UAE AI in Healthcare Market Outlook to 2030

By Use Case, By Care Setting, By Technology, By Deployment Model, By Buyer Type, and By Emirate

- Product Code: TDR0363

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “UAE AI in Healthcare Market Outlook to 2030 – By Use Case, By Care Setting, By Technology, By Deployment Model, By Buyer Type, and By Emirate” provides a comprehensive analysis of the AI-driven transformation within the healthcare sector of the United Arab Emirates. The report covers the overview and genesis of the industry, overall market size in terms of revenue, and in-depth market segmentation by clinical and operational applications. It also provides insights into major trends and developments, the regulatory and licensing landscape including PDPL, SaMD, and ADHICS, as well as customer-level profiling that highlights procurement practices of both public and private providers. The report concludes with future market projections based on volumes of imaging studies, AI module deployment, hospital adoption patterns, emirate-level demand, and cause-and-effect relationships. Success case studies are included to highlight both major opportunities and cautions for stakeholders across the UAE healthcare ecosystem.

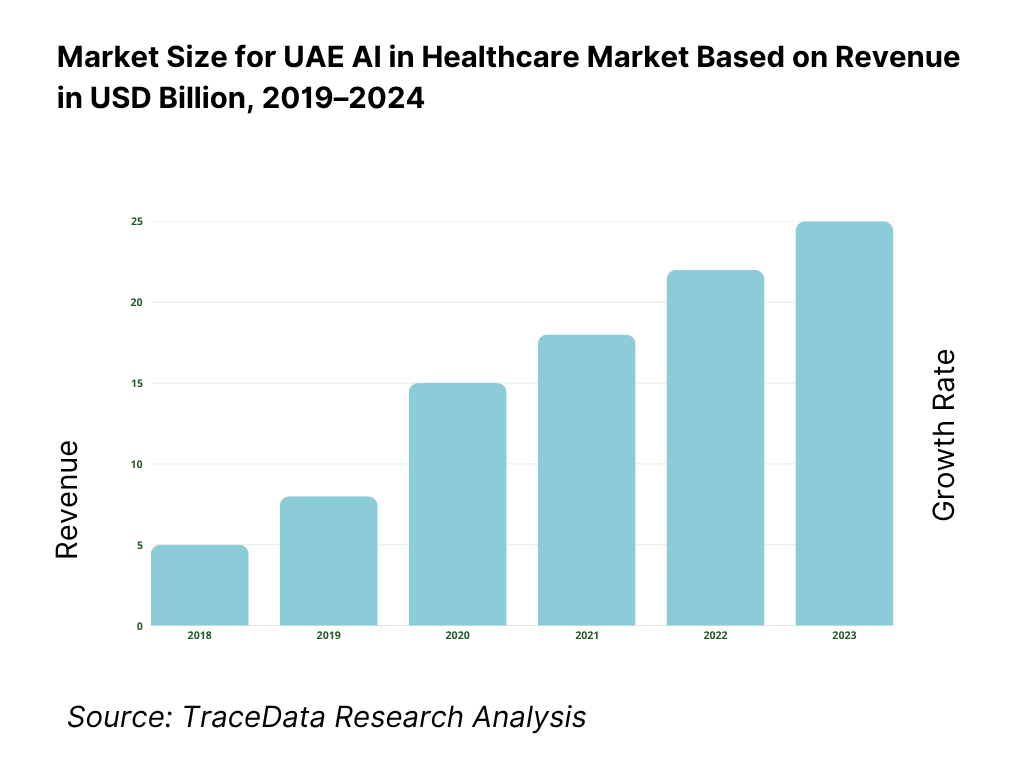

UAE AI in Healthcare Market Overview and Size

The UAE AI in Healthcare market is valued at USD 17.2 million in 2023, reflecting the scale of pilot and early commercial deployments in imaging AI, decision support, and analytics. In the UAE, the key hubs driving adoption are Abu Dhabi and Dubai. Abu Dhabi has become an innovation center due to MBZUAI, G42’s headquarters, and strong public health funding. Dubai leads in hospital digital maturity and private group deployment readiness. Their advanced infrastructure, healthcare tourism appeal, and regulatory support converge to make them dominant nodes in this AI health market.

What Factors are Leading to the Growth of the UAE AI in Healthcare Market:

Data gravity from population, connectivity, and clinical exchanges: The UAE’s health-AI rollout is powered by massive, high-frequency data flows across a digitally connected population of 10,678,556 residents and 199.424 mobile subscriptions per 100 people. With an economy valued at USD 537.08 billion, the country has the fiscal headroom to scale enterprise AI adoption. Mandated health information exchanges strengthen the data backbone: Abu Dhabi’s Malaffi manages 3.5 billion clinical records, while Dubai’s NABIDH links 9.47 million patient records across 1,300+ facilities. These connected rails enable AI use cases in clinical decision support, imaging triage, and revenue-cycle automation.

