UAE Diode Lasers Market Outlook to 2035

By Application Area, By Power Output, By Wavelength Range, By End-User Setting, and By Emirate

- Product Code: TDR0489

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “UAE Diode Lasers Market Outlook to 2035 – By Application Area, By Power Output, By Wavelength Range, By End-User Setting, and By Emirate” provides a comprehensive analysis of the diode laser industry in the United Arab Emirates. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and compliance landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the UAE diode lasers market. The report concludes with future market projections based on aesthetic and dermatology procedure growth, medical tourism inflows, technology adoption in healthcare and industrial sectors, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

UAE Diode Lasers Market Overview and Size

The UAE diode lasers market is valued at approximately ~USD ~ million, representing the supply of semiconductor-based laser systems used across medical, aesthetic, dental, ophthalmic, and selective industrial applications. Diode lasers operate through electrically pumped semiconductor junctions and are widely adopted due to their compact form factor, energy efficiency, wavelength specificity, lower operating costs, and compatibility with portable and clinic-based platforms.

The market is strongly anchored by the UAE’s rapidly expanding aesthetic medicine ecosystem, high per-capita healthcare spending, and the country’s positioning as a regional hub for cosmetic procedures and advanced outpatient treatments. Diode lasers are extensively used in laser hair removal, skin rejuvenation, vascular lesion treatment, acne management, and minor surgical procedures, particularly in dermatology and aesthetic clinics. Beyond aesthetics, adoption is also growing in dental practices, ENT procedures, ophthalmology adjunct applications, and selective industrial marking and sensing use cases.

Dubai and Abu Dhabi together account for the majority of diode laser installations in the UAE, driven by concentration of premium clinics, hospital networks, medical free zones, and international patient inflows. Dubai leads in aesthetic and cosmetic laser installations due to its strong medical tourism pull, dense network of private clinics, and rapid technology refresh cycles. Abu Dhabi represents a structurally stable demand center, supported by government-backed healthcare investments, public-private hospital systems, and regulated adoption of advanced medical technologies. Northern emirates such as Sharjah and Ras Al Khaimah are emerging growth pockets, driven by rising local demand for affordable aesthetic treatments and expansion of mid-tier clinics.

What Factors are Leading to the Growth of the UAE Diode Lasers Market

Rapid expansion of aesthetic and cosmetic procedure volumes strengthens core demand: The UAE has witnessed sustained growth in non-invasive and minimally invasive aesthetic procedures, particularly laser hair removal, skin tightening, pigmentation correction, and vascular treatments. Diode lasers are among the most :faster treatment times, and relatively lower complication rates when operated by trained practitioners. Clinics favor diode laser platforms because they allow high patient throughput, standardized treatment protocols, and strong return on investment. This procedural volume growth directly translates into steady replacement demand, upgrades to higher-power systems, and multi-wavelength platform adoption.

Medical tourism and premium private healthcare ecosystem accelerate technology adoption: The UAE’s positioning as a global medical tourism destination has led clinics and hospitals to continuously invest in advanced, globally recognized laser technologies. International patients often expect access to the latest laser platforms, safety standards, and treatment outcomes comparable to Europe and North America. As a result, premium diode laser systems with higher power output, integrated cooling mechanisms, and customizable wavelength configurations are increasingly favored by high-end clinics. This dynamic accelerates technology refresh cycles and supports pricing resilience in the premium segment of the market.

Shift toward outpatient, clinic-based, and portable laser systems supports diode laser penetration: Healthcare delivery in the UAE is increasingly shifting toward outpatient and day-care settings, particularly for dermatology and dental procedures. Diode lasers align well with this shift due to their compact design, lower infrastructure requirements, and ease of integration into clinic environments. Compared to larger solid-state or gas-based laser systems, diode lasers offer lower maintenance costs, simpler power requirements, and easier operator training. This makes them especially attractive to small and mid-sized clinics, franchise-based aesthetic chains, and newly established practices across secondary cities.

Which Industry Challenges Have Impacted the Growth of the UAE Diode Lasers Market:

Price competition from low-cost imports and private-label systems impacts margin stability and purchasing confidence: While the UAE diode lasers market benefits from strong demand fundamentals, it faces persistent price pressure due to the influx of low-cost imported systems, particularly from Asia, marketed through private-label distributors and trading entities. These systems often compete aggressively on upfront pricing, creating challenges for established international brands that invest heavily in R&D, clinical validation, regulatory compliance, and after-sales infrastructure. For clinics, the presence of widely varying price points can complicate purchasing decisions, increase perceived risk around performance consistency, and, in some cases, lead to suboptimal clinical outcomes that affect overall market credibility. Margin compression also limits the ability of authorized distributors to invest in training, service coverage, and long-term customer support.

