Thailand Stationery Products Market Outlook to 2030

By Product Category (Paper Products, Writing Instruments, Desk Supplies, School Supplies, Filing & Storage), By End User (Educational Institutions, Corporate Offices, Retail Consumers, Government Sector), By Distribution Channel (Offline Retail)

- Product Code: TDR0213

- Region: Asia

- Published on: July 2025

- Total Pages: 80

Report Summary

The report titled “Thailand Stationery Products Market Outlook to 2030 – By Product Category (Paper Products, Writing Instruments, Desk Supplies, School Supplies, Filing & Storage), By End User (Educational Institutions, Corporate Offices, Retail Consumers, Government Sector), By Distribution Channel (Offline Retail, Online Marketplace, Institutional Tenders), By Material Type, and By Region” provides a comprehensive analysis of the stationery products market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level demand profiling, key challenges and market constraints, and a detailed competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major domestic and international players in the stationery products market. The report concludes with future market projections based on consumption patterns, regional growth, evolving product preferences, and success case studies highlighting major opportunities and strategic risks.

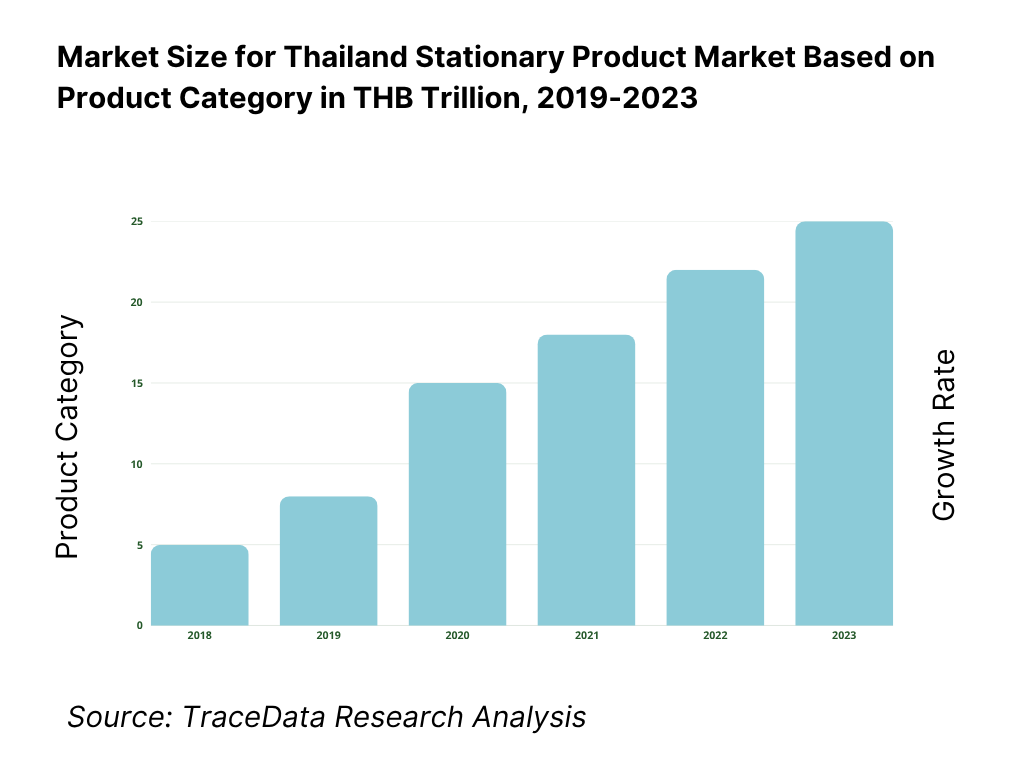

Thailand Stationary Products Market Overview and Size

The Thailand stationery products market was valued at THB 31.6 billion in 2023, driven by consistent educational expenditure, institutional procurement, and a surge in consumer demand for office and school supplies. The country’s education sector, comprising over 31,000 schools and more than 8.7 million enrolled students, continues to be the primary consumer of stationery, including paper goods, writing instruments, and desk supplies. Procurement by government and private institutions remained stable in 2023, with public education procurement orders crossing THB 5.4 billion. Leading players such as Double A, Kokuyo Thailand, Horse Brand, and Pentel dominate market volumes through diversified portfolios and institutional contracts.

