UK Soft Gelatin Capsules Market Outlook to 2030

By Shell Type, By Fill/Application, By Release Profile, By End Use, By Distribution Channel, and By Region

- Product Code: TDR0364

- Region: Europe

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “UK Soft Gelatin Capsules Market Outlook to 2030 - By Shell Type, By Fill/Application, By Release Profile, By End Use, By Distribution Channel, and By Region” provides a comprehensive analysis of the soft gelatin capsules market in the UK. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the soft gelatin capsules market. The report concludes with future market projections based on product pipelines, delivery technologies, channels and regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

UK Soft Gelatin Capsules Market Overview and Size

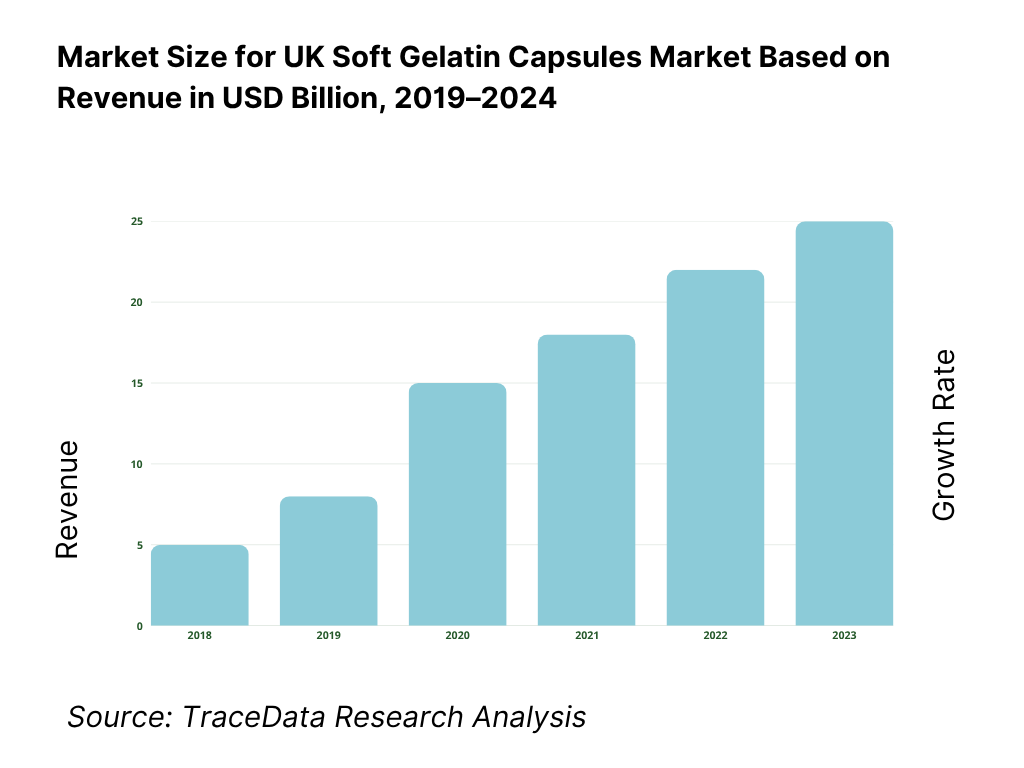

The UK soft gel capsules market is valued at USD 468.75 million, based on a five-year historical analysis of the category; the next period shows USD 500.0 million, indicating continued demand from nutraceutical and OTC portfolios as brands prioritise bioavailability, swallowability, and odour/taste masking formats.

England leads due to concentration of brand owners, pharmacy chains and e-commerce hubs—London (brand HQs, investor access), the South East/Midlands (retail distribution and packaging), and South Wales (Tredegar softgel manufacturing cluster via HBI EuroCaps). Category pull is reinforced by high-velocity supplement brands (e.g., Vitabiotics sales £196.5 million) and expanding sports-nutrition nodes (Applied Nutrition revenue £86.2 million), which favour softgel SKUs in omega-3, vitamins and botanicals. Proximate EU supply nodes (Germany, Netherlands) add resilience via CDMO networks serving UK labels.

What Factors are Leading to the Growth of the UK Soft Gelatin Capsules Market:

High-volume dispensing and dense retail access powering softgel throughput: England’s primary-care network dispensed 1.21 billion prescription items, with 1.08 billion issued via the Electronic Prescription Service—an infrastructure that favours swallow-easy formats for lipids and fat-soluble actives commonly presented as softgels. At the last count, there were 12,009 active community pharmacies able to stock OTC and supplement ranges alongside prescribed products, ensuring national availability and rapid product rotation. Macro demand is underpinned by a UK population of 69,281,400, sustaining large cohorts for vitamin D, omega-3, and condition-specific softgels across pharmacy and grocery. Together, the item flow, digital rails, and outlet density create reliable pull for softgel SKUs and private-label tenders.

