Thailand Toys and Games Market Outlook to 2029

By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region

- Product Code: TDR0053

- Region: Asia

- Published on: October 2024

- Total Pages: 80-100

Report Summary

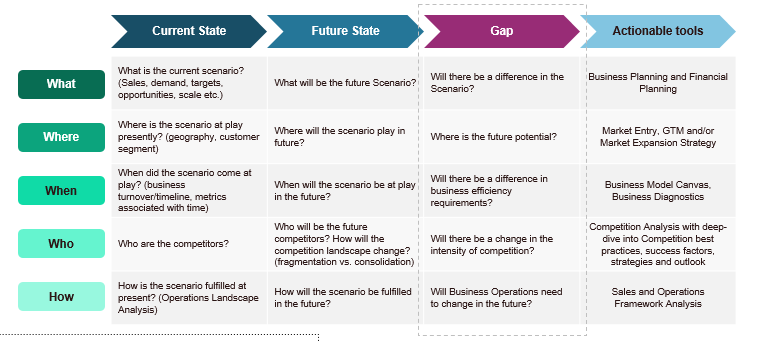

The report titled "Thailand Toys and Games Market Outlook to 2029 - By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By Region " provides a comprehensive analysis of the toys and games market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities, bottlenecks, and company profiling of major players in the toys and games market. The report concludes with future market projections based on sales revenue by product category, region, cause-and-effect relationships, and success case studies, highlighting major opportunities and cautions.

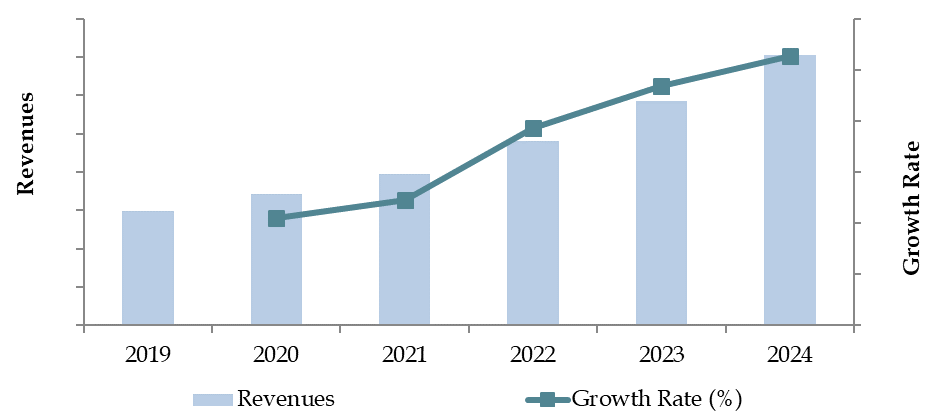

Thailand Toys and Games Market Overview and Size

The Thailand toys and games market reached a valuation of THB 20 billion in 2023, driven by increasing consumer spending, rising awareness of educational toys, and growing urbanization. The market is characterized by major players such as LEGO, Hasbro, Mattel, and Bandai Namco, along with local brands like PlanToys and B2S. These companies are recognized for their diverse product offerings, focus on innovation, and strong retail networks.

In 2023, LEGO introduced a new range of sustainable toys made from plant-based materials, aiming to meet the rising demand for eco-friendly products in Thailand. Additionally, e-commerce platforms like Lazada and Shopee have strengthened their presence, providing consumers with easy access to a wide range of toys and games. Bangkok and Chiang Mai are key markets due to their high population density and robust retail infrastructure, with a growing preference for premium and imported products in these areas.

Market Size for Thailand Toys and Games Industry on the Basis of Revenue in THB Billion, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Thailand Toys and Games Market:

Economic Factors: Rising disposable incomes and economic growth in Thailand have significantly increased consumer spending on toys and games. In 2023, toys and games purchases accounted for approximately 55% of household spending on child-related products. Parents are increasingly investing in educational and developmental toys, contributing to the market's expansion. Economic stability has also encouraged manufacturers to introduce a wider range of products catering to various income segments.

Growing Urban Population: Urbanization in Thailand has led to a surge in demand for modern toys and games, as families residing in cities seek more sophisticated and branded products for their children. The growth of the urban population, which has risen by 10% in the last five years, has further fueled demand for premium and imported toys. This demographic shift has led to an increased focus on innovation, design, and digital integration in toys.