In 2023, B2S (Central Group) expanded its omnichannel presence by opening six new flagship stores and upgrading its e-commerce interface, which collectively attracted over 3.2 million unique online visitors within the year. Key urban centers such as Bangkok and Chiang Mai are central to market expansion due to their dense concentration of schools, corporate offices, and high-income households. These cities accounted for over 40% of total retail stationery sales in 2023, reflecting their importance in driving nationwide demand.

What Factors are Leading to the Growth of Thailand Stationary Products Market

Education Reforms Driving Increased Institutional Purchases: Thailand allocates around 2.5% of GDP to education spending, approximately ฿314 billion in 2023, reflecting government priority on school infrastructure and resources. This extensive funding creates a strong foundation for consistent procurement of stationery products such as notebooks, pens, and art supplies across over 31,000 primary and secondary schools. Dual vocational training programs, with over 300,000 students engaged during the school year, further support demand for specialized stationery like engineering rulers and drafting kits. Thus, steady state investment in education across Thailand represents a reliable growth engine for the stationery market.

Corporate Re‑engagement and Office Infrastructure Expansion: Thailand’s economy grew by 3.2% in Q4 2024 and is projected at 2.4% in 2024, with increased public and private investment supporting robust corporate activity. Bangkok alone houses over 5 million formal sector employees, correlating with yearly per-office stationery consumption of approximately ฿2,500 each. The return-to-office trend since 2022, including fiscal stimulus such as the ฿10,000 digital wallet program allocated to 45 million citizens, has stimulated corporate supply chains buying pens, folders, and desk items. This renewed office spending elevates stationery demand among corporate clients, reinforcing the market’s growth trajectory.

Local Manufacturing Support from National Economic Strategy: Thailand’s industrial output forms 39.2% of GDP, with the government promoting local production. In 2023, domestic manufacturers produced over 1.2 billion sheets of paper and 150 million pens, meeting most national demand. High import duties, up to 30% on stationery components, further incentivize local manufacturing. Public investment of ฿10 trillion in infrastructure in 2024 has improved logistics networks, benefitting domestically produced stationery distribution. These supportive policies enhance supply resilience and local brand competitiveness.

Which Industry Challenges Have Impacted the Growth for Thailand Stationary Products Market

Import Dependency Impacted by Trade Volatility: Thailand imported $306.8 billion worth of goods in 2023, including crucial stationery raw materials like resin and pigments. Currency fluctuations, such as the baht’s 5% volatility in early 2024, directly increased costs for imported components, adding an additional ฿0.50–฿2 per pen or notebook unit. Frequent global supply disruptions, notably during COVID and the Russia‑Ukraine conflict, raised lead times by up to 12 weeks, forcing manufacturers to maintain high inventory buffers and pass costs onto retailers.

Raw Material Price Volatility Raising Production Costs: Thailand’s inflation slid to 1.5% in 2024, but key raw material costs remain unstable. Resin prices escalated by 12%, wood pulp by 8%, and steel by 15% since late 2023. This translated into per-unit production cost increases of ฿1–฿3 for basic pens, paper costs rising from ฿0.60 to ฿0.80 per sheet, and notebook prices rising by ฿10–฿20. These fluctuations constrain manufacturers' margin flexibility without raising retail costs.

Counterfeit Products Eroding Brand Trust: Thailand’s stationery counterfeit market accounts for around ฿4 billion annually in lost sales, roughly 5% of total category value, according to customs estimates. Counterfeits often feature poor material quality, such as ink leakage and flimsy paper, leading to widespread consumer dissatisfaction. This undermines trust in branded products and pushes some buyers toward low-cost generic options, reducing potential premium segment revenues.

What are the Regulations and Initiatives which have Governed the Market

Import Duties: Stationery products imported into Thailand face an average Most-Favoured-Nation (MFN) import tariff of 11.5 baht per 100-baht value, applied to non-agricultural goods like paper and art tools. Additionally, the government imposes a 7% VAT on shipments valued under 1,500 baht since July 2024. A 2023 notification also temporarily exempts custom duties on eligible stationery items imported for educational institutions. These duties increase acquisition costs for imported stationery, bolstering the competitiveness of domestic products and shaping procurement strategies for schools and retailers.

