UAE Consumer Electronics Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region

- Product Code: TDR0050

- Region: Middle East

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled “UAE Consumer Electronics Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer electronics market in the UAE. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Consumer Electronics Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and challenges.

UAE Consumer Electronics Market Overview and Size

The UAE consumer electronics market reached a valuation of AED 25 Billion in 2023, driven by the increasing adoption of smart devices, growing disposable income, and changing consumer preferences towards technologically advanced and innovative products. The market is characterized by major players such as Sharaf DG, Carrefour, Lulu Hypermarket, Emax, and Jumbo Electronics. These companies are recognized for their extensive distribution networks, diverse product offerings, and customer-focused services.

In 2023, Sharaf DG launched a new range of smart home products and AI-based appliances to cater to the rising demand for home automation solutions. This initiative aims to tap into the growing smart device market in the UAE and provide a more convenient lifestyle experience. Dubai and Abu Dhabi are key markets due to their high population density, robust retail infrastructure, and high demand for premium electronics.

Market Size for UAE Consumer Electronics Industry on the Basis of Revenue, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of UAE Consumer Electronics Market?

Economic Factors: The rising GDP and increasing disposable income have significantly shifted consumer preference towards advanced and premium electronics. In 2023, smart devices accounted for approximately 35% of total electronics sales in the UAE, as they offer enhanced features and connectivity options. This trend is particularly pronounced among tech-savvy buyers who are looking to upgrade their home and personal devices.

Growing Middle Class: The expanding middle class, with higher disposable income, is increasingly opting for branded consumer electronics as a status symbol and for better product quality. In recent years, the middle-income population in the UAE has grown by 8%, and this demographic shift has driven demand for premium and innovative products such as smart TVs, smartphones, and wearable devices.

Digitalization and E-commerce Growth: The rise of online marketplaces has revolutionized the way consumers purchase electronics, enhancing transparency and convenience. In 2023, around 45% of consumer electronics sales in the UAE were conducted online, reflecting a growing trend towards digital channels. These platforms offer comprehensive product listings, price comparisons, and customer reviews, which have significantly boosted market growth by making the buying process more accessible and user-friendly.

Which Industry Challenges Have Impacted the Growth for UAE Consumer Electronics Market?

Price Sensitivity: High prices of premium and branded electronics remain a significant challenge. Approximately 40% of consumers in the UAE are hesitant to purchase high-end electronics due to concerns about affordability. This issue has led to a lower adoption rate for advanced devices, potentially deterring a significant portion of prospective purchasers.

Regulatory Hurdles: Stringent regulations concerning electronics safety standards and import restrictions can limit the availability of certain products. In 2023, it was reported that around 10% of electronics offered in the market failed to meet the Emirates Authority for Standardization and Metrology (ESMA) regulations. These regulations can impose significant costs, particularly on smaller retailers and private sellers, making it challenging for them to comply.

Limited After-Sales Support: Limited access to after-sales services and warranty support is a critical barrier in the consumer electronics market, particularly affecting rural consumers. Data indicates that approximately 25% of potential buyers face difficulties in accessing reliable after-sales services for electronics purchased online. This limitation not only restricts market access for a significant segment of the population but also constrains overall market growth.

What are the Regulations and Initiatives which have Governed the Market?

Import Regulations for Consumer Electronics: The UAE government enforces stringent regulations on the importation of electronics, requiring all imported products to have ESMA certification and meet specific environmental and safety criteria. In 2023, imports of certain electronic items, such as mobile devices and home appliances, dropped by 5% due to stricter enforcement of these regulations, limiting the entry of non-compliant and substandard products.

Consumer Protection Regulations: The UAE mandates strict consumer protection regulations for electronic products to ensure they meet safety and quality standards. These regulations are enforced by ESMA and require electronics to pass rigorous testing before they can be sold. In 2022, approximately 85% of consumer electronics passed the mandatory certification on their first attempt, indicating a high level of compliance in the market.

Government Support for Digital Transformation: To promote the adoption of advanced technologies, the UAE government has introduced several initiatives under its Vision 2030 plan, including tax exemptions for local manufacturers and incentives for R&D in the technology sector. These measures aim to foster innovation and increase the production of locally-made electronics, thereby reducing dependence on imports. In 2023, the government allocated AED 700 million in grants for tech startups focusing on consumer electronics.

UAE Consumer Electronics Market Segmentation

By Market Structure: Organized retail stores dominate the market due to their strong presence in malls, established trust with customers, and wide range of product offerings. They often provide personalized services, extended warranties, and attractive financing options. E-commerce platforms hold a significant share as they offer competitive pricing, convenience, and a broad selection of products. Hypermarkets such as Carrefour and Lulu are also key players, leveraging their extensive store networks and bundling strategies to attract budget-conscious consumers.