Hospital throughput and medical tourism intensify AI demand: The UAE healthcare system operates under significant pressure with 25,642,705 hospital visits, 3,593,344 emergency attendances, 173 hospitals, and 18,497 beds. Abu Dhabi alone accounts for 12,736,544 visits, while Dubai contributes 9,186,070, making them AI-ready hubs for clinical deployment. Medical tourism adds another layer: Dubai welcomed 691,000 health tourists with healthcare spending of AED 1.03 billion, largely concentrated in specialty diagnostics and surgery. This combination of local demand and international inflows creates a strong pipeline for AI-enabled imaging, perioperative optimization, and digital follow-up care.

Workforce scale and digital readiness enable adoption at enterprise level: The UAE healthcare workforce includes 155,618 professionals, comprising 31,844 doctors and 65,510 nurses, offering a substantial base for AI-augmented workflows. Government facilities recorded 6,506,187 hospital visits, while private providers managed 19,136,518, reflecting a diverse multi-payer ecosystem ideal for interoperable AI across RIS, PACS, EHR, and HIE platforms. With a total of 7,029 healthcare facilities nationwide, procurement pathways for AI solutions are extensive. This scale and structure create the conditions for rapid enterprise-wide rollouts of regulated AI modules for productivity, clinical accuracy, and operational command centers.

Which Industry Challenges Have Impacted the Growth of the UAE AI in Healthcare Market:

Capacity-to-demand mismatch strains clinical workflows: High patient volumes stress clinical workflows, with 25,642,705 hospital visits and 3,593,344 emergency visits processed by a workforce of 31,844 doctors and 65,510 nurses. Acute hubs such as Abu Dhabi (12,736,544 visits) and Dubai (9,186,070 visits) face the heaviest burdens. The imbalance amplifies the need for AI to manage triage, optimize reporting turnaround, and automate documentation. The challenge lies in embedding AI seamlessly so it alleviates clinical pressure without adding cognitive or IT load on already overextended teams.

Fragmented data across emirates and systems complicates scaling: Despite advanced HIEs, national interoperability remains fragmented. Abu Dhabi’s Malaffi holds 3.5 billion clinical records, while Dubai’s NABIDH consolidates 9.47 million patient records across 1,300+ facilities. Parallel ecosystems create technical hurdles in mapping HL7, FHIR, and DICOM standards, reconciling duplicate patient records, and managing consent. These complexities prolong integration timelines and increase costs for AI vendors, especially when deploying multi-site inference pipelines that must meet diverse facility-level compliance and governance requirements.

Compliance and cybersecurity workload across large provider base: Compliance is a significant operational challenge. Abu Dhabi’s ADHICS cybersecurity framework and Dubai’s DHA regulations mandate robust governance, encryption, and audit processes for AI systems. This applies across 69 hospitals in Abu Dhabi and the UAE’s 7,029 total healthcare facilities. Vendors must pass rigorous security checks, supplier-risk assessments, and continuous monitoring before deployment. While essential, this compliance workload can slow down AI onboarding and require substantial ongoing resources from both hospitals and technology providers.

What are the Regulations and Initiatives which have Governed the Market:

Personal data protection under Federal Decree-Law No. 45 of 2021 (PDPL): The PDPL governs the processing of personal data in the UAE, requiring lawful bases for data use, strict purpose limitations, and safeguards for cross-border transfers to approved jurisdictions. For healthcare AI, this law frames requirements for de-identification, consent, and secure lifecycle management of models. It directly impacts how providers and vendors structure their AI workflows, particularly for cloud-based training and inference that interacts with non-UAE infrastructure.

Medical device & SaMD registration via MOHAP: AI systems classified as Software as a Medical Device (SaMD) must undergo registration with MOHAP. This requires the involvement of a licensed UAE marketing authorization holder and complete product and site registration. MOHAP indicates an average registration timeline of 45 working days. These steps ensure that AI solutions in imaging, CDS, and pathology meet clinical safety and efficacy requirements before deployment across the country’s 173 hospitals and 7,029 healthcare facilities.

Emirate-level security and HIE mandates (ADHICS, Malaffi, NABIDH): Emirate-level standards add further rigor. ADHICS in Abu Dhabi mandates cybersecurity and governance compliance for all health facilities. Connectivity mandates require participation in HIEs: Malaffi with 3.5 billion clinical records and NABIDH spanning 1,300+ facilities and 9.47 million patient records. For AI vendors, this means strict pre-deployment testing, documentation, and audit trails across Abu Dhabi’s 69 hospitals and the broader UAE system. These requirements ensure secure integration but increase the compliance burden for market entry.