Digitalization and Online Sales: The rise of e-commerce platforms and online marketplaces has transformed the way consumers purchase toys and games. In 2023, around 45% of toys and games sales in Thailand were conducted online, reflecting a growing shift towards digital channels. Online platforms offer convenience, variety, and detailed product information, making the buying process easier for parents. This trend is further supported by social media and influencer marketing, which play a crucial role in shaping consumer preferences.

Which Industry Challenges Have Impacted the Growth for Thailand Toys and Games Market

Quality and Safety Concerns: Concerns about product safety and quality remain significant challenges in the Thailand toys and games market. Approximately 45% of parents are hesitant to purchase toys due to fears of harmful materials and lack of safety certification, particularly for low-cost or non-branded products. This issue has led to a growing demand for certified, high-quality toys, but has also made it difficult for smaller or unregulated brands to compete in the market.

Regulatory Hurdles: Strict regulations regarding toy safety and environmental standards, such as the need for products to comply with the Thai Industrial Standards (TIS) and international safety norms, have posed challenges for manufacturers and importers. In 2023, around 18% of toys were reported to have failed to meet these standards, resulting in higher compliance costs and delays in product launches, particularly for smaller companies.

Competition from Digital Entertainment: The increasing popularity of digital entertainment, including mobile games and video streaming platforms, has posed a significant challenge to the traditional toys and games market. In 2023, screen-based activities accounted for a growing portion of children's entertainment, reducing demand for physical toys. This shift is forcing traditional toy manufacturers to innovate and create products that can compete with digital experiences.

What are the Regulations and Initiatives which have Governed the Market:

Toy Safety Standards: The Thai government enforces strict toy safety regulations under the Thai Industrial Standards (TIS), ensuring that all toys sold in the country meet specific safety criteria related to materials, design, and functionality. These standards focus on preventing hazards like choking, toxicity, and sharp edges. In 2023, around 80% of toys sold in Thailand were certified by the TIS, highlighting a high compliance rate among domestic and international brands.

Import Restrictions on Toys: The import of toys in Thailand is regulated by customs laws, which impose tariffs and safety checks. Imported toys must comply with both Thai and international safety standards, and non-compliance can result in product recalls or bans. In 2023, stricter enforcement of these regulations led to a 10% decline in the importation of non-compliant or low-quality toys, helping to protect consumers from unsafe products.

Government Support for Educational Toys: To promote early childhood development and learning, the Thai government has introduced initiatives that encourage the use of educational toys, particularly in schools and daycare centers. These initiatives include tax incentives for companies producing educational and STEM-focused toys. In 2023, educational toys accounted for 25% of total market sales, driven by increased awareness of their developmental benefits and government backing.

Thailand Toys and Games Market Segmentation

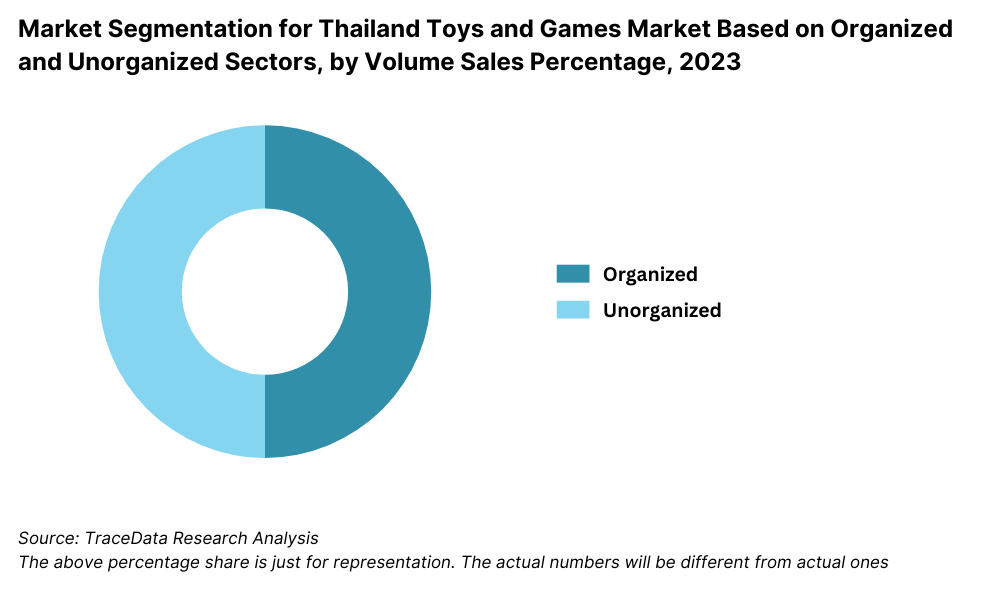

By Market Structure: Branded international toy manufacturers, such as LEGO, Mattel, and Hasbro, dominate the market due to their strong global reputation, product quality, and established retail partnerships. These brands are particularly popular in urban areas where consumers are willing to pay a premium for branded toys. Local manufacturers like PlanToys also hold a significant share, especially in the eco-friendly and educational toy segments, appealing to environmentally conscious and educationally focused consumers.

