UAE Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Service Segments, By End Users, By Mode of Transport, By Type of Warehousing, and By Emirates

- Product Code: TDR0330

- Region: Middle East

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “UAE Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Service Segments, By End Users, By Mode of Transport, By Type of Warehousing, and By Emirates” provides a comprehensive analysis of the logistics and warehousing sector in the UAE. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the UAE Logistics and Warehousing Market. The report concludes with future market projections based on service demand, transport mode, end-user verticals, region-wise outlook, cause-and-effect relationships, and case studies highlighting growth opportunities and strategic considerations.

UAE Logistics and Warehousing Market Overview and Size

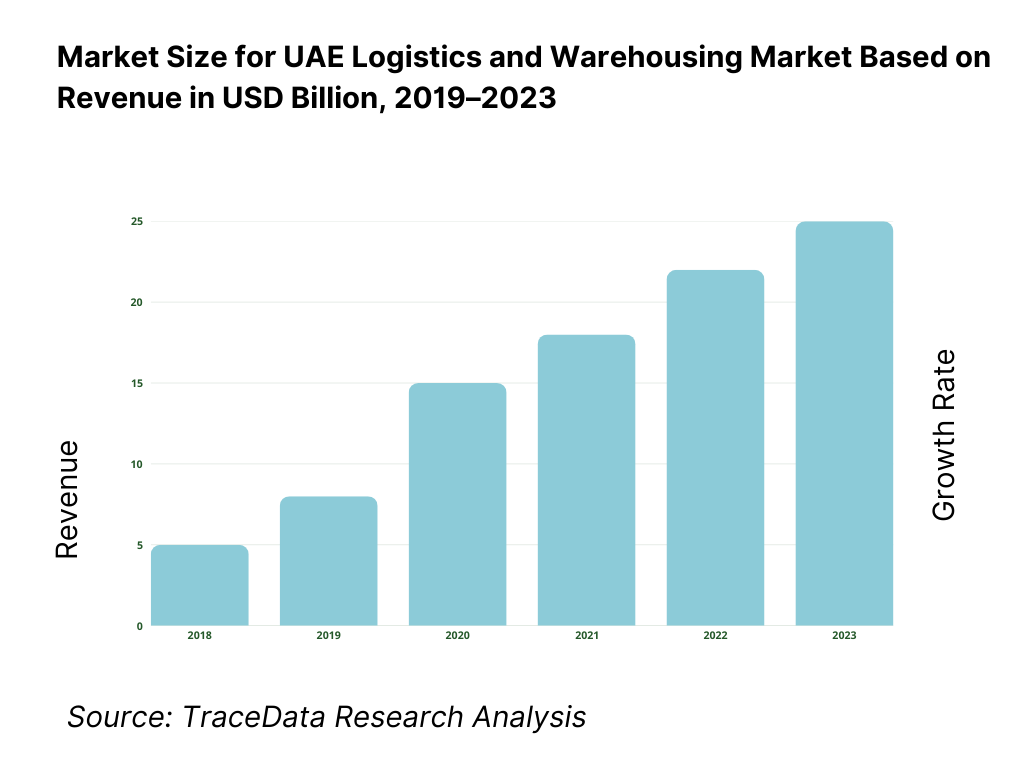

The UAE logistics and warehousing market reached an estimated valuation of AED 85 Billion in 2023, driven by the country’s role as a regional trade and transport hub, rising e-commerce penetration, and continuous infrastructure investment. The market is dominated by players such as DP World, Emirates Logistics, Aramex, Agility Logistics, and Hellmann Worldwide Logistics, offering integrated solutions across freight forwarding, last-mile delivery, cold storage, and bonded warehousing.

Dubai remains the epicenter of logistics due to its well-established ports (Jebel Ali), airports, and free zones like Dubai South and JAFZA. Abu Dhabi and Sharjah are also emerging as key logistics corridors due to industrial diversification and government-led logistics cluster development.

In 2023, Emirates Post Group and Aramex launched joint last-mile delivery optimization programs, targeting reduced delivery time by 30% to meet the e-commerce sector’s growing needs.

What Factors are Leading to the Growth of UAE Logistics and Warehousing Market

Strategic Geographic Location: UAE’s location between Europe, Asia, and Africa positions it as a vital transshipment hub. Over 50% of global trade routes pass within 8 hours’ flight of the UAE, increasing its importance in global supply chains.

