carvolution and gowago.ch are also gaining traction with younger, urban customers due to their fully digital and flexible car financing solutions.

3. What are the Growth Drivers for the Switzerland Auto Finance Market?

Growth in the market is driven by factors such as rising EV adoption, favorable financing terms offered by banks and captive finance companies, and the increasing popularity of car subscription models. Advancements in AI-driven credit scoring and digital approval processes are also making auto finance more accessible and efficient for a broader consumer base.

4. What are the Challenges in the Switzerland Auto Finance Market?

Key challenges include rising interest rates, which increase the cost of borrowing, and stringent credit assessment norms that limit access for younger or lower-income borrowers. Additionally, a lack of awareness about alternative financing options—especially in rural areas—continues to restrict market penetration. Regulatory complexity and evolving compliance requirements may also pose operational hurdles for smaller and emerging players.