Thailand Consumer Appliances Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances

- Product Code: TDR0055

- Region: Asia

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled “Thailand Consumer Appliances Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer appliances market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Thailand Consumer Appliances Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Thailand Consumer Appliances Market Overview and Size

The Thailand consumer appliances market reached a valuation of THB 150 Billion in 2023, driven by the increasing demand for energy-efficient products, changing consumer lifestyles, and rapid urbanization. The market is characterized by major players such as Electrolux, LG, Panasonic, Mitsubishi Electric, and Samsung, known for their extensive distribution networks, innovative product offerings, and strong brand presence.

In 2023, LG launched a new range of smart appliances to cater to the growing demand for connected home products. This initiative aims to tap into the rising preference for convenience and smart technology integration among Thai consumers. Bangkok and Chiang Mai are key markets due to their high population density and robust retail infrastructure.

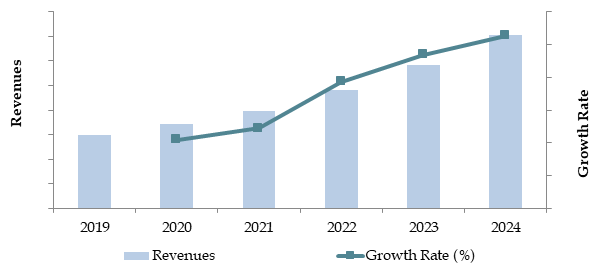

Market Size for Thailand Consumer Appliances Industry Based on Sales Revenue in THB Billion, 2018-2023

(Source: TraceData Research Analysis)

What Factors are Leading to the Growth of Thailand Consumer Appliances Market:

Economic Factors: The rising disposable income and increased consumer spending on home improvement products have significantly boosted the demand for consumer appliances. In 2023, large appliances such as refrigerators and washing machines accounted for approximately 45% of total sales revenue, as consumers increasingly seek to upgrade their household equipment.

Urbanization and Housing Development: The expansion of urban housing and the development of new residential projects have been crucial growth drivers. With urbanization increasing by 2.3% annually, more consumers are investing in household appliances to furnish new homes. This trend is particularly pronounced in the capital city of Bangkok and other major cities like Phuket and Pattaya.

Energy Efficiency and Sustainability: The growing focus on energy efficiency and environmentally sustainable products has influenced consumer purchasing behavior. In 2023, approximately 35% of all appliances sold in Thailand were categorized as energy-efficient, reflecting a shift towards products that offer long-term cost savings and lower environmental impact.

Industry Challenges Impacting the Growth of Thailand Consumer Appliances Market

Intense Competition: The Thai market is highly competitive, with several international and local brands vying for market share. Price wars and frequent promotions have led to margin pressures, particularly for mid-tier and smaller players. This has made it difficult for new entrants to establish a strong foothold.

Supply Chain Disruptions: Supply chain issues, including component shortages and rising logistics costs, have impacted product availability and led to delays in new product launches. In 2023, nearly 18% of retailers reported supply disruptions that affected their ability to meet consumer demand.

Regulatory Hurdles: Strict regulations related to product safety standards, environmental compliance, and energy efficiency can pose barriers to market entry for international players. In 2023, the government introduced new labeling requirements for energy efficiency, which added to the compliance costs for manufacturers and retailers.

What are the Regulations and Initiatives Which Have Governed the Market:

Energy Efficiency Standards for Appliances: The Thai government has implemented stringent energy efficiency standards for household appliances, requiring products to meet specific energy consumption criteria. Labels indicating energy efficiency ratings are mandatory on all major appliances, helping consumers make informed choices. In 2023, around 80% of appliances sold met the high energy efficiency standards set by the government, showing significant compliance among manufacturers.

Import Tariffs and Trade Policies: The government enforces strict import regulations and tariffs on non-ASEAN consumer appliances to support local production. These regulations include import duties of up to 20% on large appliances like refrigerators and washing machines. In 2023, imports of major appliances decreased by 7% due to higher tariffs on non-ASEAN products, encouraging local sourcing and production.

Government Incentives for Eco-Friendly Appliances: To promote the use of energy-efficient and environmentally friendly appliances, the Thai government offers various incentives, such as tax exemptions, rebates, and subsidies. These initiatives are targeted at both manufacturers and consumers to increase the adoption of sustainable products. In 2023, eco-friendly appliances accounted for 30% of total appliance sales, reflecting a positive response to government policies.

Thailand Consumer Appliances Market Segmentation

By Market Structure: The market is primarily segmented into organized and unorganized sectors. The organized sector, including large retail chains and online platforms, holds a dominant share due to its extensive product range, competitive pricing, and robust after-sales services. The unorganized sector, consisting of small retailers and traditional stores, caters mainly to rural and semi-urban regions where consumers often prefer personal interactions and localized offerings.