Ageing demographics expanding category use-cases for softgels: An older population drives daily-dose supplementation and easier-to-swallow dosage forms. Parliamentary analysis shows 12.7 million people aged 65+ in the UK, indicating a large, chronic-care and prevention-oriented cohort for omega-3, vitamin D, and GI-friendly softgels. The overall population reached 69.3 million, adding absolute headroom for pharmacy and e-commerce channels that prioritise compliant, tamper-evident formats. In parallel, England’s dispensing system still processes over 1.1 billion items through community pharmacies, keeping adherence tools (mini-softgels, odour-masked oils) in focus for older users. These macro numbers collectively support predictable demand for lipid-based and targeted-release softgels across Rx/OTC and food-supplement boundaries.

Domestic resource base and trade flows securing inputs for softgel fills: Softgel portfolios rely on fish oils and animal/alternative gelatins. UK vessels landed 719,000 tonnes of sea fish, while total imports of fish and fish products reached 743,000 tonnes, ensuring sustained access to omega-3 inputs even when domestic catches vary. On the gelatin side, the UK cattle and calf population stands just below 9.2 million, a critical baseline for compliant bovine-gelatin supply chains, complemented by EU proximity for additional sourcing. These volumes, combined with established rendering and purification standards, give formulators confidence in lipid availability and shell materials continuity—key for large pharmacy ranges and private-label campaigns that depend on uninterrupted production.

Which Industry Challenges Have Impacted the Growth of the UK Soft Gelatin Capsules Market:

Input volatility and herd dynamics tighten gelatin availability: Bovine-gelatin shells dominate many UK softgels, making livestock trends strategically relevant. Government statistics place UK cattle and calves at just under 9.2 million, with official releases noting declines into 2024, signalling pressure on domestic collagen sources. Any contraction in breeding herds complicates long-term gel mass planning, validation batches, and multi-month campaign scheduling on rotary-die lines. While EU and global sourcing mitigate shocks, QA teams must maintain country-of-origin traceability and TSE/BSE documentation for every lot—an administrative and supply-risk load amplified when local heads fall and reliance shifts to imports and alternative shells.

Import dependence for marine lipids exposes operations to logistics and quality controls: Despite strong domestic fisheries, the UK relied on 743,000 tonnes of imported fish and fish products, with a separate record of 611,000 tonnes of imported sea fish alone. This scale of inbound supply means oxidation management, transport temperatures, and customs lead-times materially affect softgel peroxide/anisidine metrics and release testing cadence. As landings abroad by UK vessels hit 279,000 tonnes, supply chains become multi-jurisdictional, raising variance in oil characteristics and CoA formats. These realities increase QA/QP workload and buffer-stock needs to keep omega-3 and specialty-lipid SKUs on shelf without deviation notices.

Capacity planning under tight labour and compliance windows: Manufacturing remains sensitive to skilled-labour availability and inspection timing. The UK vacancy series shows persistently elevated job openings across the economy, with the latest headline count at 728,000 vacancies, complicating recruitment for GMP/validation roles. Concurrently, the medicines regulator confirmed that GMP/GDP certificate validity was extended until the end of 2024, while on-site inspections resumed—requiring plants to be audit-ready as extensions roll off. Together, staffing constraints and inspection scheduling drive contingency planning on campaign lengths, tech-transfer slots, and release resources for pharma-grade and high-spec nutraceutical softgels.

What are the Regulations and Initiatives which have Governed the Market:

MHRA Manufacturer’s/Importer’s Authorisation (MIA/MIA-IMP) and GMP oversight: Medicinal softgels supplied to the UK require MHRA licensure and ongoing GMP compliance. The regulator confirmed automatic extension of GMP/GDP certificate validity until the end of 2024, alongside the return of on-site inspections, tightening audit preparedness for dosage-form manufacturers and importers. With England’s dispensing system pushing 1.21 billion items and 1.08 billion EPS issues through regulated channels, adherence to GMP/GDP across production and wholesale distribution remains the legal backbone for Rx/OTC softgel flows from factory to pharmacy.

Food Standards Agency (FSA) framework for food supplements and borderline products: Softgels marketed as food supplements must meet FSA rules on composition, labelling, and claims, operating alongside trading-standards enforcement. The retail system servicing 12,009 active community pharmacies distributes large volumes of supplement SKUs, increasing exposure to labelling checks and claim scrutiny. The UK population of 69,281,400 further amplifies oversight breadth across nations and regions. While the GB regime differs from EU processes applying in Northern Ireland, businesses must evidence safety and composition for oil-filled capsules and keep technical files ready for inspection.

