Ukraine Auto Finance Market Outlook to 2029

By Market Structure (Bank, Captive, NBFC), By Type of Vehicles Financed, By Loan Tenure, By Interest Rate Structures, By Region, and By Consumer Segments

- Product Code: TDR0152

- Region: Europe

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Ukraine Auto Finance Market Outlook to 2029 – By Market Structure (Bank, Captive, NBFC), By Type of Vehicles Financed, By Loan Tenure, By Interest Rate Structures, By Region, and By Consumer Segments” provides a comprehensive analysis of the auto finance industry in Ukraine. The report includes an overview and genesis of the industry, overall market size in terms of credit disbursed and loan book outstanding, market segmentation, major trends and developments, regulatory landscape, consumer behavior analysis, issues and challenges, and a comparative competitive landscape. The report concludes with future projections for the market by credit disbursed, by type of financial institution, vehicle type, region, and other variables, alongside key success case studies and strategic imperatives.

Ukraine Auto Finance Market Overview and Size

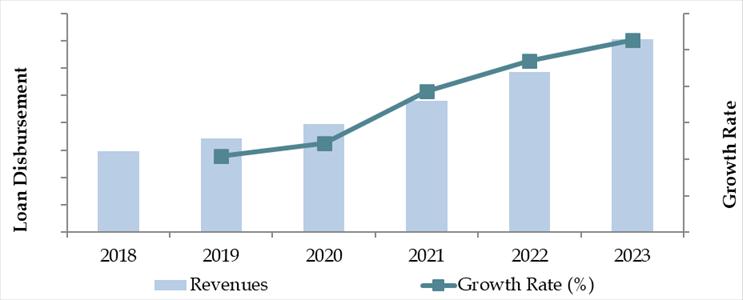

The Ukraine auto finance market was valued at approximately UAH 38 Billion in 2023, driven by an increase in demand for personal mobility, availability of structured auto financing options, and recovery of economic activities post-COVID-19 and geopolitical disruptions. Despite macroeconomic challenges, the market is gradually expanding, with key players including PrivatBank, OTP Leasing, Ukrsotsbank, Porsche Finance Group Ukraine, and Credit Agricole Bank actively participating.

In 2023, OTP Leasing launched a digitally integrated auto loan approval platform, accelerating the loan disbursal process and reducing turnaround time by up to 40%. Kyiv, Lviv, and Dnipro are the most prominent urban hubs in terms of vehicle loan demand, owing to higher per capita income and increased urbanization.

Market Size for Ukraine Auto Finance Industry on the Basis of Credit Disbursed (UAH Billion), 2018–2023

What Factors are Leading to the Growth of Ukraine Auto Finance Market:

Macroeconomic Recovery and Car Ownership Aspirations: Post-pandemic recovery coupled with the resumption of economic activity following initial geopolitical instability has renewed consumer interest in vehicle ownership. A growing share of consumers, especially in urban centers—are now more inclined to finance vehicle purchases than pay upfront.

OEM Captive Financing and Promotional Campaigns: Captive arms of OEMs such as Porsche Finance Group Ukraine and Renault Credit Ukraine have introduced zero down-payment and low-interest rate schemes to stimulate demand. These campaigns contributed to a 15% YoY growth in financed vehicle sales during 2023.

Digital Lending Platforms and API Integrations: Increasing use of automated credit scoring models and partnerships with automotive e-commerce platforms (such as Auto.Ria) have enabled faster loan processing and improved customer reach. In 2023, around 35% of auto loans originated digitally, particularly among younger, tech-savvy customers aged 25–40.

Which Industry Challenges Have Impacted the Growth of Ukraine Auto Finance Market

Macroeconomic Uncertainty and Currency Volatility: Persistent economic instability, including currency devaluation and inflation, has dampened consumer confidence and constrained the ability of lenders to offer long-term auto financing solutions. In 2023, the Ukrainian Hryvnia (UAH) experienced a depreciation of approximately 12% against major currencies, impacting loan affordability and increasing the cost of imported vehicles. This has created risk aversion among both consumers and financiers.