Dependence on skilled operators and variability in practitioner training affects treatment outcomes and device utilization: Although diode lasers are considered relatively user-friendly compared to more complex laser platforms, treatment efficacy and patient safety remain highly dependent on operator skill, parameter selection, and adherence to protocols. In the UAE, rapid expansion of aesthetic clinics has led to uneven levels of practitioner experience, particularly in high-volume hair removal centers and newly established practices. Insufficient training or high staff turnover can result in inconsistent outcomes, adverse events, or underutilization of advanced system features. This variability can reduce perceived value for premium systems and slow upgrade cycles if clinics are unable to fully leverage the technological capabilities of their equipment.

Regulatory compliance costs and approval timelines create barriers for smaller distributors and newer market entrants: Medical and aesthetic laser devices in the UAE are subject to registration, conformity assessment, and licensing requirements prior to commercialization and clinical use. While this regulatory structure supports patient safety and market formalization, it also increases entry costs for smaller distributors and limits the speed at which new models can be introduced. Delays in product approvals, documentation requirements, and post-market surveillance obligations can extend time-to-market and increase working capital requirements. These factors disproportionately affect mid-tier and emerging suppliers, potentially narrowing competition in regulated channels while allowing informal or gray-market devices to persist in less regulated segments.

What are the Regulations and Initiatives which have Governed the Market:

Medical device registration and safety compliance requirements governing laser-based systems: Diode laser systems used in medical and aesthetic applications in the UAE must comply with national medical device regulations covering safety, performance, labeling, and post-market monitoring. Devices are required to undergo registration and approval processes prior to sale, ensuring alignment with internationally recognized standards for laser safety and electromagnetic compatibility. These requirements influence system design, documentation, and clinical claims, and they shape procurement decisions by hospitals and licensed clinics that prioritize fully compliant equipment. Compliance obligations also necessitate coordination between manufacturers, authorized distributors, and healthcare facilities to ensure traceability and ongoing regulatory adherence.

Licensing and practitioner credentialing frameworks governing laser usage in clinical settings: Laser-based treatments in the UAE are governed not only at the device level but also through practitioner licensing and facility accreditation requirements. Clinics must ensure that laser procedures are performed by licensed professionals with documented training and competency in laser operation. Regulatory authorities increasingly emphasize protocol adherence, safety measures, and incident reporting, particularly in high-volume aesthetic practices. These frameworks influence demand by favoring reputable suppliers that provide structured training programs, certification support, and clinical documentation aligned with regulatory expectations.

Government initiatives supporting healthcare quality, medical tourism, and technology adoption: Broader healthcare initiatives aimed at positioning the UAE as a regional center for high-quality medical services indirectly support the diode lasers market. Investments in healthcare infrastructure, encouragement of medical tourism, and promotion of advanced outpatient care models create an environment where clinics are incentivized to adopt modern, internationally benchmarked technologies. While these initiatives do not directly mandate specific device types, they elevate expectations around treatment outcomes, patient experience, and safety—factors that favor advanced diode laser platforms with proven clinical performance and strong brand recognition.

