UAE Warehousing Market Outlook to 2035

By Warehouse Type, By End-Use Industry, By Temperature Control, By Ownership Model, and By Emirate

- Product Code: TDR0495

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “UAE Warehousing Market Outlook to 2035 – By Warehouse Type, By End-Use Industry, By Temperature Control, By Ownership Model, and By Emirate” provides a comprehensive analysis of the warehousing industry in the United Arab Emirates. The report covers an overview and genesis of the market, overall market size in terms of value and capacity, detailed market segmentation; trends and developments, regulatory and permitting landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major warehousing operators in the UAE market. The report concludes with future market projections based on trade and logistics expansion, port-centric development, e-commerce and omnichannel growth, industrial diversification initiatives, free-zone–led infrastructure development, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

UAE Warehousing Market Overview and Size

The UAE warehousing market is valued at approximately ~USD ~ billion, representing the supply of storage, handling, and value-added logistics infrastructure across conventional dry warehouses, temperature-controlled facilities, bonded warehouses, and specialized industrial storage formats. Warehousing assets in the UAE typically include large-format distribution centers, free-zone warehouses, port-adjacent logistics parks, and urban last-mile facilities designed to support regional trade, re-export activity, and domestic consumption.

The market is anchored by the UAE’s strategic geographic location linking Asia, Europe, and Africa; its role as a regional trading and re-export hub; and sustained investment in ports, airports, and logistics free zones. Strong demand is generated by third-party logistics providers, multinational distributors, regional trading houses, e-commerce platforms, FMCG companies, pharmaceuticals, and industrial players that use the UAE as a consolidation and redistribution base for the Middle East, Africa, and South Asia. Warehousing demand is further reinforced by the country’s high import dependence, large expatriate population, and steady growth in consumer goods, healthcare, and industrial supplies.

Dubai and Abu Dhabi represent the largest warehousing demand centers in the UAE. Dubai dominates due to its concentration of ports, airports, free zones, and regional headquarters, making it the primary hub for regional distribution, e-commerce fulfillment, and re-exports. Abu Dhabi is a growing demand center driven by industrial diversification, manufacturing investments, and integrated logistics developments linked to ports and industrial cities. The Northern Emirates account for a smaller but rising share of demand, supported by cost-competitive land availability, expanding port infrastructure, and spillover from capacity constraints and rising rentals in core hubs. While urban locations see strong demand for last-mile and fast-moving consumer goods storage, peripheral logistics zones continue to attract large-format regional distribution centers due to scalability and cost efficiency.

What Factors are Leading to the Growth of the UAE Warehousing Market:

Expansion of trade, re-exports, and regional distribution strengthens structural demand: The UAE continues to function as a central trading and redistribution hub for the Middle East, Africa, and parts of South Asia, driving sustained demand for warehousing infrastructure. Importers, exporters, and regional distributors rely on the country’s efficient customs processes, free-zone incentives, and multimodal connectivity to consolidate inventory and serve multiple markets from a single base. Warehousing facilities play a critical role in enabling these flows by offering bonded storage, inventory staging, cross-docking, and value-added services such as labeling, repackaging, and light assembly. As trade volumes grow and supply chains become more time-sensitive, the need for modern, scalable, and strategically located warehouses continues to expand.

E-commerce growth and omnichannel retail models accelerate space absorption: Rapid growth in e-commerce and digital retail across the UAE has significantly increased demand for fulfillment centers, sortation hubs, and last-mile warehouses. Online platforms and omnichannel retailers require facilities that support high inventory turnover, fast order processing, and proximity to end consumers. This has led to increased absorption of mid-sized and large warehouses in urban and peri-urban locations, as well as rising demand for flexible leasing models that allow operators to scale capacity quickly. Warehousing layouts are increasingly designed to accommodate automation, mezzanine floors, and technology-enabled inventory management systems, reinforcing the shift toward modern, purpose-built assets.

Industrial diversification and manufacturing growth support long-term capacity requirements: The UAE’s focus on industrial diversification, food security, pharmaceuticals, and advanced manufacturing has created new sources of warehousing demand beyond traditional trading activities. Manufacturing facilities require adjacent or integrated storage for raw materials, work-in-progress, and finished goods, often with specific compliance and handling requirements. Cold storage demand is rising in parallel, driven by food processing, pharmaceuticals, healthcare supplies, and vaccine distribution. These structural shifts are expanding the warehousing market beyond generic storage toward specialized and higher-value formats that offer temperature control, regulatory compliance, and integrated logistics services.

