Uganda Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Mode of Transport (Road, Rail, Air, Water), By End Users (FMCG, Retail, Pharma, Agriculture), By Warehousing Type (Cold Storage, Dry Storage, Fulfillment Centers), By Region

- Product Code: TDR0332

- Region: Africa

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Uganda Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Mode of Transport (Road, Rail, Air, Water), By End Users (FMCG, Retail, Pharma, Agriculture), By Warehousing Type (Cold Storage, Dry Storage, Fulfillment Centers), By Region” provides a comprehensive analysis of the logistics and warehousing market in Uganda. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Uganda Logistics and Warehousing Market. The report concludes with future market projections based on revenue, by mode of transport, warehousing types, regions, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Uganda Logistics and Warehousing Market Overview and Size

The Uganda logistics and warehousing market reached a valuation of UGX 3.8 Trillion in 2023, driven by expanding trade volumes, infrastructure development, and a surge in e-commerce activity. The sector is dominated by key players including DHL Uganda, Bolloré Logistics, Uganda Freight Forwarders Association (UFFA) members, and emerging domestic warehousing service providers. These companies are known for their growing transportation networks, integration of digital solutions, and alignment with regional trade corridors like the Northern Corridor.

In 2023, Uganda launched key infrastructure upgrades at the Kampala Industrial and Business Park (KIBP) and Tororo Inland Port, aimed at strengthening the country’s warehousing capacity and enhancing cross-border trade efficiency. Kampala, Jinja, and Gulu have emerged as high-potential logistics hubs due to their strategic location, manufacturing activity, and connectivity to neighboring countries such as Kenya, South Sudan, and the DRC.

What Factors are Leading to the Growth of Uganda Logistics and Warehousing Market:

Growing Trade and Imports: Uganda's trade with regional partners and global markets has grown steadily, with imports accounting for over 60% of cargo movement. As trade volumes increase, logistics and storage demand for essential goods, construction material, machinery, and FMCG products has grown proportionately.

E-Commerce and Retail Expansion: The rise in digital shopping and e-commerce platforms, especially among urban consumers, has led to increased demand for last-mile delivery and fulfillment centers. In 2023, online sales grew by over 25%, driving the need for warehousing and reliable distribution channels across major towns.

Public and Private Infrastructure Projects: Investment in infrastructure such as roads (e.g., Kampala–Mpigi Expressway), rail upgrades under the Standard Gauge Railway (SGR) plan, and inland logistics parks have helped strengthen the logistical backbone of the country. These improvements reduce transport costs and enhance supply chain efficiency.

Which Industry Challenges Have Impacted the Growth for Uganda Logistics and Warehousing Market

Inadequate Infrastructure and Road Conditions: Poor Road quality, particularly in rural areas and feeder routes, significantly hampers the movement of goods. As per Uganda National Roads Authority (UNRA), only about 25% of the road network is paved, leading to high transit times and vehicle maintenance costs. This issue contributes to an average delay of 2–3 days for goods moving between central and border towns, affecting overall logistics efficiency.

Limited Cold Chain and Specialized Warehousing: There is a critical shortage of cold storage and temperature-controlled warehousing in Uganda, especially outside major cities like Kampala. As of 2023, cold chain infrastructure catered to less than 30% of the country’s agricultural and pharmaceutical demand. This results in significant post-harvest losses, particularly in perishable exports such as fish and fruits, with losses reported at up to 40% in some regions.

High Fuel and Transportation Costs: Volatile fuel prices and limited multimodal integration increase logistics costs, which account for nearly 40% of the final price of goods in Uganda—one of the highest in the East African region. These high costs are passed on to end consumers, reducing competitiveness for manufacturers and exporters.

What are the Regulations and Initiatives which have Governed the Market

Trade Facilitation through URA and ECTS: The Uganda Revenue Authority (URA) has implemented Electronic Cargo Tracking Systems (ECTS) to monitor goods in transit. This regulation helps reduce cargo theft and delays, increasing visibility and security. As of 2023, over 80% of high-value goods moving to/from Kenya and South Sudan were tracked using ECTS.