Fisheries and animal-by-product rules shaping softgel inputs: Omega-3 oils and gelatin sourcing sit under UK fisheries and animal-by-product controls. Official fisheries statistics logged 719,000 tonnes of UK vessel landings and 743,000 tonnes of total fish and fish-product imports; rendering and collagen use must meet hygiene and traceability requirements through approved establishments. On the bovine side, the cattle and calf population just under 9.2 million feeds into regulated supply chains that require TSE/BSE statements and gel mass provenance down to lot level. Compliance with these numeric realities anchors supplier qualification and audit scopes for softgel manufacturers.

UK Soft Gelatin Capsules Market Segmentation

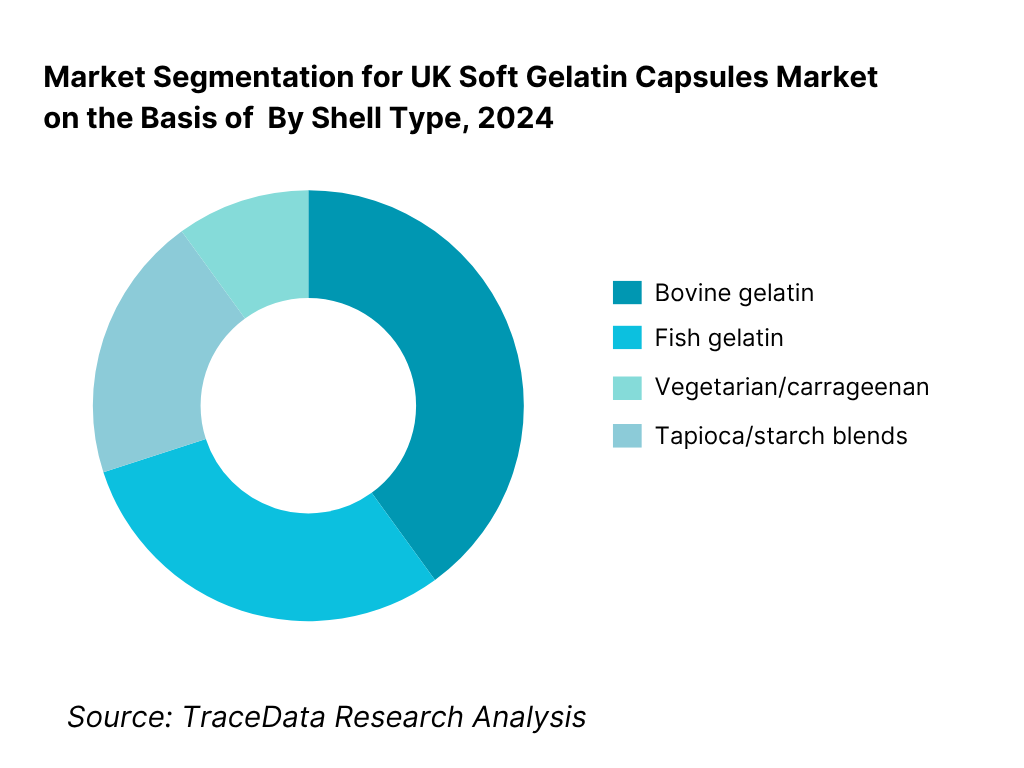

By Shell Type: UK Soft Gelatin Capsules market is segmented by shell into bovine gelatin, fish gelatin, vegetarian/carrageenan and tapioca/starch blends. Recently, bovine gelatin has a dominant market share in the UK under the segmentation shell type, driven by reliable film-forming properties, seam integrity on rotary-die lines, and wide supplier availability with TSE/BSE-compliant documentation. Brand owners value its predictable rheology and compatibility with lipophilic fills such as omega-3 and vitamin D, enabling high throughput with tight weight-variation control. Fish gelatin demand is rising for pescatarian/halal positioning, while vegetarian shells scale in TiO₂-free and clean-label applications.