By Age Group: The toys and games market in Thailand is segmented into various age groups. The 3-8 year age group holds the largest share, as parents prioritize educational and developmental toys for young children. Toys for infants (0-2 years) and older children (9-14 years) also contribute significantly to the market, with the latter driven by demand for board games, action figures, and electronic toys.

By Distribution Channels: Physical retail stores, including department stores and toy specialty shops, dominate the distribution channel in the Thailand market, accounting for a majority of the sales. However, online platforms like Shopee and Lazada are rapidly gaining market share, especially post-pandemic, due to the convenience and wider selection they offer.

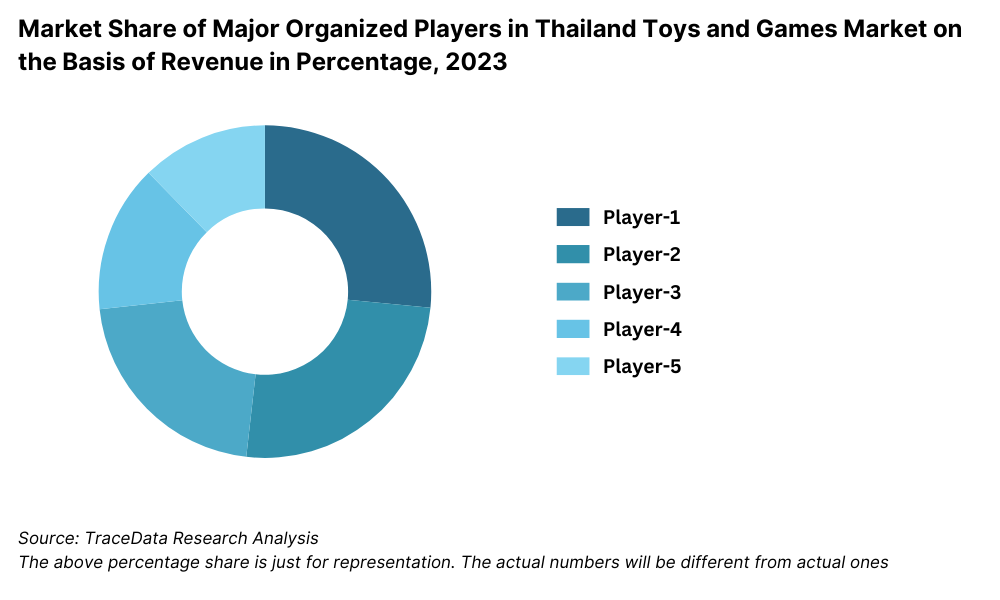

Competitive Landscape in Thailand Toys and Games Market

The Thailand toys and games market is moderately concentrated, with both international and domestic players competing for market share. While global brands like LEGO, Mattel, and Hasbro lead the premium and branded segment, local companies such as PlanToys and B2S have strengthened their positions by focusing on eco-friendly and educational toys. The rise of e-commerce platforms such as Lazada, Shopee, and Central Online has diversified the market, offering consumers a wider range of choices and competitive prices.

| Company Name | Establishment Year | Headquarters |

|---|---|---|

| PlanToys | 1981 | Trang, Thailand |

| Mattel Bangkok Limited | 1998 | Samut Prakan, Thailand (subsidiary of Mattel Inc., USA) |

| Hasbro Inc. | 1923 | Pawtucket, Rhode Island, USA |

| Lego A/S | 1932 | Billund, Denmark |

| Toys"R"Us (Thailand) | 1996 | Bangkok, Thailand |

| Garena (Thailand) | 2009 | Singapore (operating in Thailand) |

Some of the recent competitor trends and key information about competitors include:

LEGO: As a leader in the construction toy category, LEGO has increased its market share in Thailand by launching eco-friendly products and focusing on educational sets. In 2023, the brand introduced a new line of plant-based plastic toys, which contributed to a 15% rise in sales compared to the previous year.

