Switzerland Logistics and Warehousing Market Outlook to 2029

By Mode of Transport (Road, Rail, Air, Sea), By End-Users (Retail, Manufacturing, Healthcare, FMCG, E-commerce), By Type of Warehousing (General, Cold Storage, Bonded), and By Region

- Product Code: TDR0212

- Region: Europe

- Published on: July 2025

- Total Pages: 80

Report Summary

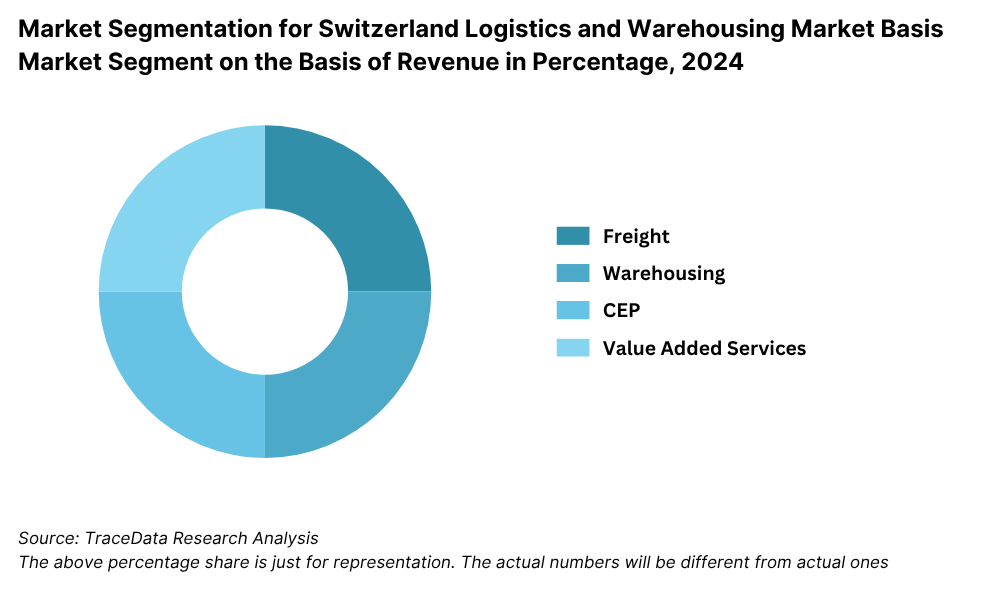

The report titled “Switzerland Logistics and Warehousing Market Outlook to 2029 – By Mode of Transport (Road, Rail, Air, Sea), By End-Users (Retail, Manufacturing, Healthcare, FMCG, E-commerce), By Type of Warehousing (General, Cold Storage, Bonded), and By Region.” provides a comprehensive analysis of the logistics and warehousing market in Switzerland. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, key trends and developments, regulatory landscape, customer profiling, challenges and bottlenecks, competitive landscape including cross-comparisons, and company profiling of major players in the logistics and warehousing ecosystem. The report concludes with future projections based on revenue, key sectors, transport modes, and regional trends, supported by success case studies and impact analysis.

Switzerland Logistics and Warehousing Market Overview and Size

The Switzerland logistics and warehousing market was valued at CHF 23.5 Billion in 2023, driven by the country’s strategic location at the heart of Europe, its advanced infrastructure, and increasing demand from sectors such as pharmaceuticals, precision manufacturing, and e-commerce. The market is marked by the presence of global and regional players including DHL Supply Chain, Kühne + Nagel, Galliker, Planzer, and Swiss Post Logistics, all of which operate across diverse service segments ranging from freight forwarding to inventory management and cold chain logistics.

In 2023, Kühne + Nagel introduced a new AI-based warehousing solution to improve efficiency in managing pharmaceutical inventories, demonstrating the market’s shift towards automation and digitization. Zurich, Geneva, and Basel are key logistics hubs, supported by proximity to international airports and multimodal infrastructure linking them to the rest of Europe.

