Thailand Cold Chain Market Outlook to 2029

By Market Segments (Cold Storage and Cold Transportation), By Temperature Type (Chilled and Frozen), By End-User Industries (FMCG, Pharmaceuticals, Seafood, Meat & Poultry, and Others), and By Region

- Product Code: TDR0329

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Thailand Cold Chain Market Outlook to 2029 – By Market Segments (Cold Storage and Cold Transportation), By Temperature Type (Chilled and Frozen), By End-User Industries (FMCG, Pharmaceuticals, Seafood, Meat & Poultry, and Others), and By Region” provides a comprehensive analysis of the cold chain industry in Thailand. It encompasses the sector’s evolution, market size by revenue, segmentation, key trends and developments, regulatory framework, customer profiling, challenges, competitive landscape, cross-comparisons, market opportunities and risks, and company profiles of leading players. The report concludes with future projections through 2029, offering a roadmap for market participants based on growth drivers and case examples.

Thailand Cold Chain Market Overview and Size

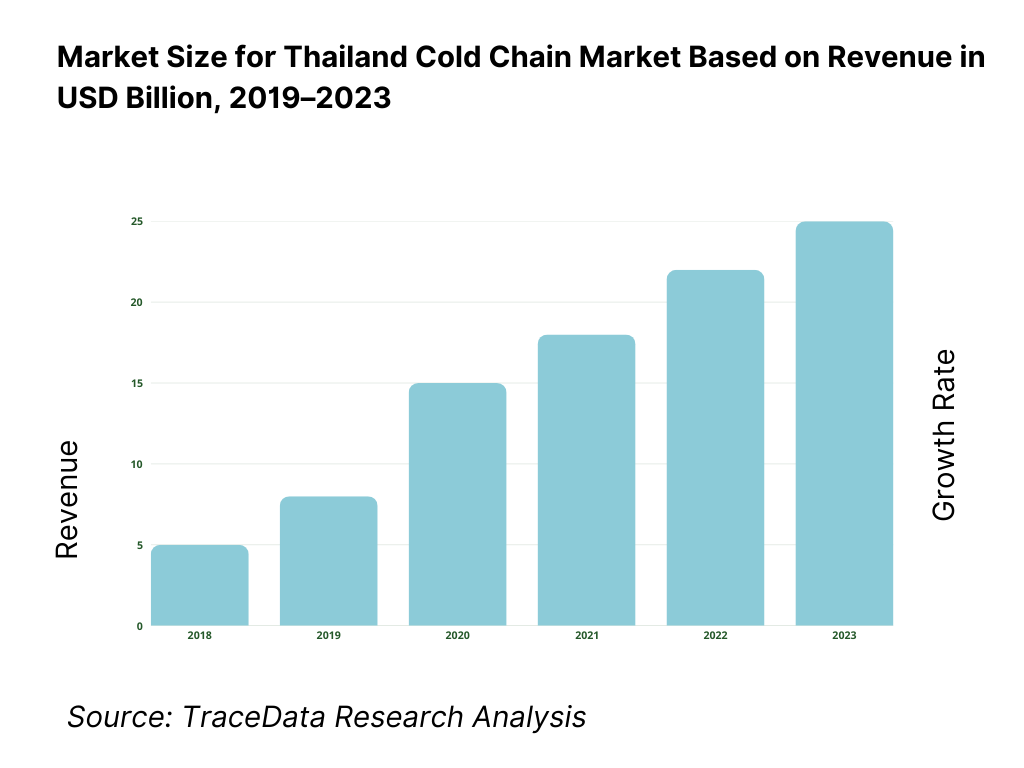

The Thailand cold chain market was valued at THB 108 Billion in 2023, driven by increasing demand for temperature-controlled logistics solutions across the food, pharmaceutical, and retail industries. The rise of modern retail formats, health-conscious consumer behavior, and stringent product quality norms have amplified the importance of cold chain infrastructure.