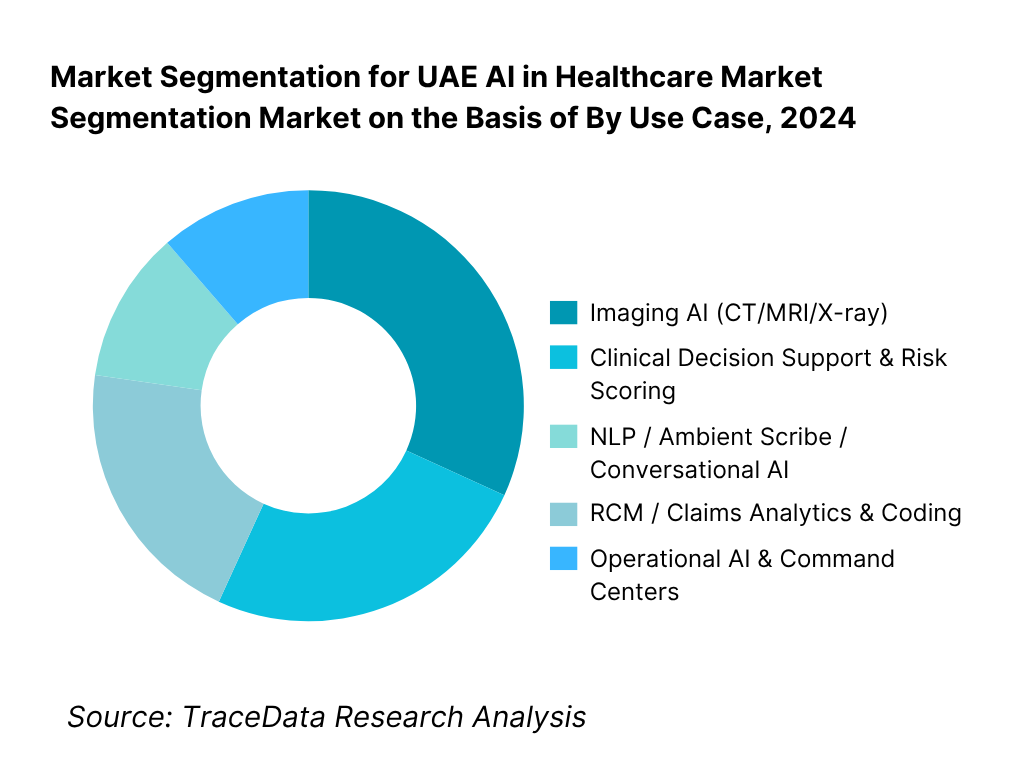

UAE AI in Healthcare Market Segmentation

By Use Case: Imaging AI (CT/MRI/X-ray) holds the lion’s share of deployments. Given the maturity of image-based algorithm models (e.g. lung nodule detection, chest X-ray triage), imaging is the easiest clinical entry point. Hospitals already possess PACS and radiology workflows, reducing integration friction. Clinical validation for imaging AI has more precedent globally, reducing vendor risk. Further, radiology bottlenecks (turnaround times, backlog) are acute in UAE, making AI-assisted reads attractive. Many pilot programs began in radiology, anchoring the dominance of imaging AI in the use-case segmentation.