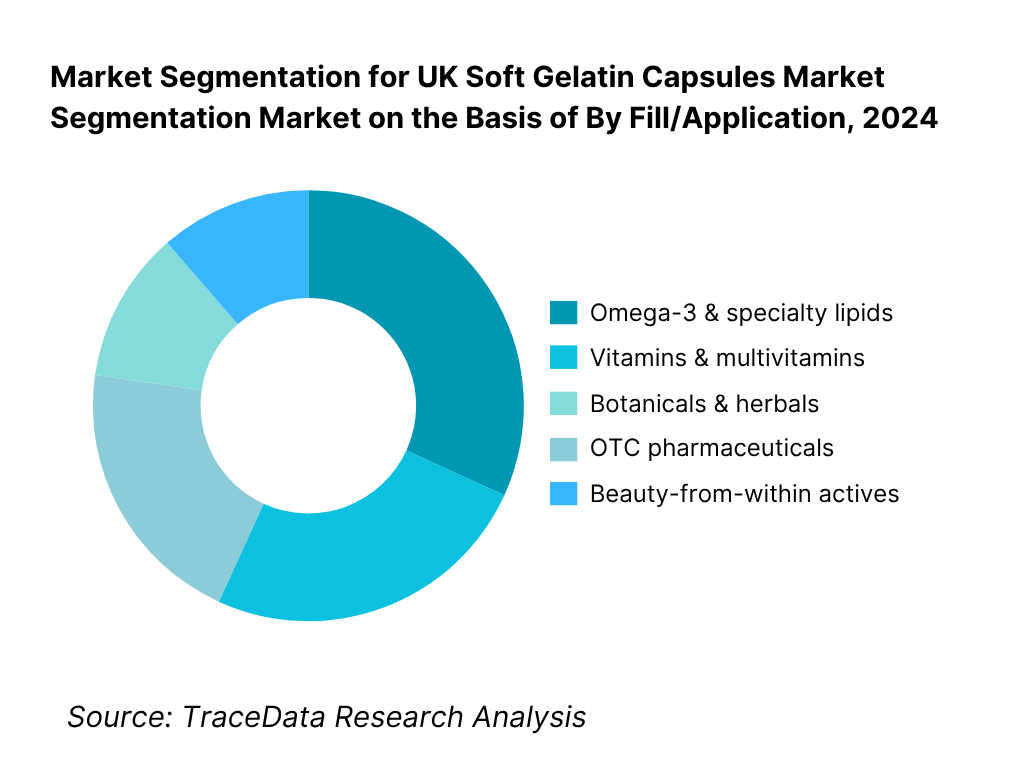

By Fill/Application: UK Soft Gelatin Capsules market is segmented by fill into omega-3 & specialty lipids, vitamins & multivitamins, botanicals & herbals, OTC pharmaceuticals, and beauty-from-within actives. Recently, omega-3 & specialty lipids have a dominant market share under this segmentation, due to the natural fit of oil-based actives with softgel delivery, lower peroxide/anisidine benchmarks enforced by leading retailers, and strong consumer familiarity with fish-oil capsules. The format also supports deodorised concentrates, mini-softgels for better adherence, and nitrogen-blanketed processing—making it the default in heart-health, pregnancy and joint-health ranges across pharmacies and online channels.

Competitive Landscape in UK Soft Gelatin Capsules Market

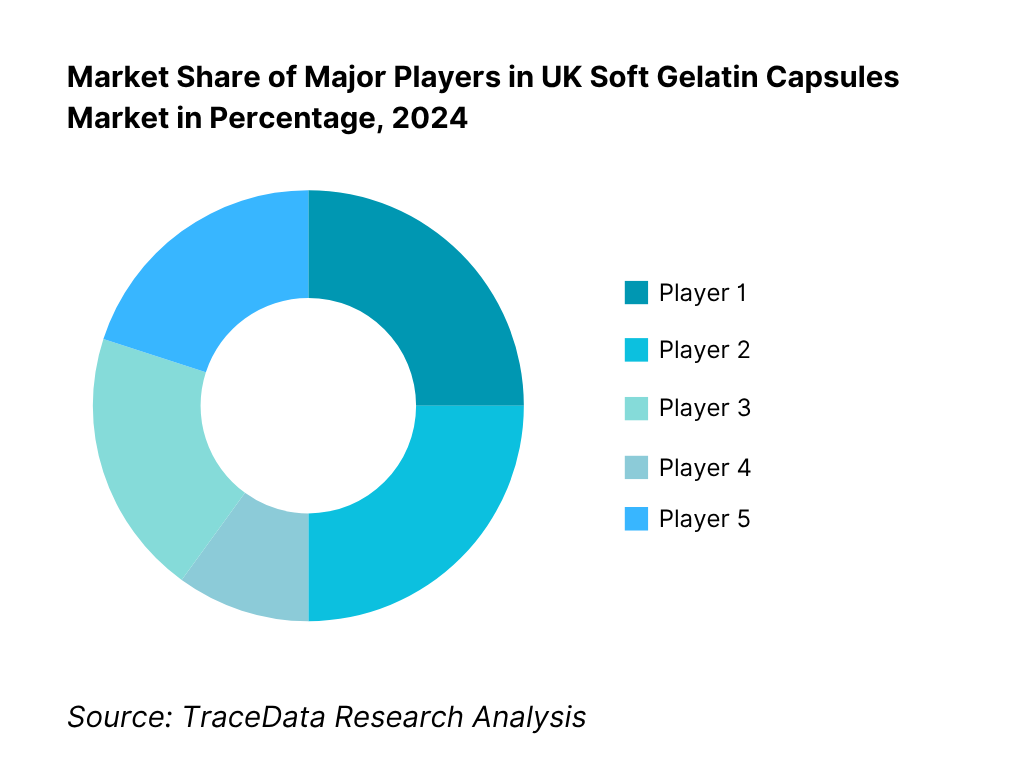

The UK soft gel capsules market exhibits concentrated capabilities among global CDMOs and specialised UK/EU players, with brand-side demand anchored by pharmacy chains, grocery health aisles and D2C platforms. Scale producers bring multi-line rotary-die assets, TiO₂-free colour systems and enteric technologies, while UK private-label programmes and sports-nutrition brands intensify SKU churn. This consolidation highlights the significant influence of a few technology-rich manufacturers alongside agile private-label suppliers.

