UAE POS Lending Market Outlook to 2029

By Market Structure (Banks, BNPL and Private Finance Companies), By Retail Segments (Fashion, Electronics, Furniture and others), and By Region (Riyadh, Eastern Province, Makkah)

- Product Code: TDR0084

- Region: Middle East

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “UAE POS Lending Market Outlook to 2029 - By Market Structure (Banks, BNPL and Private Finance Companies), By Retail Segments (Fashion, Electronics, Furniture and others), and By Region (Riyadh, Eastern Province, Makkah)” provides a comprehensive analysis of the POS lending market in the UAE. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the POS Lending Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

UAE POS Lending Market Overview and Size

The UAE POS lending market reached a valuation of AED 4 Billion in 2023, driven by the increasing demand for convenient and instant financing solutions, the proliferation of e-commerce, and the growing adoption of digital payment systems. The market is characterized by major players such as Tabby, Postpay, Tamara, Spotii, and Zip. These companies are recognized for their innovative financial products, strong partnerships with merchants, and customer-centric services.

In 2023, Tabby launched a new 'Pay Later' feature to enhance customer experience and streamline the purchase process across various retail sectors. This initiative aims to tap into the growing digital economy in the UAE and provide a more flexible payment option for consumers. Dubai and Abu Dhabi are key markets due to their high economic activity and advanced digital infrastructure.

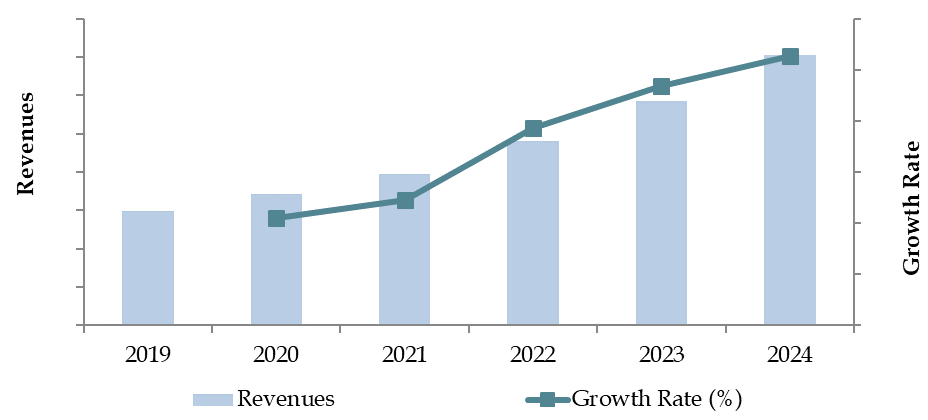

Market Size for UAE POS Lending Industry on the Basis of Transaction Value in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of UAE POS Lending Market:

Economic Factors: The economic recovery post-pandemic and the rise in consumer spending have significantly driven the demand for POS lending services. In 2023, POS lending accounted for approximately 20% of total consumer financing in the UAE, offering a seamless and interest-free credit option at the point of sale. This trend is particularly pronounced among younger consumers who prefer flexible payment options.

Growing E-Commerce Sector: The expansion of the e-commerce sector in the UAE has boosted the POS lending market, as more consumers seek instant financing solutions for online purchases. In recent years, the e-commerce sector in the UAE has grown by 25%, directly influencing the adoption of POS lending services, which facilitate convenient and cashless transactions.

Digitalization: The rise of digital payment systems and fintech innovations has revolutionized the POS lending market, enhancing transparency and convenience. In 2023, around 60% of POS lending transactions in the UAE were conducted online, reflecting a growing trend towards digital channels. These platforms offer instant approvals, flexible repayment options, and seamless integration with e-commerce platforms.

Which Industry Challenges Have Impacted the Growth of UAE POS Lending Market:

Regulatory Hurdles: Stringent regulations concerning credit lending and consumer protection can limit the flexibility and availability of certain POS lending products. In 2023, it was reported that approximately 15% of POS lending applications were rejected due to stricter credit scoring criteria. These regulations can impose significant compliance costs, particularly on emerging fintech companies.