Material Usage Compliance: Thailand mandates compliance with materials standards outlined by the Thai Industrial Standards Institute (TISI). In 2023, TISI reported 1,200 certified paper, plastic, and metal stationery SKUs, audited for safe chemical migration and quality. Products failing compliance face import suspension until materials pass tests aligned with ISO protocols, increasing lead time by 4–6 weeks. This strict regulation maintains product integrity and consumer safety but raises barriers for small or new importers lacking certified supply chains.

Eco-Label Requirements: The Thai Green Label (TGL), established in 1993, currently covers over 8,000 certified products, including paper and office supplies. Under the Green Public Procurement (GPP) initiative, central government agencies reported spending 217 million baht on eco-labeled goods across 1,872 SKUs in the fiscal year 2022—amounting to nearly half of their recorded procurement value. Achieving TGL certification requires adherence to a full lifecycle analysis under ISO 14024 and is voluntary, but government bodies are incentivized to favor eco-labeled products. This drives demand for certified stationery while increasing compliance efforts for manufacturers.

Thailand Stationary Products Market Segmentation

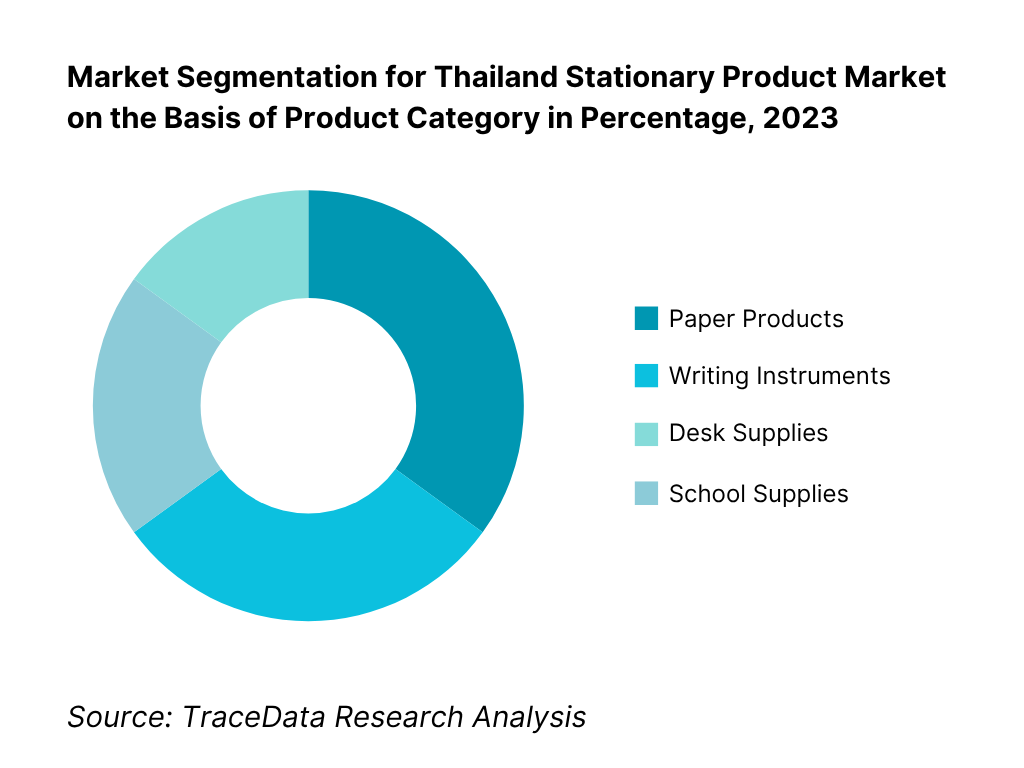

By Product Category: The market is dominated by Paper Products, owing to structural demand across educational, corporate, and creative segments. Notebooks, copier paper, and journals remain staples for Thai schools and offices. The education system reinforces high unit sales, while urban consumer preferences for artisanal and personalized paper goods further reinforce dominance.