E-commerce Boom: The UAE e-commerce market surpassed AED 27 Billion in 2023, increasing the demand for last-mile delivery services and fulfillment centers. Fulfillment solutions now represent over 15% of total warehousing demand.

Free Trade Zones and Infrastructure: Government investments in free zones, rail logistics (Etihad Rail), and smart ports have significantly boosted logistics capability. In 2023, over 90% of logistics operations in Dubai were handled through free zones offering tax-free incentives.

Which Industry Challenges Have Impacted the Growth for UAE Logistics and Warehousing Market

High Operational Costs: The UAE logistics market faces significant operational cost burdens, particularly around warehousing rentals, fuel prices, and labor. In 2023, operating costs accounted for nearly 45% of total logistics expenditure, making profitability a challenge for smaller logistics players. Dubai’s Grade-A warehouse rents surged by 12% year-over-year, tightening margins further for SMEs and startups.

Fragmented Last-Mile Delivery Ecosystem: While last-mile delivery has grown with e-commerce, it remains fragmented and cost-inefficient. An industry report in 2023 revealed that delivery failure rates touched 18% due to inaccurate address data and poor logistics coordination, particularly in dense urban zones like Sharjah and Abu Dhabi suburbs.

Talent and Skill Shortages: Despite automation growth, there is a 25% shortfall in skilled logistics personnel, including warehouse managers, inventory planners, and customs clearance experts. This talent gap has slowed the adoption of advanced supply chain technologies and hampered service quality.

What are the Regulations and Initiatives which have Governed the Market

Customs and Free Zone Regulations: The UAE has implemented simplified customs clearance mechanisms within JAFZA, KIZAD, and Dubai South, allowing 24- to 48-hour processing for bonded goods and transit cargo. These zones offer 100% foreign ownership, tax exemptions, and 0% import/export duties, helping attract global logistics firms.

National Freight and Logistics Strategy 2030: Spearheaded by the UAE Ministry of Energy and Infrastructure, this strategy aims to position UAE among top 10 global logistics hubs by 2030. It includes investment in rail (Etihad Rail Phase 2), green logistics zones, and digital platforms. By end-2023, over AED 2 billion had been committed to logistics infrastructure expansion.

Sustainability Regulations: In line with the UAE Net Zero 2050 Vision, logistics companies are now mandated to adopt sustainable practices such as fleet electrification, green warehousing, and carbon reporting. As of 2023, over 30% of major warehousing facilities in Dubai and Abu Dhabi had installed solar rooftops and energy-efficient HVAC systems.

UAE Logistics and Warehousing Market Segmentation

By Market Structure: The organized segment dominates the UAE logistics and warehousing market due to the presence of large, globally integrated logistics firms, well-managed industrial parks, and adherence to international service standards. Companies operating in this space—such as DP World, DHL, and Agility—offer value-added services like inventory optimization, bonded warehousing, and smart fleet tracking. The unorganized segment, though smaller, still plays a role in last-mile logistics, informal courier services, and smaller-scale storage in non-regulated industrial zones. However, increasing regulatory compliance and customer expectations are pushing this segment toward formalization.

%2C%202023.png)

By Service Segment: Freight forwarding and contract logistics form the backbone of the UAE logistics ecosystem. Freight forwarding dominates due to UAE’s positioning as a transshipment hub for air and sea cargo. Contract logistics, including warehousing and value-added services like packaging, labeling, and last-mile delivery, is rapidly growing with the rise of e-commerce and retail demand. Cold chain logistics is also emerging, driven by pharmaceuticals, F&B, and fresh produce imports.

%2C%202023.png)

By Mode of Transport: Road transport remains the dominant mode for domestic cargo movement, especially within the Emirates. Sea freight leads in international logistics due to ports like Jebel Ali, Khalifa Port, and Port Rashid. Air freight plays a critical role in high-value and time-sensitive cargo, supported by Dubai International Airport and Abu Dhabi International Airport.