UAE Diode Lasers Market Segmentation

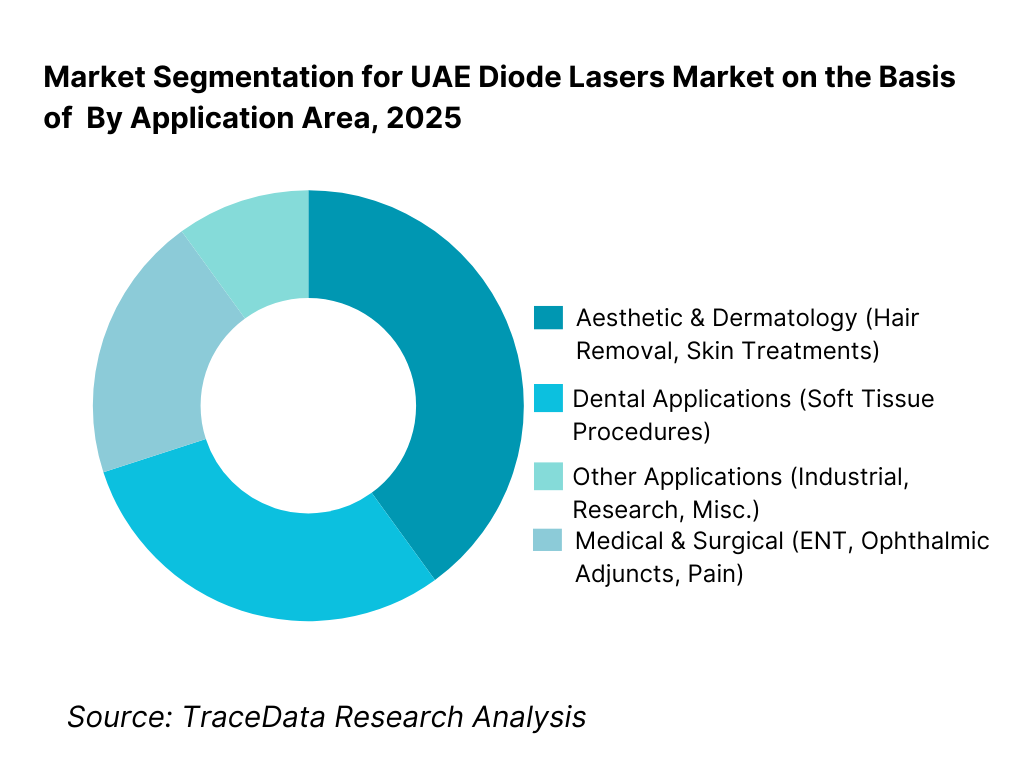

By Application Area: The aesthetic and dermatology segment holds dominance in the UAE diode lasers market. This is because diode laser systems are most widely deployed for laser hair removal, skin rejuvenation, pigmentation treatment, and vascular lesion management—procedures that form the core revenue base of aesthetic clinics across the UAE. High treatment frequency, repeat sessions, and strong consumer acceptance make aesthetics the most volume-driven application. While medical, dental, and minor surgical applications are growing steadily, the aesthetics segment continues to benefit from clinic expansion, medical tourism inflows, and rapid technology refresh cycles.

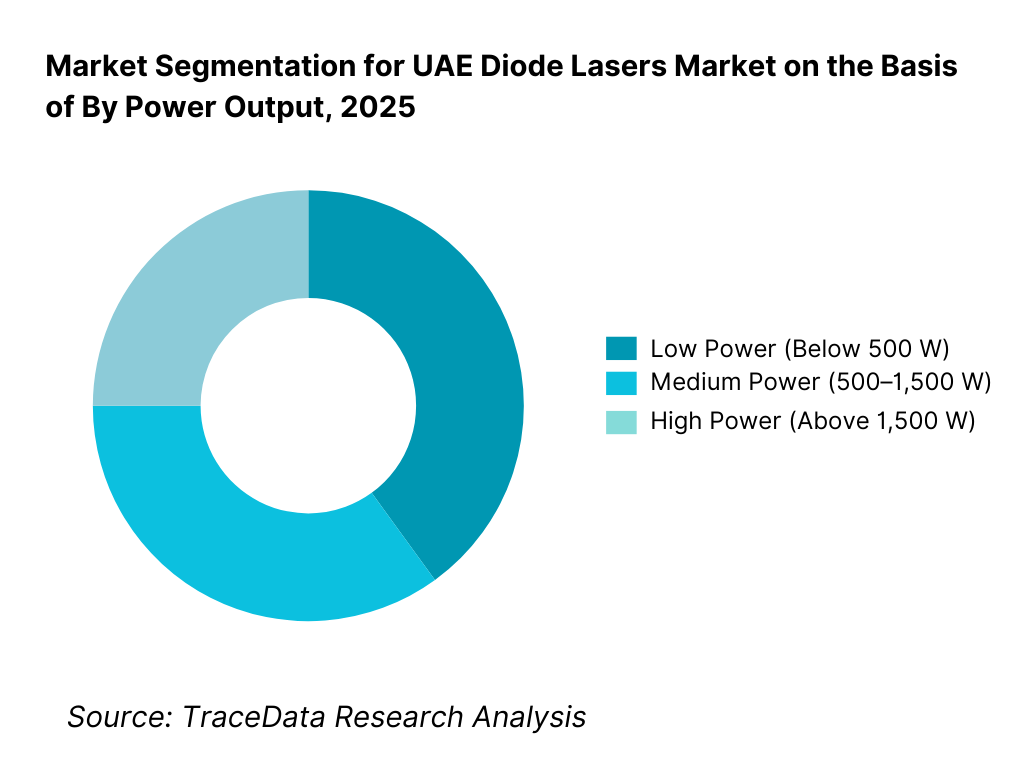

By Power Output: Mid-to-high power diode laser systems dominate the UAE market as clinics prioritize faster treatment times, higher patient throughput, and improved efficacy across a wide range of skin types. Systems in this category are preferred by high-volume aesthetic centers and multi-branch clinic chains. Low-power systems continue to find adoption in dental clinics and niche medical applications, while very high-power platforms remain limited to premium clinics due to cost and infrastructure requirements.