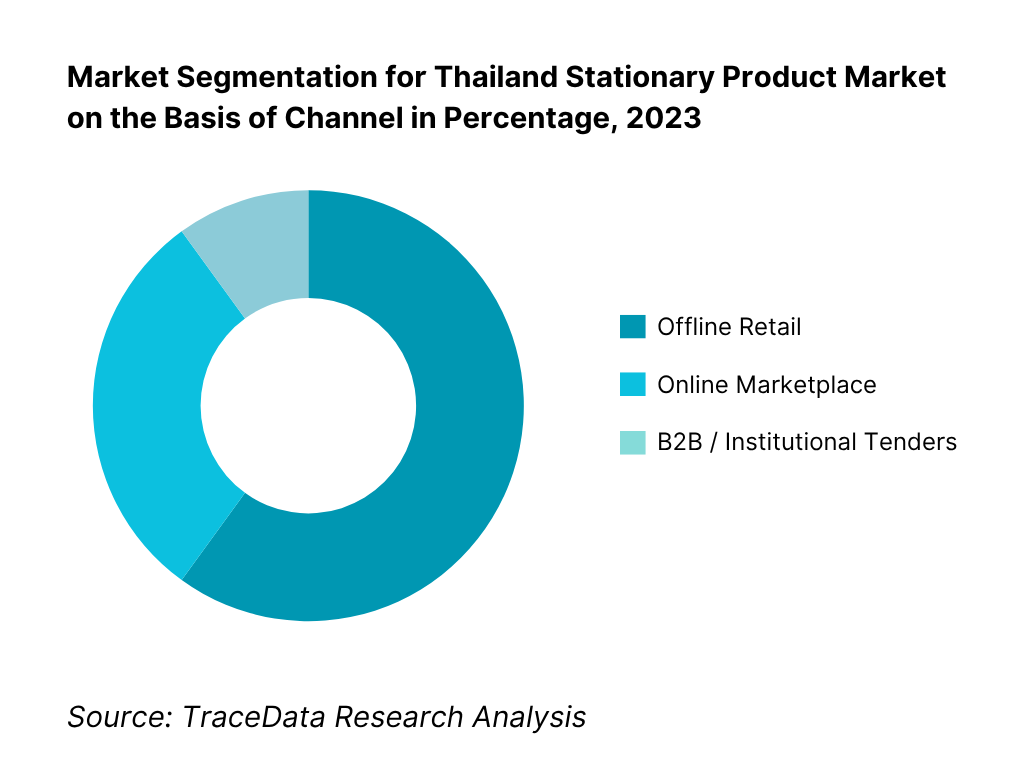

By Channel: Offline Retail leads due to extensive networks of local stationery stores, bookstores, and hypermarkets. Thai consumers still prefer tactile examination of paper quality and ink before purchase. However, Online Marketplaces such as Shopee capture growing share (approx. 30%) driven by convenience and access to niche and imported brands. B2B public tenders (offices, schools) maintain a steady institutional channel.