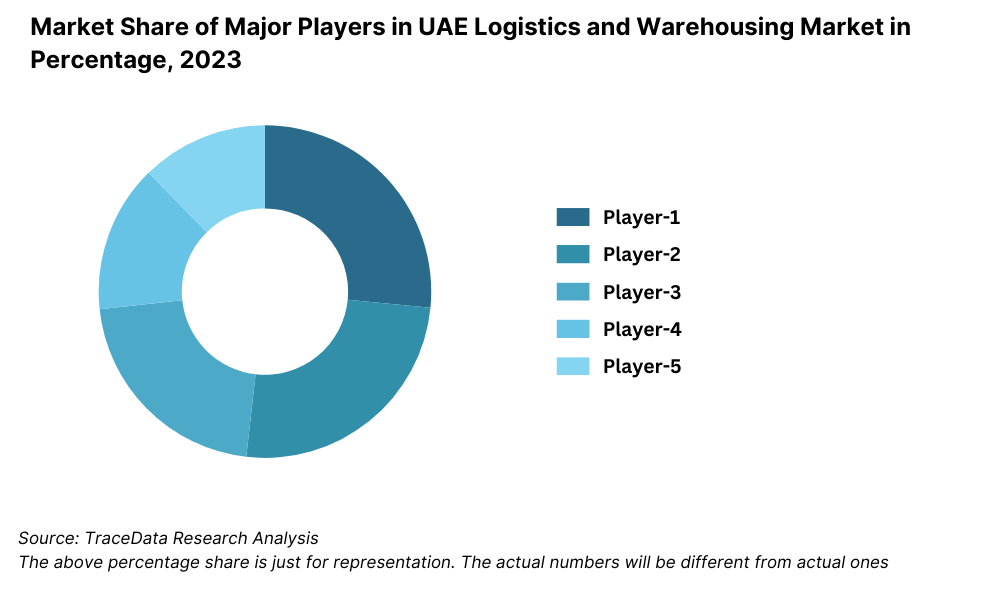

Competitive Landscape in UAE Logistics and Warehousing Market

The UAE logistics and warehousing market is moderately consolidated, with a mix of global logistics giants and regional players dominating key service segments. Dubai and Abu Dhabi serve as operational hubs for many of these companies, leveraging advanced infrastructure, free zone advantages, and digital innovations. Notable players include DP World, Aramex, Emirates Logistics, Agility Logistics, Hellmann Worldwide Logistics, Trukker, RSA Global, and Mohebi Logistics, who offer integrated logistics and warehousing services across multiple sectors.

Company | Establishment Year | Headquarters |

DP World | 2005 | Dubai, UAE |

Aramex | 1982 | Dubai, UAE |

Agility Logistics | 1979 | Dubai, UAE (MENA HQ) |

Emirates Logistics | 2002 | Dubai, UAE |

Hellmann Worldwide Logistics | 1871 | Dubai, UAE (Regional HQ) |

Trukker | 2016 | Abu Dhabi, UAE |

RSA Global | 2009 | Dubai, UAE |

Mohebi Logistics | 1931 | Dubai, UAE |

Some of the recent competitor trends and key information about competitors include:

DP World: A leading enabler of global trade, DP World expanded its logistics footprint in 2023 with the launch of CARGOES Logistics, a digital platform offering end-to-end supply chain services. The company handled over 20 million TEUs at Jebel Ali Port in 2023 and continues investing in smart port and automation technologies.

Aramex: Aramex saw 17% YoY growth in e-commerce deliveries in 2023, supported by last-mile optimization and partnerships with regional retailers. It is investing in AI-driven route planning and expanding fulfillment centers in Dubai and Riyadh.

Agility Logistics: Agility enhanced its contract logistics and cold chain warehousing capacity by over 30% in 2023. The company is targeting high-growth sectors such as healthcare, food, and retail, and has opened a new 26,000 sqm facility in Dubai South.

Emirates Logistics: Focused on integrated logistics, the company introduced real-time freight visibility tools in 2023, aimed at improving customer transparency across the GCC trade corridor.

Trukker: As a regional digital freight network, Trukker expanded operations to Saudi Arabia and Egypt and added cross-border trucking services. The platform processed over 1.2 million shipments in 2023, focusing on tech-led scalability.

RSA Global: Known for supply chain digitization, RSA Global reported 40% growth in demand for bonded warehousing and value-added logistics services in 2023, especially from pharma and FMCG sectors.

Mohebi Logistics: With over 90 years in operation, Mohebi is a major player in FMCG and cold chain logistics. In 2023, the company added 20,000 pallet positions in its Abu Dhabi warehouse and partnered with global food distributors for regional consolidation.

What Lies Ahead for UAE Logistics and Warehousing Market?