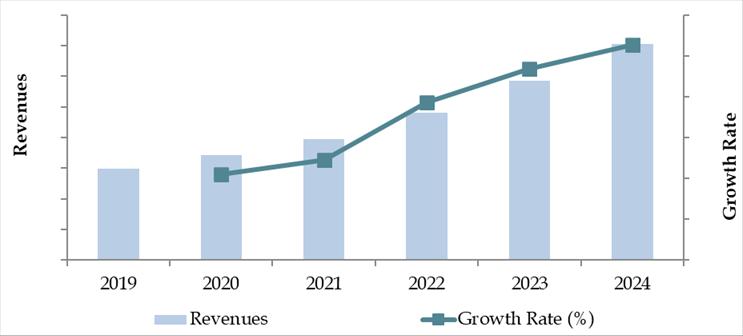

Market Size for Switzerland Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors Are Leading to the Growth of Switzerland Logistics and Warehousing Market:

Strategic Location: Switzerland's central location in Europe and proximity to Germany, France, and Italy makes it a crucial logistics corridor for pan-European trade. The country serves as a transit hub for high-value goods, especially in pharma and precision engineering.

High-Value Industry Demand: Switzerland’s strong pharmaceutical and precision machinery sectors, which require specialized logistics such as cold chain or bonded warehousing, continue to drive growth. In 2023, over 30% of warehouse space was dedicated to temperature-controlled and high-security storage solutions.

Growth of E-commerce: Online retail sales in Switzerland reached CHF 14 Billion in 2023, pushing the need for last-mile delivery, cross-border logistics, and fulfillment centers. Companies like Swiss Post and Amazon Logistics are investing in urban warehousing and automation technologies to meet rising consumer expectations.

Which Industry Challenges Have Impacted the Growth for Switzerland Logistics and Warehousing Market

High Operating Costs: Switzerland’s high labor and real estate costs significantly impact logistics and warehousing profitability. On average, warehouse rental rates in key Swiss cities such as Zurich and Geneva are 30–40% higher than the European average. Additionally, driver wages and compliance with strict labor laws increase cost pressures, particularly for small and medium-sized operators.

Cross-Border Regulatory Complexity: Despite being part of the Schengen zone, Switzerland is not an EU member, resulting in complex customs and compliance requirements for cross-border logistics. In 2023, approximately 28% of logistics companies reported shipment delays and increased administrative costs due to changing EU customs protocols and bilateral trade documentation needs.

Infrastructure Congestion in Urban Areas: Major logistics hubs like Zurich and Basel face increasing congestion and space limitations, affecting last-mile delivery efficiency. In 2023, the average delivery time in city centers increased by 14%, driven by traffic restrictions, construction activity, and limited warehousing space, especially for temperature-sensitive goods.

What are the Regulations and Initiatives which have Governed the Market

Swiss Federal Logistics Strategy (2022–2026): The Swiss government has launched a comprehensive logistics development plan focusing on sustainable transport, reduction of CO₂ emissions, and increased use of intermodal freight. The initiative includes subsidies for rail-based freight movement and digital infrastructure upgrades. By 2023, over CHF 250 million had been allocated to logistics sustainability projects under this strategy.

Strict Environmental and Noise Emission Regulations: Logistics operators must comply with strict environmental laws, including vehicle emissions standards (EURO 6 and above), noise pollution limits, and sustainable packaging mandates. In 2023, nearly 21% of logistics providers in urban areas had to upgrade their vehicle fleets or modify operations to comply with new environmental zoning laws.

Customs Modernization Program: To streamline cross-border trade, the Swiss Federal Customs Administration has introduced the “DaziT” program, aiming to digitize customs processing and reduce bureaucratic hurdles for freight movement. As of late 2023, more than 65% of logistics companies had enrolled in this program, improving processing times by up to 20% for EU-bound cargo.

Switzerland Logistics and Warehousing Market Segmentation

By Market Structure: Organized players dominate the market due to their strong technological infrastructure, regulatory compliance, and ability to provide end-to-end logistics services. Companies such as Kühne + Nagel, DHL Supply Chain, and Swiss Post Logistics have established trust through consistent service quality, digital capabilities, and scalable operations. These firms offer value-added services like automated inventory management, WMS integration, and cold chain tracking, which are increasingly preferred by clients in high-value sectors such as pharmaceuticals and e-commerce. Unorganized players, while present in the market, primarily operate in niche and localized logistics segments. They face challenges in scaling due to limited access to technology, labor, and capital.