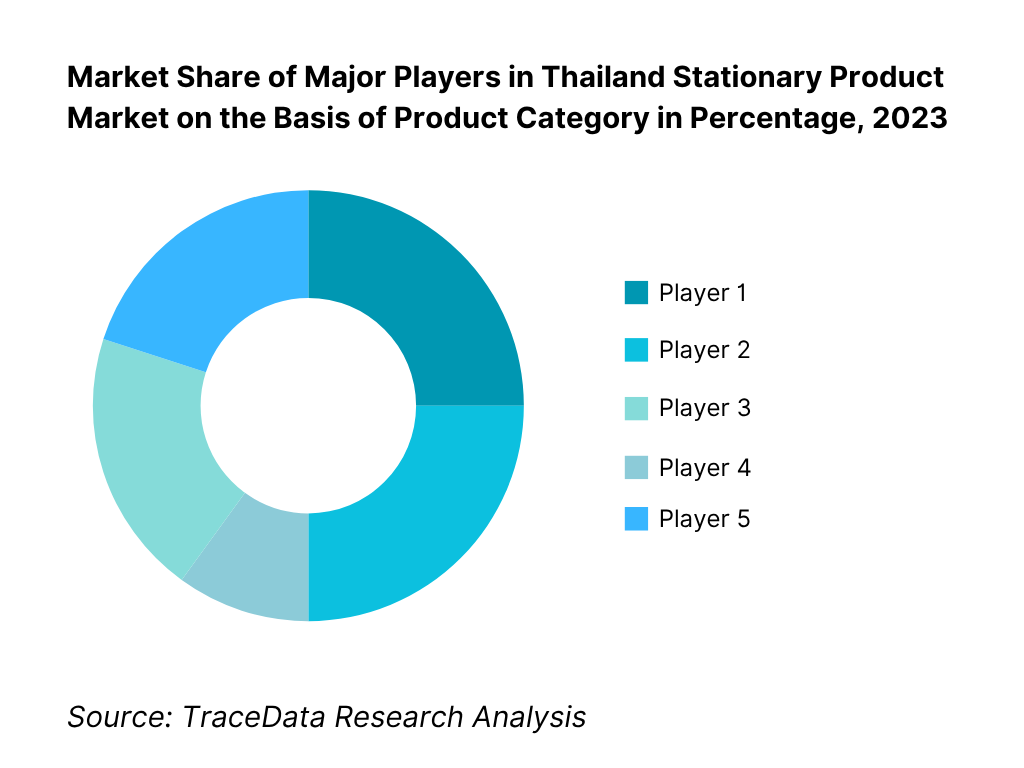

Competitive Landscape in Thailand Stationery Products Market

The Thailand stationery products market is moderately fragmented, with a mix of long-established local manufacturers, international brands, and emerging eco-friendly and e-commerce-focused players. Traditional retail giants, government-contracted suppliers, and imported premium brands dominate institutional and consumer segments. However, the rise of sustainability-conscious consumers and the expansion of digital marketplaces such as Shopee and Lazada have enabled newer entrants to gain visibility and market share across urban and semi-urban regions.

Name | Type | Founding Year |

Bangkok Bank | Bank | 1944 |

Kasikorn Bank | Bank | 1945 |

Siam Commercial Bank | Bank | 1907 |

Krungthai Bank | Bank | 1966 |

TMBThanachart Bank (TTB) | Bank | 1957 |

AEON Thana Sinsap | NBFC | 1992 |

Krungsri Auto | NBFC | 2003 |

Muang Thai Leasing | NBFC | 1992 |

Asia Sermkij Leasing | NBFC | 1984 |

Ngern Tid Lor Public Company | NBFC | 2001 |

Toyota Leasing (Thailand) | Captive | 1993 |

Honda Leasing (Thailand) | Captive | 2002 |

Nissan Leasing (Thailand) | Captive | 1997 |

Mercedes-Benz Leasing (Thailand) | Captive | 1988 |

BMW Financial Services Thailand | Captive | 1999 |

Some of the recent competitor trends and key information about major players include:

Double A (1991) Public Co., Ltd.: As Thailand’s most recognized paper brand, Double A continues to dominate the paper product segment with large-scale domestic manufacturing and export operations. In 2023, the company reported a production volume of over 600,000 tons of high-quality copier paper, supported by 1.5 million contracted farmers under its “KHAN-NA” sustainable pulp program. Its school and office paper products remain standard across institutions.

Pentel (Thailand) Co., Ltd.: Pentel strengthened its market share in 2023 through a 20% expansion in distribution partnerships with major retail chains like B2S and OfficeMate. The brand introduced new product lines featuring recycled plastic pens and refillable mechanical pencils aimed at school students and creative professionals. Pentel also increased its online visibility via exclusive Shopee campaigns during school reopening months.

Faber-Castell (Thailand): The company experienced 15% growth in premium stationery sales in 2023, driven by increased demand for colored pencils, sketch pens, and fine-art supplies among Thai consumers aged 18–35. Its focus on environmentally safe, non-toxic products, along with its “EcoPencil” range, made it a preferred brand in Bangkok’s high-income districts and international school circuits.

Horse Brand Stationery: Known for its wide range of correction fluids, stamp pads, and markers, Horse Brand registered a 10% increase in domestic volume sales in 2023 through institutional procurement contracts with over 500 government schools. The brand leveraged its price advantage and local manufacturing efficiency to dominate in Tier 2 and Tier 3 cities across Northern and Northeastern Thailand.

