United States Cold Chain Market Outlook to 2029

By Market Structure, By Temperature Type (Chilled and Frozen), By End Users (Fruits & Vegetables, Dairy, Pharmaceuticals, Meat & Seafood), By Ownership (3PL & Owned), and By Region

- Product Code: TDR0334

- Region: North America

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “United States Cold Chain Market Outlook to 2029 - By Market Structure, By Temperature Type (Chilled and Frozen), By End Users (Fruits & Vegetables, Dairy, Pharmaceuticals, Meat & Seafood), By Ownership (3PL & Owned), and By Region” provides a comprehensive analysis of the cold chain logistics industry in the United States. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, by market structure, product segments, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

United States Cold Chain Market Overview and Size

The United States cold chain market reached a valuation of USD 86 Billion in 2023, driven by increasing demand for temperature-sensitive food and pharmaceutical products, expansion of e-commerce grocery delivery, and stringent food safety regulations. The market is dominated by major players such as Lineage Logistics, Americold, United States Cold Storage, and VersaCold. These companies are recognized for their nationwide warehouse coverage, investment in automation and monitoring technologies, and integrated cold transportation solutions.

In 2023, Lineage Logistics announced the expansion of its automated cold storage facility in Texas, equipped with high-density ASRS systems and IoT sensors for real-time temperature tracking. California, Texas, and Florida are the leading regions due to their large agriculture and pharmaceutical distribution networks and proximity to major ports.

What Factors are Leading to the Growth of United States Cold Chain Market:

Rising Demand for Frozen and Chilled Foods: The demand for perishable food products, such as frozen vegetables, meat, dairy, and ready-to-eat meals, has seen substantial growth. In 2023, frozen foods alone represented nearly 38% of the cold chain volume, driven by urban consumers’ preference for convenience and longer shelf life.

Pharmaceutical Sector Expansion: With increasing demand for temperature-controlled distribution of vaccines, biologics, and specialty medicines, pharmaceutical cold chain logistics grew by 11% YoY in 2023. The COVID-19 pandemic accelerated investment in ultra-low temperature storage and GDP-compliant logistics infrastructure.

E-commerce and Online Grocery: The rise of online grocery delivery platforms, such as Amazon Fresh, Instacart, and Walmart+, has created a surge in demand for last-mile cold chain logistics. In 2023, e-commerce-related cold chain logistics accounted for 16% of total market revenue.

Which Industry Challenges Have Impacted the Growth for United States Cold Chain Market

Infrastructure and Capacity Constraints: Despite significant investment, the U.S. cold chain infrastructure faces capacity limitations, especially in high-demand regions such as the Midwest and Southeast. According to industry estimates, over 30% of cold storage warehouses are operating at over 90% capacity, resulting in bottlenecks and increased costs for temperature-sensitive goods. The shortage of modern facilities with automation and energy-efficient technologies remains a persistent issue.

High Operational Costs: Cold chain logistics involves high fixed and variable costs due to energy consumption, specialized equipment, compliance with safety standards, and temperature-controlled vehicles. In 2023, electricity costs accounted for nearly 35% of operating expenses in cold storage facilities, making profitability margins tighter for small and mid-sized operators.

Skilled Labor Shortage: Maintaining cold chain integrity requires a skilled workforce capable of handling refrigeration systems, quality control, and specialized handling protocols. The industry reported a 21% gap in required versus available skilled technicians in 2023, leading to operational inefficiencies and risks of spoilage.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety Modernization Act (FSMA): Implemented by the FDA, FSMA mandates strict compliance for the transportation of perishable goods, including detailed temperature logging, sanitation practices, and vehicle maintenance protocols. As of 2023, over 85% of cold chain logistics providers had adopted electronic temperature monitoring systems to comply with FSMA regulations.

Drug Supply Chain Security Act (DSCSA): The DSCSA governs the movement of pharmaceuticals through the cold chain, requiring serialization, traceability, and chain-of-custody records. This act has accelerated the deployment of blockchain and RFID technologies across pharmaceutical cold chain networks, particularly post-COVID-19.

Investment in Sustainable Infrastructure: Federal and state governments have initiated incentive programs encouraging the development of energy-efficient cold storage warehouses. The U.S. Department of Agriculture’s REAP (Rural Energy for America Program) provided grants covering up to 25% of renewable energy and efficiency improvement projects for cold chain facilities in 2023.