Warehouse Receipt System (WRS) Act: Uganda’s Warehouse Receipt System Act allows farmers and traders to deposit commodities in licensed warehouses and receive a warehouse receipt as collateral. This boosts access to credit and encourages formal warehousing practices. In 2023, over UGX 120 billion worth of produce was traded through licensed warehouses.

Public-Private Partnerships for Industrial Parks: The Uganda Investment Authority (UIA) in collaboration with private developers is establishing logistics parks in key cities. Notably, the Kampala Industrial and Business Park (KIBP) has attracted over 100 companies since 2022. Such initiatives are governed under the Investment Code Act 2019, aimed at improving ease of doing business and logistics support infrastructure.

Uganda Logistics and Warehousing Market Segmentation

By Market Structure: The market is predominantly unorganized, consisting of small and medium freight forwarders and independent warehouse operators that cater to regional and city-level demand. These local players offer flexible pricing, location-specific knowledge, and customized services, especially for agriculture and FMCG clients. However, the organized sector, comprising global players like DHL, Bolloré, and regional logistics parks, is gaining momentum due to growing demand for standardization, efficiency, and integration with customs and trade regulations. Organized players are increasingly preferred by exporters, e-commerce players, and multinational companies seeking consistency and technology-driven solutions.

%2C%202023.png)

By Mode of Transport: Road transport dominates Uganda’s logistics market due to the underdeveloped rail and inland waterway networks. Over 80% of cargo movement is road-based, connecting key corridors like Kampala–Mombasa and Kampala–Gulu–Juba. Air cargo is used mainly for high-value and time-sensitive goods (pharma, electronics), while rail transport is limited to certain bulk commodities on the Malaba–Kampala route. Water transport, though underutilized, is expected to grow with Lake Victoria infrastructure investments.

%2C%202023.png)

By Type of Warehousing: Dry storage continues to be the most dominant form of warehousing in Uganda, serving retail, FMCG, and general manufacturing needs. Cold storage remains significantly underpenetrated, serving less than a third of perishable supply chain needs. Fulfillment centers and bonded warehouses are growing in response to rising e-commerce demand and cross-border trade facilitation under the East African Community (EAC) trade zone. Urban centers like Kampala and Jinja lead in modern warehousing infrastructure.

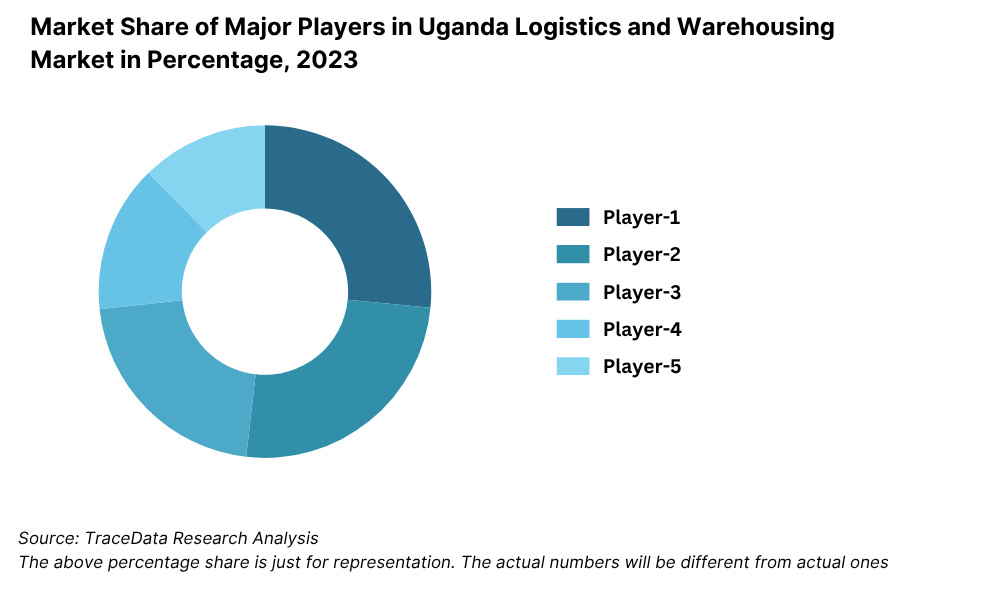

Competitive Landscape in Uganda Logistics and Warehousing Market

The Uganda logistics and warehousing market is moderately fragmented, with a mix of global logistics firms, regional transport operators, and local warehouse providers. While multinationals like DHL and Bolloré lead in structured logistics solutions, local companies and freight forwarders play a vital role in last-mile distribution and cross-border trade. The emergence of industrial parks and e-commerce fulfillment providers is also reshaping the competitive dynamics.