Key players such as JWD InfoLogistics, DB Schenker Thailand, Nichirei Logistics, and Bangkok Cold Storage Service lead the market, leveraging technology-integrated warehousing and GPS-enabled transport fleets. In 2023, JWD InfoLogistics expanded its cold storage facilities in the Bang Na–Trad area to support the rising demand from food processors and vaccine distributors.

What Factors are Leading to the Growth of Thailand Cold Chain Market:

Rising Processed Food and Export Demand: Thailand’s status as a major food processing and seafood export hub has accelerated the need for temperature-controlled storage and transportation, especially for perishable items like fruits, vegetables, seafood, and meat.

Healthcare and Vaccine Logistics: The post-pandemic surge in biologics, vaccines, and temperature-sensitive pharmaceuticals has driven significant investments in GDP-compliant cold storage and last-mile cold delivery capabilities across urban centers.

Retail and Quick Commerce Growth: Expanding supermarket chains, convenience stores, and online grocery platforms such as Big C, Tops, and HappyFresh are creating consistent demand for chilled and frozen logistics for fresh produce and ready-to-eat items.

Which Industry Challenges Have Impacted the Growth for Thailand Cold Chain Market

High Operating and Energy Costs: Cold storage facilities consume significantly more energy compared to ambient warehouses, leading to high operational expenditure. In 2023, electricity costs accounted for nearly 35–40% of total warehouse operating expenses, especially for facilities storing frozen and pharmaceutical products. This impacts profitability, particularly for small and mid-sized players.

Limited Cold Chain Infrastructure in Rural Areas: While urban regions like Bangkok, Chonburi, and Samut Prakan have relatively well-developed cold storage capacity, rural and border provinces lack modern cold infrastructure. This results in high spoilage rates for perishable farm produce and limits the reach of cold chain-dependent sectors such as agri-exports and healthcare.

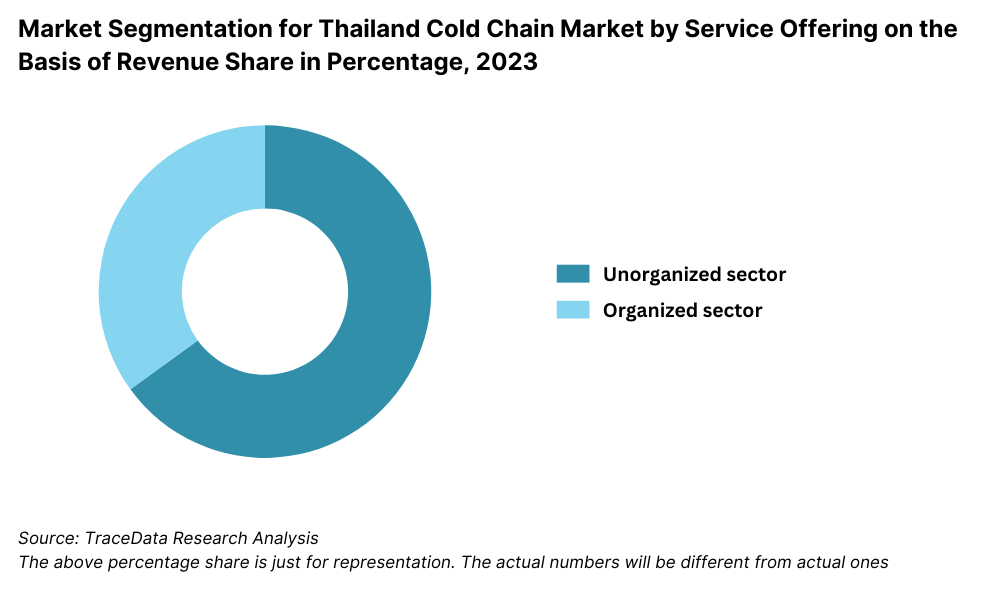

Fragmented Market Structure: The market is dominated by a mix of large integrated players and small unorganized operators. In 2023, over 65% of cold chain service providers were SMEs operating with minimal technological integration. This fragmentation leads to inconsistent service standards, low traceability, and limited scalability.