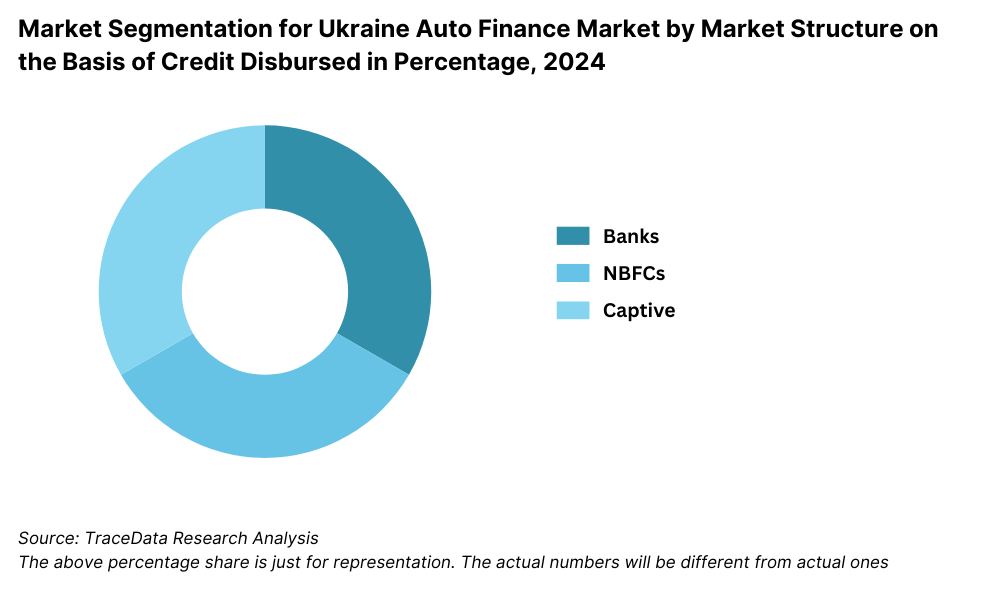

Limited Risk Appetite Among Lenders: The Ukrainian auto finance market remains dominated by a handful of large banks and captive finance companies. Smaller financial institutions and NBFCs have been slow to enter the market due to concerns about default risks and vehicle repossession challenges. According to industry estimates, less than 40% of auto loans are financed by NBFCs or leasing firms, limiting competitive dynamics and product innovation in the sector.

Underdeveloped Credit Scoring Infrastructure: A major hurdle to market growth is the lack of standardized and reliable credit scoring mechanisms, especially outside Tier-1 cities. In rural and semi-urban areas, many consumers remain underbanked or have limited credit history, leading to high rejection rates for auto loan applications. As per 2023 estimates, nearly 30% of potential borrowers are unable to qualify due to inadequate documentation or lack of formal credit scores.

What are the Regulations and Initiatives Which Have Governed the Market

Collateral and Vehicle Registration Requirements: Ukrainian regulations mandate full collateralization and registration of financed vehicles with government authorities, including a lien record against the vehicle. This provides protection to the financing institutions but can delay loan disbursals. In 2023, nearly 15% of loan applications experienced delays due to paperwork or discrepancies in vehicle documentation.

Interest Rate Caps and Consumer Protection Laws: The National Bank of Ukraine has enforced maximum interest rate thresholds and enhanced consumer transparency norms. All financial institutions must disclose the effective annual percentage rate (APR) and associated charges upfront. This has helped prevent predatory lending, though it has also led to conservative risk pricing by lenders.

Government Subsidy Programs and Leasing Incentives: In response to falling car sales during 2022–2023, the Ukrainian government introduced time-bound subsidy programs aimed at promoting leasing and low-emission vehicles, particularly for rural development and agricultural mobility. These programs helped increase leasing penetration by 18% YoY in 2023 and encouraged partnerships between banks and auto OEMs.