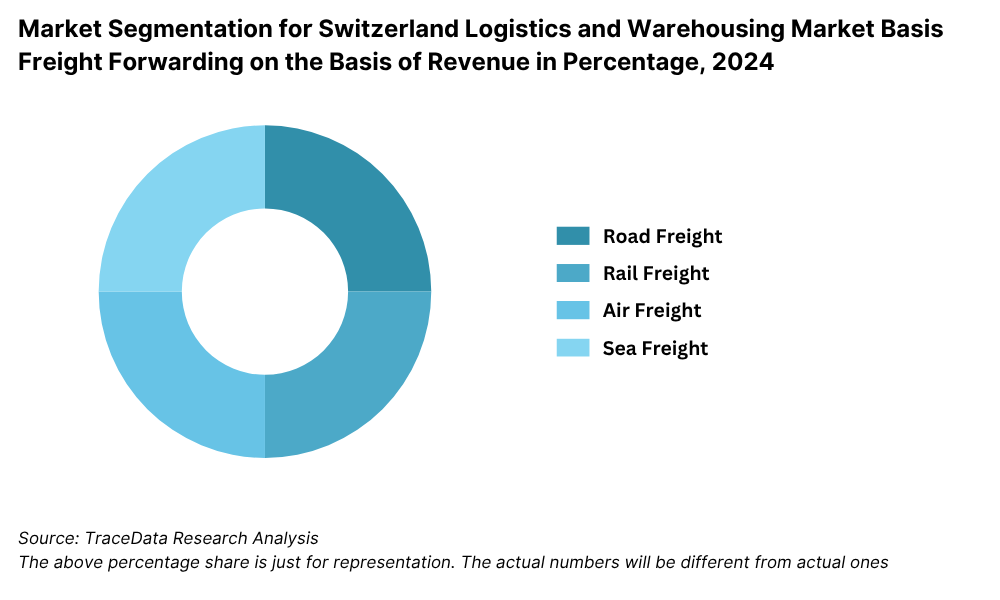

By Mode of Transport: Road transport is the leading mode of logistics in Switzerland due to its flexibility, coverage, and efficiency in connecting urban and rural areas. It is widely used for domestic distribution and short-haul international shipments. Rail transport follows as a sustainable and government-promoted alternative, especially for cross-border freight. Switzerland’s investment in intermodal terminals has further supported the integration of rail in long-haul transport. Air freight is prominent in high-value and time-sensitive goods, particularly in pharma and electronics sectors, with Zurich and Geneva acting as key hubs. Sea and inland waterway transport play a limited role, mainly in bulk imports via the Rhine corridor.

By End-User Industry: The pharmaceutical sector is the largest end-user of logistics and warehousing services in Switzerland, supported by the country’s strong life sciences ecosystem. This segment demands specialized services including temperature-controlled storage and GDP-compliant transport. Retail and FMCG follow, driven by urban consumption and growing e-commerce activity. Manufacturing and industrial clients require both raw material logistics and finished goods warehousing, with a focus on just-in-time delivery and parts consolidation. E-commerce is a fast-emerging sector, contributing to the rising demand for urban distribution centers and automation-enabled fulfillment facilities.