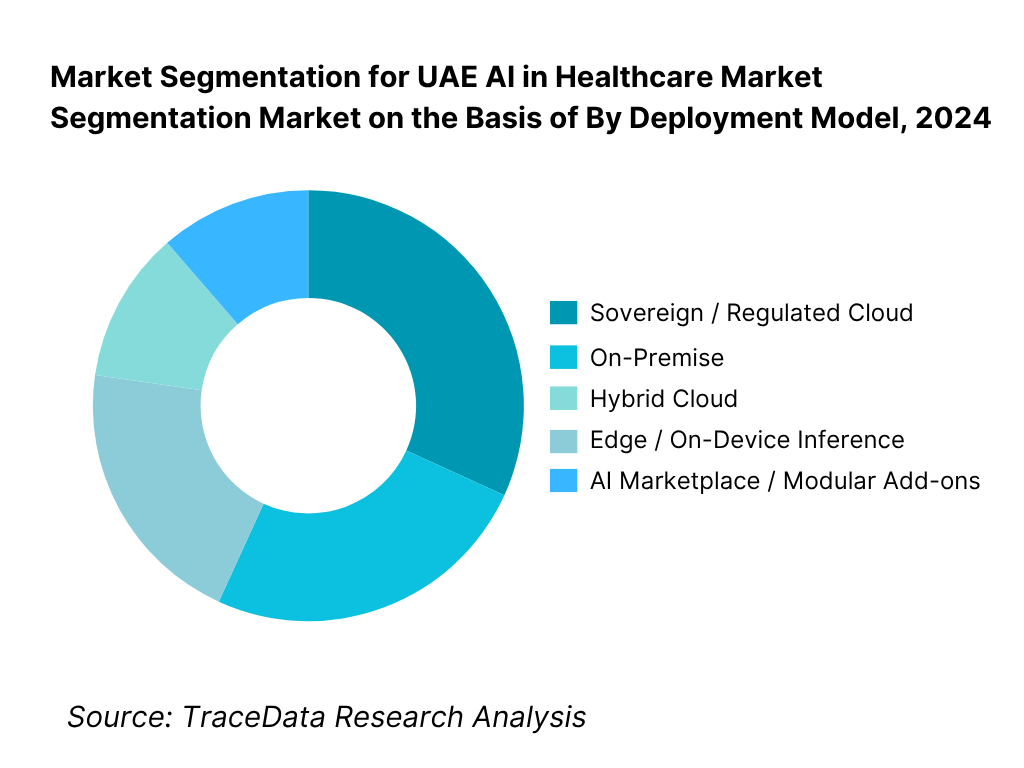

By Deployment Model: Sovereign / Regulated Cloud deployments currently lead. Many vendors and hospitals prefer managed cloud in UAE data centers due to data-residency, compliance, and scalability. The UAE is expanding its sovereign cloud infrastructure (e.g. via G42, ADNOC, Mubadala) which lowers latency and increases trust. Hospitals that lack scale or IT investment prefer cloud models to avoid upfront infrastructure spend. On-prem remains in legacy or sensitive settings, and edge inference is still emerging, so cloud-based deployment captures the bulk of spend today.

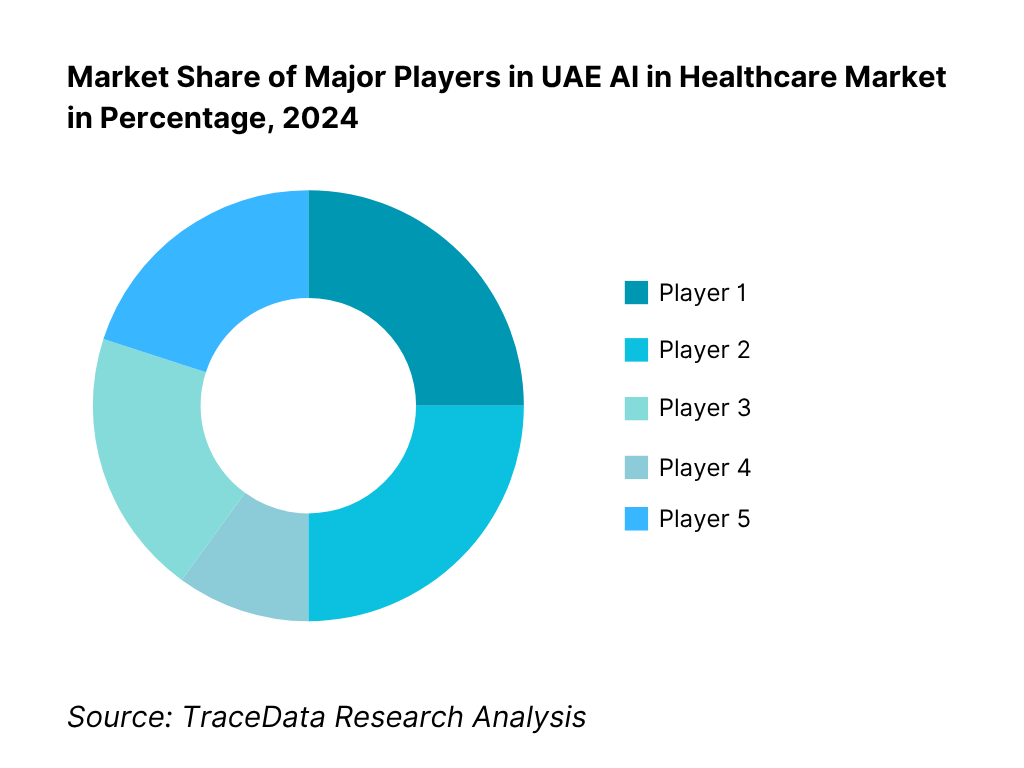

Competitive Landscape in UAE AI in Healthcare Market

The UAE AI in Healthcare market is concentrated, with a few global and regional AI firms commanding strong presence via partnerships, proof-of-concept scale-ups, and integration with local hospitals. The competitive intensity is moderate but growing, with entry barriers in clinical validation, regulatory approvals, and data access.

