UAE Consumer Appliances Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances

- Product Code: TDR0051

- Region: Middle East

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled “UAE Consumer Appliances Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), By Distribution Channel, By Consumer Demographics, and By Emirates” provides a comprehensive analysis of the consumer appliances market in the UAE. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and a comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Consumer Appliances Market. The report concludes with future market projections based on sales revenue, by product categories, region, market structure, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

UAE Consumer Appliances Market Overview and Size

The UAE consumer appliances market reached a valuation of AED 6 Billion in 2023, driven by the increasing demand for modern and energy-efficient appliances, growing population, and changing consumer preferences towards technologically advanced products. The market is characterized by major players such as LG, Samsung, Bosch, Siemens, and Electrolux, which are recognized for their innovative products, strong brand presence, and extensive distribution networks.

In 2023, Samsung launched a new range of smart home appliances featuring AI integration to enhance user experience and optimize energy consumption. This initiative aims to tap into the growing smart appliance segment in the UAE, providing a more convenient and efficient appliance usage experience. Dubai and Abu Dhabi are key markets due to their high population density and robust retail infrastructure.

Market Size for UAE Consumer Appliances Industry Based on Revenues in USD Billion, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of UAE Consumer Appliances Market:

Economic Factors: The economic recovery post-COVID-19 and a rise in disposable incomes have significantly driven consumer preference towards premium and smart appliances. In 2023, high-end appliances accounted for approximately 45% of total appliance sales in the UAE, as they offer enhanced functionality and energy savings, which align with consumer demand for sustainable solutions.

Technology Adoption: The rapid adoption of IoT and AI technologies in consumer appliances is transforming the market. In 2023, around 30% of appliances sold in the UAE were smart appliances, reflecting a growing trend towards digital and automated solutions. These appliances offer features such as remote control, energy monitoring, and customized settings, which have significantly boosted market growth.

Growing Expat Population: The expanding expat population, which constitutes about 88% of the total UAE population, drives demand for a wide range of consumer appliances catering to diverse lifestyle needs. This demographic shift has spurred demand for both basic and luxury appliances, supporting the market's expansion.

Which Industry Challenges Have Impacted the Growth of UAE Consumer Appliances Market

Regulatory Compliance: Stringent regulations concerning energy efficiency standards and import restrictions have posed challenges for manufacturers and distributors. In 2023, it was reported that around 15% of appliances did not meet the new energy efficiency criteria, leading to increased compliance costs and delays in product launches.

Price Sensitivity: Despite the economic recovery, price sensitivity remains a significant barrier, particularly among lower-income households. Data indicates that approximately 35% of potential buyers are hesitant to invest in premium or smart appliances due to higher upfront costs. This has constrained market access for a significant segment of the population, affecting overall market growth.

Supply Chain Disruptions: Ongoing global supply chain disruptions have affected the availability and pricing of consumer appliances in the UAE. In 2023, supply shortages led to a 10% increase in appliance prices, impacting sales volumes and prompting manufacturers to explore local sourcing and production options.

What are the Regulations and Initiatives that have Governed the Market:

Energy Efficiency Regulations: The UAE government mandates minimum energy performance standards for all consumer appliances sold in the country. These regulations are aimed at reducing energy consumption and promoting sustainability. In 2022, approximately 85% of new appliances met the required energy efficiency criteria, indicating a high level of compliance within the industry.

Import Restrictions on Specific Appliances: The government enforces restrictions on the import of certain categories of appliances that do not meet safety or environmental standards. In 2023, imports of non-compliant appliances dropped by 12% due to stricter enforcement of these regulations.

Government Incentives for Sustainable Products: To promote the adoption of energy-efficient and environmentally friendly appliances, the UAE government has introduced various incentives, including reduced import duties and subsidies for green appliances. In 2023, green appliances represented about 18% of the total appliance sales, a number expected to grow as these incentives take effect.

UAE Consumer Appliances Market Segmentation

By Market Structure: The UAE consumer appliances market is primarily driven by organized retailers due to their established brand presence, diverse product offerings, and comprehensive after-sales services. Organized retailers, including large electronic chains and hypermarkets, hold a significant share of the market as they provide an array of options, competitive pricing, and warranties. Unorganized retailers, on the other hand, cater to budget-conscious consumers, often offering lower-priced products and more flexible purchasing options. E-commerce platforms like Amazon.ae and Noon.com are rapidly gaining traction, capturing a growing share of the market due to convenience, competitive pricing, and a broad product range.