Competitive Landscape in UAE Diode Lasers Market

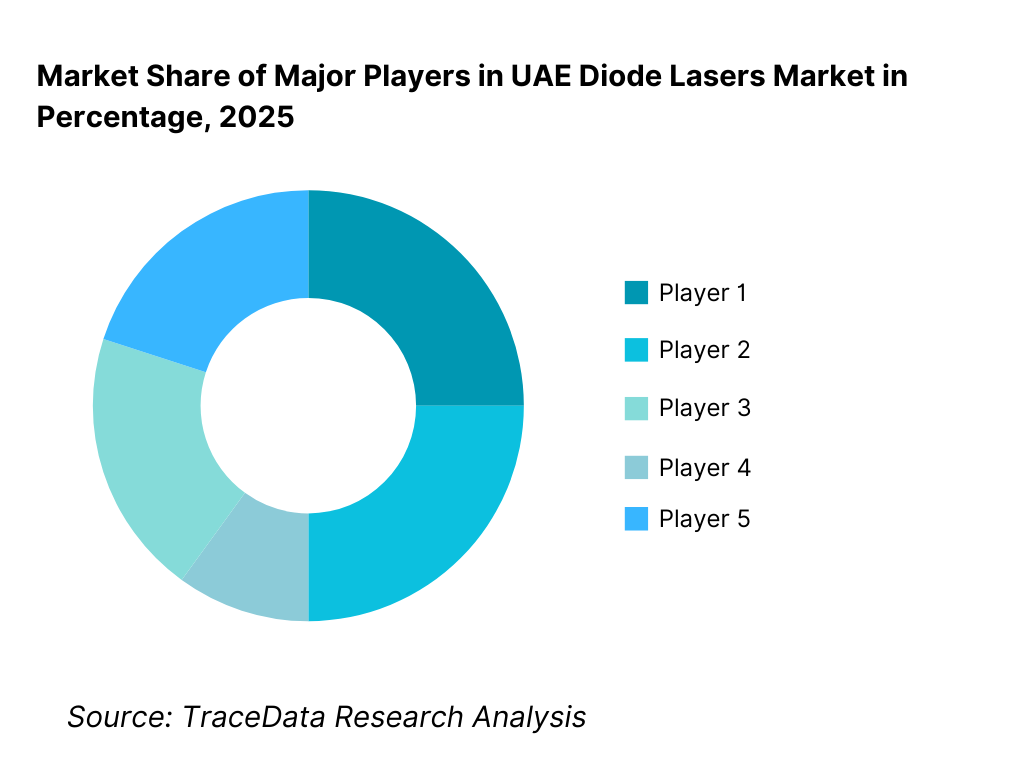

The UAE diode lasers market exhibits moderate-to-high fragmentation, characterized by the presence of global medical laser manufacturers, regional distributors, and private-label systems sourced through international OEMs. Market leadership is influenced by brand credibility, clinical performance, regulatory compliance, local service support, and practitioner training infrastructure. While established international brands dominate the premium segment, mid-tier and entry-level segments face intense competition from cost-competitive suppliers offering aggressive pricing and flexible financing.

Premium brands are preferred by high-end clinics and hospitals that emphasize safety, clinical outcomes, and international patient expectations. Meanwhile, smaller clinics and high-volume hair removal centers often balance upfront cost considerations with acceptable performance, leading to a diverse competitive mix across market tiers.

Key Companies Operating in the UAE Diode Lasers Market

Name | Founding Year | Original Headquarters |

Lumenis | 1966 | Yokneam, Israel |

Cynosure | 1991 | Massachusetts, USA |

Alma Lasers | 1999 | Caesarea, Israel |

Candela Medical | 1970 | Massachusetts, USA |

Fotona | 1964 | Ljubljana, Slovenia |

Asclepion Laser Technologies | 1977 | Jena, Germany |

Bison Medical | 2000 | Taipei, Taiwan |

Jeisys Medical | 2001 | Seoul, South Korea |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Lumenis: Lumenis continues to hold a strong premium position in the UAE diode lasers market, particularly in high-end dermatology and aesthetic clinics. Its competitive strength lies in clinical validation, global brand recognition, and advanced cooling and safety technologies. The company benefits from strong distributor partnerships and demand from clinics catering to international medical tourists.

Alma Lasers: Alma Lasers remains highly competitive in the UAE due to its focus on multi-application platforms and modular system configurations. Its diode laser offerings are widely adopted by clinics seeking flexibility across hair removal and skin treatments. The brand’s emphasis on practitioner training and localized service support reinforces its market presence.

Candela Medical: Candela competes strongly in the premium and upper-mid segments, with diode laser systems known for consistent performance and strong clinical outcomes. The company’s positioning is supported by a reputation for safety, robust after-sales support, and alignment with regulatory expectations in tightly controlled healthcare environments.

Cynosure: Cynosure’s diode laser platforms appeal to clinics prioritizing efficiency, treatment speed, and integration with broader aesthetic device portfolios. The company benefits from brand familiarity among dermatologists and aesthetic practitioners, particularly those trained in North America and Europe.