By Product Type: Smartphones hold the largest share in the UAE consumer electronics market due to the high penetration rate and continuous innovation in this segment. Home appliances such as refrigerators, washing machines, and air conditioners follow closely, reflecting the growing demand for modern living solutions. Smart home devices, including smart TVs, AI-based appliances, and home automation products, are also gaining popularity due to increased consumer awareness and the desire for enhanced connectivity and convenience.

By Distribution Channel: Offline channels, including large retail stores and hypermarkets, dominate the distribution landscape due to their established presence and ability to offer a hands-on product experience. E-commerce platforms, however, are rapidly growing, driven by the shift towards online shopping, better product comparisons, and the availability of multiple payment options. Direct sales through company-owned stores and authorized distributors also hold a significant share, especially for premium products that require personalized sales support.

Competitive Landscape in UAE Consumer Electronics Market

The UAE consumer electronics market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of online platforms such as Sharaf DG, Carrefour, Lulu Hypermarket, Emax, and Jumbo Electronics have diversified the market, offering consumers more choices and services.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Samsung Electronics | Televisions, Mobile Devices | 1938 | Suwon, South Korea |

Sony Corporation | Televisions, Imaging Devices | 1946 | Tokyo, Japan |

Apple Inc. | Computers, Mobile Devices | 1976 | Cupertino, California, USA |

LG Electronics | Televisions, Home Appliances | 1958 | Seoul, South Korea |

Panasonic Corporation | Home Appliances, Audio Devices | 1918 | Osaka, Japan |

Canon Inc. | Imaging Devices | 1937 | Tokyo, Japan |

Jumbo Electronics | Multi-category Electronics Retailer | 1974 | Dubai, UAE |

Sharaf Group | Multi-category Electronics Retailer | 1975 | Dubai, UAE |

HP Inc. | Computers and Peripherals | 1939 | Palo Alto, California, USA |

Huawei Technologies | Mobile Devices, Wearables | 1987 | Shenzhen, China |

Nikon Corporation | Imaging Devices | 1917 | Tokyo, Japan |

Some of the recent competitor trends and key information about competitors include:

Sharaf DG: As one of the leading electronics retailers in the UAE, Sharaf DG recorded over 5 million monthly visitors in 2023, marking a 20% increase in user engagement compared to the previous year. The company’s extensive product offerings, competitive pricing, and frequent promotions have made it a go-to destination for electronics buyers in the region. Sharaf DG’s focus on enhancing its e-commerce platform has also contributed to its strong market position.

Carrefour: A popular hypermarket chain, Carrefour saw a 25% increase in sales of consumer electronics in 2023. The company’s wide distribution network, bundled offers, and loyalty programs have been well received by value-seeking customers. Carrefour’s emphasis on in-store customer experience and exclusive in-store promotions have helped drive its growth in the electronics segment.

Lulu Hypermarket: Known for its wide variety of products and competitive pricing, Lulu Hypermarket reported a 30% growth in electronics sales in 2023. The company’s extensive store network and focus on providing a broad range of electronics from entry-level to premium segments have solidified its presence in the market. Lulu’s focus on offering value-for-money options has attracted a large number of budget-conscious consumers.

Emax: Emax, a prominent player in the consumer electronics retail sector, saw a 35% increase in sales of smart home devices and wearables in 2023. The company’s strategy of offering bundled deals, financing options, and a strong in-store experience has made it a popular choice among consumers seeking innovative and premium products. Emax has also expanded its online presence to capture the growing demand for e-commerce in the UAE.

Jumbo Electronics: One of the oldest electronics retailers in the UAE, Jumbo Electronics recorded a 15% increase in sales in 2023. The company’s focus on offering a comprehensive range of electronics, from home appliances to high-end audio-visual products, has enabled it to maintain a strong position in the market. Jumbo’s emphasis on customer service, after-sales support, and warranty programs has helped increase customer loyalty and satisfaction.

.png)

What Lies Ahead for UAE Consumer Electronics Market?

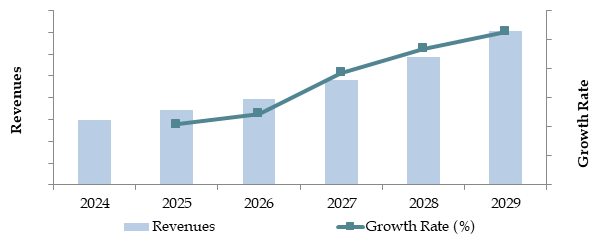

The UAE consumer electronics market is projected to grow steadily by 2029, exhibiting a robust CAGR during the forecast period. This growth is expected to be fueled by factors such as increasing disposable incomes, technological advancements, and rising consumer confidence in the electronics sector.