United States Cold Chain Market Segmentation

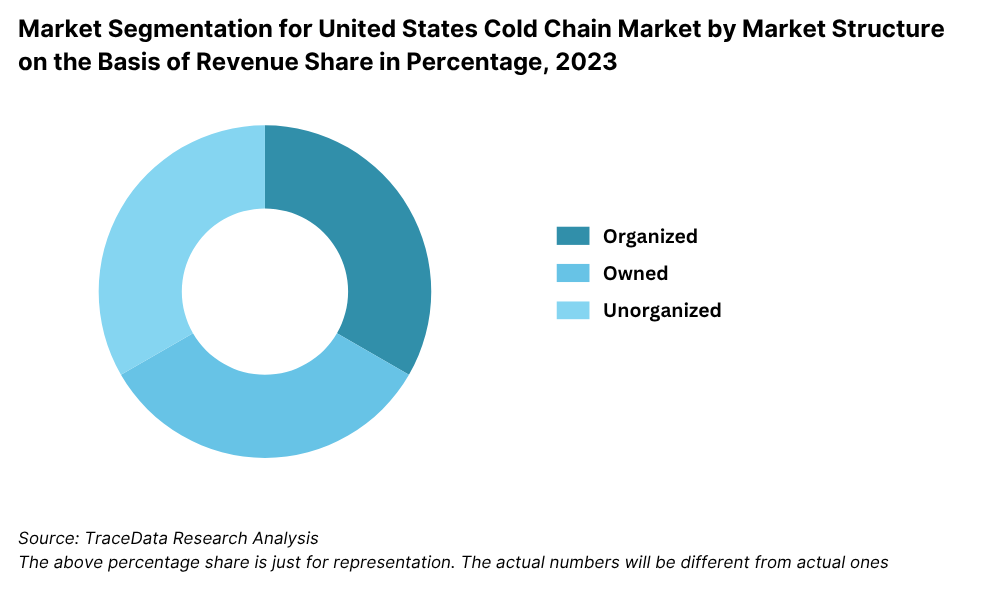

By Market Structure: The U.S. cold chain market is primarily dominated by organized third-party logistics (3PL) providers due to their ability to offer end-to-end integrated cold storage and transportation solutions. These providers invest heavily in advanced infrastructure, automation, and regulatory compliance, making them the preferred partners for large food, retail, and pharmaceutical companies. In contrast, owned cold chain operations—primarily managed by food processors, retailers, and pharma manufacturers—hold a significant share in sectors where control over product integrity and data security is critical.

By Temperature Type: Frozen logistics dominates the U.S. cold chain market owing to high demand from frozen meat, seafood, dairy products, and frozen meals. This segment benefits from longer shelf life requirements and bulk transport efficiency. The chilled segment, while smaller in share, has grown rapidly due to demand for fresh produce, ready-to-eat foods, and beverages, particularly in urban grocery and food service channels.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

By End Users: The food industry is the largest end-user of cold chain services in the U.S., with frozen foods, meat, seafood, dairy, and fresh produce accounting for over 70% of market revenue. The pharmaceutical sector, especially after the COVID-19 pandemic, has seen rapid growth due to the demand for vaccine distribution and temperature-sensitive biologics. Other growing sectors include floral products and specialty chemicals.

