UAE On-Demand Home Services Market Outlook to 2029

By Market Structure, By Service Categories, By Type of Customers, By Service Frequency, By Region

- Product Code: TDR0083

- Region: Middle East

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “UAE On-Demand Home Services Industry Market Outlook to 2029 - By Market Structure, By Service Categories, By Type of Customers, By Service Frequency, By Region.” provides a comprehensive analysis of the on-demand home services industry in the UAE. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the UAE On-Demand Home Services Industry. The report concludes with future market projections based on service revenue, by market, service categories, region, cause and effect relationship, and success case studies highlighting major opportunities and cautions.

UAE On-Demand Home Services Market Overview and Size

The UAE on-demand home services market reached a valuation of AED 3.5 Billion in 2023, driven by increasing consumer preference for convenience, rising disposable incomes, and the demand for high-quality services. The market is characterized by major players such as UrbanClap (now Urban Company), ServiceMarket, Justlife, Helpling, and MrUsta. These companies are recognized for their extensive service networks, diverse service offerings, and customer-focused platforms.

In 2023, Urban Company expanded its operations in Abu Dhabi to tap into the growing market for home cleaning, beauty, and repair services. Dubai and Abu Dhabi are key markets due to their large expatriate populations, high income levels, and strong demand for convenient service solutions.

Market Size for UAE On-Demand Home Services Industry on the Basis of Revenues in USD Million, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of UAE On-Demand Home Services Market:

Economic Factors: The rising cost of living and increased work-life demands have significantly driven consumers to seek on-demand home services. In 2023, on-demand home services accounted for approximately 70% of total household service needs, offering cost and time efficiency to busy professionals and families. This trend is particularly pronounced in urban areas like Dubai and Abu Dhabi.

Growing Expatriate Population: The expanding expatriate population in the UAE has increased the demand for home services such as cleaning, maintenance, and personal grooming. This demographic often prefers outsourced services due to busy lifestyles and higher disposable incomes.

Digitalization: The rise of app-based platforms has revolutionized how consumers access home services, enhancing transparency and convenience. In 2023, around 60% of on-demand home services in the UAE were booked through online platforms, reflecting a growing trend towards digital engagement. These platforms offer easy booking, payment options, and reviews, boosting market growth.

Which Industry Challenges Have Impacted the Growth for UAE On-Demand Home Services Market

Quality and Trust Issues: Concerns about the reliability and quality of service providers remain significant challenges in the UAE on-demand home services market. According to a recent survey, approximately 45% of consumers are hesitant to use on-demand home services due to concerns about provider professionalism, safety, and service quality. This has led to lower trust levels among potential users, potentially deterring around 20% of prospective customers from using these services regularly.

Regulatory Hurdles: Strict labor regulations and visa requirements for service workers in the UAE can limit the availability of service providers, particularly for smaller companies or independent contractors. In 2023, about 18% of service providers faced difficulties meeting labor law compliance standards, which impacted their ability to operate efficiently. These regulatory hurdles increase operational costs, especially for platforms that rely heavily on freelance or part-time workers.

Competition and Market Fragmentation: The market is highly fragmented with a mix of local independent service providers and larger app-based platforms. This fragmentation leads to inconsistent service quality and difficulties in standardizing pricing. Smaller players often struggle to compete with well-established platforms, which can stifle market growth and limit innovation in certain service categories.

What are the Regulations and Initiatives Which Have Governed the Market:

Labor Law Compliance: The UAE government enforces strict labor regulations to ensure the fair treatment of workers in the on-demand home services industry. This includes requirements for fair wages, regulated working hours, and mandatory insurance coverage for service providers. In 2023, approximately 85% of service providers in the industry complied with these labor laws, ensuring a high standard of protection for workers.

Consumer Protection Regulations: The UAE government has implemented stringent consumer protection laws aimed at ensuring transparency and accountability in the on-demand services market. These laws mandate clear communication of service terms, pricing, and guarantees, as well as providing recourse for dissatisfied customers. In 2023, the number of consumer complaints related to service quality decreased by 12%, reflecting improved adherence to these regulations.