What are the Regulations and Initiatives which have Governed the Market

Cold Chain Development Strategy under EEC (2023–2027): As part of the broader EEC plan, the Thai government has prioritized the development of integrated cold logistics hubs and temperature-controlled corridors. Incentives include tax breaks and public-private partnerships for cold warehouse development in zones like Rayong and Chachoengsao.

National Food Safety and Traceability Guidelines: Under updated regulations from the Ministry of Public Health, all cold storage and transport providers handling food items are required to maintain traceability logs and real-time temperature monitoring from source to retail. In 2023, compliance audits were conducted for over 500 operators across Thailand.

GDP Compliance for Pharma Logistics: From 2022 onwards, the Food and Drug Administration (FDA) of Thailand mandated strict adherence to Good Distribution Practices (GDP) for all pharmaceutical cold chain logistics. This includes validated cold rooms, temperature mapping, and digital logs for all vaccine and biologic transport.

Thailand Cold Chain Market Segmentation

By Market Structure: The cold chain market in Thailand is largely dominated by regional and small-to-mid-sized operators, particularly in fresh produce and seafood categories, due to their competitive pricing and local sourcing capabilities. These players are often preferred by local retailers and exporters for their deep-rooted supplier relationships and cost-effective services. However, organized third-party cold chain providers such as JWD InfoLogistics, Nichirei Logistics, and DB Schenker have gained significant traction in high-value segments such as pharmaceuticals, QSR, and food exports. These players benefit from advanced temperature monitoring systems, automated warehouses, and international certifications, which attract multinational clients seeking compliance and reliability.

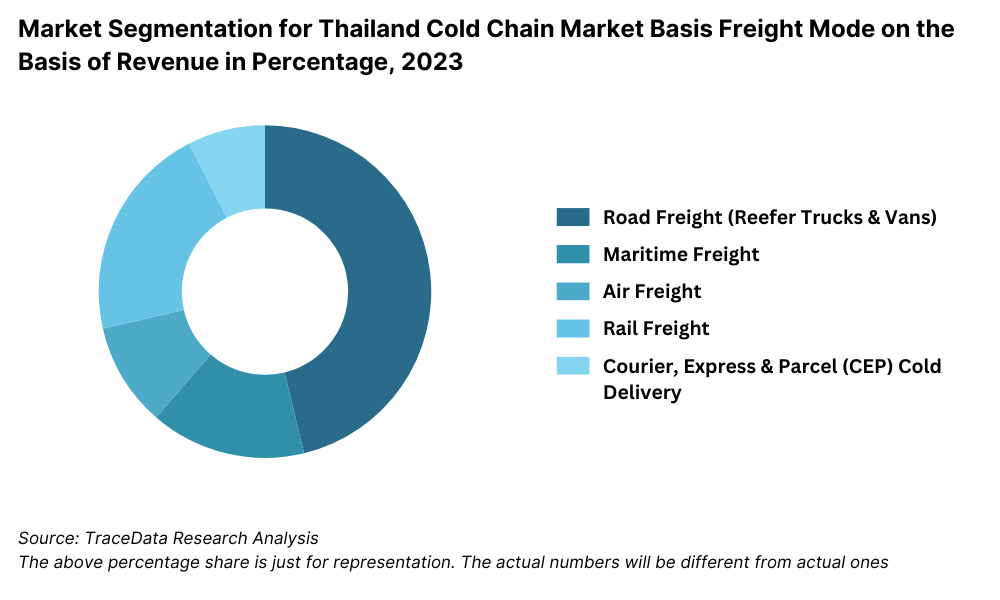

By Mode of Transport: Road transport remains the dominant mode for cold chain logistics in Thailand, supporting both urban last-mile deliveries and long-haul interprovincial shipments. It is widely used for transporting dairy, meat, beverages, and pharma products. Cold chain maritime transport plays a vital role in the export of frozen seafood and processed food, especially via Laem Chabang Port. Air freight is extensively used for urgent pharmaceutical deliveries and high-value perishable goods, primarily routed through Suvarnabhumi Airport. Rail-based cold chain transport remains limited but is expected to grow with infrastructure upgrades under the EEC.