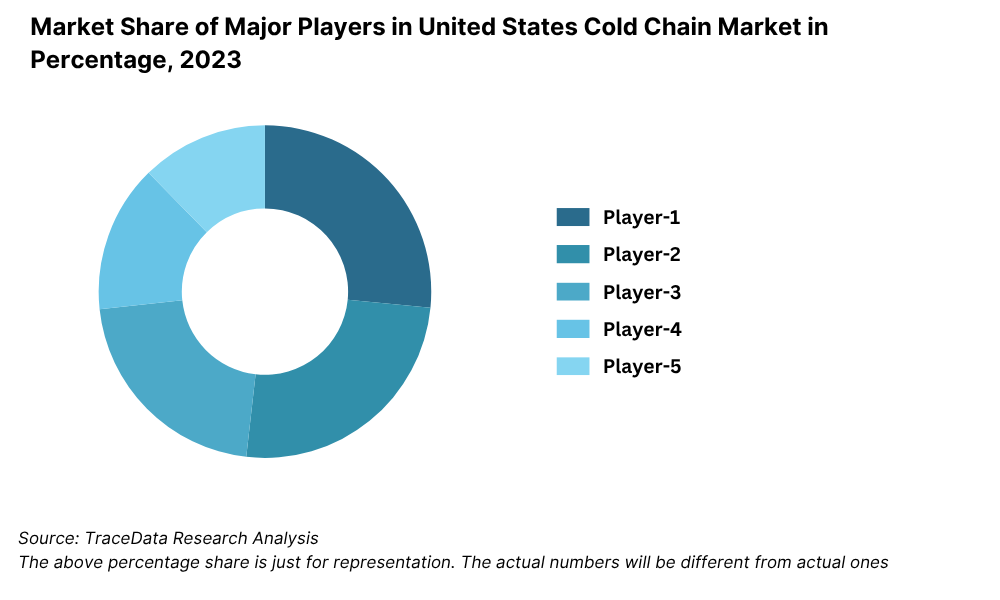

Competitive Landscape in United States Cold Chain Market

The United States cold chain market is moderately concentrated, with a few dominant players and several specialized regional providers. Major national and international logistics firms such as Lineage Logistics, Americold, United States Cold Storage, VersaCold, and Burris Logistics play a critical role in maintaining cold chain continuity across diverse industries including food, pharmaceuticals, and chemicals. The rise of automation, tech-integrated warehousing, and sustainable infrastructure has become a key focus across competitors.

Company | Establishment Year | Headquarters |

Lineage Logistics | 2008 | Novi, Michigan |

Americold Realty Trust | 1903 | Atlanta, Georgia |

United States Cold Storage | 1889 | Voorhees, New Jersey |

VersaCold Logistics Services | 1946 | Vancouver, Canada |

Burris Logistics | 1925 | Milford, Delaware |

Some of the recent competitor trends and key information about major players include:

Lineage Logistics: As the largest global cold storage company, Lineage Logistics operates over 400 facilities in 20+ countries, with 70+ warehouses across the U.S. In 2023, Lineage expanded its Texas and California sites using high-density automation and AI-driven energy optimization tools. The company reported a 12% increase in capacity utilization, positioning itself as a technology-first logistics partner.

Americold Realty Trust: With over 240 temperature-controlled warehouses globally, Americold remains a key player in the North American food cold chain. In 2023, it completed acquisition of a Midwest-based refrigerated transport firm to expand its end-to-end cold logistics service. The company also saw a 9% YoY growth in revenue, attributed to e-commerce grocery partnerships.

United States Cold Storage (USCS): USCS operates more than 40 refrigerated warehouses nationwide and serves major food and pharma clients. In 2023, the company introduced real-time visibility tools and blockchain-backed shipment traceability, significantly improving customer retention. USCS also partnered with solar developers to reduce carbon footprint across five major facilities.

VersaCold Logistics Services: Though headquartered in Canada, VersaCold has increased its U.S. footprint by targeting cross-border cold chain operations. In 2023, it reported a 15% increase in bi-national frozen food shipments through its border-adjacent distribution hubs. The company emphasizes high compliance standards and pharma-grade certifications.

Burris Logistics: A family-owned logistics firm with a strong East Coast presence, Burris Logistics focuses on end-to-end cold logistics for retailers and food service companies. In 2023, it launched a fleet electrification initiative and upgraded four distribution centers with smart energy management systems, boosting energy efficiency by 18%.

What Lies Ahead for United States Cold Chain Market?