Fotona: Fotona differentiates through engineering depth and precision, with diode lasers often positioned alongside its broader laser ecosystem. Its systems are favored by clinics that emphasize procedural versatility and long-term durability over lowest upfront cost.

Asian OEM and Private-Label Suppliers: A growing number of Asian manufacturers supply diode laser systems into the UAE through private-label arrangements. These players compete primarily on pricing and financing flexibility, enabling penetration into high-volume hair removal centers and emerging clinics. However, variability in service quality and regulatory compliance remains a key differentiator compared to established global brands.

What Lies Ahead for UAE Diode Lasers Market?

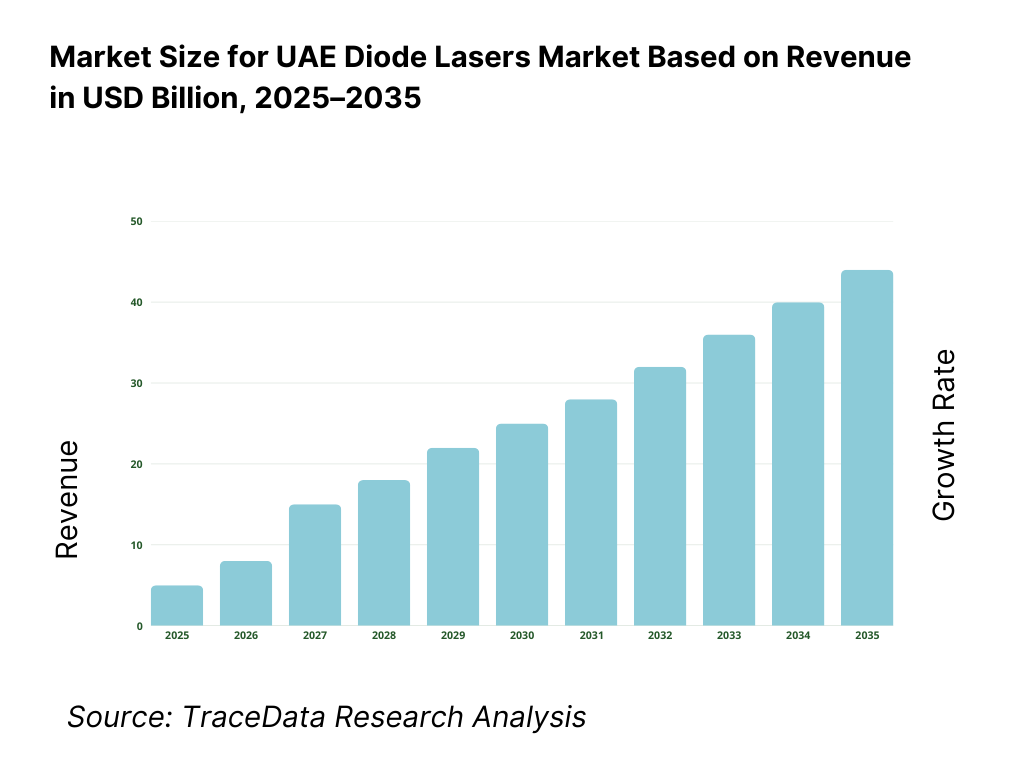

The UAE diode lasers market is expected to expand steadily through 2035, supported by sustained growth in aesthetic and dermatology procedures, increasing medical tourism inflows, and continued investment in private healthcare and outpatient clinic infrastructure. Growth momentum is further reinforced by rising consumer acceptance of non-invasive cosmetic treatments, expanding clinic networks across major emirates, and the preference for compact, energy-efficient laser platforms that align with clinic-based care models. As providers increasingly prioritize faster treatment cycles, predictable clinical outcomes, and scalable service offerings, diode lasers will remain a cornerstone technology across aesthetic, dental, and selective medical applications in the UAE.

Transition Toward Higher-Power and Multi-Application Diode Laser Platforms: The future of the UAE diode lasers market will see a shift from single-application, entry-level systems toward higher-power and multi-application platforms capable of addressing a broader range of skin types, indications, and treatment protocols. Clinics are increasingly demanding systems that deliver faster treatment times, improved penetration depth, and consistent results across diverse patient profiles. This trend is particularly evident in high-volume hair removal and skin treatment centers, where throughput and efficiency directly impact profitability. Suppliers offering modular, upgradeable platforms with multiple wavelength options will be better positioned to capture premium demand.