Name | Founding Year | Original Headquarters |

Siemens Healthineers | 1847 | Erlangen, Germany |

GE HealthCare | 1994 | Milwaukee, USA |

Philips (Healthcare) | 1891 | Eindhoven, Netherlands |

Agfa HealthCare | 1867 | Berlin, Germany |

Sectra | 1978 | Linköping, Sweden |

InterSystems | 1978 | Cambridge, USA |

Oracle Health (Cerner) | 1979 | Kansas City, USA |

Aidoc | 2016 | Tel Aviv, Israel |

Qure.ai | 2016 | Mumbai, India |

Viz.ai | 2016 | San Francisco, USA |

Annalise.ai | 2019 | Sydney, Australia |

Lunit | 2013 | Seoul, South Korea |

M42 (G42 Healthcare + Mubadala Health) | 2023 | Abu Dhabi, UAE |

Prognica Labs | 2017 | Dubai, UAE |

Altibbi | 2010 | Amman, Jordan |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Siemens Healthineers: Siemens has strengthened its UAE footprint by integrating its AI-powered Radiology Companion into SEHA facilities, improving radiology reporting efficiency. Its AI offerings have been embedded within syngo.via platforms, with adoption tied to imaging backlog reduction.

GE HealthCare: GE has expanded its Edison AI platform across Dubai-based hospitals, focusing on CT and MRI workflow automation. The company has also partnered with local providers to deliver AI-assisted cardiac imaging, reflecting growing demand in specialty care.

Philips: Philips has advanced collaborations with NMC and Cleveland Clinic Abu Dhabi to deploy its AI-enabled IntelliSpace suite. These deployments emphasize precision diagnostics and population health management, aligned with Dubai’s digital health strategy.

Aidoc: Aidoc has launched emergency imaging triage pilots with Burjeel and Mediclinic hospitals. Its AI stroke and pulmonary embolism modules are in use, addressing critical care timelines and positioning Aidoc as a leading specialty AI vendor.

G42 Healthcare (M42): As the UAE’s homegrown champion, M42 has accelerated its AI initiatives through genomic sequencing platforms and predictive analytics. Leveraging sovereign cloud and MBZUAI’s research, it is building integrated AI pipelines across oncology, radiology, and pathology.

What Lies Ahead for UAE AI in Healthcare Market?