Shift Towards Smart and Connected Devices: As the UAE government continues to push for digital transformation, there is anticipated to be a gradual increase in both the availability and demand for smart and connected consumer electronics. This trend is supported by rising consumer awareness and the growing popularity of home automation solutions and smart devices.

Integration of Advanced Technologies: The integration of advanced technologies such as AI, IoT, and big data analytics in product design, development, and retail strategies is expected to provide consumers with more personalized and innovative products. These technological advancements will enhance product value, improve customer experience, and streamline the buying process, making it more efficient and user-friendly.

Growth of E-commerce Platforms: The market is seeing a significant shift towards online channels, with major retailers investing heavily in expanding their e-commerce capabilities. This trend is particularly strong among younger consumers who prioritize convenience, variety, and competitive pricing. The increasing adoption of digital platforms is expected to drive the overall market growth, providing consumers with more options and better access to the latest products.

Focus on Energy Efficiency and Sustainability: There is a rising trend towards energy-efficient and eco-friendly consumer electronics within the UAE market. This includes initiatives such as promoting the use of energy-efficient appliances, encouraging sustainable practices in manufacturing, and supporting the use of recycled materials. These practices are becoming more important to environmentally conscious consumers and are expected to shape future buying decisions.

Expansion of Premium and Luxury Segments: The demand for high-end consumer electronics is expected to rise, driven by an increase in high-net-worth individuals and the growing preference for premium products. This trend is supported by the expansion of luxury retail spaces and the introduction of exclusive product lines targeting affluent consumers seeking enhanced features and better performance.

Increased Localization and Manufacturing Initiatives: The UAE government’s focus on increasing local production and reducing dependency on imports through various incentives and subsidies is likely to boost local manufacturing capabilities. This initiative will not only create more job opportunities but also enhance the competitiveness of locally produced electronics, contributing to the overall growth of the market.

Future Outlook and Projections for UAE Consumer Electronics Market on the Basis of Revenues in USD Billion, 2024-2029

Source: TraceData Research Analysis

UAE Consumer Electronics Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Computer and Peripherals

- In-Car Entertainment

- In-Home Consumer Electronics

- Television

- Headphones

- Imaging Devices

- By Computer and Peripherals

- Desktops

- Laptops

- Tablets

- Monitors

- Printers

- In-Car Entertainment:

- In-Car Navigation

- In-Car Speakers

- In-Dash Media Players

- In-Home Consumer Electronics:

- Audio Separates

- Digital Media Player Docks

- Hi-Fi System

- Home Cinema & Speaker System

- Speakers

- Others

- Television and Video Players:

- TV Types:

- Analog TV

- LCD

- OLED

- Plasma

- Other TVs

- Video Players:

- BD Players

- DVD Players

- Video Recorders

- TV Types:

- Headphones:

- Wireless Headbands

- Wireless Earphones

- TWS Earbuds

- Imaging Devices:

- Cameras

- Camcorders

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

By Region:

- Central (Dubai, Abu Dhabi)

- Northern Emirates (Sharjah, Ajman, Ras Al Khaimah, Fujairah)

- Western Region (Al Ain)

Players Mentioned in the Report:

- Samsung Electronics

- Sony Corporation

- LG Electronics

- Apple Inc.

- Lenovo Group Ltd.

- Dell Technologies

- Hewlett-Packard (HP)

- Toshiba Corporation

- Panasonic Corporation

- Huawei Technologies Co., Ltd.

- Microsoft Corporation

- Logitech

- Corsair

- Razer Inc.

- SteelSeries

- HyperX

- Philips

- Bosch

- Bose Corporation

- Sharp Corporation

- Haier Electronics Group Co., Ltd.

Key Target Audience:

- Consumer Electronics Retailers

- E-commerce Platforms

- Consumer Electronics Manufacturers

- Regulatory Bodies (e.g., Emirates Authority for Standardization and Metrology)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the UAE Consumer Electronics Market

5.1. Overview and Business Cycle

5.2. Household Penetration for Each Type of Consumer Electronics in UAE, 2018-2023

5.3. Replacement Cycle of Consumer Electronics by Each Category, 2018-2023

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2018-2024

9.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2018-2024

9.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2018-2024

9.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2018-2024

9.2.4. By Television and Video Players

9.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2018-2024

9.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2018-2024

9.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2018-2024

9.2.6. By Imaging Devices (Camers and Camcorders), 2018-2024

9.3. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.4. By Emirates (Abu Dhabi, Dubai, Sharjah and others), 2023-2024P

9.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Consumer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