Growing Emphasis on Patient Experience, Safety, and Outcome Consistency: Patient comfort, safety, and predictable outcomes will become increasingly central to equipment purchasing decisions. Demand is expected to rise for diode laser systems equipped with advanced cooling technologies, real-time energy modulation, and automated safety controls. Clinics catering to international and high-income patients will place greater emphasis on minimizing adverse events, reducing downtime, and ensuring consistent results across multiple sessions. These factors will favor established brands with strong clinical validation, structured training programs, and documented treatment protocols.

Expansion of Clinic Chains and Standardized Treatment Models Across Emirates: Large aesthetic clinic chains and multi-location operators are expected to expand their footprints across Dubai, Abu Dhabi, and secondary emirates. Diode lasers support this expansion by enabling standardized treatment protocols, uniform patient experiences, and centralized procurement strategies. Through 2035, this trend will strengthen demand for systems that are easy to deploy across multiple sites, supported by reliable after-sales service and consistent operator training. Suppliers capable of supporting chain-wide rollouts with predictable delivery timelines and service coverage will gain competitive advantage.

Integration of Digital Features, Software Controls, and Service-Led Business Models: Digitalization will increasingly shape the diode lasers market, with greater integration of software-driven treatment presets, usage analytics, and remote diagnostics. Clinics will expect faster onboarding, simplified operator interfaces, and improved system uptime supported by proactive maintenance. Manufacturers and distributors may increasingly bundle service contracts, training, and software updates as part of the overall value proposition, shifting competition from hardware-only sales to longer-term service-led relationships.

UAE Diode Lasers Market Segmentation

By Application Area

• Aesthetic & Dermatology (Hair Removal, Skin Rejuvenation, Pigmentation)

• Dental Applications (Soft Tissue Procedures)

• Medical & Surgical (ENT, Ophthalmic Adjuncts, Pain Management)

• Other Applications (Industrial, Research, Training)

By Power Output

• Low Power Systems

• Medium Power Systems

• High Power Systems

By Wavelength Range

• Single-Wavelength Diode Lasers

• Dual-Wavelength Diode Lasers

• Multi-Wavelength / Hybrid Platforms

By End-User Setting

• Private Aesthetic & Dermatology Clinics

• Hospitals & Medical Centers

• Dental Clinics

• Others (Research, Training, Industrial)

By Emirate

• Dubai

• Abu Dhabi

• Sharjah

• Ras Al Khaimah

• Other Emirates

Players Mentioned in the Report:

• Lumenis

• Alma Lasers

• Candela Medical

• Cynosure

• Fotona

• Asclepion Laser Technologies

• Jeisys Medical

• Asian OEM and private-label diode laser suppliers operating through regional distributors

Key Target Audience

• Diode laser manufacturers and OEMs

• Authorized distributors and medical device suppliers

• Aesthetic and dermatology clinic chains

• Hospitals and specialty medical centers

• Dental clinic networks

• Healthcare investors and clinic operators

• Medical tourism facilitators

• Healthcare regulators and accreditation bodies

Time Period:

