Switzerland Cold Chain Market Outlook to 2029

By Market Structure, By Service Offering (Cold Storage, Cold Transport), By Temperature Type, By End Users (Pharmaceuticals, Food & Beverage, Chemicals, Others), and By Region

- Product Code: TDR0328

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Switzerland Cold Chain Market Outlook to 2029 - By Market Structure, By Service Offering (Cold Storage, Cold Transport), By Temperature Type, By End Users (Pharmaceuticals, Food & Beverage, Chemicals, Others), and By Region” provides a comprehensive analysis of the cold chain industry in Switzerland. The report covers industry’s genesis and evolution, overall market size in terms of revenue, market segmentation; trends and developments, regulatory environment, customer profiling, industry challenges, and competitive landscape including market shares, service differentiation, and future opportunities. The report concludes with market forecasts by service, temperature range, end-user application, region, and includes success case studies that highlight the key opportunities and challenges.

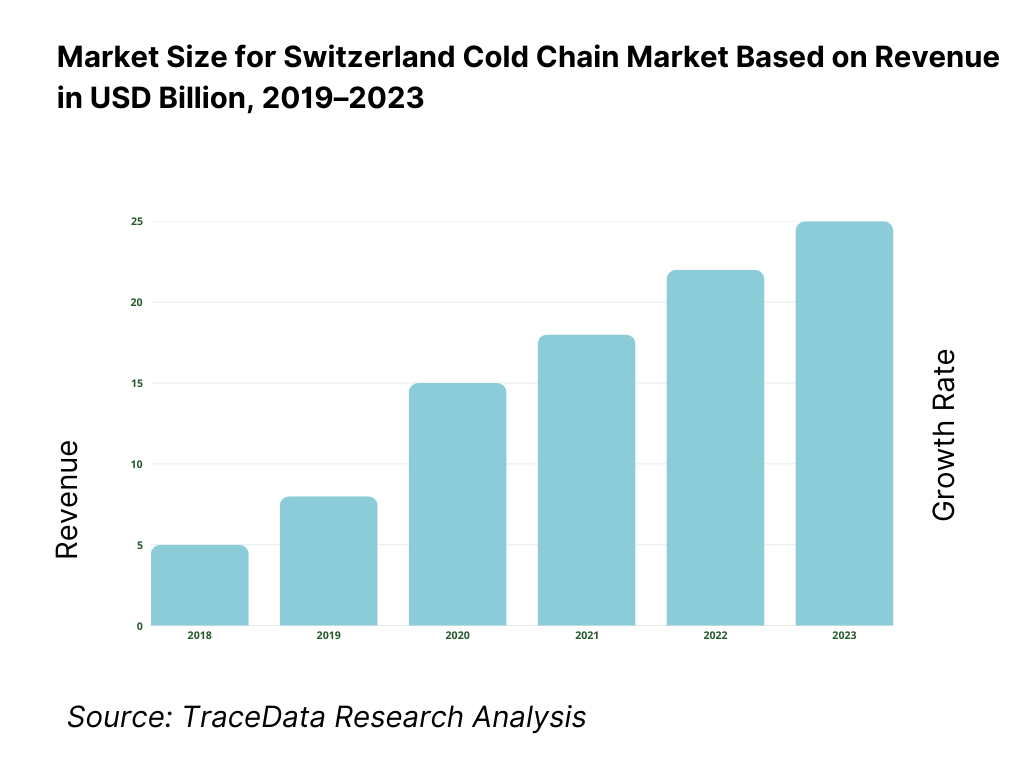

Switzerland Cold Chain Market Overview and Size

The Switzerland cold chain market reached a valuation of CHF 1.9 Billion in 2023, driven by the rising demand for temperature-controlled logistics in pharmaceuticals, food exports, and specialty chemicals. The industry is characterized by players such as Kuehne+Nagel, Swiss Post, Planzer, Galliker, and Frigo-Trans. These companies stand out for their robust cold storage infrastructure, advanced fleet management systems, and customized logistics solutions.