Company | Establishment Year | Headquarters |

DHL Uganda | 1979 | Kampala, Uganda |

Bolloré Transport & Logistics Uganda | 2001 | Kampala, Uganda |

Uganda Freight Forwarders Association (UFFA) | 2001 | Kampala, Uganda |

Spedag Interfreight | 1999 | Kampala, Uganda |

Roofings Logistics | 2010 | Kampala Industrial Area |

Fast Express Uganda | 2004 | Kampala, Uganda |

Some of the recent competitor trends and key information about competitors include:

DHL Uganda: A global leader in logistics, DHL continues to dominate express delivery, air freight, and integrated warehousing services in Uganda. In 2023, DHL expanded its regional distribution hub in Kampala, enabling faster cross-border deliveries across East Africa. The company has also invested in digital tracking and real-time inventory management systems for e-commerce and B2B clients.

Bolloré Transport & Logistics Uganda: Bolloré operates one of the largest bonded warehousing facilities in Kampala and serves clients across oil & gas, telecom, and retail. In 2023, Bolloré launched a new multimodal logistics corridor linking Mombasa, Kampala, and Eastern DRC, reducing delivery times by 15%. Its fleet modernization and investment in green logistics have further solidified its market share.

Uganda Freight Forwarders Association (UFFA): An umbrella body of licensed logistics operators, UFFA has grown to represent over 100 freight forwarding firms. Through industry partnerships, UFFA introduced capacity-building and compliance programs in 2023 to align members with EAC trade protocols and digital customs systems, enhancing professionalism and efficiency.

Spedag Interfreight: A key player in bulk and project cargo logistics, Spedag Interfreight serves manufacturing and infrastructure clients. The firm recorded a 20% rise in warehousing contracts in 2023 due to its strategic locations near industrial zones and seamless customs clearance processes.

Roofings Logistics: The logistics arm of Uganda’s largest steel manufacturer, Roofings Logistics specializes in warehousing and local distribution. In 2023, the company expanded its fleet and commissioned a new warehouse at Namanve Industrial Park to meet growing domestic demand from the construction sector.

Fast Express Uganda: Fast Express focuses on courier and SME logistics services. In 2023, the company expanded its footprint to regional towns like Mbarara and Arua, targeting FMCG and small business customers with affordable warehousing and transport solutions.

What Lies Ahead for Uganda Logistics and Warehousing Market?