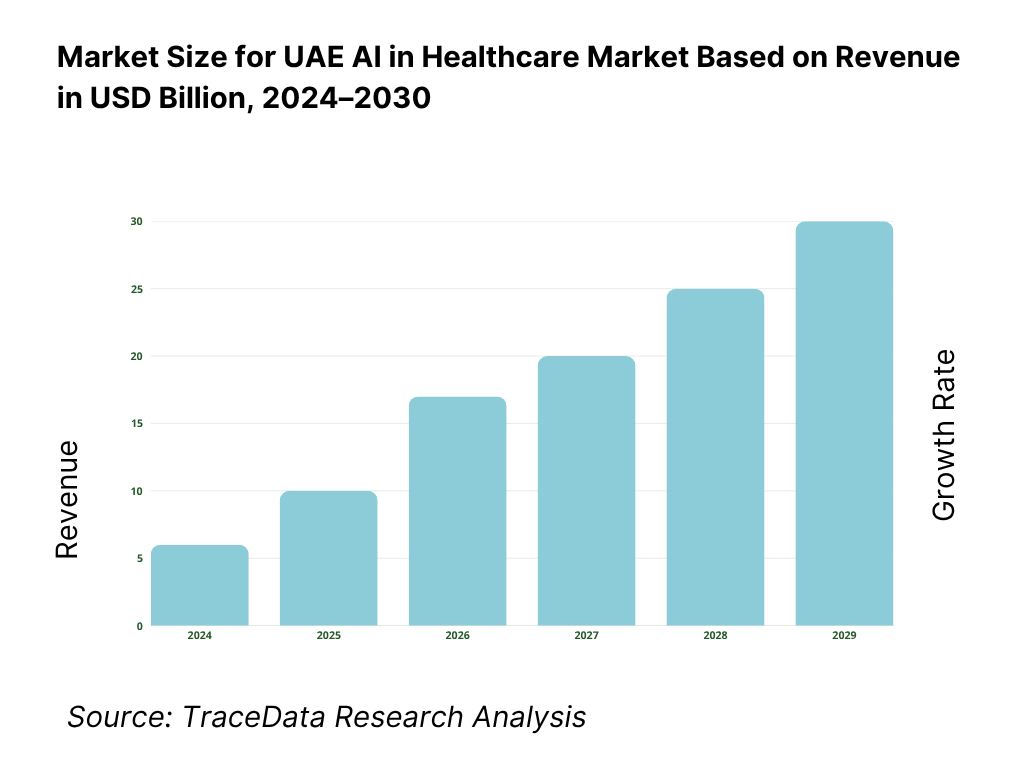

The UAE AI in Healthcare market is expected to accelerate steadily toward the end of the decade, supported by strong government digitization agendas, integration of health information exchanges, and the rapid adoption of sovereign cloud infrastructure. National initiatives under the UAE Artificial Intelligence Strategy and heavy healthcare investments position the market for transformative growth, with Abu Dhabi and Dubai serving as anchor hubs for deployment and innovation.

Rise of Cloud-Native & Hybrid AI Deployments: The UAE will continue to see a strong transition toward cloud-native and hybrid AI deployments in healthcare, enabled by sovereign cloud regions operated by G42, Microsoft Azure, and AWS. These models allow hospitals to maintain data residency while benefiting from scalable AI-powered imaging, decision support, and operational tools. Hybrid models will be particularly attractive to providers balancing regulatory requirements with scalability needs.

Focus on Clinically Validated & Outcome-Based AI Solutions: Providers and regulators in the UAE are increasingly demanding evidence-backed AI with measurable outcomes such as reduced reporting turnaround time, improved triage in emergency medicine, and better denial prevention in claims. This focus on clinical validation and ROI will drive adoption of AI modules that demonstrate tangible patient and financial impact, especially in radiology, pathology, and revenue cycle management.

Expansion into Specialty & Population Health AI: The market will see expanded demand for sector-specific AI solutions in oncology, cardiology, and population health analytics. With rising health workloads and chronic disease prevalence, providers will rely on AI to improve detection, risk stratification, and care coordination. Integration into HIEs such as Malaffi and NABIDH will ensure that AI supports population-level insights and reduces fragmentation across providers.

Leveraging Generative AI and Arabic NLP: Generative AI models and Arabic Natural Language Processing will increasingly be embedded into EHRs and clinical workflows, providing ambient scribing, discharge summary automation, and multilingual decision support. This reflects the UAE’s diverse population and healthcare tourism ecosystem, where multilingual AI capabilities are critical for effective communication and clinical documentation.

UAE AI in Healthcare Market Segmentation

By Use Case (In Value %)

Imaging AI (CT, MRI, X-ray, Ultrasound, Mammography)

Clinical Decision Support & Risk Scoring

Natural Language Processing & Ambient Scribe Solutions

Revenue Cycle Management (coding, CDI, fraud detection)

Operational AI & Hospital Command Centers

By Care Setting (In Value %)

Public Hospitals (SEHA, DHA, MOHAP facilities)

Private Multispecialty Hospitals (Mediclinic, Aster, NMC, Burjeel)

Diagnostic Imaging Centers

Specialty Clinics & Ambulatory Care

Telehealth & Virtual Care Platforms

By Technology (In Value %)

Computer Vision (CNNs for imaging analysis)

Machine Learning & Predictive Analytics

Natural Language Processing (Arabic & English)

Federated Learning & Edge AI

Generative AI / LLM-based Healthcare Applications

By Deployment Model (In Value %)

On-Premise (hospital data centers)

Sovereign Cloud (G42, Azure UAE, AWS UAE regions)

Hybrid Cloud (on-prem + cloud integrations)

Edge/On-Device AI (embedded in scanners, mobile units)

AI Marketplace / Third-Party Add-ons

By Buyer/End-User Type (In Value %)

Public Provider Networks

Private Hospital Chains

Payers & Insurance (Daman, TPAs)

Diagnostics Chains

Digital Health Platforms & Telemedicine

By Emirate (In Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

Players Mentioned in the Report:

Siemens Healthineers

GE Healthcare

Philips

Agfa HealthCare

Aidoc

Qure.ai

Viz.ai

Annalise.ai

Lunit

G42 Healthcare / M42

Prognica Labs

Oracle Health / Cerner

InterSystems

Sectra

Ada Health / Altibbi

Key Target Audience

CIOs / CMIOs of major public hospital networks (SEHA, DHA, MOHAP)

Chief Digital & Innovation Officers in private hospital groups (Mediclinic, Aster, NMC)

Health data platform leaders (Malaffi, Nabidh)

Payers & TPAs (Daman, private insurers)

Cloud & infrastructure decision makers in healthcare

Venture and private equity investors in healthtech

Sovereign AI investment arms (e.g. MGX Fund, ADQ’s tech arms)