Ukraine Auto Finance Market Segmentation

By Market Structure: Banks remain the dominant segment in the Ukrainian auto finance market due to their longstanding presence, competitive interest rates, and perceived security by consumers. Captive finance arms of global automotive OEMs such as Porsche Finance Group Ukraine and Renault Finance are steadily increasing their share by offering tailored financing packages, low interest rates, and bundled insurance services at the point of sale. NBFCs and leasing companies have a niche but growing presence, particularly in the commercial vehicle segment and among self-employed borrowers, owing to their faster processing and relaxed documentation requirements.

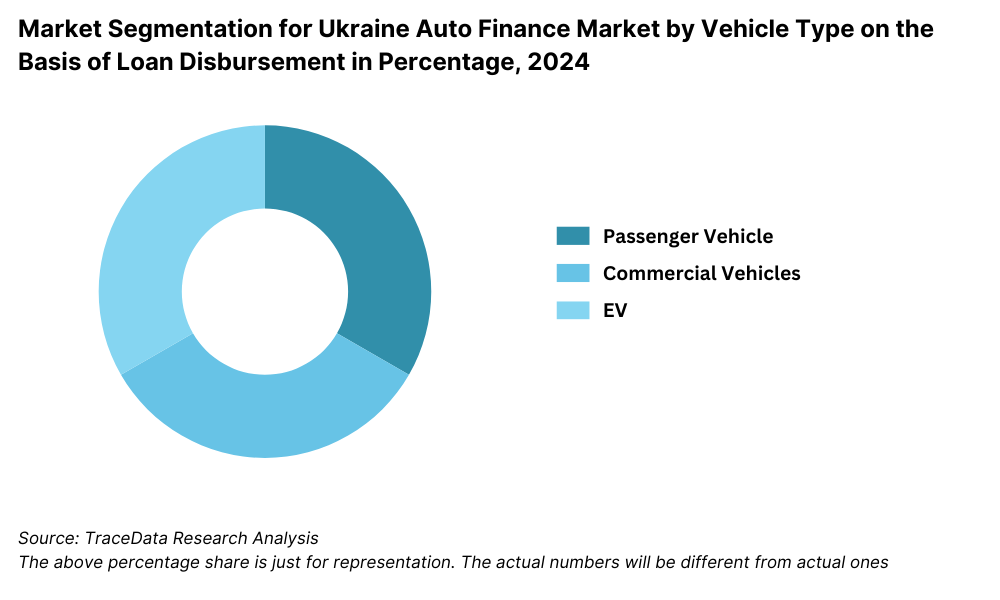

By Vehicle Type Financed: Passenger cars continue to dominate financing demand, driven by increasing urban mobility needs and growing ownership aspirations among the middle class. Commercial vehicles are financed largely through leasing arrangements and cater to SMEs and logistics operators. Meanwhile, financing for electric vehicles is gradually increasing, supported by government incentives and lower operating costs, though it remains under 5% of total disbursements.

By Loan Tenure: Loan tenures between 3 to 5 years are the most popular, offering a balance between monthly affordability and total interest payout. Short-term loans (under 3 years) are usually availed by high-income borrowers or those opting for pre-owned vehicles. Tenures above 5 years are offered in special cases, typically through OEM captive programs to promote high-value purchases.