Deli Group (Thailand): Deli Group expanded aggressively in 2023 by launching over 150 new SKUs and entering strategic partnerships with over 300 independent stationery retailers. Its offerings—ranging from geometry sets to filing systems—target budget-conscious students and SMEs. The company also piloted a dedicated B2B ordering portal to streamline bulk procurement for schools and offices in semi-urban areas.

What Lies Ahead for Thailand Stationery Products Market?

The Thailand stationery products market is expected to witness steady growth by 2030, driven by a resurgence in educational infrastructure, rising consumer interest in eco-friendly products, and expanding digital retail access across both urban and rural areas. As institutions and consumers increasingly prioritize sustainability and customization, the market is likely to diversify with value-added offerings, smart stationery, and hybrid traditional-digital learning tools.

Growth in Institutional Procurement Linked to Education Reforms: As Thailand continues to allocate significant portions of its national budget toward educational development and infrastructure, public schools and universities are expected to increase procurement of core stationery items. Curriculum reforms and digitization efforts will also drive demand for both traditional and tech-compatible supplies—such as erasable smart notebooks, touchscreen-compatible pens, and modular folders—especially within vocational training centers and newly digitalized government schools.

Rising Demand for Sustainable Stationery Products: With heightened awareness around environmental impact, especially among Thailand’s urban youth and millennial demographic, the market is poised to see an uptick in biodegradable and recycled products. Local manufacturers are likely to adopt sustainable production techniques using bamboo, recycled paper, and plant-based inks. Government-led sustainability programs and public-sector eco-procurement mandates will further encourage this transition, offering new revenue streams for eco-focused brands.

Acceleration of Online and Omnichannel Retail Distribution: The rapid expansion of internet infrastructure and 5G coverage across Thailand will continue to transform how consumers purchase stationery. E-commerce giants and niche stationery portals will benefit from increased rural access and mobile-first shopping behavior. This shift will empower small and medium enterprises (SMEs) and independent artists to enter the stationery market with custom-designed products, enabling decentralized and high-margin retail models.

Integration of Technology into Traditional Stationery: The convergence of physical and digital learning tools will shape the next phase of product innovation in Thailand. Demand for stylus-enabled pens, reusable digital notebooks, and smart planners that sync with devices is anticipated to grow, particularly within higher education institutions and urban office spaces. Companies investing in R&D and IoT-based stationary innovations will gain a competitive edge by serving a growing hybrid-learning segment.

Supportive Government Initiatives and SME Development Programs: The Thai government’s push to strengthen local industries and improve supply chain localization will benefit domestic stationery manufacturers. Incentive programs like the "SME One ID" and soft loan schemes may enable small businesses to modernize production, expand distribution, and diversify product lines. This support will foster competition, encourage innovation, and reduce dependence on imported goods in key stationery categories.

Thailand Stationary Products Market Segmentation

By Product Category

Paper Products

Writing Instruments

Desk Supplies

School Supplies

Filing & Storage

By End User

Educational Institutions

Corporate Offices

Retail Consumers

Government and Public Sector

Resellers and Distributors

By Distribution Channel

Offline Retail

Online Retail Platforms

B2B Wholesale Distributors

Institutional Tender-Based Supply

By Material Type

Plastic-Based

Metal-Based

Paper-Based

Wood-Based

Eco-Friendly/Biodegradable Materials

By Region

Bangkok Metropolitan Region

Central Thailand

Northern Thailand

Northeastern Thailand

Southern Thailand

Players Mentioned in the Report

Double A Public Co., Ltd.

Pentel (Thailand) Co., Ltd.

Pilot Pen (Thailand) Co., Ltd.

Faber‑Castell (Thailand)

Deli Group (Thailand)

Zebra (Thailand) Co., Ltd.

Kokuyo International (Thailand) Co., Ltd.

Horse Brand Stationery

SKATE Stationery

Penton Co., Ltd.

Quantum Office Supplies Co., Ltd.