By End-User Industry: The food and beverage sector is the largest user of cold chain services in Thailand, driven by rising demand for frozen food, dairy, meat, and fresh produce. The pharmaceutical sector has also expanded significantly due to the need for vaccine distribution, biologics, and sensitive drug storage. Seafood exports remain a key driver for cold storage and frozen transportation demand. Retail and QSR segments such as supermarkets and fast-food chains are increasingly relying on cold chain logistics for timely and compliant deliveries, particularly in urban and metro areas.

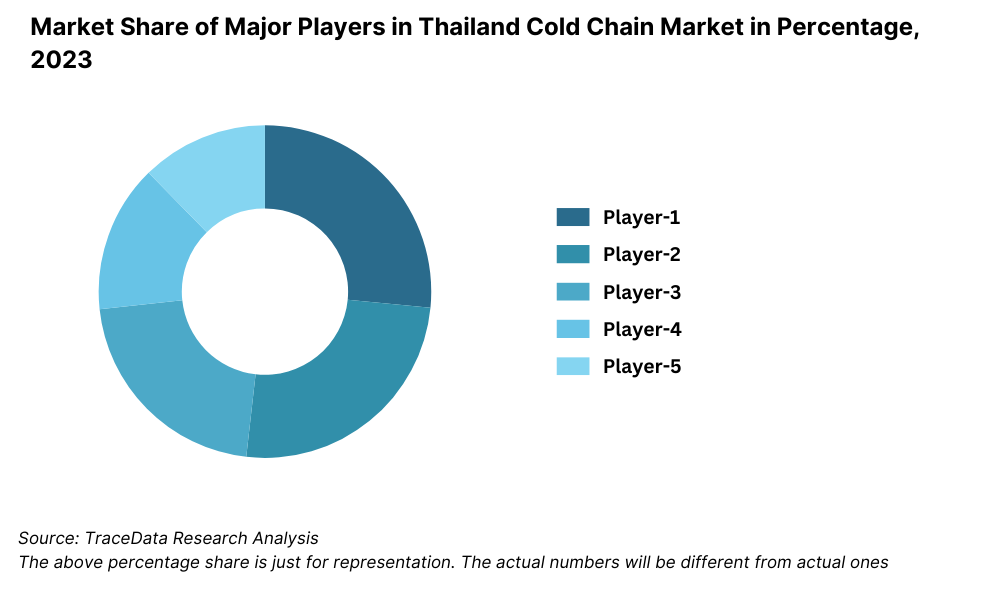

Competitive Landscape in Thailand Cold Chain Market

The Thailand cold chain market is moderately fragmented, with a combination of multinational cold logistics providers, large domestic players, and numerous regional operators serving diverse industries. The demand for compliant, efficient, and temperature-controlled logistics has driven investments in infrastructure, automation, and pharmaceutical-grade facilities. Key players include JWD InfoLogistics, Nichirei Logistics, Bangkok Cold Storage Service, DB Schenker Thailand, and SCG Logistics.

Company Name | Founding Year | Original Headquarters |

JWD InfoLogistics Public Co., Ltd. | 1979 | Bangkok, Thailand |

Bangkok Cold Storage Service Ltd. | 1964 | Bangkok, Thailand |

Nichirei Logistics Group Inc. | 1942 (TH: ~2007) | Tokyo, Japan |

DB Schenker (Thailand) Ltd. | 1872 (TH: ~1970s) | Essen, Germany |

SCG Logistics Management Co., Ltd. | 2000 | Bangkok, Thailand |

Linfox Thailand | 1956 (TH: ~2000s) | Melbourne, Australia |

Yamato Unyu (Thailand) Co., Ltd. | 1919 (TH: ~2010) | Tokyo, Japan |

Thai Cold Storage Group | 1991 | Samut Prakan, Thailand |

Cold Chain Group Thailand | 2008 | Bangkok, Thailand |

Best Cold Chain Co., Ltd. | 2015 | Bangkok, Thailand |

Some of the Recent Competitor Trends and Key Information Include:

JWD InfoLogistics: A leading integrated cold chain provider, JWD expanded its multi-temperature warehouse capacity by 15% in 2023. The company introduced AI-powered monitoring and energy-efficient systems to reduce power consumption and meet ESG goals. It also strengthened its pharmaceutical logistics vertical in response to rising vaccine demand.