Competitive Landscape in Ukraine Auto Finance Market

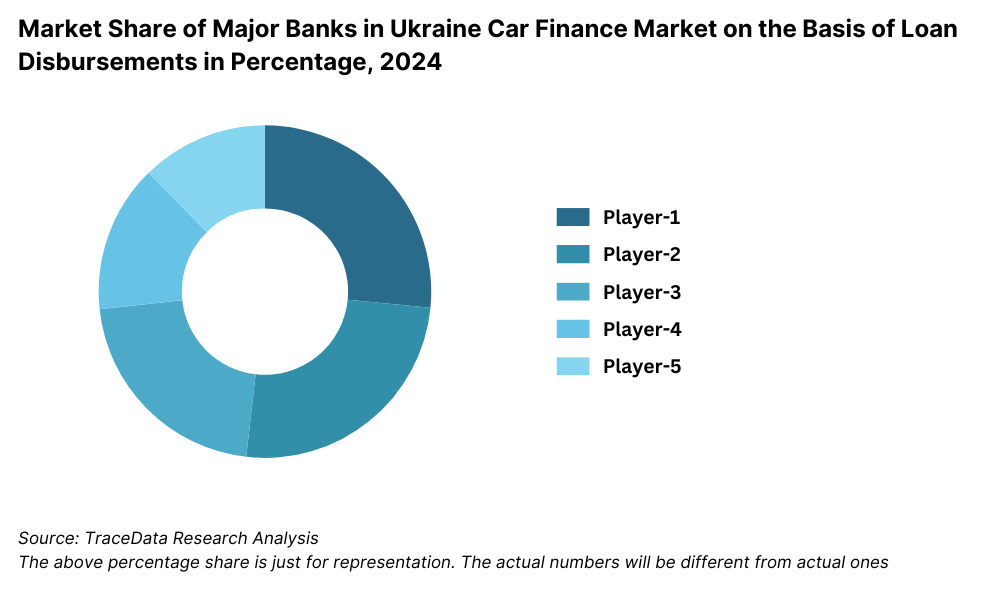

The Ukraine auto finance market is moderately concentrated, with several prominent banks and captive finance institutions holding the majority share. However, the increasing entry of leasing companies and fintech-based lenders is gradually diversifying the landscape. The market is evolving with a strong focus on digitization, customized loan offerings, and partnerships between auto OEMs and financial institutions.

| Company Name | Founding Year | Original Headquarters |

| Crédit Agricole Ukraine | 1993 | Kyiv, Ukraine |

| PrivatBank | 1992 | Dnipro, Ukraine |

| First Ukrainian International Bank (FUIB) | 1991 | Donetsk, Ukraine |

| UKRSIBBANK BNP Paribas Group | 1990 | Kharkiv, Ukraine |

| Tekom-Leasing | 2005 | Odesa, Ukraine |

| Ayvens Ukraine (formerly ALD Automotive) | 2023 | Kyiv, Ukraine |

| AutoCredo | 2010 | Kyiv, Ukraine |

| Winner Finance | 1992 | Kyiv, Ukraine |

| UkrAVTO Group (Ukravtoleasing) | 1992 | Kyiv, Ukraine |

| AVIS Leasing Ukraine | 2008 | Kyiv, Ukraine |

Some of the recent competitor trends and key information about major players include:

PrivatBank: The largest commercial bank in Ukraine, PrivatBank maintains a leading role in vehicle financing by offering competitive interest rates and simple digital onboarding. In 2023, the bank financed over 35,000 vehicle purchases through its auto loan products and continued to expand its reach via mobile and online platforms.

OTP Leasing: A key player in the leasing segment, OTP Leasing recorded a 22% YoY increase in disbursed contracts in 2023. The firm has been at the forefront of offering vehicle lease packages tailored for SMEs and commercial transporters, with a focus on light-duty and logistics vehicles.

Porsche Finance Group Ukraine: Serving as the captive finance arm for Volkswagen Group brands in Ukraine, Porsche Finance continues to dominate the financing of premium and mid-range vehicles. In 2023, it expanded its bundled insurance-financing packages and reported a 30% increase in Audi and Volkswagen lease volumes.

Ukrsotsbank: Known for its broad network and conservative lending practices, Ukrsotsbank has recently partnered with local dealerships to promote pre-approved loan programs for used car buyers. The bank has been investing in digital KYC and AI-based credit scoring models to enhance borrower experience.