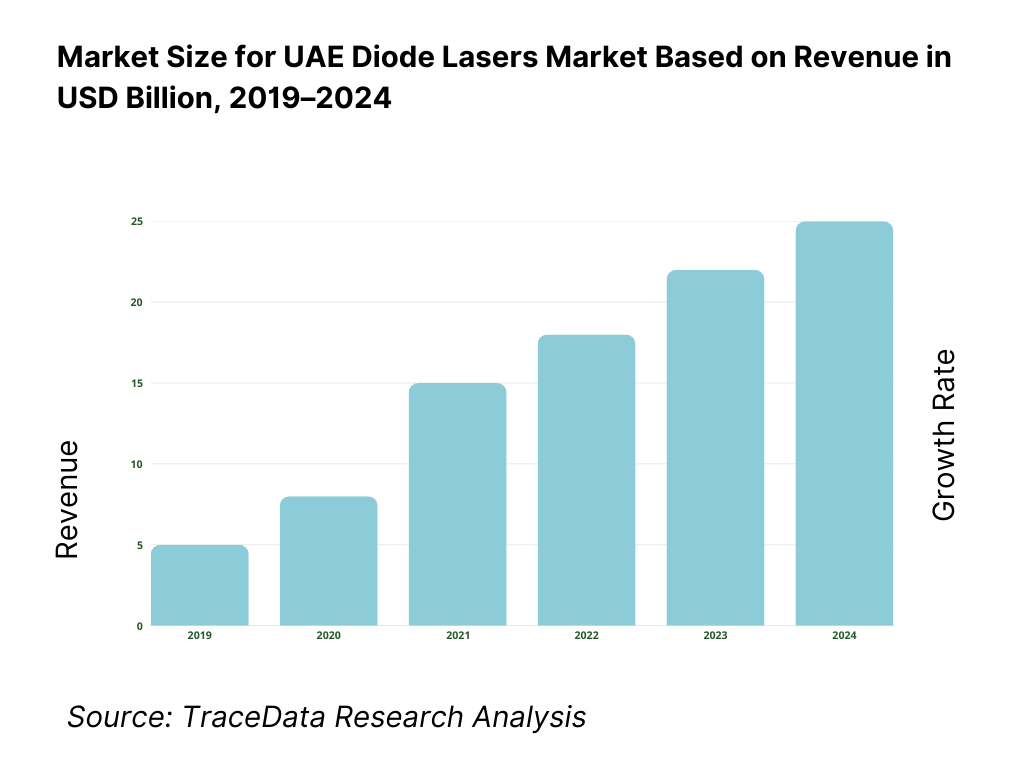

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Device and Delivery Model Analysis for Diode Lasers including direct manufacturer sales, authorized distributor models, private-label imports, and clinic-based procurement with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for Diode Lasers Market including equipment sales, service and maintenance contracts, training and certification revenues, consumables and accessories, and upgrade or replacement sales

4. 3 Business Model Canvas for Diode Lasers Market covering manufacturers, distributors, service partners, aesthetic and medical clinics, hospitals, regulators, and financing providers

5. 1 Global Diode Laser Manufacturers vs Regional and Local Suppliers including premium international brands, mid-tier regional players, and private-label or OEM-based suppliers

5. 2 Investment Model in Diode Lasers Market including R&D investments, clinical validation, distributor network expansion, training infrastructure, and service capability investments

5. 3 Comparative Analysis of Diode Laser Distribution by Direct Sales and Distributor-Led Channels including authorized dealership models and private-label sourcing

5. 4 Clinic Equipment Budget Allocation comparing diode lasers versus other energy-based devices with average capital spend per clinic per year

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by application area and by power output segment

8. 3 Key Market Developments and Milestones including regulatory approvals, clinic chain expansions, product launches, and technology upgrades

9. 1 By Application Area including aesthetics and dermatology, dental, medical and surgical, and other applications

9. 2 By Power Output including low power, medium power, and high power systems

9. 3 By Wavelength Range including single-wavelength, dual-wavelength, and multi-wavelength platforms

9. 4 By End-User Setting including aesthetic clinics, hospitals, dental clinics, and others

9. 5 By Consumer Profile including premium clinics, mid-tier clinics, and high-volume hair removal centers

9. 6 By Device Configuration including standalone systems and integrated or hybrid platforms

9. 7 By Purchase Model including outright purchase, distributor financing, and replacement or upgrade-based procurement

9. 8 By Emirate including Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, and other emirates

10. 1 Clinic Landscape and Cohort Analysis highlighting premium clinics, chain operators, and independent practices

10. 2 Equipment Selection and Purchase Decision Making influenced by power output, safety features, brand reputation, and ROI considerations

10. 3 Utilization and ROI Analysis measuring treatment throughput, payback periods, and system utilization rates

10. 4 Gap Analysis Framework addressing training gaps, service responsiveness, pricing affordability, and technology differentiation

11. 1 Trends and Developments including higher-power systems, advanced cooling technologies, multi-wavelength platforms, and software-enabled controls

11. 2 Growth Drivers including aesthetic procedure growth, medical tourism, outpatient care expansion, and clinic network scaling

11. 3 SWOT Analysis comparing global brand strength versus cost-competitive regional and private-label suppliers

11. 4 Issues and Challenges including price competition, regulatory compliance, operator skill variability, and after-sales service consistency

11. 5 Government Regulations covering medical device registration, clinic licensing, practitioner credentialing, and laser safety guidelines in the UAE

12. 1 Market Size and Future Potential of diode lasers within the broader aesthetic devices ecosystem

12. 2 Business Models including premium equipment-led models, volume-driven clinic deployments, and service-supported offerings

12. 3 Delivery Models and Type of Solutions including clinic-based installations, portable systems, and integrated treatment platforms

15. 1 Market Share of Key Players by revenues and installed base

15. 2 Benchmark of 15 Key Competitors including global premium brands, regional manufacturers, and private-label suppliers

15. 3 Operating Model Analysis Framework comparing premium brand-led models, distributor-centric models, and private-label sourcing strategies

15. 4 Gartner Magic Quadrant positioning global leaders and regional challengers in diode laser systems

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through differentiation via performance versus price-led mass-market strategies

16. 1 Revenues with projections

17. 1 By Application Area including aesthetics, dental, and medical applications

17. 2 By Power Output including low, medium, and high power systems

17. 3 By Wavelength Range including single, dual, and multi-wavelength platforms

17. 4 By End-User Setting including clinics, hospitals, and dental practices

17. 5 By Consumer Profile including premium and mid-tier clinics

17. 6 By Device Configuration including standalone and integrated systems

17. 7 By Purchase Model including direct purchase and upgrade-based replacement

17. 8 By Emirate including Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, and other emirates

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the UAE Diode Lasers Market across demand-side and supply-side entities. On the demand side, entities include aesthetic and dermatology clinics, multi-location clinic chains, hospitals and medical centers, dental clinics, day-care surgical facilities, and selective research and training institutions. Demand is further segmented by application type (hair removal, skin rejuvenation, pigmentation, vascular treatment, dental soft tissue, minor surgical use), treatment volume intensity (high-throughput vs boutique practices), and purchasing model (direct purchase, distributor-led financing, lease or upgrade-based procurement).

