UK Alcoholic Drinks Market Outlook to 2029

By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region

- Product Code: TDR0114

- Region: Europe

- Published on: January 2025

- Total Pages: 80

Report Summary

The report titled "UK Alcoholic Drinks Market Outlook to 2029 - By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region" provides a comprehensive analysis of the alcoholic drinks market in the UK. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities, bottlenecks, and company profiling of major players in the Alcoholic Drinks Market. The report concludes with future market projections based on sales revenue, by market, product types, regions, and success case studies highlighting the major opportunities and cautions.

UK Alcoholic Drinks Market Overview and Size

The UK alcoholic drinks market reached a valuation of £40 billion in 2023, driven by changing consumer preferences, increasing demand for premium and low-alcohol beverages, and evolving trends toward health-conscious choices. The market is characterized by major players such as Diageo, Molson Coors, Anheuser-Busch InBev, and Heineken, which dominate through extensive product portfolios and distribution networks. These companies are recognized for their strong brand presence, innovation in new product lines, and responsiveness to shifting consumer demands.

In 2023, Diageo launched a range of low-alcohol spirits aimed at health-conscious consumers, contributing to the market's growing premiumization trend. London and Manchester are key markets due to their high population density, tourism, and strong nightlife culture, making them hubs for alcoholic beverage consumption.

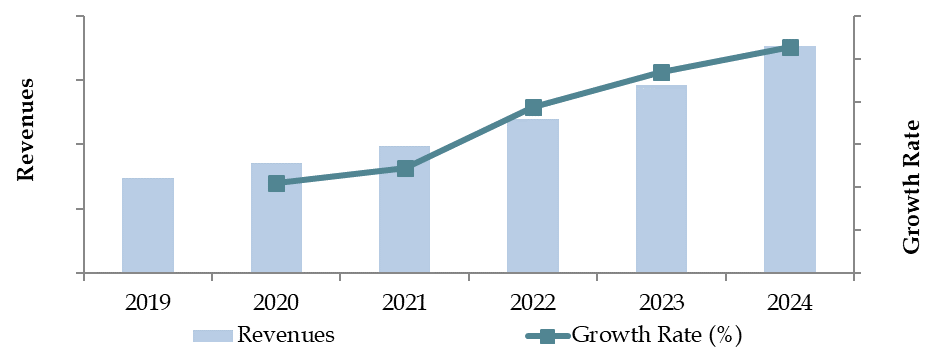

Market Size for UK Alcoholic Drinks Industry on the Basis of Revenues in USD Billion, 2018-2024

What Factors are Leading to the Growth of the UK Alcoholic Drinks Market:

Premiumization and Innovation: The rise of premium products and innovation in flavors and packaging have fueled market growth. In 2023, premium alcoholic drinks accounted for over 30% of total sales, driven by consumer interest in craft beers, artisanal spirits, and bespoke cocktail experiences. This shift is particularly pronounced among younger, affluent consumers who are willing to pay more for high-quality, unique experiences.

Health and Wellness Trends: The growing awareness of health and wellness has spurred demand for low-alcohol and non-alcoholic beverages. Low-alcohol beer and spirits saw a 15% year-on-year growth in 2023, as more consumers sought alternatives that align with a healthier lifestyle without compromising on taste and social experiences.

Digitalization and E-Commerce: The rise of online retail and direct-to-consumer sales has significantly transformed the way consumers purchase alcoholic beverages. In 2023, approximately 25% of alcoholic drinks sales in the UK were conducted through online platforms, driven by the convenience of home delivery, subscription services, and exclusive online-only product offerings. Digital marketing strategies, including targeted promotions and personalized recommendations, have also played a crucial role in expanding market reach.

Which Industry Challenges Have Impacted the Growth for the UK Alcoholic Drinks Market

Health and Wellness Concerns: The increasing awareness of health and wellness has led to a decline in the consumption of alcoholic beverages, particularly among younger consumers. According to a recent survey, approximately 30% of adults in the UK are actively reducing their alcohol intake or adopting alcohol-free lifestyles. This trend has forced major companies to pivot toward offering low-alcohol and alcohol-free alternatives, which, although growing, still face challenges in matching the profitability of traditional alcoholic drinks. This shift in consumer preferences is limiting the growth potential of high-alcohol content beverages.

