Thailand Used Agricultural Equipment Market Outlook to 2029

By Segment (Tractors, Combine Harvesters, Rice Transplanters and Implements), By Channel (C2C Channels, Multi-Brand Dealers, Bank Repossessed Equipment, and OEM Organized), By Age of Equipment and By Region

- Product Code: TDR0082

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Thailand Used Agricultural Equipment Market Outlook to 2029 - By Segment (Tractors, Combine Harvesters, Rice Transplanters and Implements), By Channel (C2C Channels, Multi-Brand Dealers, Bank Repossessed Equipment, and OEM Organized), By Age of Equipment and By Region” provides a comprehensive analysis of the used agricultural equipment market in Thailand. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Used Agricultural Equipment Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Thailand Used Agricultural Equipment Market Overview and Size

The Thailand used agricultural equipment market reached a valuation of THB 15 Billion in 2023, driven by the increasing demand for affordable farming machinery, aging equipment fleets, and growing awareness of cost-saving measures among farmers. The market is characterized by major players such as Siam Kubota Corporation, Yanmar, John Deere Thailand, and AGCO Corporation. These companies are recognized for their extensive distribution networks, diverse equipment offerings, and customer-focused services.

In 2023, Siam Kubota Corporation introduced a refurbished equipment program aimed at enhancing the availability of quality used machinery for small and medium-scale farmers. This initiative is expected to drive growth in the used equipment segment, especially in key agricultural regions such as the Central Plains and Northeastern Thailand.

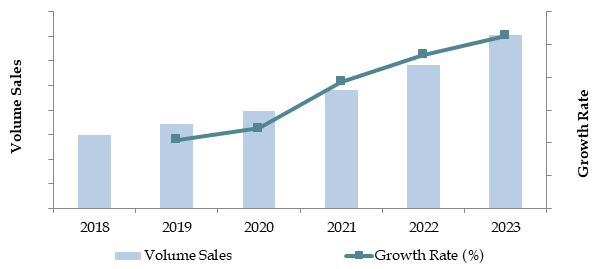

Market Size for Thailand Used Agricultural Equipment Industry on the Basis of Volume Sales in Units, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Thailand Used Agricultural Equipment Market:

Economic Factors: The rising cost of new agricultural machinery and economic pressures on small-scale farmers have significantly shifted preferences towards used equipment. In 2023, used agricultural equipment accounted for approximately 60% of total equipment sales in Thailand, offering cost savings of up to 50% compared to new machinery. This trend is particularly strong among farmers looking to minimize operational costs while maintaining productivity.

Government Subsidies: The Thai government’s financial support for agricultural development, including subsidies for acquiring used machinery, has played a crucial role in promoting the market. In recent years, these subsidies have made used equipment a more viable option for farmers with limited capital, leading to increased adoption and market growth.

Technological Advancements: The introduction of more durable and high-performance machinery has extended the lifecycle of agricultural equipment, making the used equipment market more attractive. Technological improvements in equipment design and materials have increased the resale value of such machinery, further driving market growth as farmers seek reliable and cost-effective solutions.

Which Industry Challenges Have Impacted the Growth for Thailand Used Agricultural Equipment Market:

Quality and Trust Issues: Concerns about the condition and reliability of used agricultural equipment remain significant challenges. According to recent industry reports, approximately 45% of farmers are hesitant to purchase used machinery due to fears of hidden defects and the lack of transparent maintenance records. This issue has led to a lower trust level among buyers, potentially deterring up to 25% of prospective purchasers from considering used equipment.

Regulatory Compliance: Stringent regulations regarding emissions and safety standards can limit the availability of older agricultural equipment. In 2023, it was reported that around 18% of used equipment offerings in the market failed to meet the mandatory inspection standards. These regulations impose significant costs, particularly on smaller dealers and individual sellers, making it challenging for them to comply and reducing the variety of available equipment.

Financing Barriers: Limited access to credit and financing options for used equipment purchases remains a critical barrier, particularly for small-scale farmers. Data indicates that approximately 35% of potential buyers face difficulties in securing loans for used agricultural equipment. This limitation restricts market access for a significant segment of the farming population and constrains overall market growth.