Nichirei Logistics: With its Japanese expertise, Nichirei upgraded its Bangkok facilities to meet international GDP standards for pharmaceutical storage. The company reported an 18% growth in frozen food logistics operations in 2023, fueled by increased demand from Japan-bound seafood exporters.

Bangkok Cold Storage Service: A pioneer in Thailand’s cold storage market, the company focuses on frozen seafood, poultry, and meat. In 2023, it upgraded its ammonia-based refrigeration systems and increased automated pallet racking space to enhance storage density and energy efficiency.

DB Schenker Thailand: The company expanded its pharma cold chain capabilities by launching temperature-controlled cross-border trucking to Laos and Cambodia. In 2023, it recorded a 10% YoY growth in healthcare logistics revenue and signed contracts with multiple international drug manufacturers.

SCG Logistics: Leveraging its industrial network, SCG Logistics scaled its cold chain services for the food and dairy sector in the Eastern Economic Corridor (EEC). In 2023, the firm introduced temperature-controlled smart lockers and expanded its refrigerated fleet by 22%.

Linfox Thailand: Focused on large-scale B2B cold chain solutions, Linfox implemented a predictive analytics system to reduce spoilage and optimize routing. In 2023, the company served major retail and QSR clients across 45 provinces.

What Lies Ahead for Thailand Cold Chain Market?

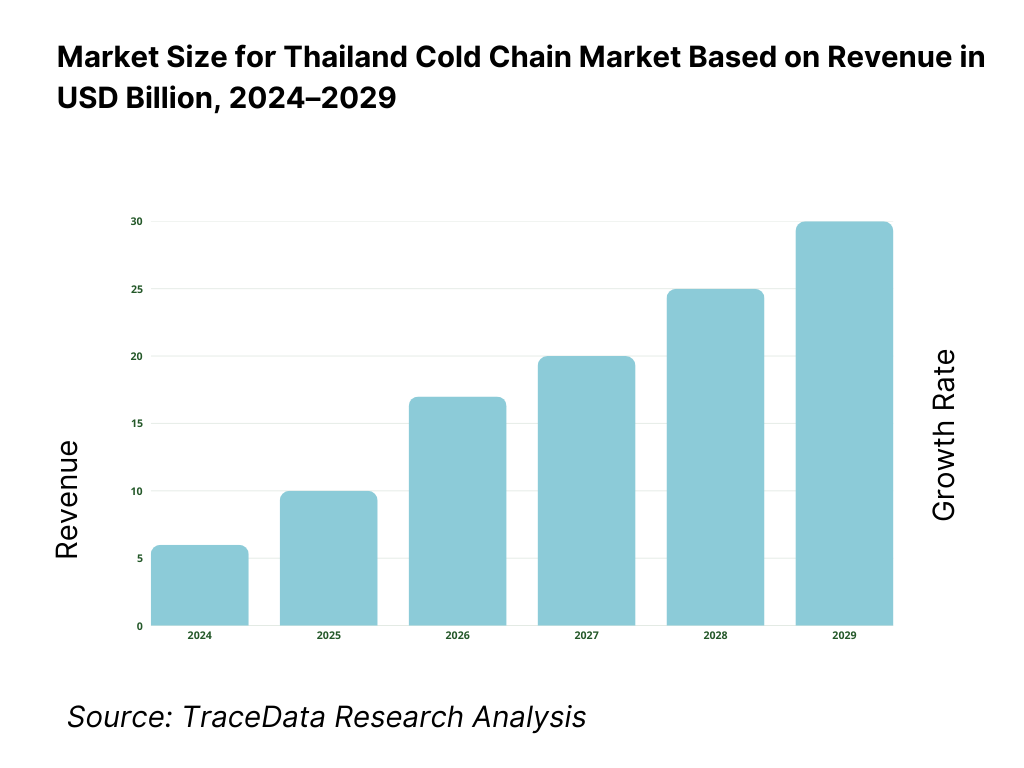

The Thailand cold chain market is projected to grow steadily through 2029, fueled by rising consumer demand for perishable goods, pharmaceutical innovation, and export-oriented food production. Strategic infrastructure developments, government incentives, and the digitization of supply chains will continue to support industry expansion. The market is expected to record a strong CAGR during the forecast period, driven by technology adoption and quality compliance.