In 2023, Kuehne+Nagel introduced automated cold storage capabilities in Zurich to cater to high-growth segments like biologics and mRNA-based pharmaceuticals. This strategic investment aims to improve last-mile efficiency and expand service capabilities. Major urban centers such as Zurich, Basel, and Geneva serve as key logistics nodes due to their concentration of pharmaceutical manufacturing and international trade activity.

What Factors are Leading to the Growth of Switzerland Cold Chain Market:

Export-Oriented Pharmaceutical Sector: Switzerland is a global hub for pharmaceutical manufacturing, with companies like Roche and Novartis depending on reliable cold chain networks to maintain the efficacy of biologics, vaccines, and temperature-sensitive APIs. In 2023, pharmaceutical exports contributed over 35% to the total demand for cold chain services, with specialty drugs requiring 2°C to 8°C storage and real-time tracking capabilities.

Evolving Food Safety Regulations: With stricter EU-aligned food safety mandates under the FSVO (Federal Food Safety and Veterinary Office), cold chain logistics providers have invested heavily in HACCP-compliant storage and tracking systems. The demand for ultra-low temperature transport for dairy, meat, and frozen bakery products has grown significantly, especially from exporters in the Vaud and Ticino regions.

Rise in Health-Conscious Consumers: The increasing demand for organic, perishable, and gourmet products has transformed retail logistics. Swiss consumers, with rising interest in quality and freshness, have driven the demand for cold chain services for premium food categories. In 2023, nearly 25% of food-related cold chain demand was attributable to health and wellness-oriented products.

Which Industry Challenges Have Impacted the Growth for Switzerland Cold Chain Market

High Operating Costs in Switzerland: The Switzerland cold chain industry faces consistently high operational expenses due to elevated electricity rates, real estate costs, and labor wages. According to TraceData Research estimates, energy costs alone account for nearly 25% of the total cold storage operating expenses in Switzerland. These high overheads pose profitability challenges, especially for small to mid-sized cold chain operators, limiting their ability to scale and invest in advanced technologies.

Infrastructure Constraints in Remote Areas: While urban centers such as Zurich and Basel are well-equipped, remote regions like Valais or Graubünden often suffer from inadequate cold storage and temperature-controlled logistics infrastructure. This disparity affects food and pharmaceutical distribution in alpine areas, leading to longer transit times and increased spoilage risks. In 2023, over 15% of perishable goods shipments to remote cantons reported temperature deviations during transit, affecting service quality and client confidence.

Regulatory Complexity and Fragmentation: Switzerland’s regulatory framework involves overlapping federal and cantonal mandates related to food safety, pharmaceutical logistics, and emissions. Navigating these complex and region-specific requirements increases compliance costs. In a 2023 industry survey, 34% of logistics providers cited regulatory fragmentation as a major bottleneck affecting cross-regional operations and investment planning.

What are the Regulations and Initiatives which have Governed the Market

Swiss GDP Ordinance and Food Law Compliance: The Swiss Federal Food Safety and Veterinary Office (FSVO) mandates strict temperature control standards for storage and transport of perishable goods. Cold chain operators are required to maintain real-time monitoring systems and digital logs for HACCP compliance. In 2023, over 92% of inspected facilities were found compliant, reflecting a highly regulated but mature operating environment.

Swissmedic Guidelines for Pharmaceutical Cold Chain: Switzerland’s national regulatory body for therapeutic products, Swissmedic, enforces GDP (Good Distribution Practice) guidelines for cold chain in pharma logistics. These include stipulations on equipment calibration, route risk analysis, and validated packaging. The country’s pharma compliance level for GDP logistics exceeded 95% in 2023, driven by investments from major players like Novartis and Roche.

Green Logistics Mandate under Swiss Climate Strategy 2050: As part of the Swiss government’s sustainability goals, cold chain companies are being incentivized to adopt low-emission technologies. This includes subsidies for electric reefer trucks, solar-powered cold warehouses, and CO₂-neutral refrigerants. In 2023, around 18% of cold chain companies availed sustainability-linked tax benefits and grants for fleet and facility upgrades.