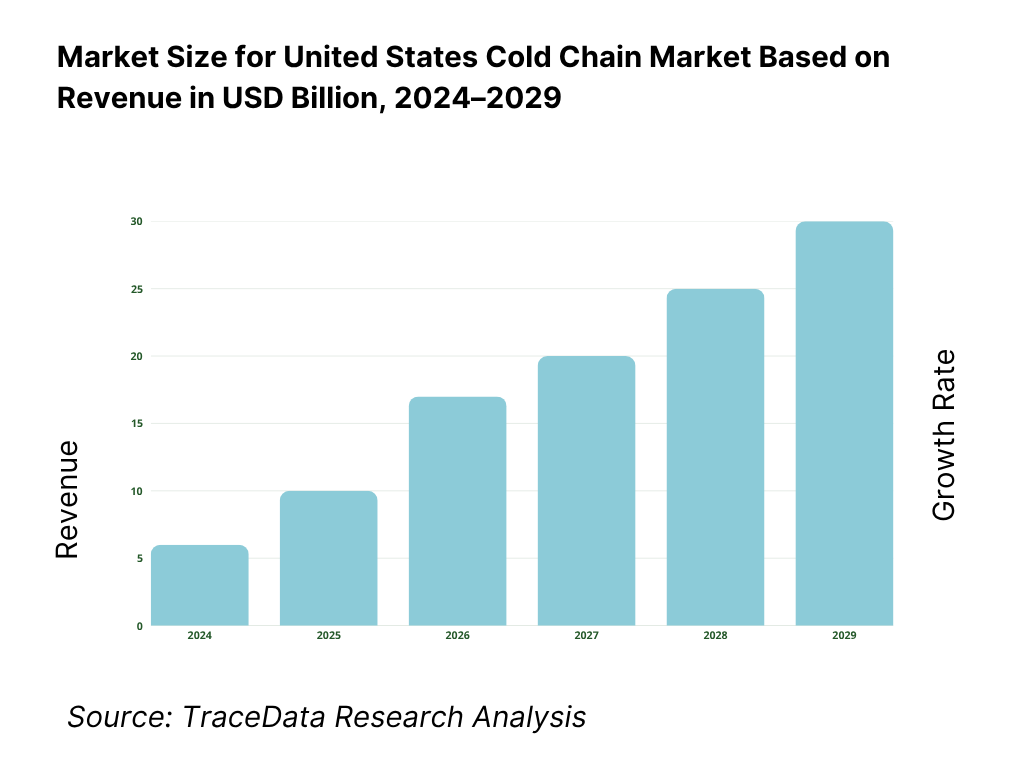

The United States cold chain market is projected to witness sustained growth through 2029, registering a strong CAGR during the forecast period. This growth will be driven by evolving consumer behavior, regulatory enforcement, technological upgrades, and expansion of perishable product categories.

Rising Demand for Pharma Cold Chain Infrastructure: With increasing R&D in biologics, mRNA therapies, and temperature-sensitive vaccines, the demand for highly controlled pharmaceutical cold chains is expected to surge. The market will see expanded investment in ultra-low temperature storage, validated packaging solutions, and compliant transport networks, particularly across clinical trial logistics and last-mile delivery.

Automation and AI Integration: Advanced warehouse automation, machine learning for route optimization, and AI-powered predictive maintenance are set to transform cold chain operations. These technologies will reduce energy consumption, minimize spoilage, and improve throughput efficiency, especially for large-scale cold storage operators. By 2029, over 50% of new cold warehouses are expected to adopt semi- or fully-automated systems.

Growth of E-Grocery and Meal Delivery Models: As online grocery, meal kits, and Q-commerce platforms continue expanding, demand for decentralized, micro-fulfillment cold hubs will increase. Urban areas are expected to see the highest penetration of these models, supporting faster last-mile delivery of chilled and frozen foods. This shift will drive cold chain providers to diversify facility formats and develop agile delivery networks.

Emphasis on Sustainability and Energy Efficiency: The push for sustainable logistics will lead to wider adoption of green cold chain practices. These include solar-powered refrigeration units, natural refrigerants, and carbon-neutral facilities. ESG (Environmental, Social, and Governance) reporting will also become a core requirement for enterprise-level clients, influencing investment in eco-friendly infrastructure and fleet electrification.

United States Cold Chain Market Segmentation

• By Market Structure:

o Organized (3PL Cold Chain Providers)

o Owned (In-House Cold Chain Operations)

• By Temperature Type:

o Chilled (0°C to 10°C)

o Frozen (Below -18°C)

o Ultra-Low Temperature (Below -70°C, mainly for pharma)

• By End User Industry:

o Fruits & Vegetables

o Meat & Seafood

o Dairy Products

o Pharmaceuticals & Biologics

o Bakery & Confectionery

o Floral and Horticulture

o Specialty Chemicals

• By Ownership Type:

o Third-Party Logistics (3PL)

o Manufacturer-Owned

o Retail-Owned

• By Mode of Transportation:

o Refrigerated Trucks

o Refrigerated Rail

o Cold Chain Air Cargo

o Reefer Containers (Maritime)

• By Region:

o Northeast

o Midwest

o South

o West

Players Mentioned in the Report:

• Lineage Logistics

• Americold Realty Trust

• United States Cold Storage

• VersaCold Logistics Services

• Burris Logistics

• NewCold Advanced Cold Logistics

• Congebec Logistics

• Penske Logistics (Cold Chain Division)

Key Target Audience:

• Cold Storage Facility Providers

• 3PL and Logistics Companies

• Food & Beverage Manufacturers

• Pharmaceutical Companies

• Regulatory Bodies (e.g., FDA, USDA)

• E-Grocery and Meal Kit Platforms

• Cold Chain Equipment Manufacturers

• Investment and Private Equity Firms

Time Period:

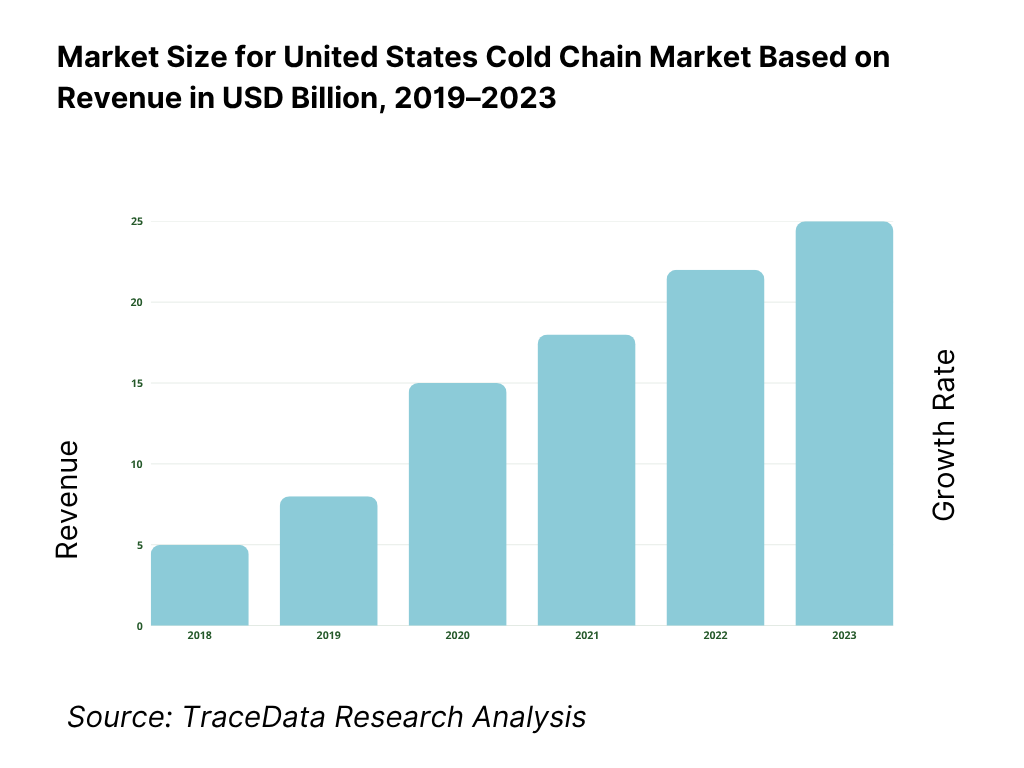

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in United States Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges that they face.

4.2. Revenue Streams for United States Cold Chain Market

4.3. Business Model Canvas for United States Cold Chain Market

4.4. Buying Decision Making Process

4.5. Supply Decision Making Process

5. Market Structure

5.1. Growth in Cold Storage Infrastructure in U.S., 2018-2024

5.2. Chilled vs. Frozen Share in U.S. Cold Chain Market, 2018-2024

5.3. Share of 3PL vs. Owned Cold Chain Operations, 2023-2024

5.4. Distribution of Cold Chain Facilities by Region and Ownership

6. Market Attractiveness for United States Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for United States Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Warehouse Capacity (Million Cu. Ft.), 2018-2024

8.3. Transport Fleet Size and Routes (Refrigerated Vehicles), 2018-2024

9. Market Breakdown for United States Cold Chain Market Basis

9.1. By Market Structure (Organized and Owned), 2023-2024P

9.2. By Temperature Type (Chilled, Frozen, Ultra-Low), 2023-2024P

9.3. By End User (Fruits & Vegetables, Dairy, Meat & Seafood, Pharmaceuticals, Others), 2023-2024P

9.4. By Ownership (3PL, Manufacturer-Owned, Retail-Owned), 2023-2024P

9.5. By Transportation Mode (Truck, Rail, Sea, Air), 2023-2024P

9.6. By Region (Northeast, Midwest, South, West), 2023-2024P

10. Demand Side Analysis for United States Cold Chain Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for United States Cold Chain Market