Competitive Landscape in Switzerland Logistics and Warehousing Market

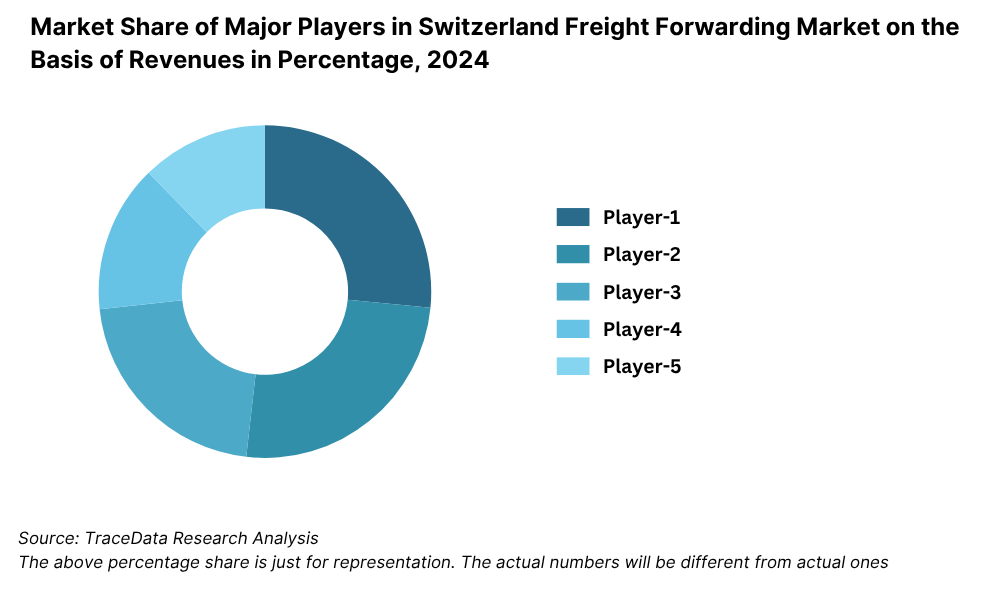

The Switzerland logistics and warehousing market is moderately consolidated, with a mix of global logistics giants, regional players, and specialized warehousing providers operating across various segments. Companies such as Kühne + Nagel, DHL Supply Chain, Swiss Post Logistics, Galliker Transport, and Planzer dominate the space. Meanwhile, niche service providers focusing on cold chain, e-commerce fulfillment, or bonded warehousing are expanding, contributing to increased competition and innovation.

Company Name | Founding Year | Original Headquarters |

Planzer Transport AG | 1936 | Dietikon, Switzerland |

Galliker Transport AG | 1918 | Altishofen, Switzerland |

Swiss Post Logistics | 1849 (logistics division: modern) | Bern, Switzerland |

Camion Transport AG | 1925 | Wil, Switzerland |

Hess Transport AG | 1964 | Derendingen, Switzerland |

Kühne + Nagel International AG | 1890 | Schindellegi, Switzerland |

DHL Supply Chain Switzerland | 1969 (CH: ~1970s) | Bonn, Germany |

DB Schenker Switzerland | 1872 (CH: ~1950s) | Essen, Germany |

Rhenus Alpina AG | 1912 | Holzwickede, Germany (Swiss ops based in Basel) |

Agility Logistics Switzerland | 1979 (CH: ~1990s) | Kuwait City, Kuwait |

CEVA Logistics Switzerland | 2006 (CH: ~2007) | Marseille, France |

UPS Switzerland | 1907 (CH: ~1990s) | Atlanta, USA |

FedEx Express Switzerland | 1971 (CH: ~1990s) | Memphis, USA |

Nippon Express Switzerland | 1937 (CH: ~1980s) | Tokyo, Japan |

Yusen Logistics Switzerland | 1955 (CH: ~2000s) | Tokyo, Japan |

Panalpina World Transport (merged into DSV) | 1935 | Basel, Switzerland (now Denmark) |

DSV Air & Sea Switzerland | 1976 (CH: ~2000s) | Hedehusene, Denmark |

Some of the recent competitor trends and key information about competitors include:

Kühne + Nagel: As one of the world’s largest logistics firms headquartered in Switzerland, Kühne + Nagel continues to invest in warehouse automation and pharma logistics. In 2023, the company expanded its cold chain capacity by 20% in Basel to cater to increasing vaccine and biologics shipments.

DHL Supply Chain: The company recorded a 15% growth in contract logistics in Switzerland in 2023, driven by e-commerce and high-tech sector demand. DHL’s new smart warehouse facility near Zurich utilizes AI-based inventory management and automated guided vehicles (AGVs) to optimize throughput and reduce lead time.

Swiss Post Logistics: Leveraging its extensive national network, Swiss Post has emerged as a leader in last-mile delivery and urban warehousing. In 2023, the company launched a sustainability program that includes EV-based delivery and solar-powered urban distribution centers, achieving a 12% reduction in carbon footprint.

Galliker Transport: Known for its expertise in cold chain and automotive logistics, Galliker saw a 10% revenue increase in 2023, supported by expansion into digital warehousing and temperature-sensitive storage in Lucerne and Lausanne. The company also introduced blockchain-enabled shipment tracking.

Planzer Transport AG: A strong player in road and rail logistics, Planzer enhanced its intermodal network in 2023 by adding new cross-border rail corridors and investing in eco-efficient warehouses. The company reported a 9% growth in pharmaceutical and medical equipment logistics.