By Product Category: Major appliances such as refrigerators, washing machines, and air conditioners represent the largest segment due to their high unit costs and essential nature in households. Small appliances, including microwave ovens, vacuum cleaners, and blenders, have shown rapid growth driven by increased adoption of convenience-focused products. Consumer electronics, such as televisions and audio systems, also constitute a significant segment, particularly in urban markets where demand for high-tech products is higher.

By Distribution Channel: The organized retail channel, including hypermarkets, supermarkets, and brand-exclusive stores, dominates the market with its focus on customer experience, comprehensive product range, and competitive pricing. Online channels have gained traction, especially in urban areas, due to the convenience of home delivery and competitive discounts. Traditional retail channels remain significant in rural regions where consumers prefer to physically inspect products before purchase.

Competitive Landscape in Thailand Consumer Appliances Market

The Thailand consumer appliances market is highly competitive, with several major players competing for market share across various product categories. Leading international companies such as Electrolux, LG Electronics, Samsung, Panasonic, and Mitsubishi Electric dominate the market, while local companies like Sharp and Toshiba have a strong presence in specific segments. The rise of e-commerce platforms and the increasing popularity of online channels have also intensified competition, providing consumers with more choices and competitive pricing.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Electrolux | Refrigerators, Dishwashers, Washing machines, Air purifiers, Microwaves | 1919 | Stockholm, Sweden |

Toshiba | Refrigerators, Washing machines, Microwaves, Rice cookers, Water heaters | 1939 | Tokyo, Japan |

Samsung Electronics | Refrigerators, Washing machines, Air conditioners, Microwaves | 1938 | Suwon, South Korea |

LG Electronics | Refrigerators, Washing machines, Air conditioners, Cooking appliances | 1958 | Seoul, South Korea |

Panasonic | Refrigerators, Microwaves, Washing machines, Air purifiers | 1918 | Osaka, Japan |

Mitsubishi Electric | Air conditioners, Refrigerators, Cooking appliances, Vacuum cleaners | 1921 | Tokyo, Japan |

Hitachi | Refrigerators, Air conditioners, Washing machines, Microwaves | 1910 | Tokyo, Japan |

Bosch | Dishwashers, Washing machines, Refrigerators, Ovens | 1886 | Gerlingen, Germany |

Haier | Washing machines, Refrigerators, Air conditioners, Cooking appliances | 1984 | Qingdao, China |

Beko | Washing machines, Refrigerators, Dishwashers, Cooking appliances | 1967 | Istanbul, Turkey |

Key Competitor Trends and Information

Electrolux: Electrolux recorded a 12% increase in sales of kitchen appliances in 2023, driven by its focus on premium and energy-efficient product lines. The brand's strong presence in the high-end segment and its commitment to sustainable solutions have contributed significantly to its growth.

LG Electronics: LG launched a new range of AI-enabled washing machines and refrigerators in 2023, aiming to strengthen its position in the smart appliance market. The company reported a 15% growth in its smart appliance category, benefiting from the rising demand for convenience and connectivity in urban households.

Samsung: Known for its innovative technologies, Samsung introduced a new series of air conditioners with advanced cooling features and IoT integration. The company reported a 20% increase in air conditioner sales, supported by its extensive distribution network and strong brand reputation.

Panasonic: Panasonic has focused on expanding its energy-efficient product portfolio, particularly in the refrigerator and air conditioning segments. The company reported a 10% increase in sales of energy-efficient products in 2023, in line with the growing consumer preference for sustainability.

Mitsubishi Electric: Mitsubishi Electric saw a 15% growth in the air conditioning segment, driven by its advanced technology and superior product quality. The company’s focus on energy-efficient and environmentally friendly products has positioned it well in the Thai market.

Sharp: Sharp is a strong player in the small appliances category, particularly in microwave ovens and rice cookers. In 2023, Sharp’s small appliance sales grew by 8%, supported by the company’s focus on product affordability and strong retail presence in rural areas.

Toshiba: Toshiba has made significant investments in expanding its product line in the washing machine and refrigerator segments. The company reported a 10% growth in its home appliance segment, driven by new product launches and strategic partnerships with local distributors.

What Lies Ahead for Thailand Consumer Appliances Market?

The Thailand consumer appliances market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by increased urbanization, rising disposable income, and growing consumer demand for energy-efficient and smart home products.