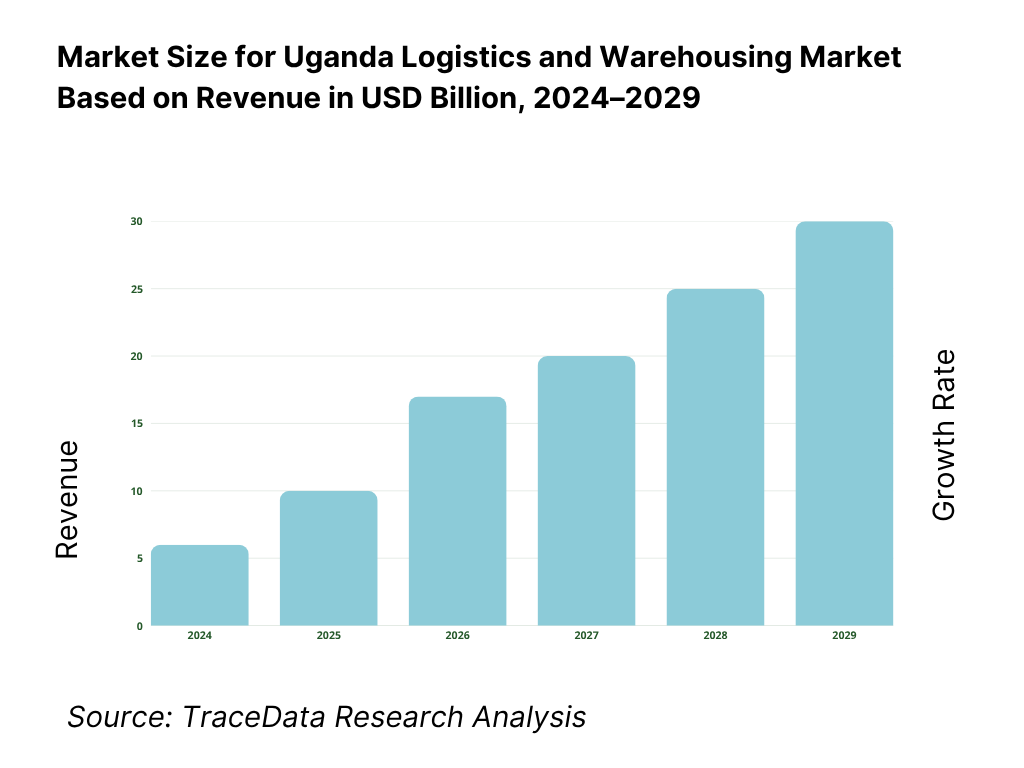

The Uganda logistics and warehousing market is projected to grow steadily through 2029, driven by regional trade integration, infrastructure development, and rising demand for organized logistics services. The sector is expected to witness a robust CAGR during the forecast period as the government and private sector continue to invest in modernization and capacity expansion.

Expansion of Regional Trade Corridors: With Uganda strategically located as a land-linked country, its role as a logistics hub for East and Central Africa will strengthen. The implementation of the African Continental Free Trade Area (AfCFTA) and improvements to the Northern Corridor and Central Corridor are expected to boost cross-border trade volumes, thereby increasing demand for storage, customs clearance, and multimodal connectivity.

Emergence of Smart Warehousing: Digitization of warehouses through the use of IoT, WMS (Warehouse Management Systems), and inventory automation is likely to transform warehousing operations in Uganda. This shift will improve stock visibility, reduce losses, and enhance supply chain efficiency. By 2029, a significant portion of newly developed warehouses is expected to be tech-enabled, especially in urban industrial zones.

Growth of Cold Chain Infrastructure: Driven by rising exports of fish, flowers, and fresh produce, as well as a growing pharmaceutical sector, the cold chain segment is expected to witness double-digit annual growth. Government incentives and PPP models will play a critical role in expanding refrigerated storage and transport capacity in secondary towns and border points.

Rise in E-commerce Fulfillment Centers: The growth of digital retail in Uganda will lead to an increase in urban micro-fulfillment centers, last-mile delivery hubs, and express courier facilities. As internet penetration and online transactions continue to rise, logistics providers will shift focus toward speed, precision, and customer experience.

Uganda Logistics and Warehousing Market Segmentation

• By Market Structure:

o Local Freight Forwarders

o Multinational Logistics Companies

o 3PL and 4PL Providers

o Government Logistics and Distribution Agencies

o Organized Sector

o Unorganized Sector

o Industrial Park-Based Operators

• By Mode of Transport:

o Road Transport

o Rail Transport

o Air Freight

o Inland Waterways

• By Type of Warehousing:

o Dry Warehousing

o Cold Storage Warehousing

o Fulfillment Centers

o Bonded Warehouses

o Agro-Commodity Warehouses

o Container Freight Stations

• By End-Use Industry:

o FMCG

o Agriculture and Agro-Processing

o Pharmaceuticals and Healthcare

o E-commerce and Retail

o Construction and Infrastructure

o Oil & Gas and Mining

• By Region:

o Central (Kampala, Mukono)

o Eastern (Jinja, Mbale)

o Western (Mbarara, Fort Portal)

o Northern (Gulu, Lira)

o Border Towns (Malaba, Elegu, Mutukula)

Players Mentioned in the Report:

• DHL Uganda

• Bolloré Transport & Logistics Uganda

• Uganda Freight Forwarders Association (UFFA)