Name | Founding Year | Original Headquarters |

Catalent Softgel & Oral Technologies | 1933 | Somerset, New Jersey, USA |

HBI EuroCaps (UK) | 1994 | Tredegar, Wales, UK |

Aenova Group (Swiss Caps) | 2008 | Starnberg, Germany |

SIRIO Europe (incl. Ayanda) | 1993 | Falkenhagen, Germany |

Thermo Fisher Scientific (Patheon) | 1974 | Massachusetts, USA |

Softigel by Procaps | 1977 | Barranquilla, Colombia |

Captek Softgel International | 1996 | California, USA |

Robinson Pharma | 1989 | California, USA |

Best Formulations | 1984 | California, USA |

Geltec Pvt. Ltd. | 1977 | Bangalore, India |

Alpex/Strides Softgel Division | 1978 | Bangalore, India |

Sirio Pharma (Global) | 1993 | Shantou, China |

Lunan Pharma Softgel | 1968 | Shandong, China |

Nature’s Value | 1993 | California, USA |

Ayanda (SIRIO Network) | 1981 | Bornholm, Denmark |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Catalent Softgel & Oral Technologies: As one of the largest global softgel manufacturers, Catalent has expanded its UK/EU operations by investing in TiO₂-free capsule technology and enhancing its enteric-release platforms, aligning with retailer and regulatory compliance shifts.

HBI EuroCaps (UK): A domestic leader in nutraceutical softgels, HBI EuroCaps has strengthened its private-label partnerships with UK retailers in 2024, while scaling up production of vegetarian and carrageenan-based capsules to meet clean-label demand.

Aenova Group (Swiss Caps): With a strong presence in Europe, Aenova has upgraded its high-capacity rotary-die lines to support large-scale nutraceutical and OTC campaigns, and introduced mini-softgels for omega-3 and vitamin D products in the UK market.

SIRIO Europe (incl. Ayanda): SIRIO has leveraged its Nordic fish-oil expertise and expanded its UK reach with condition-specific formulations such as heart health and cognitive-support softgels. The company has also increased focus on sustainability, including solvent-recovery investments.

Thermo Fisher Scientific (Patheon): Patheon’s UK/EU facilities are focusing on pharmaceutical-grade softgels, particularly for Rx categories such as analgesics and GI therapies. In 2024, the company enhanced its tech-transfer programs for UK pharma clients, enabling faster commercialization of liquid-filled formulations.

What Lies Ahead for UK Soft Gelatin Capsules Market?