Shift Towards Smart Appliances: As Thai consumers become more tech-savvy, there is anticipated to be a gradual increase in both the availability and demand for smart home appliances. The integration of IoT and AI technologies in products such as refrigerators, washing machines, and air conditioners will cater to the demand for convenience and connectivity. This trend is supported by government initiatives aimed at promoting digitalization and smart home adoption.

Rising Demand for Energy-Efficient Products: With growing awareness of environmental sustainability and rising electricity costs, consumers are increasingly opting for energy-efficient appliances. Government incentives, including tax rebates and subsidies for energy-saving products, are expected to boost the adoption of appliances that have lower energy consumption. This trend will be particularly strong in the urban and semi-urban regions.

Expansion of E-Commerce Channels: The rapid expansion of e-commerce platforms is reshaping the retail landscape for consumer appliances in Thailand. Companies are focusing on enhancing their online presence through partnerships with major e-commerce platforms like Lazada and Shopee, enabling them to reach a broader audience. The convenience of online shopping, coupled with competitive pricing, is likely to drive sales growth in the coming years.

Growth of Premium and Luxury Appliance Segments: The increasing purchasing power of the middle and upper-middle classes is driving demand for premium and luxury appliances. Consumers are now looking for high-quality, innovative, and aesthetically appealing products that offer enhanced functionality and style. This trend is particularly visible in metropolitan areas like Bangkok and Chiang Mai, where consumers are willing to spend more on premium brands.

Focus on Sustainability and Eco-Friendly Practices: There is a growing trend towards sustainable practices in the consumer appliances market, driven by both government regulations and changing consumer preferences. Companies are increasingly incorporating eco-friendly materials in their products and adopting green manufacturing practices. Initiatives such as reducing carbon emissions and promoting energy-efficient products are expected to influence consumer buying decisions, particularly in the high-end segment.

Increased Competition from Local Brands: As local brands enhance their product quality and innovation capabilities, they are expected to gain market share from international players, especially in the mid-tier segment. Competitive pricing, a better understanding of local consumer preferences, and strong after-sales service are key factors that will support the growth of local brands.

Future Outlook and Projections for Thailand Consumer Appliances Market Based on Sales Revenue in THB, 2024-2029

(Source: TraceData Research Analysis)

Thailand Consumer Appliances Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Major Appliances

- Small Appliances

- By Major Appliances

- Dishwashers

- Washing Machines

- Cooking Appliances

- Microwaves

- Freezers

- Refrigerators

- Washing Machines:

- Semi Automatic

- Automatic Washing Machines

- Cooking Appliances:

- Built-In Hobs

- Ovens

- Cooker Hoods

- Cookers

- Freezers:

- Built-In

- Freestanding

- Small Appliances

- Air Treatment Products

- Food Preparation Appliances

- Heating Appliances

- Irons

- Personal Care Appliances

- Small Cooking Appliances

- Vacuum Cleaners and Small Appliances:

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

By Region:

Northern

Central

Eastern

Western

Southern

Players Mentioned in the Report:

Samsung Electronics

LG Electronics

Whirlpool Corporation

Electrolux

Panasonic

Haier Group

Toshiba

Hitachi

Bosch

Midea

Key Target Audience:

Consumer Appliance Manufacturers

Retail Chains and Distributors

Online Marketplaces

Government Regulatory Bodies

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for the Thailand Consumer Appliances Market

4.3. Business Model Canvas for the Thailand Consumer Appliances Market

4.4. Buying Decision-Making Process

4.5. Supply Decision-Making Process

5.1. New Appliance Sales in Thailand, 2018-2024

5.2. Replacement vs. New Sales Ratio in Thailand, 2018-2024

5.3. Spend on Home Appliances in Thailand, 2024

5.4. Number of Consumer Appliance Deaers in the Thailand by Region

8.1. Revenues, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Major and Small Appliances), 2018-2024

9.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2018-2024

9.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2018-2024

9.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2018-2024

9.2.1.3. By Freezers (Built-In and Freestanding), 2018-2024

9.2.1.4. By Refrigerator (Built-In and Freestanding), 2018-2024

9.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2018-2024

9.3. By Average Price Range, 2023-2024P

9.4. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.5. By Region (Northern, Southern, Western, Eastern, Central), 2023-2024P

9.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in the Thailand Consumer Appliances Market

11.2. Growth Drivers for the Thailand Consumer Appliances Market

11.3. SWOT Analysis for the Thailand Consumer Appliances Market

11.4. Issues and Challenges for the Thailand Consumer Appliances Market

11.5. Government Regulations for the Thailand Consumer Appliances Market

12.1. Market Size and Future Potential for Online Consumer Appliances Market, 2018-2029

12.2. Business Model and Revenue Streams for Major Marketplace and Company Websites

12.3. Cross-Comparison of Leading Online Consumer Appliance Companies Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Down Payment for Consumer Appliances, 2018-2029