What are the Regulations and Initiatives which have Governed the Market:

Equipment Inspection Regulations: The Thai government mandates regular inspections of agricultural equipment to ensure compliance with safety and environmental standards. These inspections are required every two years and focus on critical components such as engine performance, emission levels, and operational safety features. In 2022, approximately 80% of used agricultural equipment passed the inspection on their first attempt, reflecting a high level of compliance and maintenance among equipment owners and dealers in the market.

Import Restrictions on Used Agricultural Equipment: Strict regulations govern the importation of used agricultural machinery into Thailand, including a maximum age limit of 7 years for most equipment types. All imported machinery must adhere to the ASEAN safety and emissions standards to be eligible for entry into the country. In 2023, imports of used agricultural equipment decreased by 10% due to enhanced enforcement of these regulations and increased scrutiny at customs checkpoints, aiming to ensure only high-quality and environmentally compliant machinery enters the Thai market.

Government Subsidies for Sustainable Farming Equipment: To promote sustainable and efficient agricultural practices, the Thai government has introduced various subsidies and financial incentives for the purchase of modern and environmentally friendly used equipment. These incentives include low-interest loans, tax deductions, and direct subsidies covering up to 30% of the equipment's cost. In 2023, these programs contributed to a 15% increase in sales of sustainable used agricultural machinery, such as equipment supporting precision farming and reduced fuel consumption, aiding farmers in adopting greener and more productive farming methods.

Thailand Used Agricultural Equipment Market Segmentation

By Type of Agricultural Equipment: In the Thailand agricultural equipment market, tractors are the leading product type within the segment of farm machinery. Tractors dominate due to their essential role in a wide range of agricultural activities, from plowing to transporting goods. The high demand for tractors in Thailand is driven by the country's large agricultural sector, where mechanization is increasingly replacing traditional farming methods to improve productivity. Combine harvesters and rice transplanters are also important, particularly in rice cultivation, which is a significant part of Thailand's agriculture, but they are more specialized compared to tractors, leading to their lower market share.

By Sales Channel: In terms of market structure, the unorganized market has a significant presence in the used agricultural equipment sector in Thailand. The unorganized market, consisting of smaller dealers, individual sellers, and informal networks, often provides more accessible pricing options for farmers. This segment is particularly dominant in rural areas where formal dealership networks may be less established. However, the organized market is gradually gaining ground as more farmers recognize the benefits of purchasing used equipment from established dealers who offer some level of warranty, financing options, and after-sales service, albeit for a slightly higher price. Regarding the origin of sale for organized dealers, the C2C channels (Consumer-to-Consumer) dominate the used agricultural equipment market in Thailand. Farmers frequently buy and sell equipment directly to one another through informal networks, local markets, or online platforms. This method allows for lower prices, as there are no intermediaries. However, multi-brand dealers and bank repossessed equipment sales are also significant, as they offer more reliability in terms of product condition and legal ownership

By Average Replacement Period: When it comes to the average replacement period in the used equipment market, tractors and other agricultural machinery are often kept in operation for extended periods due to their durability. The replacement period for used equipment is influenced by the availability of spare parts, maintenance costs, and the overall condition of the machinery. As a result, used equipment may be resold multiple times before it is finally decommissioned. Brands known for their reliability and longevity tend to dominate this segment, as their equipment can be used and resold multiple times with minimal depreciation in performance.