By Manufacturer: LG is the leading manufacturer in the UAE consumer appliances market due to its wide range of innovative products, strong emphasis on energy efficiency, and well-established service network. Samsung follows closely, driven by its strong presence in the smart appliance segment and focus on integrating advanced technologies. Bosch and Siemens are also key players in the premium appliance segment, recognized for their durability, high-performance standards, and focus on sustainability.

By Product Category Major Household Appliances: This category includes refrigerators, washing machines, and air conditioners, which account for a substantial portion of the market due to their essential nature. Consumers in the UAE tend to prefer appliances that offer advanced features such as energy efficiency, remote monitoring, and automated controls.

Competitive Landscape in UAE Consumer Appliances Market

The UAE consumer appliances market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of online platforms such as Amazon.ae, Noon.com, Carrefour, Sharaf DG, and Lulu Hypermarket have diversified the market, offering consumers more choices and services.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Samsung Electronics | Refrigerators, Washing machines, Microwaves, Cooking appliances | 1938 | Suwon, South Korea |

LG Electronics | Refrigerators, Washing machines, Microwaves, Air conditioners | 1958 | Seoul, South Korea |

Bosch | Dishwashers, Washing machines, Refrigerators, Cooking appliances | 1886 | Gerlingen, Germany |

Siemens | Refrigerators, Dishwashers, Cooking appliances, Washing machines | 1847 | Munich, Germany |

Beko | Refrigerators, Washing machines, Microwaves, Cooking appliances | 1967 | Istanbul, Turkey |

Electrolux | Dishwashers, Washing machines, Refrigerators, Microwaves | 1919 | Stockholm, Sweden |

Miele | Cooking appliances, Refrigerators, Dishwashers, Washing machines | 1899 | Gütersloh, Germany |

Teka | Cooking appliances, Refrigerators, Microwaves | 1924 | Madrid, Spain |

Dyson | Vacuum cleaners, Air purifiers | 1991 | Malmesbury, UK |

Hitachi | Refrigerators, Air conditioners | 1910 | Tokyo, Japan |

Recent Competitor Trends and Key Information:

LG Electronics: Known for its innovative and energy-efficient products, LG launched a new series of AI-integrated refrigerators in 2023, which saw a 20% increase in sales compared to traditional models.

Samsung: Focused on the smart home segment, Samsung introduced a range of interconnected appliances that can be controlled through a single app, leading to a 30% growth in sales within the smart appliance category.

Bosch: Emphasizing sustainability, Bosch expanded its green appliance portfolio and reported a 25% increase in sales of energy-efficient appliances in 2023.

Siemens: Siemens introduced a new series of compact and multifunctional kitchen appliances aimed at urban consumers, leading to a 15% increase in sales in metropolitan areas.

Electrolux: Leveraging its reputation for premium appliances, Electrolux expanded its distribution network in the UAE, achieving a 10% increase in sales volume in 2023.

What Lies Ahead for UAE Consumer Appliances Market?

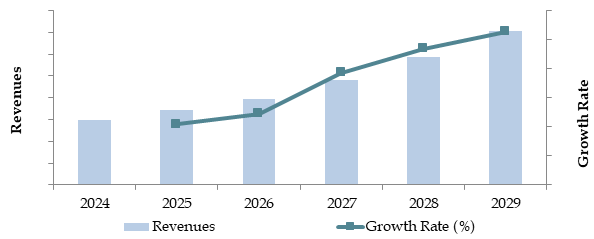

The UAE consumer appliances market is projected to grow steadily by 2029, exhibiting a robust CAGR during the forecast period. This growth is expected to be driven by economic recovery, increasing urbanization, and the rising demand for advanced and energy-efficient appliances.

Shift Towards Smart Home Appliances: The UAE consumer appliances market is expected to witness a significant shift towards smart home appliances, as consumers increasingly prioritize convenience, connectivity, and automated solutions. Smart refrigerators, washing machines, and air conditioners are anticipated to see a higher adoption rate as more households look to integrate their home appliances into a unified smart ecosystem. This trend is supported by the UAE’s Smart City initiatives and the growing penetration of IoT technology.

Increased Focus on Energy Efficiency: With a strong emphasis on sustainability, the UAE government has introduced stringent energy efficiency standards for all appliances sold in the market. As a result, manufacturers are focusing on developing energy-efficient models to comply with these regulations. This trend is expected to lead to a rise in demand for products that consume less energy, have lower environmental impact, and reduce utility costs for consumers.