Regulatory Challenges: The UK has one of the most stringent regulatory frameworks concerning the marketing, sale, and advertising of alcoholic drinks. In 2023, updated advertising restrictions placed more emphasis on responsible drinking and tighter rules on where and how alcohol can be promoted. These regulations have made it difficult for brands to reach target audiences through traditional advertising channels, impacting overall market visibility and growth opportunities. Additionally, rising alcohol duties have driven up prices, further reducing demand in price-sensitive consumer segments.

Shifting Consumer Preferences: With the younger generation showing a marked preference for experiences over products, traditional alcoholic beverages are losing appeal. Younger consumers are increasingly gravitating toward unique drinking experiences such as craft cocktails, premium spirits, and non-traditional alcoholic beverages. This generational shift has resulted in slower growth for mass-market beer and wine categories, which have historically been strong revenue drivers for the industry.

What are the Regulations and Initiatives which have Governed the UK Alcoholic Drinks Market:

Alcohol Duty Regulations: The UK government enforces strict alcohol duty regulations, which are adjusted annually and vary depending on the type and alcohol content of the beverage. In 2023, new alcohol duty reforms introduced a system based on the strength of alcohol, significantly impacting the pricing of spirits and high-alcohol content drinks. This reform aims to encourage moderation by making lower-alcohol drinks more affordable, while imposing higher taxes on stronger beverages. These regulations have reshaped pricing strategies within the industry and influenced consumer purchasing patterns.

Advertising and Marketing Restrictions: Advertising alcoholic beverages in the UK is tightly regulated to promote responsible drinking and protect vulnerable groups such as minors. The Advertising Standards Authority (ASA) and the Portman Group work together to enforce rules around the timing, placement, and content of alcohol ads. In 2023, stricter digital marketing regulations were introduced, requiring clearer labeling on social media posts by influencers promoting alcohol. These initiatives aim to reduce excessive consumption and ensure that alcohol is marketed responsibly.

Minimum Unit Pricing (MUP): Introduced in Scotland in 2018 and later adopted in Wales, Minimum Unit Pricing mandates a floor price per unit of alcohol, aimed at reducing excessive drinking by raising the price of cheap, high-strength drinks. By 2023, the policy was being considered for implementation across the rest of the UK, with reports indicating a decline in alcohol-related hospital admissions in regions where MUP was enforced. This regulation has had a significant impact on low-cost alcohol products, particularly within the supermarket sector.

UK Alcoholic Drinks Market Segmentation

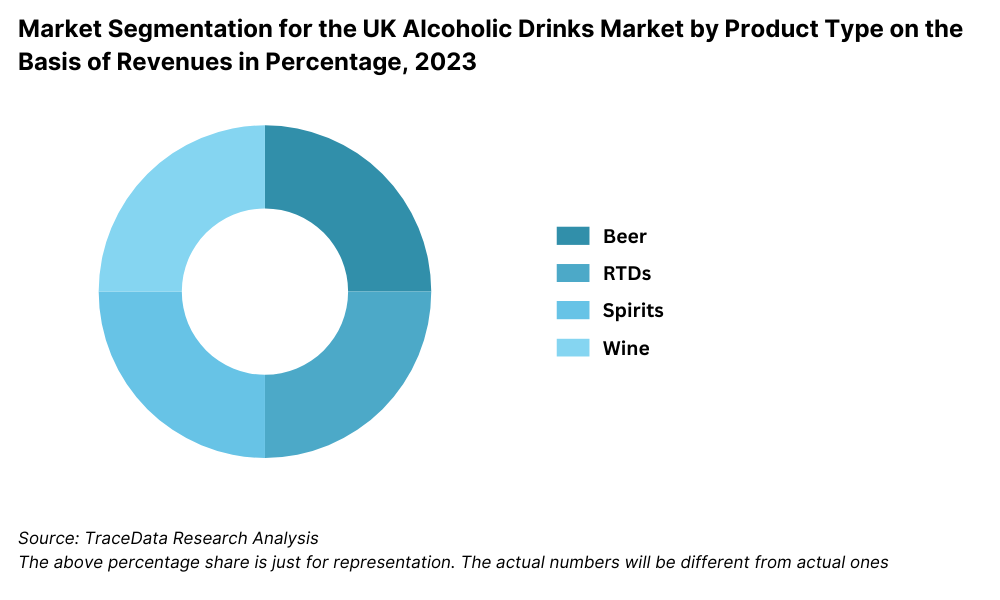

By Product Type: Beer remains the most popular alcoholic drink in the UK, driven by the nation’s strong pub culture and the growing variety of craft beer options available. Lager is the leading category within beer, while ale and stout also hold considerable market share. Spirits have seen notable growth, especially gin and whisky, as consumers increasingly turn to premium spirits for home consumption and cocktails. Wine is also a key category, with red and white wines being equally popular, though sparkling wine, particularly Prosecco, has been on the rise in recent years due to its appeal for celebratory occasions.