Credit Agricole Bank: This international player focuses heavily on rural and agricultural financing, including vehicle loans for farmers and agro-entrepreneurs. In 2023, its auto loan portfolio grew by 18%, driven by structured lending tied to seasonal income cycles.

ULF Finance: One of the fastest-growing NBFCs, ULF Finance is emerging as a competitive alternative to traditional banks. The company specializes in low-documentation vehicle loans and equipment leasing. In 2023, ULF Finance financed approximately UAH 1.8 billion worth of passenger and commercial vehicles.

What Lies Ahead for Ukraine Auto Finance Market?

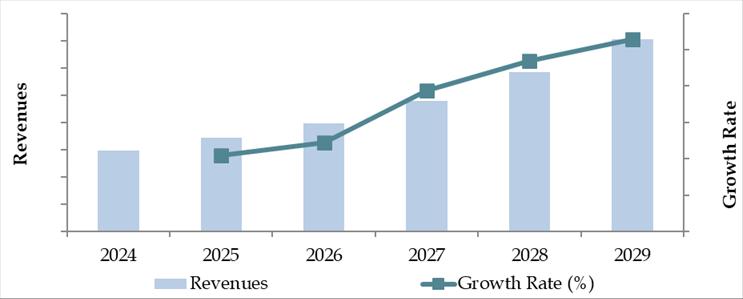

The Ukraine auto finance market is projected to grow steadily through 2029, supported by macroeconomic stabilization, increased automotive demand, and the evolution of digital lending platforms. The market is anticipated to register a moderate but consistent CAGR, with growth driven by enhanced access to credit, rising vehicle ownership aspirations, and strategic government interventions to revive consumer spending.

Expansion of Digital Auto Lending: The next few years will witness rapid growth in fully digital loan origination platforms. Lenders are expected to leverage AI-driven credit scoring, e-KYC systems, and real-time vehicle appraisal tools to reduce turnaround times. These innovations will particularly benefit underbanked populations and expand financial inclusion in semi-urban regions.

Rise in Used Vehicle Financing: With affordability remaining a key concern, the financing of used vehicles is expected to gain traction. In 2023, used cars accounted for approximately 45% of auto loans issued, and this share is projected to exceed 55% by 2029. Financial institutions are likely to introduce customized products for used vehicles with flexible tenure and warranty-linked financing models.

OEM and Captive Finance Partnerships: Global and regional auto OEMs are expected to expand their footprint in Ukraine through joint ventures with banks and leasing firms. This will lead to the development of bundled offerings that combine vehicle finance, insurance, servicing, and telematics, thereby increasing customer lifetime value and improving loan recovery rates.

Green Mobility Finance: As Ukraine progresses toward EU-aligned environmental goals, the financing of electric and low-emission vehicles is set to rise. Dedicated credit lines and tax benefits for EV financing are expected to stimulate demand. By 2029, EVs could represent up to 10% of financed vehicles, supported by infrastructure rollouts and lower total cost of ownership.

Future Outlook and Projections for Ukraine Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Ukraine Auto Finance Market Segmentation

By Market Structure:

Banks

Captive Finance Companies

Non-Banking Financial Companies (NBFCs)

Leasing Firms

Digital-First Lenders

Peer-to-Peer Lending Platforms

By Vehicle Type Financed:

Passenger Cars

Commercial Vehicles

Electric Vehicles

Two-Wheelers (Limited penetration)

Agricultural/Utility Vehicles

By Loan Tenure:

Less than 3 Years

3–5 Years

More than 5 Years

By Interest Rate Structure:

Fixed Rate Loans

Floating Rate Loans

Subsidized or Promotional Rate Loans

By Vehicle Condition:

New Vehicles

Used Vehicles

By Consumer Type:

Salaried Individuals

Self-Employed Professionals

MSME & Fleet Owners

Farmers and Agro-Entrepreneurs

By Region:

Kyiv Region

Western Ukraine (Lviv, Ivano-Frankivsk)