What Lies Ahead for Switzerland Logistics and Warehousing Market?

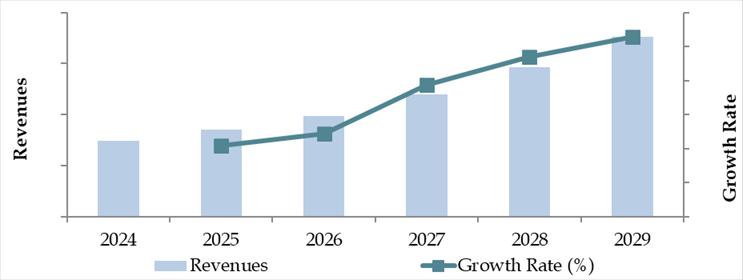

The Switzerland logistics and warehousing market is projected to witness steady growth through 2029, supported by technological transformation, increasing trade volumes, and the country’s strategic position in the heart of Europe. The market is expected to grow at a stable CAGR during the forecast period, driven by infrastructure investments, sustainability mandates, and rising demand from high-value sectors such as pharmaceuticals, precision engineering, and e-commerce.

Expansion of Cold Chain Infrastructure: As Switzerland strengthens its position as a global pharmaceutical and biotechnology hub, the demand for temperature-controlled logistics and warehousing is set to rise significantly. By 2029, cold chain storage capacity is expected to expand by over 30%, supported by GDP-compliant facilities and specialized service providers in Basel, Zurich, and Lausanne.

Digitalization and Automation of Warehousing: The future of Swiss warehousing lies in automation and smart logistics solutions. Robotics, IoT-enabled tracking, automated picking systems, and real-time warehouse management systems (WMS) are expected to become industry norms by 2029. These innovations will drive operational efficiency, lower costs, and enhance service reliability across supply chains.

Sustainability and Green Logistics: With Switzerland’s strong environmental regulations, the logistics industry is expected to adopt greener practices. These include widespread use of electric vehicles for last-mile delivery, solar-powered warehouses, and modal shifts to rail for long-haul freight. By 2029, over 50% of logistics companies are expected to align with carbon neutrality targets under the national sustainability framework.

Growth of E-commerce Fulfillment Centers: The e-commerce sector in Switzerland is poised to continue expanding, driving the need for rapid fulfillment and urban logistics solutions. By 2029, dedicated e-commerce warehouses and micro-fulfillment centers in urban regions like Zurich, Bern, and Geneva are expected to play a pivotal role in same-day and next-day delivery models.

Future Outlook and Projections for Switzerland Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Switzerland Logistics and Warehousing Market Segmentation

• By Market Structure:

Organized Logistics Service Providers

Unorganized/Independent Transporters

Contract Logistics Companies

Third-Party Logistics (3PL) Providers

Fourth-Party Logistics (4PL) Integrators

Postal and Courier Services

Specialized Warehousing Providers (e.g., cold chain, bonded)

• By Mode of Transport:

Road Transport

Rail Transport

Air Freight

Sea/Inland Waterway Transport

Multimodal Logistics

• By End-User Industry:

Pharmaceuticals and Life Sciences

Retail and FMCG

Industrial Manufacturing

E-commerce

Automotive and Machinery

Food and Beverage

High-Tech and Electronics

• By Type of Warehousing:

General Warehousing

Cold Storage Warehousing

Bonded Warehousing

Automated/Smart Warehousing

Urban/Micro-Fulfillment Centers

Dedicated Warehousing (client-specific)

• By Region:

Zurich Region

Geneva & Western Switzerland

Basel & Northwestern Switzerland

Bern & Central Region

Eastern Switzerland

Ticino

Players Mentioned in the Report:

Freight Forwarding Companies

DHL Global Forwarding

Kuehne + Nagel

Panalpina

GEODIS

AIT Worldwide Logistics

AsstrA Forwarding AG

Fracht AG

FEAG Internationale Transporte

GEODIS

DSV

DB Schenker

Kuehne + Nagel

Swisslog (automation integration)

Warehousing Companies

E‑Commerce Logistics Companies

DHL eCommerce

Asendia

7Days (Fulfillment and warehousing)