Consumer Trust and Awareness: Despite the growth in digital payments, a significant portion of the population remains wary of digital lending solutions due to concerns about data security and hidden fees. A recent survey indicated that 35% of consumers are hesitant to use POS lending services due to fears of incurring additional costs or experiencing breaches of personal information.

Market Saturation: The increasing number of fintech companies offering POS lending services has led to a competitive market environment, with businesses struggling to differentiate their offerings. Data shows that more than 10 new POS lending firms entered the market in 2023, intensifying competition and putting pressure on profit margins.

What are the Regulations and Initiatives Which Have Governed the Market:

Consumer Protection Regulations: The UAE government has implemented strict consumer protection regulations to ensure transparency and fairness in the POS lending market. These regulations require lenders to disclose all terms and conditions, including interest rates and fees, to consumers upfront. In 2023, over 90% of POS lenders were found compliant with these regulations.

Digital Transformation Initiatives: The UAE government has been promoting digital transformation across various sectors, including financial services, through initiatives such as the UAE National Digital Strategy. This strategy has facilitated the growth of the POS lending market by creating a supportive environment for fintech innovations and digital payments.

Credit Scoring Reforms: The introduction of more comprehensive credit scoring systems has enhanced the ability of POS lenders to assess consumer creditworthiness accurately. In 2023, the UAE Credit Bureau expanded its data coverage, enabling lenders to make more informed decisions and reducing the risk of defaults.

UAE POS Lending Market Segmentation

By Market Structure: Digital lenders dominate the UAE POS lending market due to their seamless integration with e-commerce platforms, rapid approval processes, and consumer-friendly features. These lenders often provide instant approvals, interest-free periods, and flexible repayment options, catering to the tech-savvy and convenience-seeking demographic. Traditional banks also hold a significant share, leveraging their established customer base and trust to offer POS lending as part of their broader financial services. Banks typically attract consumers who prioritize security and reliability in their financial transactions.

.png)

By Product Types: Interest-free instalments are the most popular product type in the UAE POS lending market, offering consumers the ability to split payments into manageable instalments without incurring interest. This product type is particularly attractive to budget-conscious consumers looking for flexibility in their purchasing decisions. Deferred payment options are also widely used, allowing consumers to delay their payments for a specified period, often used for higher-value purchases.

Competitive Landscape in UAE POS Lending Market

The UAE POS lending market is relatively concentrated, with a few major players dominating the space. However, the entrance of new fintech firms and the expansion of digital payment platforms have diversified the market, offering consumers more choices and services.

| Name | Founding Year | Original Headquarters |

| Tabby | 2019 | Dubai, UAE |

| Postpay | 2019 | Dubai, UAE |

| Cashew Payments | 2020 | Dubai, UAE |

| Spotii | 2020 | Dubai, UAE |

| Tamara | 2020 | Riyadh, Saudi Arabia |

| Lazypay (PayU) | 2002 | Gurgaon, India |

| ValU | 2017 | Cairo, Egypt |

| Afterpay (Clearpay) | 2014 | Sydney, Australia |

| Zip (formerly Quadpay) | 2013 | Sydney, Australia |

| Sezzle | 2016 | Minneapolis, USA |

Some of the recent competitor trends and key information about competitors include:

Tabby: As the leading POS lender, Tabby reported a 30% increase in transaction volume in 2023. The company’s strong merchant partnerships and focus on customer experience have solidified its market leadership.

Postpay: Postpay saw a 25% growth in merchant partnerships, expanding its reach across key retail sectors in the UAE. The platform's focus on transparency and ease of use has resonated well with consumers.

Tamara: Known for its interest-free installment plans, Tamara has quickly gained market share, particularly among younger consumers. The company reported a 20% increase in new customer sign-ups in 2023.

Spotii: Spotii’s innovative 'Buy Now, Pay Later' model has attracted a significant following among fashion and electronics retailers. The company recorded a 15% increase in sales volume in 2023.