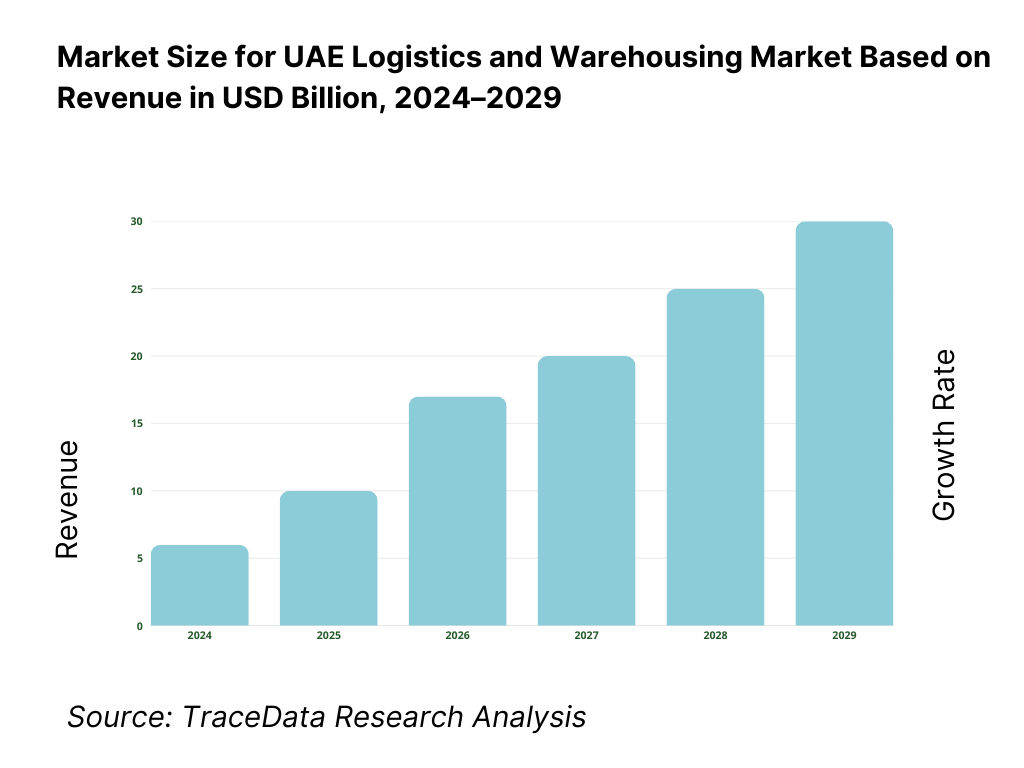

The UAE logistics and warehousing market is projected to continue its upward trajectory through 2029, supported by the country’s strategic location, trade facilitation policies, and rapid growth in e-commerce and digital retail. The market is expected to grow at a CAGR of 6.8% from 2024 to 2029, with significant investments in smart logistics infrastructure, automation, and sustainability initiatives driving the next wave of transformation.

Rise of Multimodal Logistics Integration: With the rollout of the Etihad Rail network, logistics operators are expected to increasingly adopt multimodal strategies combining rail, road, air, and sea. This integration will reduce transit time and costs, particularly for inland and cross-border freight, and support the UAE’s ambition to become a fully integrated logistics hub.

Growth of Smart Warehousing and Automation: The warehousing segment will witness a surge in automated storage systems, AI-based inventory management, and IoT-enabled smart facilities. In free zones like Dubai South and KIZAD, operators are deploying robotic picking systems and warehouse drones to enhance efficiency and reduce manpower dependency.

Expansion of Cold Chain and Pharma Logistics: Driven by regional demand for temperature-sensitive goods and pharmaceuticals, cold chain logistics is expected to grow at over 9% CAGR. UAE’s role as a vaccine and life sciences distribution hub will further fuel investment in GDP-compliant cold storage facilities and specialized fleet infrastructure.

Digital Freight Platforms and AI Optimization: Platforms offering real-time freight matching, predictive analytics for route optimization, and digital freight payments are gaining traction. By 2029, more than 50% of UAE freight forwarding transactions are expected to be facilitated through digital platforms, improving transparency and reducing brokerage inefficiencies.

Sustainability-Driven Infrastructure: With the UAE’s commitment to Net Zero by 2050, logistics providers are investing in green buildings, EV fleets, and carbon offsetting solutions. Companies are expected to adopt LEED-certified warehousing, solar-powered logistics parks, and eco-efficient packaging as part of ESG mandates from global clients.