Express Logistics Companies

DHL Express

FedEx

UPS

SkyNet Worldwide Express

DSV (provides express/e‑commerce shipping options)

Key Target Audience:

Logistics and Supply Chain Operators

Warehousing and Cold Chain Providers

E-commerce and Retail Fulfillment Companies

Transportation Infrastructure Planners

Government and Regulatory Authorities

Industrial and Pharma Manufacturers

Real Estate and Warehouse Investors

Supply Chain Technology Providers

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Switzerland Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Switzerland

4.4. LPI Index of Switzerland and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Switzerland Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Switzerland

5.2. Current Scenario for Logistics Infrastructure in Switzerland

5.3. Road Infrastructure in Switzerland including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Switzerland including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Switzerland including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Switzerland including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Switzerland Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Switzerland 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Switzerland

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Switzerland Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Switzerland Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Switzerland Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Switzerland Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Switzerland 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Switzerland Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Switzerland and Switzerland), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Switzerland Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Switzerland Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Switzerland 3PL Warehousing Segmentation

9.4.1. Switzerland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Switzerland Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Switzerland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Switzerland 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Switzerland Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Switzerland Warehousing Future Market Size on the Basis of Revenues, 2025-2029

9.7. Switzerland Warehousing Market Future Segmentation

9.7.1. Switzerland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Switzerland Warehousing Revenue By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Switzerland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Switzerland CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Switzerland CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Switzerland CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Switzerland CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Switzerland E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Switzerland CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Switzerland CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Switzerland CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Switzerland Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics and warehousing service providers in the country based on their operational scale, revenue, infrastructure capabilities, and client segments served.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects such as overall logistics spending, warehousing footprint, modal split, and trends in demand by industry.

We supplement this with detailed examinations of company-level data, relying on sources such as press releases, investor presentations, annual reports, customs data, government reports (e.g., Swiss Federal Customs Administration, Swiss Federal Statistical Office), and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, warehouse operators, freight forwarders, logistics consultants, and stakeholders representing various Switzerland Logistics and Warehousing companies and end-user industries (e.g., pharma, retail, FMCG).

This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to estimate warehouse capacity, throughput, and revenue contribution per segment, aggregating this to derive the overall market size.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers or partners. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of value chain dynamics, logistics cost structures, service pricing, warehouse leasing rates, and technology adoption.

Step 4: Sanity Check

- Bottom to top and top to bottom triangulation, combined with market size modeling exercises, is undertaken as part of the sanity check process. This includes alignment of data from industry associations, company filings, and field interviews to ensure the reliability of all quantitative and qualitative estimates used in the report.

FAQs

1. What is the potential for the Switzerland Logistics and Warehousing Market?

The Switzerland logistics and warehousing market holds strong potential, reaching an estimated valuation of CHF 23.5 Billion in 2023. This growth is driven by Switzerland’s strategic geographic location in Europe, robust infrastructure, and increasing demand from sectors such as pharmaceuticals, precision manufacturing, and e-commerce. The country’s emphasis on sustainability and digital transformation further strengthens the long-term growth prospects of the market.

2. Who are the Key Players in the Switzerland Logistics and Warehousing Market?

Key players in the Switzerland logistics and warehousing market include Kühne + Nagel, DHL Supply Chain, Swiss Post Logistics, Galliker Transport, and Planzer Transport AG. These companies are recognized for their advanced infrastructure, integrated logistics services, and strong presence across road, rail, and air freight networks. Other notable participants include Bertschi Group, Rhenus Logistics, and DSV Switzerland.

3. What are the Growth Drivers for the Switzerland Logistics and Warehousing Market?

The market's growth is primarily fueled by rising demand for cold chain logistics, especially in the pharmaceutical sector, rapid expansion in e-commerce, and increasing adoption of automation and smart warehousing solutions. Additionally, Switzerland’s push for green logistics, including electrification of fleets and modal shift to rail, contributes to sustainable industry expansion.

4. What are the Challenges in the Switzerland Logistics and Warehousing Market?

Key challenges include high operating and labor costs, regulatory complexities in cross-border logistics, infrastructure congestion in urban hubs, and a shortage of skilled logistics professionals. Moreover, strict environmental regulations and zoning laws require continuous investment in compliance and innovation, especially for small and mid-sized operators.