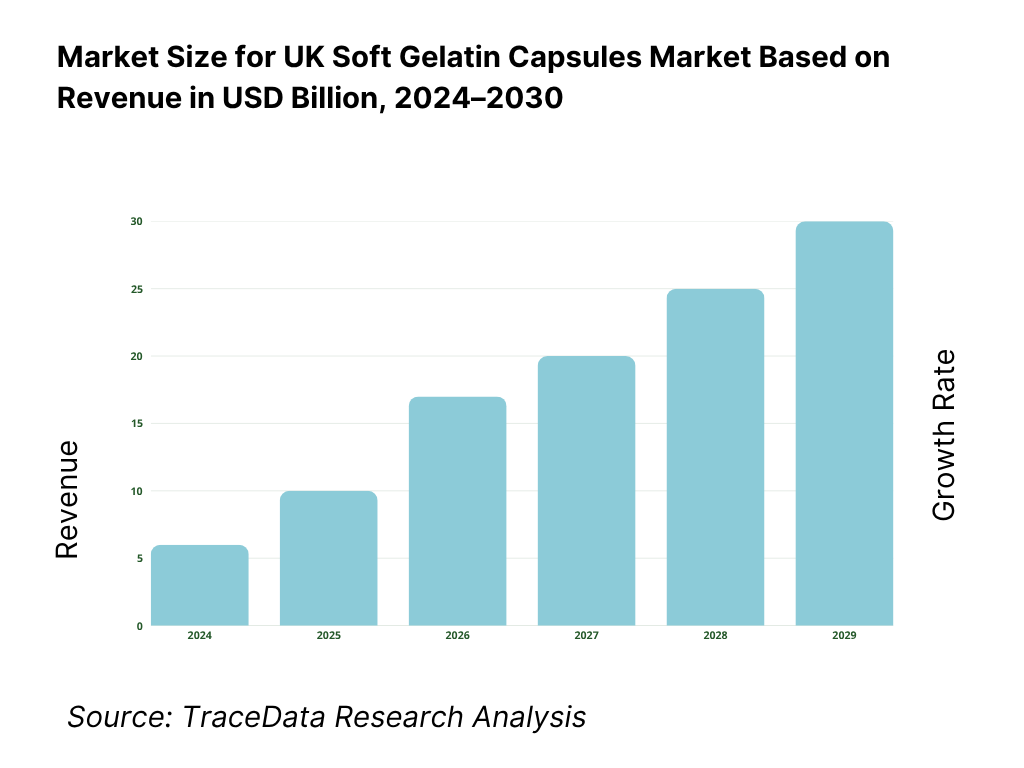

The UK soft gelatin capsules market is projected to grow steadily toward 2030, supported by strong consumer adoption of nutraceuticals, expansion of e-commerce retailing, and tightening compliance that favours high-quality GMP-certified producers. Growth will be reinforced by macro trends such as an ageing population, dense pharmacy networks, and reliable access to marine oils and bovine gelatin inputs. Together, these fundamentals create an ecosystem where both global CDMOs and domestic suppliers can scale portfolios across pharmaceuticals, OTC, and food supplements.

Rise of Vegetarian and TiO₂-Free Softgels: The future of the UK softgel market is likely to see accelerated adoption of vegetarian and carrageenan/tapioca-based shells. This shift is driven by clean-label demand, regulatory scrutiny of titanium dioxide (TiO₂), and greater alignment with retailer sustainability scorecards. Companies are investing in alternative shell polymers to retain seam integrity and dissolution reliability while offering label-friendly products.

Focus on Targeted and Outcome-Based Formulations: As brand owners and retailers increasingly seek tangible health outcomes, there will be a greater focus on targeted formulations such as enteric-coated fish-oil softgels, mini-softgels for paediatrics, and beauty-from-within capsules for skin, hair, and nail health. This trend ensures that capsule launches are closely tied to specific consumer use-cases and demonstrable clinical benefits.

Expansion of Category-Specific Demand: Demand for softgels is expected to expand significantly in categories like omega-3, vitamin D, and probiotics, which have strong clinical backing in the UK market. The ageing demographic, with 12.7 million people aged 65+, represents a natural demand base for joint health, cognitive, and heart-health formulations—all of which are traditionally delivered in softgel form.

Leveraging Technology and Automation: The use of in-line weight monitoring, nitrogen blanketing, and solvent-recovery systems will become mainstream in UK plants, improving yields and lowering environmental footprints. Automation will not only enhance consistency but also support large-scale retailer programs where turnaround times and batch reproducibility are critical.

UK Soft Gelatin Capsules Market Segmentation

By Shell Type

Bovine Gelatin Capsules

Fish Gelatin Capsules

Vegetarian / Carrageenan Capsules

Tapioca / Starch Blends

By Fill / Application

Omega-3 & Specialty Lipids

Vitamins & Multivitamins

Botanicals & Herbals

OTC Pharmaceuticals (Analgesics, Cough & Cold, GI)

Beauty-from-Within Actives (Collagen, Biotin, Hyaluronic Acid)

By Release Profile

Immediate Release Capsules

Enteric / Acid-Resistant Capsules

Sustained / Modified Release Capsules

Chewable Softgels

Mini-Softgels

By End Use

Pharmaceuticals (Rx & OTC)

Nutraceuticals & Dietary Supplements

Sports Nutrition

Cosmetics & Beauty-from-Within

Veterinary Health

By Distribution Channel

Retail Pharmacies

Grocery & Health-Food Chains

E-commerce / D2C Platforms

Hospitals & Institutional Sales

Export / Private-Label Programs

Players Mentioned in the Report:

Catalent Softgel & Oral Technologies

HBI EuroCaps (UK)

Aenova Group (incl. Swiss Caps)

SIRIO Europe (incl. Ayanda)

Softigel by Procaps

Thermo Fisher Scientific (Patheon)

Captek Softgel International

Robinson Pharma

Best Formulations

Geltec

Alpex/Strides Softgel Division

Sirio Pharma (Global)

Lunan Pharma Softgel

Nature’s Value / Santa Cruz Nutritionals

Ayanda.