Zip: A newcomer to the market, Zip has focused on building strong relationships with e-commerce platforms, offering seamless integration and instant approvals. The company reported a 10% increase in transactions within the first year of operations.

What Lies Ahead for UAE POS Lending Market?

The UAE POS lending market is projected to grow significantly by 2029, exhibiting a robust CAGR during the forecast period. This growth is expected to be fueled by the ongoing digital transformation, increasing consumer preference for flexible payment options, and the expansion of e-commerce.

Shift Towards Digital Payments: As the UAE continues to lead in digital transformation, there is anticipated to be a substantial increase in the adoption of digital payment systems, including POS lending. This trend is supported by the UAE's strategic focus on becoming a cashless society.

Integration of AI and Data Analytics: The integration of advanced technologies such as AI and big data analytics in credit scoring and risk assessment is expected to provide more accurate and personalized lending solutions. This technological advancement will enhance market transparency, boost consumer trust, and streamline the lending process.

Expansion of Merchant Partnerships: The market is seeing a growing trend towards expanding merchant partnerships, enabling POS lenders to reach a broader audience and offer more diverse financing options. This expansion is particularly strong in the retail and e-commerce sectors.

Focus on Consumer Experience: There is a rising focus on enhancing the consumer experience within the POS lending market. This includes initiatives such as instant approvals, flexible repayment plans, and user-friendly digital platforms. These practices are becoming more important as competition intensifies and are expected to influence market dynamics.

Future Outlook and Projections for UAE POS Lending Market on the Basis of Transaction Value in USD Billion, 2024-2029

UAE POS Lending Market Segmentation

By Market Structure:

- Private Finance Companies

- Traditional Banks

- BNPL Companies

By Loan Size:

- <AED 1,000

- AED 1,000 - 5,000

- AED 5,000 - 10,000

- >AED 10,000

- Online

- Offline

By Mode of Lending:

By Retail Segment:

- Fashion and Apparel

- Electronics and Appliances

- Furniture and Home Goods

- Healthcare Services

- Travel and Leisure

- Education

By Age of Consumer:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- Western Region

Players Mentioned in the Report:

- Tabby

- Postpay

- Cashew Payments

- Spotii

- Tamara

- Lazypay (PayU)

- ValU

- Afterpay (Clearpay)

- Zip (formerly Quadpay)

- Sezzle

Key Target Audience:

- POS Lending Companies

- E-Commerce Platforms

- Retailers

- Fintech Companies

- Financial Institutions

- Regulatory Bodies (e.g., UAE Central Bank)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Overview and Genesis for Retail Lending Industry

4.2. Total Retail Lending Industry Size, Historical and Current (Credit Card Lending and EMI lending through banks/FCs), 2018-2023

4.3. Facts and Stats-Number of Credit Card Holders, Number of Retail Purchase Converted on EMI, regional requirement, 2018-2023

4.4. Consumer Landscape to understand type of solution which different customer wants basis age, income, location and other aspects