Which Industry Challenges Have Impacted the Growth of the UAE Warehousing Market:

Rising land costs and rental escalation in prime logistics zones impact long-term cost efficiency: Warehousing development in the UAE particularly in prime logistics hubs near ports, airports, and major urban centers—has been increasingly affected by rising land prices and rental escalation. As demand from e-commerce players, 3PLs, and regional distributors intensifies, vacancy rates in high-quality logistics parks have tightened, pushing lease rates upward. This creates pressure on occupiers operating on thin margins, such as trading companies and FMCG distributors, and can limit the ability of small and mid-sized players to secure scalable space. In some cases, occupiers delay expansion decisions, relocate to peripheral emirates, or adopt shorter lease tenures, introducing uncertainty into long-term capacity planning.

Infrastructure and access constraints create operational inefficiencies in older warehouse clusters: While the UAE has invested heavily in modern logistics parks, a significant portion of existing warehouse stock is located in older industrial areas with constrained road access, limited trailer maneuvering space, and outdated utility infrastructure. These constraints impact truck turnaround times, labor productivity, and compliance with modern fire and safety standards. As supply chains become more time-sensitive, such inefficiencies reduce the competitiveness of legacy warehouse zones and increase operating costs for occupiers. Retrofitting these facilities often involves high capital expenditure and regulatory approvals, which can discourage upgrades and slow the pace of market modernization.

Labor availability and rising operating costs affect warehousing economics: Warehousing operations in the UAE remain labor-intensive, particularly for picking, packing, and value-added services. While automation adoption is increasing, many operators continue to rely on manual labor due to cost considerations and variability in order profiles. Rising labor costs, accommodation expenses, and compliance requirements related to workforce welfare increase the overall cost base for warehouse operators. These pressures can compress margins, especially for third-party logistics providers operating under fixed-price contracts, and may limit the pace at which new capacity is absorbed or expanded.

What are the Regulations and Initiatives which have Governed the Market:

Civil defense, fire safety, and building regulations governing warehouse design and operations: Warehousing developments in the UAE must comply with civil defense regulations covering fire protection systems, emergency access, sprinkler requirements, fire compartmentalization, and evacuation planning. These regulations significantly influence warehouse design, including ceiling heights, racking configurations, material handling layouts, and storage density. Compliance is enforced through inspections and approvals at multiple stages, making regulatory adherence a critical factor in both new developments and facility upgrades. Failure to meet these standards can result in operational restrictions, penalties, or closure, reinforcing the importance of regulatory alignment in warehouse planning.

Free zone regulations and customs frameworks shaping bonded and re-export warehousing: A large share of UAE warehousing capacity is located within free zones, which operate under distinct regulatory and customs frameworks. These regulations govern bonded storage, re-export processes, inventory documentation, and permissible value-added activities. Free zone policies play a central role in enabling the UAE’s re-export-driven warehousing model by reducing duties, simplifying customs procedures, and allowing foreign ownership. However, compliance requirements related to reporting, audits, and permitted activities influence how operators structure warehouse operations and select locations based on their trade and distribution strategies.

Sustainability initiatives and energy efficiency guidelines influencing warehouse development: The UAE’s broader sustainability and energy efficiency initiatives are increasingly influencing warehouse construction and operations. Developers are encouraged to adopt energy-efficient lighting, insulation, solar rooftops, and water-efficient systems to reduce operating costs and environmental impact. While sustainability compliance is not uniformly mandated across all emirates, large occupiers and institutional investors increasingly prefer assets that align with green building standards. These requirements affect capital costs, design choices, and long-term operating economics, gradually shaping the quality and specification of new warehouse supply.