Market Segmentation for the UK Alcoholic Drinks Market by Product Type on the Basis of Revenues in Percentage, 2023

By Consumer Preferences: The growing health-conscious movement has led to increased demand for low-alcohol and non-alcoholic beverages. In 2023, low-alcohol beer and spirits accounted for around 10% of total market sales, reflecting a shift in consumer preferences toward healthier lifestyle choices. Premiumization is another significant trend, with consumers showing a willingness to spend more on higher-quality products, such as craft beers, artisanal spirits, and premium wines, particularly among younger and affluent demographics.

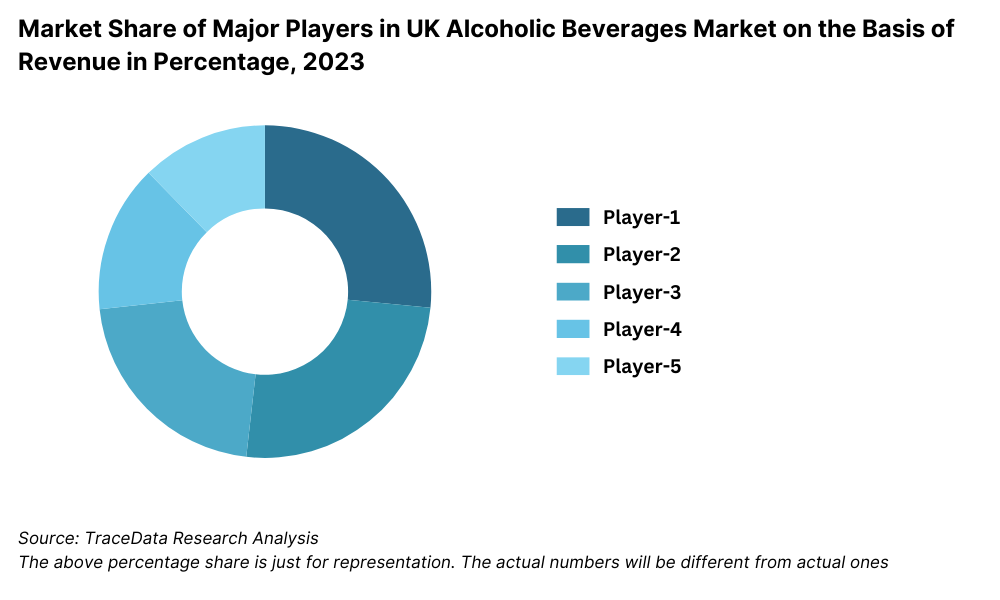

Competitive Landscape in UK Alcoholic Drinks Market

The UK alcoholic drinks market is highly competitive, with a few major players dominating the industry. However, the market has become increasingly diversified due to the rise of craft producers, premiumization trends, and the growth of online platforms that offer consumers a broader range of alcoholic beverages. Key players in the industry include Diageo, Molson Coors, Anheuser-Busch InBev, Heineken, BrewDog, and Fever-Tree, with each company bringing unique strategies to capture different segments of the market.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Diageo | 1997 | London, United Kingdom |

Heineken UK | 1864 | Edinburgh, Scotland |

Molson Coors | 1786 | Chicago, Illinois, USA |

Carlsberg UK | 1847 | Northampton, England |

AB InBev UK | 2008 | Leuven, Belgium |

Brown-Forman | 1870 | Louisville, Kentucky, USA |

Bacardi Limited | 1862 | Hamilton, Bermuda |

Pernod Ricard UK | 1975 | London, United Kingdom |

Chapel Down Group (Wine) | 2001 | Tenterden, Kent, United Kingdom |

Marston’s Brewery | 1834 | Wolverhampton, England |

Some of the recent competitor trends and key information about competitors include:

Diageo: As one of the leading global spirits companies, Diageo experienced a 10% growth in UK sales in 2023, largely driven by the popularity of its premium whiskey and gin brands, including Johnnie Walker and Tanqueray. The company has focused on expanding its presence in the low-alcohol and alcohol-free segments, capitalizing on the growing health-conscious consumer base.