Mattel: Known for iconic brands like Barbie and Hot Wheels, Mattel reported a 10% increase in sales in Thailand in 2023, driven by new product launches and successful marketing campaigns. The company also expanded its partnership with local retailers to strengthen its distribution network.

PlanToys: A pioneer in sustainable toys, PlanToys has captured a growing market share by promoting eco-friendly products. In 2023, PlanToys saw a 20% growth in sales, with strong demand from environmentally conscious consumers. The company’s emphasis on developmental and educational toys has made it a popular choice among parents and schools.

B2S: As a leading retailer of books and educational toys in Thailand, B2S has leveraged its extensive retail presence to grow its share in the toys and games market. The company reported a 12% increase in sales in 2023, with a focus on educational and STEM toys.

Shopee: One of the largest e-commerce platforms in Southeast Asia, Shopee recorded a 25% increase in toy sales in 2023. The platform’s extensive product offerings, competitive pricing, and convenient shopping experience have made it a go-to destination for toy buyers in Thailand.

Lazada: Known for its strong logistics network, Lazada saw a 20% increase in toy sales in 2023, driven by promotional campaigns and exclusive partnerships with international toy brands. The platform’s seamless shopping experience and fast delivery options have contributed to its growing popularity in Thailand.

What Lies Ahead for Thailand Toys and Games Market?

The Thailand toys and games market is projected to grow steadily through 2029, exhibiting a healthy CAGR during the forecast period. This growth will be driven by factors such as increasing disposable incomes, rising demand for educational toys, and the expansion of e-commerce platforms. The market is also expected to benefit from evolving consumer preferences toward sustainable and interactive products.

Shift Towards Digital and Interactive Toys: As technology becomes more integrated into children’s lives, there is anticipated to be a significant rise in demand for digital and interactive toys, including augmented reality (AR) and app-connected products. This shift will be driven by the growing use of mobile devices and parental preferences for educational and engaging digital content.

Rise in STEM and Educational Toys: The demand for STEM (Science, Technology, Engineering, and Math) toys is expected to continue rising as parents and educational institutions emphasize early childhood development and skills building. By 2029, educational toys are likely to constitute a larger share of the overall market, with significant investments in products that combine play with learning.

Growth of Eco-Friendly Toys: With increasing awareness of environmental sustainability, consumers are showing a preference for eco-friendly toys made from recycled or sustainable materials. Companies that prioritize sustainable practices in their production processes are expected to gain market share, and government initiatives promoting green products will further support this trend.

Expansion of E-Commerce: The rapid growth of online platforms, such as Shopee and Lazada, is expected to continue reshaping the toys and games market. E-commerce will allow consumers across Thailand, including those in rural areas, to access a wider variety of products, driving overall market growth. Additionally, online retailers are expected to offer more personalized recommendations and promotions based on consumer behavior analytics, improving the shopping experience.

Future Outlook and Projections for UAE Toys and Games Market on the Basis of Revenues in USD Billion, 2024-2029

Source: TraceData Research Analysis

Thailand Toys and Games Market Segmentation

- By Market Structure:

- Organized

- Unorganized

- By Product Type:

- Action Figures

- Dolls and Plush Toys

- Educational and STEM Toys

- Board Games and Puzzles

- Construction Sets

- Outdoor and Sports Toys

- Electronic and Digital Games

- By Age Group:

- Infants (0-2 years)

- Toddlers (3-5 years)

- Children (6-8 years)

- Preteens (9-12 years)

- Teenagers (13-15 years)

- By Distribution Channel:

- Online (Shopee, Lazada, Central Online)

- Offline (Retail Stores, Department Stores)

- By Region:

- Bangkok

- Northern Thailand

- Southern Thailand

- Central Thailand

- Eastern Thailand

Players Mentioned in the Report:

- Mattel Inc.

- Hasbro Inc.

- LEGO Group

- JAKKS Pacific

- Bandai Namco Holdings Inc.

- Nintendo Co. Ltd

- Sony Corporation

- Activision Blizzard

- Microsoft Corporation

- Garena Online (Thailand) Co. Ltd.