Rising Demand for Temperature-Sensitive Pharmaceuticals: With increased demand for vaccines, biologics, and specialty drugs, the pharmaceutical cold chain segment is expected to expand rapidly. By 2029, Thailand is projected to double its GDP-compliant cold storage capacity, particularly in urban hubs like Bangkok and Chonburi.

Growth of Frozen and Processed Food Categories: Changing consumer lifestyles and urbanization are expected to push the demand for frozen food, ready-to-eat meals, and processed meat products. This will necessitate large-scale frozen warehousing and last-mile cold delivery in metro and Tier 1 cities.

Cold Chain Infrastructure in Eastern Economic Corridor (EEC): Continued investment in cold logistics parks under the EEC framework will enhance multimodal connectivity, reduce transit time, and support high-volume exports. By 2029, integrated cold hubs are expected to become operational in Rayong and Chachoengsao, attracting both domestic and foreign investment.

Digitization and Automation in Cold Chain Operations: The use of IoT-enabled temperature tracking, automated storage and retrieval systems (AS/RS), and predictive maintenance tools is expected to become widespread. By 2029, it is estimated that over 60% of organized cold chain players will use real-time data monitoring and AI-powered inventory controls to minimize spoilage and ensure compliance.

Thailand Cold Chain Market Segmentation

• By Market Structure:

o Local Independent Cold Storage Providers

o Integrated 3PL Cold Chain Operators

o Pharmaceutical Logistics Providers

o Export-Oriented Cold Chain Companies

o E-commerce Cold Delivery Services

o Organized Sector

o Unorganized/Traditional Operators

• By Temperature Type:

o Chilled (0°C to 15°C)

o Frozen (Below 0°C)

o Cryogenic / Ultra-Cold Storage (Below −20°C)

• By Mode of Transport:

o Refrigerated Road Transport

o Cold Chain Sea Freight

o Air-Based Temperature-Controlled Cargo

o Cross-Border Reefer Trucking

o Multimodal Cold Chain Logistics

• By End-User Industry:

o Food & Beverage (Frozen Meat, Seafood, Dairy)

o Pharmaceuticals and Healthcare

o Horticulture and Floriculture

o Quick Service Restaurants (QSRs)

o Retail Chains and Supermarkets

o Exporters of Perishable Goods

o Online Grocery and Quick Commerce

• By Type of Cold Chain Infrastructure:

o Standalone Cold Storage Warehouses

o Multi-Temperature Storage Facilities

o Built-to-Suit (BTS) Cold Storage

o Temperature-Controlled Distribution Centers

o Automated Cold Warehousing

• By Region:

o Central Thailand (incl. Bangkok and Pathum Thani)

o Eastern Thailand (incl. Chonburi and Rayong - EEC)

o Northern Thailand

o Southern Thailand

o Northeastern Thailand

Players Mentioned in the Report:

Cold Chain Storage & Logistics Providers

- JWD InfoLogistics

- Nichirei Logistics Thailand

- Bangkok Cold Storage Service Ltd.

- Cold Chain Group Thailand

- DB Schenker Thailand

- Thai Cold Storage Group

- Yamato Unyu (Thailand)

- Best Cold Chain Co., Ltd.