Molson Coors: Known for its strong portfolio of beer brands, including Coors Light and Carling, Molson Coors saw a 5% decline in mass-market beer sales in 2023, but an 18% growth in craft and premium beer sales. The company has invested heavily in expanding its range of craft beer offerings to cater to evolving consumer tastes.

Anheuser-Busch InBev: The world’s largest beer company, Anheuser-Busch InBev, reported a 7% increase in UK sales in 2023, driven by strong demand for its global brands such as Budweiser and Stella Artois. The company has also focused on sustainability initiatives, including reducing plastic packaging and water consumption, which resonate well with environmentally conscious consumers.

Heineken: Heineken's UK sales grew by 8% in 2023, largely due to the rising popularity of its premium brands such as Heineken 0.0 and Desperados. The company’s focus on innovation in low-alcohol products and its sustainability initiatives, such as the use of green energy in its breweries, have contributed to its continued success in the UK market.

BrewDog: As one of the fastest-growing craft beer brands in the UK, BrewDog reported a 20% increase in sales in 2023. The company’s focus on sustainability and environmental activism, such as its carbon-negative beer production, has earned it a loyal customer base. Its direct-to-consumer sales through online channels also contributed significantly to its growth.

Fever-Tree: A leading producer of premium mixers, Fever-Tree saw a 12% increase in UK sales in 2023, driven by the rising demand for premium spirits and craft cocktails. The company’s focus on high-quality ingredients and its innovative product development, such as low-sugar mixers, have bolstered its position in the premium drinks market

Market Share of Major Players in UK Alcoholic Beverages Market on the Basis of Revenue in Percentage, 2023

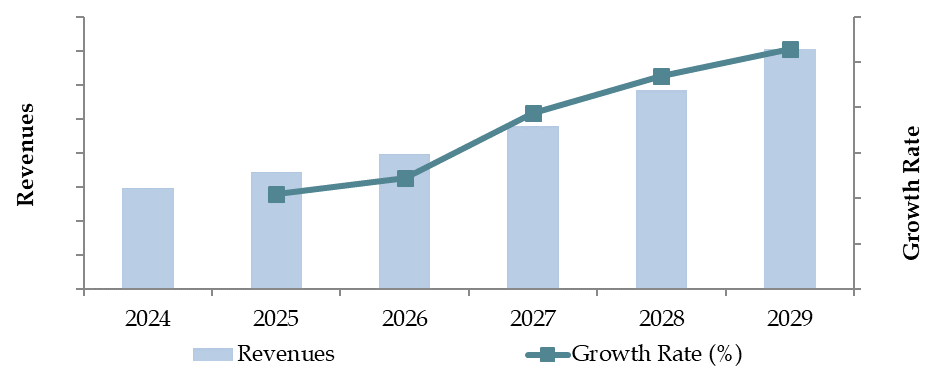

What Lies Ahead for the UK Alcoholic Drinks Market?

The UK alcoholic drinks market is projected to grow steadily by 2029, demonstrating a moderate CAGR during the forecast period. This growth is expected to be driven by shifting consumer preferences, the rise of premium and low-alcohol options, and ongoing innovations within the industry.

Shift Towards Low-Alcohol and Alcohol-Free Drinks: As health-conscious trends continue to gain momentum, the demand for low-alcohol and non-alcoholic beverages is expected to grow significantly. By 2029, these products could represent a much larger share of the total market, supported by both consumer demand and government health initiatives that encourage moderation in alcohol consumption.

Premiumization Trend: Consumers are showing an increasing willingness to pay more for premium products that offer higher quality, unique flavors, or artisanal production methods. Craft beers, premium spirits, and vintage wines are anticipated to see strong growth, with brands focusing on authenticity, heritage, and sustainability. This shift towards premiumization is expected to boost the profitability of high-end segments in the market.