Regulatory & government bodies

Key Target Audience

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for AI in Healthcare (on-premise, sovereign cloud, hybrid, edge inference)-margins, preference, strengths & weaknesses

4.2 Revenue Streams for UAE AI in Healthcare Market (per-study licensing, enterprise subscription, outcome-based contracts, bundled with PACS/EHR, AI marketplace add-ons)

4.3 Business Model Canvas for UAE AI in Healthcare Market

5.1 AI Startups & Local Innovators vs Multinational Vendors

5.2 Investment Model in UAE AI in Healthcare Market (sovereign funds, PPPs, VC, corporate venture arms, sandboxes)

5.3 Comparative Analysis of AI Adoption Funnel by Public vs Private Providers

5.4 Budget Allocation for AI & Digital Health by Hospital Size/Ownership

8.1 Revenues (Historical, In USD Bn & AED)

9.1 By Market Structure (Public vs Private Hospitals; In-house vs Outsourced AI Solutions)

9.2 By Use Case (Imaging AI, Clinical Decision Support, NLP & Scribes, RCM & Claims Analytics, Operational AI Command Centers)

9.3 By Healthcare Verticals (Radiology, Cardiology, Oncology, Pathology, Emergency Medicine, Population Health)

9.4 By Provider Size (Large multispecialty hospitals, Medium hospitals, Diagnostic chains, Clinics & Ambulatory centers)

9.5 By End-User Designation (Radiologists, Pathologists, Emergency Physicians, Hospital Admins, Payers)

9.6 By Mode of Deployment (On-premise, Cloud, Edge, Hybrid)

9.7 By Customization Level (Standardized vs Customized AI models)

9.8 By Emirate (Abu Dhabi, Dubai, Sharjah, Northern Emirates)

10.1 Provider Client Landscape & Cohort Analysis

10.2 Decision-Making Process for AI Procurement (CIO, CMIO, Radiology Leads, Procurement Committees)

10.3 AI ROI & Effectiveness Framework (LOS reduction, reporting turnaround time, denial reduction, AED savings)

10.4 Gap Analysis Framework (demand for validated Arabic datasets, shortage of annotated imaging data, edge AI gaps)

11.1 Trends & Developments in UAE AI in Healthcare Market

11.2 Growth Drivers (HIE coverage, PDPL enforcement, imaging backlog, medical tourism demand, sovereign AI investments)

11.3 SWOT Analysis

11.4 Issues & Challenges (integration with legacy RIS/PACS, physician trust, fragmented regulatory approvals)

11.5 Government Regulations & Policies (PDPL, ADHICS, DOH AI approval frameworks, cloud residency laws)

12.1 Market Size & Future Potential for Online AI-enabled Telehealth & Diagnostics

12.2 Business Models & Revenue Streams (subscription tele-AI, per-scan analysis, pay-per-consult)

12.3 Delivery Models & Types of AI-powered Solutions Offered (virtual triage, AI-powered tele-radiology, chronic care management)

15.1 Market Share of Key Players (Basis Revenues in UAE AI Healthcare Market)

15.2 Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Business Model, Number of Deployments, Revenues, Pricing, Technology Stack, Best-selling Solutions, Strategic Tie-ups, Recent Developments)

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant Mapping (AI in Healthcare Vendors, UAE/Regional Presence)

15.5 Bowman’s Strategic Clock for Competitive Advantage

16.1 Revenues (Projections in USD Bn & AED)

17.1 By Market Structure (Public vs Private; In-house vs Outsourced)

17.2 By Use Case (Imaging, CDS, NLP, RCM, Ops AI)

17.3 By Healthcare Verticals (Radiology, Oncology, Pathology, Cardiology, Population Health)

17.4 By Provider Size

17.5 By End-User Designation

17.6 By Deployment Mode

17.7 By Customization Level

17.8 By Emirate

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire UAE AI in Healthcare ecosystem, identifying both demand-side and supply-side entities. On the demand side, this includes public provider networks (SEHA, DHA, MOHAP hospitals), private healthcare groups (Aster, Mediclinic, NMC, Burjeel), payers and TPAs (Daman, private insurers), and government health information exchanges (Malaffi, NABIDH). On the supply side, we track multinational medtech and AI firms (Siemens, GE, Philips), regional startups (G42 Healthcare/M42, Prognica Labs), cloud vendors (G42 Cloud, Azure, AWS), and academic R&D hubs (MBZUAI, Khalifa University). Based on this mapped ecosystem, we shortlist 5–6 leading AI healthcare providers in the country using financial disclosures, deployment reach, and client partnerships as core evaluation criteria. Sourcing for this step is conducted through UAE Ministry of Health reports, emirate-level health authority publications, press releases, and proprietary databases.