- Linfox Thailand

Pharmaceutical Cold Chain Specialists

- Zuellig Pharma

- DHL Supply Chain (Healthcare)

- World Courier Thailand

- Marken Thailand

E-commerce and Q-Commerce Cold Logistics

- Fuze Post (by JWD)

- Flash Express (Cold Delivery Vertical)

- CJ Logistics Cold Chain

- Freshket

- HappyFresh Logistics

Key Target Audience:

- Cold Chain Storage and Transport Companies

- Food Processing and Export Firms

- Pharmaceutical Distributors and Hospitals

- Supermarket Chains and QSR Brands

- Technology Providers for Cold Chain Automation

- Logistics Infrastructure Investors

- Government Agencies (e.g., BOI, FDA Thailand)

- Research and Consulting Firms

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Thailand Cold Chain Market

4. Macroeconomic Framework for Thailand

4.1. Macroeconomic framework for Thailand Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Cold Chain Contribution to Logistics Sector and Its Historical Trends

4.3. Ease of Doing Business in Thailand

4.4. Export-Import Trends for Perishable Goods (Meat, Seafood, Fruits, Pharmaceuticals)

4.5. Cold Chain Integration in ASEAN Trade Corridors

5. Infrastructure in Thailand Cold Chain Market

5.1. Landscape of Cold Chain Warehouses and Refrigerated Trucking Fleets

5.2. Current Scenario for Cold Chain Infrastructure in Thailand

5.3. Road Infrastructure in Thailand Including Reefer Truck Availability, Toll Routes, Key Distribution Corridors

5.4. Air Infrastructure in Thailand Including Pharmaceutical Corridors, Key Airports, FTK and Cold Cargo Capabilities

5.5. Sea Infrastructure Including Volume of Cold Exports (Seafood/Meat), Major Ports with Cold Chain Connectivity

5.6. Regional Cold Chain Infrastructure Mapping Across Thailand

6. Thailand Cold Chain Market Size

6.1. Basis Revenues, 2018-2024P

6.2. Basis Storage Capacity and Reefer Fleet Volume, 2018-2024P

7. Thailand Cold Chain Market Segmentation

7.1. By Market Structure

7.2. By Temperature Type (Chilled, Frozen, Cryogenic)

7.3. By Mode of Transport

7.4. By End User Industries, 2018-2024P

7.5. By Type of Cold Storage Infrastructure

7.6. By Region

8. Trends and Developments in Thailand Cold Chain Market

8.1. Technology Adoption and Real-Time Monitoring

8.2. Sustainable Cold Chain Infrastructure (Green Warehousing, Solar Cooling)

8.3. Expansion of E-commerce and Online Grocery Delivery Cold Chain

8.4. Shift Toward End-to-End Cold Chain Logistics Solutions

8.5. Digitization of Inventory and Order Fulfillment in Cold Storage

9. Regulatory Landscape and Government Support

9.1. FDA Guidelines for Pharmaceutical Cold Chain (GDP Compliance)

9.2. Food Safety and Traceability Requirements for Cold Logistics

9.3. BOI Investment Incentives for Cold Chain Infrastructure

9.4. Eastern Economic Corridor (EEC) Cold Logistics Incentives

9.5. Sanitary and Phytosanitary Measures (SPS) for Export-Oriented Cold Chain

10. Competitive Landscape in Thailand Cold Chain Market

10.1. Company Overview and Service Offering

10.2. Company Profiles with Founding Year and Headquarters

10.3. Cross Comparison by Storage Capacity, Fleet Size, Region Served, Sector Focus

10.4. Recent Developments and Expansion Plans

10.5. Technology and Automation in Cold Chain Operations

11. End User Analysis

11.1. Cold Chain Needs by Sector (F&B, Pharma, Retail, QSR, Horticulture)

11.2. Customer Preferences on In-house vs Outsourced Cold Chain

11.3. Spending Pattern and Budget Allocation by End Users

11.4. Major Cold Chain Contracts by Sector and Region

11.5. Challenges Faced by End Users (Compliance, Access, Cost, Delivery Time)

12. Thailand Cold Chain Market Future Size

12.1. Basis Revenues, 2025-2029

12.2. Basis Capacity (Cubic Meters) and Reefer Vehicles, 2025-2029

13. Thailand Cold Chain Market Future Segmentation

13.1. By Temperature Type, 2025-2029

13.2. By End User Industry, 2025-2029

13.3. By Infrastructure Type (Automated, BTS, Shared), 2025-2029

13.4. By Region, 2025-2029

13.5. Recommendation

13.6. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side (e.g., food processing, frozen and chilled F&B, pharmaceutical, retail chains, QSRs, and exporters) and supply-side (e.g., cold storage operators, refrigerated transporters, 3PL providers, pharma distributors) entities within the Thailand Cold Chain Market.