UAE Logistics and Warehousing Market Segmentation

By Market Structure:

Organized Logistics Players

Unorganized Local Operators

3PL and 4PL Service Providers

Government-Linked Logistics Companies

Courier & Express Delivery Services

Freight Forwarders

Contract Logistics Providers

By Service Segment:

Freight Forwarding (Air, Sea, Road)

Contract Logistics

Last-Mile Delivery

Cold Chain Logistics

Express Delivery

Value-Added Warehousing Services

By Mode of Transport:

Road Freight

Sea Freight

Air Freight

Rail Freight (Etihad Rail integration)

By Type of Warehousing:

Ambient Storage

Cold Storage

Bonded Warehouses

Fulfillment Centers

Automated Warehousing

Dedicated vs. Shared Warehousing

By End User Industry:

E-commerce

Retail & FMCG

Automotive

Healthcare & Pharmaceuticals

Oil & Gas

Industrial Manufacturing

Food & Beverage

By Emirate:

Dubai

Abu Dhabi

Sharjah

Ras Al Khaimah

Ajman

Fujairah

Umm Al Quwain

Players Mentioned in the Report:

DP World

Aramex

Agility Logistics

Emirates Logistics

Hellmann Worldwide Logistics

Trukker

RSA Global

Mohebi Logistics

Key Target Audience:

Logistics and Freight Companies

E-commerce and Retail Companies

Industrial Warehousing Operators

Regulatory Authorities (e.g., Ministry of Energy and Infrastructure, Dubai Customs)

Industrial Zone Authorities (e.g., JAFZA, KIZAD)

Cold Chain Solution Providers

Infrastructure and Real Estate Developers

Investors and PE Firms in Supply Chain

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in UAE Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for UAE Logistics and Warehousing Market

4.3. Business Model Canvas for UAE Logistics and Warehousing Market

4.4. Demand-Side Decision Making Process (Shippers, E-commerce, Retailers, etc.)

4.5. Supply-Side Decision Making Process (3PLs, Warehouse Operators, Freight Forwarders)

5. Market Structure

5.1. International Trade and Cargo Movement in UAE, 2018-2024

5.2. Modal Share of Transport (Road, Sea, Air), 2018-2024

5.3. Logistics and Warehouse Infrastructure Investments in UAE, 2024

5.4. Number of Logistics and Warehousing Providers by Emirate

6. Market Attractiveness for UAE Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for UAE Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Cargo Throughput Volume and Warehouse Space Utilization, 2018-2024

9. Market Breakdown for UAE Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Service Segment (Freight Forwarding, Contract Logistics, etc.), 2023-2024P

9.3. By Mode of Transport (Road, Air, Sea, Rail), 2023-2024P

9.4. By Warehouse Type (Ambient, Cold Storage, Fulfillment, Bonded), 2023-2024P

9.5. By End User Industry (Retail, Pharma, Automotive, etc.), 2023-2024P

9.6. By Emirates (Dubai, Abu Dhabi, Sharjah, etc.), 2023-2024P

10. Demand Side Analysis for UAE Logistics and Warehousing Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Logistics Outsourcing Decision Making

10.3. Key Needs, Challenges, and SLA Expectations

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for UAE Logistics and Warehousing Market

11.2. Growth Drivers for UAE Logistics and Warehousing Market

11.3. SWOT Analysis for UAE Logistics and Warehousing Market

11.4. Issues and Challenges for UAE Logistics and Warehousing Market

11.5. Government Regulations and Strategic Initiatives (e.g., National Freight & Logistics Strategy 2030)

12. Snapshot on Digital Logistics Platforms in UAE

12.1. Market Size and Future Potential for Digital Freight and Warehouse Platforms, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross-Comparison of Leading Digital Players Based on Services, Revenues, Network, Clients

13. UAE Cold Chain Logistics Market

13.1. Cold Chain Penetration and Capacity, 2018-2029

13.2. Growth Trends in Pharma, F&B, and Perishables

13.3. Type of Cold Storage Services with High Demand

13.4. Key Players in UAE Cold Chain Logistics Market

13.5. Revenue and Capacity Trends

14. Opportunity Matrix for UAE Logistics and Warehousing Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for UAE Logistics and Warehousing Market