Key Target Audience:

- Toy Manufacturers

- Online and Offline Retailers

- Educational Institutions

- Government and Regulatory Bodies (e.g., Ministry of Commerce)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the Thailand Toys and Games Market

5.1. Population by Age Group

5.2. Estimated Time Spent by Age Group on Toys and Recreational Activities

5.3. Number of Distributors in Thailand for Toys and Games with their Contact Details

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Action Figures, Ride-Ons and others), 2023-2024P

9.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2023-2024P

9.4. By Distribution Channel (Specialty Stores, Hypermarkets/ Supermarkets, Online Channels), 2023-2024P

9.5. By Region, 2023-2024P

9.6. By Price Range, 2023-2024P

9.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2023-2024P

10.1. Customer Segmentation and Profile

10.2. Customer Journey and Buying Decision Process

10.3. Key Motivations and Pain Points

10.4. Product Preferences and Buying Trends

11.1. Trends and Developments in Thailand Toys and Games Market

11.2. Growth Drivers for Thailand Toys and Games Market

11.3. SWOT Analysis for Thailand Toys and Games Market

11.4. Issues and Challenges for Thailand Toys and Games Market

11.5. Government Regulations for Thailand Toys and Games Market

12.1. Market Size and Future Potential for Online Toys and Games Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Toy Platforms Basis Operational and Financial Parameters

15.1. Market Share of Key Organized Brands in Thailand Toys and Games Market, FY2024

15.2. Market Share of Key Distributors in Thailand Toys and Games Market, FY2024

15.3. Benchmark of Key Competitors in Thailand Toys and Games Market Including Operational and Financial Parameters

15.4. Strength and Weakness Analysis

15.5. Operating Model Analysis Framework

15.6. Porters Five Forces Analysis for Competitor Strategy

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), 2025-2029

17.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2025-2029

17.4. By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels), 2025-2029

17.5. By Region, 2025-2029

17.6. By Price Range, 2025-2029

17.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2025-2029

17.8. Recommendation and Strategic Insights

17.9. Opportunity Analysis for Thailand Toys and Games Market

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Thailand Toys and Games Market. This includes key manufacturers, distributors, retailers, and consumers. Based on this ecosystem, we will shortlist leading 5-6 companies operating in Thailand using financial data, market share, and production volumes.

Sourcing is conducted through industry articles, market reports, and proprietary databases to perform desk research, gathering comprehensive industry-level information.

Step 2: Desk Research

A detailed desk research process is then initiated by referencing multiple secondary and proprietary sources. This helps analyze the overall market by examining sales revenue, number of competitors, pricing trends, and consumer demand. This research also includes an examination of company-level data through press releases, annual reports, and financial statements. The goal is to build a thorough understanding of the market landscape and the key players involved.

Step 3: Primary Research

Conduct in-depth interviews with C-level executives, industry experts, and stakeholders from various companies in the Thailand Toys and Games Market. These interviews help validate market assumptions, verify statistical data, and gather additional insights on operations, pricing strategies, and distribution channels.

Additionally, disguised interviews are conducted, where our team approaches companies as potential customers. This approach allows us to verify the operational and financial data shared by executives, providing a more comprehensive understanding of market dynamics, value chains, and sales channels.

Step 4: Sanity Check

- A bottom-up and top-down approach is used to cross-validate data, ensuring the accuracy of market size modeling. This sanity check process helps confirm the overall market size and provides a clear view of market trends and future projections.

FAQs

01 What is the potential for the Thailand Toys and Games Market?

The Thailand toys and games market is expected to experience substantial growth through 2029, driven by rising disposable incomes, increasing demand for educational and developmental toys, and the growing presence of e-commerce. The market's potential is further enhanced by consumer preferences for digital and interactive toys, as well as eco-friendly products, which are gaining traction among environmentally conscious buyers.

02 Who are the Key Players in the Thailand Toys and Games Market?

The Thailand Toys and Games Market is led by major international players such as LEGO, Mattel, and Hasbro, as well as domestic brands like PlanToys and B2S. These companies dominate the market due to their strong brand reputation, innovative product offerings, and extensive distribution networks. E-commerce platforms like Shopee and Lazada also play a significant role in expanding the market reach.

03 What are the Growth Drivers for the Thailand Toys and Games Market?

Key growth drivers include increasing consumer spending on toys, a growing awareness of the importance of educational toys for child development, and the expansion of online retail platforms. Additionally, the shift toward STEM-based and eco-friendly toys reflects evolving consumer preferences, further boosting market growth. The rise of digital and app-connected toys also contributes to the market’s evolution.

04 What are the Challenges in the Thailand Toys and Games Market?

The market faces several challenges, including safety and quality concerns, especially with lower-cost or unbranded products. Stringent regulatory requirements for toy safety and environmental compliance can increase costs for manufacturers. Moreover, competition from digital entertainment platforms, such as mobile games and video content, poses a challenge to traditional toy manufacturers, as more children engage with screen-based entertainment.