UAE Warehousing Market Segmentation

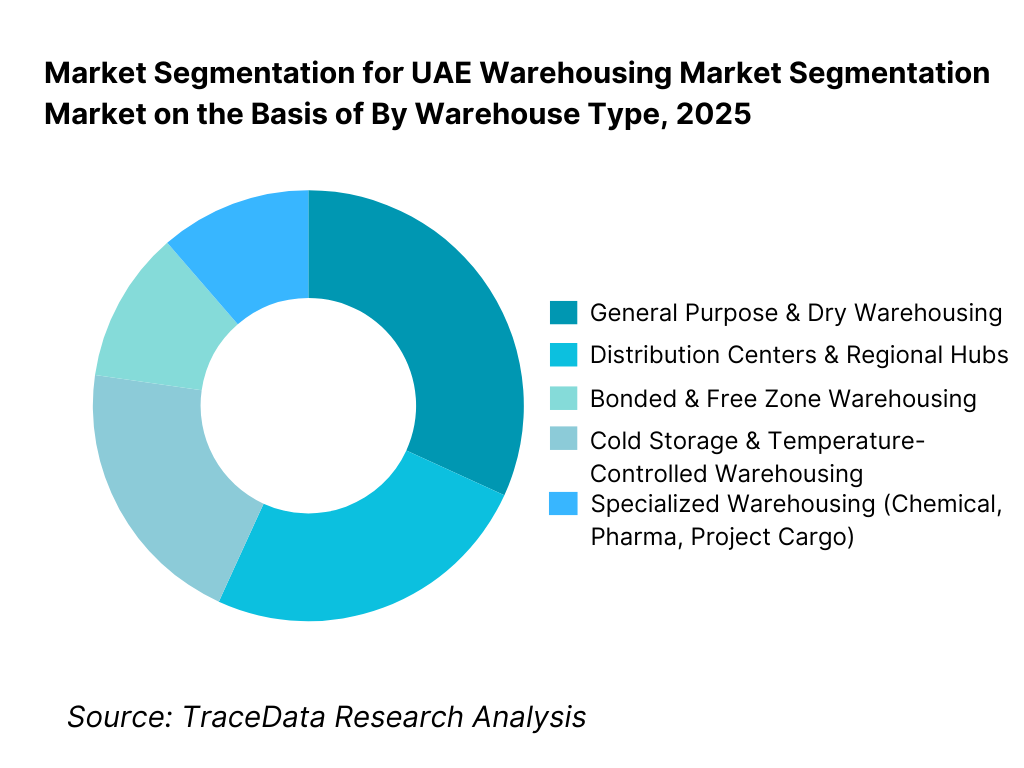

By Warehouse Type: The general purpose and distribution warehouse segment holds dominance in the UAE warehousing market. This is because the country functions as a regional trade, consolidation, and re-export hub, where large-format dry warehouses support FMCG distribution, trading activity, spare parts storage, and regional redistribution. These facilities prioritize scalability, dock density, ceiling height, and proximity to ports and highways rather than highly specialized infrastructure. While cold storage and bonded warehousing are growing rapidly, general-purpose warehouses continue to benefit from volume-driven demand, multi-tenant occupancy, and repeat leasing by distributors and 3PLs.

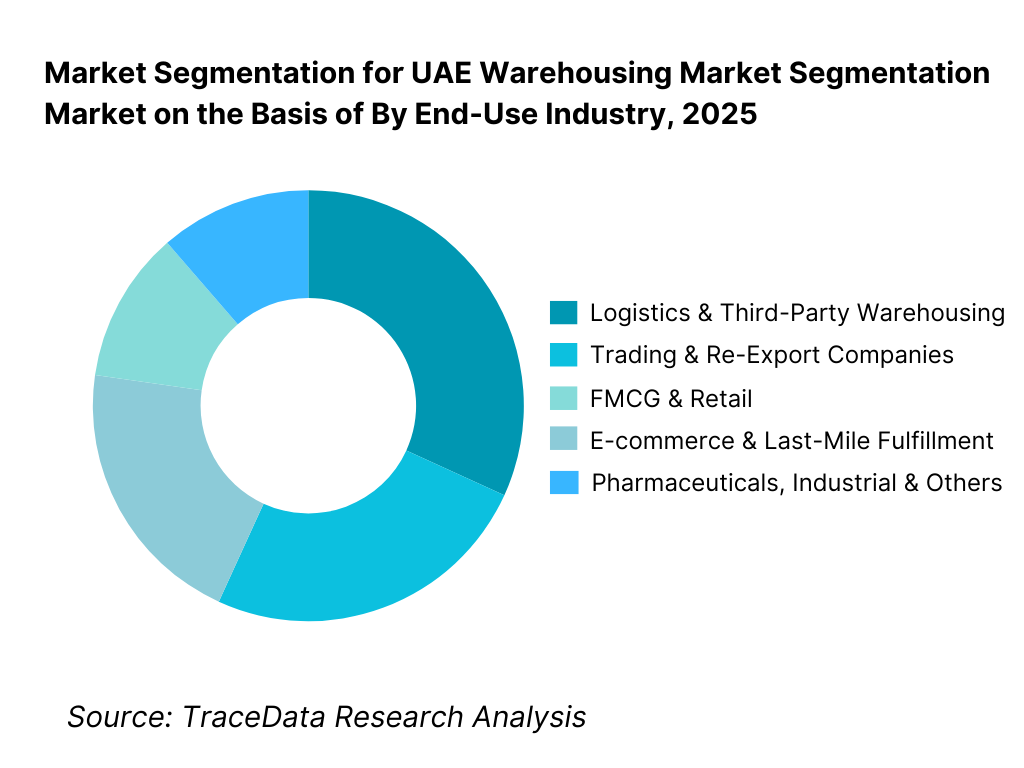

By End-Use Industry: Logistics, trade, and FMCG dominate warehousing demand in the UAE. These sectors rely on rapid inventory turnover, regional redistribution, and efficient customs handling. Third-party logistics providers and trading companies prefer flexible warehouse formats that support multiple clients and fast reconfiguration. E-commerce and retail-driven demand is expanding steadily, while industrial and pharmaceutical warehousing is growing at a faster rate but from a smaller base due to stricter compliance and infrastructure requirements.