Step 2: Desk Research

Next, we conduct exhaustive desk research, referencing a mix of secondary and proprietary databases to capture industry-level insights. This includes analyzing healthcare system statistics from MOHAP and World Bank datasets, regulatory frameworks such as PDPL and ADHICS, and AI adoption benchmarks from official UAE government portals. We aggregate insights on deployment volumes, provider readiness, vendor presence, and adoption barriers. Company-level data—sourced from press releases, annual reports, government filings, and clinical validation studies—are reviewed to evaluate partnerships, revenue streams, and footprint in UAE hospitals. This step allows us to construct a foundational understanding of the market structure, demand dynamics, and the positioning of active entities.

Step 3: Primary Research

To validate hypotheses and ground-truth secondary insights, we conduct in-depth interviews with C-level executives and decision makers from hospital networks, regulatory authorities, and AI solution providers. These include CIOs, CMIOs, radiology chiefs, and digital health directors across Abu Dhabi, Dubai, and Sharjah hospitals. Vendors such as imaging AI companies and cloud partners are also engaged. Disguised interviews are conducted under the guise of prospective clients to validate operational details such as AI module pricing models (per-scan vs. subscription), integration processes, and compliance workflows. This approach helps us triangulate financial and operational data against secondary sources, while uncovering detailed perspectives on adoption bottlenecks, value-chain workflows, and ROI perceptions across the UAE’s provider landscape.

Step 4: Sanity Check

The final step involves applying both bottom-to-top and top-to-bottom modeling to validate market estimates. Bottom-up analysis aggregates deployment volumes (e.g., imaging study loads, hospital bed counts, provider facility counts), while top-down analysis aligns estimates with UAE macroeconomic indicators such as GDP in current USD (USD 537.08 billion) and health system activity (MOHAP-reported 25.6 million hospital visits). Cross-verification ensures logical coherence between hospital-level adoption data and national-level projections. This combined approach delivers a balanced and validated market size model for the UAE AI in Healthcare market.

FAQs

01 What is the potential for the UAE AI in Healthcare Market?

The UAE AI in Healthcare Market is positioned for substantial expansion, supported by strong government digitization strategies and large-scale healthcare modernization programs. With GDP reaching USD 537.08 billion (World Bank, 2024) and a population of 10.67 million (World Bank, 2024), the country has the economic and demographic foundation to scale AI across hospitals, diagnostics, and payer systems. The market’s potential is further amplified by initiatives like Malaffi and NABIDH, which have already connected 3.5 billion and 9.47 million patient records respectively, ensuring a ready infrastructure for AI adoption.

02 Who are the Key Players in the UAE AI in Healthcare Market?

The UAE AI in Healthcare Market features leading multinational and regional players. Key participants include Siemens Healthineers, GE Healthcare, Philips, Agfa HealthCare, Sectra, InterSystems, Oracle Health (Cerner), Aidoc, Qure.ai, Viz.ai, Annalise.ai, Lunit, G42 Healthcare (M42), Prognica Labs, and Altibbi. These companies dominate due to their deep clinical validation, integration with hospital IT systems, strong UAE partnerships, and focus on specialized use cases such as imaging AI, clinical decision support, pathology, and Arabic-language health AI.

03 What are the Growth Drivers for the UAE AI in Healthcare Market?

Growth is underpinned by multiple macroeconomic and structural factors. Healthcare capacity continues to rise, with 25.6 million hospital visits and 3.59 million emergency visits reported (MOHAP, 2023). Digital adoption is reinforced by the UAE’s 199.424 mobile subscriptions per 100 people (World Bank, 2024), enabling connected care and remote AI services. Strong policy direction from the UAE Artificial Intelligence Strategy and Abu Dhabi’s investment in genomics and precision medicine (via G42 and MBZUAI) further fuel adoption. Medical tourism inflows of 691,000 international patients in Dubai also accelerate demand for AI-enabled specialty care.

04 What are the Challenges in the UAE AI in Healthcare Market?

The market faces structural and operational challenges. First, a limited clinical workforce of 31,844 doctors and 65,510 nurses (MOHAP, 2023) constrains capacity to validate, adopt, and scale AI effectively. Second, fragmented data environments across emirates—Malaffi in Abu Dhabi and NABIDH in Dubai—create technical and governance barriers for unified AI deployment. Third, compliance with regulations such as PDPL (Federal Decree-Law No. 45 of 2021) and Abu Dhabi’s ADHICS security standards adds complexity and costs, requiring all 7,029 healthcare facilities to maintain stringent privacy, cybersecurity, and licensing frameworks before deploying AI solutions.