13.2. Trends in Finance Penetration Rates Over the Years and Contributing Factors

13.3. Appliance Segments with Higher Finance Penetration

13.4. Finance Split by Banks/NBFCs/Private Finance Companies and Captive Entities, 2023-2024P

13.5. Average Finance Tenure for Consumer Appliances in the Thailand

13.6. Finance Disbursement for Consumer Appliances in Thailand, 2018-2024P

16.1. Market Share of Key Players in India Consumer Electronics Market, 2018-2024

16.1.1. Market Share of Key Players in India Washing Machine Market, 2018-2024

16.1.2. Market Share of Key Players in India Cooking Appliances Market, 2018-2024

16.1.3. Market Share of Key Players in India Refrigerator Market, 2018-2024

16.1.4. Market Share of Key Players in India Television Market, 2018-2024

16.2. Benchmarking of Key Competitors in India Consumer Electronics Market including Operational and Financial Parameters

16.3. Heat Map Analysis for Major Players in India Consumer Electronics Market

16.4. Strengths and Weaknesses Analysis

16.5. Operating Model Analysis Framework

19.1. Revenues, 2025-2029

20.1. By Market Structure (Branded and Local Brands), 2025-2029

20.2. By Type (Major and Small Appliances), 2025-2029

20.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2025-2029

20.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2025-2029

20.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2025-2029

20.2.1.3. By Freezers (Built-In and Freestanding), 2025-2029

20.2.1.4. By Refrigerator (Built-In and Freestanding), 2025-2029

20.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2025-2029

20.3. By Average Price Range, 2025-2029

20.4. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

20.5. By Region (Northern, Southern, Western, Eastern, Central), 2025-2029

20.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

20.7. Recommendation

20.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: The first step involves mapping the entire ecosystem for the Thailand Consumer Appliances Market. This includes identifying all relevant demand-side and supply-side entities, such as manufacturers, distributors, retailers, and end-users. Based on this ecosystem, the top 5-6 producers in the country are shortlisted, considering factors such as financial performance, production capacity, and market share.

Data Sourcing: Sourcing is done through industry reports, company publications, and multiple secondary and proprietary databases. This helps gather a holistic view of the market and collate industry-level information, laying the groundwork for further analysis.

Step 2: Desk Research

Comprehensive Desk Research: An exhaustive desk research process is carried out, referencing diverse secondary sources such as industry reports, trade journals, and market publications. This step focuses on understanding the overall market size, sales revenues, number of market players, pricing dynamics, and demand trends. It is supplemented by a detailed examination of company-level data using sources like annual reports, financial statements, press releases, and related documents.

Data Aggregation and Analysis: The desk research process aggregates all market-related insights, providing a comprehensive overview of the current industry landscape. This process helps construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

In-depth Interviews: A series of in-depth interviews are conducted with C-level executives and key stakeholders from various companies in the Thailand Consumer Appliances Market. This serves multiple purposes, such as validating market hypotheses, authenticating statistical data, and extracting valuable operational and financial insights from industry representatives.

Validation Strategy: As part of the validation strategy, disguised interviews are undertaken where our team approaches companies under the guise of potential customers. This method helps validate the operational and financial information shared by executives and cross-checks it against secondary sources. It also provides insights into the revenue streams, value chain, pricing strategies, and overall market dynamics.

Step 4: Sanity Check

- Sanity Check and Market Modeling: A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, are carried out to assess the accuracy and consistency of the research findings. This ensures the reliability of the data and provides a realistic view of the market.

FAQs

01 What is the Potential for the Thailand Consumer Appliances Market?

The Thailand consumer appliances market is poised for substantial growth, reaching a valuation of THB 150 Billion in 2023. This growth is driven by factors such as rising disposable income, urbanization, and increased consumer demand for energy-efficient and smart home products.

02 Who are the Key Players in the Thailand Consumer Appliances Market?

The market features several key players including Electrolux, LG Electronics, and Panasonic. These companies dominate the market due to their strong brand presence, extensive distribution networks, and diverse product offerings.

03 What are the Growth Drivers for the Thailand Consumer Appliances Market?

The primary growth drivers include increased urbanization, rising disposable incomes, and consumer preference for energy-efficient products. Technological advancements and government incentives for sustainable products also contribute to market growth.

04 What are the Challenges in the Thailand Consumer Appliances Market?

Challenges include intense competition, supply chain disruptions, and strict regulatory compliance. Additionally, evolving consumer preferences and rapid technological advancements pose a risk for companies unable to adapt quickly.