Switzerland Cold Chain Market Segmentation

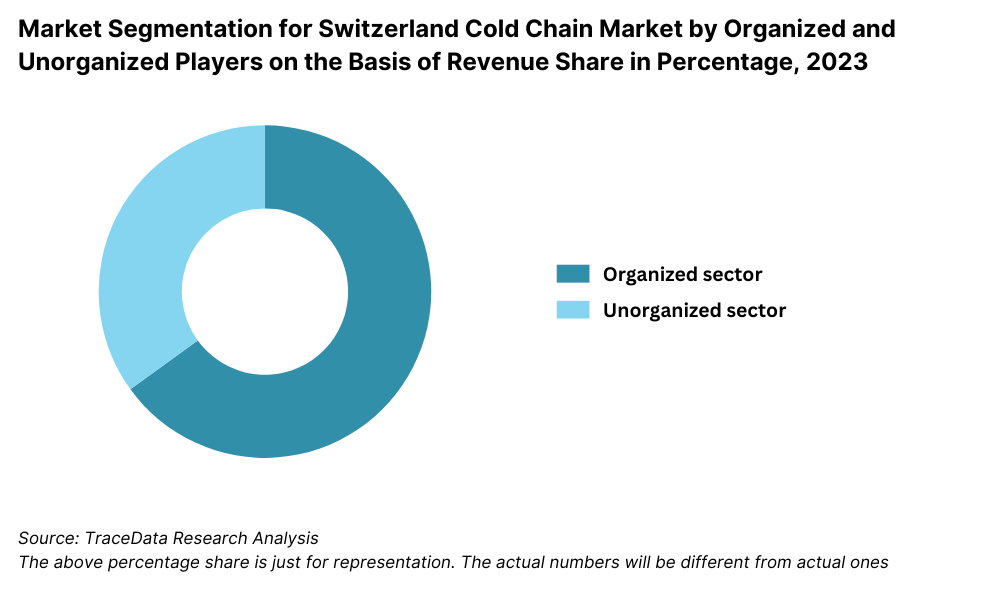

By Market Structure: The Switzerland cold chain market is predominantly organized, with large-scale logistics providers and integrated cold storage operators controlling the majority share. These companies offer end-to-end cold chain solutions with real-time monitoring, compliance with GDP and HACCP standards, and dedicated client account management. The unorganized segment, consisting of smaller regional players, contributes a limited share, often focusing on niche services such as artisanal food distribution or short-haul refrigerated transport. Their limited scalability and compliance gaps restrict their expansion into high-value sectors like pharmaceuticals.

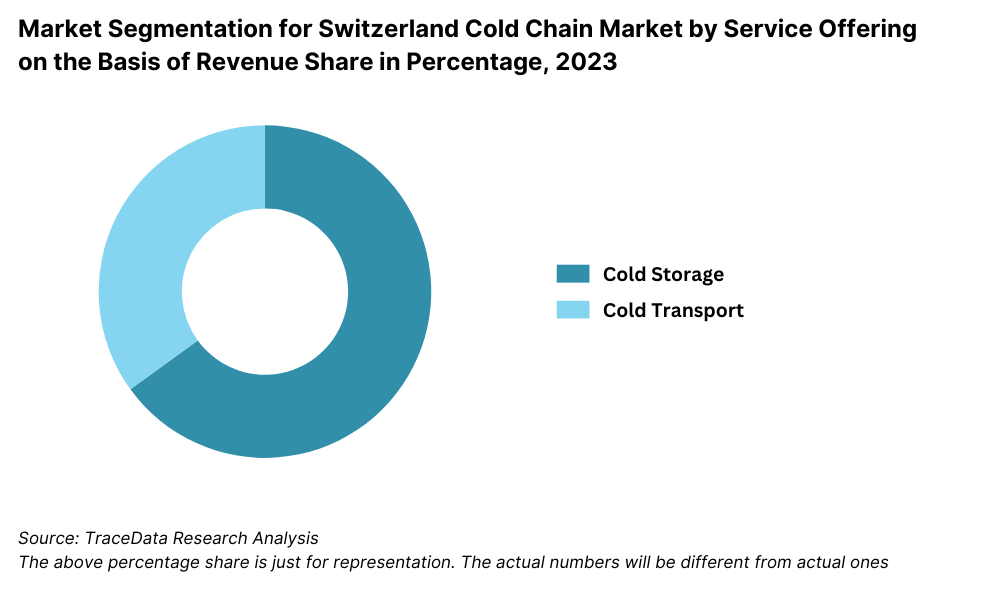

By Service Offering (Cold Storage vs Cold Transport): Cold storage holds a slightly higher share in the market due to Switzerland’s strategic focus on pharmaceutical warehousing, long-term preservation of dairy/meat products, and storage of seasonal produce. Cold transport has also grown, especially with increased demand for last-mile delivery solutions and cross-border refrigerated freight, particularly in sectors like biotechnology and specialty foods.