• Spedag Interfreight

• Roofings Logistics

• Fast Express Uganda

• Posta Uganda Logistics

• Kenlloyd Logistics

• Freightlink Logistics

• Kampala Industrial and Business Park (KIBP) Developers

Key Target Audience:

• Logistics and Transport Companies

• Warehouse Infrastructure Developers

• E-commerce Companies

• Agricultural Cooperatives and Exporters

• Government Agencies (e.g., Uganda Revenue Authority, Ministry of Works and Transport)

• Cold Chain Solution Providers

• Industrial Park Authorities

• Development Finance Institutions and Donors

• Supply Chain Consulting and Research Firms

Time Period:

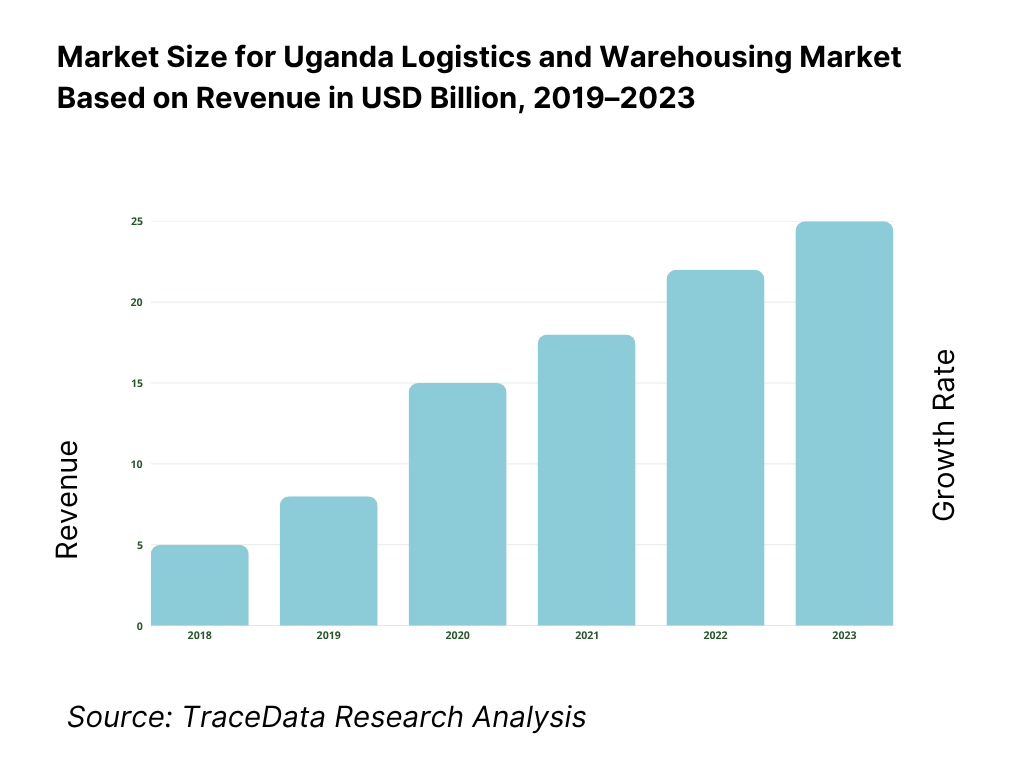

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Uganda Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Uganda Logistics and Warehousing Market

4.3. Business Model Canvas for Uganda Logistics and Warehousing Market

4.4. Logistics Service Decision Making Process

4.5. Warehousing Procurement and Leasing Decision Process

5. Market Structure

5.1. Cargo Movement Trends in Uganda, 2018-2024

5.2. Import-Export Volume and Trade Flow Analysis, 2018-2024

5.3. Spend on Logistics as a % of GDP in Uganda, 2024

5.4. Number of Logistics Operators and Warehousing Units by Region

6. Market Attractiveness for Uganda Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Uganda Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Storage Capacity (in Sq. Ft.), 2018-2024

8.3. Freight Volume (in Tons), 2018-2024

9. Market Breakdown for Uganda Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Mode of Transport (Road, Rail, Air, Water), 2023-2024P