Growth of E-commerce and Digital Sales Channels: The rapid growth of online platforms and digital sales channels is anticipated to continue, particularly as more consumers turn to online shopping for convenience. By 2029, e-commerce is expected to represent a significant portion of alcohol sales, with companies investing in seamless online purchasing experiences and direct-to-consumer delivery models. This shift will be particularly important for reaching younger, tech-savvy consumers.

Focus on Sustainability: Sustainability is becoming a central focus for both producers and consumers in the UK alcoholic drinks market. Companies are investing in eco-friendly practices, such as reducing carbon emissions, using recyclable packaging, and sourcing sustainable ingredients. These practices are not only important for meeting regulatory requirements but are also increasingly influencing consumer choices. Brands that lead the way in sustainability are likely to gain a competitive advantage as environmental concerns become more prominent.

Future Outlook and Projections for UK Alcoholic Beverages Market on the Basis of Revenues in USD Billion, 2024-2029

UK Alcoholic Drinks Market Segmentation

- By Market Structure:

- Supermarkets and Hypermarkets

- Specialist Alcohol Retailers

- Online Sales Channels

- Pubs and Bars

- Convenience Stores

- Off-Licenses

- On-Trade vs. Off-Trade

- By Product Type:

- Beer (Lager, Ale, Stout)

- Spirits (Gin, Whisky, Vodka, Rum)

- Wine (Red, White, Sparkling)

- Ready-to-Drink (RTD) Cocktails

- Low-Alcohol and Alcohol-Free Drinks

- Cider

- By Consumer Preferences:

- Premium Beverages

- Low-Alcohol and Non-Alcoholic Alternatives

- Craft Beverages (Beer and Spirits)

- Organic and Sustainable Alcoholic Drinks

- Convenience and Ready-to-Drink Options

- By Age of Consumer:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- By Region:

- London

- South East

- North West

- Scotland

- Midlands

- Wales

Players Mentioned in the Report:

- Diageo

- Molson Coors

- Anheuser-Busch InBev

- Heineken

- BrewDog

- Fever-Tree

- Carlsberg UK

- Accolade Wines

- Pernod Ricard

Key Target Audience:

- Alcohol Producers and Distributors

- Retail Chains and Supermarkets

- Online Alcohol Marketplaces

- Pubs and Bars

- Regulatory Bodies (e.g., UK Department of Health, Advertising Standards Authority)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for UK Alcoholic Drinks Market

4.3. Consumer Buying Decision Process

5.1. Market Overview and Genesis

5.2. Number of Breweries and Microbreweries, as on Date

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2018-2023

9.1.1. By Beer (Lager, Dark Beer and others), 2018-2023

9.1.1.1. By Lager (Domestic Premium and Imported Premium), 2018-2023

9.1.1.2. By Craft and Standard Beer, 2018-2023

9.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2018-2023

9.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2018-2023

9.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3.2. By Flavoured and Non-Flavoured Vodka, 2018-2023