Competitive Landscape in UAE Warehousing Market

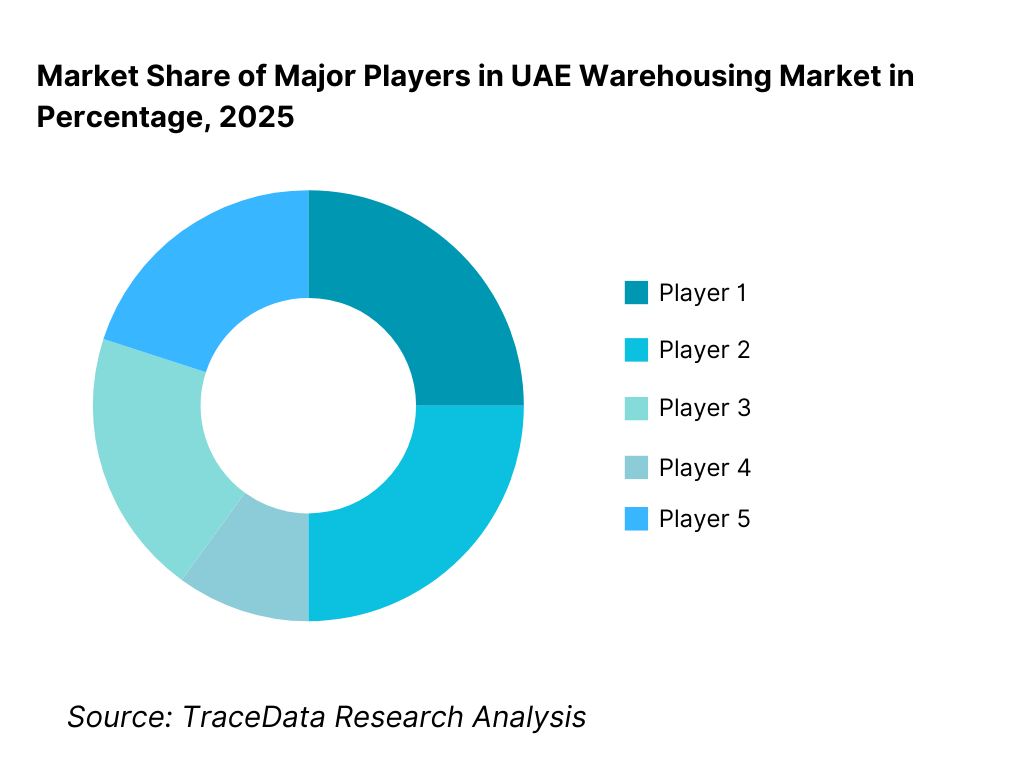

The UAE warehousing market exhibits moderate concentration, characterized by a mix of large integrated logistics park developers, free zone authorities, global logistics providers, and regional warehouse operators. Market leadership is driven by land bank access, proximity to ports and airports, regulatory approvals, infrastructure quality, tenant mix, and the ability to offer scalable, compliant, and multi-tenant facilities. Large developers dominate prime logistics corridors, while smaller operators remain competitive in secondary zones by offering pricing flexibility and customized lease structures.

Name | Founding Year | Original Headquarters |

DP World Logistics Parks | 2005 | Dubai, UAE |

Dubai South Logistics District | 2015 | Dubai, UAE |

Jebel Ali Free Zone (JAFZA) | 1985 | Dubai, UAE |

Aldar Logistics & Industrial Assets | 2004 | Abu Dhabi, UAE |

Aramex Warehousing & Logistics | 1982 | Amman, Jordan |

Agility Logistics Parks | 1979 | Kuwait City, Kuwait |

DHL Supply Chain UAE | 1969 | Bonn, Germany |

Kuehne + Nagel UAE | 1890 | Schindellegi, Switzerland |

RAK Logistics City | 2016 | Ras Al Khaimah, UAE |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

DP World Logistics Parks: DP World continues to leverage its port-centric logistics ecosystem by developing large-scale logistics parks integrated with Jebel Ali Port and other trade gateways. Its competitive strength lies in seamless port-warehouse connectivity, bonded storage capabilities, and appeal to multinational occupiers with regional distribution requirements.

JAFZA: JAFZA remains one of the most established free zone warehousing hubs in the Middle East, benefiting from mature infrastructure, regulatory clarity, and a diversified tenant base. The zone continues to attract trading companies, FMCG distributors, and light manufacturers seeking bonded warehousing and re-export advantages.

Dubai South Logistics District: Dubai South has emerged as a strategic growth corridor, particularly for e-commerce, air cargo-linked warehousing, and large-format distribution centers. Competitive positioning is supported by proximity to Al Maktoum International Airport, availability of large land parcels, and relatively flexible development frameworks.

Aldar Logistics & Industrial Assets: Aldar is strengthening Abu Dhabi’s warehousing and industrial footprint through integrated logistics and industrial developments aligned with manufacturing and diversification initiatives. Its assets appeal to long-term occupiers seeking high-quality infrastructure and proximity to industrial clusters.