By Temperature Type: The market is segmented into chilled (0°C to 8°C), frozen (-18°C to -25°C), and deep-frozen/ultra-low (-40°C and below). Chilled storage and transport dominate due to demand from pharmaceutical and dairy segments. However, the ultra-low temperature segment is rapidly expanding due to growth in biologics and advanced therapy medicinal products (ATMPs), especially in clinical research hubs such as Basel.

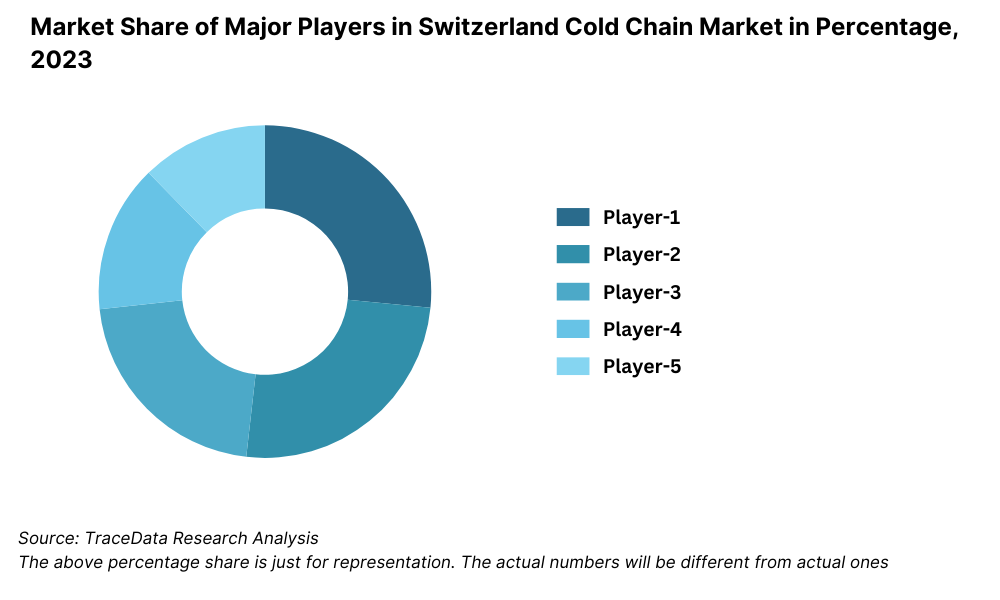

Competitive Landscape in Switzerland Cold Chain Market

The Switzerland cold chain market is moderately concentrated, with a handful of major logistics and temperature-controlled storage companies dominating operations. However, the rise of specialized players in pharmaceutical logistics and sustainable cold chain solutions has added competitive depth to the market. Companies such as Kuehne+Nagel, Swiss Post Logistics, Galliker, Planzer, Frigo-Trans, and Intertrans have established themselves as leaders with wide geographic reach, industry-compliant infrastructure, and customized service offerings.

Company | Establishment Year | Headquarters |

Kuehne+Nagel | 1890 | Schindellegi, Switzerland |

Swiss Post Logistics | 1849 | Bern, Switzerland |

Galliker Logistics | 1918 | Altishofen, Switzerland |

Planzer | 1936 | Dietikon, Switzerland |

Frigo-Trans | 1980 | Möhlin, Switzerland |

Intertrans AG | 1967 | Pratteln, Switzerland |

Some of the recent competitor trends and key information about competitors include:

Kuehne+Nagel: One of the global leaders in cold chain logistics, Kuehne+Nagel expanded its automated pharma cold storage facility in Zurich in 2023, adding 5,000 pallet spaces designed for 2°C–8°C products. The firm also deployed advanced IoT tracking across its reefer fleet to serve clients in clinical trials and biologics, contributing to a 12% revenue growth in its Swiss temperature-controlled logistics division.