Based on this ecosystem, we shortlist 6–8 leading cold chain logistics companies in Thailand, selected using parameters such as cold storage capacity, reefer fleet size, compliance certifications (GDP, HACCP), automation level, and presence across regions.

Sourcing is carried out using industry publications, trade portals, investment reports, and proprietary databases to conduct desk research and compile relevant supply chain and infrastructure-level information.

Step 2: Desk Research

A rigorous secondary research process is undertaken to gather insights from public and private domain sources including the Ministry of Public Health (Thailand), Board of Investment (BOI), Thai FDA, Cold Chain Association of Thailand, and international bodies like FAO, WHO, and OECD.

Key variables studied include total cold chain market size, segmentation by temperature type, infrastructure capacity (cold storage in cubic meters, reefer trucks), regional spread, and end-user demand patterns.

We supplement this with detailed analysis of company-level data through annual reports, investor presentations, case studies, and market research publications to build a structured industry landscape.

Step 3: Primary Research

We conduct in-depth interviews with cold chain experts, senior management from logistics providers, cold storage infrastructure developers, pharma supply chain leads, and export compliance officers.

These interviews help validate secondary insights, uncover bottlenecks in cold infrastructure, and understand emerging trends in automation, sustainability, and regulatory compliance.

Disguised interviews are conducted with warehouse and reefer fleet operators as mystery clients to collect firsthand data on pricing, technology integration, and service offerings.

A bottom-up approach is employed to build estimates of the cold chain market by aggregating segment-wise and region-wise revenue and capacity data. These are then validated using a top-down triangulation process.

Step 4: Sanity Check

Final market estimates are validated using both bottom-up and top-down methodologies, infrastructure demand-supply ratios, regional GDP correlations, and sectoral growth benchmarks.

Peer benchmarking is performed across ASEAN cold chain markets such as Vietnam, Malaysia, and Indonesia to contextualize Thailand’s positioning. Historical growth trends, regulatory changes, and investment pipelines are considered to align forecasts with macroeconomic and policy scenarios.

FAQs

1. What is the potential for the Thailand Cold Chain Market?

The Thailand cold chain market is projected to grow significantly, reaching an estimated valuation of THB 180 Billion by 2029. Growth will be driven by rising demand for temperature-sensitive products across food, pharmaceuticals, and e-commerce segments. Continued infrastructure investment, export-oriented agriculture, and increasing health awareness will further enhance the cold chain sector's strategic relevance in the national logistics ecosystem.

2. Who are the Key Players in the Thailand Cold Chain Market?

Major players in the Thailand cold chain industry include JWD InfoLogistics, Nichirei Logistics, Bangkok Cold Storage Service, DB Schenker Thailand, SCG Logistics, and Yamato Unyu (Thailand). These companies lead the market with their integrated service offerings, advanced temperature monitoring capabilities, pharmaceutical compliance certifications, and expanding infrastructure footprints across key industrial and urban zones.

3. What are the Growth Drivers for the Thailand Cold Chain Market?

Key growth drivers include increasing demand for frozen and processed food, vaccine and pharmaceutical distribution, growing export of perishables, and rapid urbanization. Additionally, government support through EEC-based logistics infrastructure, digitization of supply chains, and stricter food and drug safety norms are accelerating the shift toward modern cold chain solutions.

4. What are the Challenges in the Thailand Cold Chain Market?

The cold chain industry faces several challenges including high energy costs, limited infrastructure in rural areas, lack of skilled workforce for cold logistics operations, and market fragmentation. Maintaining compliance with international standards, addressing sustainability concerns, and upgrading existing legacy cold storage systems also remain critical issues for the sector.