Tax and Licensing Requirements: Service providers in the UAE are required to obtain the necessary licenses and permits to operate legally. These regulations include tax compliance, particularly for larger app-based platforms, to ensure that services are being provided within the legal framework. In 2023, the government introduced new guidelines that streamlined the licensing process for small businesses, increasing compliance and reducing operational barriers for smaller players.

UAE On-Demand Home Services Market Segmentation

By Market Structure: App-based platforms dominate the UAE on-demand home services market due to their strong digital presence, ease of use, and trust built through customer reviews and transparent pricing. These platforms offer a wide variety of services, from cleaning to beauty and repairs, appealing to busy professionals and families. Local independent service providers also hold a significant share, particularly in areas where personal relationships and direct referrals play a role in service selection. Aggregators, such as Justlife and Service Market, serve as intermediaries between customers and local providers, giving smaller businesses a platform to reach a broader audience.

By Service Categories: Home cleaning services lead the market in the UAE, driven by high demand from expatriates and busy households. Cleaning services are followed by beauty and wellness services, which have gained popularity due to the convenience of receiving spa-like treatments at home. Repair and maintenance services also hold a significant share, particularly in urban centers like Dubai and Abu Dhabi, where demand for quick, reliable home repairs is high. Other categories include pet care and home tutoring, which have seen niche growth as consumers look for more specialized services.

%2C%202023.png)

By Customer Type: Expatriates are the largest consumer segment in the UAE's on-demand home services market, accounting for a substantial share of total service bookings. They tend to prefer app-based platforms for their convenience and reliability. UAE nationals represent another significant customer segment, especially in high-income areas, where premium and recurring services like regular home cleaning and beauty treatments are popular. Corporate clients, such as businesses and office buildings, contribute to a growing demand for maintenance and cleaning services on a contract basis.

Competitive Landscape in UAE On-Demand Home Services Market

The UAE on-demand home services market is fragmented but becoming increasingly competitive, with major players such as Urban Company, ServiceMarket, Justlife, Helpling, and MrUsta leading the space. The entrance of new firms and the growing demand for convenient home services have diversified the market, offering consumers more choices and a broader range of services.

| Name | Founding Year | Headquarters |

| UrbanClap (Urban Company) | 2014 | Dubai, UAE |

| Helpbit | 2016 | Dubai, UAE |

| Justmop | 2015 | Dubai, UAE |

| ServiceMarket | 2013 | Dubai, UAE |

| Raha | 2018 | Dubai, UAE |

| MrUsta | 2015 | Dubai, UAE |

| WeWillFixIt | 2008 | Dubai, UAE |

| Washmen | 2015 | Dubai, UAE |

| HomeGenie | 2017 | Dubai, UAE |

| Taskmasters | 2012 | Dubai, UAE |

Some of the recent competitor trends and key information about competitors include:

Urban Company: As one of the leading platforms in the UAE, Urban Company recorded over 1.2 million service bookings in 2023, marking a 22% increase in demand compared to the previous year. The platform’s extensive service categories, including home cleaning, beauty, and repairs, have made it a preferred choice for busy expatriates and UAE nationals alike.

ServiceMarket: Specializing in home services such as moving, cleaning, and maintenance, ServiceMarket saw a 30% increase in bookings in 2023. The company’s focus on building strong relationships with local service providers and offering competitive pricing has contributed to its expanding customer base, particularly in Dubai.

Justlife: Formerly known as Justmop, Justlife has gained significant traction in the UAE’s cleaning and beauty service sectors. In 2023, the platform experienced a 20% growth in service bookings, driven by the introduction of wellness and healthcare services at home. Justlife’s emphasis on customer satisfaction and premium service offerings continues to strengthen its market position.