11.2. Growth Drivers for United States Cold Chain Market

11.3. SWOT Analysis for United States Cold Chain Market

11.4. Issues and Challenges for United States Cold Chain Market

11.5. Government Regulations for United States Cold Chain Market

12. Snapshot on Online Cold Chain Logistics Integration

12.1. Digital Platforms and Temperature Monitoring Solutions

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Cold Chain Tech Providers

13. United States Cold Chain and Pharma Logistics

13.1. Pharma Cold Chain Penetration Rate and Distribution Volumes, 2018-2029

13.2. Segment-wise Demand for Ultra-Low Temperature Solutions

13.3. Cold Chain Compliance and Regulatory Requirements

13.4. Temperature Excursion Rates and Mitigation

13.5. Vaccine and Biologics Transport Infrastructure

14. Opportunity Matrix for United States Cold Chain Market-Presented with the help of Radar Chart

15. PEAK Matrix Analysis for United States Cold Chain Market

16. Competitor Analysis for United States Cold Chain Market

16.1. Benchmark of Key Competitors including variables such as Company Overview, USP, Business Strategies, Strength, Weakness, Business Model, Technology Focus, Cold Storage Capacity, Transport Fleet Size, Recent Developments, Number of Locations by Region and Value-Added Services

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for United States Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Warehouse Capacity and Cold Transport Fleet, 2025-2029

18. Market Breakdown for United States Cold Chain Market Basis

18.1. By Market Structure (Organized and Owned), 2025-2029

18.2. By Temperature Type (Chilled, Frozen, Ultra-Low), 2025-2029

18.3. By End User (Fruits & Vegetables, Dairy, Meat & Seafood, Pharmaceuticals, Others), 2025-2029

18.4. By Ownership (3PL, Manufacturer-Owned, Retail-Owned), 2025-2029

18.5. By Transportation Mode (Truck, Rail, Sea, Air), 2025-2029

18.6. By Region (Northeast, Midwest, South, West), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for United States Cold Chain Market. Basis this ecosystem, we will shortlist leading 5-6 players in the country based upon their financial information, cold storage capacity, logistics coverage, and service portfolio.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market size in revenue terms, number of organized vs unorganized players, pricing trends, cold storage utilization levels, and demand from food and pharmaceutical industries.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, investor presentations, government databases (FDA, USDA), and logistics whitepapers. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various United States Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate capacity and revenue for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service offerings, value chain, process, pricing, technology integration and other factors.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the United States Cold Chain Market?

The United States cold chain market is positioned for robust growth, reaching a valuation of USD 86 Billion in 2023. This growth is driven by increasing demand for temperature-sensitive goods such as fresh produce, frozen foods, pharmaceuticals, and biologics. The market’s potential is further supported by expanding e-commerce grocery delivery, rising health awareness, and strict regulatory frameworks that necessitate cold chain compliance across industries.

2. Who are the Key Players in the United States Cold Chain Market?

The United States Cold Chain Market features several key players, including Lineage Logistics, Americold Realty Trust, and United States Cold Storage. These companies dominate due to their expansive cold storage infrastructure, nationwide transportation networks, and strong focus on automation and sustainability. Other notable players include VersaCold, Burris Logistics, and NewCold.

3. What are the Growth Drivers for the United States Cold Chain Market?

The primary growth drivers include rising demand for frozen and chilled food products, the expansion of pharmaceutical cold chains (particularly for vaccines and biologics), and the growth of e-commerce grocery and meal kit services. Additionally, government regulations mandating food and drug safety, along with advancements in cold chain monitoring technologies, are further propelling market growth.

4. What are the Challenges in the United States Cold Chain Market?

The United States Cold Chain Market faces several challenges, including infrastructure capacity limitations, high operational and energy costs, and a shortage of skilled cold chain personnel. Compliance with evolving regulatory requirements across different states and industries also adds complexity. Furthermore, the need for sustainability and carbon reduction in energy-intensive cold chain operations poses a long-term challenge for logistics providers.