Swiss Post Logistics: Swiss Post has heavily invested in carbon-neutral cold transport fleets, launching its first series of electric refrigerated trucks in early 2023. The company handles last-mile delivery for both pharmaceuticals and perishable food items, and reported a 9% YoY increase in its cold chain service revenues, especially in the Zurich-Geneva corridor.

Galliker Logistics: Galliker remains a key player in both food and pharma cold chain. In 2023, the company expanded its ‘Food Logistics’ and ‘HealthCare Logistics’ divisions, with new warehousing capacity in Altishofen. Their 24/7 tracked service for temperature-controlled goods helped them retain contracts with multiple Swiss grocery chains and biotech clients.

Planzer: Known for its strength in domestic distribution, Planzer introduced a temperature-controlled parcel service tailored for premium food and nutraceutical products. In 2023, the company integrated blockchain-based traceability for its pharma logistics operations, improving compliance and boosting trust among regulatory stakeholders.

Frigo-Trans: A specialist in pharmaceutical cold chain solutions, Frigo-Trans Switzerland enhanced its GDP-certified facilities in Möhlin to include deep-freeze capabilities for advanced biologics. The company reported a 17% increase in handling volumes in 2023, primarily driven by clinical trial logistics and vaccine distribution.

What Lies Ahead for Switzerland Cold Chain Market?

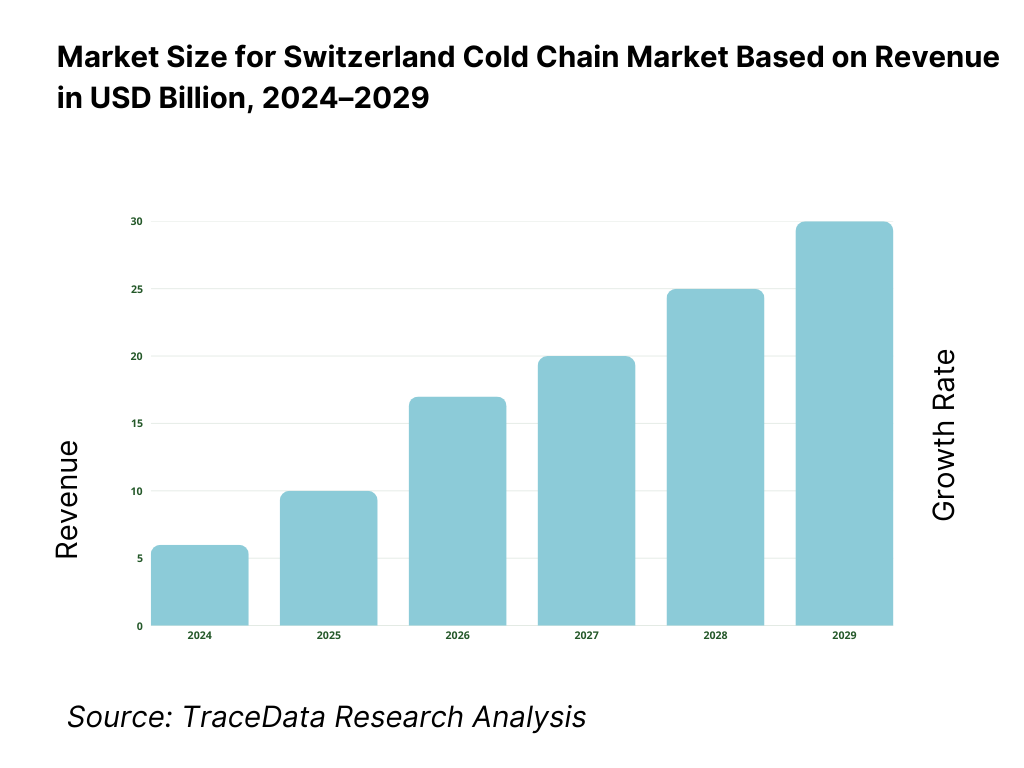

The Switzerland cold chain market is projected to witness steady growth through 2029, with a healthy CAGR expected during the forecast period. This expansion will be driven by the growing demand for biopharmaceuticals, evolving retail food consumption patterns, and regulatory compliance pressures encouraging more advanced cold chain infrastructure.