Central Ukraine (Vinnytsia, Cherkasy)

Eastern Ukraine (Kharkiv, Dnipro)

Southern Ukraine (Odesa, Mykolaiv)

Players Mentioned in the Report (Banks):

- PrivatBank

- Oschadbank

- Ukreximbank

- Raiffeisen Bank Ukraine

- OTP Bank Ukraine

- Credit Agricole Bank Ukraine

- Ukrgasbank

- PUMB (First Ukrainian International Bank)

- KredoBank

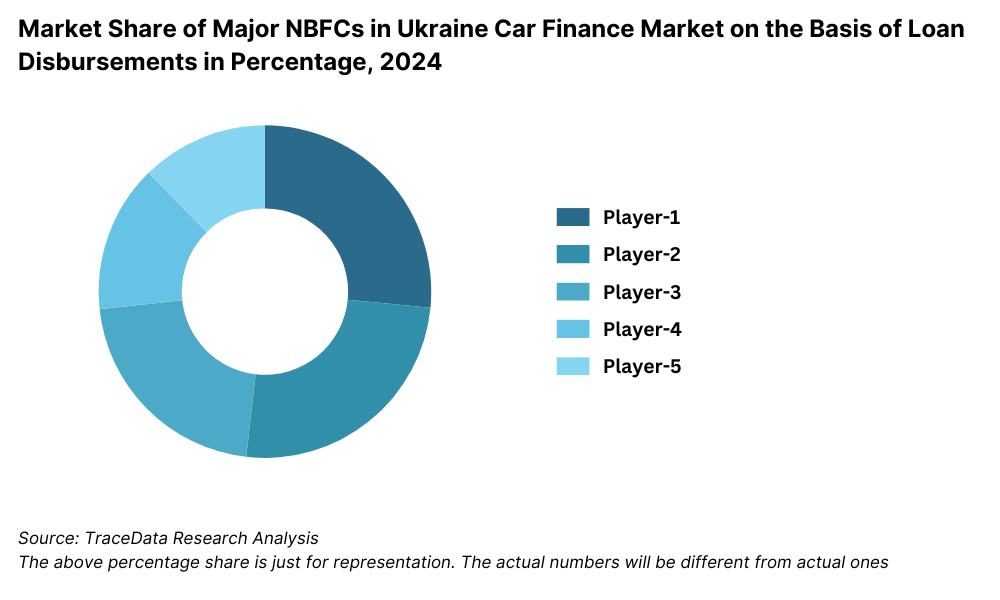

Players Mentioned in the Report (NBFCs):