On the supply side, the ecosystem includes global diode laser manufacturers, regional and local authorized distributors, private-label suppliers sourcing from international OEMs, service and maintenance providers, training and certification partners, regulatory and licensing authorities, and logistics and installation partners. From this mapped ecosystem, we shortlist 8–12 leading diode laser brands and distributors based on installed base, regulatory approvals, brand positioning (premium vs mid-tier), service coverage, and presence across Dubai, Abu Dhabi, and secondary emirates. This step establishes how value is created and captured across equipment manufacturing, distribution, installation, clinical training, after-sales service, and replacement cycles.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the UAE diode lasers market structure, demand drivers, and segment behavior. This includes reviewing trends in aesthetic and cosmetic procedure volumes, medical tourism inflows, expansion of private healthcare infrastructure, and growth of outpatient and clinic-based care models. We assess buyer preferences around treatment efficacy, patient comfort, power output, cooling technology, system reliability, and return on investment.

Company-level analysis includes review of product portfolios, wavelength configurations, power ranges, cooling mechanisms, software features, pricing positioning, distributor models, and service offerings. We also examine regulatory and compliance dynamics governing medical and aesthetic laser devices, including device registration requirements, clinic licensing norms, and practitioner credentialing frameworks. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with diode laser manufacturers, authorized distributors, aesthetic clinic owners, dermatologists, plastic surgeons, dental practitioners, hospital procurement teams, and service engineers. The objectives are threefold: (a) validate assumptions around demand concentration by application and emirate, (b) authenticate segment splits by power output, end-user setting, and pricing tier, and (c) gather qualitative insights on purchasing behavior, upgrade cycles, financing preferences, service expectations, and competitive differentiation.

A bottom-to-top approach is applied by estimating the installed base of diode laser systems, average replacement cycles, and new clinic additions across key emirates, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with distributors and clinics to validate field-level realities such as quoted pricing ranges, delivery timelines, training support quality, and common challenges related to system uptime and consumable availability.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as healthcare spending trends, medical tourism growth, clinic licensing data, and population-driven aesthetics demand. Assumptions around replacement cycles, power adoption trends, regulatory enforcement, and pricing pressure are stress-tested to understand their impact on adoption and revenue growth.

Sensitivity analysis is conducted across key variables including procedure growth rates, premium vs mid-tier system adoption, regulatory tightening scenarios, and distributor service capacity. Market models are refined until alignment is achieved between supplier shipment potential, distributor throughput, and clinic-level demand dynamics, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the UAE Diode Lasers Market?

The UAE diode lasers market holds strong potential, supported by sustained growth in aesthetic and dermatology procedures, rising consumer acceptance of non-invasive treatments, and the UAE’s positioning as a regional medical tourism hub. Diode lasers are expected to remain a core technology due to their versatility, efficiency, and suitability for high-throughput clinic environments. As clinics increasingly upgrade to higher-power and multi-application platforms, the market is expected to generate steady replacement and premiumization-led growth through 2035.

02 Who are the Key Players in the UAE Diode Lasers Market?

The market features a mix of global medical laser manufacturers, regional distributors, and private-label suppliers operating across different pricing tiers. Competition is shaped by brand credibility, regulatory compliance, clinical performance, after-sales service quality, and practitioner training support. Authorized distributors play a critical role in market penetration, customer education, and long-term equipment utilization across emirates.

03 What are the Growth Drivers for the UAE Diode Lasers Market?

Key growth drivers include expansion of aesthetic clinic networks, high procedure volumes in laser hair removal and skin treatments, increasing medical tourism inflows, and the shift toward outpatient and clinic-based care models. Additional momentum comes from technology advancements in cooling systems, higher power outputs, and multi-wavelength platforms that improve treatment efficiency and patient comfort. Strong replacement and upgrade demand further reinforces long-term growth.

04 What are the Challenges in the UAE Diode Lasers Market?

Challenges include pricing pressure from low-cost imports, variability in practitioner skill levels, and increasing regulatory compliance requirements for devices and clinics. High dependence on imported equipment exposes the market to supply chain and currency risks. Additionally, uneven service quality among distributors can impact system uptime and buyer satisfaction, influencing purchasing decisions and brand loyalty.