5.1. Offline Retail Industry Size Landscape-Growth and Opportunities

5.2. Number of Retail Stores in UAE by category of stores/type of stores, 2024

5.3. Number of Retail Stores in UAE by cities, 2024

5.4. Number of POS Installed

5.5. Revenues generated by Offline Retail industry in UAE, 2018-2023

5.6. Revenue split for offline retail industry by Category segment, 2023

5.7. Market share of major players in offline retail industry by category segment

6.1. Revenue Streams for UAE POS Lending Market,

6.2. Business Model Canvas for UAE POS Lending Market for BNPL Players, Banks and Private Finance Companies

6.3. Margin Structure Between Merchants and BNPL Companies

9.1. GMV, 2018-2024

9.2. Number of POS Lending Merchants, 2018-2024

10.1. By Market Structure (BNPL, Banks and Private Finance Companies), 2023-2024P

10.2. By Mode of Lending (Online and Offline Segment), 2023-2024P

10.3. By Retail Segment (Fashion, Electronics, Furniture and others), 2023-2024P

10.4. By Region (Dubai, Sharjah, Abu Dhabi and Others), 2023-2024P

11.1. Number of Retail Customers Registered with BNPL

11.2. Salaries of Retail Customers Registered with BNPL

11.3. Preferred POS Lending Brand for Online Payment

11.4. Preferred POS Lending Brand for In-Store Payment

11.5. Have you used BNPL Service in the Past?

11.6. Customer Landscape and Cohort Analysis

11.7. Customer Journey and Decision-Making Process

11.8. Needs, Desires, and Pain Point Analysis

11.9. Gap Analysis Framework

11.10. Customer Feedback while Purchasing POS Lending

12.1. Trends and Developments for UAE POS Lending Market

12.2. Growth Drivers for UAE POS Lending Market

12.3. SWOT Analysis for UAE POS Lending Market

12.4. Issues and Challenges for UAE POS Lending Market

12.5. Government Regulations for UAE POS Lending Market

15.1. Average Loan Term and Finance Value, 2023

15.2. Acceptance Rate Vs POS Lending Sales, 2023

16.1. Market Share of Major Players in UAE POS Lending Market for BNPL Companies, 2024

16.2. List of Major Retail Merchants and Lending Partners

16.3. Cross Comparison of POS Lending Providers (Banks, BNPL and Private Finance Companies) based on Interest Rate, Fees and Minimum Transaction Amount

16.4. Cost of Risk Involved and Acceptance Rate between Banks, Financing Companies and BNPL

16.5. Benchmark of Key Competitors in UAE POS Lending Market Basis Operational and Financial Variables

16.6. Strength and Weakness Analysis

16.7. Operating Model Analysis Framework

16.8. Gartner Magic Quadrant

16.9. Bowmans Strategic Clock for Competitive Advantage

17.1. GMV, 2025-2029

17.2. Number of POS Lending Merchants, 2025-2029

18.1. By Market Structure (BNPL, Banks and Private Finance Companies), 2025-2029

18.2. By Mode of Lending (Online and Offline Segment), 2025-2029

18.3. By Retail Segment (Fashion, Electronics, Furniture and others), 2025-2029

18.4. By Region (Riyadh, Eastern Province, Makkah, etc.), 2025-2029

18.5. Recommendations

18.6. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the UAE POS Lending Market. Based on this ecosystem, we will shortlist leading 5-6 players in the country based upon their financial information, transaction volume, and market presence.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the transaction volumes, number of market players, price level, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various UAE POS Lending Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate transaction volumes for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity check process.

FAQs

1. What is the potential for the UAE POS Lending Market?

The UAE POS lending market is poised for substantial growth, reaching a valuation of AED 4 Billion in 2023. This growth is driven by factors such as the increasing demand for flexible payment options, the expansion of the e-commerce sector, and the shift towards digital payment systems. The market's potential is further bolstered by the UAE's digital transformation initiatives, which facilitate easier access to a wide range of POS lending solutions.

2. Who are the Key Players in the UAE POS Lending Market?

The UAE POS Lending Market features several key players, including Tabby, Postpay, and Tamara. These companies dominate the market due to their innovative financial products, strong merchant partnerships, and consumer-centric services. Other notable players include Spotii and Zip.

3. What are the Growth Drivers for the UAE POS Lending Market?

The primary growth drivers include economic recovery, the rise of digital payments, and the growing e-commerce sector. The UAE's strategic focus on digital transformation and the adoption of cashless payment solutions further contribute to the growing demand for POS lending services. Additionally, the increasing preference for flexible payment options among younger consumers is driving market growth.

4. What are the Challenges in the UAE POS Lending Market?

The UAE POS Lending Market faces several challenges, including regulatory hurdles related to credit lending and consumer protection. Consumer trust and awareness issues, particularly regarding data security and hidden fees, also pose challenges to market growth. Furthermore, market saturation due to the increasing number of fintech firms entering the space intensifies competition and pressures profit margins.