Expansion of Biologics and Precision Medicine: With Switzerland emerging as a key hub for biologics and cell & gene therapies, the demand for ultra-cold and cryogenic storage is anticipated to rise sharply. Clinical trials, personalized medicine, and mRNA-based products will require highly specialized logistics solutions, creating new growth avenues for cold chain providers.

Technological Integration in Cold Chain Monitoring: The adoption of real-time temperature monitoring, AI-driven route optimization, and blockchain for supply chain transparency is expected to transform cold chain logistics. These advancements will minimize spoilage risks, improve traceability, and support compliance with stringent GDP and HACCP standards—making the logistics process smarter and more resilient.

Rise in Sustainable and Green Logistics Practices: As part of Switzerland’s 2050 carbon neutrality roadmap, logistics providers are increasingly integrating sustainable solutions. These include electric reefer fleets, solar-powered cold storage units, and eco-friendly refrigerants. By 2029, green logistics will likely become a key differentiator in client procurement processes, particularly in the pharmaceutical and premium food sectors.

Growth in Cross-Border Cold Chain Trade: With enhanced bilateral transport agreements and Switzerland’s role as a logistics hub between the EU and non-EU countries, cross-border cold chain movements—particularly for high-value goods—are expected to grow. This will benefit players offering GDP-compliant, customs-ready, and trackable cross-border cold transport solutions.

Switzerland Cold Chain Market Segmentation

• By Market Structure:

o Organized Logistics Providers

o Third-Party Logistics (3PL) Cold Chain Providers

o In-House Logistics by Manufacturers

o Small-Scale Regional Cold Chain Operators

o Unorganized/Independent Cold Storage Units

o Cold Chain Warehousing

o Cold Chain Transportation

• By Service Offering:

o Cold Storage

o Cold Transport

o Last-Mile Refrigerated Delivery

o End-to-End Temperature-Controlled Solutions

• By Temperature Type:

o Chilled (0°C to 8°C)

o Frozen (-18°C to -25°C)

o Ultra-Low (-40°C and below)

o Ambient/Controlled Room Temperature (15°C to 25°C)

• By End User Industry:

o Pharmaceuticals and Biotech

o Food and Beverage

o Specialty Chemicals and Agrochemicals

o Cosmetics and Personal Care

o Retail and E-commerce

• By Region:

o Zurich

o Basel

o Geneva

o Bern

o Vaud

o Ticino

o Lucerne and Central Switzerland

Players Mentioned in the Report:

• Kuehne+Nagel

• Swiss Post Logistics

• Galliker Logistics

• Planzer

• Frigo-Trans

• Intertrans AG

• Thermotraffic

• DHL Switzerland (Temperature Management Division)

Key Target Audience:

• Cold Chain Logistics Companies

• Pharmaceutical Manufacturers and Distributors

• Food Processing and Export Companies

• Chemical and Specialty Materials Manufacturers

• Retail Chains and E-commerce Platforms

• Government and Regulatory Bodies (e.g., Swissmedic, FSVO)

• Cold Chain Technology and IoT Providers

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Switzerland Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges that they face

4.2. Revenue Streams for Switzerland Cold Chain Market

4.3. Business Model Canvas for Switzerland Cold Chain Market

4.4. Demand Decision Making Process

4.5. Supply Chain Planning and Infrastructure Setup

5. Market Structure

5.1. Cold Storage and Transport Infrastructure in Switzerland, 2018-2024

5.2. Share of Cold Chain in Overall Logistics Market, 2018-2024

5.3. Government Investment and Public-Private Partnerships in Cold Chain, 2024

5.4. Number of Cold Storage Warehouses and Refrigerated Trucks by Region

6. Market Attractiveness for Switzerland Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Switzerland Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Volume Capacity (Storage and Transport), 2018-2024

9. Market Breakdown for Switzerland Cold Chain Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Service Offering (Cold Storage and Cold Transport), 2023-2024P