Global 3PL Players (DHL, Kuehne + Nagel, Aramex): Global logistics providers continue to expand warehousing capacity in the UAE to support contract logistics, e-commerce fulfillment, and regional distribution mandates. Their competitive edge lies in technology integration, process standardization, and the ability to bundle warehousing with transportation and value-added services.

What Lies Ahead for UAE Warehousing Market?

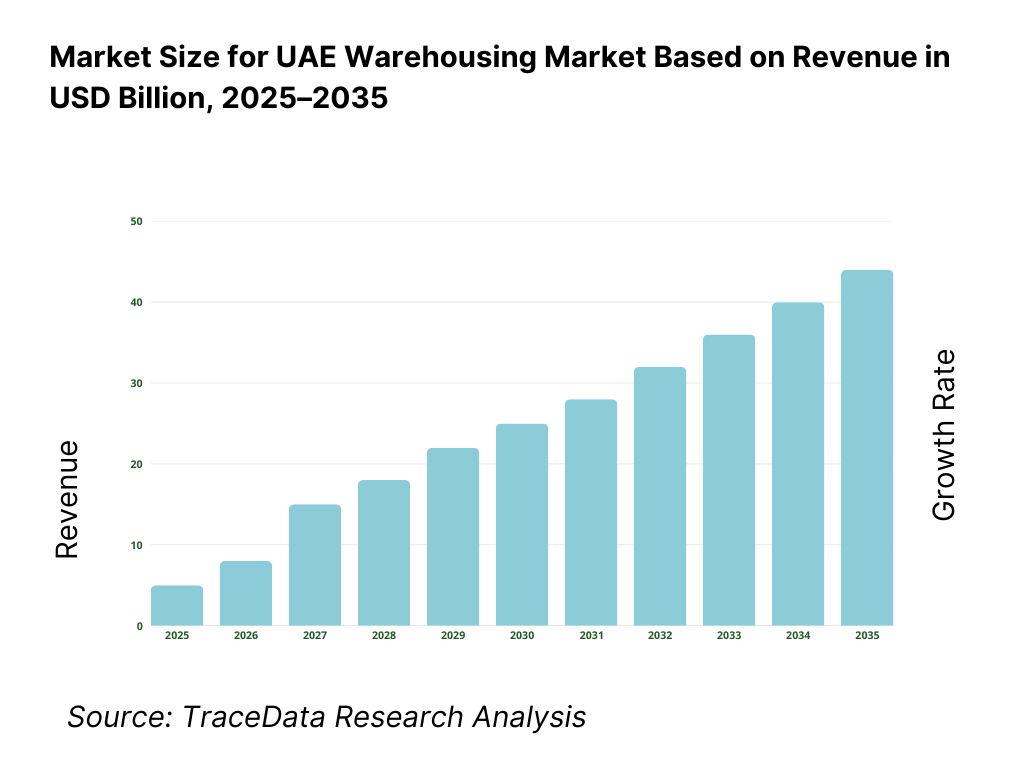

The UAE warehousing market is expected to expand steadily through 2035, supported by sustained growth in regional trade, re-export activity, e-commerce penetration, and industrial diversification initiatives. The country’s role as a logistics gateway connecting Asia, Europe, and Africa will continue to anchor long-term demand for storage and distribution infrastructure. Growth momentum is further reinforced by port-centric development, expansion of logistics free zones, increasing preference for professionally managed logistics parks, and the rising need for scalable warehousing solutions aligned with faster inventory cycles and omnichannel distribution models. As occupiers increasingly prioritize location efficiency, compliance, and operational reliability, warehousing will remain a core pillar of the UAE’s logistics and supply chain ecosystem.

Transition Toward Higher-Specification and Purpose-Built Warehousing Formats: The future of the UAE warehousing market will see a continued shift from basic storage sheds toward higher-specification and purpose-built facilities. Demand is rising for warehouses designed around operational requirements such as higher clear heights, increased dock density, temperature control, automation readiness, and regulatory compliance. Cold storage, pharmaceutical warehousing, and specialized industrial storage require tighter environmental controls, advanced fire safety systems, and robust power and backup infrastructure. Developers and operators offering customized, sector-specific warehouse formats will capture higher-value demand and secure longer-term occupier commitments.

Growing Emphasis on Speed-to-Market and Flexible Leasing Structures: Occupiers in the UAE increasingly seek rapid deployment of warehousing capacity to respond to changing trade flows, seasonal demand, and e-commerce growth. Flexible leasing models, shorter lock-in periods, and scalable space configurations are becoming critical decision factors. Large logistics parks that enable phased expansion, modular layouts, and quick fit-outs are well positioned to benefit from this trend. Through 2035, this preference for speed-to-market will strengthen demand for pre-approved logistics zones and developers with strong regulatory alignment and execution capabilities.