Helpling: Focused primarily on cleaning services, Helpling expanded its service portfolio in 2023 to include specialized cleaning options such as deep cleaning and eco-friendly solutions. The platform reported a 15% growth in bookings, with a notable increase in demand from high-income households in Abu Dhabi and Dubai.

MrUsta: Known for providing quick and reliable repair and maintenance services, MrUsta saw a 12% rise in service requests in 2023. The platform’s user-friendly app and focus on handyman services have made it popular in urban centers where minor home repairs are frequently needed.

What Lies Ahead for UAE On-Demand Home Services Market?

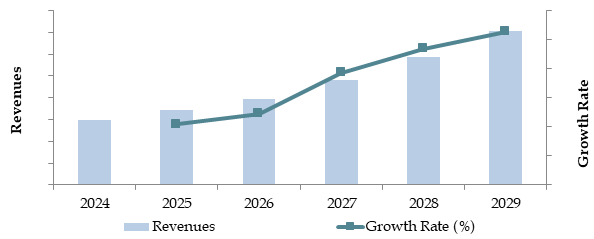

The UAE on-demand home services market is projected to grow steadily through 2029, with a respectable CAGR during the forecast period. This growth will be fueled by increasing digitalization, the growing expatriate population, and rising demand for convenience in daily tasks.

Shift Towards Premium and Personalized Services: As disposable incomes continue to rise, particularly in Dubai and Abu Dhabi, there is expected to be a shift towards premium and personalized home services. This trend will be driven by the demand for luxury cleaning, beauty treatments, and wellness services delivered at home, catering to high-income consumers who seek exclusivity and convenience.

Integration of Technology: The integration of advanced technologies such as AI, machine learning, and big data analytics in service delivery is anticipated to revolutionize the market. These technologies will allow platforms to better understand consumer preferences, optimize pricing, and match consumers with the most suitable service providers. The increased use of tech-enabled solutions is expected to enhance service quality and customer satisfaction.

Expansion of Sustainable and Eco-Friendly Services: The market is expected to see growing demand for eco-friendly home services, particularly in cleaning and maintenance. As consumers become more environmentally conscious, platforms offering green cleaning products, sustainable practices, and energy-efficient solutions are likely to gain a competitive edge. Companies that embrace sustainability will attract a growing segment of consumers who prioritize environmental responsibility.

Growth of Subscription-Based Models: The market is witnessing a shift towards subscription-based service models, particularly for cleaning and maintenance services. These models provide consumers with regular, hassle-free services at predictable costs, fostering customer loyalty and consistent revenue streams for service providers. The growth of subscription services is expected to increase, particularly among busy professionals and families.

Future Outlook and Projections for UAE On Demand Home Services Industry on the Basis of Revenues in USD Million, 2024-2029

UAE On-Demand Home Services Market Segmentation

By Market Structure:

App-Based Platforms

Local Independent Service Providers

Aggregators

Subscription-Based Services

B2B Service Providers

B2C Service Providers

By Service Categories:

Home Cleaning

Repair and Maintenance

Beauty and Wellness

Home Tutoring

Pet Care

Healthcare and Wellness at Home

By Type of Customer:

Expatriates

UAE Nationals

Corporate Clients

High-Income Households

By Service Frequency:

One-Time Services

Recurring Services (Weekly/Monthly)

By Region:

Dubai

Abu Dhabi

Sharjah

Northern Emirates

Al Ain

Players Mentioned in the Report:

Urban Company

ServiceMarket

Justlife

Helpling

MrUsta

Mahir

Washmen

Taskmaster

Key Target Audience:

App-Based Home Service Platforms

Independent Service Providers

Residential Cleaning Companies

Beauty and Wellness Service Providers

Home Repair and Maintenance Companies

Corporate Clients (Facilities Management)

Regulatory Bodies (e.g., Dubai Economy)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for UAE On-Demand Home Services Market