Comix Stationery

B2S (Central Group)

Thien Long (M&G)

Bi Hong Ha

Key Target Audience

Entities most likely to acquire this report:

Stationery Manufacturers & Brand Managers

Institutional Procurement Departments

Retail Chain Strategy Teams

Investment & Venture Capitalist Firms

Government & Regulatory Bodies

E‑commerce Platform Category Managers

Corporate Office Operations Teams

Crafts & Art Supplies Importers / Distributors

Time Period:

Historical Period: 2018-2023

Base Year: 2024

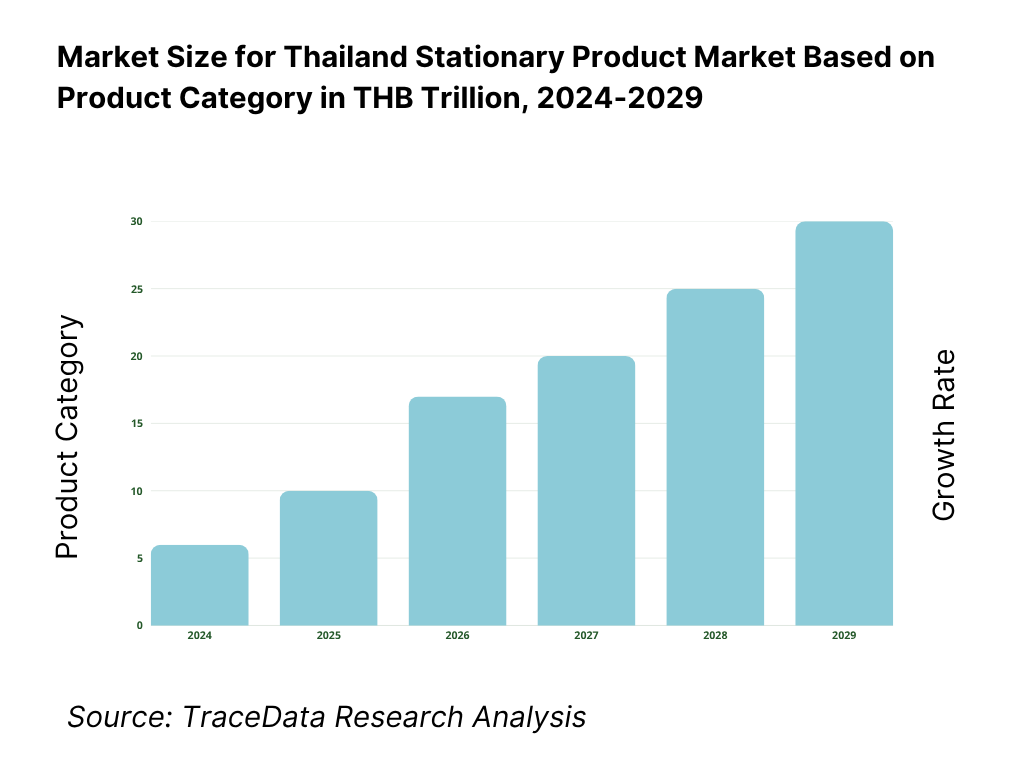

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Relationship and Engagement Models Between Manufacturers-Distributors-Retailers-Institutional Buyers

4.3. Supply Decision-Making Process

5.1. Stationery Sales in Thailand by Product Category, 2018-2024

8.1. Volume of Units Sold, 2018-2024

8.2. Value of Products Sold, 2018-2024

9.1. By Product Category (Paper Products, Writing Instruments, Desk Supplies, School Supplies, Filing & Storage), 2023-2024P

9.2. By Material Type (Plastic-Based, Paper-Based, Metal-Based, Eco-Friendly Materials), 2023-2024P

9.3. By Distribution Channel (Offline Retail, Online Marketplaces, B2B Tender, Wholesale), 2023-2024P

9.4. By End User (Educational Institutions, Corporate Offices, Government Agencies, Households), 2023-2024P

9.5. By Region (Bangkok, Central, Northern, Northeastern, Southern), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in the Thailand Stationery Products Market

11.2. Growth Drivers

11.3. SWOT Analysis for the Thailand Stationery Market

11.4. Issues and Challenges

11.5. Government Regulations

12.1. Market Size and Future Potential for Online Stationery Sales, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Retailers

13.1. Stationery Penetration Rate by User Group, 2018-2029

13.2. Changes in Consumption Behavior Over Time and Its Drivers

13.3. Product Categories with High Penetration

17.1. Market Share of Key Domestic Players, 2023

17.2. Market Share of Key Foreign Players, 2023

17.3. Benchmark of Key Competitors-Including Company Overview, USP, Business Strategies, Product Portfolio, Online Penetration, Institutional Tie-ups, Eco-Label Status