- OTP Leasing

- Ukravtoleasing

- Express Credit

- Idea Bank Leasing

- VAB Leasing

- ULF Finance

- TAS Leasing

- Credit Market

- NovaPay

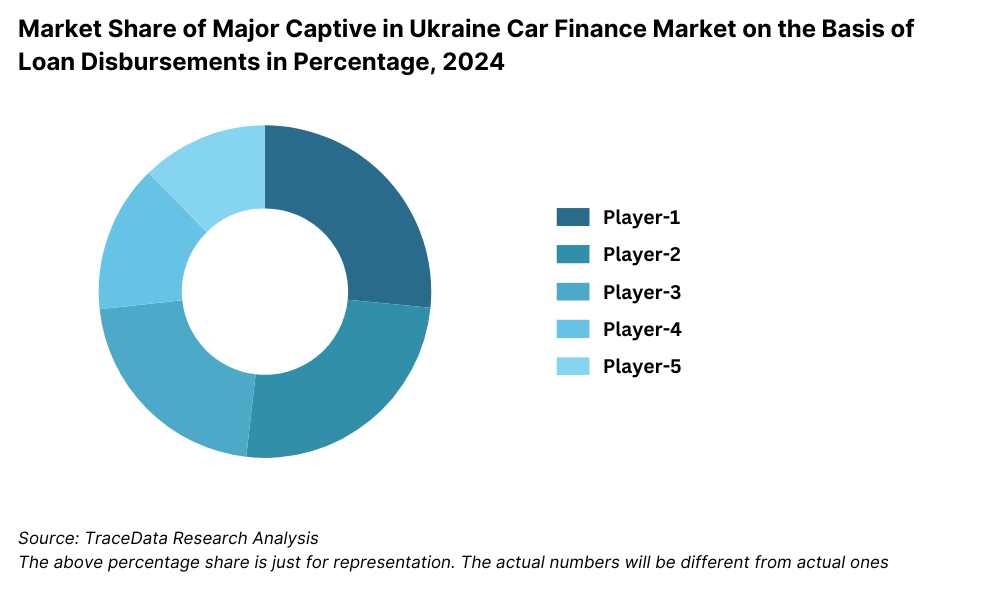

Players Mentioned in the Report (Captive):

- Toyota Financial Services Ukraine

- Volkswagen Financial Services Ukraine

- Renault Finance Ukraine

- BMW Financial Services Ukraine

- Mercedes-Benz Financial Services Ukraine

- Stellantis Financial Services Ukraine

Key Target Audience:

Commercial and Retail Banks

Captive Automotive Finance Companies

Used and New Car Dealerships

Leasing and NBFC Players

Government and Regulatory Bodies (e.g., National Bank of Ukraine)

Automotive OEMs and Distributors

Fintech and Digital Lending Platforms

Research Institutions and Industry Analysts

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Ukraine by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

8.3. Number of Vehicles Financed, 2018-2024

9.1. By Market Structure (Bank, Multi-Finance NBFCs, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Ukraine Car Finance Market

11.2. Growth Drivers for Ukraine Car Finance Market

11.3. SWOT Analysis for Ukraine Car Finance Market

11.4. Issues and Challenges for Ukraine Car Finance Market

11.5. Government Regulations for Ukraine Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

16. PEAK Matrix Analysis for Ukraine Car Finance Market

17.1. Market Share of Key Banks in Ukraine Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Ukraine Car Finance Market, 2024

17.3. Market Share of Key Captive in Ukraine Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Ukraine Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Ukraine Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 financial institutions in the country based upon their loan disbursal volume, portfolio size, and digital infrastructure.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the credit disbursed, number of lenders, interest rate trends, consumer segments, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Ukraine Auto Finance Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate loan disbursal for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Ukraine Auto Finance Market?

The Ukraine auto finance market holds strong growth potential, reaching an estimated valuation of UAH 38 Billion in 2023. This growth is fueled by rising demand for personal mobility, increasing penetration of structured financing products, and the digital transformation of lending services. Continued government incentives and partnerships between OEMs and finance institutions are expected to further expand the market by 2029.

2. Who are the Key Players in the Ukraine Auto Finance Market?

The Ukraine Auto Finance Market is led by key players such as PrivatBank, OTP Leasing, and Porsche Finance Group Ukraine. These institutions dominate the market through their extensive financial networks, competitive loan products, and integration with automotive dealerships. Other prominent players include Ukrsotsbank, Credit Agricole Bank, and ULF Finance.

3. What are the Growth Drivers for the Ukraine Auto Finance Market?

Major growth drivers include increased vehicle ownership demand, post-COVID economic recovery, and expanding access to digital lending platforms. Rising urbanization and the introduction of low-interest and bundled financing schemes by OEMs are also contributing significantly to market expansion. The increasing affordability of used vehicles and supportive government policies for EV financing further strengthen market prospects.

4. What are the Challenges in the Ukraine Auto Finance Market?

The Ukraine Auto Finance Market faces several challenges, including macroeconomic volatility, limited credit access in rural regions, and underdeveloped credit scoring infrastructure. Regulatory delays in vehicle registration and lien processing can hinder loan disbursal efficiency. Additionally, conservative risk appetite among lenders and a fragmented leasing ecosystem present ongoing barriers to market growth.