Key Target Audience

Brand owners — pharmaceuticals (Rx/OTC)

Nutraceutical & sports-nutrition brands

Retail pharmacy chains and grocery health buyers

E-commerce/D2C health platforms

Investments and venture capitalist firms (growth equity & buy-out funds)

Government and regulatory bodies (MHRA, Food Standards Agency)

Packaging & printing converters (blister/bottle, laser marking)

Raw-material suppliers

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Softgel Manufacturing (In-House, Outsourced CDMOs, Hybrid Models-Margins, Preferences, Strengths, Weaknesses)

4.2. Revenue Streams for UK Soft Gelatin Capsules Market (Rx, OTC, Nutraceuticals, Private-Label, Exports, Licensing)

4.3. Business Model Canvas for UK Soft Gelatin Capsules Market

5.1. Freelance/Small-Scale Encapsulators vs. Full-Scale CDMOs

5.2. Investment Model in UK Soft Gelatin Capsules Market (CAPEX for rotary-die lines, drying tunnels, solvent recovery systems)

5.3. Comparative Analysis of Production & Approval Funnel (MHRA vs. FSA pathways; Pharma vs. Food Supplements)

5.4. Softgel Budget Allocation by Company Size (Global Pharma, Mid-Sized Nutraceuticals, SMEs/Private Label)

8.1. Revenues, Historical

9.1. By Market Structure (In-House and Outsourced Softgel Manufacturing)

9.2. By Capsule Type (Bovine Gelatin, Fish Gelatin, Vegetarian/Carrageenan, Tapioca/Starch Blends)

9.3. By Industry Verticals (Pharmaceuticals, Nutraceuticals, Cosmetics, Veterinary Health, Sports Nutrition)

9.4. By Company Size (Large Pharma, Mid-Sized Nutraceuticals, SMEs/Private Label Retailers)

9.5. By Fill Type (Omega-3 Oils, Vitamins & Minerals, Botanicals, Rx APIs, Beauty-from-Within Actives)

9.6. By Release Profile (Immediate, Enteric/Acid-Resistant, Sustained, Chewable, Mini-Softgels)

9.7. By Open and Customized Formulations (Standard SKUs vs. Tailor-Made Softgels)

9.8. By Region (England, Scotland, Wales, Northern Ireland)

10.1. Client Landscape and Cohort Analysis (Pharma, Nutraceuticals, Retail Chains, SMEs)

10.2. Product Development Needs and Decision-Making Process

10.3. Effectiveness and ROI Analysis (Category Velocity, Repeat Purchases, Shelf Turnover)

10.4. Gap Analysis Framework

11.1. Trends and Developments (Vegetarian Capsules, TiO₂-Free Shells, Mini-Softgels, Online Retail)

11.2. Growth Drivers (Nutraceutical Demand, Aging Population, Regulatory Clarity, E-commerce Penetration)

11.3. SWOT Analysis for UK Soft Gelatin Capsules Market

11.4. Issues and Challenges (Raw Material Supply, Certification Complexity, Stability, Energy Costs)

11.5. Government Regulations (MHRA Licensing, FSA Supplement Rules, EU/Pharmacopoeia Standards, Labeling & Advertising)

12.1. Market Size and Future Potential for Online Sales of Softgels in UK

12.2. Business Model and Revenue Streams (Subscriptions, Private Label, Bundles)

12.3. Delivery Models and Types of Products Offered (Pharmacy Click & Collect, D2C, Retailer Sites)

15.1. Market Share of Key Players in UK Softgel Market Basis Revenues

15.2. Benchmark of Key Competitors in UK Soft Gelatin Capsules Market (Company Overview, USP, Business Strategies, Business Model, Number of Encapsulation Lines, Revenues, Pricing per Thousand, Technology Used, Best-Selling SKUs, Clients, Tie-Ups, Marketing, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant (Technology & Compliance Leadership)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues, Forecast

17.1. By Market Structure (In-House and Outsourced Softgel Manufacturing)

17.2. By Capsule Type (Bovine, Fish, Vegetarian, Tapioca/Starch)

17.3. By Industry Verticals (Pharma, Nutraceuticals, Cosmetics, Veterinary, Sports Nutrition)

17.4. By Company Size (Large Enterprises, Mid-Sized, SMEs)

17.5. By Fill Type (Omega-3, Vitamins, Botanicals, Rx, Beauty)

17.6. By Release Profile (Immediate, Enteric, Sustained, Chewable, Mini)

17.7. By Open and Customized Formulations

17.8. By Region (England, Scotland, Wales, Northern Ireland)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire ecosystem of the UK Soft Gelatin Capsules Market, identifying both demand-side and supply-side entities. On the supply side, this includes gelatin producers (bovine, fish, vegetarian/carrageenan), excipient and plasticiser suppliers, contract development and manufacturing organisations (CDMOs), pharmaceutical and nutraceutical brand owners, packaging vendors, and logistics partners. On the demand side, we identify pharmacy chains, grocery and health-food retailers, e-commerce platforms, hospitals, and end-consumers with specific health-use cases such as omega-3 supplementation or vitamin D intake. From this ecosystem, we shortlist 5–6 leading manufacturers and CDMOs based on their financial disclosures, UK market presence, client partnerships, and product portfolio strengths. Sourcing for this stage relies on government trade statistics (e.g., DEFRA fisheries, ONS livestock data), company filings, MHRA certification records, and industry publications. This allows us to collate macro-level indicators like input availability (fish landings, cattle herds), pharmacy network density, and import volumes, which underpin the UK’s softgel market structure.