Competitive Landscape in Thailand Used Agricultural Equipment Market

The Thailand used agricultural equipment market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of online platforms such as Siam Kubota Corporation, Yanmar, John Deere Thailand, AGCO Corporation, and New Holland have diversified the market, offering farmers more choices and services.

| Name | Founding Year | Original Headquarters |

| Siam Kubota Thailand | 1978 | Bangkok, Thailand |

| John Deere Thailand | 1837 (Thailand: 1999) | Moline, Illinois, USA |

| Mitsubishi Mahindra Agricultural Machinery (Thailand) | 2015 | Chachoengsao, Thailand |

| Usedmachinery.bz | 2005 | Bangkok, Thailand |

| Tractor Corner Thailand | 2016 | Bangkok, Thailand |

| Thaitractor.com | 2009 | Bangkok, Thailand |

| Machine Serve Co., Ltd. | 2012 | Bangkok, Thailand |

| Mascus Thailand | 2001 | Amsterdam, Netherlands (Operations in Thailand) |

| Tractor2hand.com | 2008 | Bangkok, Thailand |

Some of the recent competitor trends and key information about competitors include:

Siam Kubota Corporation: As one of the leading agricultural equipment manufacturers in Thailand, Siam Kubota recorded a 15% increase in used equipment sales in 2023, driven by the launch of a refurbished equipment program targeting small and medium-scale farmers. The company’s extensive service network and reliable after-sales support have made it a preferred choice among farmers.

Yanmar: Known for its durable and efficient machinery, Yanmar saw a 20% growth in used equipment sales in 2023, particularly in the tractor and harvester segments. The company's focus on integrating modern technology with traditional farming practices has been well received by Thai farmers looking for reliable and cost-effective equipment.

John Deere Thailand: John Deere reported a 25% increase in sales of used agricultural equipment in 2023, primarily due to its strong dealer network and the introduction of financing options for used machinery. The company's emphasis on providing high-quality, performance-driven equipment has strengthened its market position.

AGCO Corporation: Specializing in a wide range of agricultural equipment, AGCO saw a 10% increase in used equipment sales in 2023, with significant demand for its advanced precision farming tools. The company’s commitment to innovation and sustainability has attracted a growing customer base in Thailand.

New Holland: New Holland recorded a 12% growth in used equipment sales in 2023, with a notable increase in demand for its eco-friendly machinery. The company's efforts to promote sustainable farming practices through its product offerings have resonated well with environmentally conscious farmers in Thailand.

What Lies Ahead for Thailand Used Agricultural Equipment Market?

The Thailand used agricultural equipment market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by economic factors, government support, and increasing adoption of modern agricultural practices.

Shift Towards Precision Agriculture: As the Thai government continues to promote modern and efficient farming practices, there is anticipated to be a gradual increase in the demand for used equipment that supports precision agriculture. This trend is supported by government incentives and a growing awareness among farmers of the benefits of precision farming, such as increased crop yields and reduced resource usage.

Integration of Smart Technology: The integration of advanced technologies such as IoT (Internet of Things) and data analytics in agricultural equipment is expected to provide farmers with more accurate and actionable insights. This technological advancement will enhance the efficiency of farming operations, boost productivity, and make the used equipment market more attractive to tech-savvy farmers.

Growth of Refurbished Equipment Programs: The market is seeing a growing trend towards refurbished equipment programs, where used machinery undergoes rigorous inspections and comes with warranties. This trend is particularly strong among small and medium-scale farmers who seek cost-effective yet reliable solutions. The increasing availability of refurbished equipment is expected to attract more buyers who prioritize performance and post-purchase support.

Focus on Sustainable Farming Practices: There is a rising trend towards sustainable farming practices within the agricultural sector. This includes the use of eco-friendly machinery, such as equipment that reduces fuel consumption and emissions. These practices are becoming increasingly important to farmers who are environmentally conscious and are expected to influence purchasing decisions in the used equipment market.

Future Outlook and Projections for Thailand Used Agricultural Equipment Market on the Basis of Volume Sales in Units, 2024-2029

Thailand Used Agricultural Equipment Market Segmentation

- By Market Structure:

- Auction Companies

- C2C

- Multi-Brand Non-Franchise Dealerships

- OEM Certified Dealers

- By Type of Equipment:

- Tractors

- Harvesters

- Tillers

- Seeders

- Plows

- Sprayers

- By Age of Equipment:

- <3 years

- 3-5 years

- 5-10 years

- 10 years

- By Payment:

- Financed

- Non-Financed

- By Region:

- Central

- Northern

- Northeastern

- Southern

- Eastern

Players Mentioned in the Report:

- Siam Kubota Thailand

- John Deere Thailand

- Mitsubishi Mahindra Agricultural Machinery (Thailand)

- Usedmachinery.bz

- Tractor Corner Thailand

- Thaitractor.com

- Machine Serve Co., Ltd.