17.4. Strengths and Weaknesses

17.5. Operating Model Analysis Framework

17.6. Gartner Magic Quadrant

17.7. Bowmans Strategic Clock

18.1. Volume Projections, 2025-2029

18.2. Value Projections, 2025-2029

19.1. By Product Category, 2025-2029

19.2. By Material Type, 2025-2029

19.3. By Distribution Channel, 2025-2029

19.4. By End User, 2025-2029

19.5. By Region, 2025-2029

19.6. Analyst Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: We begin by mapping the ecosystem and identifying both the demand-side and supply-side entities within the Thailand Stationery Products Market. On the demand side, this includes schools, corporate offices, government institutions, and online buyers; while on the supply side, we assess domestic manufacturers, importers, distributors, and retail networks. Based on this mapping, we shortlist 5–6 key market players in the country, evaluating them on metrics such as SKU variety, institutional contract presence, geographic reach, and product innovation.

Sourcing Information: We utilize government education reports, customs and trade statistics, and multiple proprietary and open-access databases to conduct comprehensive desk research. This helps us gather verified industry-level insights such as import volumes, manufacturing output, and institutional procurement trends relevant to the stationery sector.

Step 2: Desk Research

Exhaustive Data Analysis: An extensive desk research process is undertaken, referencing sources such as government economic dashboards, World Bank public reports, and national trade portals. Our research includes analysis of production and consumption patterns, import-export dependencies, school enrollment data, employment by sector, and retail sales growth. This ensures a comprehensive understanding of the macroeconomic and microeconomic factors influencing the Thailand stationery products market.

Company-Level Data: In addition to industry-level insights, we collect and examine company-specific data from financial filings, brand websites, and public disclosures. This includes an assessment of product portfolios, pricing structures, eco-friendly initiatives, revenue segmentation (offline/online), and expansion strategies of each major stationery manufacturer and distributor operating in Thailand.

Step 3: Primary Research

Interviews with Key Stakeholders: We conduct direct interviews with senior executives, procurement heads, product managers, and industry specialists associated with major Thai and global stationery brands. These interviews are structured to validate our assumptions, understand demand shifts, gauge product innovation cycles, and verify institutional procurement timelines and volume cycles.

Validation through Disguised Interviews: To supplement the findings, our team also engages in disguised interviews with retailers, B2B distributors, and procurement agents, posing as potential clients. This enables us to gather on-ground operational data related to delivery timelines, order volumes, pricing tiers, margins, and product preferences. These insights are used to cross-verify official data shared by key players and uncover latent market dynamics.

Step 4: Sanity Check

- Data Validation and Market Modeling: Both bottom-up and top-down modeling frameworks are applied to validate our findings. Market size estimates and growth projections are rigorously cross-verified against actual import quantities, per capita consumption, school-level demand, and channel-specific revenue data. This multi-layered approach ensures that final estimates reflect both supply-side realities and consumption-side behavior, offering a reliable and data-backed understanding of the Thailand stationery products market.

FAQs

1. How big is the Thailand Stationery Products Market?

The Thailand stationery products market is valued at USD 867 million, supported by educational and office demand coupled with growing e‑commerce adoption.

2. What are the major challenges in the Thailand Stationery Products Market?

Key challenges include import dependency for premium materials, competition from digital alternatives, commodity-driven price volatility, and uneven online availability in rural areas.

3. Who are the major players in the Thailand Stationery Products Market?

Major players include Double A, Pentel, Pilot, Faber‑Castell, Deli, Zebra, Kokuyo, Thien Long, and others dominating through distribution, product range, institutional contracts, and digital channels.

4. What are the growth drivers of the Thailand Stationery Products Market?

Growth is driven by consistent educational demand, return‑to‑office trends, eco‑friendly product uptake, and expansion of online platforms like Shopee and Lazada.

5. What trends are shaping the Thailand Stationery Products Market?

- Current trends include personalized and artisanal stationery, eco-conscious materials, e‑commerce penetration, and smart/incorporated tech items (e.g. reusable notebooks).