4.3. Business Model Canvas for UAE On-Demand Home Services Market

8.1. Revenues, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Service Categories (Home Cleaning, Repair & Maintenance, Beauty & Wellness, Home Tutoring, Pet Care, Healthcare & Wellness), 2023-2024P

9.4. By Region (Dubai, Abu Dhabi, Sharjah, Northern Emirates, Al Ain), 2023-2024P

9.5. By Type of Customer (Expatriates, UAE Nationals, Corporate Clients, High-Income Households), 2023-2024P

9.6. By Service Frequency (One-Time Services, Recurring Services), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for UAE On-Demand Home Services Market

11.2. Growth Drivers for UAE On-Demand Home Services Market

11.3. SWOT Analysis for UAE On-Demand Home Services Market

11.4. Issues and Challenges for UAE On-Demand Home Services Market

11.5. Government Regulations for UAE On-Demand Home Services Market

13.1. Benchmark of Key Competitors in UAE On-Demand Home Services Market Including Variables Such as Vintage, Key Management, Revenue, Headquarters, Total Employees, USP, Services Offered, Booking Mode, Rating, Customer Reviews, Cancellation & Refund Policies, Social Media Presence, Discounts, Recent Developments

13.2. Strength and Weakness

13.3. Operating Model Analysis Framework

13.4. Gartner Magic Quadrant

13.5. Bowmans Strategic Clock for Competitive Advantage

14.1. Revenues, 2025-2029

15.1. By Market Structure (Organized and Unorganized Market), 2025-2029

15.2. By Service Categories (Home Cleaning, Repair & Maintenance, Beauty & Wellness, Home Tutoring, Pet Care, Healthcare & Wellness), 2025-2029

15.3. By Region (Dubai, Abu Dhabi, Sharjah, Northern Emirates, Al Ain), 2025-2029

15.4. By Type of Customer (Expatriates, UAE Nationals, Corporate Clients, High-Income Households), 2025-2029

15.5. By Service Frequency (One-Time Services, Recurring Services), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the UAE On-Demand Home Services Market. Based on this ecosystem, we will shortlist leading 5-6 service providers in the country, focusing on their financial information, service capacity, and customer base.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We explore aspects such as service revenues, the number of market players, service pricing, demand, and other variables. This research is further supplemented with detailed examinations of company-level data, relying on sources such as press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various UAE On-Demand Home Services companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate the volume of services rendered for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews where we approach each company under the guise of potential customers. This approach allows us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analyses, along with market size modeling exercises, are undertaken to assess the sanity check process.

FAQs

1. What is the potential for the UAE On-Demand Home Services Market?

The UAE On-Demand Home Services Market is poised for substantial growth, reaching a projected valuation of AED 5.2 Billion by 2029. This growth is driven by factors such as rising disposable incomes, increased demand for convenience, and the shift towards app-based service platforms. The market's potential is further bolstered by the expanding expatriate population and digitalization efforts that facilitate easier access to a variety of home services.

2. Who are the Key Players in the UAE On-Demand Home Services Market?

The UAE On-Demand Home Services Market features several key players, including Urban Company, ServiceMarket, and Justlife. These companies dominate the market due to their extensive service networks, strong digital presence, and diverse service offerings. Other notable players include Helpling and MrUsta.

3. What are the Growth Drivers for the UAE On-Demand Home Services Market?

The primary growth drivers include economic factors, such as rising disposable incomes and increased consumer preference for convenience. Additionally, the expanding expatriate population and the rising popularity of digital platforms have contributed to the growing demand for on-demand home services. These factors, combined with a strong tech infrastructure in the UAE, are expected to further enhance market growth.

4. What are the Challenges in the UAE On-Demand Home Services Market?

The UAE On-Demand Home Services Market faces several challenges, including quality and trust issues related to the reliability of service providers. Regulatory challenges, such as strict labor laws and compliance requirements, can also impact the availability of service providers. Additionally, market fragmentation and labor shortages in specialized service categories pose significant barriers to market growth.