- Mascus Thailand

- Tractor2hand.com

Key Target Audience:

- Used Agricultural Equipment Dealers

- Online Equipment Marketplaces

- Agricultural Financing Companies

- Regulatory Bodies (e.g., Ministry of Agriculture and Cooperatives)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Export & Import of Food Crops in Thailand-By Value & Volume, 2023-2024P

4.2. Agricultural Indicators in Thailand & Agricultural Land Area by Utilization in Thailand, 2023-2024P

4.3. Agricultural GDP of Thailand & Production of Top 5 Crops in Thailand, 2023-2024P

4.4. Relevance of agriculture in selected APEC member economies (Contribution of Agriculture, Forestry & Fishing towards Overall GDP, 2023)

4.5. Significance of Technology in Thailand Agriculture Equipment Market (Agribusiness Tools, Digital Marketplace Tools and Digital Tools; Map of Technology and Maturity Stage in Thailand Agriculture Ecosystem)

5.1. Production of Small-Holder Estate Crops, 2018-2024

5.2. Production of Large-Holder Estate Crops, 2018-2024

5.3. Paddy / Rice Production in Thailand (Paddy Production, Paddy Harvested Area, Revenue from Rice Segment and Rice Consumption by Age, 2018-2024)

5.4. Cropping Pattern of Rice in Thailand (Cropping Cycle of Rice in Thailand, Major Rice Producing Regions and Average Temperature in Major Agricultural Regions during Cropping Cycle)

5.5. Characteristics of Farmers & Cross Comparison of Farm Labor Wages, 2020-2023 (Nominal Wages and Real Wages)

5.6. Farmer Decision Making Parameters (Region / Soil Properties, Land Holding Size, Type of Crops, Brand Value & Price, Credit Availability, Fuel Efficiency and After Sales Services & Maintenance Cost)

6.1. Value Chain Process-Role of Entities, Operating Model, Margins Stakeholders, and Challenges they face

6.2. Business Model Canvas for Thailand Agriculture Equipment Market

6.3. Sourcing Model for Used Agricultural Equipment in India

7.1. Equipment Usage Ratio in Thailand, 2018-2024

7.2. Spend on Farming Inputs in Thailand, 2024

10.1. Revenues, 2018-2024P

10.2. Sales Volume, 2018-2024

10.3. Used: New Ratio, 2018-2024

11.1. By Product Type (Tractors, Combine Harvesters, Rice Transplanters and Implements), 2018-2024P

11.2. By Market Structure (Organized and Unorganized Market), 2023-2024P

11.3. By Origin of Sale for Organized Dealers (C2C Channels, Multi-Brand Dealers, Bank Repossessed Equipment, and OEM Organized), 2023-2024P

11.4. By Average Replacement Period, 2023-2024P

11.5. By Financed and Non-Financed, 2023-2024P

12.1. Farmer Landscape and Cohort Analysis

12.2. Farmer Journey and Decision Making

12.3. Need, Desire, and Pain Point Analysis

12.4. Gap Analysis Framework

13.1. Trends and Developments for Thailand Used Agriculture Equipment Market

13.2. Growth Drivers for Thailand Used Agriculture Equipment Market

13.3. SWOT Analysis for Thailand Used Agriculture Equipment Market

13.4. Issues and Challenges for Thailand Used Agriculture Equipment Market

13.5. Government Regulations for Thailand Used Agriculture Equipment Market

14.1. Total Finance Disbursed for Used Agricultural Equipment Sales in Thailand, 2018-2024P

14.2. Finance Penetration Rate and Average Down Payment for Used Agriculture Equipment, 2018-2029

14.3. How the Finance Penetration Rates are Changing Over the Years with Reasons

14.4. Type of Used Equipment Segment for which Finance Penetration is Higher

14.5. Used Agriculture Equipment Finance Split by Banks/NBFCs/Private Finance Companies and Captive Entities, 2023-2024P

14.6. Average Used Agriculture Equipment Finance Tenure in Thailand

17.1. Market Size and Future Potential for Online B2C and C2B used Agriculture Equipment market based on transactions, 2018-2029