10.5. By Income, Age and Gender Split, 2024

11.1. Trends and Developments in the UAE Consumer Electronics Market

11.2. Growth Drivers for UAE Consumer Electronics Market

11.3. SWOT Analysis for UAE Consumer Electronics Market

11.4. Issues and Challenges in the UAE Consumer Electronics Market

11.5. Government Regulations and Initiatives for UAE Consumer Electronics Market

12.1. Market Size and Future Potential for Online Consumer Electronics Market, 2018-2029

12.2. Business Model and Revenue Streams of Leading Online Platforms

12.3. Cross Comparison of Leading Online Consumer Electronics Platforms Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Ticket Size for Consumer Electronics, 2018-2029

13.2. Trends in Financing Options for Consumer Electronics

13.3. Popular Consumer Electronics Segments with Higher Finance Penetration Rates

13.4. Finance Split by Banks/NBFCs/Private Finance Companies, 2023-2024P

13.5. Average Loan Tenure for Consumer Electronics Financing in UAE

13.6. Finance Disbursement for Consumer Electronics in INR Crores, 2018-2024P

16.1. Market Share of Key Players in UAE Consumer Electronics Market, 2018-2024

16.2. Market Share of Key Players in UAE Computer and Peripherals Market, 2018-2024

16.3. Market Share of Key Players in UAE In-Car Entertainment Market, 2018-2024

16.4. Market Share of Key Players in UAE In-Home Consumer Electronics Market, 2018-2024

16.5. Market Share of Key Players in UAE Television Market, 2018-2024

16.6. Market Share of Key Players in UAE Headphones Market, 2024

16.7. Market Share of Key Players in UAE Imaging Devices Market, 2024

16.8. Benchmarking of Key Competitors in UAE Consumer Electronics Market including Operational and Financial Parameters

16.9. Heat Map Analysis for Major Players in UAE Consumer Electronics Market

16.10. Strengths and Weaknesses Analysis

16.11. Operating Model Analysis Framework

16.12. Gartner Magic Quadrant

16.13. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Sales Volume, 2025-2029

18.1. By Market Structure (Branded and Local Brands), 2025-2029

18.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2025-2029

18.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2025-2029

18.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2025-2029

18.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2025-2029

18.2.4. By Television and Video Players

18.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2025-2029

18.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2025-2029

18.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2025-2029

18.2.6. By Imaging Devices (Camers and Camcorders), 2025-2029

18.3. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

18.4. By Emirates (Dubai, Sharjah, Abu Dhabi and others), 2025-2029

18.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

18.6. Recommendations

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the UAE Consumer Electronics Market. Based on this ecosystem, we will shortlist leading 5-6 players in the country based on their financial performance, market share, and product portfolio. Data sourcing is made through industry articles, multiple secondary sources, and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a comprehensive analysis of the market, aggregating industry-level insights on market size, sales revenue, number of market players, product categories, price levels, and consumer demand.

We supplement this research with detailed examinations of company-level data, relying on sources such as press releases, annual reports, financial statements, and other publicly available documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, senior management, and other stakeholders representing various UAE Consumer Electronics Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate sales volume, market shares, and the competitive landscape for each player, thereby aggregating data to derive overall market insights.

As part of our validation strategy, our team executes disguised interviews, approaching companies under the guise of potential customers. This enables us to validate operational and financial information shared by company executives, cross-checking this data against secondary sources. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, pricing strategies, and other key factors influencing the market.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, are undertaken to ensure data integrity and to cross-verify the findings. A comprehensive sanity check process is implemented to validate the accuracy of the final market projections.

FAQs

01 What is the potential for the UAE Consumer Electronics Market?

The UAE consumer electronics market is poised for substantial growth, reaching a valuation of AED 25 Billion in 2023. This growth is driven by factors such as the increasing demand for smart devices, growing disposable incomes, and the shift towards more connected and innovative products.

02 Who are the Key Players in the UAE Consumer Electronics Market?

The UAE Consumer Electronics Market features several key players, including Sharaf DG, Carrefour, Lulu Hypermarket, and Emax. These companies dominate the market due to their extensive distribution networks, strong brand presence, and diverse product offerings.

03 What are the Growth Drivers for the UAE Consumer Electronics Market?

The primary growth drivers include economic factors, such as rising disposable incomes and the increased demand for premium products. The expanding digital landscape and integration of technology into retail processes also contribute to the growing demand for electronics in the UAE.

04 What are the Challenges in the UAE Consumer Electronics Market?

The UAE Consumer Electronics Market faces several challenges, including high price sensitivity and limited access to after-sales services in rural areas. Regulatory challenges, such as stringent safety and quality standards, can also impact the availability of products.