9.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2018-2023

9.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2023

9.2.1. By Distribution Channel for Off Trade, 2023

9.3. By Region, 2023-2024P

10.1. Customer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Consumer Needs, Preferences, and Pain Points

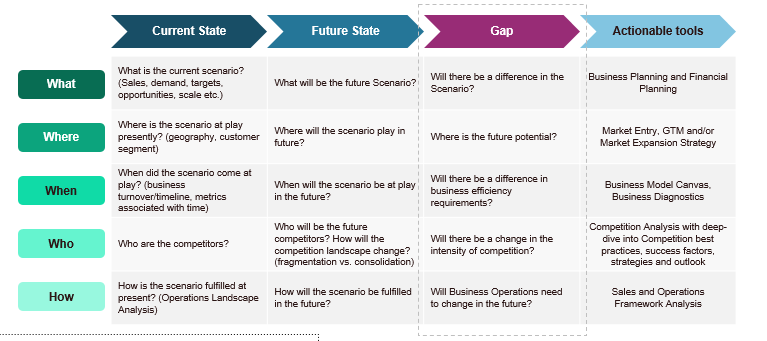

10.4. Gap Analysis Framework

11.1. Trends and Developments in UK Alcoholic Drinks Market

11.2. Growth Drivers for UK Alcoholic Drinks Market

11.3. SWOT Analysis for UK Alcoholic Drinks Market

11.4. Issues and Challenges for UK Alcoholic Drinks Market

11.5. Government Regulations for UK Alcoholic Drinks Market

14.1. Market Share of Key Players in Alcoholic Beverages Market, 2023

14.2. Market Share of Key Players in Beer Market, 2023

14.3. Market Share of Key Players in Wine Market, 2023

14.4. Market Share of Key Players in Spirits Market, 2023

14.5. Market Share of Key Players in RTDs Market, 2023

14.6. Benchmark of Key Competitors in UK Alcoholic Drinks Market Basis 15-20 Operational and Financial Parameters

14.7. Strength and Weakness of Key Competitors

14.8. Operating Model Analysis Framework

14.9. Gartner Magic Quadrant for Market Positioning

14.10. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

15.2. Sales Volume, 2025-2029

16.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2025-2029

16.1.1. By Beer (Lager, Dark Beer and others), 2025-2029

16.1.1.1. By Lager (Domestic Premium and Imported Premium), 2025-2029

16.1.1.2. By Craft and Standard Beer, 2025-2029

16.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2025-2029

16.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2025-2029

16.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3.2. By Flavoured and Non-Flavoured Vodka, 2025-2029

16.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2025-2029

16.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2025-2029

16.2.1. By Distribution Channel for Off Trade, 2025-2029

16.3. By Region, 2025-2029

17.1. Strategic Recommendation

17.2. Opportunity Identification

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities for the UK Alcoholic Drinks Market. Based on this ecosystem, we will shortlist the top 5-6 producers in the country, considering their financial information, production capacity, and sales volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Exhaustive desk research is conducted by referencing diverse secondary and proprietary databases. This approach enables a thorough analysis of the market, gathering insights on sales revenues, number of market players, price levels, demand trends, and more. We further analyze company-level data using press releases, annual reports, financial statements, and similar documents. This process establishes a foundational understanding of both the overall market and the specific companies operating within it.

Step 3: Primary Research

In-depth interviews are initiated with C-level executives and other stakeholders representing various companies in the UK Alcoholic Drinks Market. This interview process validates market hypotheses, confirms statistical data, and extracts valuable operational and financial insights. A bottom-to-top approach is employed to evaluate volume sales for each key player, aggregating this data to form an overall market view.

Validation strategy includes disguised interviews, where our team approaches companies as potential customers. This method helps validate the operational and financial information shared by executives, allowing us to cross-check this data against secondary sources. These interviews also provide in-depth insights into revenue streams, value chains, pricing strategies, and other key market factors.

Step 4: Sanity Check

- Sanity checks are performed through bottom-up and top-down analysis, along with market size modeling exercises. This ensures the accuracy and reliability of the data collected and supports a robust assessment of the overall market.

FAQs

1. What is the potential for the UK Alcoholic Drinks Market?

The UK alcoholic drinks market is expected to grow steadily, reaching a valuation of £40 billion by 2029. This growth is driven by evolving consumer preferences, including the rising demand for premium beverages, low-alcohol and alcohol-free alternatives, and the expansion of digital sales channels. The shift towards healthier lifestyles and the increasing interest in craft beverages also play a significant role in the market's potential.

2. Who are the Key Players in the UK Alcoholic Drinks Market?

The UK alcoholic drinks market includes key players such as Diageo, Molson Coors, Anheuser-Busch InBev, Heineken, BrewDog, and Fever-Tree. These companies dominate the market with their extensive product portfolios, strong brand recognition, and innovative approaches to product development. Craft beer producers and smaller premium brands also contribute to the market's diversity and growth.

3. What are the Growth Drivers for the UK Alcoholic Drinks Market?

The primary growth drivers include changing consumer preferences toward premium, low-alcohol, and non-alcoholic beverages. The rise of health-consciousness, premiumization trends, and the increasing popularity of craft drinks are contributing significantly to market expansion. Additionally, the growth of online and direct-to-consumer sales channels is facilitating easier access to a wider variety of alcoholic beverages, driving further growth.

4. What are the Challenges in the UK Alcoholic Drinks Market?

The UK alcoholic drinks market faces several challenges, including regulatory restrictions on alcohol advertising and increasing taxes through alcohol duty reforms. Health and wellness trends are also leading to declining consumption of traditional alcoholic drinks, particularly among younger generations. Additionally, supply chain disruptions and sustainability concerns are significant hurdles that companies in the market need to address to maintain their competitive edge.