17.2. Business Model and Revenue Streams

17.3. Cross comparison of leading online used Agri-equipment Companies basis Operational and Financial variables

18.1. Market Share of Key Players in Thailand Used Agri-Equipment Market, 2023

18.2. Benchmark of Key Competitors in Thailand Used Agriculture Equipment Market Including Operational and Financial Variables

18.3. Strength and Weakness

18.4. Operating Model Analysis Framework

18.5. Gartner Magic Quadrant

18.6. Bowmans Strategic Clock for Competitive Advantage

19.1. Revenues, 2025-2029

19.2. Sales Volume, 2025-2029

19.3. Used: New Ratio, 2025-2029

20.1. By Product Type (Tractors, Combine Harvesters, Rice Transplanters and Implements), 2025-2029

20.2. By Market Structure (Organized and Unorganized Market), 2025-2029

20.3. By Origin of Sale for Organized Dealers (C2C Channels, Multi-Brand Dealers, Bank Repossessed Equipment, and OEM Organized), 2025-2029

20.4. By Average Replacement Period, 2025-2029

20.5. Recommendation

20.6. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: Identify all the demand-side and supply-side entities within the Thailand Used Agricultural Equipment Market. Based on this ecosystem, we will shortlist leading 5-6 equipment manufacturers and dealers in the country by analyzing their financial information, production capacity/volume, and market reach.

Data Sourcing: Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market and collate comprehensive industry-level information.

Step 2: Desk Research

Comprehensive Desk Research: Engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating insights such as sales revenues, the number of market players, pricing levels, demand, and other key variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and other relevant documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

In-depth Interviews: Initiate a series of in-depth interviews with C-level executives and other stakeholders representing various companies and end-users within the Thailand Used Agricultural Equipment Market. This interview process serves multiple purposes: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from industry representatives. A bottom-to-top approach is undertaken to evaluate sales volumes for each player, thereby aggregating to the overall market.

Validation Strategy: As part of our validation strategy, the team executes disguised interviews by approaching each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives and corroborate this data against secondary databases. These interactions also provide a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

- Sanity Check Process: Bottom-to-top and top-to-bottom analyses, along with market size modeling exercises, are undertaken to assess and ensure the accuracy and reliability of the data.

FAQs

1. What is the potential for the Thailand Used Agricultural Equipment Market?

The Thailand used agricultural equipment market is poised for substantial growth, driven by the increasing need for cost-effective machinery, government support for sustainable farming, and the shift towards modern agricultural practices. The market's potential is further bolstered by rising adoption of precision farming technologies, which enhances productivity while reducing operational costs.

2. Who are the Key Players in the Thailand Used Agricultural Equipment Market?

The Thailand Used Agricultural Equipment Market features several key players, including Siam Kubota Corporation, Yanmar, and John Deere Thailand. These companies dominate the market due to their extensive distribution networks, strong brand presence, and diverse equipment offerings. Other notable players include AGCO Corporation and New Holland.

3. What are the Growth Drivers for the Thailand Used Agricultural Equipment Market?

The primary growth drivers include economic factors, such as the high cost of new machinery and financial pressures on small-scale farmers, which make used equipment a more attractive option. Government subsidies for agricultural development, combined with increased awareness of sustainable farming practices, also contribute to the growing demand for used agricultural equipment.

4. What are the Challenges in the Thailand Used Agricultural Equipment Market?

The Thailand Used Agricultural Equipment Market faces several challenges, including quality and trust issues related to the condition and performance of used machinery. Regulatory challenges, such as stringent inspection and emissions standards, can also impact the availability of older equipment models. Additionally, limited access to financing options for purchasing used equipment poses significant barriers to market growth, particularly for small-scale farmers.