Growing Adoption of Premium and Luxury Appliances: The rising number of high-income expatriates and affluent Emirati households has led to an increased demand for premium and luxury consumer appliances. Brands such as Bosch, Siemens, and Electrolux are expected to benefit from this trend by offering high-end products with advanced features such as AI integration, touch controls, and aesthetic designs.

Integration of Advanced Technologies: The integration of advanced technologies such as AI and big data analytics in appliances is expected to provide consumers with more personalized and efficient solutions. Smart home appliances will allow users to control and monitor their devices remotely, leading to enhanced convenience and energy savings. This technological advancement will also boost consumer trust, streamline the buying process, and increase market transparency.

Future Outlook and Projections for UAE Consumer Appliances Market on the Basis of Revenues in USD Billion, 2024-2029

Source: TraceData Research Analysis

UAE Consumer Appliances Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Major Appliances

- Small Appliances

- By Major Appliances

- Dishwashers

- Washing Machines

- Cooking Appliances

- Microwaves

- Freezers

- Refrigerators

- Washing Machines:

- Semi Automatic

- Automatic Washing Machines

- Cooking Appliances:

- Built-In Hobs

- Ovens

- Cooker Hoods

- Cookers

- Freezers:

- Built-In

- Freestanding

- Small Appliances

- Air Treatment Products

- Food Preparation Appliances

- Heating Appliances

- Irons

- Personal Care Appliances

- Small Cooking Appliances

- Vacuum Cleaners and Small Appliances:

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

- By Region:

- Northern Emirates (Sharjah, Ras Al Khaimah, Fujairah, Umm Al Quwain, Ajman)

- Southern Emirates (Dubai, Abu Dhabi)

- Central UAE (Al Ain)

Players Mentioned in the Report:

- BSH Home Appliances FZE

- LG Electronics Gulf FZE

- Better Life LLC

- Haier Electronics Group Co. Ltd.

- Samsung Electronics Co. Ltd.

- AB Electrolux

- Hisense Middle East

- Teka Kuchentechnik UAE LLC

- Dyson Limited

- Kärcher

Key Target Audience:

- Consumer Electronics Retailers

- Online Marketplaces

- Appliance Manufacturers

- Importers and Distributors

- Regulatory Bodies (e.g., Ministry of Industry and Advanced Technology)

- Research and Development Institutions

- Consumer Associations

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for the UAE Consumer Appliances Market

4.3. Business Model Canvas for the UAE Consumer Appliances Market

4.4. Buying Decision-Making Process

4.5. Supply Decision-Making Process

5.1. New Appliance Sales in the UAE, 2018-2024

5.2. Replacement vs. New Sales Ratio in the UAE, 2018-2024

5.3. Spend on Home Appliances in the UAE, 2024

5.4. Number of Consumer Appliance Deaers in the UAE by Region

8.1. Revenues, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Major and Small Appliances), 2018-2024

9.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2018-2024

9.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2018-2024

9.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2018-2024

9.2.1.3. By Freezers (Built-In and Freestanding), 2018-2024

9.2.1.4. By Refrigerator (Built-In and Freestanding), 2018-2024

9.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2018-2024

9.3. By Average Price Range, 2023-2024P

9.4. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.5. By Emirates, 2023-2024P

9.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in the UAE Consumer Appliances Market

11.2. Growth Drivers for the UAE Consumer Appliances Market

11.3. SWOT Analysis for the UAE Consumer Appliances Market

11.4. Issues and Challenges for the UAE Consumer Appliances Market

11.5. Government Regulations for the UAE Consumer Appliances Market

12.1. Market Size and Future Potential for Online Consumer Appliances Market, 2018-2029

12.2. Business Model and Revenue Streams for Major Marketplace and Company Websites

12.3. Cross-Comparison of Leading Online Consumer Appliance Companies Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Down Payment for Consumer Appliances, 2018-2029

13.2. Trends in Finance Penetration Rates Over the Years and Contributing Factors

13.3. Appliance Segments with Higher Finance Penetration

13.4. Finance Split by Banks/NBFCs/Private Finance Companies and Captive Entities, 2023-2024P

13.5. Average Finance Tenure for Consumer Appliances in the UAE

13.6. Finance Disbursement for Consumer Appliances in the UAE, 2018-2024P

16.1. Market Share of Key Players in India Consumer Electronics Market, 2018-2024

16.1.1. Market Share of Key Players in India Washing Machine Market, 2018-2024

16.1.2. Market Share of Key Players in India Cooking Appliances Market, 2018-2024

16.1.3. Market Share of Key Players in India Refrigerator Market, 2018-2024

16.1.4. Market Share of Key Players in India Television Market, 2018-2024

16.2. Benchmarking of Key Competitors in India Consumer Electronics Market including Operational and Financial Parameters