9.3. By Temperature Type (Chilled, Frozen, Ultra-Low), 2023-2024P

9.4. By End User (Pharmaceuticals, F&B, Chemicals, Others), 2023-2024P

9.5. By Region (Zurich, Basel, Geneva, Others), 2023-2024P

10. Demand Side Analysis for Switzerland Cold Chain Market

10.1. Customer Landscape and End-User Segmentation

10.2. Procurement Decision-Making and Key Considerations

10.3. Needs, Constraints, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments in Switzerland Cold Chain Market

11.2. Growth Drivers for Switzerland Cold Chain Market

11.3. SWOT Analysis for Switzerland Cold Chain Market

11.4. Issues and Challenges for Switzerland Cold Chain Market

11.5. Government Regulations for Switzerland Cold Chain Market

12. Snapshot on Cold Chain in Swiss Pharma and Biotech Sector

12.1. Temperature-Sensitive Logistics Volume and Growth Outlook, 2018-2029

12.2. Business Models and Regulatory Compliance

12.3. Cross Comparison of Leading Logistics Providers-Services, Clients, Coverage, and Certifications

13. Switzerland Cold Chain Technology Landscape

13.1. Technology Penetration-IoT, AI, Blockchain, and Automation

13.2. Adoption of Sustainable and Smart Cold Chain Infrastructure

13.3. Innovation Trends in Packaging and Temperature Monitoring

14. Opportunity Matrix for Switzerland Cold Chain Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Switzerland Cold Chain Market

16. Competitor Analysis for Switzerland Cold Chain Market

16.1. Benchmark of Key Competitors in Switzerland Cold Chain Market including Company Overview, Service Offering, USP, Client Industries, Revenue, Certifications, Geographic Presence, Fleet Size, and Storage Capacity

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Switzerland Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Volume Capacity (Storage and Transport), 2025-2029

18. Market Breakdown for Switzerland Cold Chain Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Service Offering (Cold Storage and Cold Transport), 2025-2029

18.3. By Temperature Type (Chilled, Frozen, Ultra-Low), 2025-2029

18.4. By End User (Pharmaceuticals, F&B, Chemicals, Others), 2025-2029

18.5. By Region (Zurich, Basel, Geneva, Others), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Switzerland Cold Chain Market. Basis this ecosystem, we will shortlist leading 5–6 players in the country based upon their financial information, infrastructure capacity, and operational scale.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the revenue size, number of cold storage and transport players, pricing structures, regional coverage, and regulatory landscape. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Switzerland Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate revenue contribution and service capabilities for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of infrastructure capacities, process flows, value chain, and pricing benchmarks.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Switzerland Cold Chain Market?

The Switzerland Cold Chain Market is poised for steady growth, reaching a valuation of CHF 1.9 Billion in 2023. This growth is driven by increasing demand from the pharmaceutical sector, evolving food consumption patterns, and rising exports of temperature-sensitive goods. The market’s potential is further supported by Switzerland’s advanced infrastructure, regulatory compliance culture, and investments in smart cold chain technologies.

2. Who are the Key Players in the Switzerland Cold Chain Market?

The Switzerland Cold Chain Market features several key players, including Kuehne+Nagel, Swiss Post Logistics, and Galliker. These companies dominate the market due to their comprehensive cold storage and transport networks, strong presence in pharma logistics, and investment in automation and sustainability. Other notable players include Planzer, Frigo-Trans, and Intertrans AG.

3. What are the Growth Drivers for the Switzerland Cold Chain Market?

The primary growth drivers include Switzerland’s strong pharmaceutical exports, the rising demand for biologics and vaccines, and the increasing consumption of high-quality perishable foods. Regulatory standards that mandate temperature-controlled logistics, coupled with the adoption of advanced monitoring technologies, further propel market expansion. Additionally, Switzerland’s geographic location facilitates seamless cross-border cold chain connectivity within Europe.

4. What are the Challenges in the Switzerland Cold Chain Market?

The Switzerland Cold Chain Market faces several challenges, including high operational costs related to energy, labor, and real estate. Regional disparities in infrastructure, especially in alpine areas, can impact service consistency. Regulatory fragmentation between federal and cantonal levels adds complexity, while workforce shortages in cold chain operations remain a concern for long-term scalability and efficiency.