Integration of Technology, Automation, and Energy Efficiency in Warehousing Operations: Technology adoption will play a growing role in shaping warehousing demand. Automation, warehouse management systems, robotics, and data-driven inventory control are increasingly influencing facility design and space requirements. At the same time, energy efficiency—through LED lighting, solar rooftop installations, insulated envelopes, and efficient cooling systems—will become more central to procurement decisions as occupiers seek to reduce operating costs and align with sustainability objectives. Warehouses that support automation and energy optimization will command premium rents and higher occupancy rates.

Port-Centric and Multimodal Logistics Development Strengthening Demand Clusters: Future warehousing growth in the UAE will be closely tied to port-centric and multimodal logistics developments. Integration of warehouses with seaports, airports, and major highway networks reduces transit times and enhances supply chain resilience. Developments around major trade gateways will continue to attract regional distribution centers, bonded warehouses, and consolidation hubs serving multiple international markets. This clustering effect will reinforce demand concentration in key logistics corridors while driving secondary growth in cost-competitive emirates.

UAE Warehousing Market Segmentation

By Warehouse Type

• General Purpose & Dry Warehousing

• Distribution Centers & Regional Hubs

• Cold Storage & Temperature-Controlled Warehousing

• Bonded & Free Zone Warehousing

• Specialized Warehousing (Pharma, Chemical, Project Cargo)

By Temperature Control

• Ambient Warehousing

• Chilled Storage

• Frozen Storage

• Controlled Atmosphere Warehousing

By Ownership Model

• Leased Warehousing

• Owner-Occupied Warehousing

• Build-to-Suit Warehousing

By End-Use Industry

• Logistics & Third-Party Warehousing

• Trading & Re-Export

• FMCG & Retail

• E-commerce & Last-Mile Fulfillment

• Pharmaceuticals, Industrial & Others

By Emirate

• Dubai

• Abu Dhabi

• Sharjah

• Northern Emirates (Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain)

Players Mentioned in the Report:

• DP World Logistics Parks

• Jebel Ali Free Zone (JAFZA)

• Dubai South Logistics District

• Aldar Logistics & Industrial Assets

• Agility Logistics Parks

• Aramex Warehousing & Logistics

• DHL Supply Chain UAE

• Kuehne + Nagel UAE

• RAK Logistics City

• Regional warehouse developers, free zone authorities, and third-party logistics providers

Key Target Audience

• Warehousing developers and logistics park operators

• Third-party logistics (3PL) providers

• E-commerce and omnichannel retailers

• Trading and re-export companies

• FMCG, pharmaceutical, and industrial manufacturers

• Free zone authorities and port operators

• Institutional real estate investors and logistics-focused funds

• Supply chain, logistics, and operations heads

Time Period:

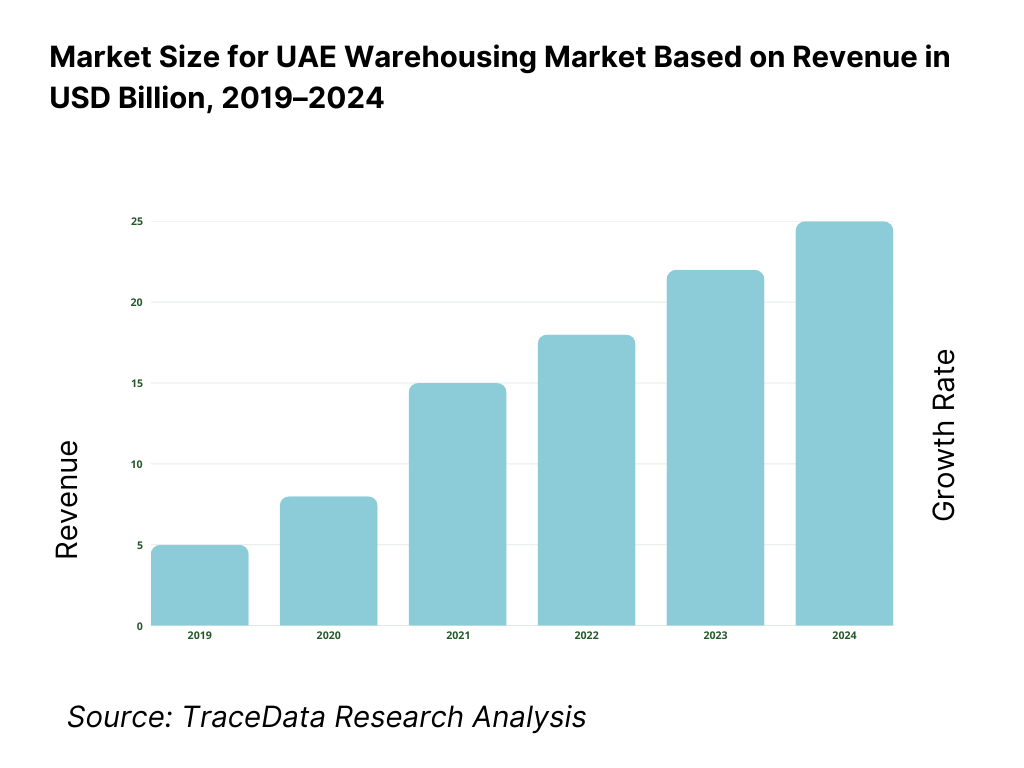

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Warehousing Delivery Model Analysis including single-tenant warehouses, multi-tenant logistics parks, bonded warehousing, build-to-suit facilities, and temperature-controlled warehouses with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for Warehousing Market including warehouse leasing revenues, storage and handling charges, value-added services, bonded storage fees, and cold chain premiums

4. 3 Business Model Canvas for Warehousing Market covering logistics park developers, warehouse owners, third-party logistics providers, free zone authorities, customs bodies, and end-user occupiers

5. 1 Organized Logistics Parks vs Standalone and Legacy Warehouses including free zone logistics parks, port-centric developments, and independent warehouse operators

5. 2 Investment Model in Warehousing Market including developer-owned assets, institutional investment, joint ventures, and build-to-suit arrangements

5. 3 Comparative Analysis of Warehousing Utilization by Third-Party Logistics Providers and Owner-Occupied Models including contract logistics and captive storage

5. 4 Occupier Cost Structure Analysis comparing warehousing rentals versus transportation, labor, and inventory holding costs

8. 1 Warehousing revenues and capacity from historical to present period

8. 2 Growth Analysis by warehouse type and by end-use industry

8. 3 Key Market Developments and Milestones including logistics park launches, port expansions, regulatory updates, and major tenant commitments

9. 1 By Market Structure including organized logistics parks, free zone warehouses, and standalone facilities

9. 2 By Warehouse Type including general purpose, distribution centers, cold storage, bonded warehousing, and specialized warehouses

9. 3 By Ownership Model including leased, owner-occupied, and build-to-suit warehouses

9. 4 By End-Use Industry including logistics, trading and re-export, FMCG and retail, e-commerce, and pharmaceuticals and industrial

9. 5 By Storage Type including ambient, chilled, frozen, and controlled atmosphere warehousing

9. 6 By Warehouse Size including small, mid-sized, and large-format facilities

9. 7 By Tenancy Type including single-tenant and multi-tenant warehouses

9. 8 By Emirate including Dubai, Abu Dhabi, Sharjah, and Northern Emirates

10. 1 Occupier Landscape and Cohort Analysis highlighting 3PLs, trading companies, e-commerce players, and manufacturers

10. 2 Warehouse Location and Leasing Decision Making influenced by proximity to ports, rental costs, compliance, and scalability

10. 3 Utilization and ROI Analysis measuring occupancy rates, rental yields, and asset productivity

10. 4 Gap Analysis Framework addressing Grade A availability, cold chain shortages, and regulatory compliance gaps

11. 1 Trends and Developments including growth of logistics parks, cold chain expansion, automation, and sustainability initiatives

11. 2 Growth Drivers including trade and re-export growth, e-commerce expansion, industrial diversification, and infrastructure investment

11. 3 SWOT Analysis comparing UAE warehousing strengths versus regional logistics hubs

11. 4 Issues and Challenges including land availability, rental escalation, labor costs, and compliance requirements

11. 5 Government Regulations covering civil defense norms, free zone policies, customs regulations, and warehousing compliance in the UAE

12. 1 Market Size and Future Potential of cold storage and temperature-controlled warehousing

12. 2 Business Models including captive cold storage, third-party cold chain logistics, and integrated food and pharma supply chains

12. 3 Delivery Models and Type of Solutions including chilled, frozen, and pharma-grade storage infrastructure

15. 1 Market Share of Key Players by warehousing capacity and revenues

15. 2 Benchmark of 15 Key Competitors including logistics park developers, free zone authorities, and global 3PL operators

15. 3 Operating Model Analysis Framework comparing developer-led, free zone-led, and 3PL-operated warehousing models

15. 4 Gartner Magic Quadrant positioning global logistics players and regional warehousing operators

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through location differentiation versus cost-led warehousing strategies

16. 1 Revenues and capacity projections

17. 1 By Market Structure including organized parks, free zones, and standalone warehouses

17. 2 By Warehouse Type including general purpose, distribution, and cold storage

17. 3 By Ownership Model including leased, owner-occupied, and build-to-suit

17. 4 By End-Use Industry including logistics, trade, e-commerce, and manufacturing

17. 5 By Storage Type including ambient, chilled, and frozen

17. 6 By Warehouse Size including small, mid-sized, and large facilities

17. 7 By Tenancy Type including single-tenant and multi-tenant

17. 8 By Emirate including Dubai, Abu Dhabi, Sharjah, and Northern Emirates

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the UAE Warehousing Market across demand-side and supply-side entities. On the demand side, entities include third-party logistics providers, regional trading and re-export companies, e-commerce and omnichannel retailers, FMCG distributors, pharmaceutical and healthcare companies, industrial manufacturers, cold chain operators, and government-linked entities requiring storage and distribution infrastructure. Demand is further segmented by warehouse usage (regional distribution, last-mile fulfillment, bonded storage, temperature-controlled storage), project type (new development, relocation, expansion, retrofit), and occupancy model (single-tenant, multi-tenant, build-to-suit).