Step 2: Desk Research

The second stage involves conducting exhaustive desk research through diverse secondary and proprietary databases. This includes detailed analysis of market fundamentals such as prescription dispensing volumes, nutraceutical uptake, and distribution footprint across the UK. Industry-level insights are aggregated from government publications, financial filings, press releases, and audited annual reports of leading players such as Catalent, HBI EuroCaps, Aenova, SIRIO, and Thermo Fisher. During this stage, we build a baseline of the market by examining aspects like number of production lines, installed capacity, technology adoption (enteric release, TiO₂-free systems), and retailer participation in private-label softgel programs. This creates a comprehensive foundation of the supply-demand balance and enables us to understand competitor positioning and market attractiveness.

Step 3: Primary Research

Following desk research, we conduct structured in-depth interviews with C-level executives, QA/QP managers, production heads, procurement leads, and retail buyers within the UK softgel ecosystem. These interactions validate hypotheses on capacity utilisation, lead times, technology gaps, and pricing thresholds (per-thousand-capsule campaigns). A bottom-up approach is employed by aggregating revenue contributions and output volumes of individual CDMOs and brand owners, while a top-down validation is cross-checked using pharmacy dispensing volumes and nutraceutical category performance. As part of the validation strategy, disguised interviews are conducted under the guise of potential clients. This ensures authenticity of operational and financial data, while providing visibility into revenue streams, value chains, certification processes, and ESG-linked investments.

Step 4: Sanity Check

Finally, a sanity check is performed by reconciling bottom-to-top calculations (line-level throughput and company-level disclosures) with top-to-bottom modelling (macro demand flows, pharmacy and retail footprint, livestock and fish-oil inputs). This triangulation ensures the robustness of the market sizing and growth analysis. Multiple iterations of modelling are conducted to remove anomalies and align outputs with official UK government statistics, regulatory records, and validated company data.

FAQs

01 What is the potential for the UK Soft Gelatin Capsules Market?

The UK Soft Gelatin Capsules Market demonstrates strong potential, supported by macroeconomic, demographic, and healthcare trends. With the UK population reaching 69.3 million and an ageing cohort of 12.7 million people aged 65+, demand for easy-to-swallow formats such as softgels continues to rise. Nutraceutical adoption in pharmacies and online channels has been reinforced by wide retail coverage, with 12,009 active community pharmacies dispensing both prescription and supplement products. These structural factors underline the market’s long-term growth potential across pharmaceuticals, nutraceuticals, and beauty-from-within applications.

02 Who are the Key Players in the UK Soft Gelatin Capsules Market?

The UK Soft Gelatin Capsules Market is led by a mix of domestic and global players. Catalent Softgel & Oral Technologies, HBI EuroCaps (UK), and Thermo Fisher Scientific (Patheon) dominate with large-scale manufacturing assets, advanced enteric technologies, and regulatory expertise. Aenova Group, SIRIO Europe (Ayanda), and Softigel by Procaps bring strong European and global capacity. Other notable participants include Captek Softgel International, Robinson Pharma, Best Formulations, and Geltec Pvt. Ltd., supplying the UK market via imports and partnerships with brand owners and retailers.

03 What are the Growth Drivers for the UK Soft Gelatin Capsules Market?

The UK softgel segment is driven by structural macroeconomic factors. Prescription flows remain high, with 1.21 billion items dispensed in England and 1.08 billion processed through electronic systems, ensuring reliable channels for Rx/OTC softgels. Nutraceutical demand is underpinned by fisheries and livestock resources: UK vessels landed 719,000 tonnes of sea fish while cattle and calf herds stood at just under 9.2 million, securing omega-3 and gelatin inputs. Combined with e-commerce expansion and consumer preference for bioavailable formats, these drivers fuel consistent category demand.

04 What are the Challenges in the UK Soft Gelatin Capsules Market?

The market faces several challenges that influence capacity, compliance, and input economics. On the supply side, the UK imported 743,000 tonnes of fish and fish products, exposing the industry to global logistics risks, oxidation control, and customs lead times. Domestically, cattle herds declining below 9.2 million head create volatility for bovine gelatin supply. Labour remains constrained, with 728,000 job vacancies across the economy, limiting skilled GMP roles in QA/QP and manufacturing. These factors, combined with regulatory scrutiny on TiO₂ and sustainability, pose hurdles for consistent throughput and cost-effective expansion.