16.3. Heat Map Analysis for Major Players in India Consumer Electronics Market

16.4. Strengths and Weaknesses Analysis

16.5. Operating Model Analysis Framework

19.1. Revenues, 2025-2029

20.1. By Market Structure (Branded and Local Brands), 2025-2029

20.2. By Type (Major and Small Appliances), 2025-2029

20.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2025-2029

20.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2025-2029

20.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2025-2029

20.2.1.3. By Freezers (Built-In and Freestanding), 2025-2029

20.2.1.4. By Refrigerator (Built-In and Freestanding), 2025-2029

20.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2025-2029

20.3. By Average Price Range, 2025-2029

20.4. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

20.5. By Emirates, 2025-2029

20.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

20.7. Recommendation

20.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for UAE Consumer Appliances Market. This process includes segmenting the market based on various factors such as market structure, product categories, distribution channels, and key stakeholders. Leading manufacturers, distributors, and retailers are shortlisted based on their financial performance, market share, and production capacity.

Sourcing is conducted through industry reports, secondary research, and proprietary databases to gather data on the market size, product demand, sales channels, and growth drivers. This approach provides a comprehensive view of the market landscape and the interdependencies between various entities.

Step 2: Desk Research

An exhaustive desk research process is carried out using diverse secondary sources and proprietary databases. This process includes the analysis of industry reports, government publications, news articles, and company websites to gather industry-level insights. Key data points such as sales revenues, number of market players, average pricing, and market trends are compiled to develop a foundational understanding of the UAE Consumer Appliances Market.

Company-level data is examined through sources like press releases, annual reports, and financial statements. This analysis helps in identifying key market participants, understanding their strategies, and evaluating their performance in the UAE market. Data collected at this stage is used to construct a detailed market structure and assess the competitive landscape.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives and other key stakeholders representing various companies in the UAE Consumer Appliances Market. These interviews serve multiple purposes: validating hypotheses, authenticating statistical data, and extracting operational and strategic insights from industry experts. The focus is on gathering information related to sales volume, pricing strategies, distribution channels, and consumer preferences.

A disguised interview approach is adopted to validate operational and financial information. This methodology involves contacting companies under the guise of potential customers to ensure the data provided by company representatives is accurate and in line with secondary research findings. This approach also helps in understanding market dynamics, customer service practices, and pricing policies.

Step 4: Sanity Check

- Bottom-up and top-down analyses are used along with market size modeling exercises to ensure the accuracy of data collected. A sanity check is performed by comparing the aggregated data with market benchmarks and other research findings. This step confirms the validity of market projections and insights, providing a solid foundation for the overall research conclusions and recommendations.

FAQs

01 What is the potential for the UAE Consumer Appliances Market?

The UAE consumer appliances market is expected to experience substantial growth, reaching a projected valuation of AED 9 Billion by 2029. This growth is driven by factors such as increasing urbanization, rising disposable incomes, and a growing focus on energy efficiency and smart home solutions. The expanding middle and high-income population segments in the UAE also contribute to a greater demand for premium and luxury appliances.

02 Who are the Key Players in the UAE Consumer Appliances Market?

The UAE Consumer Appliances Market features several prominent players, including LG Electronics, Samsung, Bosch, and Siemens. These companies dominate the market due to their extensive product portfolios, strong brand presence, and focus on technological innovation. Other notable players include Electrolux, Midea, Nikai, and Super General, which cater to various market segments ranging from budget-conscious consumers to high-end buyers.

03 What are the Growth Drivers for the UAE Consumer Appliances Market?

The primary growth drivers include technological advancements, such as the integration of IoT and AI in home appliances, and the increasing preference for energy-efficient and smart appliances. The UAE government’s focus on sustainability and energy conservation has also led to a rise in demand for eco-friendly appliances. Additionally, the rapid growth of e-commerce platforms has made it easier for consumers to access a wider range of products, further boosting market growth.

04 What are the Challenges in the UAE Consumer Appliances Market?

The UAE Consumer Appliances Market faces several challenges, including stringent regulatory compliance related to energy efficiency standards and import restrictions. Price sensitivity among certain consumer segments and the need for extensive after-sales service networks are additional barriers. Supply chain disruptions and fluctuating raw material prices can also impact product availability and pricing, posing challenges for manufacturers and retailers.