On the supply side, the ecosystem includes logistics park developers, free zone authorities, private warehouse owners, global and regional 3PL operators, construction contractors, warehouse fit-out and automation providers, fire and safety system suppliers, cold chain technology providers, and regulatory bodies including civil defense and free zone authorities. From this mapped ecosystem, we shortlist a representative set of large logistics park developers, free zone operators, and leading warehouse operators based on land bank size, asset quality, geographic coverage, tenant mix, compliance capability, and presence across key emirates. This step establishes how value is created and captured across land development, warehouse construction, leasing, operations, and value-added logistics services.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the UAE warehousing market structure, demand drivers, and segment behavior. This includes review of trade and re-export trends, port and airport cargo volumes, e-commerce growth indicators, industrial diversification initiatives, and logistics infrastructure development pipelines. We assess occupier preferences related to location proximity, lease flexibility, compliance standards, operating costs, and scalability.

Company-level analysis includes review of logistics park offerings, warehouse specifications, rental benchmarks, occupancy models, service capabilities, and expansion strategies of major developers and operators. We also examine regulatory and compliance frameworks governing warehouse development and operations, including civil defense requirements, free zone regulations, customs frameworks, and sustainability initiatives. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with logistics park developers, warehouse owners, 3PL operators, e-commerce fulfillment managers, trading companies, cold chain operators, and industrial occupiers. The objectives are threefold: (a) validate assumptions around demand concentration, leasing behavior, and location preferences, (b) authenticate segment splits by warehouse type, end-use industry, and emirate, and (c) gather qualitative insights on rental dynamics, occupancy rates, operating costs, compliance challenges, and future capacity requirements.

A bottom-to-top approach is applied by estimating warehousing capacity, average rental values, and utilization across key segments and emirates, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with warehouse operators and brokers to validate on-ground realities such as lease negotiations, fit-out timelines, compliance bottlenecks, and availability constraints in prime logistics zones.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market view, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as trade growth, logistics throughput, industrial investment announcements, and infrastructure expansion plans. Assumptions related to rental escalation, land availability, regulatory enforcement, and operating cost trends are stress-tested to assess their impact on warehouse absorption and development activity. Sensitivity analysis is conducted across key variables including e-commerce growth intensity, cold chain adoption, free zone policy changes, and supply pipeline timing. Market models are refined until alignment is achieved between developer supply, occupier demand, and logistics activity indicators, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the UAE Warehousing Market?

The UAE Warehousing Market holds strong long-term potential, supported by the country’s role as a regional trade and re-export hub, sustained growth in logistics and e-commerce activity, and continued investment in port-centric and free-zone–led infrastructure. Demand for modern, compliant, and scalable warehousing solutions is expected to remain strong across general storage, distribution, cold chain, and specialized segments. As supply chains become more time-sensitive and service-oriented, professionally managed warehousing assets are likely to capture increasing value through 2035.

02 Who are the Key Players in the UAE Warehousing Market?

The market features a mix of large logistics park developers, free zone authorities, global third-party logistics providers, and regional warehouse operators. Competition is shaped by access to strategically located land, regulatory approvals, asset quality, tenant mix, and the ability to offer integrated logistics services. Free zone operators and port-linked developers play a central role in enabling bonded and re-export warehousing, while global 3PLs drive demand for high-spec, technology-enabled facilities.

03 What are the Growth Drivers for the UAE Warehousing Market?

Key growth drivers include expansion of regional trade and re-export volumes, rapid growth of e-commerce and omnichannel retail, increasing demand for cold storage and pharmaceutical warehousing, and industrial diversification initiatives. Additional momentum comes from port and airport expansion, development of integrated logistics zones, and rising preference for flexible leasing and scalable capacity. The UAE’s connectivity, regulatory frameworks, and logistics infrastructure continue to reinforce its position as a preferred regional distribution base.

04 What are the Challenges in the UAE Warehousing Market?

Challenges include rising land and rental costs in prime logistics zones, limited availability of large contiguous plots in core hubs, and compliance-related cost pressures associated with fire safety and regulatory standards. Older warehouse stock faces operational inefficiencies and upgrade requirements, while labor and operating cost inflation can impact margins for warehouse operators. In addition, demand concentration in select emirates can lead to capacity tightness and rental volatility, influencing occupier expansion decisions.