16. Competitor Analysis for UAE Logistics and Warehousing Market

16.1. Benchmark of Key Competitors Including Company Overview, USP, Strengths, Business Model, Coverage, Fleet/Warehouse Capacity, Value-Added Services

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Mapping

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for UAE Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Cargo Volume and Warehouse Utilization, 2025-2029

18. Market Breakdown for UAE Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Service Segment (Freight Forwarding, Contract Logistics, etc.), 2025-2029

18.3. By Mode of Transport (Road, Air, Sea, Rail), 2025-2029

18.4. By Warehouse Type (Ambient, Cold Storage, Fulfillment, Bonded), 2025-2029

18.5. By End User Industry (Retail, Pharma, Automotive, etc.), 2025-2029

18.6. By Emirates (Dubai, Abu Dhabi, Sharjah, etc.), 2025-2029

19. Recommendation

20. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities for the UAE Logistics and Warehousing Market. This includes logistics service providers (3PL/4PL), warehousing operators, cold chain specialists, freight forwarders, e-commerce players, and industrial end users.

Based on this ecosystem, we shortlist the leading 5–6 players in each category based on operational scale, revenue size, infrastructure capacity, and service diversification.

Sourcing is conducted through industry reports, market intelligence platforms, logistics publications, and proprietary databases to perform desk research and build an initial ecosystem model.

Step 2: Desk Research

We engage in comprehensive desk research utilizing a blend of secondary sources such as trade publications, government databases (e.g., UAE Federal Competitiveness & Statistics Centre), free zone portals (e.g., JAFZA, KIZAD), and proprietary databases.

This phase helps us analyze key metrics such as market revenues, segment-level share, warehouse inventory stock, rental trends, throughput volumes, and transportation mix.

We also assess company-level data through annual reports, investor presentations, media interviews, and press releases. These insights enable us to build baseline estimates of market structure, pricing models, service offerings, and regional performance.

Step 3: Primary Research

A structured set of in-depth interviews is conducted with senior executives, logistics managers, warehouse operators, real estate developers, and government stakeholders from free zones and trade authorities.

These interviews help validate hypotheses, cross-check secondary data, and capture real-time trends in service demand, pricing benchmarks, customer challenges, and automation adoption.

A bottom-up approach is used to estimate volume and revenue metrics at the company level, which is then aggregated to calculate market size.

To reinforce validation, disguised interviews are also performed where our team contacts logistics players under the guise of potential corporate clients, enabling firsthand access to pricing structures, warehouse availability, and process models.

Step 4: Sanity Check

A top-down and bottom-up triangulation model is used to cross-validate total market size, segment-wise contribution, and growth forecasts.

This includes building predictive models, conducting correlation checks with macroeconomic and trade activity indicators, and benchmarking against regional logistics hubs such as KSA and Singapore.

FAQs

1. What is the potential for the UAE Logistics and Warehousing Market?

The UAE logistics and warehousing market holds strong growth potential, having reached an estimated AED 85 Billion in 2023. Driven by the UAE’s strategic geographic location, world-class infrastructure, and growing trade activity, the sector is expected to expand steadily through 2029. The increasing shift toward e-commerce, digital transformation, and the government’s focus on positioning UAE as a global logistics hub further enhances its long-term potential.

2. Who are the Key Players in the UAE Logistics and Warehousing Market?

Prominent players in the UAE logistics market include DP World, Aramex, Agility Logistics, Emirates Logistics, and Hellmann Worldwide Logistics. Other significant players such as Trukker, RSA Global, and Mohebi Logistics also play a vital role in offering warehousing, cold chain, and last-mile services across various Emirates.

3. What are the Growth Drivers for the UAE Logistics and Warehousing Market?

Key growth drivers include the rise of e-commerce and online retail, massive infrastructure investments in ports, rail, and logistics zones, and government support through free trade zones and digital trade facilitation policies. Additionally, trends like automation in warehousing, multimodal transport integration, and green logistics initiatives are accelerating the sector's development.

4. What are the Challenges in the UAE Logistics and Warehousing Market?

Major challenges include high operational costs, particularly in warehousing and last-mile delivery, as well as talent shortages in specialized logistics functions. Fragmentation in last-mile services and inconsistent address systems in urban areas can lead to delivery inefficiencies. Additionally, compliance with emerging sustainability standards requires ongoing investment, posing difficulties for smaller operators.