9.3. By Type of Warehousing (Dry, Cold Storage, Fulfillment, Bonded), 2023-2024P

9.4. By End-Use Industry (FMCG, Agriculture, Pharma, E-commerce, Retail, Oil & Gas), 2023-2024P

9.5. By Region (Central, Western, Eastern, Northern, Border Towns), 2023-2024P

10. Demand Side Analysis for Uganda Logistics and Warehousing Market

10.1. Customer Landscape and Sector-Wise Demand Profiling

10.2. Logistics Outsourcing Trends and Preferences

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Uganda Logistics and Warehousing Market

11.2. Growth Drivers for Uganda Logistics and Warehousing Market

11.3. SWOT Analysis for Uganda Logistics and Warehousing Market

11.4. Issues and Challenges for Uganda Logistics and Warehousing Market

11.5. Government Regulations for Uganda Logistics and Warehousing Market

12. Snapshot on Cold Chain and E-commerce Fulfillment Market

12.1. Market Size and Future Potential for Cold Chain and Fulfillment Centers, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Cold Chain and Fulfillment Companies Based on Infrastructure, Coverage, Clients, and Capabilities

13. Uganda Logistics Infrastructure Investment Landscape

13.1. Public and Private Sector Projects, Industrial Parks, and SEZs

13.2. Investment Trends in Cold Chain and Smart Warehousing

13.3. Multilateral and Donor Agency Funding Initiatives

13.4. Role of PPPs in Logistics Infrastructure Development

14. Opportunity Matrix for Uganda Logistics and Warehousing Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Uganda Logistics and Warehousing Market

16. Competitor Analysis for Uganda Logistics and Warehousing Market

16.1. Benchmark of Key Competitors in Uganda Logistics and Warehousing Market including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Client Base, Regional Presence, Recent Developments, Fleet Size, Warehousing Capacity

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Uganda Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Storage Capacity (in Sq. Ft.), 2025-2029

17.3. Freight Volume (in Tons), 2025-2029

18. Market Breakdown for Uganda Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Mode of Transport (Road, Rail, Air, Water), 2025-2029

18.3. By Type of Warehousing (Dry, Cold, Fulfillment, Bonded), 2025-2029

18.4. By End-Use Industry (FMCG, Agriculture, Pharma, Retail, E-commerce), 2025-2029

18.5. By Region (Central, Western, Eastern, Northern, Border Towns), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Uganda Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 players in the country based upon their operational footprint, infrastructure capacity, fleet size, and warehouse volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like revenue streams, warehousing capacity, fleet availability, demand by end-use industry, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, investment proposals, regulatory filings, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Uganda Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate cargo volume and warehouse utilization for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Uganda Logistics and Warehousing Market?

The Uganda logistics and warehousing market holds strong growth potential, reaching a valuation of UGX 3.8 Trillion in 2023. This growth is driven by the expansion of regional trade corridors, the rise in e-commerce and retail activity, and increasing investments in transport and warehouse infrastructure. The country’s strategic location as a land-linked hub for East and Central Africa further strengthens its role as a key logistics gateway.

2. Who are the Key Players in the Uganda Logistics and Warehousing Market?

The Uganda Logistics and Warehousing Market features several key players, including DHL Uganda, Bolloré Transport & Logistics Uganda, and Spedag Interfreight. These companies lead the organized segment with integrated logistics solutions and regional distribution capabilities. Other notable players include Fast Express Uganda, Roofings Logistics, and member firms of the Uganda Freight Forwarders Association (UFFA).

3. What are the Growth Drivers for the Uganda Logistics and Warehousing Market?

Key growth drivers include growing regional trade under the EAC and AfCFTA frameworks, public-private investments in industrial parks and transport infrastructure, and the expansion of cold storage and fulfillment centers. The rise in demand from FMCG, agriculture, and e-commerce sectors also contributes significantly to the increasing need for modern logistics solutions.

4. What are the Challenges in the Uganda Logistics and Warehousing Market?

The Uganda Logistics and Warehousing Market faces challenges such as inadequate road infrastructure, high fuel and freight costs, and limited cold chain capacity. Additionally, a shortage of skilled personnel and low digital adoption among small logistics providers hinder operational efficiency. These structural and capacity constraints need to be addressed to unlock the full potential of the sector.